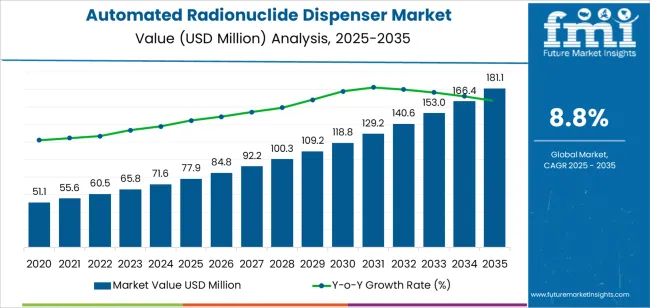

The global automated radionuclide dispenser market is projected to reach USD 181.2 million by 2035, recording an absolute increase of USD 103.2 million over the forecast period. The market is valued at USD 77.9 million in 2025 and is set to rise at a CAGR of 8.8% during the assessment period. The overall market size is expected to grow by nearly 2.3 times during the same period, supported by increasing demand for nuclear medicine procedures and radiopharmaceutical therapies, driving demand for precise dispensing technologies and increasing investments in healthcare infrastructure and radiation safety protocols globally. However, stringent regulatory requirements and high equipment costs may pose challenges to market expansion.

The expansion trajectory reflects fundamental shifts in nuclear medicine practices, where radiopharmaceutical preparation has emerged as a critical factor determining treatment accuracy and radiation safety in diagnostic imaging and therapeutic applications. Healthcare facilities face mounting pressure to implement automated dispensing systems that minimize radiation exposure to pharmacy personnel while ensuring precise radiopharmaceutical dosing for patient administration. Advanced automated dispensers deliver dose accuracy within plus or minus 2-3% tolerance levels, enabling nuclear medicine departments to achieve consistent quality standards while protecting staff from cumulative radiation exposure that occurs during manual radiopharmaceutical handling and dose preparation procedures.

Regional market dynamics show pronounced variation, with developed markets emphasizing radiation safety automation and workflow optimization while emerging economies prioritize nuclear medicine capacity expansion and radiopharmacy infrastructure development. Hospital nuclear medicine departments and centralized radiopharmacies represent the primary demand centers, where sterile and non-sterile dispenser systems integrate with existing hot cell configurations to standardize dose preparation and contamination control protocols. The technology landscape encompasses various shielding configurations and automation levels, creating diverse product offerings tailored to specific facility sizes and procedural volume requirements across pharmaceutical manufacturing, hospital, and research applications.

Investment patterns indicate sustained commitment from healthcare systems and radiopharmaceutical manufacturers toward dispensing equipment that supports quality assurance and personnel safety objectives. Nuclear medicine managers pursue systems that reduce manual handling while improving dose consistency, driving adoption of sophisticated automation platforms despite substantial capital costs. The convergence of nuclear medicine growth, personalized medicine trends, and occupational safety standards establishes favorable conditions for market expansion through 2035, though implementation challenges related to regulatory compliance complexity and installation costs will require ongoing attention from manufacturers and facility operators to ensure safe radiopharmaceutical preparation across diverse nuclear medicine environments and operational configurations.

Between 2025 and 2030, the automated radionuclide dispenser market is projected to expand from USD 77.9 million to USD 118.8 million, resulting in a value increase of USD 40.9 million, which represents 39.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for radiopharmaceutical precision dosing in nuclear medicine departments and centralized radiopharmacies, product innovation in automated shielding systems and dose calibration technologies, as well as expanding integration with radiopharmacy information management systems and quality assurance protocols. Companies are establishing competitive positions through investment in advanced radiation shielding designs, electronic dose verification systems, and strategic market expansion across pharmaceutical, hospital, research, and other nuclear medicine applications.

From 2030 to 2035, the market is forecast to grow from USD 118.8 million to USD 181.2 million, adding another USD 62.4 million, which constitutes 60.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized dispensing systems, including advanced sterile processing configurations and integrated radiopharmacy automation solutions tailored for specific therapeutic radionuclide requirements, strategic collaborations between dispenser manufacturers and radiopharmaceutical developers, and an enhanced focus on contamination control and regulatory compliance. The growing emphasis on theranostic applications and alpha-emitter therapy will drive demand for advanced, high-performance automated radionuclide dispenser solutions across diverse nuclear medicine applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 77.9 million |

| Market Forecast Value (2035) | USD 181.2 million |

| Forecast CAGR (2025-2035) | 8.8% |

The automated radionuclide dispenser market grows by enabling nuclear medicine facilities to achieve precise radiopharmaceutical dosing and radiation safety compliance while protecting pharmacy personnel from occupational exposure. Nuclear medicine departments face mounting pressure to implement automated preparation systems that reduce manual handling of radioactive materials, with automated dispensers typically reducing personnel radiation exposure by 60-80% compared to manual dose preparation methods, making automation essential for long-term staff safety and regulatory compliance. The expansion of nuclear medicine procedures creates demand for reliable dispensing equipment that can handle increasing patient volumes while maintaining consistent dose accuracy across diagnostic imaging and therapeutic radionuclide administration.

Government initiatives promoting radiation safety standards and radiopharmacy quality assurance programs drive adoption in pharmaceutical, hospital, research, and other applications, where dose precision has a direct impact on treatment efficacy and diagnostic image quality. The global growth of nuclear medicine and radiopharmaceutical therapy accelerates dispenser demand as healthcare systems seek equipment capable of handling diverse radionuclides including positron emitters, gamma emitters, and therapeutic isotopes while maintaining sterility and contamination control. However, substantial capital investment requirements and complex regulatory approval processes may limit adoption rates among smaller nuclear medicine facilities and regions with developing radiopharmacy infrastructure.

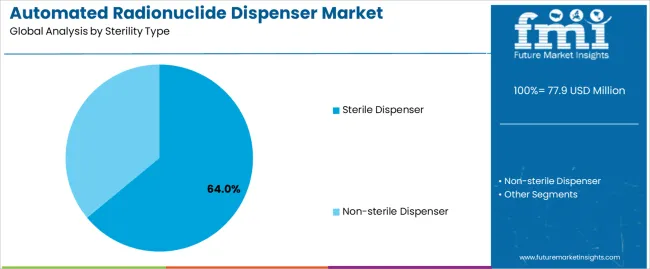

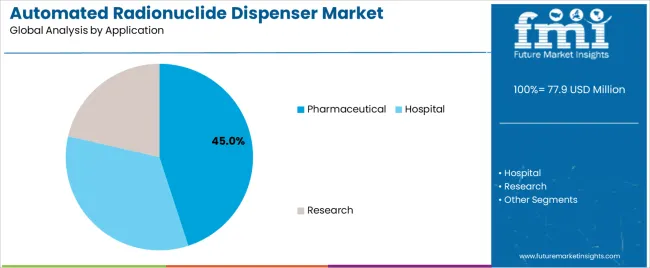

The market is segmented by sterility type, application, and region. By sterility type, the market is divided into sterile dispenser and non-sterile dispenser. Based on application, the market is categorized into pharmaceutical, hospital, and research. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

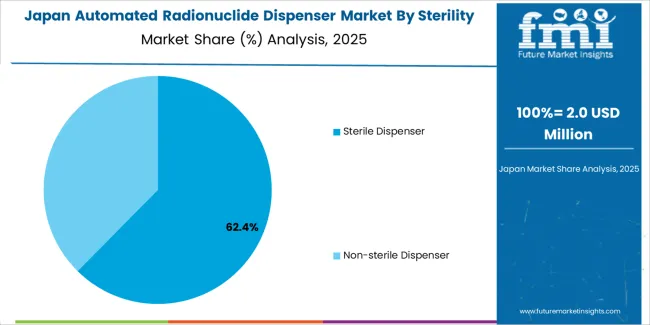

The sterile dispenser segment represents the dominant force in the automated radionuclide dispenser market, capturing approximately 64% of total market share in 2025. This category delivers comprehensive radiopharmaceutical preparation capabilities with integrated aseptic processing and contamination control features. The sterile dispenser segment's market leadership stems from its critical role in injectable radiopharmaceutical preparation, compliance with pharmaceutical manufacturing standards, and ability to maintain product sterility during radioactive material handling and dose subdivision operations.

The non-sterile dispenser segment maintains a substantial 36% market share, serving facilities that handle sealed radioactive sources and pre-packaged radiopharmaceuticals requiring dose fractionation without sterile compounding requirements.

Key advantages driving the sterile dispenser segment include:

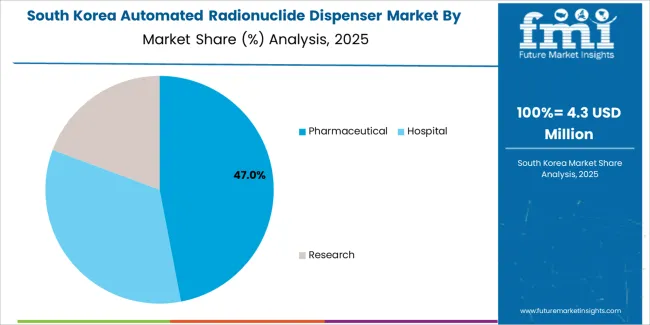

Pharmaceutical applications dominate the automated radionuclide dispenser market with approximately 45% market share in 2025, reflecting the critical need for high-volume radiopharmaceutical production in centralized manufacturing facilities where automated dispensing enables consistent product quality and worker protection. The pharmaceutical segment's market leadership is reinforced by widespread adoption across commercial radiopharmacies, contract manufacturing organizations, and radiopharmaceutical development facilities, which require validated automated systems for regulatory compliance and production efficiency.

The hospital segment represents 38% market share through nuclear medicine departments and in-house radiopharmacies that provide patient-specific dose preparation services for diagnostic imaging and therapeutic procedures. The research segment accounts for 17% market share, featuring specialized dispensing requirements for radiopharmaceutical development, preclinical studies, and academic research programs.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to nuclear medicine expansion and safety requirements. First, nuclear medicine procedure volume growth creates increasing requirements for efficient radiopharmaceutical preparation, with global nuclear imaging procedures estimated at 40 million annually and growing 4-6% per year according to medical imaging industry data, requiring automated dispensing infrastructure to support increasing patient demand while maintaining dose consistency and preparation efficiency. Second, occupational radiation safety regulations drive facilities toward automation solutions, with cumulative radiation exposure limits for nuclear medicine workers established at 20 millisieverts annually in most jurisdictions, creating compelling safety rationale for automated systems that eliminate manual handling during dose preparation and subdivision processes. Third, radiopharmaceutical complexity increases incentivize adoption of precision dispensing equipment, with newer therapeutic radioisotopes requiring sub-milliliter dosing accuracy and alpha-emitter therapies demanding specialized containment capabilities that exceed manual handling safety thresholds.

Market restraints include substantial equipment acquisition costs affecting purchasing decisions and capital planning cycles, particularly for fully-integrated sterile dispensing systems where installations can exceed USD 200,000 per unit including shielding and hot cell integration, posing financial barriers for community hospitals and emerging nuclear medicine programs operating on constrained equipment budgets. Regulatory complexity regarding radioactive material handling, pharmaceutical compounding standards, and radiation safety compliance creates additional challenges, as facility implementation requires coordination across multiple regulatory domains including nuclear regulatory authorities, pharmaceutical oversight agencies, and occupational safety organizations during equipment validation and operational qualification.

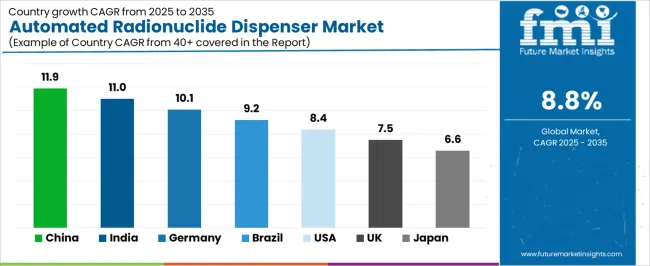

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where nuclear medicine capacity expansion and radiopharmaceutical manufacturing development drive demand for automated dispensing equipment through healthcare infrastructure investment programs and domestic radioisotope production initiatives. Technology advancement trends toward modular dispensing configurations with scalable automation levels, integrated dose verification systems utilizing advanced radiation detection, and remote operation capabilities enabling centralized radiopharmacy models serving multiple satellite facilities are enabling next-generation product development. The market could face disruption if alternative dose preparation approaches, such as unit-dose radiopharmaceutical packaging or point-of-care radioisotope generators with integrated dispensing, eliminate the need for facility-based dose subdivision while maintaining equivalent quality and safety performance compared to current centralized radiopharmacy dispensing operations.

| Country | CAGR (2025-2035) |

|---|---|

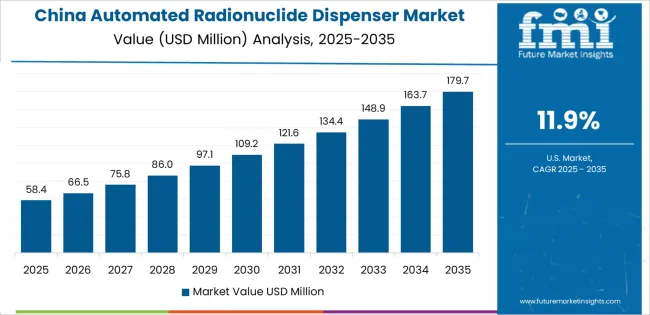

| China | 11.9% |

| India | 11% |

| Germany | 10.1% |

| Brazil | 9.2% |

| United States | 8.4% |

| United Kingdom | 7.5% |

| Japan | 6.6% |

The automated radionuclide dispenser market is gaining momentum worldwide, with China taking the lead thanks to aggressive nuclear medicine infrastructure development and domestic radiopharmaceutical manufacturing expansion programs. Close behind, India benefits from cancer care capacity building and nuclear medicine department establishment initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where comprehensive nuclear medicine services and radiopharmacy quality standards strengthen its role in European healthcare systems. Brazil demonstrates robust growth through nuclear medicine modernization and radiopharmaceutical production development, signaling continued advancement in Latin American healthcare infrastructure. Meanwhile, the United States maintains steady progress through theranostic therapy adoption and radiopharmacy automation initiatives, while the United Kingdom and Japan continue to record consistent advancement driven by nuclear medicine innovation and radiation safety enhancement programs. Together, China and India anchor the global expansion story, while established markets build stability and technological sophistication into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Automated Radionuclide Dispenser Market with a CAGR of 11.9% through 2035. The country's leadership position stems from comprehensive nuclear medicine infrastructure development, intensive radiopharmaceutical manufacturing capacity expansion, and aggressive cancer care program implementation driving adoption of automated dispensing systems. Growth is concentrated in major healthcare centers and radiopharmaceutical production facilities, including Beijing, Shanghai, Guangzhou, and Chengdu, where hospital nuclear medicine departments, commercial radiopharmacies, and research institutes are implementing automated dispenser technologies for safety enhancement and quality assurance. Distribution channels through medical equipment distributors, radiopharmacy suppliers, and direct manufacturer relationships expand deployment across tertiary hospitals, regional cancer centers, and centralized radiopharmaceutical manufacturing facilities. The country's Healthy China 2030 initiative provides policy support for nuclear medicine advancement, including investment in radiopharmacy automation and radiation safety infrastructure.

Key market factors:

In major metropolitan healthcare centers, emerging cancer care facilities, and government hospital networks, the adoption of automated radionuclide dispensing systems is accelerating across nuclear medicine departments, centralized radiopharmacies, and research institutions, driven by cancer burden increases and government healthcare modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 11% through 2035, linked to comprehensive nuclear medicine capacity expansion and increasing focus on radiation safety enhancement solutions. Indian healthcare facilities are implementing automated dispensing equipment and radiation protection technologies to improve operational efficiency while meeting international safety standards for radiopharmaceutical preparation. The country's National Cancer Grid initiative creates sustained demand for nuclear medicine infrastructure, while increasing emphasis on occupational safety drives adoption of automation systems that protect pharmacy personnel.

Germany's advanced nuclear medicine sector demonstrates sophisticated implementation of automated radionuclide dispensing systems, with documented integration showing 85-90% automation rates in major hospital radiopharmacies and commercial production facilities through comprehensive quality assurance platforms. The country's healthcare infrastructure in major medical centers, including Berlin, Munich, Hamburg, and Frankfurt, showcases integration of sterile dispensing technologies with existing nuclear medicine departments, leveraging expertise in radiopharmacy practice and pharmaceutical quality standards. German healthcare facilities emphasize regulatory compliance and radiation safety excellence, creating demand for validated automated systems that support pharmaceutical manufacturing standards and occupational protection requirements. The market maintains strong growth through focus on quality improvement and safety optimization, with a CAGR of 10.1% through 2035.

Key development areas:

The Brazilian market demonstrates growing implementation of automated radionuclide dispensing technologies based on nuclear medicine service expansion and radiopharmaceutical manufacturing development for enhanced healthcare capabilities. The country shows solid potential with a CAGR of 9.2% through 2035, driven by cancer care infrastructure investment and nuclear medicine capacity building across major healthcare regions, including São Paulo, Rio de Janeiro, Minas Gerais, and Rio Grande do Sul. Brazilian facilities are adopting automated dispensing equipment for compliance with radiation safety requirements, particularly in public hospital nuclear medicine departments and in commercial radiopharmacy operations serving multiple healthcare facilities. Technology deployment channels through medical equipment distributors, nuclear medicine suppliers, and specialized radiopharmacy consultants expand coverage across diverse healthcare settings.

Leading market segments:

The USA market demonstrates advanced implementation of automated radionuclide dispensing technologies based on theranostic therapy expansion and radiopharmaceutical innovation for enhanced treatment capabilities. The country shows solid potential with a CAGR of 8.4% through 2035, driven by alpha-emitter therapy approvals and personalized nuclear medicine advancement across major healthcare networks, including academic medical centers, integrated health systems, and commercial radiopharmacies. American facilities are adopting specialized dispensing systems for compliance with pharmaceutical compounding standards, particularly in centralized radiopharmacies requiring USP 797 compliance and in research institutions implementing novel radiopharmaceutical development programs. Technology deployment channels through nuclear medicine equipment distributors, radiopharmacy consultants, and direct manufacturer relationships expand coverage across diverse nuclear medicine applications.

Leading market segments:

The United Kingdom's automated radionuclide dispenser market demonstrates mature implementation focused on pharmaceutical quality compliance and centralized radiopharmacy models, with documented deployment across 75-80% of major hospital nuclear medicine departments through established procurement frameworks. The country maintains steady growth momentum with a CAGR of 7.5% through 2035, driven by NHS nuclear medicine service consolidation and radiopharmacy quality assurance requirements aligned with Medicines and Healthcare products Regulatory Agency standards. Major healthcare regions, including London, Manchester, Birmingham, and Scotland, showcase consistent deployment of sterile dispensing systems that support MHRA-compliant radiopharmaceutical preparation requiring pharmaceutical manufacturing controls and quality documentation.

Key market characteristics:

Japan's automated radionuclide dispenser market demonstrates sophisticated implementation focused on precision dose preparation and comprehensive contamination control, with documented integration achieving 90-95% automation performance in major university hospital nuclear medicine departments through advanced quality management systems. The country maintains steady growth momentum with a CAGR of 6.6% through 2035, driven by nuclear medicine service excellence and radiation safety cultural emphasis aligned with strict occupational protection standards. Major healthcare regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of automated dispensing platforms that integrate with existing radiopharmacy infrastructure and comprehensive radiation monitoring protocols.

Key market characteristics:

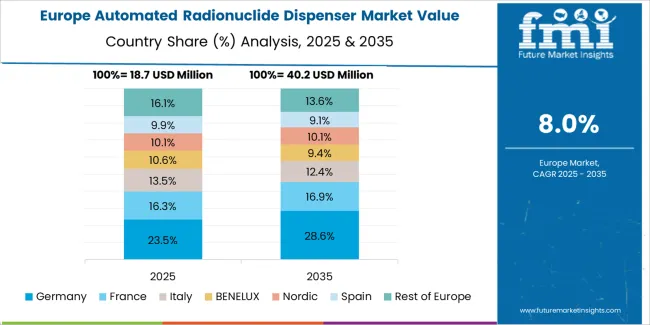

The automated radionuclide dispenser market in Europe is projected to grow from USD 28.6 million in 2025 to USD 55.6 million by 2035, registering a CAGR of 6.9% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.4% by 2035, supported by its extensive nuclear medicine infrastructure and major healthcare centers, including Berlin, Munich, and Hamburg hospital networks.

France follows with a 19.8% share in 2025, projected to reach 20.3% by 2035, driven by comprehensive radiopharmacy centralization programs and nuclear medicine service expansion. The United Kingdom holds a 16.7% share in 2025, expected to decrease to 16.1% by 2035 due to mature market conditions. Italy commands a 13.5% share, while Spain accounts for 9.8% in 2025. The Netherlands maintains 4.2% in 2025, reaching 4.6% by 2035 on radiopharmacy automation initiatives. The Rest of Europe region is anticipated to hold 4.8% in 2025, expanding to 5.1% by 2035, attributed to increasing automated dispenser adoption in Nordic countries and emerging Central and Eastern European nuclear medicine programs.

The Japanese automated radionuclide dispenser market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of sterile dispensing platforms and precision dose verification systems with existing hospital radiopharmacy infrastructure across university medical centers, national hospitals, and specialized nuclear medicine facilities. Japan's emphasis on pharmaceutical quality and radiation safety drives demand for validated automated systems that support regulatory compliance requirements and occupational protection commitments in radiopharmaceutical preparation. The market benefits from strong partnerships between international dispenser manufacturers and domestic medical equipment distributors, creating comprehensive service ecosystems that prioritize equipment reliability and technical support programs. Healthcare centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced radiopharmacy implementations where dispensing systems achieve 99% dose accuracy through comprehensive quality control management and precision calibration protocols.

The South Korean automated radionuclide dispenser market is characterized by growing international equipment provider presence, with companies maintaining significant positions through comprehensive installation support and technical services capabilities for hospital and pharmaceutical applications. The market demonstrates increasing emphasis on nuclear medicine quality improvement and radiation safety enhancement initiatives, as Korean healthcare facilities increasingly demand validated automated systems that integrate with domestic electronic medical record platforms and sophisticated radiopharmacy management systems deployed across major hospital complexes. Regional medical equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and validation documentation programs for nuclear medicine operations. The competitive landscape shows increasing collaboration between multinational dispenser companies and Korean healthcare technology specialists, creating integrated service models that combine international pharmaceutical quality standards with local nuclear medicine practice requirements and precision healthcare systems.

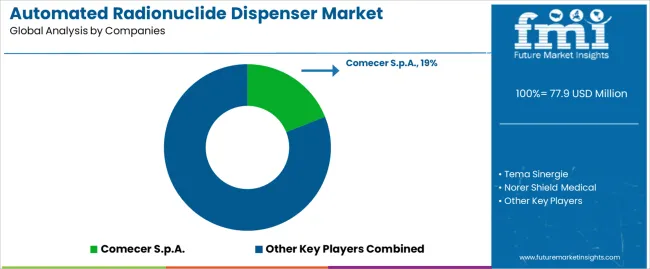

The automated radionuclide dispenser market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 48-54% of global market share through established radiopharmacy relationships and comprehensive product portfolios. Competition centers on dose accuracy performance, radiation shielding effectiveness, and regulatory compliance support rather than price competition alone. Comecer S.p.A. leads with approximately 19% market share through its comprehensive nuclear medicine equipment and radiopharmacy automation portfolio.

Market leaders include Comecer S.p.A., Tema Sinergie, and Norer Shield Medical, which maintain competitive advantages through global installation base, extensive validation documentation libraries, and deep expertise in pharmaceutical quality standards and radiation safety regulations across multiple jurisdictions, creating trust and reliability advantages with hospital nuclear medicine departments and commercial radiopharmacy operations. These companies leverage research and development capabilities in shielding design innovation and ongoing technical support relationships to defend market positions while expanding into theranostic applications and alpha-emitter handling capabilities.

Challengers encompass Mirion and Von Gahlen, which compete through specialized dispenser platforms and strong regional presence in key nuclear medicine markets. Technology specialists, including LabLogic Systems, Universad Giken, and Beijing Zhonghe Yongtai Technology, focus on specific automation levels or application segments, offering differentiated capabilities in modular configurations, customized shielding designs, and specialized dose verification technologies.

Regional players and emerging automation equipment manufacturers create competitive pressure through manufacturing cost advantages and rapid installation capabilities, particularly in high-growth markets including China and India, where domestic production provides advantages in pricing flexibility and local technical support availability. Market dynamics favor companies that combine regulatory expertise with comprehensive validation support offerings that address the complete implementation cycle from equipment specification through operational qualification and ongoing compliance documentation programs.

| Item | Value |

|---|---|

| Quantitative Units | USD 77.9 million |

| Sterility Type | Sterile Dispenser, Non-sterile Dispenser |

| Application | Pharmaceutical, Hospital, Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Comecer S.p.A., Tema Sinergie, Norer Shield Medical, Mirion, Von Gahlen, LabLogic Systems, Universad Giken, Beijing Zhonghe Yongtai Technology, Bequerel & Sievert, Tianjin Zhongfuan Technology, Sunvic |

| Additional Attributes | Dollar sales by sterility type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with dispenser manufacturers and distribution networks, equipment specifications and shielding requirements, integration with radiopharmacy operations and quality assurance programs, innovations in automation technology and radiation protection systems, and development of specialized platforms with enhanced dose accuracy and contamination control capabilities. |

The global automated radionuclide dispenser market is estimated to be valued at USD 77.9 million in 2025.

The market size for the automated radionuclide dispenser market is projected to reach USD 181.1 million by 2035.

The automated radionuclide dispenser market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in automated radionuclide dispenser market are sterile dispenser and non-sterile dispenser.

In terms of application, pharmaceutical segment to command 45.0% share in the automated radionuclide dispenser market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automated Tool Grinding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Machine Learning Market Forecast Outlook 2025 to 2035

Automated CPR Device Market Size and Share Forecast Outlook 2025 to 2035

Automated Compound Storage and Retrieval (ACSR) Market Size and Share Forecast Outlook 2025 to 2035

Automated People Mover Market Size and Share Forecast Outlook 2025 to 2035

Automated Colony Picking Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Truck Loading System Market Size and Share Forecast Outlook 2025 to 2035

Automated Microplate Handling Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Solid Phase Extraction Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Mineralogy Solution Market Size and Share Forecast Outlook 2025 to 2035

Automated Material Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automated Feeding Systems Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Automated Solar Panel Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Automated Molecular Diagnostics Testing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Infrastructure Management (AIM) Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automated Window Blinds Market Size and Share Forecast Outlook 2025 to 2035

Automated Cell Culture Systems Market Analysis - Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA