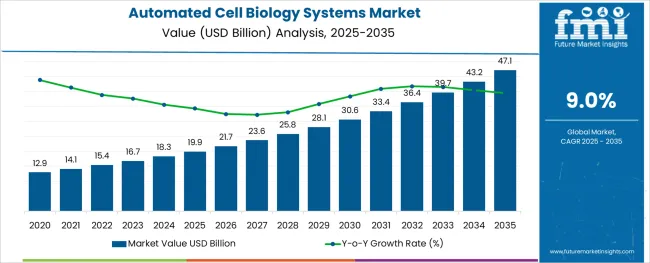

The Automated Cell Biology Systems Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 47.1 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Product, Cell Culture, Application, and End User and region. By Product, the market is divided into Cell Culture Process Automatization Instrument or Robot (Multiple Function), Automated Bioreactor (Single or Multiple Function), Automated Cell Culture Media Exchange System (Single Function), Automated Culture Media Analyzer (Single Function), Automated Cell Wash-and-Concentrate System (Single Function), Automated Cell Counter (Single Function), Automated Fill And Finish System (Single Function), Automated Cell Storage Equipment (Single Function), and Management Software.

In terms of Cell Culture, the market is classified into Finite Cell Line Cultures and Infinite Cell Line Cultures. Based on Application, the market is segmented into Cell Therapy, Drug Development, Stem Cell Research, and Regenerative Medicine. By End User, the market is divided into Mega Pharmaceutical companies, Biopharmaceutical companies, CDMOs/CMOs, Research organizations, and Academic institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0 % of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

The market value for automated cell biology systems was approximately 65.8% of the overall ~USD 18.3 Billion global bioprocess technology market in 2024.

The sale of automated cell biology systems expanded at a CAGR of 6.6% from 2020 to 2024.

Technologies like microfluidics and lab-on-a-chip represent a strategic approach to support the shift to user-friendly automated equipment. By using microculture systems in place of conventional Petri plates and flasks for cellular tests, researchers have been able to minimize the number of reagents used while still achieving high-throughput cell generation and culture in a controlled setting.

The development of tissue engineering aims to increase the possibility of replacing tissue development for regenerating or restoring organ and tissue function. Tissue engineering technology has advanced significantly in recent years, and it is now widely used in domains other than medicine, such as organs-on-a-chip, bioelectronic devices, cultured meats, and so on.

Cell culture is the primary method used for tissue engineering manufacturing. Therefore, it is crucial for tissue engineering research to maintain high standards for cell culture settings.

Modern uses of analytical system automation include clinical, pharmacological, and biomedical environments. The automatic system has played a significant role in both qualitative and quantitative analysis. Optically driven, electrochemical, and mass spectroscopic approaches have all been used as analytical techniques. Robotic automation lowers the cost of analysis while providing high precision and high system throughput.

Numerous lab-on-chip advancements have been made for cell culture and certain other biomedical applications. A cell culture device indicates the viability of the cells, nutrient consumption, nutrient output in the fermentation process, and pharmacological effect.

Because of the aforementioned factors, it is anticipated that from 2025 to 2035, the global automated cell biology systems market will expand at a CAGR of 9.0%.

As automated cell culture, on-chip is widely acknowledged as a benchmark parameter in existing microfluidic systems for cell biology, and a plethora of studies have been documented in the literature. At the research laboratory level, the minimization and downsizing of additional peripheral equipment are considered a fundamental necessity for the utilization of automated devices in cell culture, coupled with the need for systems that are ready-to-use in a plug-and-play mode.

Currently, the use of micro-devices for fluidic control is limited to the use of relatively complicated, specialized, and bulky external equipment and macro-to-micro interface systems, necessitating the ongoing assistance of human operators to manage fluid flow in an unstandardized and manual manner.

The systematic application of a suitably integrated control system for accurate fluid handling in a remote control framework will significantly improve the usability and readout dependability of micro-bioreactors. This is crucial in automating cell culture techniques, reducing human involvement, and significantly lowering the number of connection tubes, intake and output ports, and bulky external equipment.

The adoption of such control systems is gaining traction, owing to the above-mentioned factors, and this is set to pose lucrative opportunities for growth within the global automated cell biology systems market during the forecasted years.

Cell-based therapies have the ability to provide a successful treatment for medical disorders that are presently incurable. Their widespread commercialization has been put at risk by constraints such as scaling up and automating labor-intensive research discoveries, high production costs, and batch variance in large-scale automated manufacturing.

Additionally, even though many cell culture labs employ automated tools to do away with manual duties like handling plates, highly-trained lab staff are still required to spend hours every day maintaining these devices. As a result, the majority of benchtop automation has limitations in terms of scaling in cell culture facilities.

Furthermore, the utilization of mammalian cell culture is quickly expanding. Even though the fundamental processes for sustaining cells are quite repeatable, the majority of cell culture operations are still done by hand.

Personnel is required to perform repetitive tasks for hours on end each day, and frequently they must come in after regular working hours to cater to the cells or modify their biology to accommodate the workload. Both the workflow's throughput and its ability to be tracked are limited by this dependence on manual steps.

With the above-mentioned factors, the market for automated cell biology systems experiences a restraint in growth.

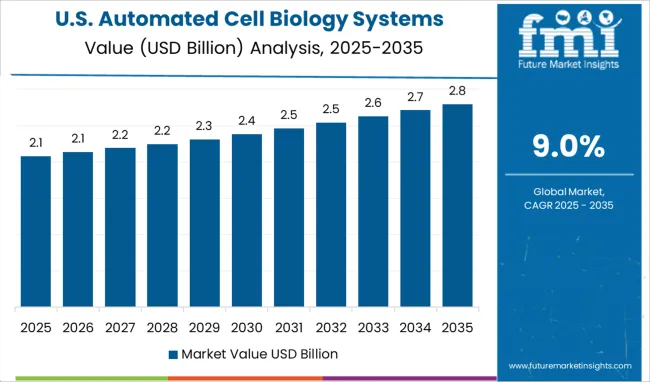

With a market share of 89.8% in all of North America in 2024, the USA presently dominates the region and is expected to sustain this growth throughout the forecast period.

The increasing expenditure on Research and Development in the area can be attributed to the market's expansion. Additionally, the expansion of pharmaceutical firms and manufacturers in the area together with rising public awareness of stem cell therapy is anticipated to significantly contribute to the market's expansion. Additionally, it is predicted that the rising number of bone marrow and cord blood transplants across the region will favorably influence market growth.

China represents roughly 64.9% of the East Asia market in 2024, with growth at a lucrative CAGR of 13.7% throughout the forecast period. China has a significant demand for automation, according to the International Federation of Robotics (IFR). According to sales volume, China was one of the top five markets for industrial robots in 2020.

The China Robot Industry Alliance estimates that Chinese robot suppliers sold about 20,400 units in 2020, increasing their share of the global market from 25% to 29% from 2013 until 2020. With the growing wave in automation, as well as its adoption, China is posed to be a highly lucrative market for automated cell biology systems over the forecast period.

During the forecast years, Germany is projected to grow at a CAGR of nearly 7.2% in the global automated cell biology systems market. The European Medicinal Agency (EMA) granted the CliniMACS Prodigy platform approval for the commercial manufacturing process in 2020 for the customization of protocols, which is accomplished through modularity and flexible programming, allowing its use for a number of different cell types, including the development of CAR-T cells, macrophages, virus-specific T-cells, and dendritic cells. With the manufacturing of such capable platforms, Germany is set to aid with the growth of the overall market during the projected period.

Automated cell counters (single function) are the leading segment as a product, hold approximately 34.6% market share in 2024, and are expected to present high growth at a CAGR of 8.1% throughout the forecast period. The benefit of using an automated cell counter is that it largely eliminates human bias from the cell counting process.

They can count more cells and are frequently faster than manually counting, which improves statistical accuracy. Automated cell counters are also employed in research and clinical labs. They can be used on urine and blood samples to count the different cell types present or to evaluate the viability of a cultivated cell line for investigation.

Infinite cell line cultures hold a global market share of around 76.2%, in 2024. Infinite cell line cultures are more robust and convenient to work with than primary cells since they can reproduce indefinitely. Infinite cell line cultures are also convenient for researchers because they are less expensive, easier to use, and able to survive more stages than primary cells. Because cell lines have a limitless supply of material and are simple to alter and grow, they are preferred for multiple screenings.

Drug development holds a share of around 35.4% in 2024, and this segment is expected to display gradual growth over the forecast period. New scientific developments in basic research, drug development, drug discovery, and customized medicine applications are being driven by 3D cell cultures. To understand the full potential of the technology, researchers can operate more efficiently with complex reagents and precious cells with the aid of high throughput, automated liquid handling solutions.

Biopharmaceutical companies hold the highest market share value of 27.4% during the year 2024. Growing drug development activities propelled by the rising demand for personalized medicine will propel this segment in terms of growth during the projected years. With the standardization of laboratory protocols, as well as the utilization of automated systems for process control technologies during the production process, this segment gains a higher share among the rest of the end users within the global market.

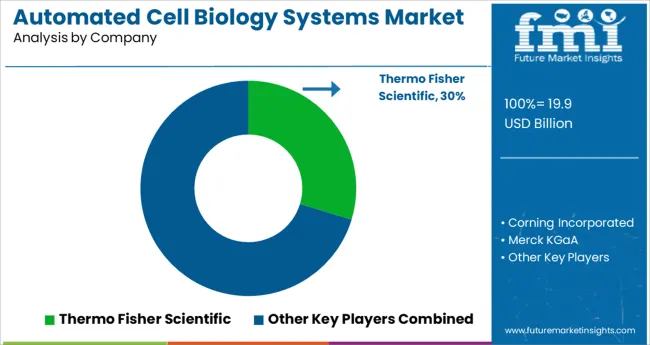

Key players in the market present novel solutions for the lab automation processes for cell biology systems. Moreover, with increasing approvals from the regulatory authorities for software-based total lab automation systems, the key players are presented with an opportunistic outlook for growth during the forecast period.

Similarly, recent developments related to companies manufacturing automated cell biology systems have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, North Africa, and South Africa |

| Key Market Segments Covered | Product, Cell Culture, Application, End User, and Region |

| Key Companies Profiled | Thermo Fisher Scientific; Corning Incorporated; Merck KGaA; Lonza; Sartorius AG; Hitachi. Ltd; Nanoentek; ChemoMetec; Danaher corporation; Agilent Technologies; Perkin Elmer (Nexcelom Bioscience LLC.); F. Hoffmann-La Roche AG; SHIMADZU CORPORATION; Bio-Rad Laboratories; Miltenyi Biotec; Sinfonia Technology; SHIBUYA CORPORATION; Advanced Instruments; Cell Culture Company, LLC; BD; Hamilton Company |

| Pricing | Available upon Request |

The global automated cell biology systems market is estimated to be valued at USD 19.9 billion in 2025.

It is projected to reach USD 47.1 billion by 2035.

The market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types are cell culture process automatization instrument or robot (multiple function), automated bioreactor (single or multiple function), automated cell culture media exchange system (single function), automated culture media analyzer (single function), automated cell wash-and-concentrate system (single function), automated cell counter (single function), automated fill and finish system (single function), automated cell storage equipment (single function) and management software.

finite cell line cultures segment is expected to dominate with a 56.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Cell Block Systems Market

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Automated Cell Therapy Processing Systems Market Trends - Outlook & Forecast 2025 to 2035

Automated Cell Shakers Market Analysis by Product, Cell Culture Type, Application, End User, and Region through 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cell Harvesting Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Compounding Systems Market

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Sample Storage Systems Market Growth - Trends & Forecast 2025 to 2035

Automated Liquid Handling Systems Market

Automated Breast Ultrasound Systems Market Outlook - Share, Growth & Forecast 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Microbial Detection Systems Market

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Nucleic Acid Extraction Systems Market Analysis – Growth, Trends & Forecast 2024-2034

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA