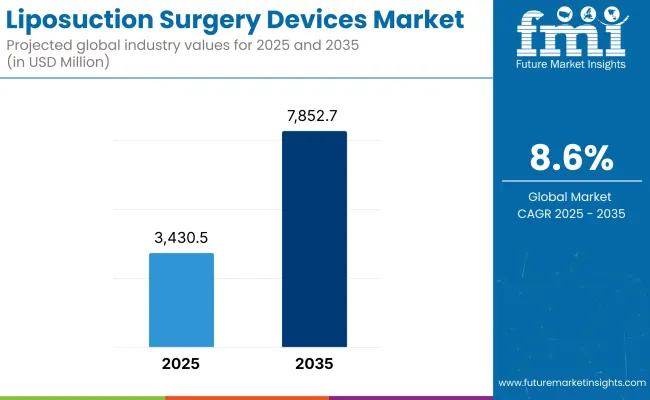

The global Liposuction Surgery Devices Market is projected to be valued at approximately USD 3,430.5 million in 2025 and is expected to reach USD 7,852.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 8.6% over the forecast period.

Market expansion is being fueled by the rising global prevalence of obesity, increased demand for minimally invasive body contouring procedures, and broader acceptance of aesthetic surgery across both developed and emerging regions. Technological advancements including power-assisted, laser-assisted, and radiofrequency-assisted liposuction systems are significantly enhancing procedural accuracy, reducing recovery times, and improving patient satisfaction.

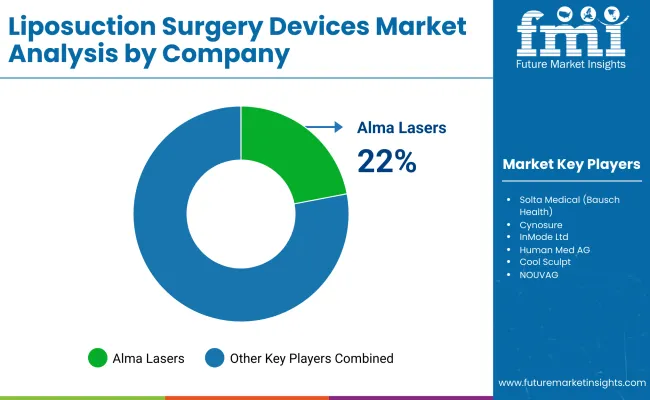

Leading manufacturers such as InMode Ltd., Cynosure, and Alma Lasers are actively integrating next-generation technologies aimed at streamlining surgical workflows and elevating clinical outcomes. In 2025, the liposuction surgery devices landscape is being defined by innovation-driven strategies and cross-disciplinary collaborations. Prominent companies are focusing on the development of integrated, regulatory-compliant devices tailored for precision-based body contouring.

A notable advancement includes Apyx® Medical Corporation’s received USA FDA clearance for its AYON Body Contouring System™. Designed for ultrasound-assisted liposuction and RF-based skin tightening using the proprietary Renuvion® technology, AYON enables surgeons to deliver comprehensive body contouring treatments with enhanced precision and efficiency. “AYON is designed to streamline procedures, elevate surgical precision, and ultimately deliver better outcomes for patients,” said Charlie Goodwin, President and CEO of Apyx Medical.

In North America, expansion is supported by early adoption of robotic and power-assisted liposuction systems, particularly within USA ambulatory surgical centers. Increasing utilization of AI-powered imaging and advanced fat-processing platforms, along with collaborative efforts between device manufacturers and aesthetic clinics, is further driving regional momentum.

In Europe, compliance with Medical Device Regulation (MDR) standards has catalysed innovation in RF- and laser-assisted systems. High-growth areas such as Southern Spain and the French Riviera are also benefiting from a surge in medical tourism. Additionally, the introduction of eco-friendly cannula systems and ultrasound-guided contouring devices is aligning clinical innovation with sustainability objectives.

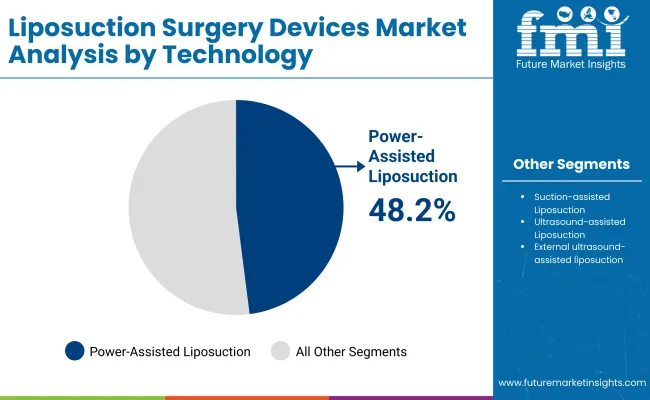

By 2025, Power-Assisted Liposuction is expected to command a 48.2% revenue share in the global market. This dominance has been attributed to its ability to deliver efficient fat removal with less physical strain on surgeons. Mechanical vibration technology is used to facilitate quicker fat disruption, leading to reduced procedure time and improved precision.

PAL devices have been widely adopted in high-volume practices due to their reliability and minimal tissue trauma. Additionally, compatibility with other techniques and user-friendly device designs have enhanced their clinical appeal. As demand for minimally invasive procedures continues to rise, the preference for PAL is being reinforced by favourable outcomes, shorter recovery times, and increasing trust among both practitioners and patients.

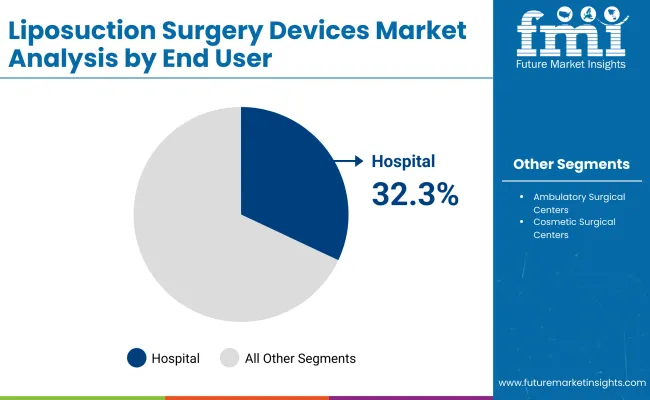

Hospitals are projected to dominate the end-user segment with an estimated 32.3% revenue share in 2025. Their leadership is attributed to the capacity to manage complex and high-risk liposuction procedures within settings equipped with advanced surgical infrastructure and multidisciplinary care teams.

Hospitals also offer access to specialized medical personnel and comprehensive post-operative care, making them the preferred venue for aesthetic surgeries requiring anesthesia or extended monitoring. With increasing investments in surgical technology and growing patient confidence in hospital-based care, this segment continues to be the primary driver of procedural volume and revenue in the global liposuction surgery devices market.

Barriers to Growth: Regulatory Hurdles, and Rising Competition from Non-Surgical Alternatives

High operational costs and the side potential effects associated with liposuction surgery devices such as the possibility of scarring, uneven fat removal, and strict regulations in cosmetic procedures affect the market for liposuction surgery devices. Given that the surgery requires highly skillful professionals, it becomes a consideration that discourages accessibility in certain regions.

Furthermore, the pattern of non-surgical fat loss measures like cryolipolysis and body contouring through RF has started to gain a foothold of late; therefore, one could suspect that this may affect the demand for liposuction. Other hindrances to market growth have factored in consumer disbelief toward post-surgery complications and long recovery times.

Emerging Opportunities: Advanced Technologies, Aesthetic Tourism, and Expanding Accessibility in Liposuction

The emergent opportunities for the market would include increased commonness for body sculpting operations for the purpose of aesthetic tourism and investment in developing new-generation liposuction devices used offices. More effective and safer approaches are currently being developed with the coming of AI-enabled treatment planning, integrations of robotics-assisted liposuction, and augmentations of hybrid liposuction technologies using combined laser and ultrasound modalities.

Growing acceptance of fat grafting and stem cell-enriched liposuction for regenerative medicine further adds to the diversity of the market. Additionally, enhanced financing options for aesthetic procedures and increasing office-based liposuction options will continue improving the accessibility of a larger audience.

Advancements in Energy-Assisted Liposuction: The changes in the body contouring industry are taking place due to some energy-assisted liposuction techniques like laser-assisted, ultrasound-assisted, and radiofrequency-assisted methods. These sophisticated technologies better ensure fat removal whilst hurting surrounding tissue to the least extent, causing lesser recovery time and increasing the level of patient satisfaction. For example, SmartLipo is laser-assisted liposuction whose liquefying effect on fat eases its extraction.

VASERlipo Is an example of ultrasound-assisted liposuction, which translates into a high-quality emulsification of fat and better outcomes. BodyTite is another example of radiofrequency-assisted liposuction; besides fat removal, it stimulates collagen deposition, which improves skin elasticity. Innovations along these lines have caused an increased demand from patients for less invasive procedures that necessitate less downtime. With progress in technology and clinical research, energy-assisted liposuction will further refine body-shaping techniques and broaden their applicability in both aesthetic and reconstructive procedures.

Growth of Non-Invasive and Hybrid Body Contouring Solutions: Accurate effective fat reduction and skin tightening solutions are sought after by the growing patient population without the fear that goes with classic surgery. Rapidly accelerating demand includes many non-invasive, hybrid body-contouring solutions-the combination methods between new liposuction types such as advanced skin-tightening technologies with tools of radiofrequency and lasers.

Cryolipolysis (CoolSculpting) HIFU, and electromagnetic muscle stimulation (EMS) are putting an additional, gradual fat loss and muscle toning benefits to liposuction. Additionally, combining surgical liposuction and minimally invasive techniques provides patients with better contouring with less downtime since these approaches allow more personalized treatment plans.

The market is expected to grow in harmony with the technological advancement clear through coupling surgical and non-surgical body sculpting techniques. It would experience an uptake in combination therapeutic modalities that address different needs and preferences of patients.

Market Outlook

There is a steady growth in the liposuction surgical devices market of the United States owing to the demand for body contouring procedures, rising incidences of obesity, and innovation in minimally invasive surgical procedures. Social media and professional guidelines towards a more minimally invasive approach to body sculpting has further accelerated the market with aesthetic procedures in high demand. USA players are much focused on enhancing the efficiencies and safety of laser-assisted liposuction (LAL), ultrasound-assisted liposuction (UAL), and power-assisted liposuction (PAL).

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

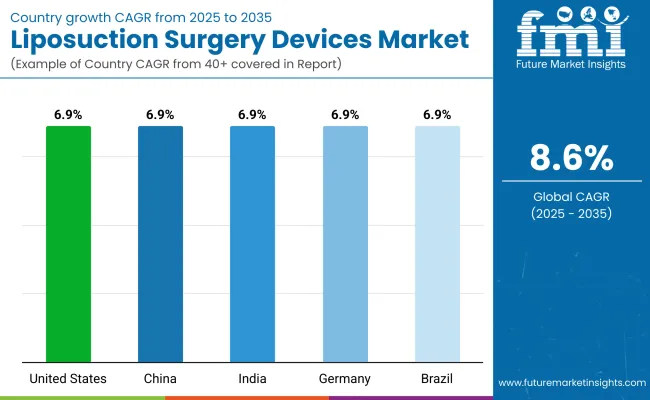

| United States | 6.9% |

Market Outlook

The Chinese market for devices that support liposuction surgery is growing rapidly due to rising available funds and an expanding aesthetic consciousness in the increasing number of cosmetic surgery clinics. With an emerging middle class consuming more on aesthetic procedures, advanced liposuction techniques are increasingly adopted. Technological advancements in body contouring devices and government support for medical tourism benefit the market as well.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.9% |

Market Outlook

With the growing number of cosmetic surgery units, viable processes for treatment procedures, and the uninterrupted influx of medical tourists, the liposuction surgery devices market in India has been on a steady incline.

The prices for aesthetic surgeries at internationally recognized hospitals are so low that they further enhance the option of India as the preferred destination for minimally invasive fat reduction procedures. There seems to be great demand for laser-assisted and tumescent liposuction techniques, which finally allow quicker recoveries and happier patients.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.9% |

Market Outlook

Germany's liposuction surgery devices market is expanding due to a strong healthcare infrastructure, increasing demand for high-quality aesthetic procedures, and the presence of globally recognized plastic surgeons. The adoption of robot-assisted liposuction techniques and integration of AI in cosmetic surgery planning are further transforming the market landscape. Additionally, the aging population seeking body rejuvenation procedures is boosting demand for non-invasive and minimally invasive liposuction treatments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.9% |

Market Outlook

Brazil is among the world's largest cosmetic surgery markets, Brazil's liposuction ranks one among the most sought-after procedures. Owing to its rich aesthetics culture, the many internationally reputed plastic surgeons practicing in Brazil, and the low prices attached to such procedures, Brazil has cornered the medical tourism market for body contouring procedures.

Furthermore, technologically advanced liposuction methods are increasingly in demand because of their precise fat-removing abilities with minimal downtime, including laser-assisted liposuction and power-assisted liposuction (PAL).

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.9% |

With the rising acceptance of minimally invasive body contouring, the industry is greatly challenged by the changing trends of laser-based and ultrasound-based liposuction technologies, coupled with the tilt of consumers themselves toward improving external beauty.

ompanies are continuously innovating suction-assisted, power-assisted, and energy-assisted liposuction devices for competitive gains within the industry. The market is influenced by large medical device companies, cosmetic surgery specialists, and new entrants into the aesthetic technology field, all of which shape the future of liposuction surgery solutions.

Alma Lasers (22-26%)

Strong in liposuction, this pioneer of laser-assisted liposuction systems bring high precision and less downtime for recovery. Among its latest technologies developed, for instance, LipoLife has made fat removal effective and skin tightening and faster recovery. With much focus on novel advances, Alma Lasers continues to raise industry standards for minimally invasive body shaping procedure.

Solta Medical (Bausch Health) (18-22%)

Solta Medical is an ultrasound-assisted liposuction company known for its VASERlipo technology. According to this technology, fat emulsification is enhanced with much more optimization because of surrounding tissues being well disengaged during the injection - this defines the use as a body-sculpting-importing choice. Grounded firmly by the views of innovation, it spurs future developments in ultrasound-based body contouring solutions while advancing its level in aesthetic medicine.

Cynosure (Hologic) (10-14%)

A leading innovator in the field of minimally invasive liposuction, Cynosure applies laser techniques for the destruction of fat and focuses on better skin tightening. The pioneer system in this regard is SmartLipo that uses laser energy to evaporate fat by liquefaction, which brings about lesser trauma and, thus faster recovery in patients. Cynosure's abundance of investment in laser aesthetics is strengthening its status as a forerunner of energy-based liposuction devices.

InMode Ltd. (8-12%)

InMode Ltd. is known for its radiofrequency-assisted liposuction (RFAL) systems, including BodyTite technology, which enables simultaneous fat reduction and skin contraction. By applying RF energy, InMode systems offer contouring with minimal to non-invasive procedures, making them appealing to patients wanting surgical alternatives. The company remains highly proactive with continual injecting into advancements of RF-based body sculpting.

Human Med AG (5-9%)

A strong competitor in water-jet assisted liposuction, Human Med AG specializes in a gentler approach to fat harvesting and body contouring. Its WAL (Water-Assisted Liposuction) technology minimizes tissue trauma while preserving fat cell viability for potential grafting applications. With a focus on patient safety and comfort, Human Med continues to refine its water-based liposuction solutions for optimal results.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Suction-assisted Liposuction, Ultrasound-assisted Liposuction, External ultrasound-assisted liposuction, Power-assisted Liposuction, Laser-assisted Liposuction, Water-assisted Liposuction, Twin Cannula-assisted Liposuction, Tumescent Liposuction, Aspirator Devices, RF-assisted Liposuction

Hospitals, Ambulatory surgical centers and Cosmetic surgical centers

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Liposuction Surgery Devices Market was USD 3,430.5 million in 2025.

The Liposuction Surgery Devices Market is expected to reach USD 7,852.7 million in 2035.

Rising Adoption of Liposuction Surgery Devices has significantly increased the demand for Liposuction Surgery Devices Market.

The top key players that drives the development of Liposuction Surgery Devices Market are Alma Lasers, Solta Medical (Bausch Health), Cynosure (Hologic), InMode Ltd. And Human Med AG

Suction-assisted Liposuction is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by End-User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by End-User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liposuction Market Insights – Growth, Demand & Forecast 2024-2034

Biosurgery Equipment Market Size and Share Forecast Outlook 2025 to 2035

Post-Surgery Skin Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Neurosurgery Surgical Power Tools Market Analysis – Growth & Forecast 2022-2032

Electrosurgery Accessories Market Size and Share Forecast Outlook 2025 to 2035

Guided Surgery Kits Market Size, Growth, and Forecast for 2025 to 2035

Electrosurgery Generators Market Analysis - Size, Share, and Forecast 2025 to 2035

Electrosurgery Devices Market Overview - Trends & Growth Forecast 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Cardiac Surgery Devices Market Analysis – Trends & Forecast 2024-2034

Cosmetic Surgery Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cataract Surgery Device Market Analysis – Growth & Forecast 2024-2034

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bariatric Surgery Device Market Insights – Growth & Forecast 2024-2034

Refractive Surgery Device Market Insights – Growth & Forecast 2024-2034

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Dental Flap Surgery Market Size and Share Forecast Outlook 2025 to 2035

Dental Microsurgery Market Overview - Trends & Forecast 2024 to 2034

Stereotactic Surgery Devices Market Insights by Product, Application, and Region through 2035

Mixed Reality Surgery Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA