The global automated suturing devices market is projected to expand from USD 3.6 billion in 2025 to USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9%. Market growth is being driven by several key factors, including the rising global adoption of minimally invasive surgical (MIS) techniques, rapid advances in robotic-assisted suturing, and the increasing burden of chronic diseases requiring surgical intervention.

Automated suturing devices are favored for their ability to improve surgical precision, reduce procedure time, and minimize the potential for human error, thereby enhancing both clinical outcomes and workflow efficiency. The integration of automation into suturing processes reflects a broader shift toward digitally enabled operating rooms, reinforcing the relevance of these devices in modern surgical environments.

Prominent manufacturers such as Medtronic, Ethicon (a Johnson & Johnson company), and B. Braun are leading innovation in this space. These companies are investing aggressively in R&D to develop next-generation suturing tools that align with the evolving needs of laparoscopic, endoscopic, and robotic procedures. For instance, Medtronic’s Endo Stitch™ suturing device is widely used for its ergonomic design and effectiveness in MIS workflows.

In January 2025, Surgimatix launched aproxim8™, a novel device targeting laparoscopic soft tissue fixation. According to Jane Kiernan, CEO of Surgimatix, “Our approach is to imagine a much better way to perform laparoscopic soft tissue fixation. We look for a significant unmet clinical need with a large market opportunity.”

These statements reflect the strategic focus of key vendors on solving procedural pain points while tapping into high-growth applications. Overall, the market is poised for strong performance as demand for precision-driven, minimally invasive solutions continues to escalate. Automated suturing devices are increasingly embedded in AI-powered surgical systems, enabling real-time adjustments, anatomical mapping, and enhanced tissue handling.

These innovations improve patient outcomes by supporting more predictable and standardized procedures. With healthcare systems emphasizing value-based care, such technology integrations are anticipated to increase the appeal of automated suturing in both hospital and ambulatory surgical environments.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 3.6 Billion |

| Market Value (2035F) | USD 7.1 Billion |

| CAGR (2025 to 2035) | 6.9% |

North America dominates the global automated suturing devices market due to its advanced healthcare infrastructure, strong R&D ecosystem, and high procedural volumes for MIS. The USA market, in particular, benefits from favorable reimbursement policies, high penetration of robotic-assisted surgery, and continuous investment in clinical research and device trials. As a result, hospitals across the USA are integrating automated suturing tools into standardized surgical workflows.

Meanwhile, Europe is witnessing robust growth, particularly in countries like Germany, France, and the UK, where the adoption of minimally invasive and robotic surgical systems is accelerating. Public healthcare systems in these countries are increasingly supportive of innovative surgical technologies, particularly those that align with goals of shorter recovery time, reduced complications, and lower hospitalization costs. This regional momentum is also supported by joint ventures between healthcare providers and medical device companies, fostering new product development and adoptio

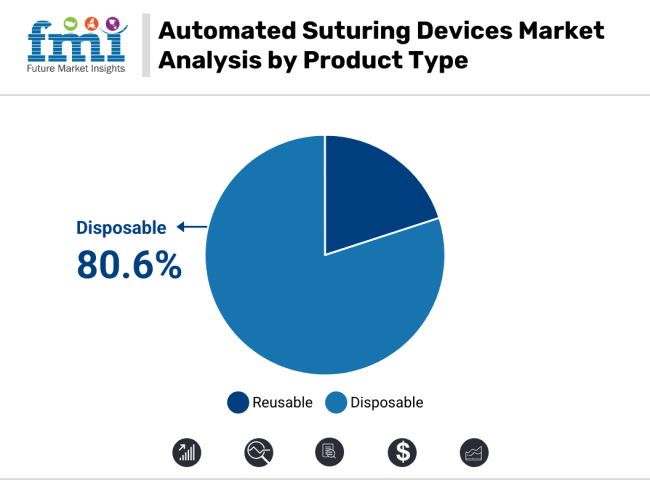

Disposable automated suturing devices account for 80.6% of global market revenue in 2025, underscoring their dominant position across outpatient and ambulatory settings. The post-COVID-19 emphasis on infection control, combined with the need for efficient, sterile solutions, has accelerated the shift toward single-use surgical tools.

These devices offer clear advantages, including eliminating sterilization needs, reducing cross-contamination risk, and improving operational turnaround in high-volume environments. Hospitals and surgical centers increasingly favor disposable solutions to reduce labor and compliance costs, especially in minimally invasive procedures.

Manufacturers such as Ethicon and Medtronic have responded by expanding their portfolios of disposable suturing systems with a focus on precision mechanics, ease of use, and hygiene compliance. As efficiency and safety remain top priorities, disposable suturing devices are expected to continue dominating procurement decisions.

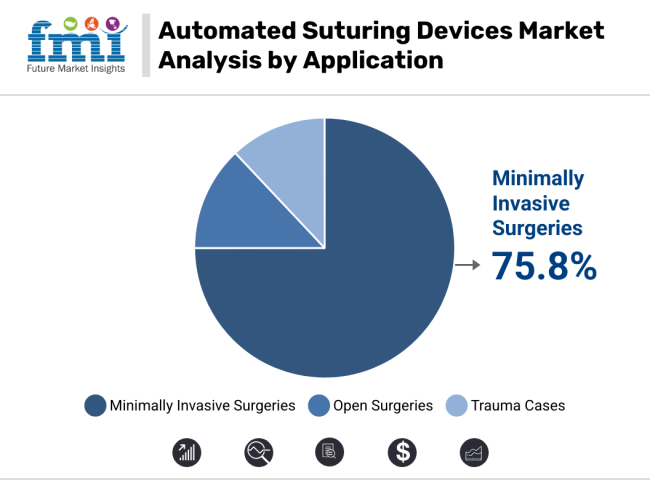

By application, minimally invasive surgery (MIS) accounts for 75.8% of total market revenue in 2025. This dominance reflects the rapid expansion of laparoscopic, endoscopic, and robotic-assisted surgeries across specialties such as gynecology, general surgery, and urology.

Automated suturing systems are highly valued in these procedures for their ability to deliver precise suturing in confined anatomical spaces, reduce procedure time, and support faster postoperative recovery.

The transition from open to minimally invasive techniques has been supported by both clinical guidelines and patient preference, driving widespread adoption. Devices like Medtronic’s Endo Stitch and Ethicon’s ProxiSure™ have gained significant market traction due to their intuitive handling and reliable closure performance. As procedure volumes continue to rise and case complexity increases, the demand for automation-enhanced suturing tools is expected to strengthen across all major surgical disciplines.

North America is the leading revenue-generating region in the Automated Suturing Devices market owing to the robust healthcare infrastructure, availability of ICU setups, robots surgery adoption Automated Suturing Devices adoption and investment in medical research. North America held the highest market share for suturing devices as the presence of key market players avail driving forces that elucidate suturing device progression and commercialization in the USA and Canada.

Many types of surgeries are common in the region, including robotic-assisted which automated suturing has the potential to help streamline. Innovation: AI technologies and robotic approaches in suturing procedures in surgeries are enhancing accuracy with fewer procedural complications. A well-established healthcare insurance system in North America is likely to support the adoption and utilization of advanced medical devices such as automated suturing systems.

In addition, sustained R&D funding, robust FDA regulatory support, and collaboration of medical technology companies and academic research institutions for new surgical solution innovation will ensure USA market leadership.

Europe occupies a significant share of the Automated Suturing Devices Market, owing to a growing aging population, rising surgical interventions, and increasing government-led investments in healthcare innovation. Minimally invasive surgery (MIS) techniques are a growing field of these countries, including Germany, France and the United Kingdom, in demand for automated suturing devices. Advanced hospitals and specialty surgical facilities are present in the area that benefits from automated suturing to obtain better patient outcomes.

The European Medical Device Regulation (MDR) imposes strict regulations on the medical device market, so the sutures should meet high standards of safety and efficacy, which promotes innovative suturing technologies. Laparoscopic procedures have many advantages over traditional procedures in complex surgeries and the gradual increase in laparoscopic surgical procedures performed across Europe and the western world will propel the implementation for robotic and automated suturing in these approaches.

Accelerated growth rates of this sector have led to the United Kingdom and Germany being amongst the leading countries with hospital collaborations and academic research projects at their being focused on improving the automation of suturing efficiency via AI-enabled surgical robots.

The fastest growth in the Automated Suturing Devices Market is expected in the Asia-Pacific region, driven by increasing health care expenditure per capita, growing awareness regarding sophisticated surgical options, and rapid adoption of robotic assisted surgeries in several countries including China, Japan, India and South Korea.

Countries such as India and Thailand are emerging as global hotspots for medical tourism, falling in line to provide better suturing methods to patients. Asia-pacific governing bodies are investing in the healthcare sector to provide better healthcare infrastructure and are subsidizing surgeries that require robotic-assisted surgical technologies. With an aging population in the region, there is an increase in chronic diseases and need for surgical procedures, where automated suturing can effectively improve surgical efficiency and minimize recovery time.

With huge investments in robotic surgery, China and Japan are teaming up with many top companies changing how hospitals implement AI-assisted suturing devices. The region’s thriving med-tech sector will also feed local low-cost automated suturing solutions.

High Cost of Automated Suturing Devices

The high price tag of robotic-assisted suturing systems and automated devices remains a restraint to accessibility in low- and middle-income countries. The financial burden includes purchasing and maintaining the devices, and specialized training for surgeons none of which tends to be feasible for smaller hospitals and clinics.

Regulatory Hurdles and Approval Delays

Strict regulations and long approval processes for automated surgical devices may delay the market release of new manufacturers. As no two countries share the exact same compliance framework, global companies find it difficult to be pressured into developing the product approval process which is common across the globe.

Technical Limitations and Learning Curve

While automated suturing devices reduce human error, surgical teams require extensive training to operate advanced robotic suturing systems effectively. Device malfunctions and limited adaptability in complex procedures are still barriers to full-scale adoption.

Integration of AI and Robotics in Automated Suturing

Automated suturing devices are incorporating AI-driven real-time feedback mechanisms that enable surgeons to enhance accuracy and minimize complications. Businesses are now pouring into robot-assisted suturing systems: these attempt to improve procedural efficiency while reducing post-surgical infections.

Rising Demand for Minimally Invasive Surgeries (MIS)

Patients want less invasive procedures and healthcare providers want minimally invasive surgeries. Such devices lower the timeline for procedures, increase accuracy, and hasten patient recovery rates; as such, they are critical to laparoscopic, cardiovascular, and orthopedic surgeries.

Development of Cost-Effective Automated Suturing Solutions

Affordable and reusable automated suturing devices are being developed and designed for portability and portability, opening up new patient segments in emerging markets. This means novel biodegradable sutures and smart suturing technologies will revolutionise next-generation surgical approaches.

Following this period, healthcare providers and surgeons embraced advanced suturing technologies to improve surgical precision, minimize time of procedures, and enhance patient outcomes, resulting in considerable uptake of automated suturing devices from 2020 to 2024.

The increasing prevalence of minimally invasive or robot-assisted surgeries and minimal recovery time laparoscopic procedures was leading to an increased demand for automated suturing solutions - a divergence away from traditional standard manual suturing methodologies that were fraught with the risks of inexact or inconsistent stitching quality and extended timescale for each service line.

Abundant demand for cosmetic and reconstructive surgeries, organ transplants, and trauma wound closures also drove the rapid growth of the market. Soon with the revolutions in suturing automation this problem boiled down giving way to minimization of medical human errors, hand tremors which led to instability of suturing making it sometime hazardous due to fatigue after long procedures following up with 2nd Revolution Detailing toward Automation of Suturing.

Rising concern over infection control and hospital-acquired infections (HAIs) in parallel boosted demand for single-use disposable automated suturing devices, which minimize cross low risk of cross-recontamination, and aided compliance with sterilization.

Next-generation automated suturing devices and robotic systems received the regulatory approvals by the USA Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the World health organization (WHO), which offer more accurate sutures, better wound closure strength, and lower infection risks.

Robotic-assisted suturing systems, AI-guided needle placement, and smart sensor-based suture delivery systems were implemented by hospitals and ambulatory surgical centres, resulting in enhanced surgical efficiency and post-procedure recovery rates for patients. With robotic surgery gaining traction and being applied to various specialities, such as gynaecology, urology, cardiothoracic surgery and gastroenterology, automated suturing devices were imperative to generate techniques of minimally invasive, precise and reproducible wound closure.

The shift to value-based healthcare and new surgical reimbursement models compelled hospitals to look for cost-effective automated suturing options that would reduce operating room time, post-operative complications and hospital readmissions. Innovations, including robotic-assisted suturing, AI-powered surgical stitch assist, and automated laparoscopic suturing, added to enhanced accuracy and safety in intricate surgical procedures.

To reduce post-operative complications and speed recovery, researchers created self-adjusting needle positioners, automated devices for tying knots, and biodegradable sutures. Surgeons were able to execute the high-precision wound closures with minimal tissue trauma due to 3D imaging assisted robotic suturing platforms, resulting in less need for manual intervention and improved procedural consistency.

Surgeons could achieve a new level of precision and control in stitching with improved systems for haptics, adaptive robotic appendages, and self-adjusting mechanisms for suture delivery, yielding more even tension and superior healing outcomes. AI-powered real-time imaging so far enhanced by robotic guidance systems has permitted surgeons to navigate complex structures for improved slugging of deep tissues and anastomoses of blood vessels.

Although it was progressive, the market continued to encounter challenges such as high device prices, limited training of surgeons on robotic suturing platforms, and regulatory barriers for newly emerging automation technologies in the suture market. Advanced automated Suturing devices remained mostly unaffordable for these low-resource healthcare services, which stuck to traditional suture techniques.

Furthermore, technical complexities in robotic-assisted suturing systems necessitated special training and hindered their widespread implementation. To standardize automated suturing techniques across a wide variety of surgical procedures, manufacturers ran into challenges with inter-operability between robotic platforms as well as manual suturing workflows.

Moreover, a steep learning curve to effectively train surgeons and OR staff to fully integrate AI-assisted and robotic suturing systems into ORs led to them being excluded from the event. But with investments by companies in AI-powered suturing algorithms, low-cost automatic suture delivery systems, and bioengineered smart sutures, automated suturing technologies became more accessible, user friendly, and economical, ultimately dismantling early adoption barriers.

The future of surgical wound management, minimally invasive procedures, and trauma care will involve a surge in AI-assisted robotic suturing, nanotechnology-based wound closure systems, and self-healing bioengineered sutures that will transform the automated suturing devices market between 2025 and 2035.

Future autonomous robotic suturing platforms will incorporate real-time AI learning algorithms capable of adapting to different tissue types, thus automatically optimizing not only stitch placement, but dynamically controlling suture tension as well. With adaptive force sensors embedded in AI-driven robotic arms, increased dexterity will allow practitioners to achieve suturing in small or complicated anatomical areas with more consistency and precision.

Artificial intelligence-based robotic-assisted suture platforms will refine surgical stitching by examining the real-time imaging data and dynamically adjusting the suture depth, tension, and placement accordingly. Data on surgical outcome will allow patients to be segregated as per their clinical features using machine learning based computational methods. With voice-controlled and gesture-based suturing systems, surgeons will be able to operate with halting-free operation, helping improve sterility and workflow efficiency.

Moreover, automated hemostatic suturing technologies will minimize per-surgical blood loss, allowing patient recovery time to be shortened, and post-operative complications to be reduced. Traditional non-absorbable stitches will be replaced with nanotechnology-based bio absorbable sutures, which can be absorbed by our bodies and do not need to be removed after the surgery, as such its application promotes quicker tissue regeneration.

For the second approach, scientists will create self-sealing, drug-coated stitches that autonomously release antimicrobial agents and growth factors that prevent infections and speed recovery and, ultimately, they’ll bring about faster healing of tissues.

Smart sutures equipped with biosensors will track wound healing, identify infections, and deliver real-time data to doctors, enabling timely intervention for complications. The use of bioengineered uses for tissue adhesives in conjunction with biodegradable suture alternatives will offer seamless, scarless wound closure with dramatic improvements in cosmetic and reconstructive surgery results.

In the realm of wound repair, the emergence of patient-specific sutures and wound closure systems via 3D bioprinting will give surgeons the ability to select suture types and materials based on individual tissue healing properties for optimal long-term structure of the wound and increased corporeal elasticity.

Robotic-assisted, AI-powered suturing systems will achieve widespread use for laparoscopic, robotic, and minimally invasive surgeries to enhance surgical accuracy and reduce operative durations. This real-time touch sensation will enhance the precision of surgeons while using robotic-assisted suturing tools; AI-controlled haptic feedback systems will assist in minimizing tissue damage.

The 3D-printed customizable, patient-specific sutures will deliver optimized closure strength for wounds of different shapes and sizes, and facilitate faster recovery for patients. With the roll-out of vision systems powered by artificial intelligence, robotic assisted motion control, and automated real-time error detection, surgeons will soon be able to achieve near-perfect suture consistency across several surgical procedures, including laparoscopic surgery, and drive further adoption.

Moreover, growing integration of robotic suturing in the outpatient and ambulatory setting will lead to faster closure of wounds while enabling minimally invasive techniques that can lead to better patient turnaround and efficiency in hospital operation.

Cost efficiency and sustainability will also be the future of automated suturing. AI will further bring down operation costs with automated suture manufacturing, biodegradable suture materials, and decentralized robotic surgical training platforms. Moreover, the incorporation of block chain-secured surgical tracking systems will substantially improve the traceability of devices, compliance with regulations, and the monitoring of outcomes post-surgery to ensure the efficacy of global health systems.

AI-led predictive maintenance platforms can help further improve the longevity of robotic-assisted suturing systems while also enhancing device uptime, thereby driving a reduction in total cost of ownership for hospitals and surgical centres. With the advancements in sustainable practices, eco-friendly suture materials formed from bioengineered polymers will help cut down on surgical-sector waste while contributing to worldwide green hospital goals.

Robotic-assisted, AI-powered suturing systems will achieve widespread use for laparoscopic, robotic, and minimally invasive surgeries to enhance surgical accuracy and reduce operative durations. This real-time touch sensation will enhance the precision of surgeons while using robotic-assisted suturing tools; AI-controlled haptic feedback systems will assist in minimizing tissue damage.

The 3D-printed customizable, patient-specific sutures will deliver optimized closure strength for wounds of different shapes and sizes, and facilitate faster recovery for patients. With the roll-out of vision systems powered by artificial intelligence, robotic assisted motion control, and automated real-time error detection, surgeons will soon be able to achieve near-perfect suture consistency across several surgical procedures, including laparoscopic surgery, and drive further adoption.

Moreover, growing integration of robotic suturing in the outpatient and ambulatory setting will lead to faster closure of wounds while enabling minimally invasive techniques that can lead to better patient turnaround and efficiency in hospital operation. Cost efficiency and sustainability will also be the future of automated suturing. AI will further bring down operation costs with automated suture manufacturing, biodegradable suture materials, and decentralized robotic surgical training platforms.

Moreover, the incorporation of block chain-secured surgical tracking systems will substantially improve the traceability of devices, compliance with regulations, and the monitoring of outcomes post-surgery to ensure the efficacy of global health systems.

AI-led predictive maintenance platforms can help further improve the longevity of robotic-assisted suturing systems while also enhancing device uptime, thereby driving a reduction in total cost of ownership for hospitals and surgical centres. With the advancements in sustainable practices, eco-friendly suture materials formed from bioengineered polymers will help cut down on surgical-sector waste while contributing to worldwide green hospital goals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments and regulatory agencies approved robotic-assisted suturing devices, bio absorbable sutures, and automated laparoscopic suturing systems. |

| Technological Advancements | Automated suturing devices integrated robotic-assisted control, AI-guided needle placement, and real-time imaging for precision stitching. |

| Industry Applications | Automated suturing was widely used for laparoscopic surgery, trauma wound management, and robotic-assisted surgical procedures. |

| Adoption of Smart Equipment | Hospitals and surgical centres relied on robotic suturing arms, AI-enhanced laparoscopic suturing tools, and disposable automated suture devices. |

| Sustainability & Cost Efficiency | Companies focused on cost-effective automated suturing systems, reducing surgical errors, and increasing robotic-assisted precision. |

| Data Analytics & Predictive Modelling | AI-driven real-time suture tension monitoring, predictive healing analytics, and automated surgical precision tracking improved procedural success rates. |

| Production & Supply Chain Dynamics | The market faced high manufacturing costs, supply chain disruptions, and limited training for robotic suturing adoption. |

| Market Growth Drivers | Growth was driven by rising surgical volumes, increasing demand for minimally invasive procedures, and advancements in robotic suturing technology. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered automated surgical stitching regulations, bioengineered self-sealing sutures compliance, and block chain-based surgical tracking will define surgical standards. |

| Technological Advancements | Quantum-enhanced AI suturing models, self-healing nanotech sutures, and bioengineered smart wound closure systems will redefine surgical outcomes. |

| Industry Applications | Expansion into self-healing wound sutures, AI-powered real-time surgical guidance, and robotic-assisted vascular anastomosis will reshape surgical innovation. |

| Adoption of Smart Equipment | Self-sealing AI-powered sutures, real-time remote robotic surgical assistance, and block chain-integrated surgical device traceability will improve patient care. |

| Sustainability & Cost Efficiency | Biodegradable smart sutures, AI-optimized suture production, and decentralized surgical automation technologies will enhance cost efficiency and eco-friendliness. |

| Data Analytics & Predictive Modelling | Quantum-assisted personalized suturing, AI-powered wound healing optimization, and predictive AI-based robotic suture placement will improve surgical outcomes. |

| Production & Supply Chain Dynamics | AI-driven suture production optimization, decentralized robotic-assisted surgery hubs, and block chain-powered automated surgical tracking will improve global accessibility. |

| Market Growth Drivers | The expansion of AI-powered surgical robotics, nanotechnology-based smart sutures, and regenerative bioengineered wound closure systems will drive future market growth. |

By Application, the United States market is segmented into Cardiac Surgery, General Surgery, Gynaecological Surgery, Neurological Surgery, and others. It is reported that more than 50 million surgical procedures are performed annually in United States which is resulting into exponential growth in investment in the automated suturing for open and laparoscopic procedure.

There is a growing prevalence of chronic diseases, along with an increasing number of trauma cases, leading to a rise in the number of surgical procedures, which is a major factor responsible for increasing demand for effective wound closure, is fuelling the growth of the market. Factors such as the rising adoption of robotic-assisted and endoscopic suturing products in general, orthopaedic and cardiovascular surgeries are expected to drive the market growth.

As surgical procedures become more common, the need for disposable automatic suturing devices to minimize Surgical Site Infections (SSIs) that lead to post-operative complications is becoming one of the biggest challenges faced by hospitals and ambulatory surgery centres (ASCs). Companies like Medtronic, Ethicon and Apollo Endo-surgery, are also enabling AI and robotic-assisted suture systems along with precision, efficiency and patient recovery time.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

The United Kingdom Automated Suturing Devices Market is growing due to increasing demand for minimally invasive surgeries, increasing initiatives for surgical site infections prevention, and NHS investments in robotic-assisted surgery. The United Kingdom alone, where the National Health Service performs over 10M surgeries a year, presents a market potential for numerous automated suturing solutions across elective or emergency surgical applications.

Needle and thread are being replaced in more and more surgeries as laparoscopic (keyhole) and other procedures turn to automated suturing devices to enhance accuracy, accelerate recovery and improve patient outcomes. Antimicrobial-coated suturing devices are being increasingly adopted by hospitals focused on reducing mouthpiece surgical infections (SSIs) and improving post-operative wound management capabilities.

Additionally, the growing usage of robotic-assisted suturing systems in NHS hospitals is propelling demand for automated suturing solutions pertaining to complex cardiac, orthopaedic and gastrointestinal procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

The Automated Suturing Devices Market in the European Union is growing due to increasing government investments in surgical innovation, rising adoption of robotic-assisted suturing technologies, and strong regulatory support for infection control measures. The Automated Suturing Devices Market in the European Union is growing due to increasing government investments in surgical innovation, rising adoption of robotic-assisted suturing technologies, and strong regulatory support for infection control measures.

The European Union’s Horizon Europe Program, focused on USD 4.72 billion medical technology, also drives innovation on automated suturing and wound closure solutions. Robotic-assisted suturing devices are widely used in complex surgical procedures such as cardiac, gastrointestinal, and bariatric surgeries across Germany, France, and Italy. This trend of single-use automated suturing devices is reducing surgical complications, cross-contamination risks, and in line with European Union’s health and safety policies.

Moreover, the development of machine-assisted suturing systems for minimally invasive surgeries improves surgical accuracy and post-surgical recovery rates.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

The Japanese Automated Suturing Devices Market is growing owing to increasing population geriatric along with the rising demand for minimal invasive surgeries and strong government support for Improvements in medical robotics. Japan is one of the oldest countries in the world with a population over 28% over 65 years old, which leads to many chronic diseases and increased surgical procedures.

The Japanese government has invested USD 1.8 billion to encourage robotic surgery and medical device research, leading to the creation of intelligent automated suturing systems powered by artificial intelligence. Furthermore, adoption of robotic-assisted suturing devices in robotic minimally invasive surgeries, especially in cardiovascular, urological, and gastrointestinal procedures, is predicted to enhance surgical efficiency and minimize duration of postoperative recovery.

Moreover, the rising number of hybrid operating rooms set up in Japanese hospitals is enabling advanced laparoscopic/robotic-assisted surgery, which is driving the demand for next generation suturing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.1% |

The increasing volumes of surgical procedures and growing adoption of surgical suturing robots are estimated to grow the South Korea Automated suturing devices market. South Korea’s Ministry of Health and Welfare has pledged USD 1.2 billion for medical robotics and surgical innovation and automated suturing devices are gaining molecular in hospital and ASC settings.

The growing population undergoing laparoscopic and robotic-assisted surgeries is driving demand for sophisticated suturing solutions with the potential to improve precision and decrease the duration of procedures. AI refers to the development of computer systems that can carry out tasks that would typically require human intelligence, in this case, in the areas of surgical planning and automated suturing systems which leads to even better patient outcomes with less risk of surgical complications.

In particular, South Korea's medical robotics top players, including Medi-Robo and Curexo, are leading the way in developing next-generation automated suturing technologies that are capable of suturing during open and minimally invasive surgery.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The automated suturing devices market is expanding due to increasing demand for minimally invasive surgeries (MIS), robotic-assisted suturing, and advanced wound closure techniques. Companies are focusing on AI-driven robotic suturing, ergonomic handheld devices, and enhanced precision control mechanisms to improve surgical efficiency, reduce operation time, and optimize patient recovery. The market includes global leaders and specialized medical device manufacturers, each contributing to technological advancements in endoscopic, laparoscopic, and open surgical suturing solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 15-20% |

| Ethicon (Johnson & Johnson) | 12-16% |

| Apollo Endosurgery, Inc. | 10-14% |

| BD (Becton, Dickinson and Company) | 8-12% |

| Smith & Nephew plc | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Develops robotic-assisted suturing solutions, endoscopic suturing systems, and minimally invasive closure devices. |

| Ethicon (Johnson & Johnson) | Specializes in automated wound closure systems, high-precision laparoscopic suturing devices, and AI-powered needle control. |

| Apollo Endosurgery, Inc. | Manufactures OverStitch™ endoscopic suturing devices and X-Tack™ fixation systems, improving gastrointestinal and bariatric surgical outcomes. |

| BD (Becton, Dickinson and Company) | Provides mechanical suturing solutions, laparoscopic closure systems, and bioabsorbable sutures to enhance wound healing. |

| Smith & Nephew plc | Offers automated suturing for soft tissue repair, orthopedic procedures, and minimally invasive wound closure. |

Key Company Insights

Medtronic plc (15 to 20%)

Medtronic dominates the automated suturing devices market, providing robotic-assisted suturing and advanced endoscopic closure products. This includes AI-powered surgical guidance, real-time needle positioning and improved visualization during precise closure of the wound.

Ethicon (Johnson & Johnson) (12-16%)

Ethicon is focused on high-efficiency automated suturing systems and robots that include surgical tools for robotic-driven procedures, laparoscopic closure and smart tissue management solutions.

Apollo Endosurgery, Inc. (10-14%)

Apollo Endosurgery is a market leader in endoscopic suturing systems, including OverStitch™ and X-Tack™, which enhance gastrointestinal and metabolic surgery outcomes.

BD (Becton, Dickinson and Company) (8-12%)

BD provides laparoscopic and open surgical suturing solutions, incorporating biodegradable suture materials and mechanical closure devices to reduce surgical site infections.

Smith & Nephew plc (5-9%)

Smith & Nephew develops automated suturing solutions for orthopedic and general surgical applications, focusing on tissue-friendly closure methods and fast healing technologies.

Other Key Players (40-50% Combined)

Several medical device manufacturers contribute to next-generation suturing innovations, robotic-assisted wound closure, and AI-powered surgical technologies. These include:

The overall market size for Automated Suturing Devices Market was USD 3.6 Billion in 2025.

The Automated Suturing Devices Market is expected to reach USD 7.1 Billion in 2035.

The demand for automated suturing devices will grow due to the rising number of minimally invasive surgeries, increasing preference for precision in wound closure, advancements in surgical technology, and the growing need for faster healing and reduced procedural time in hospitals and ambulatory centre.

The top 5 countries which drives the development of Automated Suturing Devices Market are USA, UK, Europe Union, Japan and South Korea.

Reusable and Disposable Automated Suturing Devices Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA