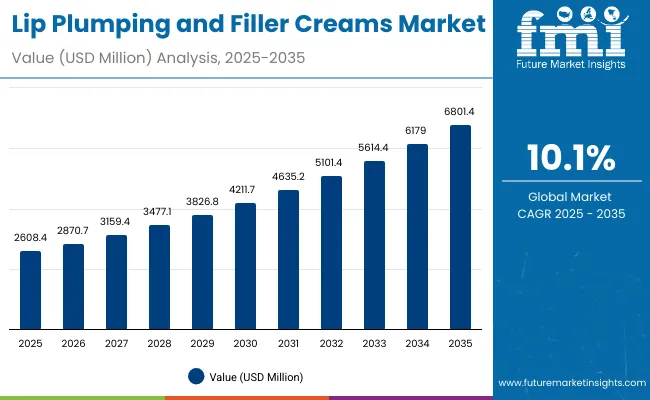

The Lip Plumping and Filler Creams Market is expected to record a valuation of USD 2,608.4 million in 2025 and USD 6,801.4 million in 2035, with an increase of USD 4,192.0 million, which equals a growth of over 193% over the decade. The overall expansion represents a CAGR of 10.1% and a 2X increase in market size.

Lip Plumping and Filler Creams Market Key Takeaways

| Metric | Value |

|---|---|

| Lip Plumping and Filler Creams Market Estimated Value in (2025E) | USD 2,608.4 million |

| Lip Plumping and Filler Creams Market Forecast Value in (2035F) | USD 6,801.4 million |

| Forecast CAGR (2025 to 2035) | 10.1% |

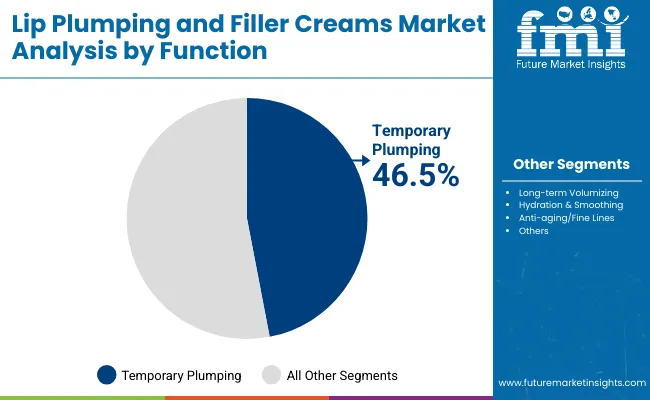

During the first five-year period from 2025 to 2030, the market increases from USD 2,608.4 million to USD 4,211.7 million, adding USD 1,603.3 million, which accounts for nearly 38% of the total decade growth. This phase records steady adoption in North America and Europe, driven by established brands like Too Faced, Dior, and Buxom capturing strong retail presence. Temporary plumping dominates this period as it caters to over 46% of consumer demand, reflecting consumer preference for instant and non-invasive solutions. Vegan claims accelerate adoption in developed markets, supported by the clean-beauty movement and growing demand for dermatologist-tested, cruelty-free alternatives.

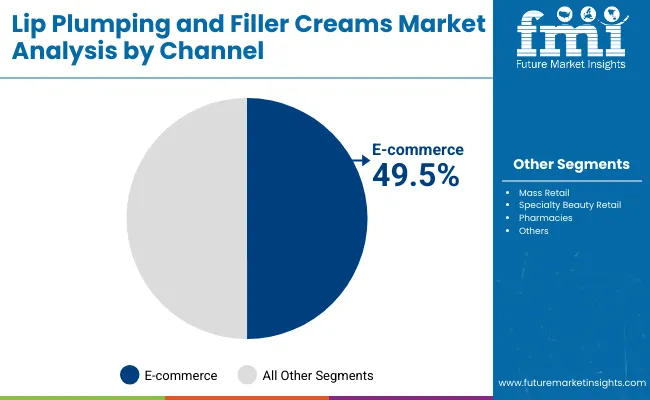

The second half from 2030 to 2035 contributes USD 2,588.7 million, equal to over 62% of total growth, as the market jumps from USD 4,211.7 million to USD 6,801.4 million. This acceleration is powered by widespread penetration in Asia-Pacific, particularly China (CAGR 17.9%) and India (CAGR 20.6%), where aspirational middle-class consumers and rising e-commerce penetration are fueling adoption. Long-term volumizing and hydration-focused products gain momentum, while hybrid formats like gloss-serum combinations expand cross-category appeal. E-commerce continues to dominate but specialty beauty retail and pharmacies also scale, supported by consumer trust in professional-grade products.

From 2020 to 2024, the Lip Plumping and Filler Creams Market grew steadily, expanding from a niche cosmetic-enhancement category into a mainstream beauty segment. During this period, the competitive landscape was dominated by cosmetic giants like Too Faced and Dior, which controlled nearly 10% of revenue share combined, emphasizing gloss-based plumping products targeted at Western markets. Competitive differentiation relied heavily on branding, influencer-driven marketing, and multi-channel retail strategies, while serums and balms were still considered complementary products. Clean-label and vegan claims began to gain momentum, setting the stage for the next growth phase.

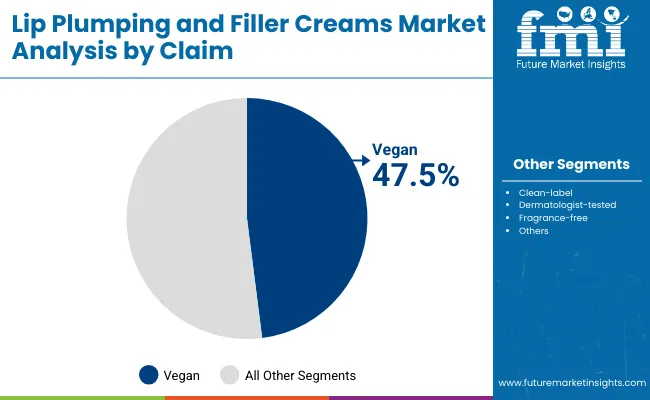

Demand for lip plumping and filler creams will expand to USD 2,608.4 million in 2025, and the revenue mix will shift as vegan, dermatologist-tested, and fragrance-free claims grow beyond 47% share. Traditional cosmetic leaders face rising competition from indie beauty brands and K-beauty innovators like Laneige and Fenty Beauty, who are pioneering hybrid formats and marketing strategies driven by social media engagement and online exclusives. Major global players are pivoting to hybrid models, integrating lip care with anti-aging benefits to retain relevance. Emerging entrants specializing in serum-based solutions, hyaluronic acid formulations, and multi-functional glosses are gaining share. The competitive advantage is moving away from product design alone to brand community strength, e-commerce visibility, and sustainability-led positioning.

Advances in cosmetic formulations have improved plumping efficacy, allowing for more effective hydration, volume, and anti-aging benefits. Temporary plumping creams and glosses have gained popularity due to their suitability for quick aesthetic enhancements without medical procedures. The rise of hyaluronic acid and peptide-based products has contributed to enhanced results with safer profiles, while menthol and niacin derivatives create immediate effects favored by younger demographics. Industries such as premium beauty, mass cosmetics, and K-beauty are driving demand for products that combine functionality with luxury appeal.

Expansion of vegan, clean-label, and dermatologist-tested claims has fueled market growth, reflecting consumer shifts toward sustainable and safe formulations. Innovations in serum-based applications, multifunctional glosses, and cross-category formats (lip care × skincare hybrids) are expected to open new application areas. Segment growth is expected to be led by E-commerce channels, vegan claims, and temporary plumping formats, supported by rising middle-class consumption in Asia-Pacific and sustained demand for premium offerings in the USA and Europe.

The market is segmented by function, active ingredient, product type, channel, and claim. By function, categories include temporary plumping, long-term volumizing, hydration & smoothing, and anti-aging/fine lines, reflecting diverse consumer needs across demographics. Active ingredients cover peptides, hyaluronic acid, menthol/capsaicin, niacin derivatives, and collagen boosters, showcasing the innovation pipeline driving efficacy. Product type segmentation includes glosses, serums, balms, and creams, representing both cosmetic and hybrid skincare formats.

Channels encompass e-commerce, mass retail, specialty beauty retail, and pharmacies, with online leading in global adoption. Claims segmentation highlights vegan, clean-label, dermatologist-tested, and fragrance-free categories, underscoring rising consumer demand for ethically sourced and safe beauty solutions. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with China, India, and the USA emerging as the fastest-growing markets.

| Function | Value Share% 2025 |

|---|---|

| Temporary plumping | 46.5% |

| Others | 53.5% |

The temporary plumping segment is projected to contribute 46.5% of the Lip Plumping and Filler Creams Market revenue in 2025, maintaining its lead as the dominant function category. This is driven by ongoing consumer demand for instant, visible lip enhancement without the need for invasive procedures. Temporary plumping products, often formulated with menthol, niacin derivatives, or capsaicin, deliver rapid effects and appeal strongly to younger consumers seeking quick aesthetic results.

The segment’s growth is also supported by the popularity of plumping glosses and serums that double as both color cosmetics and skincare. Compact formats and social media promotion have enhanced adoption, particularly in e-commerce platforms where consumers seek trend-driven solutions. As long-term volumizing and hydration-focused products gain ground, temporary plumping will remain the core entry point for lip enhancement, acting as the backbone of global market adoption.

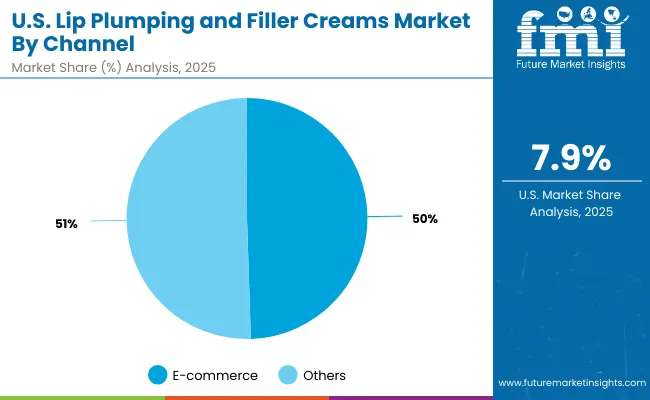

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

The e-commerce segment is forecasted to hold 49.5% of the Lip Plumping and Filler Creams Market share in 2025, led by its ability to provide wider product visibility, convenience, and direct-to-consumer engagement. Online platforms are favored for their role in driving product discovery, exclusive launches, and influencer-led promotions, particularly among Gen Z and millennial consumers.

Its dominance is further reinforced by the rise of subscription models and social-commerce integration, which encourage repeat purchases and loyalty. Cross-border e-commerce, especially in Asia-Pacific, has enabled global consumers to access international brands like Too Faced, Laneige, and Fenty Beauty without geographical constraints. As online-exclusive product lines expand and clean-label certifications are promoted digitally, e-commerce will continue to outpace traditional retail, remaining the primary growth driver in global lip plumping demand.

| Claim | Value Share% 2025 |

|---|---|

| Vegan | 47.5% |

| Others | 52.5% |

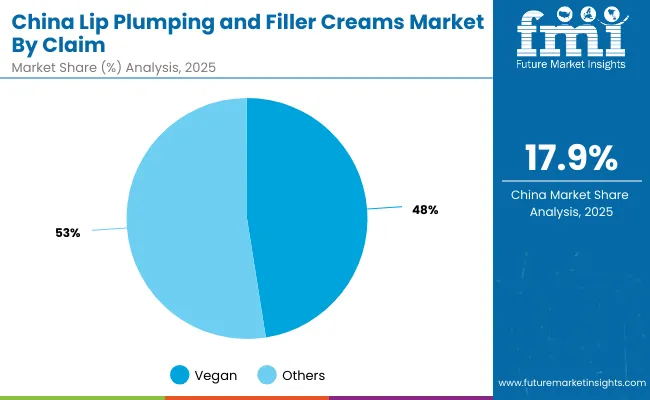

The vegan claim segment is projected to account for 47.5% of the Lip Plumping and Filler Creams Market revenue in 2025, establishing it as the leading claim type. Vegan formulations are preferred for their cruelty-free positioning, alignment with sustainability values, and compatibility with clean-beauty trends. This claim resonates strongly with ethically conscious consumers, particularly in China, where vegan-labeled lip products already capture nearly half of total market value.

Its suitability across glosses, serums, and creams has made vegan claims a standard marketing feature among both premium and mass brands. Developments in plant-based peptides, botanical actives, and clean formulations have further expanded adoption, while regulatory and certification bodies add trust to the segment. Given its balance of ethical appeal and marketability, vegan claims are expected to maintain their leading role in global consumer preference and competitive positioning.

Rising Popularity of Hybrid Lip Care-Cosmetic Products

One of the strongest growth drivers is the surge in hybrid products that function as both cosmetics and skincare. Lip plumping creams and glosses are increasingly infused with hydrating agents like hyaluronic acid and peptides, allowing them to address multiple consumer needs simultaneously instant plumping, hydration, and fine-line reduction. This has proven particularly effective in retaining consumers who are transitioning from traditional color cosmetics toward functional beauty products. Brands such as Laneige and Clinique are capitalizing on this convergence by positioning lip plumpers as part of broader skincare regimens rather than just cosmetic add-ons, thereby expanding consumer use frequency and pushing higher repeat sales.

E-commerce Exclusivity and Social Media Amplification

The dominance of e-commerce (49.5% share in 2025) is reinforced by the way brands launch online-exclusive lines and influencer-led campaigns that resonate with digitally native consumers. Platforms such as Instagram, TikTok, and Xiaohongshu in China have become primary channels for discovery and trust-building. Viral trends such as "lip plumping challenges" or before-and-after user content drive organic demand spikes and position products as must-have items. This creates a feedback loop where demand for limited-edition or influencer-collaborated products sells out quickly online, reinforcing exclusivity and keeping consumer engagement consistently high.

Consumer Concerns Around Irritation and Safety Profiles

Although temporary plumping products account for 46.5% share in 2025, a significant restraint is the potential irritation caused by active ingredients like menthol, capsaicin, or niacin derivatives. Sensitive skin users frequently report tingling, burning sensations, or redness, which can deter repeat purchases. With rising demand for dermatologist-tested and fragrance-free claims, brands must navigate a delicate balance between delivering the desired plumping effect and ensuring safety. Negative consumer reviews on e-commerce platforms amplify these concerns and can stall product adoption in markets with stricter consumer-protection laws.

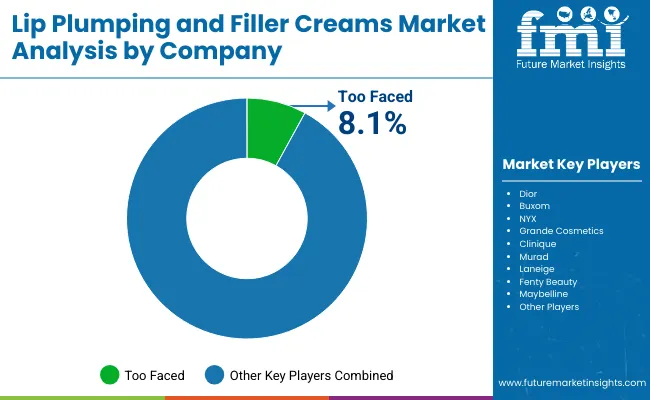

Intense Market Fragmentation and Brand Saturation

The competitive landscape is highly fragmented, with Too Faced holding just 8.1% share globally in 2025 and the rest distributed across dozens of players. This saturation has led to pricing pressures and the need for constant innovation, particularly in glosses and serums. While established brands dominate offline retail, smaller indie brands are flooding e-commerce with affordable alternatives, making it challenging for global leaders to maintain differentiation. This fragmentation reduces margins and makes long-term volumizing or premium-positioned products harder to scale.

Accelerated Growth of Vegan and Clean-Label Claims in Asia-Pacific

With 47.5% of global revenue in 2025 already linked to vegan claims, the trend toward vegan, cruelty-free, and clean formulations is expanding fastest in Asia-Pacific. In China, vegan lip plumpers account for USD 121.6 million in 2025, and this demand is amplified by younger Gen Z consumers who actively check product labels for ethical compliance. As clean beauty regulations tighten, global players are reformulating their products with plant-based peptides, botanical extracts, and non-irritant active substitutes, setting new benchmarks for product development.

Cross-Category Integration with Anti-Aging and Skincare Routines

A major emerging trend is the positioning of lip plumping and filler creams as part of anti-aging skincare routines. Beyond temporary plumping, long-term volumizing and hydration-focused products are now marketed with claims like "reduces fine lines" or "smooths lip texture", appealing to older demographics. This allows brands to tap into both cosmetic and anti-aging spending pools, significantly enlarging the target market. As the global anti-aging market grows, lip plumping creams are shifting from an impulse cosmetic buy to a routine skincare investment, boosting average revenue per consumer.

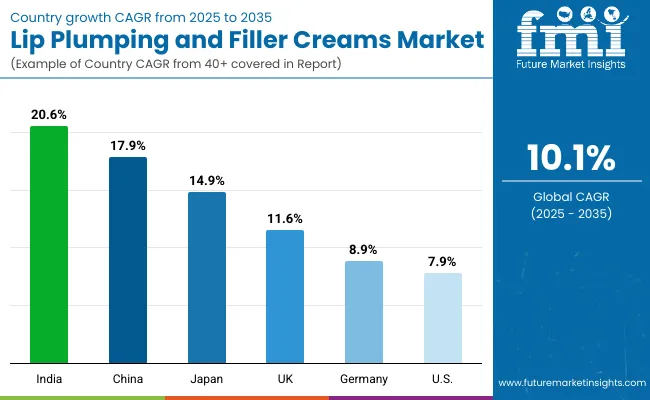

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 17.9% |

| USA | 7.9% |

| India | 20.6% |

| UK | 11.6% |

| Germany | 8.9% |

| Japan | 14.9% |

Between 2025 and 2035, India and China emerge as the fastest-growing markets in the global lip plumping and filler creams industry, with projected CAGRs of 20.6% and 17.9%, respectively. India’s rapid expansion is driven by the rising middle-class population, aspirational consumption, and strong uptake of e-commerce beauty platforms, making international brands more accessible to Tier-2 and Tier-3 cities. Similarly, China’s growth is anchored by the Gen Z and millennial consumer base, which is highly responsive to vegan and clean-label positioning.

Social media platforms like Douyin and Xiaohongshu amplify demand through influencer-driven tutorials and real-time promotions, enabling premium and indie brands alike to scale quickly. Japan, with a CAGR of 14.9%, benefits from its mature beauty market’s pivot toward anti-aging lip care and multifunctional products, positioning lip plumping creams as part of holistic skincare routines rather than one-off cosmetic enhancements.

By contrast, developed Western markets demonstrate steady but slower growth trajectories. The USA, accounting for a large base share, will grow at a CAGR of 7.9%, supported by consistent consumer spending on premium brands and dominance of e-commerce channels (49.5% in 2025). The UK and Germany, growing at 11.6% and 8.9%, reflect a balance of premiumization and the rising influence of clean-label and vegan claims, particularly in specialty retail and pharmacy-driven channels. These countries will remain important revenue anchors due to established brand loyalty and regulatory-driven trust in product claims, but the highest incremental growth will come from Asia-Pacific markets, where demand for lip enhancement aligns with broader trends in self-expression, social commerce, and rapid beauty adoption cycles.

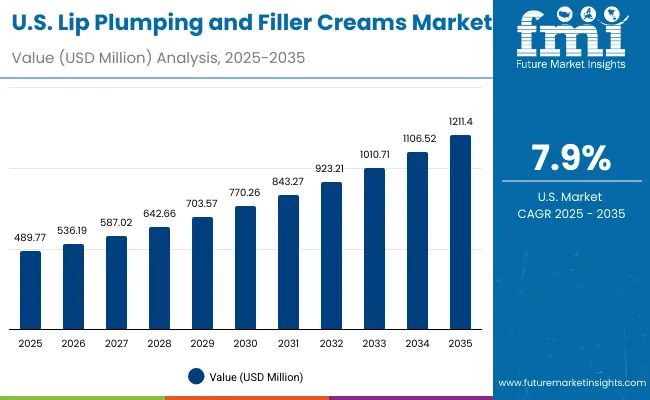

| Year | USA Lip Plumping and Filler Creams Market (USD Million) |

|---|---|

| 2025 | 489.77 |

| 2026 | 536.19 |

| 2027 | 587.02 |

| 2028 | 642.66 |

| 2029 | 703.57 |

| 2030 | 770.26 |

| 2031 | 843.27 |

| 2032 | 923.21 |

| 2033 | 1,010.71 |

| 2034 | 1,106.52 |

| 2035 | 1,211.40 |

The Lip Plumping and Filler Creams Market in the United States is projected to grow at a CAGR of 7.9%, supported by sustained demand for instant lip enhancement and the dominance of e-commerce as a distribution channel. Brands like Too Faced, Maybelline, and Fenty Beauty are leveraging online exclusives, influencer collaborations, and subscription models to expand consumer reach. Clinically tested and dermatologist-approved claims are driving sales in pharmacies and specialty beauty retail, reinforcing consumer trust in a highly competitive space. The USA market is also witnessing steady uptake of vegan and clean-label products, which account for nearly half of sales, reflecting rising awareness of ethical and sustainable formulations.

The Lip Plumping and Filler Creams Market in the United Kingdom is expected to grow at a CAGR of 11.6%, supported by premiumization trends, strong clean-beauty adoption, and consumer loyalty toward established brands. UK consumers increasingly favor vegan and fragrance-free formulations, creating opportunities for both luxury houses like Dior and mass brands such as NYX and Maybelline. Specialty beauty retailers are a major growth channel, with pharmacies also playing a significant role in consumer adoption due to trust in professional-grade products. The rise of AR-powered digital try-ons in online platforms is expanding virtual shopping experiences, further strengthening e-commerce adoption.

India is witnessing the fastest growth in the Lip Plumping and Filler Creams Market, with a forecast CAGR of 20.6% through 2035. Rising disposable incomes, aspirational lifestyles, and the expansion of online retail are fueling market penetration, especially in Tier-2 and Tier-3 cities. International brands are scaling through cross-border e-commerce platforms, while local players are experimenting with affordable glosses and serums infused with hyaluronic acid and peptides. Consumer adoption is also supported by beauty influencers and regional digital campaigns that introduce global product trends to domestic audiences.

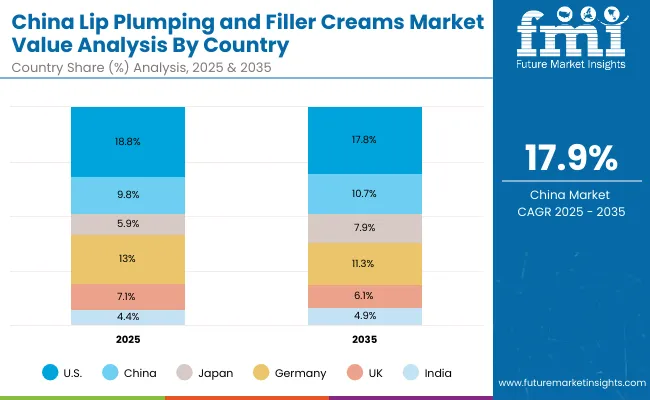

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.8% |

| China | 9.8% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 4.4% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.8% |

| China | 10.7% |

| Japan | 7.9% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 4.9% |

The Lip Plumping and Filler Creams Market in China is expected to grow at a CAGR of 17.9%, one of the highest among leading economies. Strong demand is driven by Gen Z and millennial consumers prioritizing vegan and clean-label formulations, which already account for 47.5% share (USD 121.6 million in 2025). Social-commerce platforms such as Douyin and Xiaohongshu are amplifying brand presence, creating viral demand cycles for plumping glosses and serums. Domestic brands are leveraging competitive pricing and fast product cycles to challenge international leaders, while government-backed e-commerce infrastructure is enabling cross-border beauty trade.

| USA by Channel | Value Share% 2025 |

|---|---|

| E-commerce | 49.5% |

| Others | 50.5% |

The Lip Plumping and Filler Creams Market in the United States is projected at USD 489.8 million in 2025, with e-commerce contributing 49.5% (USD 242.4 million) and offline channels including mass retail, specialty beauty, and pharmacies accounting for 50.5% (USD 247.4 million). The strong share of e-commerce highlights how USA consumers rely on digital-first discovery, exclusive online drops, and influencer-led campaigns to shape purchasing behavior. This balance with offline reflects the role of established retail channels in driving dermatologist-tested and fragrance-free claims, which remain a trust anchor for more cautious buyers.

Growth is further supported by subscription-based D2C models and digital try-on tools that provide personalization. Major brands like Too Faced, Fenty Beauty, and Clinique are investing in multi-channel visibility, with product launches synchronized across both Sephora outlets and online platforms to maximize reach. As hybrid formats (gloss-serum balms) gain adoption, the USA market is expected to continue its steady expansion, bridging impulse cosmetic purchases with skincare-driven anti-aging positioning.

| China by Claim | Value Share% 2025 |

|---|---|

| Vegan | 47.5% |

| Others | 52.5% |

The Lip Plumping and Filler Creams Market in China is valued at USD 256.1 million in 2025, with vegan claims leading at 47.5% (USD 121.6 million) and non-vegan or mixed formulations accounting for 52.5% (USD 134.5 million). The dominance of vegan reflects the strength of ethical, clean-label, and sustainability-driven consumption, particularly among Gen Z buyers who actively scrutinize ingredients before purchasing. Cross-border e-commerce platforms and domestic giants such as Tmall and JD.com are amplifying this segment by highlighting cruelty-free and plant-based credentials.

This demand positions China as a fastest-growing hub (CAGR 17.9%), where local and K-beauty-inspired brands compete aggressively with global players. Social-commerce ecosystems like Douyin and Xiaohongshu create viral sales spikes, with lip plumping glosses often trending through before-and-after testimonials. Long-term volumizing creams infused with peptides and hyaluronic acid are gaining traction, but temporary plumping glosses remain the gateway for consumer trial. The competitive edge lies in affordable, trend-driven vegan products, making China a crucial innovation and volume-driven market.

The Lip Plumping and Filler Creams Market is moderately fragmented, with Too Faced leading at 8.1% global value share in 2025, while the remaining 91.9% is divided among global beauty leaders and rising indie brands. Too Faced’s early entry into the plumping gloss category, coupled with its strong Sephora presence and e-commerce visibility, has helped it establish leadership.

Established premium players such as Dior, Fenty Beauty, and Clinique are expanding through clean-label glosses and serums positioned at the luxury end of the spectrum, while mass brands like Maybelline and NYX capture younger demographics with affordable, trend-driven products. Mid-sized innovators including Grande Cosmetics, Murad, and Laneige are leveraging active ingredients such as hyaluronic acid and peptides to merge lip care with skincare, making them relevant for hydration and anti-aging segments.

The competitive differentiation is shifting from basic plumping efficacy to ecosystem strategies, which include hybrid positioning (cosmetic × skincare), sustainability credentials (vegan, fragrance-free), and digital-first launches supported by social-commerce campaigns. Indie brands are also gaining traction by offering online-exclusive, cruelty-free products that resonate with Gen Z and millennial buyers. In this fragmented landscape, the ability to sustain relevance will depend on branding strength, innovation in active ingredients, and alignment with clean-beauty consumer expectations.

Key Developments in Lip Plumping and Filler Creams Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Function | Temporary plumping, Long-term volumizing, Hydration & smoothing, Anti-aging/fine lines |

| Active Ingredient | Peptides, Hyaluronic acid, Menthol/capsaicin, Niacin derivatives, Collagen boosters |

| Product Type | Glosses, Serums, Balms, Creams |

| Channel | E-commerce, Mass retail, Specialty beauty retail, Pharmacies |

| Claim | Vegan, Clean-label, Dermatologist-tested, Fragrance-free |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, China, India, Japan, United Kingdom, Germany |

| Key Companies Profiled | Too Faced, Dior, Buxom, NYX, Grande Cosmetics, Clinique, Murad, Laneige, Fenty Beauty, Maybelline |

| Additional Attributes | Dollar sales by function, channel, and claim; adoption trends in vegan and clean-label positioning; rising demand for hybrid gloss-serum and balm formulations; sector-specific growth in premium beauty, mass cosmetics, and K-beauty; revenue segmentation by e-commerce and offline retail; integration with AR-powered try-ons and subscription-based D2C models; regional trends influenced by Gen Z consumer behavior and clean beauty regulations; and innovations in peptide, hyaluronic acid, and collagen-boosting actives. |

The Lip Plumping and Filler Creams Market is estimated to be valued at USD 2,608.4 million in 2025.

The market size for the Lip Plumping and Filler Creams Market is projected to reach USD 6,801.4 million by 2035.

The Lip Plumping and Filler Creams Market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in the Lip Plumping and Filler Creams Market are glosses, serums, balms, and creams.

In terms of function, the temporary plumping segment is projected to command 46.5% share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Lipstick Market

Lipolyzed Butter Fat Market

Lipid Injectable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA