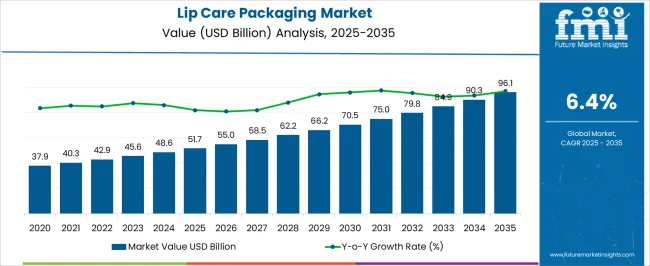

The Lip Care Packaging Market is estimated to be valued at USD 51.7 billion in 2025 and is projected to reach USD 96.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

| Metric | Value |

|---|---|

| Lip Care Packaging Market Estimated Value in (2025 E) | USD 51.7 billion |

| Lip Care Packaging Market Forecast Value in (2035 F) | USD 96.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The lip care packaging market is gaining significant traction as beauty and personal care brands prioritize sustainability, portability, and user-centric functionality in packaging innovation. Consumer preferences are rapidly evolving toward packaging formats that offer ease of use, hygiene, and on-the-go application. The rise of clean beauty and eco-conscious consumers has led to the adoption of recyclable, biodegradable, and refillable packaging alternatives.

Manufacturers are responding with packaging solutions that integrate tamper-evident features, airtight seals, and user-friendly applicators while optimizing aesthetics and shelf presence. The market is also seeing a shift toward localized and customizable packaging to cater to diverse cultural preferences and seasonal launches.

In addition, the growing influence of social media-driven skincare trends and direct-to-consumer sales channels is accelerating the demand for innovative lip care packaging formats. As sustainability mandates tighten and consumers demand transparency and functionality, packaging providers are expected to focus on minimalistic, efficient, and eco-forward solutions that align with brand storytelling and global regulatory expectations.

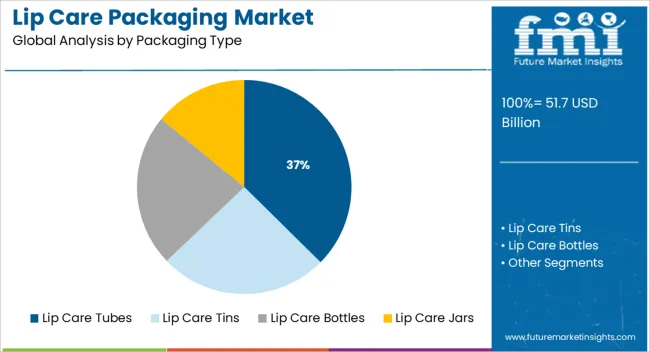

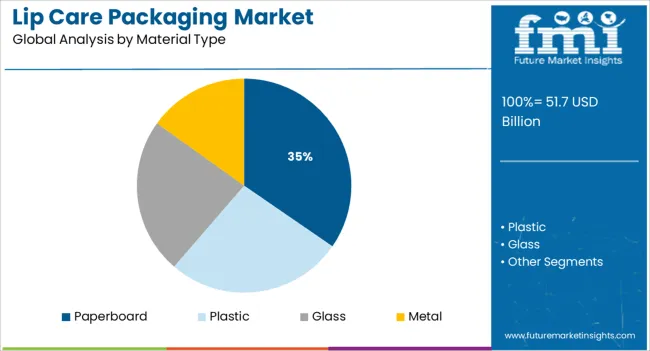

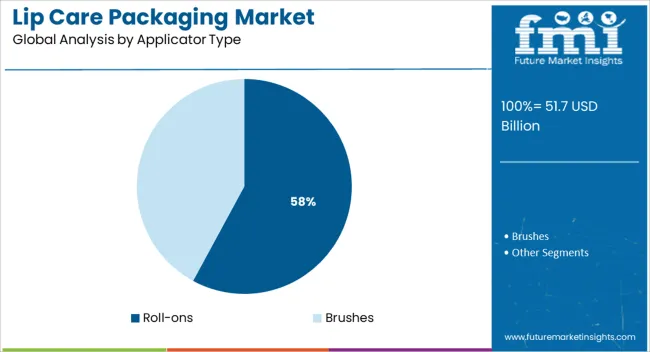

The market is segmented by Packaging Type, Material Type, and Applicator Type and region. By Packaging Type, the market is divided into Lip Care Tubes, Lip Care Tins, Lip Care Bottles, and Lip Care Jars. In terms of Material Type, the market is classified into Paperboard, Plastic, Glass, and Metal. Based on Applicator Type, the market is segmented into Roll-ons and Brushes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lip care tubes segment is anticipated to hold a 37.4% revenue share within the packaging type category in 2025, establishing itself as the leading format. This dominance is driven by the format’s portability, hygienic dispensing mechanism, and compatibility with a wide range of formulations including balms, gels, and medicated products.

Tubes offer an excellent barrier against contamination while ensuring precise dosage control, which has contributed to their broad acceptance across both premium and mass-market segments. The format’s ease of use and resealability have positioned it as a consumer favorite for travel and daily skincare routines.

Additionally, the ability to customize tube aesthetics through printing and labeling technologies has allowed brands to maintain a strong shelf impact while aligning with their identity and marketing campaigns. These combined advantages have reinforced lip care tubes as the most practical and scalable packaging type in the category.

The paperboard material segment is projected to command a 34.6% share of revenue in 2025 within the material type category. This leading position is attributed to growing consumer and regulatory pressure to eliminate plastic waste and transition to recyclable, biodegradable alternatives.

Paperboard’s renewable sourcing and compatibility with sustainable production practices have made it a preferred choice for brands seeking to improve their environmental footprint. Advancements in moisture-resistant and food-safe coatings have expanded paperboard’s applicability to lip care products, enabling it to protect sensitive formulations while supporting aesthetic flexibility.

Brands leveraging minimalistic, earth-toned packaging are adopting paperboard to reflect eco-conscious values and appeal to sustainability-minded consumers. Furthermore, its ability to support embossing, foil stamping, and other branding elements without compromising recyclability has helped paperboard become the material of choice for premium and eco-friendly lip care product lines.

Roll-ons are expected to dominate the applicator type category with a 57.9% share of revenue in 2025. This leadership is a result of their smooth and controlled application process, which enhances user experience by ensuring even product distribution and minimizing waste. The tactile cooling effect of the roll-on mechanism has also contributed to its popularity among consumers seeking comfort and targeted application, particularly for soothing or medicated lip care solutions.

Brands are integrating roll-ons with both liquid and semi-solid formulations, extending their use across a variety of product types including tints, serums, and treatments. Roll-ons support hygienic, touch-free usage which has gained importance in post-pandemic consumer preferences.

Their compact structure and ease of storage further support retail efficiency and consumer mobility. As cosmetic innovation continues to blend skincare with functionality, roll-on applicators are positioned to maintain dominance across both therapeutic and cosmetic lip care offerings.

The growing importance of presentable appearance and grooming among urban class, for having a positive impression in the professional world, has created considerable opportunities for cosmetics market. This trend of personal grooming among working men and women with high standard of living is contributing to the packaging requirements of cosmetic products such as lip care packaging.

Lip care packaging market has launched various innovative lip care packaging products which appeal to the aesthetic sense of customers, ultimately leading to increase in sales. The incorporation of customization options and bio-material packaging has created a new segment in the lip care packaging market by attracting new customers and brand owners.

Cosmetics packaging manufacturers are finding ways to offer packaging solution that specifically addresses the wide product range available in the lip care market segment. Owing to the nature of lip care products, lip care packaging has to give prime importance to packaging functions such as showcasing of products, communicating information about product specifications, communicating brand value and enhancing the visual appeal of the product on retail shelves.

One of the major factor promoting the growth of lip care packaging market is the increase in per capita disposable income among people in emerging economies.

The trend of personal grooming is not only popular among young population but also catching up with people from all generations. Either be it an elderly or an adult, self-grooming is prevalent among all. Another factor promoting the lip care packaging market is the increased variety of organic and natural lip care products in the market especially appealing to health conscious people.

However, low physical stability of plastic tubes restrains the lip care packaging market as low density plastics such as LLDPE, have the tendency to crack or tear due to recurrent usage. Moreover, the chemicals used in production of lip care products acts as a barrier for the lip care packaging market.

The global lip care packaging market is witnessing developments in terms of design and functionality of packaging. Lip care packaging tubes with friendly end compartment are new phenomena introduced by few packaging manufacturers. The lip care packaging tubes have a compartment in the tubes called the friendly end which contains lesser amount of the lip care paste.

The innovative design has enabled lip care consumers to share lip balms among friends by reducing the chances of transferring germs to one another.

Geographically, the lip care packaging market is segmented into five key regions: North America, Asia Pacific, Europe, Latin America and Middle East and Africa (MEA). Europe is the leading market segment in the global lip care packaging market.

However, due to increased demand in China and India, the Asia Pacific region is expected to witness a healthy growth rate over the forecast period of 2020-2025. North America is expected to grow at a steady rate, whereas MEA is expected to have a significant growth over the forecasted period due to governmental regulations and economic labor rates.

Some of the key players operating in the lip care packaging market are Arminak & Associates LLC, Park Tech A/S, The Packaging Company, HCP Packaging Co. Ltd., Eastar Cosmetic Packaging, and IMS Ningbo Limited.

The report offers an accurate evaluation of the market through detailed qualitative insights and verifiable projections about market size. The projections presented in the report have been derived using proven research methodologies and assumptions.

The global lip care packaging market is estimated to be valued at USD 51.7 billion in 2025.

The market size for the lip care packaging market is projected to reach USD 96.1 billion by 2035.

The lip care packaging market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in lip care packaging market are lip care tubes, lip care tins, lip care bottles and lip care jars.

In terms of material type, paperboard segment to command 34.6% share in the lip care packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Lipidomics Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Lipstick Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA