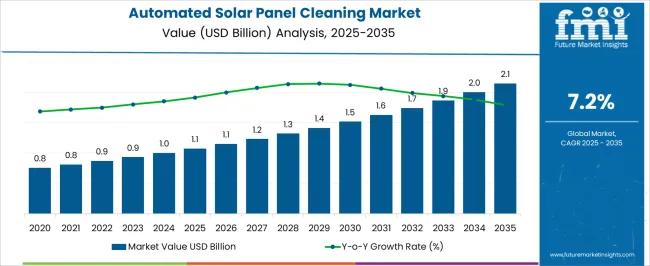

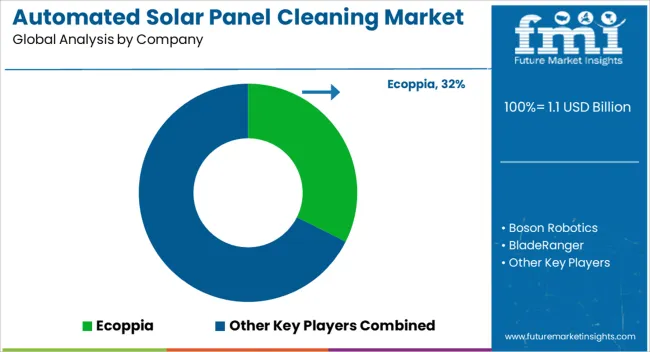

The automated solar panel cleaning market, valued at USD 1.1 billion in 2025 and projected to reach USD 2.1 billion by 2035 at a CAGR of 7.2%, demonstrates characteristics consistent with the early to mid-stages of the market maturity curve. Initial adoption is concentrated among large-scale solar farm operators and utility-scale photovoltaic installations, where the economic benefits of automated cleaning, reduced manual labor costs, optimized energy yield, and minimized panel degradation are most tangible.

During the first few years, from 2025 to 2028, growth is relatively modest, rising from USD 1.1 billion to USD 1.3 billion, reflecting cautious investment and gradual validation of technology performance under diverse environmental conditions. As awareness increases and cost-benefit analyses mature, adoption expands more rapidly from 2028 onwards, with market value reaching USD 1.7 billion by 2032. This acceleration corresponds to increasing penetration among mid-sized commercial and industrial solar installations, driven by efficiency optimization requirements and standardization of cleaning systems.

Toward the latter part of the forecast period, between 2032 and 2035, the market growth moderates slightly as adoption reaches saturation in segments with clear operational advantages, bringing the market value to USD 2.1 billion. The overall adoption lifecycle indicates an initial innovation-driven phase, followed by early adoption among high-value installations, progressing toward early majority engagement as cost, reliability, and awareness barriers diminish. The trajectory highlights a measured but steady expansion consistent with emerging automation technologies within the renewable energy sector.

| Metric | Value |

|---|---|

| Automated Solar Panel Cleaning Market Estimated Value in (2025 E) | USD 1.1 billion |

| Automated Solar Panel Cleaning Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The automated solar panel cleaning market represents a specialized segment within the global solar energy and renewable technology industry, emphasizing efficiency, maintenance reduction, and energy optimization. Within the broader solar operations and maintenance market, it accounts for about 5.6%, driven by demand from utility-scale solar farms, commercial installations, and large residential projects. In the solar cleaning and maintenance equipment sector, it holds nearly 4.8%, reflecting adoption of robotic systems, automated brush mechanisms, and water-free cleaning solutions.

Across the renewable energy services segment, the market captures 4.3%, supporting improved energy yield, reduced labor requirements, and operational safety. Within the industrial automation and smart energy management category, it represents 3.9%, highlighting integration with IoT, remote monitoring, and predictive maintenance tools. In the green technology and environmental solutions sector, it secures 3.5%, emphasizing water-saving and sustainable cleaning methods. Recent developments in this market have focused on robotics, sensor integration, and AI-driven operational efficiency. Innovations include automated robotic cleaners with brush and vacuum systems, AI-powered dirt detection, and autonomous scheduling to maximize solar output.

Key players are collaborating with solar farm operators, robotics manufacturers, and renewable energy service providers to enhance performance, reduce maintenance downtime, and extend panel lifespan. Adoption of dry-cleaning methods, energy-efficient motors, and water-recycling systems is gaining traction to address environmental and resource concerns. Additionally, cloud-based monitoring, IoT connectivity, and modular designs are being deployed to scale operations across large solar installations.

The current market landscape reflects strong interest from utility operators, commercial establishments, and industrial solar farm owners seeking to optimize energy output and reduce manual labor costs.

Automated cleaning technologies are being adopted to address dust, dirt, and environmental residue that reduce panel efficiency, particularly in arid and high-dust regions. The market is benefiting from technological advancements in robotic cleaning systems, integration with IoT monitoring, and solar asset management platforms that allow scheduled or demand-based cleaning.

Rising investments in large-scale solar projects, combined with growing awareness of maintaining peak operational performance, are creating significant opportunities for solution providers. The future outlook remains promising as cost reductions, automation trends, and the shift toward sustainable energy solutions further drive adoption across multiple end-use sectors.

The automated solar panel cleaning market is segmented by technology, application, and geographic regions. By technology, automated solar panel cleaning market is divided into wet cleaning and dry cleaning. In terms of application, automated solar panel cleaning market is classified into commercial, residential, and industrial & utility. Regionally, the automated solar panel cleaning industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

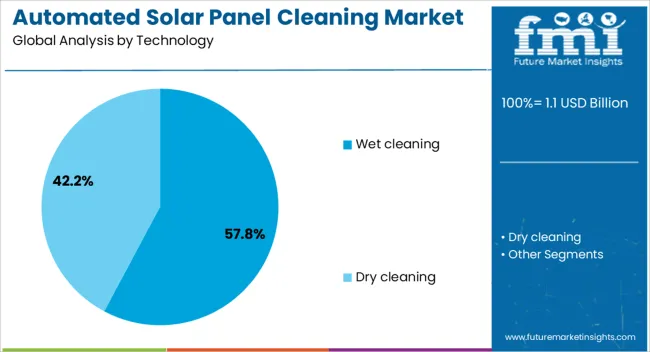

The wet cleaning technology segment is projected to account for 57.8% of the Automated Solar Panel Cleaning market revenue in 2025, making it the leading technology type. This dominance is being attributed to its high cleaning efficiency, especially in environments with heavy dust accumulation, bird droppings, or sticky residues that are difficult to remove through dry methods.

Wet cleaning systems are capable of restoring optimal panel performance by thoroughly washing surfaces without causing abrasion to the glass. The segment’s growth has been supported by the increasing use of water-efficient systems and the integration of automated water recycling technologies that reduce operational costs.

As large-scale solar farms expand in diverse environmental conditions, wet cleaning offers a reliable method to maintain consistent energy yields The preference for this method is also reinforced by its compatibility with both manual and robotic cleaning units, enabling greater flexibility and scalability in deployment.

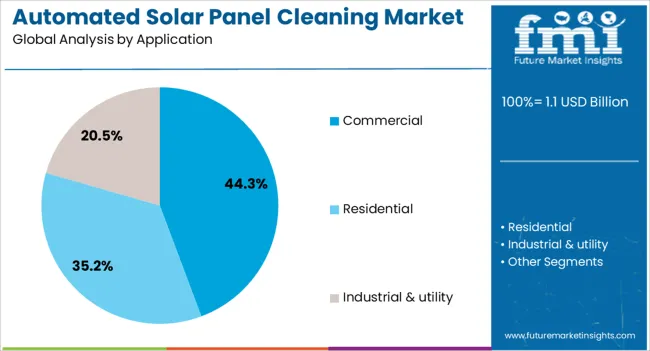

The commercial application segment is expected to capture 44.3% of the total Automated Solar Panel Cleaning market revenue in 2025, positioning it as a major end-use category. This leadership is being driven by the rising adoption of rooftop and ground-mounted solar installations in commercial establishments such as manufacturing units, warehouses, and office complexes.

Commercial solar panel owners prioritize operational efficiency and return on investment, which has increased demand for automated solutions that minimize manual intervention and downtime. The growth of this segment is also supported by the rising trend of corporate sustainability initiatives, where maintaining maximum solar output is essential for meeting energy targets.

The ability to integrate cleaning systems with remote monitoring platforms allows commercial operators to schedule cleanings during non-operational hours, further enhancing productivity. With commercial energy consumers seeking consistent performance and reduced maintenance costs, automated cleaning solutions are becoming an indispensable part of solar asset management in this sector.

The automated solar panel cleaning market has expanded significantly due to the rising adoption of solar energy systems and the need to maintain optimal energy output. Dust, dirt, and environmental residues can reduce panel efficiency, prompting the use of automated cleaning solutions that minimize manual intervention while ensuring consistent performance. Robotic cleaners, waterless systems, and remotely operated devices have been increasingly implemented across residential, commercial, and utility-scale installations.

Technological advancements in sensors, automation, and energy efficiency have enhanced cleaning precision and minimized water consumption. The market is further driven by the global shift toward renewable energy, operational cost reduction, and the demand for high performance solar installations, establishing automated cleaning solutions as critical components in sustainable energy management strategies.

Utility scale solar farms are major adopters of automated solar panel cleaning solutions to maintain peak energy production across vast arrays of photovoltaic modules. Dust accumulation, bird droppings, and environmental debris can reduce panel efficiency by a significant margin, directly impacting revenue generation. Automated systems, including robotic cleaners and waterless brushes, allow for continuous maintenance without interrupting power generation, reducing labor costs and operational downtime. Integration with monitoring software enables operators to schedule cleaning cycles based on weather conditions, energy output data, and environmental factors. With the global expansion of large-scale solar projects, the adoption of automated cleaning technologies has become essential to ensure reliability, efficiency, and long-term performance of solar assets.

Commercial and industrial sectors are increasingly implementing automated solar panel cleaning systems to maintain rooftop and facility mounted photovoltaic installations. Businesses with large energy demands, such as factories, warehouses, and commercial complexes, rely on high efficiency solar systems to reduce electricity costs. Automated cleaning ensures that panels remain free from dust, grime, and pollution residues, preserving optimal energy generation throughout the year. Remote monitoring capabilities, programmable cleaning schedules, and integration with IoT systems allow facility managers to optimize maintenance cycles and reduce operational intervention. The combination of efficiency gains, labor savings, and long term system protection makes automated cleaning an attractive solution for commercial and industrial solar installations globally.

Advancements in robotics, sensor integration, and automated control systems have significantly improved the performance and versatility of solar panel cleaning solutions. Sensors detect dust accumulation, moisture levels, and environmental conditions to trigger precise cleaning cycles. Waterless and low water consumption cleaning systems have been developed to address resource scarcity concerns, while robotic cleaners navigate complex panel layouts with minimal human oversight. Modular and scalable designs allow deployment across small rooftop arrays or extensive solar farms. Additionally, integration with monitoring and energy management software enables predictive maintenance, performance tracking, and cost optimization. These technological innovations have enhanced the operational efficiency, sustainability, and reliability of automated solar panel cleaning systems across diverse installations.

Residential solar installations are increasingly adopting automated cleaning solutions to maintain energy output while reducing manual effort and maintenance time. Homeowners benefit from small scale robotic cleaners or smart brush systems that operate autonomously or through remote app control. Regular cleaning prevents efficiency losses due to dust, pollen, or environmental residues, ensuring optimal electricity production and return on investment. Integration with residential energy management systems allows users to schedule cleaning during non-peak hours or based on energy production data. Growing consumer awareness of energy efficiency, renewable energy adoption, and low maintenance solutions has reinforced the demand for automated solar panel cleaning systems in residential settings, contributing to the market’s sustained growth.

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

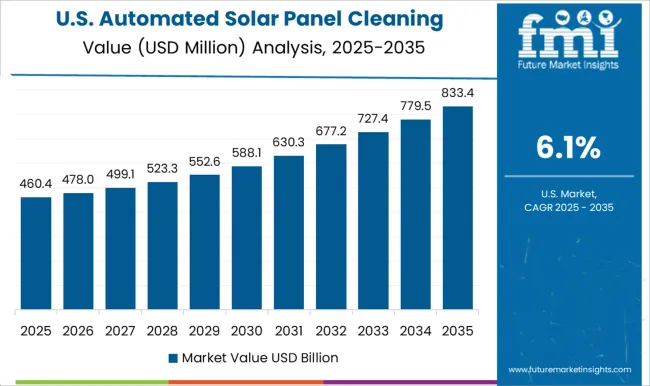

| USA | 6.1% |

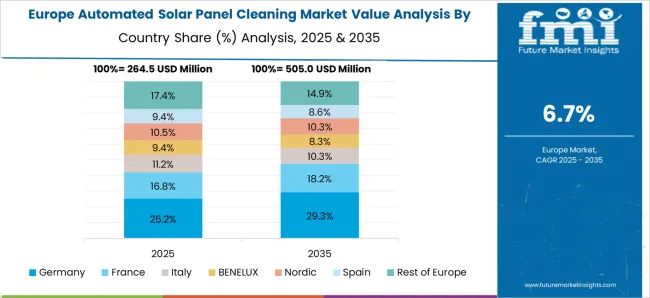

| Brazil | 5.4% |

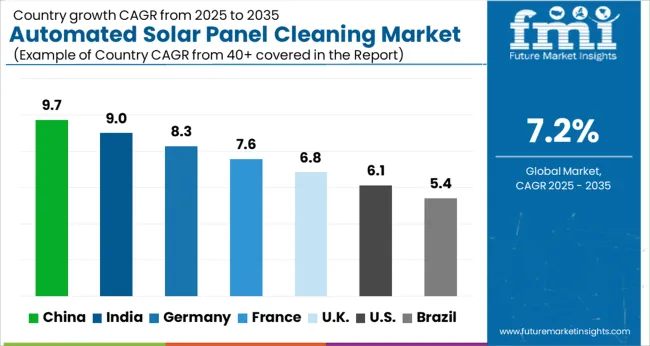

Growth in the market is driven by rising renewable energy installations and efficiency optimization initiatives. Germany records 8.3%, fueled by integration into large-scale solar farms and commercial projects. India achieves 9.0%, supported by government-backed solar programs and increasing adoption in utility-scale plants. China leads with 9.7%, benefiting from rapid expansion of solar capacity and automation technologies. The United Kingdom reaches 6.8%, where research in sustainable energy maintenance contributes to market activity. The United States reports 6.1%, with investments in commercial and residential solar cleaning solutions supporting steady development. Together, these countries reflect a diverse adoption and innovation ecosystem influencing the global trajectory of automated solar panel cleaning solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 9.7%, driven by rapid expansion of utility scale solar farms and government initiatives promoting clean energy production. Adoption has been encouraged by the need to maintain efficiency in large photovoltaic installations and reduce manual labor costs. Domestic manufacturers have focused on automated robots, brushes, and waterless cleaning systems that optimize panel performance while conserving resources. Export demand for Chinese cleaning systems has increased due to technological capabilities and competitive pricing. The market is projected to continue growth as China reinforces renewable energy capacity and operational efficiency in both commercial and utility scale solar projects.

India is projected to record a CAGR of 9.0%, driven by rapid solar capacity expansion and utility scale photovoltaic project installations. Adoption has been reinforced by increasing emphasis on operational efficiency, reduced maintenance costs, and labor optimization in large solar parks. Domestic manufacturers and startups are developing robotic and automated waterless cleaning solutions to serve arid and semi-arid regions. Government initiatives such as the National Solar Mission have accelerated deployment of advanced cleaning technologies. The market is expected to expand steadily as both commercial and utility scale solar projects continue to grow across India.

Germany is anticipated to grow at a CAGR of 8.3% in the market, supported by high penetration of rooftop and utility scale solar installations. Adoption has been promoted by the need for efficiency optimization and reduced manual labor in both residential and commercial photovoltaic systems. German manufacturers such as Kieback&Peter and Schletter focus on robotic cleaning systems and automated tracking solutions. Export demand for high quality German systems has further strengthened production capabilities. Market growth is expected to continue steadily due to the focus on renewable energy efficiency and integration with smart grid and monitoring technologies.

The United Kingdom market is projected to grow at a CAGR of 6.8%, influenced by increasing adoption of commercial and utility scale solar projects. Adoption has been encouraged by operational efficiency requirements and reduced maintenance labor costs. U K manufacturers and service providers are developing robotic and automated cleaning systems compatible with varying panel orientations and environmental conditions. Imports from Germany and China supplement domestic capabilities to meet growing demand. The market outlook indicates steady expansion as solar capacity continues to grow in industrial, commercial, and utility applications across the U K.

The United States market is expected to expand at a CAGR of 6.1%, supported by large scale solar projects, utility scale photovoltaic plants, and commercial rooftop installations. Adoption has been reinforced by the need to maintain energy generation efficiency and minimize labor and water consumption. Leading manufacturers and service providers such as SunPower, SolarBotics, and Ecoppia have deployed automated cleaning systems with AI enabled monitoring and robotic features. Investment in renewable energy infrastructure and operation optimization ensures steady growth in the U S market. Both utility and commercial solar segments continue to rely on automated cleaning systems to maximize performance.

The market is highly competitive, driven by demand for efficiency, reduced water usage, and maintenance cost reduction in utility-scale and commercial solar installations. Ecoppia, a pioneer in robotic dry-cleaning solutions, leads with AI-enabled autonomous cleaning systems optimized for large-scale solar farms, offering remote monitoring and predictive maintenance features. Boson Robotics and BladeRanger focus on modular robotic platforms that combine waterless cleaning technologies with AI-assisted navigation to enhance cleaning efficiency and reduce downtime. Companies such as Hekabot, Heliotex, and NOMADD target regional markets with adaptable, semi-autonomous solutions designed for rooftop and mid-size solar arrays.

Premier Solar Cleaning, Serbot, and UT Pumps & Systems integrate mobile robotic units with fluid delivery systems for selective water-based cleaning applications, emphasizing durability in harsh environments. Industry incumbents such as Sharp Corporation and Saint-Gobain Surface Conditioning leverage brand reputation and technical expertise to provide turnkey solutions alongside solar panel manufacturing and maintenance contracts. The market competition is influenced by automation capabilities, cleaning efficiency, operational endurance, integration with solar monitoring platforms, and sustainability credentials. Strategic collaborations with solar EPCs, long-term service agreements, and continuous R&D in AI-guided navigation, solar dust detection, and modular robotic designs provide significant differentiation, shaping adoption trends and global deployment strategies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Technology | Wet cleaning and Dry cleaning |

| Application | Commercial, Residential, and Industrial & utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ecoppia, Boson Robotics, BladeRanger, Clean Solar Solutions, Heliotex, Hekabot, Indisolar Products, Karcher, Langfang Sol-Bright, NOMADD, Premier Solar Cleaning, Sharp Corporation, Serbot, Saint-Gobain Surface Conditioning, SunBrush mobil, Solar Service Professionals, and UT Pumps & Systems |

| Additional Attributes | Dollar sales by cleaning system type and application, demand dynamics across residential, commercial, and utility-scale solar installations, regional trends in solar efficiency optimization adoption, innovation in automation, brush and waterless technologies, and sensor integration, environmental impact of water use and energy consumption, and emerging use cases in large-scale solar farms, rooftop systems, and remote solar installations. |

The global automated solar panel cleaning market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the automated solar panel cleaning market is projected to reach USD 2.1 billion by 2035.

The automated solar panel cleaning market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in automated solar panel cleaning market are wet cleaning and dry cleaning.

In terms of application, commercial segment to command 44.3% share in the automated solar panel cleaning market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dry Type Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Biology Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA