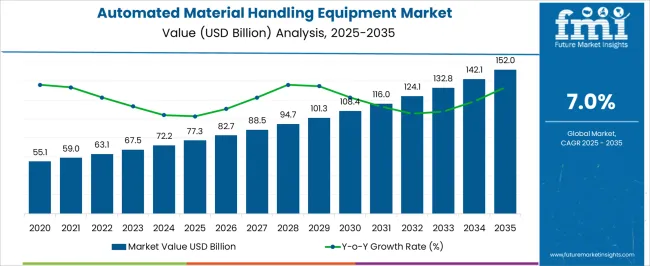

The Automated Material Handling Equipment Market is estimated to be valued at USD 77.3 billion in 2025 and is projected to reach USD 152.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. The automated material handling equipment market is projected to expand significantly, advancing from USD 55.1 billion in 2020 to USD 152.0 billion by 2035, highlighting a strong upward trend across the 16-year span. The first growth phase from 2020 to 2025 shows expansion from USD 55.1 billion to USD 72.2 billion, driven by rising adoption of automation in warehouses, e-commerce distribution centers, and large-scale manufacturing plants. This period is marked by the deployment of conveyor systems, sortation solutions, and automated guided vehicles designed to enhance operational efficiency and reduce labor reliance.

Between 2026 and 2030, the market progresses from USD 77.3 billion to USD 101.3 billion, supported by increasing global trade volumes, demand for lean inventory operations, and the integration of robotics into material flow systems. Companies invest heavily in intelligent software for real-time tracking and predictive maintenance, ensuring higher equipment reliability and throughput optimization. The final phase from 2031 to 2035 accelerates growth, with the market increasing from USD 108.4 billion to USD 152.0 billion. This stage is powered by widespread usage of autonomous mobile robots, IoT-based monitoring, and AI-enabled equipment that streamlines cross-border logistics and complex multi-channel supply chains. Expanding 3PL partnerships and heavy investments in automated cold chain storage also reinforce momentum.

| Metric | Value |

|---|---|

| Automated Material Handling Equipment Market Estimated Value in (2025 E) | USD 77.3 billion |

| Automated Material Handling Equipment Market Forecast Value in (2035 F) | USD 152.0 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The automated material handling equipment market is witnessing robust expansion, propelled by the rapid shift towards warehouse digitalization, e-commerce growth, and the need to optimize labor costs. As supply chains become increasingly complex and customer expectations for faster delivery intensify, automated systems are being prioritized to improve accuracy, throughput, and scalability.

Technologies such as robotics, AI-based vision systems, and industrial IoT are being integrated with material handling platforms to ensure real-time decision-making, inventory visibility, and energy efficiency. Additionally, global labor shortages and rising safety standards are pushing manufacturers and logistics providers to adopt intelligent solutions that can operate in dynamic environments with minimal human intervention.

Demand has also been bolstered by the acceleration of just-in-time delivery models and the proliferation of multi-channel retailing, both of which require faster and more reliable intralogistics systems Moving forward, collaborative ecosystems involving automation providers, logistics players, and industrial AI platforms are expected to shape the next phase of growth across regional and global markets.

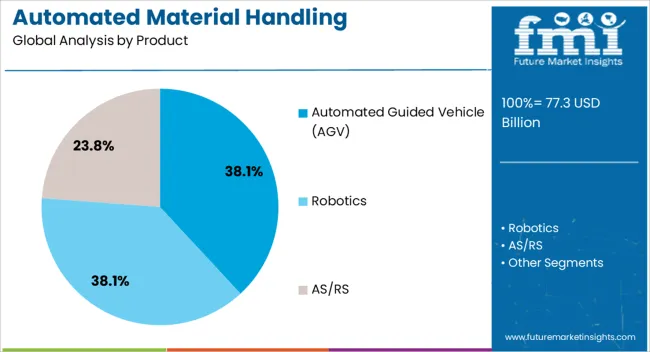

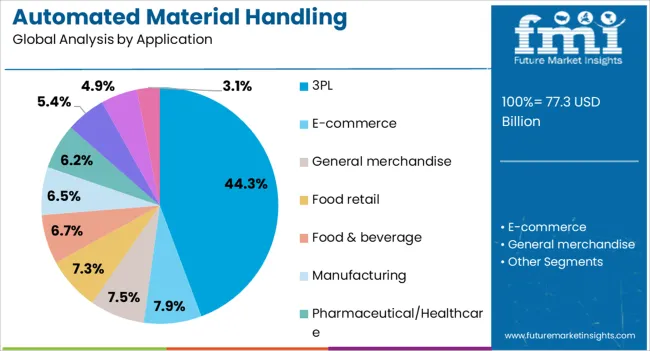

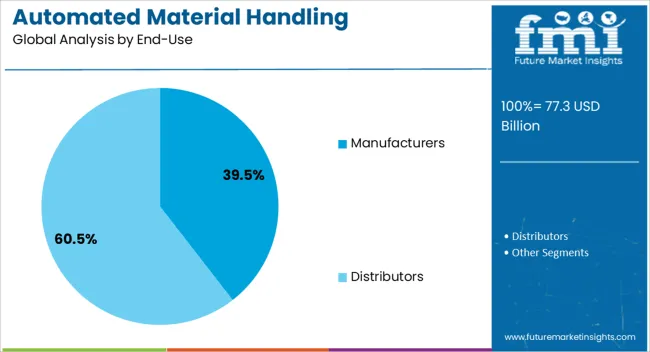

The automated material handling equipment market is segmented by product, application, end-use, and geographic regions. By product, automated material handling equipment market is divided into Automated Guided Vehicle (AGV), Robotics, AS/RS, Conveyor & Sortation System, and Others. In terms of application, automated material handling equipment market is classified into 3PL, E-commerce, General merchandise, Food retail, Food & beverage, Manufacturing, Pharmaceutical/Healthcare, Semiconductor, Secondary Battery, and Others. Based on end-use, automated material handling equipment market is segmented into Manufacturers and Distributors. Regionally, the automated material handling equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automated guided vehicle segment is projected to contribute 38.1% of the total revenue share in the automated material handling equipment market in 2025, establishing it as the leading product category. The dominance of this segment is being driven by the growing demand for flexible, scalable, and intelligent mobility solutions within modern warehouses and production facilities.

AGVs have been increasingly deployed due to their ability to transport materials autonomously across complex routes with minimal supervision, enhancing operational efficiency and reducing labor dependency. The segment’s growth has been further influenced by improvements in onboard sensors, navigation algorithms, and safety systems that allow seamless integration into human-robot collaborative environments.

Software-defined control architectures and real-time data synchronization capabilities have enabled AGVs to function within high-velocity distribution centers while maintaining precision and safety Their adaptability to changing layouts and workflows without physical infrastructure modification has made AGVs an attractive investment for enterprises seeking agility, especially in high-volume logistics and manufacturing environments.

The third-party logistics segment is expected to account for 44.3% of the revenue share in the automated material handling equipment market by 2025, making it the largest application area. The widespread adoption of automation in 3PL environments is being driven by rising order volumes, increasing demand for faster fulfillment cycles, and pressure to optimize space and labor.

Material handling systems equipped with advanced software and automation technologies are enabling third-party logistics providers to manage complex inventory workflows, dynamic routing, and real-time shipment tracking with higher efficiency. The flexibility offered by automated solutions has allowed 3PL providers to cater to diverse client requirements across sectors such as retail, automotive, and pharmaceuticals.

As e-commerce growth intensifies and peak season volumes surge, the need for scalable automation systems has become critical in maintaining service levels and reducing operational costs Integration of AGVs, autonomous mobile robots, and intelligent storage systems is enabling 3PL operators to deliver consistent performance while meeting the evolving expectations of enterprise customers.

The manufacturers segment is projected to hold 39.5% of the revenue share in the automated material handling equipment market in 2025, making it the leading end-use category. This growth is being supported by the increasing adoption of smart manufacturing principles and the need for streamlined intralogistics within production environments. Automated handling systems are playing a pivotal role in reducing material transfer times, minimizing human error, and maintaining uninterrupted production flows.

Manufacturers across industries including automotive, electronics, and consumer goods are leveraging these systems to ensure synchronized movement of components, just-in-time delivery to assembly lines, and safe handling of heavy or hazardous materials. The integration of automation with enterprise resource planning platforms and digital twin technologies has enhanced visibility across the manufacturing value chain.

Rising pressure to achieve operational resilience, coupled with workforce safety regulations and labor shortages, is further incentivizing investments in advanced handling equipment As manufacturers continue to prioritize agility and cost efficiency, the demand for intelligent and reconfigurable material handling systems is expected to remain strong.

Automated material handling equipment is being driven by e-commerce adoption, robotics integration, productivity goals, and diversified industrial applications. These factors collectively ensure its position as a key driver of efficiency in modern supply chains.

The expansion of e-commerce and retail logistics has accelerated the demand for automated material handling equipment. Warehouses and distribution centers are increasingly reliant on conveyors, shuttle systems, and automated guided vehicles to manage high-volume orders with accuracy. Retailers are prioritizing efficiency in order picking, sorting, and last-mile preparation, which has strengthened reliance on automation. Seasonal peaks and rising consumer expectations for fast deliveries have encouraged investments in scalable equipment. Companies are adopting automation not only to cut costs but also to ensure timely order processing. This shift has created a structural need for integrated handling systems that can manage complex workflows, reduce manual errors, and provide the agility required in dynamic logistics environments.

Automated material handling equipment is becoming increasingly integrated with robotics and smart control systems, allowing for higher precision and improved performance. The growing use of collaborative robots and automated guided vehicles enhances throughput and reduces reliance on labor-intensive operations. Smart warehouse management solutions are also enabling better coordination of equipment, with predictive analytics guiding operational planning. Real-time monitoring of conveyors, lifts, and automated storage systems is reducing downtime, improving safety, and extending lifecycle value. This integration has become vital for industries that demand efficiency across large-scale facilities. The continuous push toward connected, intelligent systems is shaping the evolution of automated handling as a strategic asset in industrial and commercial supply chains.

The drive for cost efficiency and productivity improvements is a core factor behind investments in automated material handling equipment. Industries are under pressure to balance rising labor costs with the need for consistent throughput. By deploying automation, companies can reduce errors, lower operating expenses, and extend equipment utilization. Automation also enhances inventory visibility and helps manage fluctuating demand without proportional increases in workforce size. For sectors such as automotive, food processing, and pharmaceuticals, automation has ensured compliance with strict operational standards while meeting output requirements. This focus on cost control and productivity has positioned automated handling systems as indispensable tools for optimizing capital expenditure and delivering long-term competitive advantages.

Beyond warehousing and retail, automated material handling equipment is finding broader applications in industries such as automotive, aerospace, food and beverage, and healthcare. Each of these sectors requires specialized handling systems to manage unique product flows and compliance needs. In automotive plants, automation improves assembly line synchronization, while in healthcare, it ensures safe and hygienic handling of sensitive materials. Aerospace facilities deploy advanced conveyors and lifting systems to manage heavy components with precision. Food and beverage manufacturers depend on automation for hygiene compliance and consistent packaging operations. The increasing diversification of use cases highlights the adaptability of handling equipment, cementing its role as a critical enabler of efficiency across global industries.

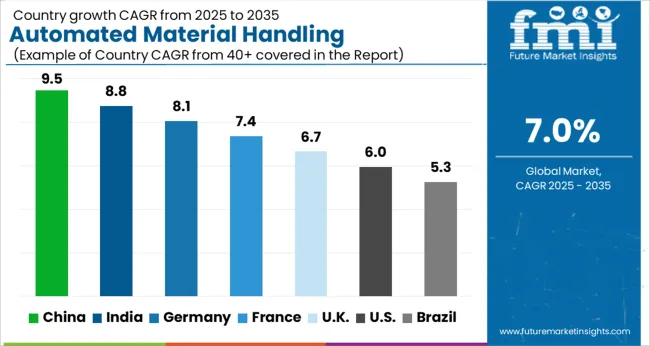

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The automated material handling equipment market is projected to grow globally at a CAGR of 7.0% from 2025 to 2035, supported by rising e-commerce volumes, labor cost optimization, and expanding adoption of robotics in warehouses and factories. China leads with a CAGR of 9.5%, driven by large-scale investments in smart logistics, rapid industrial automation, and government support for supply chain modernization. India follows at 8.8%, benefiting from fast-growing manufacturing hubs, booming e-commerce logistics, and warehouse automation in metropolitan regions. France posts 7.4%, with adoption influenced by EU regulatory frameworks and demand for efficient food and beverage logistics. The United Kingdom achieves 6.7% growth, supported by strong retail distribution automation and warehouse robotics expansion, while the United States records 6.0%, reflecting steady demand in e-commerce fulfillment, food processing, and replacement upgrades in large distribution hubs. This growth outlook positions Asia-Pacific as the leading hub, while Europe and North America maintain solid momentum through digital integration, retail automation, and industrial efficiency measures in handling equipment.

China is projected to post a 9.5% CAGR during 2025–2035, outpacing the global average of 7.0%. During 2020–2024, CAGR was about 8.1%, supported by steady investments in intralogistics and accelerated warehouse buildouts for national retail platforms. The step-up toward 2025–2035 is expected as tier-2 and tier-3 cities expand fulfillment capacity, component ecosystems deepen for conveyors, shuttles, ASRS, and AGVs, and large manufacturers standardize automated lines for export resilience. E-grocery and quick commerce have encouraged high-throughput sorting and dense storage designs, which should lift equipment intensity per square meter. Capital productivity targets by domestic champions are likely to anchor multi-year orders for shuttle-based systems, pallet ASRS, and hybrid AMR fleets in mixed-case picking.

India is expected to reach a 8.8% CAGR in 2025–2035, signaling strong momentum versus the global 7.0% benchmark. Through 2020–2024, CAGR stood near 7.6%, aided by rising e-commerce parcels, 3PL network expansions, and greenfield factories around major corridors. The next decade appears stronger as large retailers scale dark stores, FMCG and pharma invest in temperature-managed distribution, and contract logistics firms codify automated picking as a service. Government-backed industrial parks and warehousing incentives have broadened the addressable base for conveyors, AMRs, and mini-load shuttles. Equipment suppliers are tailoring modular systems for local SKU profiles, while integrators focus on rapid commissioning to meet peak seasonality in metros and emerging cities.

France is projected to grow at a 7.4% CAGR during 2025–2035, slightly above the global 7.0% trajectory. In 2020–2024, CAGR was about 6.5%, reflecting disciplined rollouts in food, beverage, and personal care hubs with measured upgrades to legacy sites. The uplift into the next period is expected from retailer distribution center renewals, high-speed sortation for grocery and apparel returns, and carton-friendly goods-to-person deployments that improve pick density. Regional networks are consolidating inventory, which raises the need for high-throughput put-to-wall, crossbelt, and loop sorters. Strong engineering talent and integrator presence support lifecycle services that keep availability high, a decisive factor for adoption in national grocery and beverage bottling clusters.

The United Kingdom is expected to deliver a 6.7% CAGR during 2025–2035, pacing below the global 7.0% but higher than recent history. During 2020–2024, CAGR is estimated at about 5.8%, shaped by incremental upgrades in grocery and general merchandise distribution, constrained new DC footprints, and phased retrofits in brownfield sites. The improvement toward 2025–2035 is attributed to dense e-grocery penetration, labor cost pressures that favor automated picking, and supermarket commitments to high-availability back-of-store flows. Regional parcel hubs are standardizing sortation and automated induction to stabilize peak operations. Integrators are packaging AMRs with WMS orchestration to shorten payback periods, which should raise adoption in mid-sized facilities across the Midlands and Northern England.

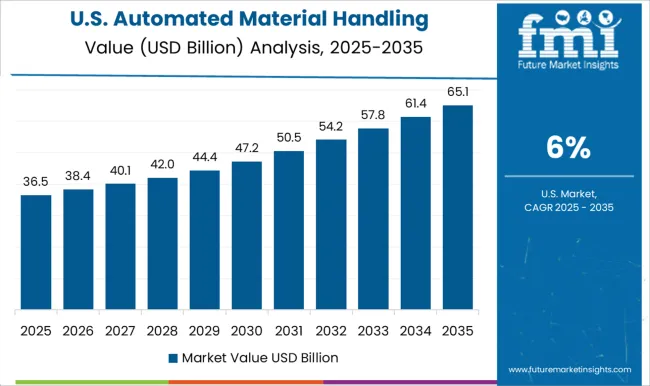

The United States is projected to record a 6.0% CAGR during 2025–2035, below the global 7.0% but on a stable upward path. In 2020–2024, CAGR was near 5.3%, shaped by strong e-commerce baselines established earlier and a deliberate shift toward brownfield retrofits over new mega-sites. The next phase points to steady installations as parcel carriers automate induction, singulation, and returns at scale, while food and beverage networks enlarge high-speed case handling tied to regional cold storage. Large retailers continue to balance AMR fleets with shuttle-based goods-to-person for SKU breadth. Replacement of aging conveyors and controls, paired with predictive maintenance, is expected to support recurring capital cycles.

The automated material handling equipment market is shaped by intense competition among global industrial leaders and specialized integrators delivering robotics, storage, and intralogistics solutions. Toyota Industries Corporation holds a dominant position with its extensive forklift portfolio and automated guided vehicle (AGV) systems, supporting large-scale warehouses and manufacturing plants. Honeywell International Inc. integrates material handling solutions with advanced warehouse execution software, catering to e-commerce and retail distribution. KION Group and SSI Schaefer combine storage systems, conveyor solutions, and automated retrieval technologies, maintaining a strong footprint across Europe, Asia, and North America. Jungheinrich AG specializes in forklifts, pallet trucks, and intralogistics automation, while KUKA AG delivers robotics integrated with automated assembly and handling lines. Murata Machinery Ltd. is recognized for its ASRS and shuttle-based warehouse solutions, ensuring efficiency in dense storage environments. Hanwha Corporation provides robotics and factory automation systems tailored for the electronics and automotive industries. Hyster-Yale Materials Handling, Inc. continues to expand in forklifts and automated lift trucks, targeting industrial and retail operations. TGW Logistics and KNAPP are leaders in end-to-end warehouse automation, focusing on goods-to-person, shuttle systems, and software-driven integration. Viastore emphasizes intralogistics software and system integration with high-performance ASRS.

Key competitive strategies include heavy investment in robotics-enabled automation, partnerships with e-commerce and 3PL providers, and scaling modular storage systems to reduce costs and commissioning timelines. Companies are also pursuing regional capacity expansion, integration of AI-driven warehouse management software, and lifecycle service models to secure long-term customer relationships. Product differentiation increasingly revolves around scalability, energy-efficient systems, and adaptability to diverse industry verticals such as automotive, food & beverage, pharmaceuticals, and e-commerce logistics.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.3 Billion |

| Product | Automated Guided Vehicle (AGV), Robotics, AS/RS, Conveyor & Sortation System, and Others |

| Application | 3PL, E-commerce, General merchandise, Food retail, Food & beverage, Manufacturing, Pharmaceutical/Healthcare, Semiconductor, Secondary Battery, and Others |

| End-Use | Manufacturers and Distributors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TOYOTAINDUSTRIESCORPORATION, HoneywellInternationalInc., KIONSSISCHAEFERGroup, JungheinrichAG, KUKAAG, MurataMachineryLtd., HanwhaCorporation, Hyster-YaleMaterialsHandling,Inc., TGWLogistics, KNAPP, and Viastore |

| Additional Attributes | Dollar sales, share, demand by region, adoption in e-commerce and manufacturing, competitor strategies, pricing trends, technology integration, and growth opportunities across logistics and industrial sectors |

The global automated material handling equipment market is estimated to be valued at USD 77.3 billion in 2025.

The market size for the automated material handling equipment market is projected to reach USD 152.0 billion by 2035.

The automated material handling equipment market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in automated material handling equipment market are automated guided vehicle (agv), _tow tractor, _forklift truck, _pallet truck, _unit load carrier, _others, robotics, _autonomous mobile robots, _cobots, _scara robots, _industrial robots, _others, as/rs, _unit-load, _mini-load, _others, conveyor & sortation system, _belt conveyor, _roller conveyor, _overhead conveyor, _pallet conveyor, _others and others.

In terms of application, 3pl segment to command 44.3% share in the automated material handling equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Biology Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA