The Automated Infrastructure Management (AIM) Solutions Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 12.2 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period. The data indicates steady year-over-year growth, starting with a market value of USD 3.0 billion in 2025 and progressing to USD 3.5 billion in 2026.

Growth accelerates consistently, reaching USD 5.3 billion by 2029, highlighting increased implementation of AIM for efficient infrastructure management and enhanced operational visibility. From 2030 onward, the market experiences further expansion, with values climbing from USD 6.1 billion to USD 12.2 billion by 2035. This strong growth phase is driven by technological advancements, increasing need for automated monitoring, and rising complexity of IT infrastructure in enterprises. The 15.0% CAGR signals robust market momentum, offering considerable opportunities for technology providers and investors. The continuous increase in market size year after year emphasizes the strategic importance of AIM solutions in optimizing network infrastructure, reducing downtime, and improving overall efficiency. The AIM Solutions Market demonstrates sustained high growth, underpinned by rising demand for automation and infrastructure management, making it an attractive area for investment and innovation over the next decade.

| Metric | Value |

|---|---|

| Automated Infrastructure Management (AIM) Solutions Market Estimated Value in (2025 E) | USD 3.0 billion |

| Automated Infrastructure Management (AIM) Solutions Market Forecast Value in (2035 F) | USD 12.2 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The automated infrastructure management (AIM) solutions market is gaining momentum as enterprises prioritize real-time visibility, data traceability, and compliance across physical network infrastructure. Rising complexities in data center operations, heightened demand for automated asset tracking, and increasing vulnerabilities associated with unmanaged ports are driving adoption.

Regulatory frameworks and security protocols are further reinforcing the shift from manual to intelligent infrastructure management tools. AIM systems are increasingly being embedded in smart building environments, hybrid cloud infrastructures, and edge computing deployments to enhance uptime, reduce operational overhead, and optimize capacity planning.

As digital transformation initiatives accelerate, demand for integrated infrastructure management platforms is projected to increase, with future growth bolstered by AI-driven analytics, predictive maintenance capabilities, and compliance automation in data-heavy sectors.

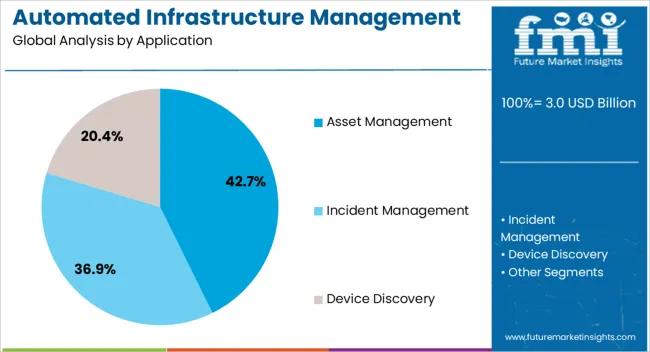

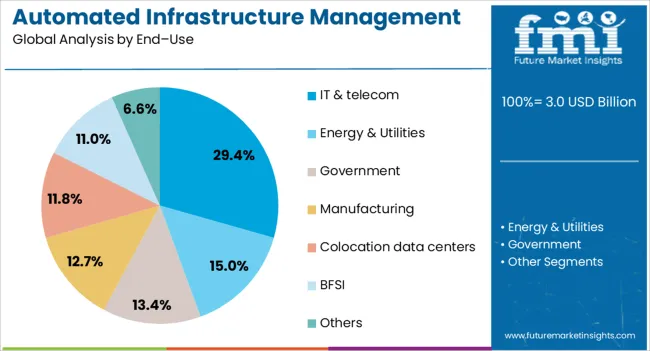

The automated infrastructure management (AIM) solutions market is segmented by application, end–use, and geographic regions. By application, the automated infrastructure management (AIM) solutions, the market is divided into Asset Management, Incident Management, and Device Discovery. In terms of end–use, the automated infrastructure management (AIM) solutions market is classified into IT & telecom, Energy & Utilities, Government, Manufacturing, Colocation data centers, BFSI, and Others. Regionally, the automated infrastructure management (AIM) solutions industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Asset management is projected to lead the market with 42.7% revenue share in 2025, driven by the rising need for centralized visibility and lifecycle control of network-connected assets. Organizations are increasingly adopting AIM systems to mitigate asset misplacement, downtime, and audit non-compliance.

The ability to automate asset discovery, tracking, and inventory reporting has proven crucial for large-scale IT environments where physical and virtual infrastructures coexist. Enhanced regulatory mandates and tighter governance around infrastructure lifecycle management have further strengthened the position of this segment.

As remote work models and hybrid networks grow, asset management through AIM platforms is enabling better performance tracking, security, and operational control across distributed environments.

The IT & telecom sector is anticipated to contribute 29.4% of overall market revenue in 2025, making it the dominant end-use segment. This leadership is being reinforced by the sector’s expansive data center footprint, increasing network complexity, and demand for fault-tolerant infrastructure management.

Telecom providers and IT enterprises are implementing AIM systems to enable real-time port monitoring, cable traceability, and streamlined troubleshooting. The integration of AIM platforms with DCIM (Data Center Infrastructure Management) systems and network operations centers is helping reduce operational downtime while improving service delivery efficiency.

Furthermore, as 5G rollout accelerates and hyperscale networks expand, AIM systems are emerging as critical infrastructure components to maintain system integrity and compliance across evolving digital ecosystems.

The market has been witnessing robust growth as organizations globally strive for enhanced visibility, control, and automation of increasingly complex and distributed IT environments. AIM solutions enable the automated monitoring, tracking, and management of network assets, physical infrastructure, and IT resources, facilitating faster fault detection, streamlined maintenance, and optimized resource utilization. The ongoing expansion of data centers, rapid cloud adoption, and the proliferation of Internet of Things (IoT) devices have dramatically increased the complexity of IT infrastructures, creating a pressing need for scalable and intelligent management systems.

The evolution of enterprise IT infrastructure towards more distributed, hybrid, and multi-cloud environments has led to unprecedented complexity in asset management and network operations. Organizations face challenges in tracking and managing a vast array of physical and virtual devices, diverse network elements, and multi-vendor hardware and software ecosystems. AIM solutions have become essential in addressing these challenges by providing automated discovery, real-time mapping, and comprehensive asset inventory management, enabling IT teams to maintain accurate visibility across the entire infrastructure. The increasing integration of edge computing devices and IoT endpoints further complicates asset tracking and fault resolution. AIM platforms facilitate faster issue identification and resolution, minimizing downtime and enhancing service reliability. These factors are driving widespread AIM adoption across industries such as telecommunications, BFSI, healthcare, and government sectors, where operational continuity is critical.

The integration of artificial intelligence, machine learning, and advanced analytics into AIM solutions has revolutionized infrastructure management by enabling predictive maintenance and proactive issue detection. Machine learning models analyze vast volumes of historical and real-time operational data to identify patterns indicative of potential failures or performance degradation. This allows for preemptive interventions, reducing unexpected outages and costly downtime. Intelligent automation streamlines routine network management tasks such as configuration, compliance checks, and anomaly detection, freeing IT staff to focus on strategic initiatives. Real-time dashboards and alerting systems offer actionable insights, enhancing decision-making and operational efficiency. The integration of AIM with broader IT service management (ITSM) and network management systems promotes seamless workflow automation, supporting digital transformation and agile IT operations.

Given the heterogeneity of organizational IT environments and evolving business needs, demand for AIM solutions that offer flexibility, scalability, and customization has increased markedly. Modular architectures allow enterprises to scale their AIM deployments in line with network growth and complexity, while cloud-based and hybrid deployment options provide operational agility and reduced infrastructure overheads. Customizable monitoring dashboards, reporting tools, and automation workflows enable organizations to align AIM capabilities with specific operational requirements, security policies, and regulatory compliance mandates. The growing adoption of hybrid IT architectures and multi-cloud strategies necessitates interoperable AIM platforms capable of managing diverse infrastructure components seamlessly. Vendors emphasize user-centric design, enhanced security features, and integration capabilities with existing IT ecosystems to broaden market penetration and cater to diverse customer segments, including SMEs and large enterprises.

Despite clear benefits, the adoption of AIM solutions faces challenges related to the complexity of integration, high upfront costs, and ongoing operational expenses. Legacy infrastructure environments often require extensive customization and integration efforts, potentially leading to deployment delays and increased resource requirements. Smaller organizations may find the initial capital expenditure and total cost of ownership prohibitive, hindering adoption despite growing awareness of AIM benefits. Data security, privacy, and compliance concerns also affect procurement decisions, especially in highly regulated industries. To address these barriers, vendors are introducing flexible pricing models, including subscription-based and managed service offerings, which lower entry barriers. Emphasis on comprehensive customer support, training programs, and simplified deployment processes helps mitigate integration challenges. Collaborative partnerships with system integrators and technology providers further facilitate smoother implementation, fostering wider adoption and sustained market growth.

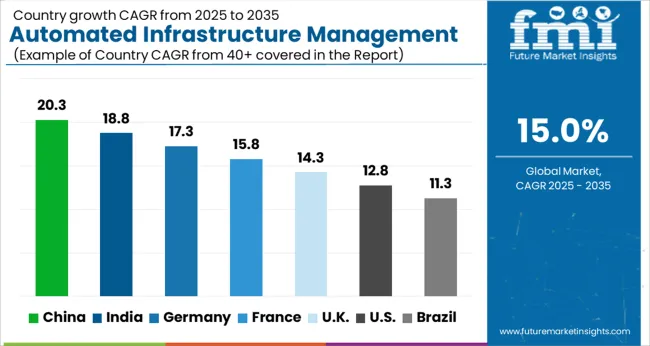

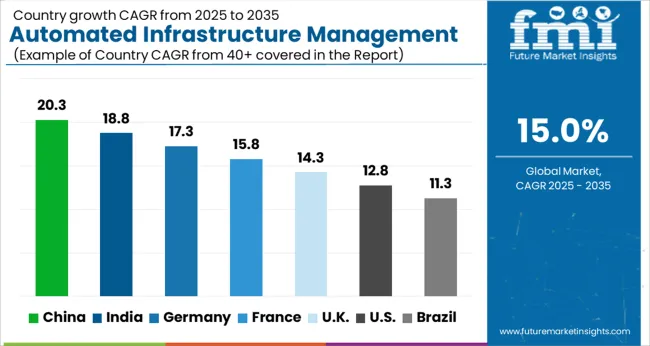

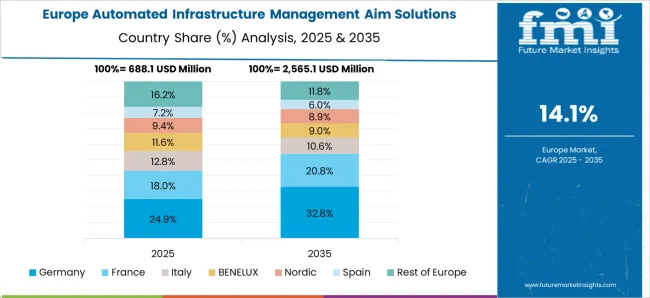

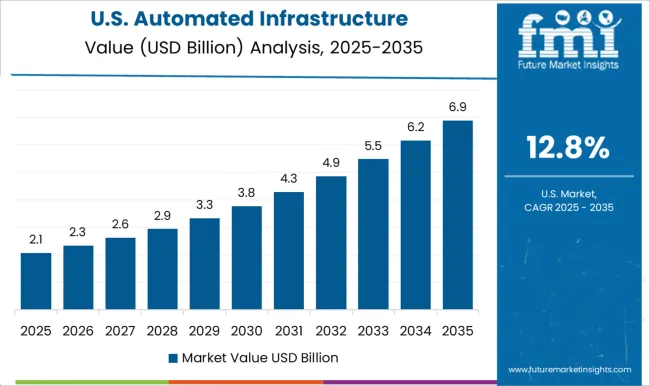

The market is expected to grow at a CAGR of 15.0% from 2025 to 2035, driven by increasing demand for efficient network management, automation, and enhanced data center operations. China leads with a 20.3% CAGR, supported by rapid digital transformation and extensive telecom infrastructure upgrades. India follows at 18.8%, fueled by growing data center construction and expanding IT services sector. Germany, growing at 17.3%, benefits from advanced automation technologies and robust enterprise adoption. The UK, at 14.3%, experiences steady growth due to increasing cloud computing and network modernization. The USA, with a 12.8% CAGR, reflects strong investment in intelligent network management and infrastructure optimization. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automated infrastructure management solutions industry in China is expected to grow at a CAGR of 20.3% between 2025 and 2035, driven by rapid digital transformation across telecommunications and data center operations. Chinese firms such as Huawei and ZTE are investing heavily in AI-enabled infrastructure management systems to optimize network efficiency and reduce operational costs. Integration of smart monitoring and automated fault detection systems is becoming widespread, particularly in large urban centers and industrial hubs. Government initiatives to develop smart cities and 5G infrastructure further accelerate demand. Collaborative efforts with global technology providers support the development of scalable AIM platforms tailored to domestic requirements.

India is forecast to expand at a CAGR of 18.8% through 2035, propelled by growing data center capacity and telecom infrastructure upgrades. Major providers like Tejas Networks and Sterlite Technologies are focusing on modular and cost-efficient AIM products suited for emerging urban and rural deployments. The rise in cloud service providers and digital enterprises fuels demand for real-time asset management and predictive maintenance solutions. Regulatory emphasis on network reliability and cybersecurity enhances uptake. Expansion of government digital initiatives such as Digital India is further strengthening market growth prospects.

Sales of automated infrastructure management solutions in Germany are anticipated to grow at a CAGR of 17.3% from 2025 to 2035, driven by industrial automation and the growth of Industry 4.0. Leading technology firms are integrating AIM with IoT and AI to enable enhanced monitoring of manufacturing and logistics infrastructure. Demand from telecommunications providers for network optimization remains strong. The German market emphasizes reliability and compliance with stringent data protection regulations. Investments in upgrading legacy infrastructure with automated management systems contribute to steady market expansion.

The United Kingdom’s automated infrastructure management solutions market is set to expand at a CAGR of 14.3% over the coming decade, supported by increasing deployment of data centers and telecom upgrades. Market growth is fueled by demand for centralized monitoring and enhanced asset visibility in enterprises. British companies and service providers are investing in cloud-based AIM solutions offering scalability and security. Government policies promoting digital infrastructure resilience accelerate adoption. The rising need to reduce operational costs in network management drives investments in automation and AI integration.

The United States market for automated infrastructure management solutions is forecasted to grow at a CAGR of 12.8% between 2025 and 2035, propelled by expanding cloud infrastructure and enterprise digitization efforts. Providers such as Cisco and Juniper Networks focus on AI-driven platforms that offer predictive analytics and seamless integration with existing network operations. Increasing cybersecurity concerns encourage adoption of comprehensive monitoring systems. Investments in 5G network deployments and edge computing infrastructure further support demand. Strategic partnerships between technology vendors and service providers strengthen market presence.

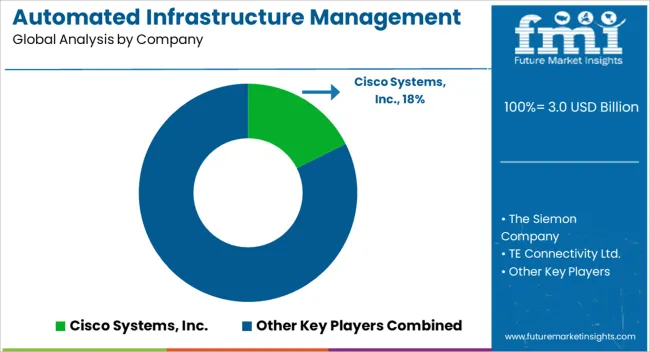

The Automated Infrastructure Management (AIM) solutions market is characterized by major technology and network infrastructure companies delivering advanced tools for real-time asset monitoring, connectivity management, and infrastructure optimization. Cisco Systems, Inc. leads with comprehensive AIM platforms that integrate network intelligence and automation for enterprise and data center environments. The Siemon Company and TE Connectivity Ltd. focus on high-quality physical infrastructure components combined with smart management systems to enhance network reliability. Rittal GmbH & Co. KG and Reichle & De-Massari Holding AG provide modular infrastructure solutions designed for seamless integration with AIM software, supporting scalability and efficient resource management. Panduit Corporation offers a broad portfolio of AIM hardware and software, targeting improved operational efficiency in data centers and commercial buildings. Nexans Network Solutions NV and RIT Tech (Intelligence Solutions) Ltd. develop innovative sensing and analytics technologies that enhance visibility into network assets. PagerDuty, Inc. and Ivanti International Limited contribute complementary IT operations and asset management software, integrating with AIM platforms to provide comprehensive management. Technology giants including Microsoft Corporation, IBM Corporation, Hewlett-Packard Company, and Fujitsu Limited provide cloud-based and hybrid AIM solutions that support digital transformation initiatives. Fiber Mountain, Inc., CommScope Holding Company, Inc., CA Technologies, Inc., and Anixter International, Inc. complete the market landscape with specialized offerings focused on connectivity intelligence, automation, and infrastructure security.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Application | Asset Management, Incident Management, and Device Discovery |

| End–Use | IT & telecom, Energy & Utilities, Government, Manufacturing, Colocation data centers, BFSI, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., The Siemon Company, TE Connectivity Ltd., Rittal Gmbh & Co. Kg, RIT Tech (Intelligence Solutions) Ltd., Reichle & De–Massari Holding AG, Panduit Corporation, PagerDuty, Inc., Nexans Network Solutions NV, Microsoft Corporation, Metz Connect Holding GmbH, Ivanti International Limited, IBM Corporation, Hewlett–Packard Company, Furukawa Electric Co., Ltd., Fujitsu Limited, Fiber Mountain, Inc., CommScope Holding Company, Inc., CA Technologies, Inc., and Anixter International, Inc |

| Additional Attributes | Dollar sales by solution type and industry application, demand dynamics across data centers, telecommunications, and enterprise IT environments, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in AI-driven asset tracking, predictive analytics, and real-time network visualization, environmental impact of energy consumption in data centers and hardware lifecycle, and emerging use cases in cloud infrastructure optimization, hybrid IT management, and automated fault detection and resolution. |

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Biology Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Centrifuge System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA