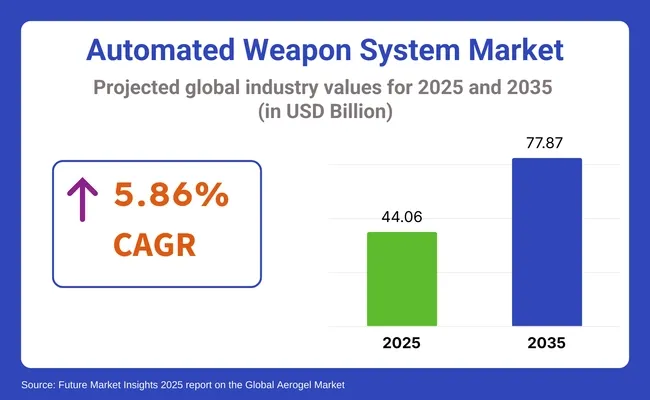

The global automated weapon system market is projected to grow from USD 44.06 billion in 2025 to USD 77.87 billion by 2035, reflecting a CAGR of 5.86% during the forecast period. This market growth is being driven by increasing defense budgets, escalating geopolitical tensions, and rising demand for advanced autonomous defense technologies.

Automated weapon systems are being adopted across land-based military platforms, air defense systems, and naval warfare units to enhance combat precision, reduce human casualties, and improve operational efficiency. Global investments are being allocated to modernize defense infrastructure in response to evolving security threats and dynamic defense strategies.

Technological advancements in artificial intelligence (AI), robotics, and sensor fusion technology are being leveraged to develop sophisticated automated weapon systems with capabilities such as autonomous target detection, tracking, and engagement. Increased demand is being observed for unmanned aerial vehicles (UAVs), autonomous ground vehicles, and naval drones due to their operational advantages and tactical flexibility.

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 44.06 billion |

| Market Size in 2035 | USD 77.87 billion |

| (CAGR) | 5.86% |

Significant focus is being placed on integrating AI-enabled weapon systems within network-centric defense architectures to effectively counter emerging threats. These systems are being incorporated into strategic defense initiatives across both developed and developing countries to strengthen national security.

As highlighted by GeirHåøy, Chief Executive Officer of Kongsberg Gruppen, “What is being seen, even from the defense side now, is the question of how commercial products and systems can be utilized and militarized.” This statement underscores the growing trend of commercial technology integration by leading defense contractors to accelerate and standardize the deployment of automated weapon systems.

Major industry players such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, and BAE Systems are heavily investing in research and development, strategic partnerships, and global market expansion. Automation and network-centric warfare capabilities are being enhanced to improve the versatility, accuracy, and effectiveness of automated weapon systems. The market is expected to experience consistent growth and rapid technological evolution through 2035

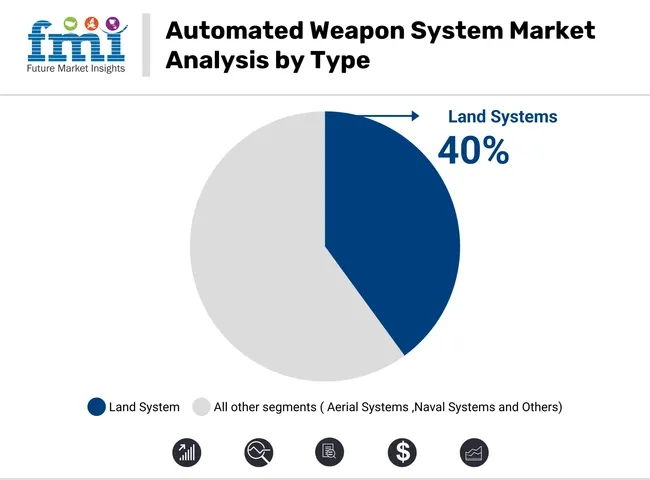

The automated weapon system market is being shaped by increasing investments in AI, robotics, and defense automation. Land-based autonomous platforms and military end users are being prioritized as countries upgrade conventional warfare strategies with intelligent technologies.

Land-based automated weapon systems are projected to dominate by type, capturing 40% of the market share in 2025. These systems are being adopted to enhance combat performance, enable remote operations, and reduce human exposure in hostile terrains. Unmanned ground vehicles (UGVs), robotic combat systems, and AI-powered turret systems are being integrated by defense leaders such as Lockheed Martin, Rheinmetall AG, and Hanwha Aerospace.

Platforms like the Uran-9, developed by Kalashnikov Concern, and autonomous land vehicles used by the USA Army are being deployed with advanced sensor suites, AI target acquisition, and real-time battlefield analytics. The adoption of such systems is being accelerated by government-backed defense modernization initiatives, increased battlefield digitization, and the need for precision-guided, low-latency response capabilities in land combat scenarios.

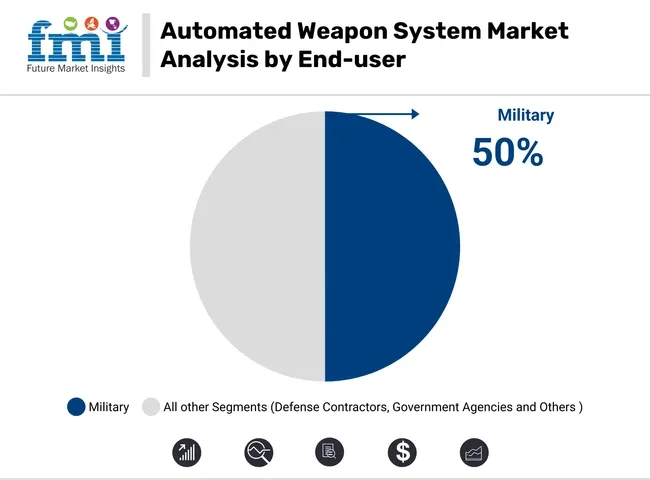

The military sector is expected to dominate the end-user segment, accounting for 50% of the market in 2025. Autonomous weapon systems are being deployed by military forces to improve strategic agility and operational efficiency. Countries such as the United States, China, Israel, and South Korea are being recognized for leading advancements in AI-enabled defense automation.

Companies like Raytheon Technologies, Elbit Systems, and Northrop Grumman are being awarded defense contracts to develop loitering munitions, AI-guided fire control systems, and autonomous unmanned combat platforms. These systems are being embedded within next-generation defense frameworks to support electronic warfare, tactical reconnaissance, and real-time threat neutralization. Military reliance on automation is being driven by rising geopolitical tensions, personnel safety priorities, and the emergence of multi-domain warfare.

On-premises deployment is projected to dominate the automated weapon system market in 2025, driven by its superiority in data security, response latency, and control over mission-critical operations. Militaries prioritize on-site infrastructure for sensitive weapon systems to mitigate cybersecurity risks and maintain autonomy over tactical systems.

Countries like the USA and Israel continue to rely on on-premises setups for real-time control of unmanned combat vehicles, smart missile systems, and surveillance platforms. Defense contractors such as BAE Systems and Honeywell offer hardened, localized deployments to support encrypted communications and secure operations, ensuring resilient and uninterrupted performance in high-risk combat zones.

Sensors are expected to lead the automated weapon system market by component in 2025, owing to their critical role in surveillance, target acquisition, navigation, and threat detection. These sensors, including infrared, radar, LiDAR, and electro-optical systems, are integrated into unmanned vehicles, missile systems, and robotic platforms to ensure precision and situational awareness.

Major defense players like Thales Group, Leonardo, and Raytheon are advancing multi-sensor fusion technologies to enable real-time data interpretation and autonomous combat decisions. As automated platforms grow more complex, sensors serve as the foundational element for responsive, intelligent weapon systems optimized for modern battlefield environments.

Artificial intelligence (AI) is poised to dominate the automated weapon system market by technology in 2025, driven by its integration into advanced targeting, decision-making, and threat response frameworks. AI-enabled systems offer real-time battlefield intelligence, autonomous threat detection, and precision strike capabilities, which are increasingly being adopted in both land-based and aerial defense platforms.

Defense giants like Lockheed Martin and Northrop Grumman are actively embedding AI into loitering munitions and surveillance drones to enhance operational efficiency. As nations seek tactical superiority through smarter combat solutions, AI remains the cornerstone of next-generation autonomous defense systems across global military programs.

The automated weapon system market is growing due to rising defense budgets and AI advancements, while ethical concerns, regulatory challenges, and technological risks are influencing adoption and market development.

Increasing defense budgets and technological advancements are driving market growth.

Rising global defense budgets are leading to increased investments in automated weapon systems designed to enhance operational efficiency and precision. These systems are being adopted to reduce human involvement in dangerous combat situations and improve decision-making accuracy.

Significant progress in artificial intelligence, machine learning, and sensor technologies is enabling the creation of sophisticated autonomous weapons capable of functioning effectively in diverse environments. Military organizations are prioritizing these technologies to counter evolving security threats and maintain strategic advantages. Continued innovation and funding are expected to accelerate market expansion and the deployment of automated weapon systems worldwide.

Ethical concerns and regulatory challenges are limiting widespread adoption

The deployment of automated weapon systems is facing ethical and legal scrutiny regarding accountability, autonomous decision-making, and compliance with international humanitarian laws. Concerns about unintended escalation and the difficulty in distinguishing combatants from civilians highlight risks inherent in autonomous weapon use.

Additionally, the lack of unified global regulations governing these systems has created a fragmented regulatory landscape, complicating their development and adoption. These regulatory challenges are slowing down procurement processes and limiting the acceptance of automated weapon systems by various countries, emphasizing the need for clear international frameworks to enable responsible use and standardization.

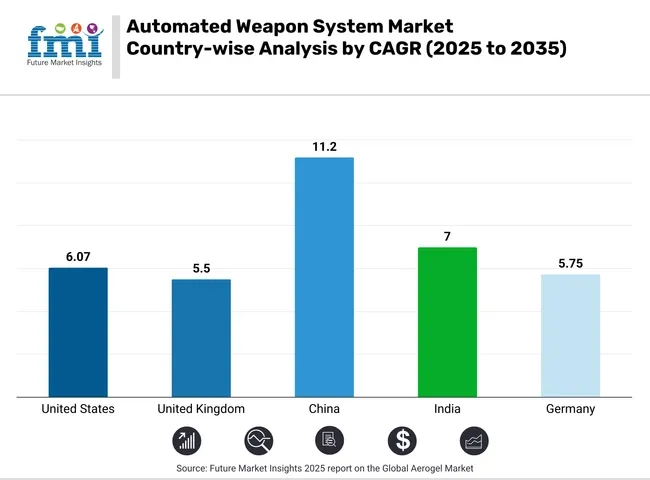

The automated weapon system market is expanding globally. Growth is driven by defense modernization, AI integration, and increased military spending. Rapid growth is recorded in China and India. Innovation and precision characterize the markets in the United States, Germany, and the United Kingdom.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.07% |

| United Kingdom | 5.5% |

| China | 11.2% |

| India | 7% |

| Germany | 5.75% |

The United States automated weapon system market is projected to grow at a CAGR of 6.07% through 2035. Significant investments in defense modernization and autonomous weapon development are being made. Leading defense contractors, including Lockheed Martin, Raytheon Technologies, and Northrop Grumman, drive innovation in drones, missile systems, and robotic weapons.

Government funding facilitates deployment across military branches. Integration of advanced AI, sensor technologies, and cybersecurity enhances weapon accuracy and operational safety. Regulatory frameworks and reimbursement policies promote adoption. Research, development, and deployment are concentrated in the USA, supporting steady market growth.

The United Kingdom automated weapon system market is expected to grow at a CAGR of 5.5% through 2035. Investments in autonomous military technologies and defense modernization programs are driving growth. Major defense firms such as BAE Systems, QinetiQ, and MBDA UK lead development of drones, smart missile systems, and robotic platforms.

Ministry of Defence funding promotes AI, robotics, and sensor integration. Collaboration with NATO allies accelerates innovation and strategic deployment. A balance of research excellence and practical defense applications characterizes the UK market. Regulatory support and R&D infrastructure underpin the steady expansion of autonomous defense systems.

The automated weapon system market in china is forecasted to grow rapidly at a CAGR of 11.2% through 2035. Military modernization and AI-driven autonomous defense technology adoption propel growth. Leading corporations such as China Aerospace Science and Technology Corporation (CASC) and China North Industries Group Corporation (Norinco) expand capabilities in drones, robotic ground vehicles, and smart missile systems.

Government initiatives emphasize AI, robotics, and digital defense platforms. Increased defense budgets and technology adoption accelerate market expansion. Domestic innovation and policy support position China as a key global player in automated weapons.

The automated weapon system market in india is projected to grow at a CAGR of 7% through 2035. Growth is driven by rising defense expenditure and modernization initiatives. Indigenous firms including Bharat Electronics Limited (BEL) and Defense Research and Development Organisation (DRDO) advance unmanned aerial vehicles and smart missile systems.

Technology transfers are facilitated by international partnerships. government's emphasis on self-reliance and Make in India initiatives supports local production. Geopolitical tensions and strategic priorities sustain demand. Training programs and infrastructure investments further stimulate automated weapon system adoption.

German automated weapon system market is expected to grow at a CAGR of 5.75% through 2035. Growth is supported by precision engineering, high-quality manufacturing, and extensive research and development. Leading companies such as Rheinmetall AG, Krauss-MaffeiWegmann (KMW), and Hensoldt AG develop robotic vehicles, missile defense systems, and advanced munitions.

Government policies prioritize safety, precision, and AI integration. Defense budgets and EU collaborative projects enhance innovation. Germany benefits from strong export activity and technological excellence, maintaining a leading position in automated weapon system production and development.

The automated weapon system market is led by Tier 1 defense contractors such as Lockheed Martin, Northrop Grumman, General Dynamics, and BAE Systems, which dominate through large-scale defense contracts and extensive R&D. Lockheed Martin has developed autonomous UAVs and ground vehicles, while Northrop Grumman focuses on AI-driven targeting technologies.

Tier 2 companies like Israel Aerospace Industries and Thales Group specialize in regional markets and autonomous naval systems. Tier 3 includes startups such as Anduril Industries, focusing on innovative drone swarms and AI surveillance. High entry barriers include R&D costs, regulations, and advanced expertise. The market is moderately consolidated with ongoing collaborations.

Recent Industry Developments

Between 2024 and 2025, significant advancements have been made in the automated weapon system market.In January 2025, Anduril Industries launched the Fury, an uncrewed fighter jet developed for the USA Air Force's Next-Generation Air Dominance program. This system emphasizes advanced software and rapid, cost-effective delivery of drones and other technologies.

In February 2025, Anduril Industries and General Atomics were selected to prototype the USA Air Force and Navy’s new autonomous fighter jet, the Collaborative Combat Aircraft (CCA). The CCA project requires sophisticated AI for autonomous operations, supporting flexible, collaborative missions with or without human pilots. These developments highlight the growing emphasis on AI integration and autonomous capabilities in modern defense strategies.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 44.06 billion |

| Projected Market Size (2035) | USD 77.87 billion |

| CAGR (2025 to 2035) | 5.86% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Types Analyzed (Segment 1) | Land systems; Naval systems; Aerial systems; Cyber systems |

| Components Analyzed (Segment 2) | Sensors; Weapons; Command and control systems; Communication systems |

| Technologies Analyzed (Segment 3) | Artificial intelligence; Machine learning; Robotics; Autonomous navigation |

| Deployment Modes Covered (Segment 4) | On-premises systems; Cloud-based systems |

| End Users Covered (Segment 5) | Military, Defense contractors, Government agencies |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; United Kingdom; Germany; France; China; India; Israel; Australia; Russia |

| Key Players Influencing the Market | BAE Systems; Honeywell; Kongsberg Gruppen; Textron; Northrop Grumman; Israel Aerospace Industries; Mitsubishi Heavy Industries; Thales Group; Leonardo; L3Harris Technologies; Lockheed Martin |

| Additional Attributes | System interoperability trends; R&D spending & procurement cycles; Export control & regulatory frameworks; Modernization program drivers; Maintenance & support services; Cybersecurity resilience requirements |

The automated weapon system market is segmented by type into land systems, naval systems, aerial systems, and cyber systems.

By component, the market includes sensors, weapons, command and control systems, and communication systems.

By technology, the market is categorized into artificial intelligence, machine learning, robotics, and autonomous navigation.

By deployment mode, the market is segmented into on-premises and cloud-based systems.

In terms of end users, the market includes military, defense contractors, and government agencies.

The market covers North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

The market is expected to reach USD 77.87 billion by 2035, growing at a CAGR of 5.86%.

Key players include BAE Systems, Honeywell, Kongsberg Gruppen, Textron, Northrop Grumman, Israel Aerospace Industries, Mitsubishi Heavy Industries, Thales Group, Leonardo, L3Harris Technologies, and Lockheed Martin.

The growth is driven by increasing defense budgets, demand for advanced military technologies, and precision in automated defense systems.

The market is expected to grow at a CAGR of 5.86% from 2025 to 2035.

The defense sector dominates the market with a focus on unmanned systems and advanced targeting technologies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Automated Control System Market Growth – Trends & Forecast 2024-2034

Automated Sortation System Market Growth - Trends & Forecast 2024 to 2034

Automated Centrifuge System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automated Cell Block Systems Market

Automated Compounding Systems Market

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Biology Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Automated Process Control System Market Growth – Trends & Forecast 2024-2034

Automated Fire Protection Market Growth – Trends & Forecast 2024-2034

Automated Liquid Handling Systems Market

Automated Breast Ultrasound Systems Market Outlook - Share, Growth & Forecast 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Automated Optical Inspection System Market Report - Trends & Forecast 2024 to 2034

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA