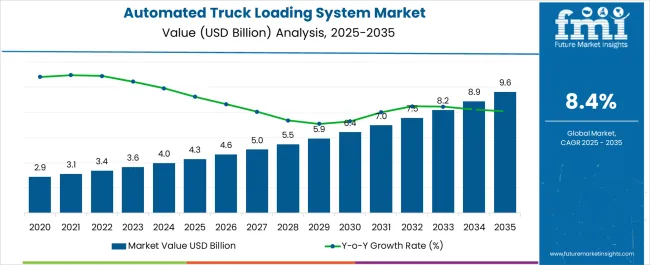

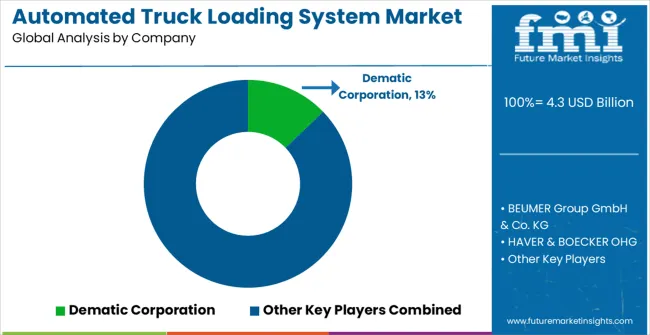

The Automated Truck Loading System Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 9.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Automated Truck Loading System Market Estimated Value in (2025 E) | USD 4.3 billion |

| Automated Truck Loading System Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Automated Truck Loading System (ATLS) market is gaining strong momentum as industries increasingly adopt automation to improve efficiency, reduce manual labor, and minimize operational costs. The growing demand for faster loading and unloading processes across logistics, manufacturing, food and beverages, and e-commerce is driving adoption. Automated systems provide consistent performance, improve safety, and optimize space utilization, which are critical factors for industries facing high throughput requirements.

Advancements in conveyor technologies, robotic integration, and real-time monitoring solutions are enhancing the adaptability and performance of ATLS solutions, allowing businesses to scale operations efficiently. Rising investments in digital logistics, smart warehousing, and automated supply chain infrastructure are further shaping market demand.

The growing emphasis on sustainability and reduced carbon footprint is also encouraging industries to adopt systems that minimize energy consumption and optimize resource usage With increasing global trade volumes and rising pressure on logistics operations to deliver efficiency, the Automated Truck Loading System market is expected to expand significantly, supported by technology-driven advancements and strong industry demand.

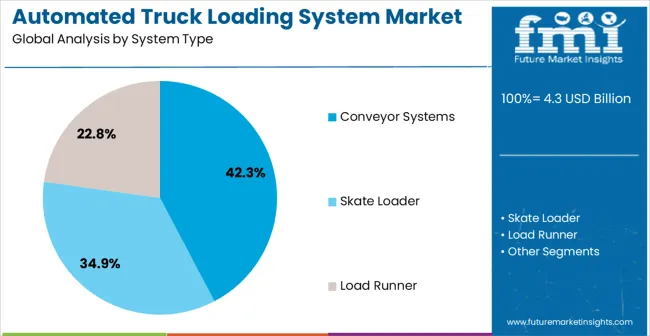

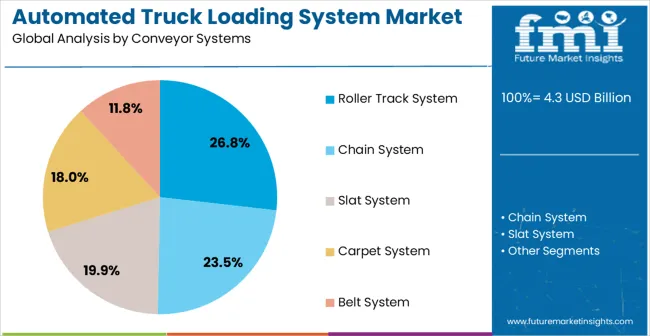

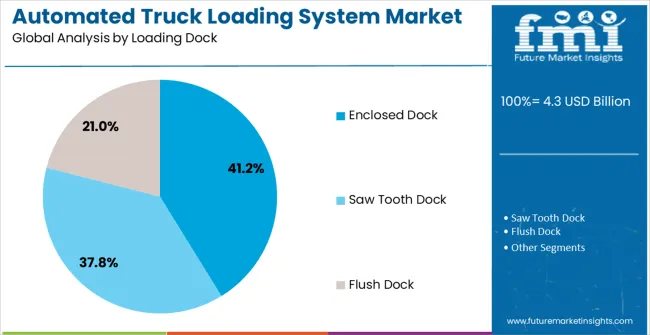

The automated truck loading system market is segmented by system type, conveyor systems, loading dock, application industry, and geographic regions. By system type, automated truck loading system market is divided into Conveyor Systems, Skate Loader, and Load Runner. In terms of conveyor systems, automated truck loading system market is classified into Roller Track System, Chain System, Slat System, Carpet System, and Belt System. Based on loading dock, automated truck loading system market is segmented into Enclosed Dock, Saw Tooth Dock, and Flush Dock. By application industry, automated truck loading system market is segmented into Automotive, Air Cargo, FMCG, Paper, Consumer Durables, Post & Parcel, and Other Application. Regionally, the automated truck loading system industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conveyor systems segment is projected to hold 42.3% of the Automated Truck Loading System market revenue in 2025, making it the leading system type. Growth in this segment is being driven by its ability to ensure high-speed, continuous, and reliable material handling for various industries. Conveyor systems provide consistent and efficient movement of goods, reducing manual handling and lowering operational costs.

Their modular design allows for customization to meet diverse industry needs, while integration with automated control systems enhances monitoring and performance. Industries such as retail, e-commerce, and manufacturing rely on conveyors for seamless flow between warehouse operations and truck loading, which improves throughput and reduces downtime.

The systems are also recognized for their energy efficiency and ability to minimize product damage, further reinforcing their adoption As companies continue to expand distribution networks and optimize supply chain processes, conveyor systems are expected to maintain their leadership position, supported by advancements in automation, robotics, and smart logistics integration.

The roller track system segment is expected to account for 26.8% of the Automated Truck Loading System market revenue in 2025, making it a significant contributor among loading dock technologies. This growth is being driven by its widespread adoption in industries requiring flexible, cost-effective, and efficient truck loading solutions. Roller track systems reduce the need for forklifts and manual handling, allowing for faster operations with improved safety.

Their simplicity of design, ease of installation, and compatibility with different types of trailers make them a preferred option in logistics and manufacturing environments. The ability to integrate roller tracks with conveyor systems enhances overall efficiency, creating a seamless flow from warehouse to truck.

Industries benefit from reduced labor costs, improved turnaround times, and minimized risk of cargo damage As businesses continue to seek solutions that optimize truck utilization and loading times, the roller track system segment is expected to remain a vital part of the ATLS market, supported by ongoing innovation and efficiency-focused adoption.

The enclosed dock segment is anticipated to capture 41.2% of the Automated Truck Loading System market revenue in 2025, making it the dominant loading dock type. Its leadership is being reinforced by the growing need for secure, climate-controlled, and safe loading environments across industries such as food and beverages, pharmaceuticals, and retail. Enclosed docks protect goods and personnel from external conditions, ensuring uninterrupted operations in all weather situations.

They are increasingly valued for their role in maintaining product quality and ensuring compliance with safety and hygiene standards. Integration of enclosed docks with advanced conveyor and robotic systems provides streamlined workflows and enhances efficiency. The ability to reduce risks related to theft, contamination, and accidents further supports adoption in high-value and sensitive industries.

Growing demand for sustainability has also highlighted the energy-saving benefits of enclosed docks, which help minimize heat loss and optimize facility energy consumption As industries continue to prioritize safety, quality, and compliance, enclosed docks are expected to maintain their leading share in the market.

In certain product categories, logistics costs accounts for the major portion of the total costs, which has led to shift the focus towards more economical and efficient logistics operations. Now a days, manufacturers emphasized on improving production efficiency as a means to gain a competitive edge, as well as to achieve operational excellence.

Introduction of automation in logistics improves operations and flexibility, while ensuring high efficiency. Manufacturers are focusing on post-manufacturing operations so as to cut costs, an area that has been totally neglected in the past. There are significant opportunities to cut costs in post manufacturing operations and effectively speed up the entire cash cycle.

There has been growing use of automated truck loading systems for loading and unloading of goods or materials. This reduces labor cost, minimizes product damage, optimizes time management and ensures high efficiency in the supply chain.

Traditionally, the manual truck loading process was adopted in the industries; however, labor scarcity manifests a major hurdle. As a result, it has emerged as the strongest factor pushing for consolidation and automation in logistics operations.

Consequently, there is a steady rise in the adoption rate of automated truck loading systems in many industries, such as food & beverage, paper, automotive, dairy, chemical-cosmetic, pharmaceutical, electrical, glass, tobacco, and general manufacturing.

Retirement of the skilled warehouse workers and truck drivers in developed regions such as Europe and North America is another factor that has led to an increase in the adoption of automated truck loading systems as a post manufacturing solution in industry logistics.

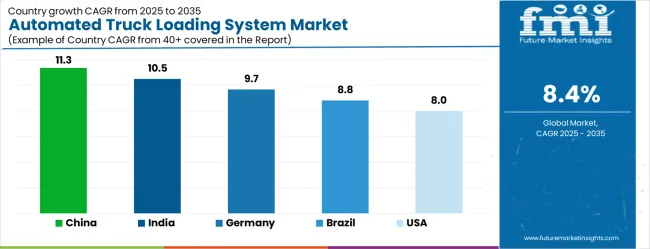

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| Brazil | 8.8% |

| USA | 8.0% |

| UK | 7.1% |

| Japan | 6.3% |

The Automated Truck Loading System Market is expected to register a CAGR of 8.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.3%, followed by India at 10.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.3%, yet still underscores a broadly positive trajectory for the global Automated Truck Loading System Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.7%. The USA Automated Truck Loading System Market is estimated to be valued at USD 1.5 billion in 2025 and is anticipated to reach a valuation of USD 1.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 203.5 million and USD 134.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| System Type | Conveyor Systems, Skate Loader, and Load Runner |

| Conveyor Systems | Roller Track System, Chain System, Slat System, Carpet System, and Belt System |

| Loading Dock | Enclosed Dock, Saw Tooth Dock, and Flush Dock |

| Application Industry | Automotive, Air Cargo, FMCG, Paper, Consumer Durables, Post & Parcel, and Other Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dematic Corporation, BEUMER Group GmbH & Co. KG, HAVER & BOECKER OHG, Joloda International Ltd (Joloda Hydraroll Limited), Actiw Oy, Ancra Systems B.V., Asbreuk Service B.V., Cargo Floor B.V., GEBHARDT Fördertechnik GmbH, Maschinenfabrik Möllers GmbH, Secon Components S.L., VDL Systems B.V., Euroimpianti S.p.A., C&D Skilled Robotics Inc., and ATLS Ltd |

The global automated truck loading system market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the automated truck loading system market is projected to reach USD 9.6 billion by 2035.

The automated truck loading system market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in automated truck loading system market are conveyor systems, skate loader and load runner.

In terms of conveyor systems, roller track system segment to command 26.8% share in the automated truck loading system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Poly Bagging Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated External Defibrillator Market Analysis – Size, Share, and Forecast 2025 to 2035

Automated Suturing Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA