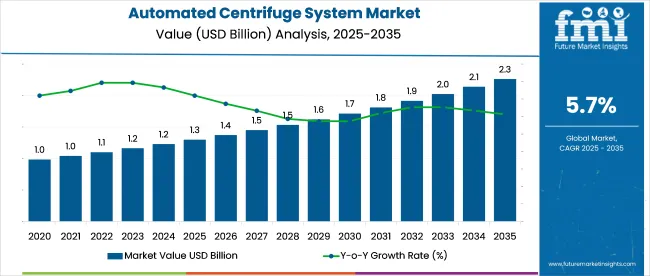

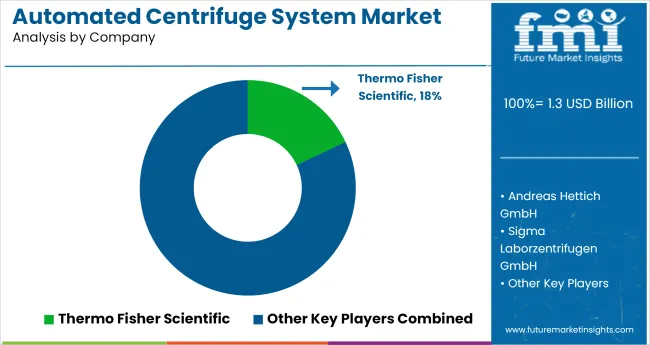

The automated centrifuge system market is expected to expand from USD 1.3 billion in 2025 to approximately USD 2.3 billion by 2035, at a CAGR of 5.7%. The market expanded steadily, driven by increased adoption in clinical diagnostics, molecular biology, and pharmaceutical R&D.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.3 billion |

| Projected Market Size in 2035 | USD 2.3 billion |

| CAGR (2025 to 2035) | 5.7% |

By 2025, demand is expected to remain robust across hospital laboratories and biotechnology firms, as the need for high-throughput and reproducible processing becomes integral to modern lab automation. Integration of centrifuge units with broader laboratory information systems (LIS) and robotics platforms is enhancing operational efficiency and reducing manual errors. Innovations in rotor design, closed-system safety, and programmability are positioning automated centrifuges as a critical component in standardized sample workflows.

The automated centrifuge system market plays a precision-driven role across several high-value sectors. In the USD 8 billion global laboratory automation industry, automated centrifuges account for 4–6%, supported by growing needs for efficiency in diagnostics and research labs. Within the clinical diagnostics equipment market, valued at over USD 60 billion, 5-7% of instrumentation demand is attributed to automated separation systems that enhance sample throughput.

In pharmaceutical R&D and QA labs, which form part of the USD 90 billion drug development tools sector, automated centrifuges represent about 3-5% of capital spending. Biotechnology tools, a USD 80 billion market, allocate around 4-6% to high-speed centrifuges. Even in bioprocessing, 6-8% of equipment budgets are directed to continuous, automated separation systems.

The market is gaining traction due to increasing clinical testing volumes, rising demand for high-throughput diagnostics, and the shift toward fully automated laboratory workflows. Key investment areas include floor-standing units, fully automated systems, and hospital lab applications.

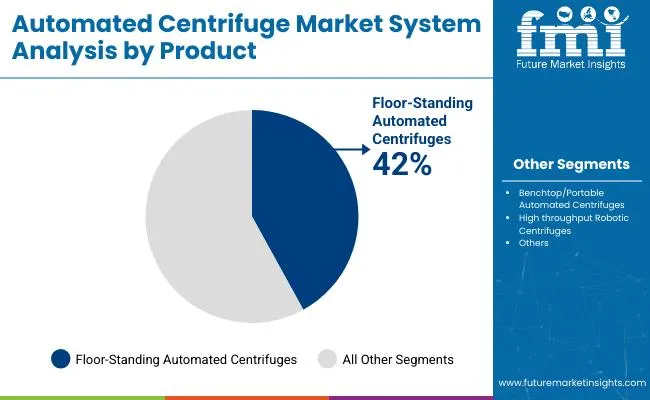

Floor-standing automated centrifuges are projected to secure 41.5% of the market by 2025. These units offer high-speed operation and larger capacity, making them suitable for centralized labs and high-volume testing facilities.

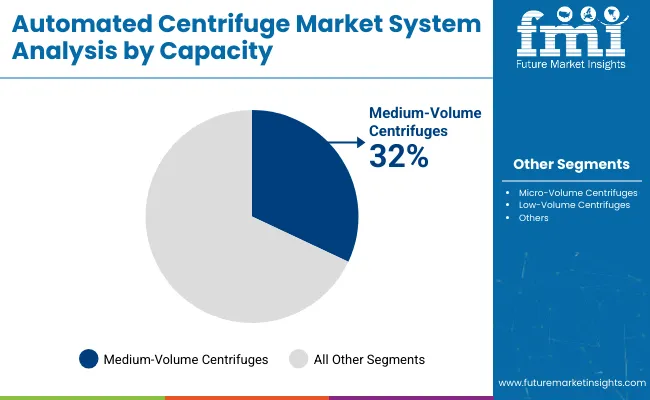

Medium-volume centrifuges are expected to account for 32% of the total market by 2025. These systems balance processing speed and cost-efficiency, making them ideal for mid-sized labs and regional diagnostic centers.

Fully automated centrifuges are forecasted to lead the market with 63% share by 2025. These systems streamline sample handling, loading, and unloading, enhancing accuracy and reducing manual labor.

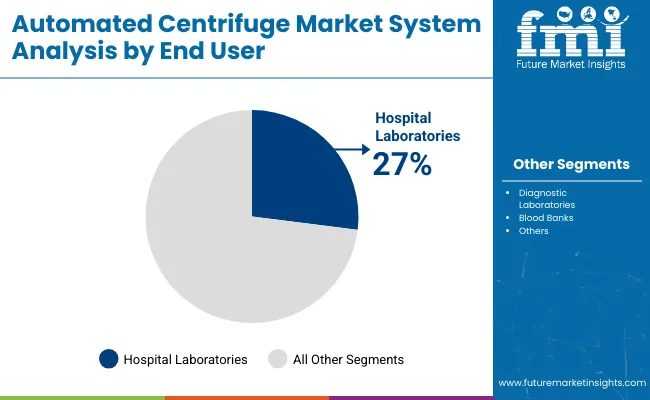

Hospital laboratories are projected to hold 27% share of the market by 2025. Growing test volumes, rapid diagnostic needs, and round-the-clock operations are fueling demand in this segment.

Adoption of automated centrifuge systems is accelerating due to rising throughput demands and tighter quality validation in bioprocessing and diagnostics. Advances in rotor programming and sample balancing have cut cycle variability, while demand for compact, high-capacity systems is reshaping procurement in clinical labs and biomanufacturing environments.

High-Throughput Labs Drive Rapid Configuration Adoption

Automated centrifuge systems with programmable rotor switching and pre-set cycle libraries saw a 39% increase in adoption across clinical labs and contract testing centers. Labs processing over 5,000 samples/day reduced setup time by 44% using systems with self-balancing modules. High-speed models (≥18,000 rpm) enabled plasma separation in under 8 minutes, boosting sample clearance by 31% per shift.

Integration with barcode-based tube recognition cut loading errors by 23%, while smart-lid diagnostics trimmed maintenance downtime by 17%. Vendors offering customizable batch protocols gained traction, especially among blood banks and genomic labs prioritizing speed and traceability. These upgrades pushed Cap Ex justification under 15 months in 2025.

Biomanufacturing Demands Precision and Contamination Control

Biopharma firms expanded use of automated centrifuge systems for cell harvesting and virus clarification, with GMP-compliant units accounting for 52% of new installs in 2025. Closed-bowl configurations reduced contamination risk, cutting batch rejection rates by 28% in upstream operations. Inline automation with liquid handlers enabled continuous feed processing, shrinking manual intervention cycles by 34%.

High-volume biologics facilities scaled rotor capacity to 12 L+, raising yield per run by 22% without increasing footprint. Embedded temperature control systems achieved ±0.5°C stability, essential for enzyme and protein preservation. These performance metrics are now central to equipment selection, particularly in mRNA and viral vector production.

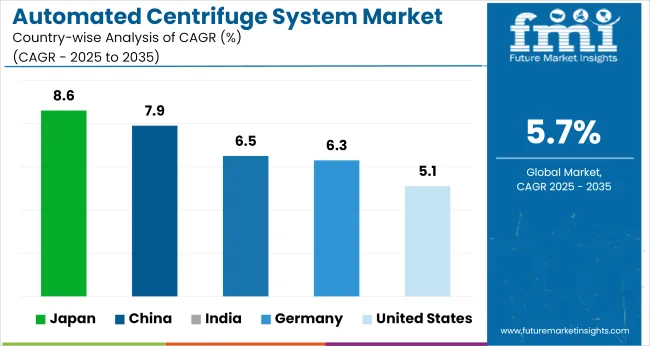

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.6% |

| China | 7.9% |

| India | 6.5% |

| Germany | 6.3% |

| United States | 5.1% |

The global market is forecast to expand at a global CAGR of 5.7% between 2025 and 2035. Japan shows the highest momentum among the five profiled countries, reaching 8.6%, reflecting rising demand for automation in pharmaceutical manufacturing and diagnostics. China, as a leading BRICS nation, follows closely at 7.9%, propelled by capacity additions in biotech hubs and supportive state investments in laboratory automation.

India also maintains a strong trajectory with a CAGR of 6.5%, outperforming the global baseline by 14%, driven by a growing presence of diagnostic labs and R&D units in Tier 1 and Tier 2 cities. Among OECD members, Germany shows moderate acceleration at 6.3%, driven by upgrades in hospital automation protocols. In contrast, the USA trails at 5.1%, 11% below the global average, influenced by slower adoption cycles in public healthcare institutions and mature demand saturation across key industrial applications.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

The market in Japan is projected to grow at a CAGR of 8.6% between 2025 and 2035. From 2020 to 2024, demand remained largely tied to hospital-based diagnostic labs and university research centers. The new decade is witnessing wider deployment in pharmaceutical QC labs, life sciences R&D, and regenerative medicine facilities. Government funding for cell and gene therapy infrastructure is supporting automation in sample preparation processes, including high-throughput centrifugation.

China is forecast to expand at a CAGR of 7.9% through 2035. During 2020 to 2024, uptake was primarily seen in national testing centers and COVID-era genomic surveillance labs. Moving forward, automation in centrifuge operations is being adopted across over 600 university biology departments and 100+ biotech parks in Tier 1 and Tier 2 cities. Government-backed modernization of life sciences capabilities is fueling the transition from manual centrifuges to programmable, integrated systems.

India is expected to grow at a CAGR of 6.5% from 2025 to 2035. From 2020 to 2024, demand was concentrated in tier-1 diagnostic labs and large hospital networks. The post-2025 period is seeing rapid scale-up across contract research organizations (CROs) and mid-sized pathology labs as automation becomes a key differentiator. AI-integrated centrifuges that enable remote monitoring and batch diagnostics are gaining traction, especially in oncology and molecular biology labs.

Germany is projected to grow at a CAGR of 6.3% during the forecast period. Between 2020 and 2024, demand remained focused on university labs and pharmaceutical validation setups. As of 2025, lab automation has become a national priority under the High-Tech Strategy 2025. Automated centrifuges are now integral to modernization efforts in more than 120 publicly funded biotech hubs, especially in Baden-Württemberg, Bavaria, and North Rhine-Westphalia.

The United States market is poised to grow at a CAGR of 5.1% from 2025 to 2035. From 2020 to 2024, usage was dominated by hospital labs, CDC testing centers, and pharma manufacturing QC units. Post-pandemic restructuring is accelerating lab automation across commercial labs, with high-throughput automated centrifuges being deployed to process large specimen volumes quickly. Investments in biosample storage, biobanking, and clinical diagnostics are boosting system demand.

The automated centrifuge system market is characterized by strong competition between analytical instrument giants and niche lab automation providers. Thermo Fisher Scientific and Beckman Coulter dominate the market with robust robotic centrifugation platforms integrated into high-throughput clinical and biopharma workflows. Thermo’s CW3 series and Beckman’s Allegra X-30R have widespread adoption in genomics and sample prep due to their integration with LIMS and cloud diagnostics.

Eppendorf SE and Haier Biomedical maintain strong presence in academic and small-lab settings, offering compact, programmable units with safety-lock features and intuitive UIs. Agilent Technologies and HighRes Biosolutions are scaling modular systems designed for drug discovery pipelines, while Sigma Laborzentrifugen and Biosan target the diagnostics segment in Central Europe and the Baltics. Innovation centers on rotor adaptability, automated tube recognition, and HEPA-filtered enclosed chambers to ensure contamination-free operation.

Recent Automated Centrifuge System Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 2.3 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Benchtop/Portable Automated Centrifuges, Floor-Standing Automated Centrifuges, High-Throughput Robotic Centrifuges |

| Capacities Analyzed (Segment 2) | Micro-Volume, Low-Volume, Medium-Volume, Large-Volume |

| Automation Levels Analyzed (Segment 3) | Semi-Automated, Fully Automated |

| End Users Analyzed (Segment 4) | Hospital Laboratories, Diagnostic Laboratories, Blood Banks, Academic & Research Organizations, Biopharmaceutical Companies, Contract Research Organizations, Other Specialized Facilities |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Thermo Fisher Scientific, Andreas Hettich GmbH, Sigma Laborzentrifugen GmbH, HighRes Biosolutions, Agilent Technologies, BioNex Solutions, Inc., Core Laboratories, Beckman Coulter, Inc., Biosan, Haier Biomedical, Eppendorf SE, Tharmac, Corning Incorporated |

| Additional Attributes | Dollar sales by automation and capacity type, rising demand in high-throughput diagnostics, growing adoption in biopharma research workflows, and increasing shift toward fully integrated lab automation platforms. |

The market is categorized into benchtop/portable automated centrifuges, floor-standing automated centrifuges, and high-throughput robotic centrifuges. Each type addresses different space, capacity, and automation requirements across laboratory settings.

Based on sample volume handling, the market includes micro-volume, low-volume, medium-volume, and large-volume centrifuges. This segmentation caters to diverse application needs, from small-scale diagnostics to large-volume bioprocessing.

Automation levels define the market into semi-automated and fully automated centrifuges, with increasing adoption of fully automated systems to reduce human intervention and enhance process consistency.

End-use segments comprise hospital laboratories, diagnostic laboratories, blood banks, academic and research organizations, biopharmaceutical companies, contract research organizations, and other specialized facilities requiring automated sample separation.

Regional analysis includes North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

The market is estimated to be worth USD 1.3 billion in 2025.

The market is forecasted to reach USD 2.3 billion by 2035.

The market is set to expand at a CAGR of 5.7% over the forecast period.

Floor-standing automated centrifuges hold the largest share at 41.5% in 2025.

Japan is the top-growing country, projected to grow at a CAGR of 8.6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Poly Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated External Defibrillator Market Analysis – Size, Share, and Forecast 2025 to 2035

Automated Suturing Devices Market Analysis - Growth & Forecast 2025 to 2035

Automated Blood Processing Equipment Market Growth – Trends & Forecast 2025 to 2035

Automated Container Terminal Market Analysis by Automation, Product, Project, and Region: Forecast for 2025 to 2035

Automated Parcel Delivery Terminals Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA