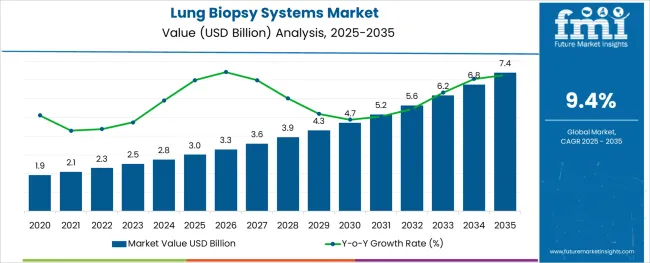

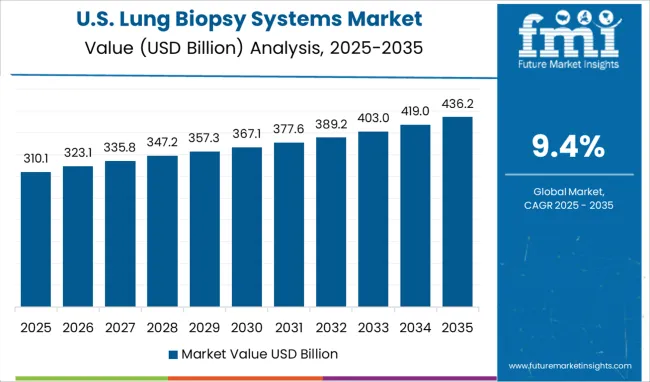

The Lung Biopsy Systems Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

The lung biopsy systems market has experienced notable momentum in recent years, driven by the increasing global prevalence of pulmonary diseases, particularly lung cancer and chronic respiratory conditions. A growing emphasis on early and accurate disease diagnosis has positioned lung biopsy procedures as a critical component of modern respiratory care, with healthcare systems prioritizing investments in advanced diagnostic tools.

The market has been further supported by rising awareness of minimally invasive diagnostic techniques and the development of technologically enhanced biopsy systems offering improved precision, reduced procedural risks, and enhanced patient outcomes. In the years ahead, market prospects are expected to strengthen as aging populations, environmental exposure risks, and smoking-related disorders fuel diagnostic demand, particularly across emerging healthcare markets.

Regulatory approvals for new product launches and strategic partnerships among medical device manufacturers are likely to contribute to market expansion. Furthermore, increased adoption of image-guided and real-time biopsy systems in both public and private healthcare settings is projected to sustain steady growth in the lung biopsy systems market globally.

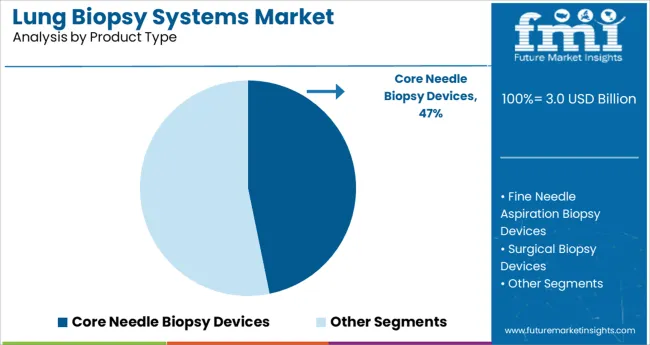

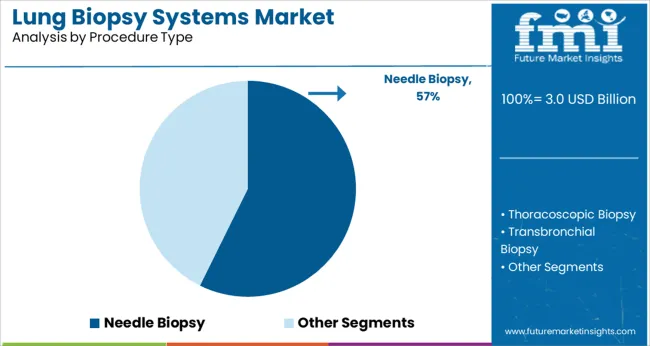

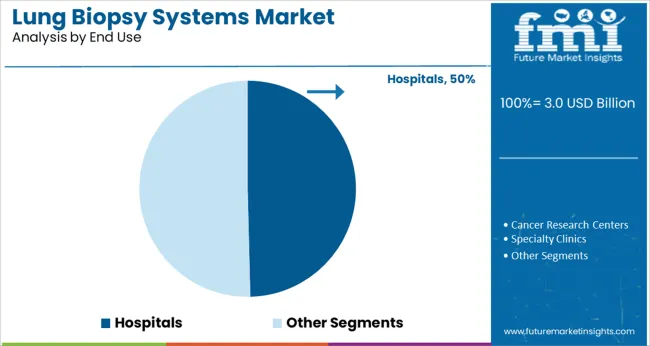

The market is segmented by Product Type, Procedure Type, and End Use and region. By Product Type, the market is divided into Core Needle Biopsy Devices, Fine Needle Aspiration Biopsy Devices, Surgical Biopsy Devices, and Vacuum-Assisted Biopsy Devices. In terms of Procedure Type, the market is classified into Needle Biopsy, Thoracoscopic Biopsy, Transbronchial Biopsy, and Open Biopsy. Based on End Use, the market is segmented into Hospitals, Cancer Research Centers, Specialty Clinics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The core needle biopsy devices segment captured a significant 46.8% share of the lung biopsy systems market, maintaining its dominance within the product type category. The segment’s leadership has been reinforced by a strong clinical preference for core needle systems due to their ability to extract larger, intact tissue samples, which are essential for accurate histopathological analysis.

These devices have gained widespread adoption for their high diagnostic yield, cost-effectiveness, and compatibility with image-guided procedures, enabling precise targeting of lesions with minimal patient discomfort. Technological improvements such as automated, spring-loaded mechanisms and enhanced needle designs have further elevated procedural accuracy and safety profiles, encouraging adoption in both primary and specialty healthcare facilities.

Rising incidences of lung cancer and the growing trend toward minimally invasive interventions have amplified demand for core needle biopsy devices. Additionally, increasing availability of portable and user-friendly biopsy systems has supported usage in outpatient and ambulatory care settings, with the segment expected to retain its leading position as healthcare providers prioritize reliable, efficient diagnostic solutions.

Within the procedure type category, the needle biopsy segment accounted for approximately 57.3% of the total lung biopsy systems market, underscoring its widespread clinical acceptance as a preferred diagnostic method for pulmonary lesions. The segment's prominence can be attributed to its minimally invasive nature, reduced complication rates, and rapid patient recovery times compared to more invasive surgical biopsy techniques.

Needle biopsies, encompassing both fine-needle aspiration and core needle procedures, have seen escalating adoption driven by advancements in imaging modalities such as CT-guided, ultrasound-guided, and fluoroscopy-assisted systems that enhance procedural accuracy and patient safety. The continued integration of real-time navigation and robotic-assisted biopsy technologies has further improved diagnostic precision, making needle biopsy the procedure of choice for detecting both benign and malignant pulmonary abnormalities.

Market growth is being fueled by the rising prevalence of lung disorders, increased awareness of early cancer detection benefits, and expanding access to advanced diagnostic services across developing regions, positioning the needle biopsy segment for sustained leadership over the forecast period.

The hospitals segment held a commanding 49.6% share of the lung biopsy systems market within the end use category, driven by the availability of advanced diagnostic infrastructure, skilled medical personnel, and the capacity to perform complex procedures under controlled clinical environments. Hospitals continue to serve as primary centers for lung biopsies, particularly in cases involving high-risk patients, complicated lesion locations, or the need for integrated diagnostic and therapeutic services.

The segment has benefited from ongoing investments in diagnostic imaging technologies, including CT, MRI, and endobronchial ultrasound systems, which complement lung biopsy procedures and improve diagnostic accuracy. Additionally, hospitals often serve as referral centers for specialized pulmonary care, increasing procedural volumes and driving consistent demand for biopsy systems.

The growing burden of respiratory diseases and the increasing prevalence of cancer screening programs within hospital settings have further propelled the segment’s market share. It is anticipated that the hospitals segment will maintain its dominant position as healthcare systems prioritize comprehensive diagnostic capabilities and multidisciplinary care approaches for pulmonary disease management.

The increasing prevalence of lung cancer across the globe is estimated to bode well for the lung biopsy systems market growth. According to the World Health Organization (WHO), in 2024, nearly 10 million deaths occurred globally due to cancer.

Out of this, lung cancer led to about 1.80 million deaths and 2.21 million new cases were reported the same year. These numbers are expected to surge at a rapid pace, thereby pushing market growth.

Rising smoking habits, lack of physical activities, low fruit and vegetable consumption, increasing alcohol consumption, and high body mass index are expected to bolster the prevalence of cancer and propel this market. In addition to that, increasing support by regulatory bodies in terms of finances to accelerate the development of healthcare infrastructure is likely to boost growth.

Numerous patient safety risks related to biopsy systems can lead to product recalls. Product recalls may disturb a brand’s image and decline sales of lung biopsy systems in the evaluation period. Also, the high risk of infections associated with these systems may obstruct growth.

North America is expected to remain at the forefront by generating the largest lung biopsy systems market share in the upcoming years. The presence of numerous leading companies in the U.S. and the rising patient pool in Canada are anticipated to drive the regional market.

The high penetration rate of state-of-the-art devices and the presence of a well-established healthcare system across North America are a couple of other factors that would foster the market. Increasing hospital stay because of lung cancer is another vital growth driver. The availability of sophisticated equipment and facilities for timely diagnosis to reduce the duration of hospital stay is likely to bode well for the market.

Asia Pacific is projected to remain in the second position, followed by North America in the assessment period. The rising aging population prone to lung cancer across developing countries, such as India and China is likely to propel the demand for lung biopsy systems in Asia Pacific.

As per the India Brand Equity Foundation (IBEF), in 2025, the Indian healthcare sector is estimated to reach USD 372 billion. The penetration of health insurance is set to expand in future owing to the high demand for quality and cost-effective healthcare.

The rising number of various insurance companies in this country providing coverage of cancer treatment is a major factor that is set to augment the Asia Pacific market.

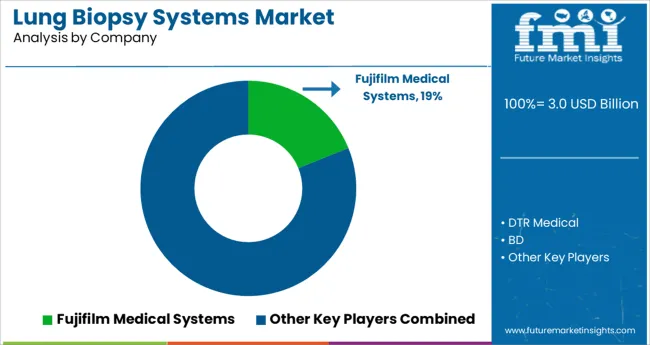

Some of the reputed companies in the global lung biopsy systems market include Fujifilm Medical Systems, DTR Medical, BD, Olympus Corporation, Medtronic, Hologic, Inc., B. Braun Melsungen AG, Cardinal Health, and Argon Medical Devices among others.

The global market is highly competitive with the presence of a large number of big and small-scale enterprises. The majority of these enterprises are increasingly focusing on technological collaborations and acquisitions to gain a competitive edge in the market. Meanwhile, a few other key players are striving to broaden their product portfolios by launching cutting-edge devices in the market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Procedure Type, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Fujifilm Medical Systems; DTR Medical; BD; Olympus Corporation; Medtronic; Hologic, Inc.; B. Braun Melsungen AG; Cardinal Health; Argon Medical Devices |

| Customization | Available Upon Request |

The global lung biopsy systems market is estimated to be valued at USD 3.0 billion in 2025.

It is projected to reach USD 7.4 billion by 2035.

The market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types are core needle biopsy devices, fine needle aspiration biopsy devices, surgical biopsy devices and vacuum-assisted biopsy devices.

needle biopsy segment is expected to dominate with a 57.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Plunger Stopper Market Insights – Trends & Growth Forecast 2024-2034

Cold Plunge Tub Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Interstitial Lung Disease Treatment Market

Non-Small Cell Lung Carcinoma (NSCLC) Market Size and Share Forecast Outlook 2025 to 2035

Non-Small Cell Lung Cancer Market Size and Share Forecast Outlook 2025 to 2035

PD1 Non-Small Cell Lung Cancer Treatment Market - Growth & Outlook 2025 to 2035

Progressive Fibrosing Interstitial Lung Disease (PF-ILD) Treatment Market – Growth & Future Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Biopsy Guidance System Market Size and Share Forecast Outlook 2025 to 2035

Microbiopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA