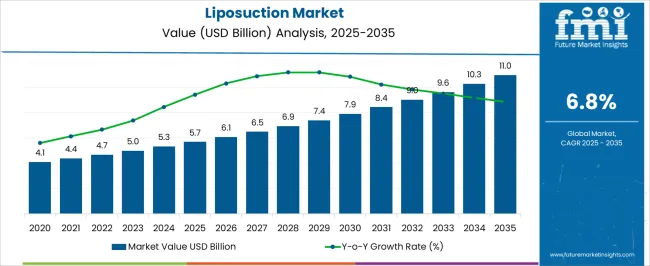

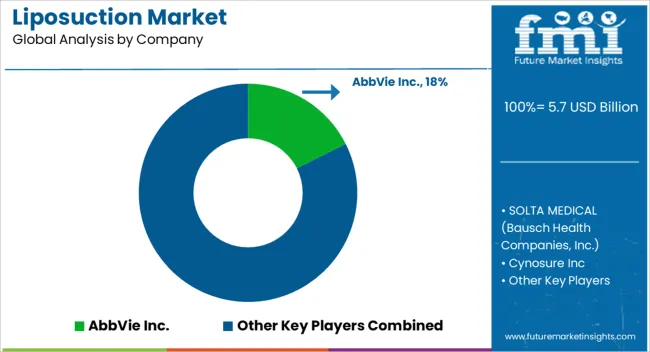

The Liposuction Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The liposuction market is experiencing strong growth driven by rising demand for aesthetic enhancement procedures, increasing disposable income, and advances in minimally invasive technologies. Current industry trends indicate growing acceptance of body contouring treatments supported by improved procedural safety and shorter recovery times. The integration of laser, ultrasound, and power-assisted systems has enhanced precision and patient outcomes, stimulating adoption across both developed and emerging markets.

Regulatory approvals and heightened consumer awareness about modern cosmetic procedures are contributing to consistent market expansion. The future outlook remains positive, with clinics and healthcare providers focusing on technology differentiation and patient-centric care.

Growth rationale is anchored in evolving lifestyle trends, the influence of social media on appearance consciousness, and the continuous innovation in surgical techniques and equipment efficiency These dynamics are collectively positioning the liposuction market for sustainable growth, higher procedural volumes, and broader accessibility through expanding clinical infrastructure.

| Metric | Value |

|---|---|

| Liposuction Market Estimated Value in (2025 E) | USD 5.7 billion |

| Liposuction Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

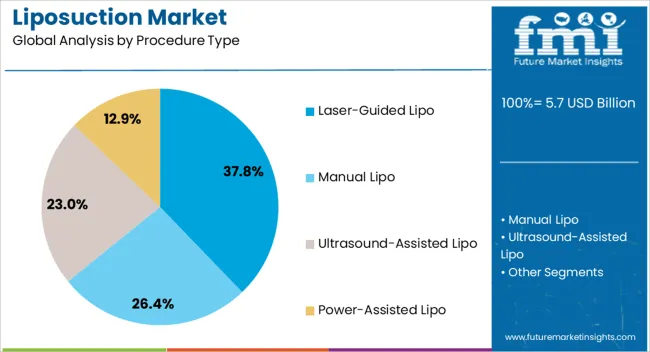

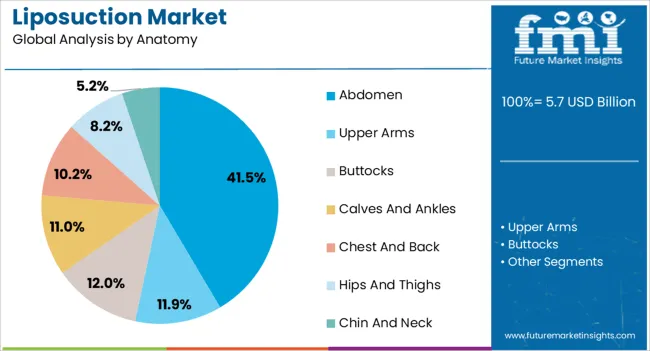

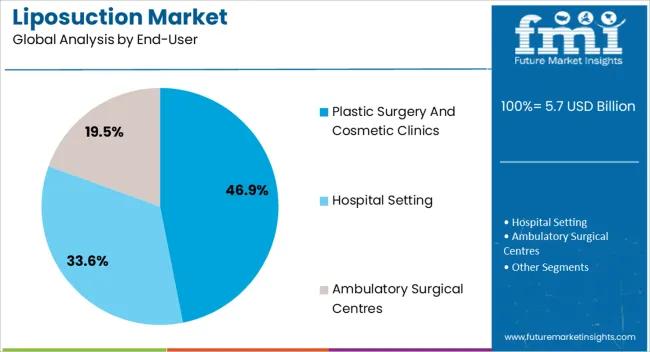

The market is segmented by Procedure Type, Anatomy, and End-User and region. By Procedure Type, the market is divided into Laser-Guided Lipo, Manual Lipo, Ultrasound-Assisted Lipo, and Power-Assisted Lipo. In terms of Anatomy, the market is classified into Abdomen, Upper Arms, Buttocks, Calves And Ankles, Chest And Back, Hips And Thighs, and Chin And Neck. Based on End-User, the market is segmented into Plastic Surgery And Cosmetic Clinics, Hospital Setting, and Ambulatory Surgical Centres. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The laser-guided lipo segment, holding 37.80% of the procedure type category, has emerged as the leading technique due to its precision, reduced downtime, and enhanced skin tightening outcomes. This method has gained preference among both surgeons and patients for its ability to target localized fat with minimal invasiveness and improved contouring results.

Continuous advancements in laser wavelengths and energy delivery systems have improved treatment safety and efficiency. The segment’s expansion is being reinforced by the integration of real-time monitoring systems that optimize energy use and reduce post-procedure complications.

Market players are investing in product development and training programs to standardize outcomes across diverse clinical settings The growing preference for technologically advanced and patient-comfort-focused solutions is expected to sustain the dominance of laser-guided liposuction in the coming years.

The abdomen segment, accounting for 41.50% of the anatomy category, has maintained leadership as the most frequently treated area in liposuction procedures. The dominance of this segment is attributed to the high concentration of fat deposits in the abdominal region and the visible aesthetic improvement achieved post-surgery.

Increased demand for body contouring in both male and female populations has strengthened procedural frequency. Advancements in cannula design and energy-assisted technologies have improved fat removal precision and reduced surgical trauma.

The abdomen’s functional and aesthetic importance has ensured continued patient demand, especially among individuals seeking improved body proportion and fitness alignment Expanding medical tourism and accessibility of qualified surgeons are further supporting the sustained growth of this segment within the global liposuction market.

The plastic surgery and cosmetic clinics segment, representing 46.90% of the end-user category, has retained its dominant position owing to high patient preference for specialized and technologically advanced treatment centers. These clinics provide personalized care, comprehensive pre- and post-operative support, and access to the latest minimally invasive devices.

The segment’s leadership is reinforced by growing procedural volumes and the rising number of board-certified aesthetic surgeons. Strategic collaborations with device manufacturers and the incorporation of advanced imaging and guidance systems have elevated procedural outcomes.

The increasing affordability of cosmetic treatments, coupled with enhanced marketing and financing options, has made liposuction more accessible to a broader consumer base Continued investments in training, infrastructure, and technology upgrades are expected to sustain this segment’s leadership and drive future market expansion.

Insights into Factors Affecting Liposuction Sales

The amplifying adoption of fat removal, along with other cosmetic surgeries, is impacted by diverse catalysts, including the portrayal of beauty standards in social media and celebrity culture. As people become conscious of their appearance and find ways to improve their looks, the demand for liposuction procedures soars. This is widely seen among the young population who are influenced by social media trends and seek to attain the body aesthetics promoted by social media influencers and celebrities, which spurs the fat removal demand globally.

Obesity is linked with diverse health concerns and aesthetic issues, directing individuals to look for solutions to cut fat and enhance their looks. The plastic surgery offers a way to target specific areas where fat reduction is difficult through diet and exercise alone. The demand towers with the ascending obesity rate, ushering the liposuction market growth.

Reasons Expected to Stunt Liposuction Future Demand

Cryolipolysis, popularly known as CoolSculpting, and radiofrequency lipolysis provide patients with nonsurgical alternatives for fat reduction, with lesser discomfort and downtime. These less invasive options are chosen by individuals who do not want to undergo a conventional plastic surgery. As these painless technologies advance and gain adoption among patients and medical professionals, they constrain the growth of the lipo surgery industry.

The insurance companies in some regions do not provide reimbursement for body contouring procedures, which limits cost-conscious patients from experiencing body contouring, as they are unwilling to pay the full cost out of pocket. The limited reimbursement influences the inclination of medical care providers to provide plastic surgery services, where insurance coverage is crucial in decision-making. The liposuction market growth is inhibited.

The global liposuction sector registered sales of USD 4.1 million in 2020. The liposuction industry experienced a HCAGR of 5.3% and attained USD 5.7 million in 2025.

The adoption of aesthetic cosmetic procedures is characterized by the diminishing stigma related to cosmetic surgeries or makeup. Promotional campaigns related to aesthetic surgeries on TV and the print media bolster the prevalence of plastic surgery surgeries.

According to an International Society of Aesthetic Plastic Surgery (ISAPS) poll from 2020, the United States, Brazil, Japan, Mexico, Italy, Germany, Turkey, France, India, and Russia are the top ten countries that perform the most cosmetic procedures and treatments. In 2020, the United States saw an 8.7% decline in surgical treatments but again performed the most procedures globally (15.9% of total), 19.3% of nonsurgical procedures, and 77.8% of injectable treatments.

Between 2025 and 2035, the body contouring ecosystem to trace its growth trajectory. The growth is attributed to continuous development in plastic surgery devices, like the innovation of refined and less invasive procedures.

The liposuction adoption is slated to gain an advantage from an aging demographic seeking rejuvenation and a continuous societal focus on physical appearance. The rising globalization and medical tourism widen the body contouring industry scope. It is envisioned that regulatory requirements for liposuction devices and procedures thrive the growth of the lipo market.

The section below covers the forecast for body contouring industry in terms of countries. Information on key countries in several parts of the globe, including North America, Asia Pacific, Europe, and others, is provided.

The United States is at the pinnacle in North America, with a CAGR of 5.60% through 2035. In Asia Pacific region, China is slated to exhibit a CAGR of 8.60% by 2035, leaving behind India at 7.70%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 5.60% |

| Italy | 6.20% |

| Spain | 5.30% |

| China | 8.60% |

| India | 7.70% |

The United States dominates the global liposuction ecosystem with a significant number of treatments operated. Technological innovations and high disposable income ushered in the adoption of fat removal in the United States. Trends in ethical marketing and patient education for plastic surgery procedures strengthen the market growth in the United States.

The United States body contouring industry witnesses a demand from urban and suburban areas, with a scaling-up trend in minimally invasive procedures. The United States has skilled practitioners and medical centers which encourages the liposuction device and equipment market expansion.

Italy has a robust cultural concentration on aesthetics, proliferating a strong demand for liposuction. The liposuction ecosystem in Italy has gained traction with a high expertise among cosmetic surgeons. The plastic surgery is prevalent among men and women in Italy, with an emphasis on body contouring, augmenting the sales.

The rise of medical tourism for cosmetic procedures, impacting market dynamics in certain regions, especially in Europe, is pivotal in Italy. The aging demographic in Italy progressively looks for plastic surgery to preserve a youthful appearance.

The liposuction industry in China is evolving, ushered by increasing disposable incomes and amplifying beauty awareness. The fat removal sector witnesses a demand for body contouring treatment among the younger population.

Urban cities like Beijing and Shanghai are centers for plastic surgery and other cosmetic surgeries, boosting body contouring sales. There is a rising trend towards amalgamating plastic surgery with other aesthetic treatments in China. Government rules and quality measures are becoming strict, shaping the liposuction market in China.

The section contains information about the leading segments in the liposuction industry. In terms of procedure type category, the power assisted body contouring segment is estimated to account for a share of 42.20% in 2025. By anatomy category, the buttocks segment is projected to dominate by holding a share of 25.60% in 2025.

| Segment | Power Assisted Lipo |

|---|---|

| Value Share (2035) | 42.20% |

Power-assisted liposuction is likely to possess a 42.20% share of the industry in 2025 and exhibit a robust CAGR from 2025 to 2035. For treatments that require significant fat grafting, the adoption of power-assisted liposuction processes plays a crucial role. The body contouring process rates spur because of the usage of power-assisted plastic surgery equipment.

Power-assisted lipo improves efficiency and accuracy, diminishing process time and maximizing patient outcomes. These devices curb surgeon fatigue, allowing longer and more intricate procedures and amplifying the operational capacity.

| Segment | Buttocks |

|---|---|

| Value Share (2035) | 25.60% |

As disposable income increases, people are able to afford cosmetic treatments, majorly focusing on the upsurge of the buttocks liposuction sector. The ascending cultural concentration on aesthetic improvement ushers the adoption of buttocks lipo. Innovations in plastic surgery procedures have made buttocks cosmetic surgeries safer and more potent, spurring sales.

The amplified advertising and consciousness campaigns accentuate the widespread adoption of buttocks lipo. Social media's impact and celebrity trends publicize the yearning for a sculpted buttock, augmenting the demand. A strengthening fitness and wellness trend upsurges individuals to look for procedures for body contouring, including the buttocks, intensifying sales.

Prominent providers emphasize regional expansion to gain revenue and proliferate sales in developing economies through the mergers and acquisitions within the liposuction market.

The vital lipo producers design and manufacture equipment and systems assisting the plastic surgery process and perform the OT with an economical approach. The plastic surgery equipment provides secretion management, along with therapy success monitoring, to ensure improved treatment results.

Expansion, product innovations, partnerships, and research sponsorship are the essential strategies used by lipo vendors to amplify the sales and mark their global presence.

Industry Updates

| Company | Johnson & Johnson MedTech |

|---|---|

| Headquarter | United States |

| Recent Advancement |

|

| Company | Ethicon |

|---|---|

| Headquarter | United States |

| Recent Advancement |

|

Key procedure type comprises manual lipo, ultrasound-assisted lipo, power-assisted lipo, and laser-guided lipo.

The anatomy category is classified as abdomen, upper arms, buttocks, calves and ankles, chest and back, hips and thighs, and chin and neck.

The sector is trifurcated into Hospital Setting, Ambulatory Surgical Centres, and Plastic Surgery and Cosmetic Clinics

Analysis of the ecosystem has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global liposuction market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the liposuction market is projected to reach USD 11.0 billion by 2035.

The liposuction market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in liposuction market are laser-guided lipo, manual lipo, ultrasound-assisted lipo and power-assisted lipo.

In terms of anatomy, abdomen segment to command 41.5% share in the liposuction market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA