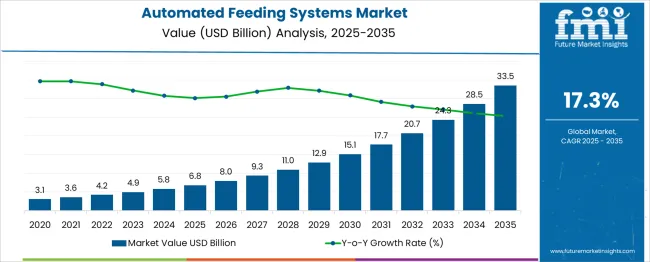

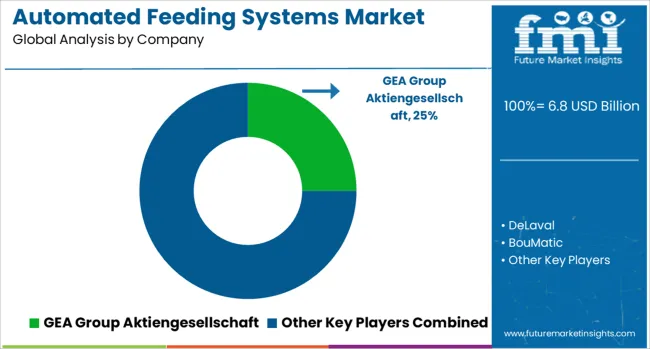

The global automated feeding systems market is forecasted to reach from USD 6.8 billion in 2025 to approximately USD 33.5 billion by 2035, recording an absolute increase of USD 26.7 billion over the forecast period. This translates into a total growth of 393.0%, with the market forecast to expand at a CAGR of 17.3% between 2025 and 2035. The market size is expected to grow by nearly 4.9X during the same period, supported by the increasing adoption of precision livestock farming technologies and growing demand for efficient feed management systems across global agricultural operations.

Between 2025 and 2030, the automated feeding systems market is projected to expand from USD 6.8 billion to USD 15.1 billion, resulting in a value increase of USD 8.3 billion, which represents 31.1% of the total forecast growth for the decade. This phase of growth will be shaped by increasing labor costs in agricultural operations, growing emphasis on feed efficiency optimization, and expanding adoption of IoT-enabled feeding systems that provide real-time monitoring and control capabilities. Livestock producers are investing in automated solutions to reduce manual labor requirements while improving feed conversion ratios and animal welfare standards.

From 2030 to 2035, the market is forecast to grow from USD 15.1 billion to USD 33.5 billion, adding another USD 18.4 billion, which constitutes 68.9% of the overall ten-year expansion. This period is expected to be characterized by advancement of artificial intelligence integration, development of precision nutrition delivery systems, and expansion of autonomous mobile feeding robots that adapt to individual animal requirements. The growing adoption of data-driven farming approaches will drive demand for sophisticated feeding systems that integrate with farm management software and provide comprehensive analytics capabilities.

Between 2020 and 2025, the automated feeding systems market experienced accelerated expansion, driven by increasing farm consolidation trends, growing emphasis on operational efficiency, and rising awareness of automated technology benefits for livestock management. The market developed as agricultural producers recognized the potential for automated feeding systems to reduce labor costs while improving feed consistency and animal performance. Technology providers began developing integrated solutions that combine feeding automation with data collection and analysis capabilities.

| Metric | Value |

| Automated Feeding Systems Market Value (2025) | USD 6.8 billion |

| Automated Feeding Systems Market Forecast Value (2035) | USD 33.5 billion |

| Automated Feeding Systems Market Forecast CAGR | 17.3% |

Market expansion is being supported by the increasing need for operational efficiency in livestock farming and corresponding demand for automated solutions that reduce labor requirements while maintaining consistent feed delivery schedules. Modern livestock operations face significant challenges including labor shortages, rising feed costs, and increasing regulatory requirements for animal welfare standards. Automated feeding systems provide solutions that address these challenges by delivering precise feed quantities at optimal times while reducing manual labor and improving feed conversion efficiency.

The growing emphasis on precision livestock farming and data-driven decision making is driving demand for advanced feeding systems that integrate with farm management software and provide comprehensive monitoring capabilities. Producers are increasingly recognizing the value of automated systems that can track individual animal consumption patterns, optimize feed formulations, and provide detailed reports for performance analysis. Investment in smart farming technologies continues to create opportunities for innovative feeding system solutions that enhance productivity and profitability.

The growing integration of Internet of Things (IoT) technologies and smart sensors is enabling automated feeding systems to provide real-time monitoring, remote control capabilities, and predictive maintenance alerts that optimize system performance and reliability. Advanced sensor networks monitor feed levels, consumption patterns, and system operation status while providing data analytics that support decision making and troubleshooting. These technological improvements are particularly valuable for large-scale livestock operations that require consistent system reliability and comprehensive operational oversight.

Modern automated feeding systems are incorporating precision nutrition capabilities that customize feed delivery based on individual animal requirements, production stages, and performance objectives. Advanced systems can adjust feed formulations, portion sizes, and feeding schedules to optimize nutrition delivery for specific animals or groups while minimizing feed waste and maximizing production efficiency. These precision feeding approaches are essential for meeting increasing demands for efficient livestock production that balances economic performance with environmental responsibility.

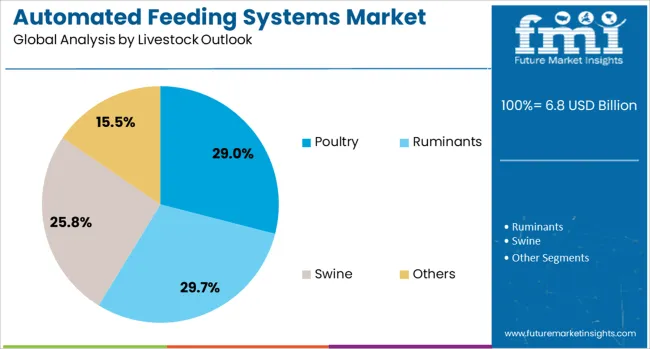

The market is segmented by component type, system category, livestock application, and region. By component type, the market is divided into hardware, software, and services. Based on system category, the market is categorized into conveyor feeding systems, rail-guided feeding systems, self-propelled feeding systems, and others. In terms of livestock application, the market is segmented into poultry, ruminants, swine, fish, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Hardware components are projected to account for 61.6% of the automated feeding systems market in 2025. This leading share is supported by the essential role of physical equipment including feeding mechanisms, conveyors, storage systems, and control hardware that form the foundation of automated feeding installations. Hardware components represent the largest investment in automated feeding system deployments and require regular maintenance and periodic replacement throughout system lifecycles. The segment benefits from ongoing technological advancement that improves system reliability, feeding precision, and integration capabilities with existing farm infrastructure.

Conveyor feeding systems are expected to represent 50% of automated feeding system installations in 2025. This dominant share reflects the widespread applicability of conveyor-based feeding solutions across diverse livestock operations and facility configurations. Conveyor systems provide reliable, consistent feed delivery with relatively straightforward installation and maintenance requirements that appeal to both small and large-scale livestock producers. The segment benefits from established technology maturity, proven operational reliability, and cost-effectiveness that makes conveyor feeding systems accessible to diverse agricultural operations.

Poultry operations are projected to contribute 29% of the market in 2025, representing the largest single livestock category for automated feeding system adoption. Poultry farming operations typically feature high animal densities and standardized feeding requirements that are well-suited for automated feeding solutions. Modern poultry facilities require precise feed delivery systems that can maintain consistent nutrition programs while supporting high production volumes and biosecurity requirements. The segment is supported by continued growth in global poultry consumption and increasing adoption of intensive production systems that benefit from automation technologies.

The Automated Feeding Systems market is advancing rapidly due to increasing labor costs in agricultural operations and growing emphasis on precision farming technologies that optimize resource utilization. The market faces challenges, including high initial capital investment requirements, technical complexity of system integration, and varying technological adoption rates among different farm sizes and regions. Technological advancement and financing options continue to influence adoption patterns and market development.

The growing integration of artificial intelligence and machine learning technologies is enabling automated feeding systems to optimize feed delivery based on real-time data analysis, predictive modeling, and adaptive learning algorithms. AI-powered systems can analyze animal behavior patterns, consumption trends, and environmental conditions to automatically adjust feeding schedules and formulations for optimal results. These advanced capabilities provide significant value for livestock producers seeking to maximize feed efficiency while maintaining animal welfare and production performance standards.

Modern automated feeding technology is incorporating autonomous mobile systems that provide flexible feeding solutions for diverse facility layouts and management approaches. Self-propelled feeding robots and automated guided vehicles can navigate complex farm environments while delivering precise feed quantities to designated locations. These mobile solutions are particularly valuable for pasture-based operations and facilities with challenging layouts that cannot accommodate fixed feeding infrastructure while maintaining operational flexibility and efficiency.

| Country | CAGR (2025-2035) |

| China | 23.4% |

| India | 21.6% |

| Germany | 19.9% |

| France | 18.2% |

| UK | 16.4% |

| USA | 14.7% |

| Brazil | 13% |

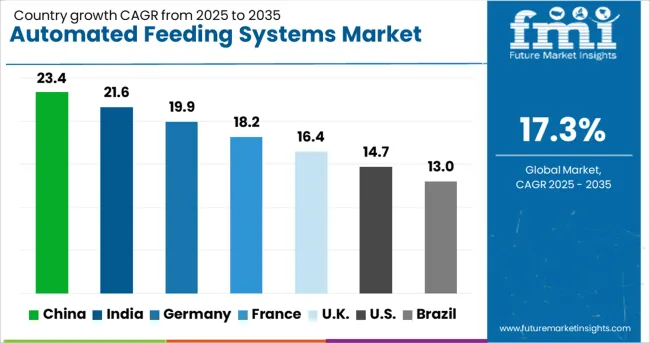

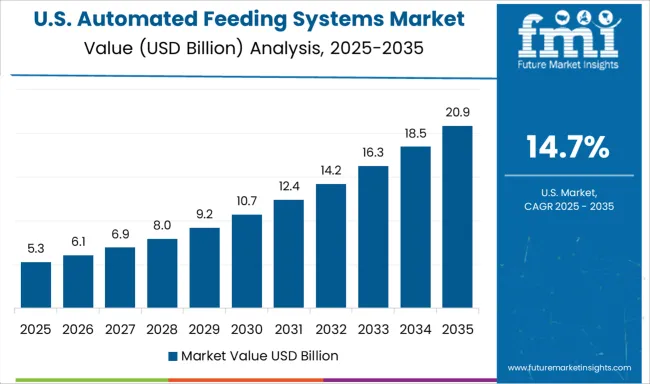

The automated feeding systems market demonstrates exceptional growth patterns across key countries, with China leading at a 23.4% CAGR through 2035, driven by massive livestock industry modernization, government support for agricultural automation, and rapidly expanding commercial farming operations that require efficient feeding solutions. India follows at 21.6%, supported by increasing farm mechanization, growing livestock sector investment, and expanding dairy industry that benefits from automated feeding technologies. Germany maintains strong growth at 19.9%, emphasizing precision farming excellence and advanced agricultural technology adoption. France grows at 18.2%, integrating automated feeding with existing livestock management systems. The UK advances at 16.4%, focusing on green farming practices and operational efficiency improvements. The USA shows steady growth at 14.7%, prioritizing large-scale commercial operations and technology integration. Brazil records 13% growth, driven by expanding livestock production and agricultural modernization initiatives. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from automated feeding systems in China is projected to exhibit the highest growth rate with a CAGR of 23.4% through 2035, driven by comprehensive livestock industry modernization programs, massive commercial farming facility construction, and government initiatives supporting agricultural automation technologies. The country's rapidly expanding livestock sector and increasing emphasis on production efficiency are creating significant demand for advanced feeding systems that reduce labor requirements while improving feed conversion ratios. Major agricultural companies and commercial livestock operations are implementing automated feeding solutions that support large-scale production goals and quality control standards.

Government agricultural modernization programs are supporting technology adoption through subsidies, training programs, and infrastructure development that facilitates automated feeding system implementation throughout major livestock production regions.

Revenue from automated feeding systems in India is expanding at a CAGR of 21.6%, supported by increasing farm mechanization initiatives, expanding dairy industry investment, and government programs promoting agricultural technology adoption. The country's growing livestock sector and increasing emphasis on productivity improvement are creating opportunities for automated feeding system implementation across diverse farming operations. Dairy cooperatives and commercial livestock operations are gradually investing in feeding automation that supports increased production capacity and operational efficiency.

Agricultural development programs and technology transfer initiatives are facilitating access to automated feeding technologies while providing training and support services that enable successful system implementation throughout Indian livestock operations.

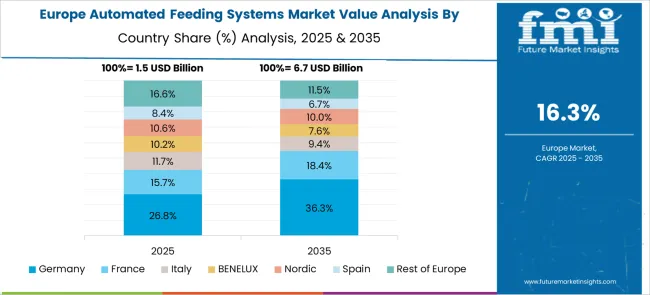

Revenue from automated feeding systems in Germany is growing at a CAGR of 19.9%, driven by emphasis on precision farming excellence, comprehensive environmental compliance requirements, and advanced agricultural technology integration that supports livestock production practices. German livestock operations are implementing sophisticated feeding automation systems that optimize resource utilization while meeting stringent environmental regulations and animal welfare standards. The country's established agricultural technology sector and engineering expertise enable development of innovative feeding solutions that serve both domestic and export markets.

Precision agriculture programs and initiatives are driving adoption of advanced feeding systems that integrate with comprehensive farm management software and environmental monitoring systems throughout German livestock operations.

Revenue from automated feeding systems in France is expanding at a CAGR of 18.2%, supported by integration of feeding automation with existing livestock management systems, comprehensive agricultural support programs, and emphasis on operational efficiency that maintains traditional farming values while embracing technological innovation. French livestock operations are implementing automated feeding solutions that complement established management practices while providing efficiency improvements and labor savings. Agricultural cooperatives and family farming operations are accessing feeding automation through cooperative purchasing programs and shared service arrangements.

Agricultural modernization and cooperative development programs are facilitating automated feeding system adoption while maintaining emphasis on farming practices and regional agricultural traditions throughout French livestock production areas.

Revenue from automated feeding systems in the UK is projected to grow at a CAGR of 16.4%, driven by emphasis on green farming practices, operational efficiency improvements, and comprehensive animal welfare standards that benefit from automated feeding precision and consistency. British livestock operations are implementing feeding automation systems that support environmental goals while improving labor efficiency and animal welfare outcomes. Government agricultural policies and environmental regulations are encouraging adoption of technologies that reduce environmental impact while maintaining production competitiveness.

Environmental responsibility programs and efficiency initiatives are supporting automated feeding system adoption through grant programs, technical support services, and demonstration projects that showcase technology benefits throughout British agricultural communities.

Demand for automated feeding systems in the USA is expanding at a CAGR of 14.7%, driven by large-scale commercial livestock operations, comprehensive technology integration programs, and emphasis on production efficiency that supports competitive positioning in global agricultural markets. American livestock producers are implementing advanced feeding automation systems that integrate with comprehensive farm management software and provide detailed analytics for performance optimization. Technology providers are developing sophisticated solutions that meet the complex requirements of large-scale operations while providing scalability and reliability.

Commercial agriculture development and technology innovation programs are supporting automated feeding system advancement through research funding, demonstration programs, and industry partnership initiatives that drive technology development and market adoption throughout American agricultural operations.

Demand for automated feeding systems in Brazil is growing at a CAGR of 13%, supported by expanding livestock production capacity, agricultural modernization initiatives, and increasing investment in commercial farming operations that require efficient feeding solutions. Brazilian livestock operations are gradually implementing feeding automation systems that support production expansion while addressing labor challenges and improving operational consistency. Government agricultural development programs and financing initiatives are facilitating technology adoption across diverse farm sizes and regional conditions.

Infrastructure development and agricultural financing programs are supporting automated feeding system adoption through equipment financing, technical assistance programs, and infrastructure improvement initiatives that enable technology implementation throughout Brazilian livestock production regions.

The automated feeding systems market is defined by competition among agricultural technology companies, livestock equipment manufacturers, and specialized automation solution providers. Companies are investing in advanced automation technologies, IoT integration, precision feeding capabilities, and comprehensive service support to deliver reliable, efficient, and innovative feeding solutions. Strategic partnerships, technological advancement, and global market expansion are central to strengthening product portfolios and market presence.

GEA Group Aktiengesellschaft offers comprehensive automated feeding solutions with advanced control systems and integration capabilities for large-scale livestock operations. DeLaval provides innovative feeding automation systems with emphasis on dairy operation optimization and precision nutrition delivery. BouMatic delivers specialized feeding solutions for dairy operations with focus on system reliability and operational efficiency. DAIRYMASTER offers automated feeding systems with comprehensive farm management integration and data analytics capabilities.

FarmFeeder provides mobile automated feeding solutions with emphasis on flexibility and operational convenience. Fullwood JOZ delivers comprehensive livestock management systems including advanced feeding automation technologies. HETWIN - FÜTTERUNGSTECHNIK offers specialized feeding systems with focus on precision delivery and system customization. LELY provides robotic feeding solutions with advanced automation and individual animal management capabilities. RNA Automation Limited delivers conveyor-based feeding systems with emphasis on reliability and maintenance efficiency. Rovibec Agrisolutions offers comprehensive feeding automation solutions for diverse livestock operations. Schauer Agrotronic GmbH provides electronic feeding systems with advanced control and monitoring capabilities. Trioliet delivers self-propelled feeding systems with emphasis on operational flexibility and efficiency.

| Items | Values |

|---|---|

| Quantitative Units | USD 6.8 billion |

| Component Type | Hardware, Software, Services |

| System Category | Conveyor Feeding Systems, Rail-Guided Feeding Systems, Self-Propelled Feeding Systems, Others |

| Livestock Application | Poultry, Ruminants, Swine, Fish, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, France, Brazil |

| Key Companies Profiled | GEA Group Aktiengesellschaft, DeLaval, BouMatic, DAIRYMASTER, FarmFeeder, Fullwood JOZ, HETWIN - FÜTTERUNGSTECHNIK, LELY, RNA Automation Limited, Rovibec Agrisolutions, Schauer Agrotronic GmbH, Trioliet |

| Additional Attributes | Dollar sales by component type, system category, and livestock application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established agricultural technology companies and emerging automation specialists, producer preferences for conveyor versus mobile feeding solutions, integration with IoT technologies and farm management software, innovations in precision nutrition delivery and individual animal management, and adoption of artificial intelligence capabilities with predictive analytics and adaptive feeding optimization features. |

The global automated feeding systems market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the automated feeding systems market is projected to reach USD 33.5 billion by 2035.

The automated feeding systems market is expected to grow at a 17.3% CAGR between 2025 and 2035.

The key product types in automated feeding systems market are hardware, software and services.

In terms of system outlook , conveyor feeding systems segment to command 50.0% share in the automated feeding systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Centrifuge System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA