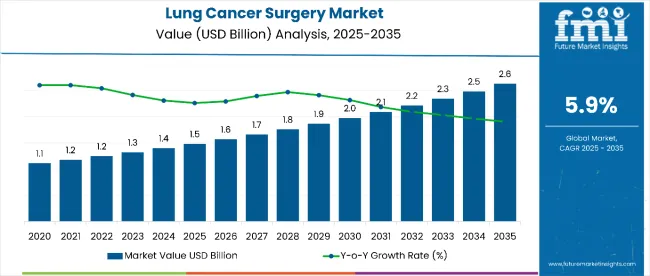

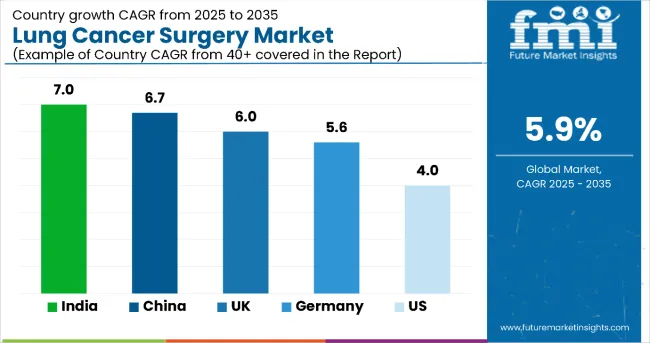

The global lung cancer surgery market is projected to reach USD 1.48 billion in 2025, and is expected to expand further to USD 2.64 billion by 2035 at a steady 5.9% CAGR.

This growth is underpinned by a combination of factors: improved early-detection efforts via low-dose CT screening, expanding access to care through government-backed patient-support programs, and rising awareness driven by high-profile public figures sharing their own experiences. In India, for example, the Health Minister’s Cancer Patient Fund has lowered financial barriers for underprivileged patients, contributing to double-digit treatment uptake in select tertiary centers.

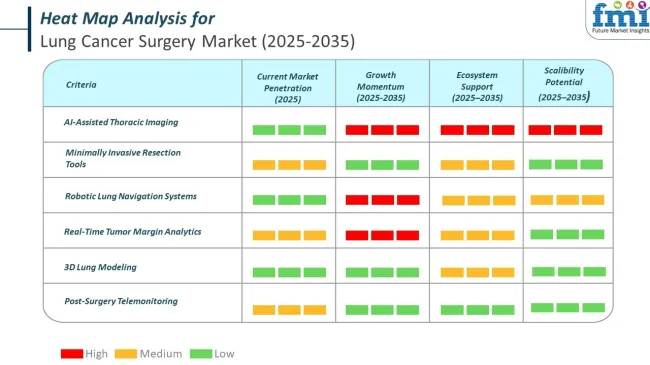

Innovation has been a focal point for leading medical device manufacturers in the lung cancer surgery industry. Intuitive Surgical CEO Gary Guthart stated in 2024, “Advancements in robotic-assisted thoracic procedures are redefining precision and patient recovery in oncology.”

Traceability and data-driven care have gained prominence in lung cancer surgeries due to rising demand for outcome transparency and post-operative monitoring. In 2024, Olympus Corporation launched an AI-enhanced imaging system integrated with patient record tagging, enabling clinicians to correlate intraoperative visuals with long-term outcomes. Industry recognition has followed innovation closely.

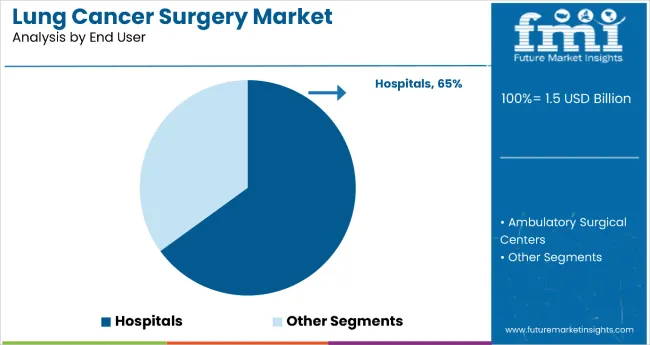

By 2035, robotic-assisted systems are expected to account for over 40% of lung cancer surgical procedures. Hospital-based procedures will continue to represent more than 65% of global demand, while outpatient and ambulatory surgical centers gain traction due to cost-efficiency and faster recovery protocols. As healthcare systems emphasize precision surgery and digital integration, lung cancer surgery is shifting toward minimally invasive, traceable, and technology-driven intervention.

Lung cancer remains a major health burden across top economies, requiring significant investment in oncology care and follow‑up services. The largest absolute case load is in China, where more than 1.4 million people are currently living with the disease.

The United States follows, with over 288,000 cases, while Japan, despite a smaller population, has nearly 146,000 patients. Germany and India contribute substantial totals as well, though for different reasons Germany due to higher detection and aging demographics, and India due to population size despite much lower per‑capita rates.

Per‑capita prevalence shifts the perspective, showing where lung cancer places the greatest relative strain on health systems. Japan leads by a wide margin, while Canada, France, and China all post rates above 95 per 100,000, in contrast to far lower levels seen in India.

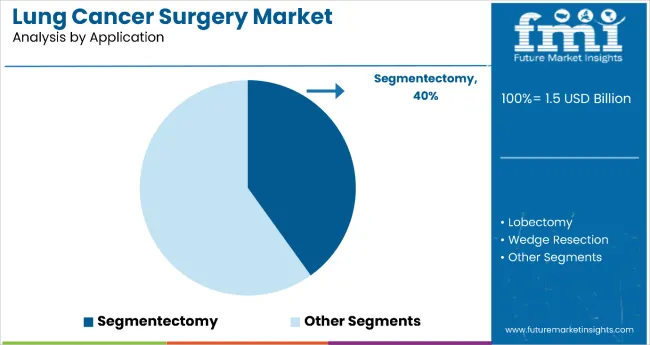

Segmentectomy holds a substantial position with 40.1% of the market share in the application category within the lung cancer surgery market. This significant market presence is attributed to segmentectomy's lung-sparing advantage and its growing acceptance as a preferred treatment option for early-stage non-small cell lung cancer (NSCLC), particularly in aging populations and high-risk patients with limited pulmonary reserve. The procedure offers an optimal balance between oncological efficacy and preservation of lung function, making it increasingly attractive for patients who cannot tolerate more extensive resections.

The segment's strong performance is reinforced by segmentectomy's projected CAGR of around 5.5% from 2025 to 2035, driven by improved surgical techniques and standardization of protocols across institutions. As the global population ages and early detection programs expand through low-dose CT screening, the demand for lung-preserving surgical options continues to grow. The procedure's ability to achieve adequate oncological margins while maintaining respiratory function positions segmentectomy as a key growth driver in the evolving landscape of precision lung cancer surgery.

Hospitals dominate the lung cancer surgery market with 65.0% of the market share in the end user category. This substantial leadership is attributed to hospitals' comprehensive infrastructure, availability of multidisciplinary teams, and access to advanced surgical technologies including robotic systems and thoracoscopic tools. Hospitals serve as the primary hub for complex lung cancer surgeries due to their ability to manage post-operative complications, provide intensive care support, and offer integrated cancer care services.

The segment's dominance is reinforced by hospitals' strong referral networks, government-backed funding in both developed and emerging economies, and their role as centers of excellence for thoracic oncology. Hospitals are expected to maintain their market leadership with a projected CAGR of 5.8% from 2025 to 2035, supported by continued investment in advanced surgical technologies and expansion of specialized lung cancer programs. As robotic-assisted systems are expected to account for over 40% of lung cancer surgical procedures by 2035, hospitals' superior infrastructure and resources position them to remain the dominant end-user segment through continued adoption of cutting-edge surgical technologies and comprehensive care delivery models.

The United States lung cancer surgery industry is projected to grow from USD 420 million in 2025 to USD 620 million by 2035, registering a CAGR of 4.0%. This growth is underpinned by a well-established healthcare infrastructure, consistent reimbursement policies, and rapid adoption of advanced surgical technologies.

The country leads globally in the integration of robotic-assisted thoracic surgery systems, such as Intuitive Surgical’s da Vinci platform, which enables high precision, reduced post-operative complications, and quicker recovery. Medtronic and Ethicon (J&J) also dominate the USA sectorthrough their comprehensive portfolios of minimally invasive instruments and surgical energy platforms.

Widespread cancer screening initiatives, particularly low-dose CT scans, have significantly improved early diagnosis rates, making surgical resection more viable. Government-backed programs and insurance coverage further facilitate access to both traditional and robotic lung surgeries across public and private institutions.

However, the sectormaturity limits ultra-high growth potential, and competition from emerging alternatives such as targeted therapies and immuno-oncology drugs poses a long-term challenge. Nevertheless, the USA will continue to represent the highest absolute sectorvalue due to high procedural volume, innovation leadership, and strong hospital investments in surgical robotics and thoracic oncology specialization.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4% |

China ranks as the second-largest growth engine in the global lung cancer surgery sector, with an estimated value of USD 1.12 billion in 2025, expected to reach USD 2.13 billion by 2035, reflecting a robust CAGR of 6.7%. The industry is underpinned by three structural themes.

First, China faces the world’s highest lung cancer incidence, largely linked to air pollution, tobacco use, and aging demographics-driving a steady pipeline of operable cases. Second, the government’s Healthy China 2030 agenda includes funding for early detection programs and a tiered expansion of thoracic oncology services at both provincial and tertiary care levels. Surgical intervention rates have surged as a result, particularly in eastern provinces and Tier 1 cities like Shanghai and Beijing.

Technology localization is accelerating. Domestic giants such as Shanghai MicroPort and Sinovation Medical are rapidly scaling robotic surgery solutions with strong government backing, challenging foreign players on cost and customizability.

Additionally, National Reimbursement Drug List (NRDL) reforms and value-based procurement policies are pressuring device makers to deliver high-performance solutions at lower price points, spurring innovation in energy instruments and navigation systems.

However, access gaps remain across rural and western regions, where CT-screening coverage and surgical infrastructure lag. Despite this, China's vast population, public health prioritization, and accelerating medical device localization make it a high-opportunity industry.

| Country | CAGR 2025 to 2035 |

|---|---|

| China | 6.7% |

India is emerging as one of the most dynamic sector in the global lung cancer surgery landscape, with an estimated industry size of USD 0.62 billion in 2025, projected to reach USD 1.23 billion by 2035, yielding a CAGR of 7.0%. Three macro-level trends shape this trajectory.

First, India is witnessing a consistent rise in lung cancer prevalence-primarily due to smoking, biomass exposure, and urban air pollution-particularly in northern and eastern states. Despite the traditionally low surgical intervention rate, the share of resectable cases is increasing due to better access to diagnostics and expanded use of CT screening in urban hospitals.

Second, private healthcare systems such as Apollo, Fortis, and Max Healthcare are investing in advanced thoracic surgery infrastructure, including robotic-assisted surgery and intraoperative navigation. Multinational players like Medtronic and Olympus are aggressively expanding partnerships with Indian surgical centers to co-develop training programs and deploy affordable versions of minimally invasive tools.

Third, regulatory reforms under India’s National Medical Devices Policy 2023 are encouraging domestic innovation and foreign direct investment in surgical technologies, especially in Make-in-India zones such as Telangana and Gujarat.

However, affordability remains a barrier for Tier 2 and Tier 3 cities, where out-of-pocket spending limits access to robotic or advanced thoracoscopic procedures. Still, favorable demographics, fast-improving infrastructure, and a rapidly scaling middle class position India as one of the fastest-growing surgical oncology sector worldwide.

| Country | CAGR 2025 to 2035 |

|---|---|

| India | 7.0% |

Germany stands as the leading market for lung cancer surgery in Western Europe, valued at USD 0.58 billion in 2025 and projected to reach USD 1.03 billion by 2035, growing at a CAGR of 6.0%. The country's position is reinforced by its strong public healthcare infrastructure, early diagnosis capabilities, and comprehensive reimbursement system under statutory health insurance (GKV), which covers the majority of thoracic surgical interventions.

Germany's cancer registries and lung screening programs facilitate the timely identification of resectabletumors, especially in high-risk populations. Germany also benefits from advanced surgical capabilities, with widespread availability of video-assisted thoracoscopic surgery (VATS) and increasing deployment of robotic-assisted thoracic surgery (RATS) in university-affiliated and large private hospitals.

The presence of globally recognized research centers, such as Charité - Universitätsmedizin Berlin and Heidelberg University Hospital, fosters continuous innovation and early adoption of next-gen techniques. Furthermore, companies like Siemens Healthineers and Karl Storz are deeply integrated into the German ecosystem, supplying AI-enabled imaging and endoscopic technologies tailored for precision oncology.

Regulatory efficiency under the BfArM and alignment with European Union Medical Device Regulation (EU MDR) ensure safety and rapid industry access for new surgical platforms. However, a shortage of thoracic surgeons and rising labor costs may create operational bottlenecks in smaller clinics. Even so, Germany remains a high-value, innovation-ready industry with institutional support for quality-driven lung cancer surgical care.

| Country | CAGR 2025 to 2035 |

|---|---|

| Germany | 6.0% |

The United Kingdom represents a mature lung cancer surgery sector, estimated at USD 0.54 billion in 2025 and projected to grow to USD 0.95 billion by 2035, registering a CAGR of 5.6%. The UK's strength lies in its centralized National Health Service (NHS), which ensures standardized care pathways, early intervention, and uniform access to surgical treatment across regions.

The implementation of the NHS Targeted Lung Health Checks (TLHC) program has significantly improved the early detection of lung cancer, especially among high-risk populations such as long-term smokers aged 55-74. Advanced surgical capabilities are concentrated in regional cancer hubs such as The Royal Brompton and Papworth Hospitals, which routinely perform video-assisted and robotic-assisted resections.

The National Institute for Health and Care Excellence (NICE) provides robust technology evaluation frameworks, encouraging adoption of clinically proven innovations like AI-assisted navigation and single-port thoracoscopy. Moreover, the UK has one of Europe’s highest rates of minimally invasive thoracic surgeries per capita, a metric supported by consistent investment in surgical training and infrastructure.

Challenges remain around wait times and post-pandemic elective surgery backlogs, which can delay timely interventions in certain NHS trusts. Nevertheless, with its well-funded public system, forward-looking screening strategy, and clear regulatory processes, the UK offers an attractive, scalable environment for advanced lung cancer surgical solutions.

| Country | CAGR 2025 to 2035 |

|---|---|

| United Kingdom | 5.6% |

Japan is a high-value, technologically advanced lung cancer surgery market, expected to be valued at USD 0.50 billion in 2025 and projected to reach USD 0.89 billion by 2035, growing at a CAGR of 5.9%. The country faces one of the highest age-adjusted incidences of lung cancer globally, due in part to its rapidly aging population and long-term tobacco exposure. However, Japan’s strength lies in its proactive health policy and robust national insurance system, which fully reimburses thoracic surgical procedures and incentivizes early-stage interventions.

University hospitals and regional cancer centers across Tokyo, Osaka, and Nagoya are equipped with advanced robotic platforms and AI-integrated imaging systems. Institutions like the National Cancer Center Japan and Keio University Hospital serve as innovation hubs for minimally invasive lung cancer surgery, often piloting the latest endoscopic, laser, and energy-assisted resection tools.

Furthermore, Japan’s Ministry of Health, Labour and Welfare (MHLW) actively promotes the digitization of surgery through funding programs that support high-definition intraoperative imaging, real-time pathology, and surgical robotics.

Regulatory alignment with PMDA guidelines ensures efficient device approval while maintaining strict safety standards. However, workforce constraints-particularly among thoracic surgeons-and a conservative stance toward new surgical adoption in rural hospitals remain limiting factors. Still, with a deeply embedded innovation culture and state-funded care pathways, Japan remains a cornerstone industry for lung cancer surgical innovation in East Asia.

| Country | CAGR 2025 to 2035 |

|---|---|

| Japan | 5.9% |

Brazil is the leading lung cancer surgery industry in Latin America, projected to be valued at USD 0.42 billion in 2025 and expected to reach USD 0.80 billion by 2035, reflecting a CAGR of 6.6%. The country is experiencing rising lung cancer incidence driven by continued tobacco use, growing urban pollution, and aging population demographics.

Despite historically limited access to advanced care, Brazil has made substantial strides in thoracic oncology, particularly in urban hubs like São Paulo, Rio de Janeiro, and Porto Alegre. The Unified Health System (SUS) and growing private insurance coverage are expanding access to surgical treatment, though disparities persist.

Leading hospitals such as Hospital Israelita Albert Einstein and A.C. Camargo Cancer Center have adopted robotic-assisted thoracic systems and VATS platforms, partnering with global players like Medtronic and Johnson & Johnson to pilot advanced surgical protocols. Government investments under the “MaisEspecialidades” initiative have aimed to decentralize oncology services and upgrade regional surgical capacity.

While import dependency and regulatory bottlenecks through ANVISA can slow device approvals, recent reforms are improving timelines and post-industry surveillance systems. Brazil’s mid-term outlook is buoyed by increased local manufacturing of surgical equipment, regional training programs, and telemedicine support for post-operative care. As diagnostic rates improve and surgical capacity expands, Brazil is set to be Latin America’s most investable growth industry in lung cancer surgery.

| Country | CAGR 2025 to 2035 |

|---|---|

| Brazil | 6.6% |

Mexico is an emerging lung cancer surgery industry in Latin America, with an estimated value of USD 0.30 billion in 2025, projected to reach USD 0.58 billion by 2035, translating to a CAGR of 6.7%. Lung cancer is one of the top causes of cancer-related deaths in Mexico, driven by high smoking rates, environmental exposure, and delayed diagnosis.

While historically underpenetrated, the surgical landscape is evolving due to public-private collaborations and policy initiatives aimed at expanding oncology care coverage. Leading urban centers such as Mexico City, Monterrey, and Guadalajara are home to high-capacity cancer institutions like Instituto Nacional de Cancerología (INCan) and Hospital Zambrano Hellion.

These centers are pioneering the use of minimally invasive techniques such as VATS and early-stage robotic-assisted thoracic surgery. Efforts are also being made to establish regional diagnostic hubs under Mexico’s National Cancer Control Plan, aiming to reduce time-to-treatment gaps.

Regulatory improvements led by COFEPRIS have shortened the approval cycle for surgical devices, encouraging multinational OEMs to enter the industry with locally adapted, cost-sensitive platforms. However, barriers remain: wide urban-rural disparities in surgical access, limited reimbursement coverage for robotic procedures, and a shortage of specialized thoracic surgeons in public hospitals. Nevertheless, increasing investment in infrastructure, combined with steady demand from the expanding middle class, positions Mexico as a high-growth, transition-phase industry in lung cancer surgery.

| Country | CAGR 2025 to 2035 |

|---|---|

| Mexico | 6.7% |

Canada represents a stable and innovation-friendly lung cancer surgery industry, valued at USD 0.36 billion in 2025 and forecast to grow to USD 0.65 billion by 2035, posting a CAGR of 6.0%. As one of the top five countries globally in per capita cancer care spending, Canada’s universal healthcare system ensures equitable access to surgical oncology services, particularly in major provinces like Ontario, Quebec, and British Columbia. Early detection programs such as Lung Cancer Screening Pilots funded by Health Canada are facilitating diagnosis at resectable stages, significantly improving surgical candidacy rates.

Canadian hospitals are early adopters of advanced thoracic technologies. Centers like Toronto General, Montreal’s Jewish General Hospital, and Vancouver General have widely integrated VATS and RATS platforms, often as part of clinical research trials in collaboration with global OEMs.

Moreover, Canada’s adoption of AI-enabled imaging and intraoperative navigation tools is accelerating through public-private grants offered by agencies such as CIHR and NRC-IRAP. On the regulatory side, Health Canada’s Medical Device Single Audit Program (MDSAP) streamlines quality and industry access for surgical platforms, aligning Canadian compliance with international best practices.

Challenges persist in surgical capacity allocation and long waitlists-especially in rural regions. However, the strong emphasis on value-based care, government support for innovation, and a well-networked academic hospital system make Canada an attractive industry for scalable and tech-enabled lung cancer surgical interventions.

| Country | CAGR 2025 to 2035 |

|---|---|

| Canada | 6.0% |

Australia represents a high-potential, innovation-driven lung cancer surgery industry, valued at USD 0.33 billion in 2025 and forecast to reach USD 0.61 billion by 2035, growing at a CAGR of 6.4%. The country has one of the most advanced public healthcare systems globally, with Medicare covering nearly all lung cancer surgical procedures across major public hospitals.

The government’s National Lung Cancer Screening Program, scheduled for full rollout by 2025, is expected to significantly increase early-stage diagnosis rates, thereby expanding the pool of operable patients. Surgical innovation is highly concentrated in urban medical hubs such as Sydney, Melbourne, and Brisbane. Institutions like Peter MacCallum Cancer Centre and Royal Prince Alfred Hospital have adopted robotic-assisted and video-assisted thoracoscopic procedures as standard practice.

Australia’s healthcare policy strongly supports evidence-based technology adoption, leading to rapid clinical integration of image-guided bronchoscopy, intraoperative pathology tools, and AI-based surgical planning systems. Regulatory oversight from the Therapeutic Goods Administration (TGA) is rigorous yet efficient, with growing alignment to international device safety standards.

However, limitations include surgeon workforce shortages in remote regions and the high cost of robotic platforms, which can restrict widespread access outside tier-1 centers. Nonetheless, Australia’s progressive regulatory climate, digital infrastructure, and funding for precision medicine place it among the most attractive secondary sector for lung cancer surgical device companies.

| Country | CAGR 2025 to 2035 |

|---|---|

| Australia | 6.4% |

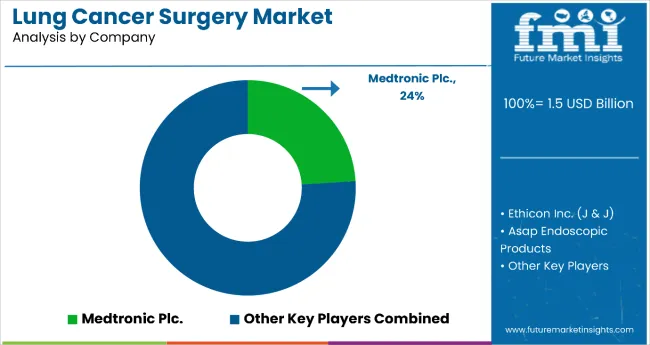

The global lung cancer surgery industry is moderately consolidated, with five major players accounting for a substantial share of the overall revenue. Intuitive Surgical Inc. leads the field with an estimated 22-24% industry share, owing to its dominance in robotic-assisted thoracic procedures through its flagship da Vinci systems. The company continues to drive innovation with next-generation robotic platforms like da Vinci 5 while targeting emerging sector with compact, cost-effective systems.

Medtronic Plc., holding an estimated 18 to 20% share, maintains a strong position through its expansive global distribution network, extensive hospital partnerships, and diverse product offerings, including surgical staplers and advanced energy devices.

Ethicon Inc. (Johnson & Johnson) captures around 16-18% of the industry, focusing on product integration, comprehensive surgeon training programs, and cutting-edge hemostatic technologies, enhancing its appeal among high-volume surgical centers.

Olympus Medical Systems Corp., with a 10-12% share, commands leadership in thoracoscopic and bronchoscopic visualization systems, thanks to advancements in high-definition optics and hybrid imaging tools that aid early cancer detection. Karl Storz, accounting for 8-10% of the industry, strengthens its presence with modular endoscopy platforms and long-standing contracts across European and North American hospitals. Together, these companies shape the competitive landscape through continuous innovation, strategic expansion, and strong clinical partnerships.

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2024) | USD 1.48 billion |

| Projected Industry Size (2034) | USD 2.64 billion |

| Overall Industry CAGR (2024 to 2034) | 5.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Product Segment | Thoracoscopes, Mediastinoscopes, Bronchoscopes, Robotic-Assisted Thoracic Surgery Systems, Surgical Staplers, Advanced Energy Instruments (Advanced Bipolar Instruments, Ultrasonic Instruments), Basic Energy Instruments (Bipolar Instruments, Monopolar Instruments). |

| By Application | Lobectomy, Segmentectomy, Wedge Resection, Pneumonectomy |

| End Users | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Asap Endoscopic Products, Ethicon Inc. (J & J), Medtronic Plc., Germed USA Inc., Teleflex Incorporated, B. Braun Melsungen AG, Karl Storz, Richard Wolf, Olympus Medical Systems Corp, Intuitive Surgical Inc., PENTAX Medical Company, FUJIFILM Holdings Corporation, Ambu A/S. |

| Additional Attributes | Technological Innovations, Regulatory Compliance, Sustainability Initiatives, Industry Dynamics |

| Customization and Pricing | Available upon request |

By product, the market includes thoracoscopes, mediastinoscopes, bronchoscopes, robotic-assisted thoracic surgery systems, surgical staplers, surgical energy instruments, advanced energy instruments, advanced bipolar instruments, ultrasonic instruments, basic energy instruments, bipolar instruments, and monopolar instruments.

By application, the primary procedures are lobectomy, segmentectomy, wedge resection, and pneumonectomy.

By end-user, the market is divided into hospitals and ambulatory surgical centres.

The industry is spread across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The global industry is expected to reach USD 2.64 billion by 2035, growing from USD 1.48 billion in 2025 at a CAGR of 5.7%.

Segmentectomy holds the largest share in the lung cancer surgery industry due to its lung-sparing approach, while lobectomy is projected to grow at the fastest CAGR of 6.1%.

Intuitive Surgical Inc., Medtronic Plc., and Ethicon Inc. (J&J) are the top players, with significant investments in robotic systems, staplers, and energy devices.

Robotic-assisted thoracic surgery systems are growing at the highest CAGR of 7.5%, driven by demand for precision, reduced complications, and faster recovery times.

North America remains the highest revenue-generating region, supported by strong healthcare infrastructure, early diagnosis, and high adoption of advanced surgical technologies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lung Biopsy Systems Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Plunger Stopper Market Insights – Trends & Growth Forecast 2024-2034

Cold Plunge Tub Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Interstitial Lung Disease Treatment Market

Non-Small Cell Lung Carcinoma (NSCLC) Market Size and Share Forecast Outlook 2025 to 2035

Non-Small Cell Lung Cancer Market Size and Share Forecast Outlook 2025 to 2035

PD1 Non-Small Cell Lung Cancer Treatment Market - Growth & Outlook 2025 to 2035

Progressive Fibrosing Interstitial Lung Disease (PF-ILD) Treatment Market – Growth & Future Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA