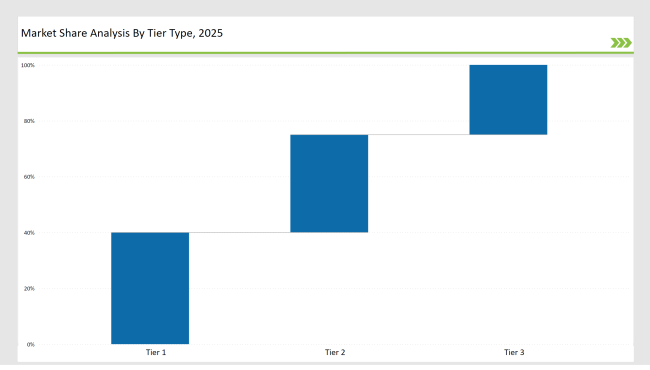

The global automated poly bagging machines market is highly segmented and competitive, classified into Tier 1, Tier 2, and Tier 3 based on market presence and strategies. The leading players, Autobag (Sealed Air), Sharp Packaging Systems, and PAC Machinery, dominate as Tier 1 companies, commanding over 40% of the market share.

These companies excel by leveraging economies of scale, innovative automation, and global distribution networks. With a strong emphasis on sustainability and smart packaging technologies, Tier 1 players continue to strengthen their market leadership.

Tier 2 players, such as Pregis, Rennco, and Audion Packaging Machines, represent around 35% of the global market share. These companies target medium-sized enterprises, focusing on cost-effective and highly customizable packaging solutions. Their strengths lie in enhancing operational efficiency and offering industry-specific solutions.

Tier 3 players, including regional manufacturers, startups, and private labels, contribute 25% to the global market share. These smaller players cater to niche markets, specializing in eco-friendly, lightweight, and high-speed automation solutions. Despite limited resources, Tier 3 players bring agility and adaptability, addressing market gaps with innovative solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Autobag, Sharp Packaging Systems, PAC Machinery) | 20% |

| Rest of Top 5 (Pregis, Rennco) | 12% |

| Next 5 of Top 10 (Audion Packaging Machines, Smipack, Arpac, Combi Packaging Systems, ProMach) | 8% |

The Automated Poly Bagging Machines Market is segmented based on its key end-use industries:

To meet industry demands, vendors offer a diverse range of solutions:

Throughout the year, industry leaders made significant strides in advancing the Automated Poly Bagging Machines Market. Autobag, Sharp Packaging Systems, PAC Machinery, Pregis, and Rennco played pivotal roles by launching sustainable solutions, investing in technology, and expanding market reach. The focus on IoT-enabled products, recyclable materials, and operational efficiency has driven the market forward.

The emergence of AI-driven automation and biodegradable packaging highlights the industry's move toward sustainability. These strategic developments have strengthened global supply chains, offering enhanced efficiency and compliance with environmental standards. Moving forward, the industry is set for further growth with continued advancements in automation, material innovation, and smart logistics solutions.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Autobag (Sealed Air), Sharp Packaging Systems, PAC Machinery |

| Tier 2 | Pregis, Rennco, Audion Packaging Machines |

| Tier 3 | Smipack, Arpac, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Autobag (Sealed Air) | In March 2024, launched AI-powered automated bagging lines for e-commerce fulfillment. |

| Sharp Packaging Systems | In April 2024, introduced high-speed biodegradable bagging solutions for retail. |

| PAC Machinery | In May 2024, developed real-time IoT-enabled bagging equipment for logistics companies. |

| Pregis | In July 2024, expanded paper-based poly bag alternatives, reducing single-use plastic dependency. |

| Rennco | In August 2024, introduced customizable heat-sealable poly bags for industrial applications. |

| Smipack | In September 2024, launched high-speed automated shrink-wrapping solutions to enhance packaging. |

| Arpac | In October 2024, developed durable and high-performance bagging systems for industrial use. |

| Combi Packaging Systems | In November 2024, introduced customizable, integrated bagging solutions for diverse industries. |

The future of Automated Poly Bagging Machines lies in smart automation, IoT-driven monitoring, and sustainability initiatives. Innovations such as robotic-assisted bagging stations and predictive maintenance algorithms will reduce operational costs while increasing packaging efficiency. The push for biodegradable and recyclable poly bags will further shape industry advancements, ensuring regulatory compliance and market growth.

Leading manufacturers include Autobag (Sealed Air), Sharp Packaging Systems, PAC Machinery, Pregis, Rennco, Smipack, Arpac, and Combi Packaging Systems.

The top 10 players collectively account for approximately 40% of the global market.

Market concentration is classified as medium, with top players holding between 30-60% of the total market share. This indicates a competitive yet somewhat consolidated market.

Tier-3 companies, including startups and regional manufacturers, contribute about 25% of the market by offering niche and localized packaging solutions that address specific customer needs.

Innovation in this sector is driven by advancements in AI-driven automation, IoT-enabled monitoring systems, and the rising demand for sustainable, recyclable, and biodegradable packaging solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Poly Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Wicketed Bagging Machines Market

Competitive Overview of Automated Tray Fill and Seal Machines Companies

Market Positioning & Share in the Polyamide Industry

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Polybutene-1 Manufacturers

Industry Share Analysis for Polywoven Bag Companies

Market Share Insights of Bagging Machine Providers

Industry Share Analysis for Polyester Straps Companies

Wicketed Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Tea Polyphenols Suppliers

Industry Share Analysis for Polycoated Cup Stock Companies

Market Share Insights of Polycoated Packaging Providers

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Polyurethane Dispersions Manufacturers

Competitive Overview of Polycoated Paper Packaging Market Share

Key Companies & Market Share in the Laminating Machines Sector

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Market Share Distribution Among Tray Former Machines Manufacturers

Industry Share & Competitive Positioning in Tray Sealer Machines

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA