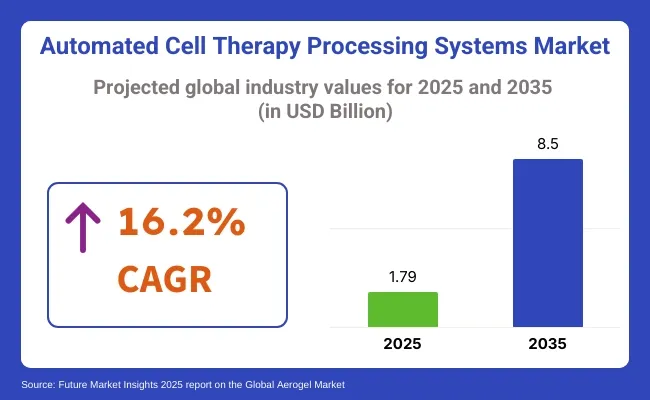

The global Automated Cell Therapy Processing Systems Market is projected to be valued at USD 1.79 billion in 2025 and is expected to reach USD 8.5 billion by 2035, registering a CAGR of 16.2% during the forecast period. This expansion is driven by the escalating demand for personalized medicine, particularly in treating chronic diseases such as cancer and autoimmune disorders.

The adoption of automated and closed systems enhances manufacturing efficiency, reduces contamination risks, and ensures compliance with Good Manufacturing Practices (GMP), thereby improving product quality and scalability. Technological advancements, including the integration of artificial intelligence and machine learning, are further streamlining cell therapy processes, leading to cost reductions and increased throughput.

Moreover, supportive regulatory frameworks and increased investments in cell and gene therapy research are fostering innovation and accelerating market growth. These factors collectively position the market for sustained expansion over the next decade.

Prominent manufacturers in this market include Thermo Fisher Scientific, Miltenyi Biotec, Lonza, Fresenius Kabi, and Cellares. These companies are actively investing in research and development to introduce advanced processing systems that enhance efficiency and scalability in cell therapy manufacturing.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1.79 Billion |

| Market Value (2035F) | USD 8.5 billion |

| CAGR (2025 to 2035) | 16.2% |

In January 2025, CPC (Colder Products Company) launched the MicroCNX™ Nano Connector, a sterile, small-format connector designed to improve the safety and efficiency of cell and gene therapy processing. Troy Ostreng, Senior Product Manager for CPC's biopharmaceutical business, said "Now, CGT processing assemblies that include the MicroCNX Nano connectors will allow users to easily click together the connector halves to create a sterile flow path. This is a major advancement for CGT applications."

In North America, market growth has been predominantly driven by robust investments in cell and gene therapy manufacturing capabilities. Adoption of automated and closed processing systems has been accelerated by the presence of leading biotech firms and favourable regulatory support from agencies such as the FDA, and reduced error rates. Government funding and incentives have further supported the widespread deployment of closed-system solutions across clinical trials sites and CDMO’s.

In Europe, strong adoption of Automated Cell Therapy Processing Systems has been facilitated by increasing demand for scalable CGT solutions and strict regulatory compliance under EMA guidelines. Investments have been funnelled into R&D and cleanroom automation, particularly in Germany, the UK, and the Netherlands. Funding support from regional health authorities and innovation councils has been extended to strengthen infrastructure. Rising focus on decentralized manufacturing and reduced contamination risks has reinforced the shift toward closed-loop processing technologies.

The non-stem cell therapy segment has been observed to hold the largest market share, accounting for approximately 42.1% of total revenue in 2025. This dominance has been driven by the increasing application of CAR-T and T-cell therapies in oncology, which require scalable, sterile, and automated platforms for consistent processing.

Greater clinical success rates and rapid commercialization potential have contributed to the segment’s prominence. Regulatory approvals and funding have also been directed more heavily toward non-stem cell-based products due to their therapeutic precision. Additionally, closed processing systems have been increasingly adopted to support the complex handling requirements of immune-based therapies, enhancing process efficiency and reducing contamination risks, thereby reinforcing the segment’s growth trajectory.

The pre-commercial/R&D scale segment has captured a revenue share of approximately 74.0% in 2025, primarily due to its extensive use in early-phase clinical trials and translational research. A surge in investigational cell therapy programs has led to increased deployment of closed and automated systems at small-scale facilities.

Process optimization and proof-of-concept validations have been prioritized, requiring flexible, modular systems for iterative testing. As regulatory bodies emphasize data integrity and reproducibility, automation has been adopted to ensure standardized procedures during development. Moreover, academic institutions and biotech start-ups have increasingly relied on these systems to accelerate time-to-clinic, positioning this segment as the foundation of market innovation and pipeline expansion.

High Capital Investment and Technological Complexity

Automated and closed cell therapy processing systems implementation involves considerable capital investment, which poses a hindrance to small and emerging biotech companies. Moving from manual to automated workflows requires top-of-the-line robotics, AI-assisted monitoring, and real-time control of processes, for which the upfront costs and technical complexity can be high. The challenge of ensuring adherence to evolving regulatory standards for Advanced Therapy Medicinal Products (ATMPs) also makes things more complicated. To address these challenges, companies are building modular and scalable automation solutions, enabling a gradual implementation without interfering with productive workflows already in place in factories.

Increasing Adoption of AI and Robotics in Cell Therapy Manufacturing

Cell therapy processing is being transformed by AI, robotics and real-time analytics, allowing for greater precision, less variability and more scalability. With the ability of AI to streamline processes, predictive analytics, automated quality controls, and real-time monitoring of critical variables, it is able to greatly enhance manufacturing efficiency. Robotic-driven closed systems increase sterility assurance, reduce contamination risk, and enable consistency across large batches. With the increased demand for automated and high-throughput cell therapy manufacturing, businesses that invest in, AI-driven automation, cloud-based bioprocessing platforms, and intelligent monitoring systems will be well-positioned for a competitive advantage in the changing market.

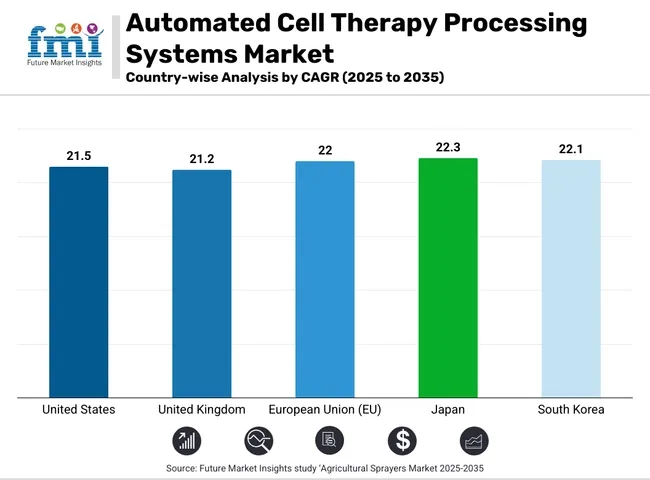

The United States dominates the automated and closed cell therapy processing systems market owing to the strong biotechnology and pharmaceutical industries in the region. Growing interest in regenerative medicine and personalized therapies increases the need for cell processing automation to aid biotechnology companies in their endeavor. Moreover, the presence of several players in the industry, in addition to the high investments in cell therapy research, would further aid in the growth of the market. Similarly, favorable regulations from organizations like the FDA facilitate the transition toward closed systems in clinical and commercial applications to boost compliance and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 21.5% |

The United Kingdom market is experiencing growth owing to the increasing government funds for cell therapy research and innovations in bioprocessing technology. An increasing number of biotech companies and research institutes are contributing to innovations in the field of automated cell processing solutions. Closed systems can be monitored in real time to ensure they meet strict regulatory requirements, ultimately leading to increased reliability and scalability of processes. Demand for platforms to manufacture cell therapy is rapidly increasing across the nation as personal medicine and immunotherapy become increasingly prevalent.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 21.2% |

Market in European Union growing at a considerable pace, owing to rising adoption of automated and closed systems used in cell therapy manufacturing Germany, France, and Belgium are notable contributors, thanks to strong biotech ecosystems and government-backed initiatives. Growing prevalence of chronic diseases and subsequent demand for advanced regenerative medicine solutions drive demand for automated processing platforms. The European Medicines Agency (EMA) is stringent with quality control measures and this, in turn, is predicted to drive the use of closed cell therapy processing systems in the region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 22.0% |

The established pharmaceutical industry in Japan and the country’s strong emphasis on regenerative medicine are expected to contribute to the growing adoption of automated and closed cell therapy processing systems. The aforementioned regulatory regime promotes innovation of biopharmaceuticals in the country with a focus on automating cell therapy manufacturing for improving precision and efficiency. Intensifying collaborations between academic research institutions and biotech firms propelling technology innovations make Japan an important market for automated cell therapy processing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 22.3% |

Rapid development of biotechnology and stem cell research propelled South Korea as one of the largest markets for automated and closed cell therapy processing system. Cell and gene therapy investment is actively promoted by the government, leading to the development of new automation solutions. The country’s advanced manufacturing infrastructure and rising adoption of personalized medicine further drive up market demand. With biopharmaceutical companies ramping up production, the demand for efficient closed processing systems is on the upswing.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 22.1% |

Cell therapy processing automated and closed cell therapy processing system is a herding step of cell therapy generation. To improve cell viability, sterility, and therapy standardization, companies are investing in automated bioprocessing, closed-system scalability, and real-time quality control solutions. Market competitiveness is fueled by novel GMP-compliant automation, AI-driven bioprocess monitoring, and single-use bioreactor innovations.

The overall market size for the Automated & Closed Cell Therapy Processing System Market was USD 1.79 Billion in 2025.

The Automated & Closed Cell Therapy Processing System Market is expected to reach USD 8.5 billion in 2035.

The demand is driven by increasing adoption of cell and gene therapies, the need for contamination-free processing, rising regulatory compliance requirements, and advancements in automation to enhance efficiency and scalability.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

Stem Cell Therapy segment is expected to lead in the Automated & Closed Cell Therapy Processing System Market

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 4: Global Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 5: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 6: North America Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 7: North America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 8: North America Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 9: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: Latin America Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 11: Latin America Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 12: Latin America Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 13: Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 14: Europe Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 15: Europe Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 16: Europe Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 17: South Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: South Asia Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 19: South Asia Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 20: South Asia Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 21: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 22: East Asia Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 23: East Asia Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 24: East Asia Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 25: Oceania Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Oceania Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 27: Oceania Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 28: Oceania Market Value (USD Million) Forecast by Scale, 2020 to 2035

Table 29: MEA Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 30: MEA Market Value (USD Million) Forecast by Workflow, 2020 to 2035

Table 31: MEA Market Value (USD Million) Forecast by Type, 2020 to 2035

Table 32: MEA Market Value (USD Million) Forecast by Scale, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Workflow, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Type, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Scale, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 8: Global Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 9: Global Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 10: Global Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 11: Global Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 14: Global Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 17: Global Market Attractiveness by Workflow, 2025 to 2035

Figure 18: Global Market Attractiveness by Type, 2025 to 2035

Figure 19: Global Market Attractiveness by Scale, 2025 to 2035

Figure 20: Global Market Attractiveness by Region, 2025 to 2035

Figure 21: North America Market Value (USD Million) by Workflow, 2025 to 2035

Figure 22: North America Market Value (USD Million) by Type, 2025 to 2035

Figure 23: North America Market Value (USD Million) by Scale, 2025 to 2035

Figure 24: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 25: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 28: North America Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 29: North America Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 30: North America Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 31: North America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 32: North America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 34: North America Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 37: North America Market Attractiveness by Workflow, 2025 to 2035

Figure 38: North America Market Attractiveness by Type, 2025 to 2035

Figure 39: North America Market Attractiveness by Scale, 2025 to 2035

Figure 40: North America Market Attractiveness by Country, 2025 to 2035

Figure 41: Latin America Market Value (USD Million) by Workflow, 2025 to 2035

Figure 42: Latin America Market Value (USD Million) by Type, 2025 to 2035

Figure 43: Latin America Market Value (USD Million) by Scale, 2025 to 2035

Figure 44: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 45: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 48: Latin America Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 54: Latin America Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 57: Latin America Market Attractiveness by Workflow, 2025 to 2035

Figure 58: Latin America Market Attractiveness by Type, 2025 to 2035

Figure 59: Latin America Market Attractiveness by Scale, 2025 to 2035

Figure 60: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 61: Europe Market Value (USD Million) by Workflow, 2025 to 2035

Figure 62: Europe Market Value (USD Million) by Type, 2025 to 2035

Figure 63: Europe Market Value (USD Million) by Scale, 2025 to 2035

Figure 64: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 65: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 68: Europe Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 69: Europe Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 71: Europe Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 72: Europe Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 74: Europe Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 75: Europe Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 77: Europe Market Attractiveness by Workflow, 2025 to 2035

Figure 78: Europe Market Attractiveness by Type, 2025 to 2035

Figure 79: Europe Market Attractiveness by Scale, 2025 to 2035

Figure 80: Europe Market Attractiveness by Country, 2025 to 2035

Figure 81: South Asia Market Value (USD Million) by Workflow, 2025 to 2035

Figure 82: South Asia Market Value (USD Million) by Type, 2025 to 2035

Figure 83: South Asia Market Value (USD Million) by Scale, 2025 to 2035

Figure 84: South Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 85: South Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 88: South Asia Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 91: South Asia Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 94: South Asia Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 97: South Asia Market Attractiveness by Workflow, 2025 to 2035

Figure 98: South Asia Market Attractiveness by Type, 2025 to 2035

Figure 99: South Asia Market Attractiveness by Scale, 2025 to 2035

Figure 100: South Asia Market Attractiveness by Country, 2025 to 2035

Figure 101: East Asia Market Value (USD Million) by Workflow, 2025 to 2035

Figure 102: East Asia Market Value (USD Million) by Type, 2025 to 2035

Figure 103: East Asia Market Value (USD Million) by Scale, 2025 to 2035

Figure 104: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 105: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 108: East Asia Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 111: East Asia Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 114: East Asia Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 117: East Asia Market Attractiveness by Workflow, 2025 to 2035

Figure 118: East Asia Market Attractiveness by Type, 2025 to 2035

Figure 119: East Asia Market Attractiveness by Scale, 2025 to 2035

Figure 120: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 121: Oceania Market Value (USD Million) by Workflow, 2025 to 2035

Figure 122: Oceania Market Value (USD Million) by Type, 2025 to 2035

Figure 123: Oceania Market Value (USD Million) by Scale, 2025 to 2035

Figure 124: Oceania Market Value (USD Million) by Country, 2025 to 2035

Figure 125: Oceania Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 128: Oceania Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 131: Oceania Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 134: Oceania Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 137: Oceania Market Attractiveness by Workflow, 2025 to 2035

Figure 138: Oceania Market Attractiveness by Type, 2025 to 2035

Figure 139: Oceania Market Attractiveness by Scale, 2025 to 2035

Figure 140: Oceania Market Attractiveness by Country, 2025 to 2035

Figure 141: MEA Market Value (USD Million) by Workflow, 2025 to 2035

Figure 142: MEA Market Value (USD Million) by Type, 2025 to 2035

Figure 143: MEA Market Value (USD Million) by Scale, 2025 to 2035

Figure 144: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 145: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 148: MEA Market Value (USD Million) Analysis by Workflow, 2020 to 2035

Figure 149: MEA Market Value Share (%) and BPS Analysis by Workflow, 2025 to 2035

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Workflow, 2025 to 2035

Figure 151: MEA Market Value (USD Million) Analysis by Type, 2020 to 2035

Figure 152: MEA Market Value Share (%) and BPS Analysis by Type, 2025 to 2035

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Type, 2025 to 2035

Figure 154: MEA Market Value (USD Million) Analysis by Scale, 2020 to 2035

Figure 155: MEA Market Value Share (%) and BPS Analysis by Scale, 2025 to 2035

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Scale, 2025 to 2035

Figure 157: MEA Market Attractiveness by Workflow, 2025 to 2035

Figure 158: MEA Market Attractiveness by Type, 2025 to 2035

Figure 159: MEA Market Attractiveness by Scale, 2025 to 2035

Figure 160: MEA Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Centrifuge System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA