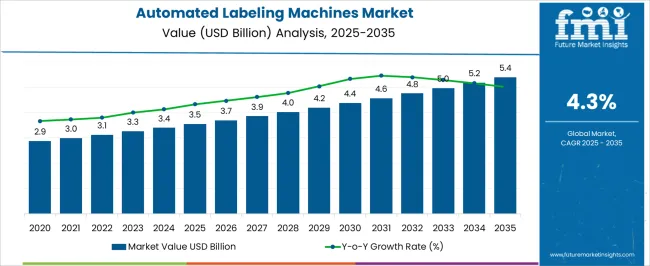

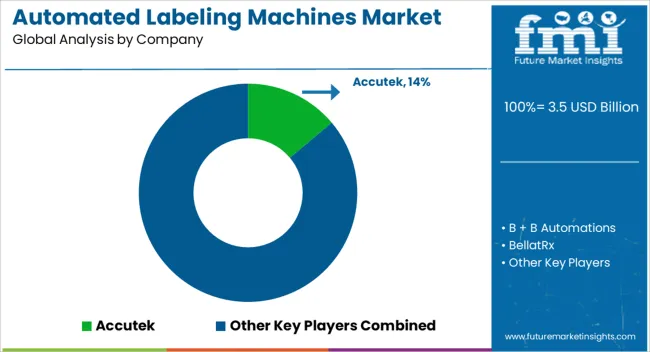

The automated labeling machines market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. The primary cost components include high-precision mechanical parts, motors, sensors, control systems, and labeling software, all of which contribute significantly to the overall capital expenditure of labeling solutions. The value chain is further impacted by research and development expenses aimed at enhancing speed, accuracy, and adaptability to different product formats.

Suppliers of mechanical components and electronic modules form a critical upstream segment, with consistent procurement quality directly affecting machine reliability and performance. System integrators and manufacturers assemble these components into fully automated units, often incorporating proprietary software for synchronization, monitoring, and error reduction. Downstream, distributors, OEM partnerships, and service providers ensure deployment, maintenance, and upgrades, which constitute recurring revenue streams and influence total operational costs. The incremental market growth from USD 3.5 billion in 2025 to USD 5.4 billion in 2035 reflects the gradual optimization of production efficiency and integration of cost-effective components without compromising precision. Economies of scale in manufacturing and improvements in supply chain logistics are likely to moderate costs over the forecast period.

The cost structure and value-chain dynamics illustrate a balanced interplay between component investment, assembly precision, software integration, and service-oriented revenue, which collectively shape market expansion and profitability.

| Metric | Value |

|---|---|

| Automated Labeling Machines Market Estimated Value in (2025 E) | USD 3.5 billion |

| Automated Labeling Machines Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The automated labeling machines market represents a specialized segment within the global packaging and industrial automation industry, emphasizing speed, precision, and operational efficiency. Within the broader packaging machinery sector, it accounts for about 6.5%, driven by demand from food and beverage, pharmaceuticals, and consumer goods manufacturers.

In the industrial automation and production equipment segment, its share is approximately 5.9%, reflecting reliance on automated systems for consistent labeling accuracy and throughput. Across the food and beverage processing market, it holds around 5.2%, supporting high-speed production lines and regulatory compliance. Within the pharmaceutical and healthcare packaging category, it represents 4.6%, highlighting critical adherence to labeling standards and traceability requirements. In the logistics and product handling equipment sector, the market contributes about 4.1%, emphasizing integration with conveyors, inspection systems, and smart packaging solutions. Recent developments in the market have focused on digital integration, precision, and flexibility. Innovations include vision-guided labeling systems, servo-driven mechanisms, and modular machine architectures for quick format changes. Key players are collaborating with software providers to incorporate IoT-enabled monitoring, predictive maintenance, and real-time reporting for enhanced operational efficiency. Adoption of high-speed labeling units, multi-lane conveyors, and touchless systems is gaining traction in the food and pharmaceutical industries. The integration with coding, inspection, and serialization solutions is being deployed to meet regulatory and traceability requirements. These advancements demonstrate how automation, accuracy, and smart manufacturing are shaping the market.

The automated labeling machines market is witnessing consistent growth due to the rising demand for packaging efficiency, product traceability, and operational automation across various industries. Increasing regulatory requirements for product labeling, along with growing consumer awareness of labeling accuracy, are driving widespread adoption across food and beverages, pharmaceuticals, personal care, and logistics sectors. The focus on minimizing manual intervention in packaging operations to reduce errors and enhance throughput is accelerating the integration of intelligent labeling systems.

Manufacturers are investing in machines capable of supporting variable data, serialization, and real-time tracking to meet compliance needs and consumer expectations. Advancements in motion control, sensor technology, and integrated vision systems are improving the speed and accuracy of automated labelers.

Furthermore, the need for consistency in labeling quality across high-speed production lines is prompting companies to replace legacy systems with fully automated alternatives. As the global packaging industry continues to evolve toward higher productivity and reduced downtime, automated labeling machines are expected to play a pivotal role in improving labeling precision, adaptability, and operational efficiency.

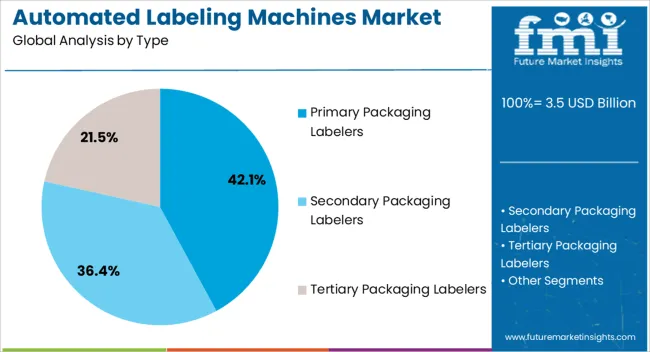

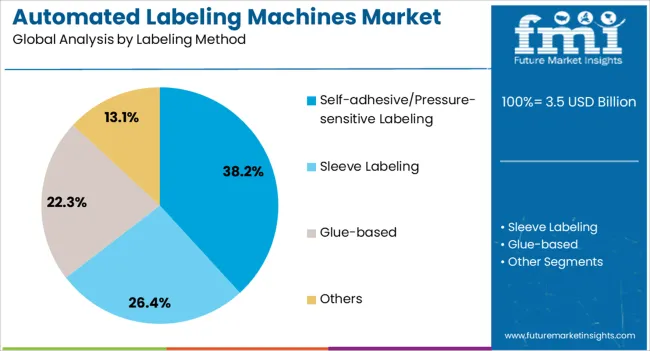

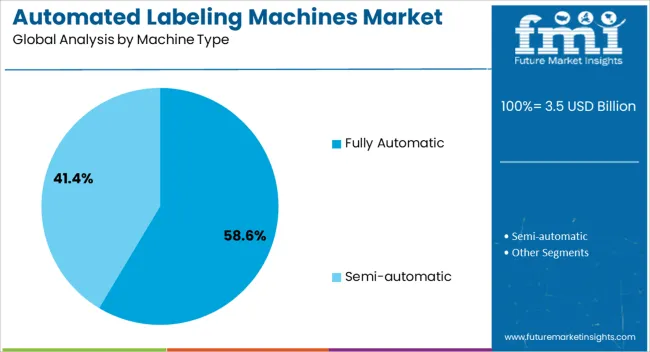

The automated labeling machines market is segmented by type, labeling method, machine type, capacity, labeling type, end use industry, and geographic regions. By type, automated labeling machines market is divided into Primary Packaging Labelers, Secondary Packaging Labelers, and Tertiary Packaging Labelers. In terms of labeling method, automated labeling machines market is classified into Self-adhesive/Pressure-sensitive Labeling, Sleeve Labeling, Glue-based, and Others. Based on machine type, automated labeling machines market is segmented into Fully Automatic and Semi-automatic. By capacity, automated labeling machines market is segmented into 200 to 500 products/min, Up to 200 products/min, 500 to 1000 products/min, and Above 1000 products/min. By labeling type, automated labeling machines market is segmented into Top & Bottom Labeling, Top Labeling, and Bottom Labeling. By end use industry, automated labeling machines market is segmented into Food & Beverages, Pharmaceuticals, Chemicals, Electronics, Consumer Goods, and Others (Logistics, etc.). Regionally, the automated labeling machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The primary packaging labelers segment is projected to account for 42.1% of the automated labeling machines market revenue share in 2025, establishing it as the leading product type. This segment’s leadership is being driven by the critical need to apply labels directly to product containers before secondary or tertiary packaging.

High-speed production environments in industries such as pharmaceuticals, beverages, and cosmetics are increasingly relying on primary labeling machines to ensure labeling compliance and product traceability at the unit level. The segment is benefiting from innovations in labeling head design, alignment technology, and automated container handling systems, which enhance precision and reduce setup time.

Additionally, the ability to apply variable data such as barcodes, QR codes, batch numbers, and expiration dates during primary labeling is strengthening its role in regulatory compliance As manufacturers seek solutions that ensure error-free, high-volume labeling without production interruption, primary packaging labelers are being adopted as the standard solution across multiple production lines worldwide.

The self-adhesive or pressure-sensitive labeling method segment is expected to represent 38.2% of the automated labeling machines market revenue share in 2025, making it the dominant labeling method. This method is being widely adopted due to its versatility, cleanliness, and ease of integration into both existing and new packaging lines.

The ability to apply labels to a wide range of container shapes, sizes, and materials without the need for heat, water, or solvents is driving its adoption in diverse industries including personal care, food, and industrial goods. The segment is gaining momentum due to advancements in adhesive technologies that allow for strong bonding, even in challenging environmental conditions such as humidity or temperature fluctuations.

Additionally, pressure-sensitive labeling supports fast label changes and enables the application of promotional or security labels, enhancing product differentiation Its compatibility with high-speed automation systems and minimal maintenance requirements are further contributing to its leadership, especially as packaging lines become more complex and multi-format.

The fully automatic machine type segment is forecasted to hold 58.6% of the automated labeling machines market revenue share in 2025, positioning it as the leading machine type. This dominance is being attributed to the growing demand for end-to-end labeling automation in large-scale manufacturing and packaging operations. Fully automatic machines offer high throughput, minimal human intervention, and consistent label placement accuracy, making them indispensable in high-volume production environments.

The segment is being supported by the integration of advanced features such as programmable logic controllers, human-machine interfaces, real-time monitoring systems, and automatic label roll changeovers. These machines also allow for greater customization, supporting various label sizes, orientations, and application methods with minimal setup time.

The growing need to reduce labor costs and increase overall equipment effectiveness is prompting industries to transition from semi-automatic or manual systems to fully automatic solutions As smart factories and Industry 4.0 principles continue to gain traction, fully automatic labeling machines are expected to dominate due to their scalability, reliability, and compatibility with digital production ecosystems.

The market has expanded as industries increasingly adopt automation to improve production efficiency, product traceability, and packaging aesthetics. These machines are widely used in food and beverages, pharmaceuticals, cosmetics, and consumer goods sectors to ensure consistent and precise label placement. Technological advancements such as vision systems, robotics integration, and adaptive software controls have enhanced speed, accuracy, and flexibility. Market growth is further influenced by regulatory requirements for product labeling, increased demand for smart packaging, and the need for scalable solutions to accommodate varying production volumes.

Vision systems have become integral to automated labeling machines, ensuring precise placement and verification of labels across high-speed production lines. Cameras and sensors monitor label alignment, print quality, and presence, reducing errors and minimizing waste. Advanced image processing software can detect defects, verify barcodes, and trigger real-time adjustments, maintaining consistency across batches. These systems are particularly essential for pharmaceutical and food industries where regulatory compliance demands high accuracy. Integration of vision systems also facilitates rapid changeovers between different products and label types. By improving quality assurance, these technologies reduce production downtime, enhance operational efficiency, and bolster consumer confidence in branded products.

Robotic automation in labeling machines has enabled higher throughput, precision, and flexibility in production environments. Robotic arms, servo motors, and automated conveyors allow handling of diverse packaging shapes, sizes, and orientations. Adaptive software ensures synchronization between labeling, filling, and packaging lines, minimizing bottlenecks. Automated setups reduce reliance on manual labor, lower operational errors, and improve worker safety by limiting repetitive tasks. Additionally, predictive maintenance algorithms monitor machine health, identifying potential failures before they occur. The adoption of robotics and automation not only increases production efficiency but also enables manufacturers to scale operations rapidly while meeting stringent quality and speed requirements in competitive industries.

The rising popularity of smart packaging with QR codes, RFID tags, and interactive labels has stimulated demand for sophisticated automated labeling machines. These machines are capable of precise placement of complex labels with embedded electronics or variable data printing, meeting consumer and regulatory requirements. Industries such as pharmaceuticals and high-end consumer goods rely on these capabilities to ensure traceability, anti-counterfeiting measures, and enhanced brand engagement. Integration with cloud-based management systems allows real-time monitoring of labeling operations, inventory tracking, and production analytics. This shift toward smart packaging has created opportunities for manufacturers to offer modular and flexible labeling solutions capable of handling diverse packaging formats and labeling technologies.

Despite advancements, the automated labeling machines market faces challenges related to high capital investment, operational costs, and ongoing maintenance requirements. Installation of advanced labeling equipment, vision systems, and robotic components can require significant upfront expenditure. Routine calibration, replacement of mechanical parts, and software updates add to operational costs. Compatibility issues with varying packaging materials, shapes, and sizes may necessitate customizations or additional attachments. Smaller manufacturers may face difficulties justifying these expenses, slowing adoption in certain regions. Addressing cost and maintenance challenges requires solutions such as modular designs, remote diagnostics, and flexible service contracts to ensure machines deliver consistent performance while maintaining cost-effectiveness across diverse production environments.

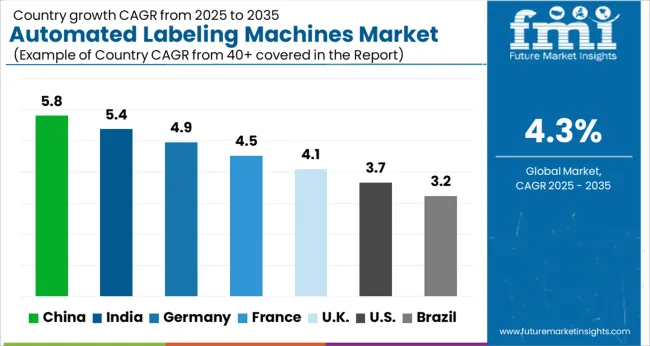

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The market is expected to expand at a CAGR of 4.3% from 2025 to 2035. India recorded 5.4% as rising industrial automation and packaging modernization supported growth. Germany reached 4.9%, reflecting steady adoption of advanced labeling solutions across manufacturing units. China led with 5.8% due to large-scale industrial investment and high demand for automation technologies. The United Kingdom stood at 4.1% with gradual implementation in food and beverage sectors, while the United States reached 3.7%, driven by retrofitting and upgrading existing production lines. These nations are central to production, expansion, and innovation within the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 5.8%, driven by increasing automation in food and beverage, pharmaceutical, and consumer goods industries. Adoption is reinforced by rising demand for high speed, precision labeling solutions that can handle diverse packaging formats. Domestic manufacturers focus on cost efficient, compact, and flexible machines to support growing production lines. Integration with digital control systems and sensors enhances accuracy and reduces production downtime. Expansion of e-commerce packaging and export oriented manufacturing further stimulates market growth.

India is expected to grow at a CAGR of 5.4%, supported by adoption in pharmaceutical, FMCG, and packaged food sectors. Demand is reinforced by need for high speed, reliable labeling to comply with packaging regulations and quality standards. Domestic and international manufacturers are supplying semi automated and fully automated systems with advanced vision inspection and servo controlled mechanisms. E-commerce driven packaging demand is also contributing to market expansion.

Germany is forecast to grow at a CAGR of 4.9%, driven by adoption in high precision packaging industries including pharmaceuticals, cosmetics, and specialty foods. Manufacturers emphasize modularity, compliance with EU standards, and integration with industrial IoT for process optimization. Adoption is reinforced by focus on accuracy, traceability, and efficiency to meet stringent quality control regulations. Advanced servo and robotic labeling systems are widely deployed.

The United Kingdom is expected to grow at a CAGR of 4.1%, supported by adoption in food, beverage, and pharmaceutical production lines. Emphasis is on automated, high speed labeling machines with flexibility for multiple packaging formats. Compliance with safety and packaging standards, as well as increasing demand for faster line changeovers, drives adoption. Integration with ERP systems enhances production management and reporting.

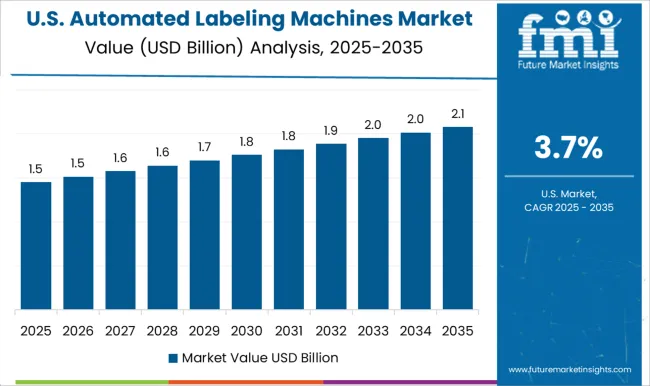

The United States is projected to grow at a CAGR of 3.7%, driven by adoption in pharmaceuticals, consumer goods, and industrial manufacturing. Demand is reinforced by need for precision labeling, traceability, and integration with automated production lines. Manufacturers are focusing on hybrid systems combining servo motors, robotic handling, and vision inspection. Expansion of contract packaging and e-commerce logistics also supports growth.

The market features a mix of global leaders and specialized regional players, all aiming to deliver high-speed, precise, and customizable labeling solutions for industries such as food and beverage, pharmaceuticals, cosmetics, and logistics. Accutek emphasizes modular and flexible labeling systems suitable for both small and large-scale operations, while B + B Automations focuses on turnkey solutions integrating robotics and automation technologies for streamlined production. Brady and Herma specialize in industrial-grade labeling machines for traceability, compliance, and safety labeling across diverse manufacturing lines. KHS, Krones, and Sidel Group offer end-to-end packaging and labeling systems, integrating high-speed production capabilities with advanced monitoring and control systems.

Marchesini Group, Sacmi Imola, and CTM Labeling Systems provide specialized solutions for pharmaceuticals and personal care sectors, emphasizing precision, compliance, and hygiene standards. Smaller and emerging players like BellatRx, FoxJet, P.E. Labellers, ProMach, and SaintyCo differentiate through cost-effective systems, customizable automation, and retrofit solutions, targeting niche industries or small-to-medium enterprises. Technological advancements such as AI-assisted vision systems, IoT-enabled monitoring, robotics integration, and predictive maintenance drive competitive strategies, enabling players to enhance throughput, reduce errors, and improve operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Type | Primary Packaging Labelers, Secondary Packaging Labelers, and Tertiary Packaging Labelers |

| Labeling Method | Self-adhesive/Pressure-sensitive Labeling, Sleeve Labeling, Glue-based, and Others |

| Machine Type | Fully Automatic and Semi-automatic |

| Capacity | 200 to 500 products/min, Up to 200 products/min, 500 to 1000 products/min, and Above 1000 products/min |

| Labeling Type | Top & Bottom Labeling, Top Labeling, and Bottom Labeling |

| End Use Industry | Food & Beverages, Pharmaceuticals, Chemicals, Electronics, Consumer Goods, and Others (Logistics, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Accutek, B + B Automations, BellatRx, Brady, CTM Labeling Systems, FoxJet, Herma, KHS, Krones, Marchesini Group, P.E. Labellers, ProMach, Sacmi Imola, SaintyCo, and Sidel Group |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across food, beverage, pharmaceutical, and consumer goods sectors, regional trends in packaging automation adoption, innovation in speed, precision, and integration with production lines, environmental impact of energy use and material waste, and emerging use cases in smart packaging, traceability, and high-speed labeling operations. |

The global automated labeling machines market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the automated labeling machines market is projected to reach USD 5.4 billion by 2035.

The automated labeling machines market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automated labeling machines market are primary packaging labelers, secondary packaging labelers and tertiary packaging labelers.

In terms of labeling method, self-adhesive/pressure-sensitive labeling segment to command 38.2% share in the automated labeling machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA