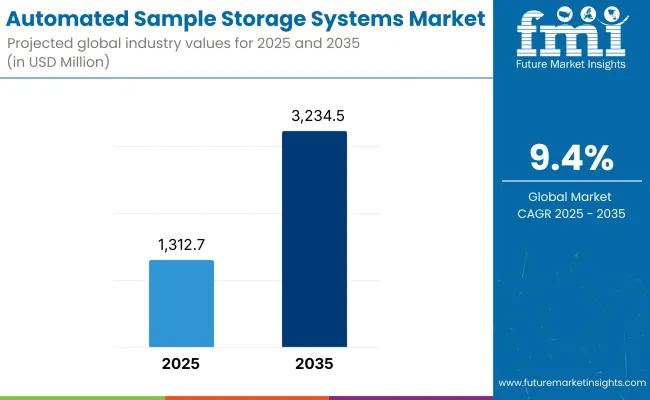

The global market for automated sample storage systems is forecasted to attain USD 1,312.7 million by 2025, expanding at 9.4% CAGR to reach USD 3,234.5 million by 2035. In 2024, the revenue of Automated Sample Storage Systems was around USD 914.9 million

Automated Sample Storage Systems is expected to have significant growth due to the increasing demand for biobanking with high-throughput along with laboratory automation and temperature-controlled storage solutions in pharmaceuticals, biotechnology, academic, and clinical research settings. Maintaining temperatures from ultra-low to cryogenic conditions, these systems give secure and efficient storage of biological samples (DNA, RNA, blood, and tissue).

With rising R&D initiatives, especially in drug discovery, genomics, and personalized medicine, there is a fast-growing demand for manageable, contamination-free, and accessible sample storage. Automation also improves sample traceability and reduces human error while adhering to strict regulatory standards. Moreover, wide adoption of robotic systems for sorting and inventorying items, uses of RFID/ Barcode tracking and inventory management software for efficient and accurate use of data are also driving the growth of the market.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,312.7 Million |

| Industry Value (2035F) | USD 3,234.5 Million |

| CAGR (2025 to 2035) | 9.4% |

North America holds a major share in the automated sample storage systems market owing to an index of pharmaceutical and biotech industries, high research funding and early adoption of laboratory automation. The USA also has the most established biobanking infrastructure of the countries included in the comparison, with many large-scale biorepositories affiliated with NIH, CDC and academic medical centers. Genomics, cancer research and clinical trials are fueling demand for automated ultra-low temperature storage.

Europe also has a firm presence in the global market, thanks to collaborative biobanking initiatives, public research funding, and strict biospecimen quality standards. Countries like Germany, UK, France, and Sweden lead in adoption with automated storage solutions implemented across university hospitals, CROs and along clinical trial centers.

Of note, in Europe, the European Biobanking and Biomolecular Resources Research Infrastructure (BBMRI-ERIC) has catalyzed the harmonization and scalability of storage practices. Increasing adoption of automation in pandemic preparedness, personalized medicine, or longitudinal health studies is likely to foster the growth of automated sample storage systems.

Regulatory interest in data integrity and sample security is driving implementation of integrated cloud monitored storage solutions in the European Region. Furthermore, the vast progress in the fields of genomics, proteomics and other life sciences have increased the demand for sample collection and this in turn is expected to fuel the growth of Automated Sample Storage Systems market in Europe.

Asia-Pacific is anticipated to be the fastest-growing region due to expanding life sciences R&D, rising healthcare digitization, and increasing public-private investments in biomedical infrastructure. Countries like China, Japan, India, South Korea, and Singapore are building large biobank networks to support precision medicine and epidemiological research.

Multinational pharmaceutical companies are outsourcing biobanking and research activities to Asia due to cost advantages and growing regulatory maturity. The adoption of modular, scalable storage units tailored for diverse climatic conditions and lab environments is accelerating. Government health initiatives focused on population genomics and infectious disease surveillance are expected to drive sustained market growth.

Challenges

Comprehensive Analysis of Challenges Impacting the Automated Sample Storage Systems Market

The high capital expenditure represents one of the major hurdles preventing the mass-adoption of automated sample storage systems, especially within small and mid-sized research institutes. Operational complexity is also a result of system maintenance, calibration and space requirements. Existing IT infrastructure integration along with data security concerns-especially with cloud-based monitoring spotlight the need for robust solutions to enable regulatory compliance.

Additionally, the diversity of sample types, container formats, and temperature requirements necessitates customized configurations, adding to procurement and validation timelines. Market penetration in emerging economies is slowed by limited technical expertise and lower levels of automation across research labs.

Opportunities

Emerging Opportunities and Innovations Driving Growth in the Automated Sample Storage Systems Market

Development of energy-efficient, cost-effective, and modular sample storage, designed to cater to the evolving needs of decentralized research facilities and mobile biobanks, presents significant opportunities in the automated sample storage systems market. Real-time inventory tracking, predictive maintenance and enhanced environmental control systems are among the developments that are revolutionising storage management capabilities.

With a rising interest in cell and gene therapy, biomarker research, and longitudinal cohort studies, there is growing need for long-term and contamination-free biospecimen storage solutions. Vendors focusing on smooth integration with laboratory information management systems and providing extensive traceability capabilities stand to flourish in this changing market

Emerging Trends

One emerging trend in the automated sample storage systems market is the growing adoption of modular and scalable designs. As research institutions, biobanks, and pharmaceutical companies handle increasing volumes of biological and chemical samples, storage systems must adapt to dynamic demands. Modular systems offer flexible configurations that allow facilities to expand storage capacity easily without major infrastructure changes.

Moreover, scalable systems also enhance energy efficiency by allowing facilities to operate only the required storage units rather than running a full-sized system at all times. This trend addresses the increasing focus on cost-effective, space-saving solutions in the life sciences sector.

From 2020 through 2024, the global automated sample storage systems market exhibited strong growth during the historical period, driven by the rising demand for high-throughput research, innovations in laboratory automation, and the increasing need for efficient sample management in the pharmaceutical and biotechnology industries. Additionally, the growth was aided by improvements in storage systems technology, such as the use of robotics and artificial intelligence, which improve sample integrity and operational efficiency.

Looking ahead to 2025 to 2035, the automated sample storage systems market is poised for continued growth, propelled by ongoing technological innovations, increased investment in research and development, and a growing emphasis on personalized medicine.

The development of next-generation storage systems with enhanced automation, scalability, and integration capabilities is expected to further improve laboratory workflows and data management. Additionally, expanding applications in biobanking, clinical research, and drug discovery, along with increasing awareness of the benefits of automation in sample storage, are anticipated to drive market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of guidelines ensuring the safety and efficacy of automated storage systems, leading to standardized protocols and usage regulations. |

| Technological Advancements | Introduction of automated storage systems integrating robotics and basic data management features, enhancing sample integrity and retrieval processes. |

| Consumer Demand | Increased adoption of automated storage systems among pharmaceutical and biotechnology companies, driven by the need for efficient sample management and compliance with regulatory standards. |

| Market Growth Drivers | Rising volume of biological samples due to increased research activities, advancements in laboratory automation, and a shift towards high-throughput screening methods. |

| Sustainability | Initial efforts towards energy-efficient storage systems and reduction of the environmental footprint associated with sample storage facilities. |

| Supply Chain Dynamics | Dependence on specialized suppliers for high-quality storage components, with efforts to localize production to mitigate supply chain disruptions observed during global events. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential harmonization of regulations across countries to balance operational efficiency with technological innovation, alongside expedited approval processes for novel storage technologies addressing unmet laboratory needs. |

| Technological Advancements | Development of advanced storage systems incorporating artificial intelligence, machine learning, and cloud-based solutions, improving sample tracking, predictive maintenance, and seamless integration with laboratory information management systems (LIMS). |

| Consumer Demand | Growing preference for scalable and customizable storage solutions across various end-users, including academic research institutions and biobanks, driven by the expansion of biorepositories and personalized medicine initiatives. |

| Market Growth Drivers | Expansion of biobanking and genomic research, increasing investments in precision medicine, continuous technological innovations enhancing storage efficiency, and a global emphasis on data integrity and reproducibility in scientific research. |

| Sustainability | Adoption of eco-friendly manufacturing processes and development of storage systems with reduced energy consumption, aligning with global sustainability initiatives and reducing operational costs for end-users. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities through technological advancements and strategic partnerships, leading to reduced dependency on imports, improved supply chain resilience, and the ability to rapidly respond to evolving laboratory needs. |

Market Outlook

The USA accounted for the largest share of the automated sample storage systems market globally owing to a rapid growth in biobanking, pharmaceutical R&D, and genomics research. With high automation in life sciences and clinical laboratory systems, there is a growing additional demand for both ultra-low and cryogenic storage systems due to the need for temperature controlled and high-throughput sample handling.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

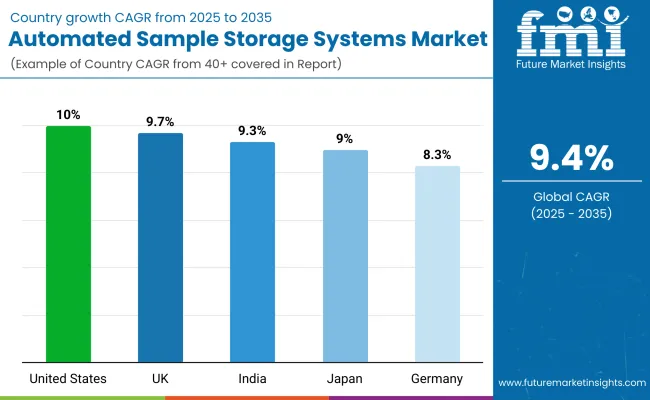

| United States | 10.0% |

Market Outlook

The automated sample storage systems market in Germany is well-developed with support from its robust pharmaceutical industry, cutting-edge healthcare research institutions, and emphasis on standardization in biospecimen management. The country is a critical market for biobank development, with strong adoption of robotic sample retrieval, modular freezing systems and barcoded inventory solutions in diagnostics and life sciences labs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 8.3% |

Market Outlook

This high-density, automated sample storage system is gaining significant traction in the UK due to the large investments in biomedical research, biobanking and NHS genomic initiatives. Examples of large-scale projects such as Genomics England and the UK Biobank have driven up sample numbers and there is increasing market demand for flexible, high-capacity, and remotely-managed cold storage systems, in both public and private sectors.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.7% |

Market Outlook

Japan’s automated sample storage systems market is technologically advanced, reflecting the country's leadership in robotics, life sciences automation, and regenerative medicine. With high investment in stem cell research, cancer registries, and personalized medicine, automated systems are increasingly essential for maintaining sample quality and workflow consistency in clinical and pharmaceutical research environments.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.0% |

Market Outlook

India’s automated sample storage systems market is in a growth phase, driven by the expansion of clinical research, pharmaceutical manufacturing, and diagnostic networks. While adoption is currently limited to top-tier institutions, rising investments in biobanking infrastructure, public health surveillance, and clinical trial digitization are creating new opportunities for scalable, energy-efficient automated systems.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.3% |

Automated Ultra-Low Temperature (ULT) Storage Systems

Automated ULT storage systems are suitable for protecting biological samples including DNA, RNA, plasma, serum, and cell cultures from −80°C to −150°C, and are commonly used in biobanks, pharmaceutical R&D, and genomic research where sample integrity over long periods of time is essential. The surge in biobanking activities, expansion of precision medicine initiatives and demand for scalable, contamination-free storage solutions are driving the growth.

The USA, Germany, Japan, and South Korea are leading markets due to heavy investments in clinical trials and biomedical research infrastructure. Future trends include robot-assisted sample retrieval, AI-driven inventory tracking, and energy-efficient cooling technologies using liquid nitrogen-free systems.

Refrigerated and Ambient Automated Storage Systems

Refrigerated and ambient automated storage systems operate at room temperature or within the 2-8°C range, making them ideal for storing various consumables such as chemical reagents, diagnostic kits, vaccines, and blood components. With the increasing volume of diagnostic tests and the growing need for sample traceability in laboratories, along with centralized reagent management in hospitals and contract research organizations (CROs), the demand for these storage solutions is steadily rising.

Europe and North America lead adoption, with rising deployment in hospital labs, academic research centers, and clinical reference labs. Emerging markets such as India and Brazil are adopting ambient automation to support high-throughput diagnostic labs. Future innovations include cloud-connected inventory software, RFID-enabled sample tracking, and modular configurations for temperature-zone hybrid storage systems.

Biobanks and Research Laboratories Leading the Automated Sample Storage Systems Landscape

Biobanks and academic research laboratories are among the primary users of automated storage systems, driven by the need to securely store and manage large volumes of biospecimens for extended periods. These facilities require storage solutions that offer high density, security, and traceability. The rising focus on population-scale genomics programs, increasing rare disease research, and growing collaborations between academic biobanks and pharmaceutical companies are key factors driving demand in this segment.

Regions such as North America and Scandinavia are at the forefront of biobank automation adoption, supported by their advanced healthcare research and development ecosystems. Future advancements in this field include the integration of blockchain for improved sample tracking, automated systems to ensure chain-of-custody compliance, and enhanced data-driven tools for optimizing storage conditions and improving sample retrieval efficiency.

Growing Demand for Automated Sample Storage Systems in Pharmaceutical and Biotechnology Companies

Pharma and biotech firms deploy automated storage systems to support drug discovery, clinical trials, and biomarker validation workflows, where sample integrity, data accuracy, and audit traceability are mission-critical. The increase in biologics and cell-based therapies, along with globalization of clinical trials, is driving demand for GxP-compliant, high-throughput sample storage solutions.

USA, Germany, Switzerland, and Japan are leading markets due to their strong life sciences industry presence. Future trends include integration of automated sample storage with LIMS/ELN platforms, predictive maintenance algorithms, and robotic sample-to-assay workflow automation.

The electromyography (EMG) devices market is competitive and steadily growing, fueled by rising neuromuscular disorder diagnoses, increased use of EMG in sports medicine and rehabilitation, and technological advancements in wireless and portable EMG systems. The demand is supported by applications in clinical diagnostics, physiotherapy, orthopedics, and neurological research. The market comprises established medical device manufacturers, diagnostic technology companies, and neurophysiology solution providers.

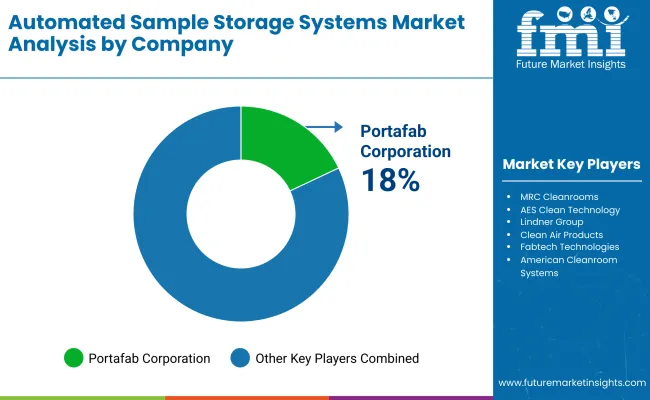

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Portafab Corporation | 18-22% |

| MRC Cleanrooms | 14-18% |

| AES Clean Technology | 10-14% |

| Lindner Group | 8-12% |

| Plascore , Inc. | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Portafab Corporation | Offers modular wall systems and prefabricated cleanroom panels used in biopharma, electronics, and food processing facilities. |

| MRC Cleanrooms | Provides turnkey cleanroom panel systems with integrated air handling and GMP-compliant wall and ceiling panels. |

| AES Clean Technology | Specializes in pharma-grade cleanroom construction with pre-engineered panelized wall and ceiling systems. |

| Lindner Group | Offers advanced architectural solutions for cleanrooms, including seamless panel designs and HVAC-integrated modules. |

| Plascore , Inc. | Manufactures honeycomb core wall and ceiling panels for cleanroom and controlled environment applications. |

Key Company Insights

Portafab Corporation (18-22%)

A market leader in modular cleanroom systems, Portafab supplies cost-effective and flexible panel configurations to diverse industries across North America and Europe.

MRC Cleanrooms (14-18%)

MRC is recognized for global project execution capabilities, offering complete cleanroom panel systems tailored for regulated industries like pharmaceuticals.

AES Clean Technology (10-14%)

AES focuses on GMP-compliant panel systems and turnkey cleanroom facilities that meet stringent FDA and EMA standards.

Lindner Group (8-12%)

A premium supplier of cleanroom construction solutions, Lindner emphasizes integrated HVAC and design-driven performance for clean environments.

Plascore, Inc. (5-9%)

Known for durable honeycomb panel technology, Plascore delivers lightweight yet strong panels ideal for critical cleanroom zones.

Other Key Players (30-40% Combined)

Other significant contributors to the clean room panels market include:

These companies drive innovation and capacity expansion through smart panel integration, compliance with ISO and GMP standards, and design customization for critical controlled environments.

Automated Ultra-Low Temperature (ULT) Storage Systems, Refrigerated and Ambient Automated Storage Systems, EMG machine and Accessories

Hospitals, Neurological Clinics, Rehabilitation Centers, Sports Medicine Clinics, and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for automated sample storage systems market was USD 1,312.7 million in 2025.

The automated sample storage systems market is expected to reach USD 3,234.5 million in 2035.

The expansion of biobanks for genomics research, personalized medicine, and rare disease studies is significantly boosting demand for secure and efficient sample storage solutions and this drive the demand for automated sample storage systems market.

The top key players that drives the development of Automated Sample Storage Systems market are, Portafab Corporation, MRC Cleanrooms, AES Clean Technology, Lindner Group, and Plascore, Inc.

Automated ultra-low temperature (ult) storage systems in product type of Automated Sample Storage Systems market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Radionuclide Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Fingerprint Identification System (AFIS) Market Size and Share Forecast Outlook 2025 to 2035

Automated Cannabis Testing Market Size and Share Forecast Outlook 2025 to 2035

Automated Algo Trading Market Size and Share Forecast Outlook 2025 to 2035

Automated Centrifuge System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automated Number Plate Recognition (ANPR) and Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automated Tray Fill and Seal Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA