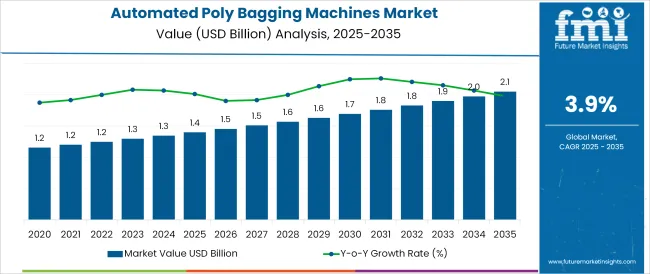

The Automated Poly Bagging Machines Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The automated poly bagging machines market is witnessing sustained growth as industries pivot toward speed, consistency, and cost-efficiency in packaging operations. Growing labour cost pressures, rising e-commerce activity, and demand for tamper-proof packaging have collectively driven the adoption of automation in bagging solutions.

Technological innovations in programmable logic controllers (PLC), touch-screen interfaces, and integration with warehouse management systems (WMS) are further enhancing machine efficiency and precision. Additionally, manufacturers are increasingly opting for high-output automated bagging systems to meet surging order volumes, particularly in food, retail, and industrial supply chains.

Regulatory focus on hygienic packaging standards, especially in food and beverage sectors, is prompting investments in stainless-steel, washdown-compatible systems. The future trajectory of the market appears promising as more businesses embrace modular, scalable bagging systems that support flexible packaging formats, reduce material waste, and integrate seamlessly with smart factory environments.

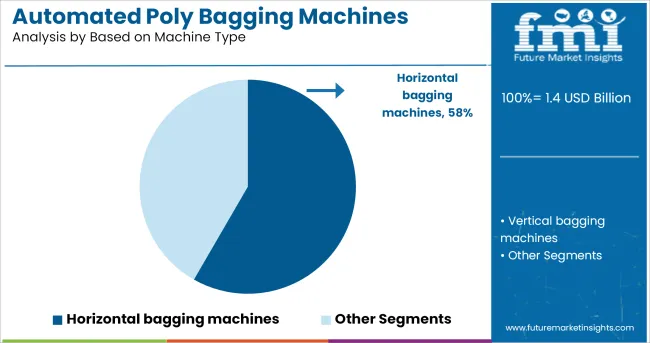

It has been observed that horizontal bagging machines account for 58.30% of market revenue within the machine type category, establishing their position as the dominant format. This preference is driven by their suitability for high-speed, continuous-motion operations and ability to accommodate a wide range of product dimensions.

Their ergonomic design, lower maintenance requirements, and seamless integration with automated conveyors and labeling systems have made them particularly advantageous in high-throughput environments.

Industries favour horizontal systems due to their reduced downtime, improved line efficiency, and the capacity to support multiple bagging styles. The adaptability to varying package sizes without significant retooling further supports operational flexibility. These advantages have collectively solidified the dominance of horizontal machines in automated poly bagging applications.

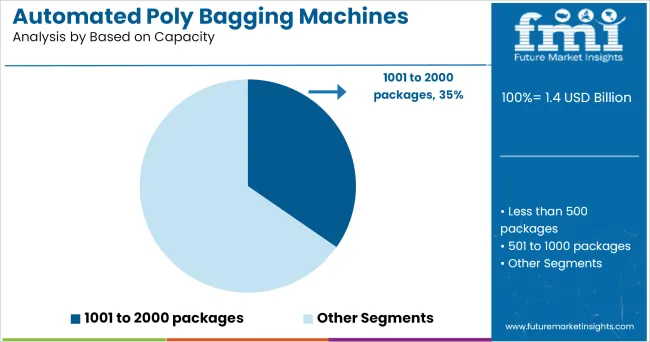

The capacity segment ranging from 1001 to 2000 packages is projected to command 34.70% of overall market revenue, indicating its role as the preferred production range. This capacity bracket strikes an ideal balance between output efficiency and space optimization, making it well-suited for mid-to-high volume operations without the need for industrial-scale infrastructure.

Businesses adopting this segment typically prioritize modularity and cost-effectiveness while aiming to meet daily packaging demand consistently. It has also been favoured for its compatibility with both single-shift and dual-shift operations, particularly among food processors and industrial packagers.

The flexibility to scale production without significant investment in larger machines or additional workforce has made this capacity range a logical choice for growing enterprises seeking automation with controlled capital expenditure.

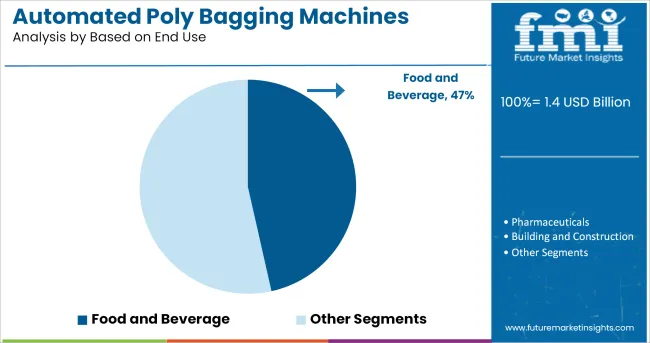

The food and beverage sector holds the largest share of end use at 46.50%, driven by its stringent hygiene requirements, high throughput demand, and increasing product variety. Automated poly bagging systems have enabled food producers to meet regulatory compliance, reduce manual handling, and maintain product freshness through consistent sealing and packaging standards.

The ability to package a diverse range of items-ranging from frozen goods to dry snacks-within short cycle times has reinforced adoption. Furthermore, consumer preference for tamper-evident, resealable, and labelled packaging has supported integration of advanced machines with inline printing and weighing capabilities.

As food manufacturers continue to optimize packaging lines for traceability, safety, and shelf appeal, the reliance on automated poly bagging systems is expected to remain central to operations across the segment.

Due to advancements of technology and advent of the internet, online shopping has become much easier than it used to be traditionally. This has not only improved the shipping and logistics of goods but also reduced delivery time. Polybag packaging plays a major role in catering customer demands.

Polybags is becoming part and parcel of online shopping due to their multi-faceted functioning and uses. The polybags are made from polyethylene and polypropylene and are used to store and transport food items, fruits, vegetables, and various small sealed products.

Automated poly bagging machines are efficient bagging equipment to manufacture bags with higher throughput, quick and fast changeovers, and less downtime. The machines are easy to use and versatile. In addition, the automated poly bagging machines can perform multiple applications with both horizontal and vertical loading capabilities.

The automated poly bagging machines can pack, scan, and print labels on the bags for shipping and sorting. The machines help in improving productivity, throughput and reduce cost. The increasing share of e-commerce sector across the globe is expected to propel the demand for automated poly bagging machines.

The automated poly bagging machines market share are reflecting high market growth due to their versatility and high return on investment. The fully automatic poly bagging machine can reduce human interference, which reduces labour costs.

Additionally, the automated poly bagging machines increase the output due to its high speed, uninterrupted continuous production without any manual operations. The machine performs all the processes like feeding, tracking, sealing, cutting, punching, and conveying to the belt automatically with synchronization. Hence, these machines require human intervention to supplement raw materials and collect the finished products.

The automatic poly bagging machine produces various and function-wise polybags for e-commerce, pharmaceuticals, food and beverages, consumer products, retail packaging industries are factors for the rise in demand for polybags and indirectly on the automated poly bag manufacturing machines.

The polybags are made from polyethylene and polypropylene material, non-biodegradable, hard to recycle, and take many years to decompose. Moreover, they are harmful to the environment as they contaminate the soil and the waterways.

Therefore, by considering the dangerous environmental repercussion, the government in many countries has banned the usage of single-use of polybags. So, lighter-weight polybags and less than 50 microns thickness are forbidden to use and produce in many countries.

Indirectly the automated polybag machines, which manufactures bags of less than 50 microns thickness, have low demands due to government restrictions. Other than this, polybags are hazardous to human health as the chemicals added to manufacture polybags are dangerous to human bodies and animals. These challenges can restrain the sales of automated poly bagging machines.

Automated poly bagging machines are mainly used in food and beverage, pharmaceuticals, construction, and chemical and fertilizer filling products. Therefore, considering the application and usefulness of the polybag manufacturing machine has significant growth.

The packaging machines are specially designed as per the customers' need, requirement and depending upon the type of product to be packed, product specification, and customized bagging configuration to increase output and efficiency.

Key players

Key Asian players

are actively involved in automated poly bagging machines market for different applications.

The manufacturers involved in manufacturing automated poly bagging machines are adopting various strategies such as technological innovation, product launch, merger and acquisition to serve the increasing demand for the automated poly bagging machines market.

In November 2024, Pregis LLC launched a new poly bagging system, designed to handle a wide range of products, increases productivity, and minimizes labour costs.

India is a fast-growing and developing country with huge demand for products due to its high population and economic growth. Moreover, many developed countries focus on the Indian market for investment and trade due to its technological advancement and progress. India has various food dishes and products according to its region; hence the packaging of food, fruits, juices, vegetables on poly bags is essential.

People purchase fruits, vegetables, retail grocery products, and even pharmaceutical products in poly bags. The increased demand for poly bags influences India's automated poly bagging machine market due to its vast population and improved food and pharmaceutical products.

The global automated poly bagging machines market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the automated poly bagging machines market is projected to reach USD 2.1 billion by 2035.

The automated poly bagging machines market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in automated poly bagging machines market are horizontal bagging machines and vertical bagging machines.

In terms of based on capacity, 1001 to 2000 packages segment to command 34.7% share in the automated poly bagging machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

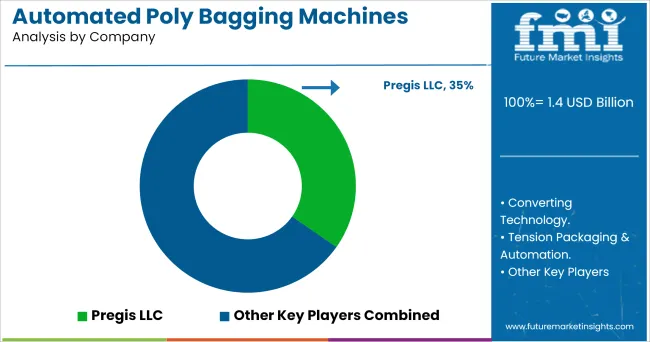

Market Share Distribution Among Automated Poly Bagging Machines Manufacturers

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA