Stem Cell Therapy Market Overview for 2025 to 2035

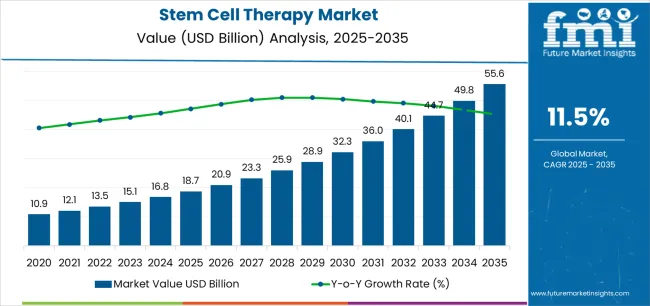

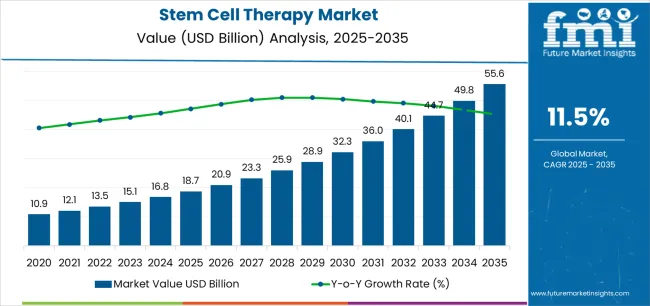

The Stem Cell Therapy Market is estimated to be valued at USD 18.7 billion in 2025 and is projected to reach USD 55.6 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

The stem cell therapy market is advancing steadily as demand for regenerative and personalized medical treatments continues to rise. Growing prevalence of chronic and degenerative diseases, coupled with technological progress in cell culture, isolation, and cryopreservation techniques, is driving adoption across global healthcare systems. Regulatory bodies are supporting research and commercialization through favorable frameworks, while public and private investments are enhancing clinical trial activity and infrastructure development.

Current market dynamics reflect increasing application of stem cell therapies in oncology, orthopedics, neurology, and cardiovascular disorders. The future outlook remains strong, with expanding treatment approvals and ongoing innovation in allogeneic and autologous platforms.

Growth rationale is anchored in the therapy’s proven ability to accelerate tissue repair, modulate immune response, and reduce treatment recovery time Rising awareness, improved logistics for stem cell storage and transport, and growing collaboration between biopharmaceutical companies and research institutions are expected to further strengthen global market expansion over the coming years.

Quick Stats for Stem Cell Therapy Market

- Stem Cell Therapy Market Industry Value (2025): USD 18.7 billion

- Stem Cell Therapy Market Forecast Value (2035): USD 55.6 billion

- Stem Cell Therapy Market Forecast CAGR: 11.5%

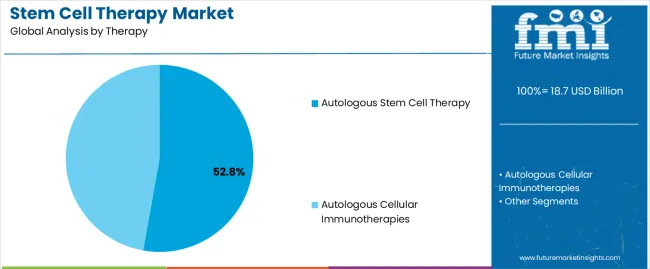

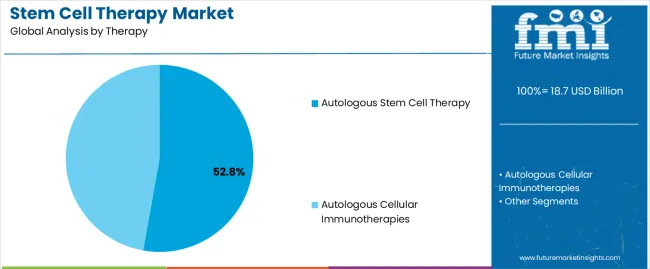

- Leading Segment in Stem Cell Therapy Market in 2025: Autologous Stem Cell Therapy (52.8%)

- Key Growth Region in Stem Cell Therapy Market: North America, Asia-Pacific, Europe

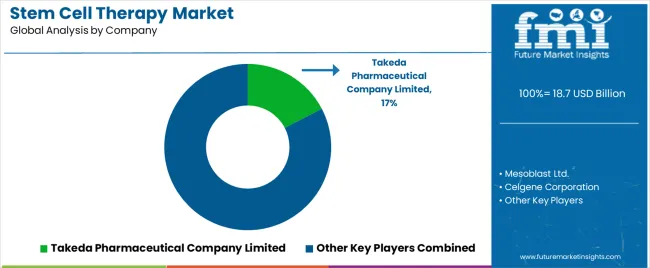

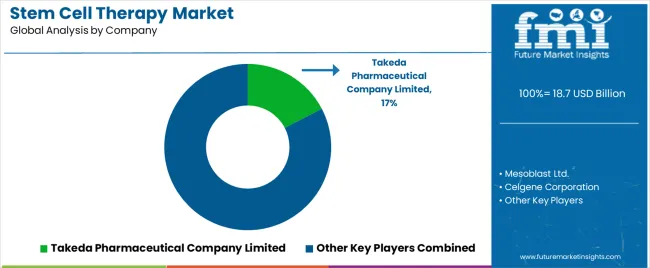

- Top Key Players in Stem Cell Therapy Market: Takeda Pharmaceutical Company Limited, Mesoblast Ltd., Celgene Corporation, Athersys, Inc., Osiris Therapeutics, Inc., Pluristem Therapeutics, Inc., Vericel Corporation, NuVasive, Inc., BrainStorm Cell Therapeutics, Inc., Cynata Therapeutics Limited, ReNeuron Group plc, Regeneus Ltd., StemCells Inc., Cytori Therapeutics, Inc., Pharmicell Co., Ltd.

| Metric |

Value |

| Stem Cell Therapy Market Estimated Value in (2025 E) |

USD 18.7 billion |

| Stem Cell Therapy Market Forecast Value in (2035 F) |

USD 55.6 billion |

| Forecast CAGR (2025 to 2035) |

11.5% |

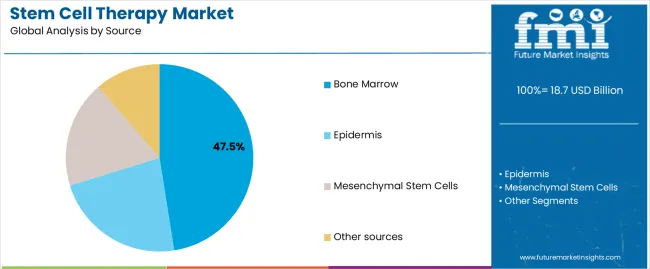

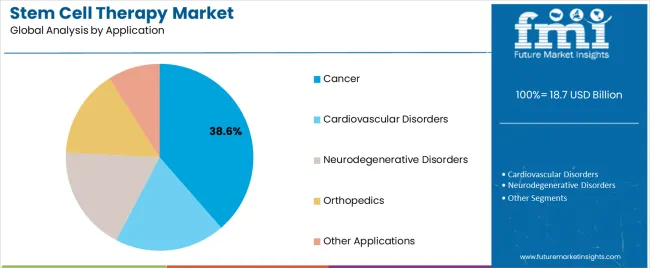

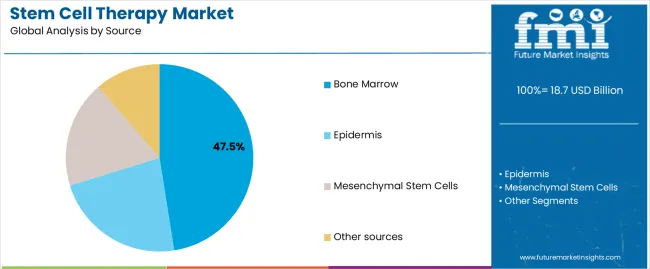

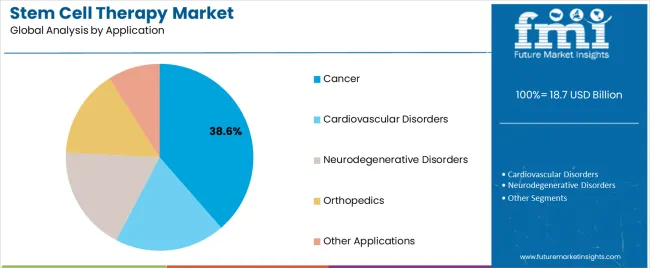

Segmental Analysis

The market is segmented by Therapy, Source, Application, and End Use and region. By Therapy, the market is divided into Autologous Stem Cell Therapy and Autologous Cellular Immunotherapies. In terms of Source, the market is classified into Bone Marrow, Epidermis, Mesenchymal Stem Cells, and Other sources. Based on Application, the market is segmented into Cancer, Cardiovascular Disorders, Neurodegenerative Disorders, Orthopedics, and Other Applications. By End Use, the market is divided into Hospitals & Clinics, Ambulatory Surgical Centers, Research Centers, and Other End-Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Therapy Segment

The autologous stem cell therapy segment, representing 52.80% of the therapy category, has maintained dominance due to its reduced risk of immune rejection and favorable safety profile. Demand has been reinforced by advancements in patient-derived stem cell processing, enabling higher precision in treatment outcomes.

Adoption has been driven by the therapy’s effectiveness in regenerative medicine and its compatibility across diverse medical applications. Regulatory acceptance and ongoing clinical validation have further strengthened confidence among healthcare providers.

Additionally, the therapy’s use in treating orthopedic, neurological, and cardiovascular disorders has enhanced its market footprint Continuous improvements in cell harvesting and culture technologies, along with patient-specific therapeutic customization, are expected to sustain segment leadership and support long-term adoption across both developed and emerging healthcare markets.

Insights into the Source Segment

The bone marrow segment, holding 47.50% of the source category, has been leading the market due to its established clinical reliability and proven therapeutic outcomes. It remains the most widely utilized source for stem cells owing to its ability to generate multiple cell types and support hematopoietic regeneration.

Widespread clinical use, well-defined extraction protocols, and regulatory standardization have reinforced its market dominance. Recent technological innovations in bone marrow aspiration and cell purification have improved efficiency and minimized procedural risks.

The segment’s growth is further supported by the increasing number of transplants and ongoing clinical trials exploring novel regenerative applications These factors collectively ensure continued preference for bone marrow as a primary source of stem cells, maintaining its strategic importance within the global market landscape.

Insights into the Application Segment

The cancer segment, accounting for 38.60% of the application category, has emerged as the leading therapeutic area due to growing demand for regenerative and immune-modulating treatments in oncology. Stem cell therapies are being increasingly utilized for hematologic malignancies and in supportive care post-chemotherapy to restore bone marrow function.

Rising cancer incidence rates globally and a shift toward targeted, patient-specific treatments are propelling segment expansion. Integration of stem cell therapy within multimodal cancer treatment protocols has enhanced clinical outcomes and survival rates.

Favorable reimbursement frameworks, expanding clinical research, and the availability of advanced treatment centers are further strengthening adoption With continued innovation in cellular reprogramming and immune engineering, the cancer segment is expected to remain a key driver of growth within the stem cell therapy market.

Stem Cell Therapy Market Size, Analysis, and Insights

- Rising prevalence of chronic diseases, such as cancer and diabetes, has been on the rise in recent years.

- Stem cell therapy offers a promising solution to repair damaged tissues and organs, making it an attractive treatment option for patients suffering from chronic diseases.

- The field of stem cell research has made significant advancements in recent years, leading to the development of new and innovative stem cell therapies.

- These therapies have shown promising results in clinical trials, leading to increased interest and demand for stem cell therapy.

- Governments and private organizations are investing heavily in stem cell research, leading to the development of new and innovative stem cell therapies.

- The investment is driving the growth of the stem cell therapy market, making it more accessible to patients.

- The regulatory environment for stem cell therapy has been favorable in recent years, making it easier for companies to develop and market stem cell therapies.

- The regulations lead to an increase in the number of companies offering stem cell therapy services, leading to increased competition and lower prices.

- Patients are becoming more aware of the benefits of stem cell therapy and are increasingly seeking out this treatment option.

- The innovative treatment options driving the growth of the stem cell therapy market, making it one of the fastest-growing segments in the healthcare industry

Key Opportunities in the Stem Cell Therapy Market

- Investments in research and development are expected to create significant opportunities during the forecast period.

- Companies that invest heavily in research and development can also benefit from favorable regulatory environments and government funding for stem cell research.

- The expansion of stem cell therapy services presents significant market opportunities for companies operating in the healthcare industry.

- The market expansion is expected to help companies capture a larger profit share and attract new customers.

- Collaborations and partnerships between companies operating in the market are likely to help them leverage each other's strengths, boosting market penetration.

- Companies are expected to collaborate on research and development, marketing, and distribution to gain a competitive advantage.

- The development of personalized medicine presents significant opportunities for companies operating in the stem cell therapy market.

- Stem cell therapy can be used to develop personalized treatments for patients, generating significant growth opportunities for companies operating in the market.

Challenges in the Stem Cell Therapy Market

- Limited understanding of the mechanisms of action of stem cell therapies, makes it difficult to predict their efficacy and the associated potential risks.

- There is also a lack of long-term data on the safety and efficacy of stem cell therapies, which makes it challenging to evaluate their long-term effects on patients.

- The high cost of stem cell therapies also restricts market growth. The high cost of research and development, as well as the strict regulatory requirements, have resulted in high prices for stem cell therapies.

- The market is highly competitive, with a large number of players offering similar treatments.

- Competition makes it difficult for new entrants to gain a foothold in the market and compete against established players.

- Lack of awareness and understanding among patients and healthcare providers about stem cell therapies also inhibits market growth.

- Misunderstanding among patients results in limited adoption of these treatments despite their potential to address unmet medical needs.

Category-wise Insights

In terms of Therapy, the Autologous Cellular Immunotherapies Segment Leads the Market Growth

| Attributes |

Details |

| Top Therapy |

Autologous Cellular Immunotherapies |

| CAGR (2025 to 2035) |

11.8% |

- Rising prevalence of chronic diseases, increasing healthcare expenditure, and growing research and development initiatives for innovative therapeutic solutions are expected to drive the segment’s growth.

- The growing preference for non-invasive and cost-effective therapeutic options is driving the demand for autologous cellular immunotherapies, as they offer a minimally invasive alternative to traditional treatments such as chemotherapy and radiation therapy.

- Increasing number of clinical trials and collaborations between research institutes and pharmaceutical companies

- Developing innovative stem cell therapies is propelling the growth of autologous cellular immunotherapies.

In terms of Source, the Bone Marrow Segment is dominating the Market

| Attributes |

Details |

| Top Source |

Bone Marrow |

| CAGR (2025 to 2035) |

11.6% |

- Widespread availability, proven clinical efficacy, and versatile applications in the treatment of a variety of medical conditions such as blood disorders, immune system disorders, and certain types of cancer.

- Increasing prevalence of blood disorders such as leukemia, lymphoma, and sickle cell anemia is driving the demand for bone marrow stem cell therapy.

- Growing number of successful bone marrow transplants and the increasing adoption of stem cell therapies in clinical practice is further fueling the growth of the bone marrow segment.

Country-wise insights

| Countries |

CAGR through 2035 |

| United States |

12.3% |

| United Kingdom |

13.3% |

| China |

12.8% |

| Japan |

13.7% |

| South Korea |

14.0% |

Presence of Advanced Healthcare Infrastructure in the United States

- Rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, and the growing need for innovative therapeutic solutions in the United States.

- Increasing healthcare expenditure, a growing geriatric population, and favorable reimbursement policies are also driving the demand for stem cell therapy in the country.

- The United States is home to several leading pharmaceutical and biotech companies that are investing heavily in research and development initiatives for developing innovative stem cell therapies.

- The presence of advanced healthcare infrastructure and a well-established regulatory framework for stem cell therapy is also propelling the growth of the market in the country.

- Increasing number of clinical trials and collaborations between research institutes and pharmaceutical companies aimed at exploring the therapeutic potential of stem cells for a range of medical conditions is further boosting the demand for stem cell therapy in the United States.

Increasing Number of Stem Cell Research Initiatives and Clinical Trials in the United Kingdom

- Favourable regulatory environment for stem cell therapy, robust healthcare infrastructure, and increasing collaborations between academia and the industry are driving the growth of the market in the United Kingdom.

- The United Kingdom has a well-established National Health Service (NHS) that provides universal access to healthcare, including stem cell therapy, to its citizens.

- Increasing number of stem cell research initiatives and clinical trials aimed at developing innovative therapeutic solutions for medical conditions such as cancer, heart disease, and neurological disorders are also contributing to the growth of the market in the United Kingdom.

- The availability of advanced technologies for the isolation, purification, and expansion of stem cells, as well as the increasing adoption of stem cell therapy in clinical practice, is further propelling the growth of the market in the country.

Availability of Cost-Effective and High-Quality Treatment Options in China

- The large population of the country, particularly the aging population, is driving the demand for stem cell therapies.

- China has emerged as a leading destination for stem cell therapy owing to the availability of cost-effective and high-quality treatment options, as well as the presence of advanced healthcare infrastructure and a well-established regulatory framework for stem cell therapy.

- The Chinese government has been actively promoting the development of stem cell therapy by providing funding support and favorable regulations to researchers and pharmaceutical companies.

- The stem cell therapy market in China is expected to witness significant growth over the coming years, transforming the country’s healthcare landscape.

Japanese Government has Been Actively Promoting the Development of Stem Cell Therapy

- Japan has been at the forefront of stem cell research and development, with several leading pharmaceutical and biotech companies investing heavily in the development of innovative stem cell therapies.

- The Japanese government has been actively promoting the development of stem cell therapy by providing funding support and favorable regulations to researchers and pharmaceutical companies.

- The availability of advanced technologies for the isolation, purification, and expansion of stem cells, as well as the increasing adoption of stem cell therapy in clinical practice, is further propelling the growth of the market in Japan.

South Korea Has a Strong Reputation for Medical Tourism

- Availability of cost-effective and high-quality treatment options, as well as the presence of advanced healthcare infrastructure and a well-established regulatory framework for stem cell therapy in South Korea.

- South Korea has a strong reputation for medical tourism, with patients from around the world seeking cost-effective and high-quality stem cell therapy options, fueling the growth of the market.

Competitive Landscape

The market is highly competitive due to the presence of several leading pharmaceutical and biotech companies. It is characterized by intense competition, rapid technological advancements, and a high degree of research and development activities aimed at developing innovative stem cell therapies. Companies are investing heavily in research and development initiatives aimed at developing novel stem cell therapies for a range of medical conditions.

Recent Development in the Stem Cell Therapy Market

In 2024, Cipla and Stempeutics formed a strategic collaboration to introduce Stempucel, a groundbreaking stem cell therapy for the treatment of critical limb ischemia. The collaboration is aimed at capitalizing on the growing demand for stem cell therapies and expanding their market share in this rapidly evolving field. The launch of Stempucel is expected to revolutionize the treatment of critical limb ischemia, a debilitating condition that affects millions of people worldwide.

Key Market Players

- Mesoblast Ltd.

- Celgene Corporation

- Athersys, Inc.

- Osiris Therapeutics, Inc.

- Pluristem Therapeutics, Inc.

- Vericel Corporation

- NuVasive, Inc.

- BrainStorm Cell Therapeutics, Inc.

- Takeda Pharmaceutical Company Limited

- Cynata Therapeutics Limited

- ReNeuron Group plc

- Regeneus Ltd.

- StemCells Inc.

- Cytori Therapeutics, Inc.

- Pharmicell Co., Ltd.

Key Coverage in the Stem Cell Therapy Market Report

- Cell-Based Therapy Market Report

- Embryonic Stem Cell Therapy Industry Analysis

- Stem Cell Therapy Sales Assessment

- Stem Cell Transplant Market Overview

- Allogeneic Stem Cell Therapy Pricing Outlook

Key Market Segmentation

By Therapy:

- Autologous Cellular Immunotherapies

- Autologous Stem Cell Therapy

By Source:

- Bone Marrow

- Epidermis

- Mesenchymal Stem Cells

- Other sources

By Application:

- Cancer

- Cardiovascular Disorders

- Neurodegenerative Disorders

- Orthopedics

- Other Applications

By End Use:

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Research Centers

- Other End-Users

By Region:

- North America

- Latin America

- East Asia

- South Asia

- Europe

- Oceania

- MEA

Frequently Asked Questions

How big is the stem cell therapy market in 2025?

The global stem cell therapy market is estimated to be valued at USD 18.7 billion in 2025.

What will be the size of stem cell therapy market in 2035?

The market size for the stem cell therapy market is projected to reach USD 55.6 billion by 2035.

How much will be the stem cell therapy market growth between 2025 and 2035?

The stem cell therapy market is expected to grow at a 11.5% CAGR between 2025 and 2035.

What are the key product types in the stem cell therapy market?

The key product types in stem cell therapy market are autologous stem cell therapy and autologous cellular immunotherapies.

Which source segment to contribute significant share in the stem cell therapy market in 2025?

In terms of source, bone marrow segment to command 47.5% share in the stem cell therapy market in 2025.