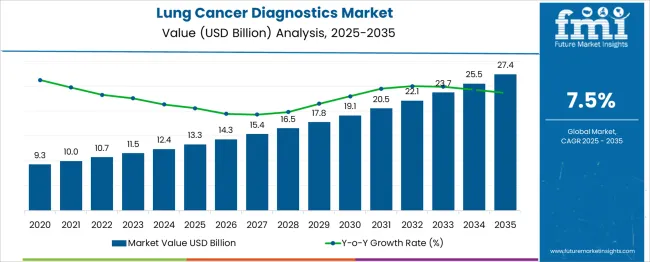

The global lung cancer diagnostics market is projected to grow from USD 13.3 billion in 2025 to approximately USD 27.4 billion by 2035, recording an absolute increase of USD 14.1 billion over the forecast period. This translates into a total growth of 106.0%, with the market forecast to expand at a CAGR of 7.5% between 2025 and 2035. The market size is expected to grow by nearly 2.06X during the same period, supported by increasing cancer incidence rates, advancements in precision medicine, rising adoption of liquid biopsies, and growing awareness about early detection benefits.

Between 2025 and 2030, the lung cancer diagnostics market is projected to expand from USD 13.3 billion to USD 20.5 billion, resulting in a value increase of USD 7.2 billion, which represents 51.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising cancer screening programs, increasing adoption of molecular diagnostics, and growing penetration of next-generation sequencing technologies in emerging markets. Healthcare providers and diagnostic companies are expanding their lung cancer testing portfolios to address the growing demand for personalized treatment approaches and companion diagnostics.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 13.3 billion |

| Forecast Value in (2035F) | USD 27.4 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

From 2030 to 2035, the market is forecast to grow from USD 20.5 billion to USD 27.4 billion, adding another USD 6.9 billion, which constitutes 48.9% of the ten-year expansion. This period is expected to be characterized by expansion of point-of-care testing, integration of artificial intelligence in diagnostic platforms, and development of multi-cancer early detection assays. The growing adoption of liquid biopsy technologies and circulating tumor DNA analysis will drive demand for advanced lung cancer diagnostic solutions with enhanced sensitivity and specificity profiles.

Between 2020 and 2025, the lung cancer diagnostics market experienced robust expansion, driven by increasing focus on early detection programs and growing awareness of targeted therapy benefits. The market developed as healthcare systems recognized the need for comprehensive molecular profiling to guide treatment decisions and improve patient outcomes. Regulatory approvals for companion diagnostics and biomarker-based tests began emphasizing the importance of precision medicine in lung cancer management for optimizing therapeutic efficacy and reducing adverse effects.

Market expansion is being supported by the increasing global burden of lung cancer and the corresponding demand for accurate, timely diagnostic solutions. Modern healthcare systems are increasingly focused on early detection strategies that can improve survival rates and treatment outcomes. The shift toward personalized medicine and targeted therapies requires comprehensive molecular characterization of tumors, driving demand for advanced diagnostic technologies, including next-generation sequencing, liquid biopsies, and companion diagnostics.

The growing focus on minimally invasive diagnostic procedures is driving demand for blood-based tests and imaging-guided biopsies that reduce patient discomfort and procedural risks. Healthcare provider’s preference for multiplexed testing platforms that can assess multiple biomarkers simultaneously is creating opportunities for innovative diagnostic solutions. The rising influence of clinical guidelines recommending molecular testing and the increasing availability of targeted therapies are also contributing to increased diagnostic test utilization across different healthcare settings and patient populations.

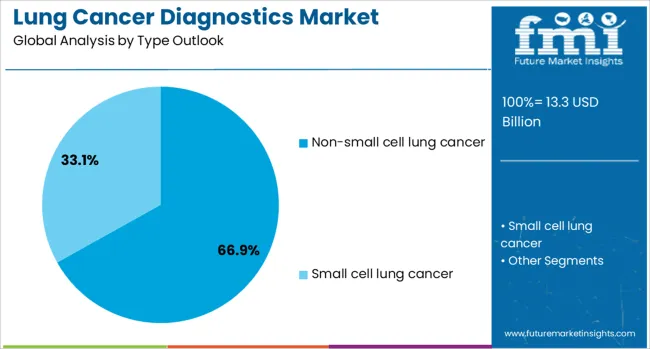

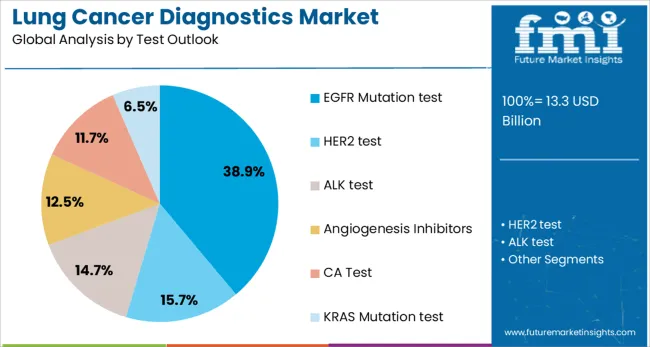

The market is segmented by type, test, end use, and region. By type, the market is divided into non-small cell lung cancer and small cell lung cancer diagnostics. Based on test, the market is categorized into EGFR mutation tests, HER2 tests, ALK tests, angiogenesis inhibitors, CA tests, and KRAS mutation tests. In terms of end use, the market is segmented into laboratories, hospitals, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The non-small cell lung cancer (NSCLC) diagnostics segment is projected to account for 66.9% of the lung cancer diagnostics market in 2025, reaffirming its position as the dominant category due to its higher prevalence compared to other lung cancer types. NSCLC represents approximately 85% of all lung cancer cases globally, making it the primary focus for diagnostic development and clinical implementation. The segment benefits from extensive research into actionable mutations and the availability of numerous targeted therapy options that require companion diagnostic testing.

This type forms the foundation of most precision medicine approaches in lung cancer, as it encompasses multiple molecular subtypes with distinct therapeutic implications. The presence of well-characterized driver mutations such as EGFR, ALK, ROS1, and KRAS in NSCLC patients has led to the development of comprehensive molecular profiling panels. Clinical guidelines consistently recommend broad molecular testing for NSCLC patients, ensuring demand and market dominance for this segment across all healthcare settings and geographic regions.

EGFR mutation tests are projected to represent 38.9% of lung cancer diagnostics demand in 2025, underscoring their role as the most established and widely adopted molecular diagnostic test in lung cancer management. The test's clinical utility is well-established, with EGFR mutations found in approximately 10-15% of Western populations and up to 50% of Asian populations with lung adenocarcinoma. The availability of multiple FDA-approved targeted therapies for EGFR-mutated tumors has created a strong clinical imperative for testing.

The segment is supported by robust clinical evidence demonstrating improved outcomes with EGFR-targeted therapy in mutation-positive patients compared to conventional chemotherapy. The test's inclusion in major clinical guidelines and reimbursement coverage across developed markets ensures consistent utilization. As resistance mechanisms to first and second-generation EGFR inhibitors become better understood, the demand for comprehensive EGFR mutation analysis, including T790M resistance mutation testing, continues to expand the market opportunity for this dominant diagnostic segment.

The laboratories segment is forecasted to contribute 51.6% of the lung cancer diagnostics market in 2025, reflecting the centralized nature of molecular diagnostic testing and the specialized expertise required for complex assay interpretation. Clinical laboratories offer standardized testing conditions, quality assurance programs, and the technical infrastructure necessary for high-throughput molecular diagnostics. This centralized model ensures consistent test quality and allows for cost-effective testing at scale.

The segment benefits from ongoing consolidation in the laboratory services industry and the increasing complexity of lung cancer molecular profiling, which requires specialized equipment and trained personnel. Reference laboratories and hospital-based molecular pathology departments serve as centers of excellence for lung cancer diagnostics, offering comprehensive testing menus that include both single-gene assays and large panel sequencing. The laboratory setting also facilitates the integration of artificial intelligence and digital pathology tools that enhance diagnostic accuracy and workflow efficiency.

The lung cancer diagnostics market is advancing rapidly due to increasing cancer incidence rates, growing adoption of precision medicine approaches, and expanding availability of targeted therapies. The market faces challenges, including high test costs, reimbursement limitations in emerging markets, and tissue adequacy issues for comprehensive molecular profiling. Innovation in liquid biopsy technologies and artificial intelligence integration continues to influence product development and market expansion patterns.

The growing adoption of liquid biopsy platforms is enabling non-invasive molecular profiling of lung cancers and providing solutions for patients with limited tissue availability. Blood-based testing offers advantages including reduced procedural risks, ability to monitor treatment response, and detection of emerging resistance mutations. Clinical validation studies and regulatory approvals for liquid biopsy assays are driving adoption across different stages of lung cancer management from initial diagnosis through treatment monitoring.

Modern lung cancer diagnostic platforms are incorporating artificial intelligence algorithms to enhance image analysis, pattern recognition, and diagnostic interpretation. AI-powered systems improve consistency in pathological assessment, reduce interpretation time, and enable automated biomarker scoring. These technologies also facilitate remote consultation and second opinion services, expanding access to specialized expertise in underserved regions while maintaining diagnostic quality standards.

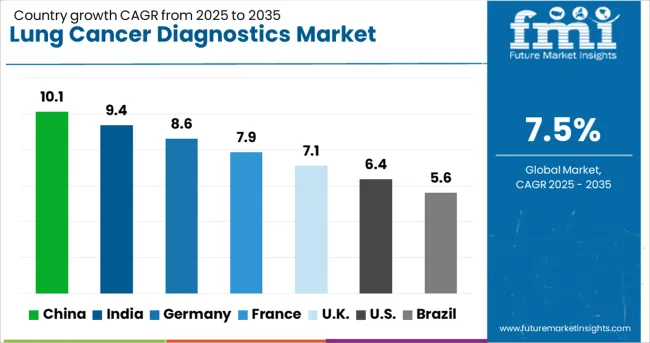

| Countries | CAGR (2025-2035) |

|---|---|

| India | 9.4% |

| China | 10.1% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The lung cancer diagnostics market is experiencing robust growth globally, with China leading at a 10.1% CAGR through 2035, driven by large patient population, expanding healthcare infrastructure, and government support for precision medicine initiatives. India follows closely at 9.4%, supported by rising cancer awareness, growing diagnostic capabilities, and increasing healthcare investment. Germany shows steady growth at 8.6%, emphasizing advanced molecular diagnostics and comprehensive testing protocols. France records 7.9%, focusing on innovative diagnostic technologies and research collaboration. The UK demonstrates 7.1% growth, prioritizing early detection programs and precision medicine adoption.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from lung cancer diagnostics in China is projected to exhibit strong growth with a CAGR of 10.1% through 2035, driven by the world's largest lung cancer patient population and rapidly expanding molecular diagnostic capabilities. The country's significant investment in healthcare infrastructure modernization and cancer screening programs is creating substantial demand for advanced diagnostic technologies. Major international and domestic companies are establishing comprehensive testing networks to serve the growing population requiring precision medicine approaches.

Revenue from lung cancer diagnostics in India is expanding at a CAGR of 9.4%, supported by increasing cancer awareness, growing healthcare expenditure, and rising adoption of molecular diagnostic technologies. The country's expanding middle class and increasing exposure to international healthcare standards are driving demand for comprehensive lung cancer molecular profiling. International diagnostic companies and domestic manufacturers are establishing testing facilities to serve the growing demand for precision medicine solutions.

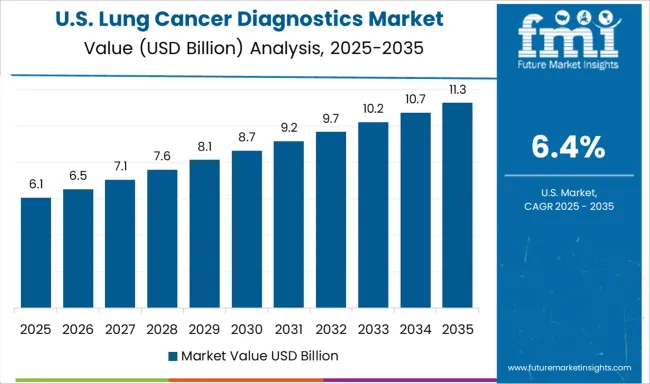

Demand for lung cancer diagnostics in the USA is projected to grow at a CAGR of 6.4%, supported by mature healthcare infrastructure, comprehensive reimbursement coverage, and strong focus on precision medicine implementation. American healthcare systems are increasingly focused on comprehensive molecular profiling, liquid biopsy adoption, and artificial intelligence integration. The market is characterized by strong demand for innovative technologies that improve diagnostic accuracy and clinical decision-making.

Revenue from lung cancer diagnostics in Germany is projected to grow at a CAGR of 8.6% through 2035, driven by the country's strong focus on clinical research, advanced healthcare technology adoption, and comprehensive cancer care delivery. German healthcare systems consistently demand high-quality, evidence-based diagnostic solutions that demonstrate clinical utility and cost-effectiveness.

Revenue from lung cancer diagnostics in the UK is projected to grow at a CAGR of 7.1% through 2035, supported by NHS strategic initiatives promoting early detection and precision medicine adoption. British healthcare policy emphasizes cost-effective diagnostic strategies and evidence-based technology assessment, positioning advanced molecular diagnostics as essential components of comprehensive cancer care.

Revenue from lung cancer diagnostics in France is projected to grow at a CAGR of 7.9% through 2035, supported by the country's strong focus on clinical research, technology innovation, and comprehensive cancer care networks. French healthcare systems prioritize evidence-based diagnostic approaches and maintain leadership in molecular pathology and precision medicine development.

Revenue from lung cancer diagnostics in Brazil is projected to grow at a CAGR of 5.6% through 2035, supported by healthcare system modernization, increasing cancer awareness, and growing adoption of molecular diagnostic technologies. The country's expanding economy and healthcare investment are creating opportunities for advanced diagnostic service expansion across major metropolitan areas.

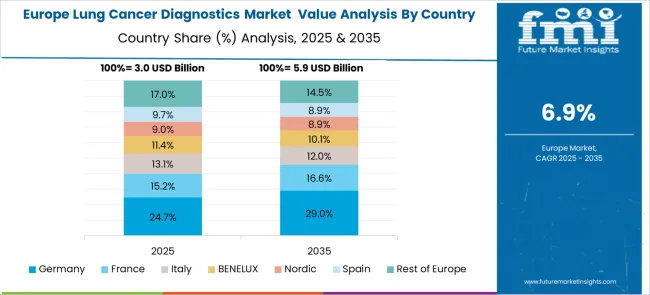

The European lung cancer diagnostics market demonstrates sophisticated development across major economies with Germany leading through its precision molecular diagnostics excellence and advanced clinical research capabilities, supported by companies emphasizing comprehensive genomic profiling platforms, next-generation sequencing technologies, and integrated precision medicine solutions while maintaining strict quality standards and regulatory compliance protocols. The UK shows strength in national healthcare integration and evidence-based diagnostic approaches, with organizations specializing in standardized molecular testing programs and cost-effective precision medicine implementation that meet rigorous clinical standards.

France contributes through its clinical research excellence and comprehensive cancer care networks, delivering advanced diagnostic solutions that combine molecular pathology expertise with modern precision medicine technologies. Sweden and Nordic countries emphasize innovative diagnostic technologies and patient-centered healthcare approaches. Italy and Spain demonstrate growth in specialized molecular diagnostics applications and cancer care infrastructure modernization. The market benefits from stringent EU medical device regulations, established clinical research infrastructure, and growing demand for comprehensive molecular profiling that provides superior therapeutic guidance and patient outcomes.

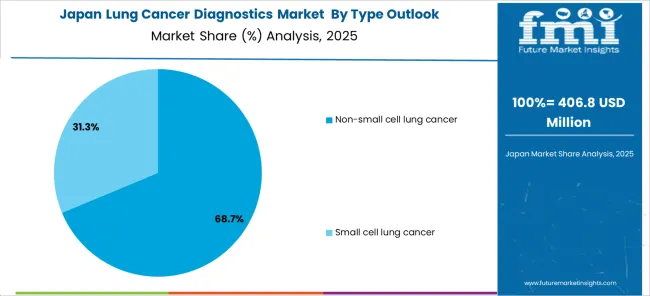

The Japanese lung cancer diagnostics market demonstrates steady growth driven by precision healthcare focus, advanced molecular technology development, and healthcare system preference for high-quality diagnostic solutions that ensure superior accuracy and clinical utility throughout cancer care management. Japanese organizations prioritize sophisticated molecular profiling capabilities and comprehensive quality assurance systems, creating demand for lung cancer diagnostics featuring advanced genomic analysis, liquid biopsy technologies, and integrated artificial intelligence platforms that align with Japanese precision medicine standards.

The market emphasizes technological innovation in molecular diagnostics, biomarker discovery, and personalized treatment approaches that reflect Japanese attention to detail in clinical care delivery and patient outcome optimization. Growing investment in aging population healthcare solutions and cancer care modernization supports adoption of next-generation diagnostic platforms with comprehensive genomic profiling, predictive analytics, and integrated clinical decision support capabilities. Japanese healthcare providers focus on diagnostic accuracy, consistent clinical performance, and long-term patient benefit through advanced precision medicine implementation.

The South Korean lung cancer diagnostics market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of precision medicine technologies, and growing demand for advanced molecular diagnostics requiring comprehensive genomic analysis and clinical interpretation capabilities. The market benefits from South Korea's technological leadership in biotechnology and increasing focus on personalized medicine initiatives that drive investment in sophisticated diagnostic platforms meeting international clinical standards.

Korean healthcare organizations increasingly adopt comprehensive molecular profiling systems, artificial intelligence-powered diagnostic tools, and integrated precision medicine protocols to improve cancer care outcomes and treatment efficiency while ensuring regulatory compliance requirements. Growing influence of Korean biotechnology companies and clinical research initiatives supports demand for advanced lung cancer diagnostic solutions that ensure comprehensive functionality while maintaining cost-effectiveness and clinical accessibility. The integration of digital health technologies and telemedicine capabilities creates opportunities for innovative diagnostic platforms with remote consultation and specialized expertise access capabilities.

The lung cancer diagnostics market is characterized by competition among established diagnostic companies, biotechnology firms, and emerging precision medicine players. Companies are investing in advanced molecular technologies, artificial intelligence integration, comprehensive testing panels, and global market expansion to deliver accurate, accessible, and clinically actionable lung cancer diagnostic solutions. Technology innovation, clinical evidence generation, and regulatory approval strategies are central to strengthening product portfolios and market presence.

F. Hoffmann-La Roche Ltd leads the market with significant global presence, offering comprehensive companion diagnostic solutions with a focus on targeted therapy guidance and precision medicine integration. Thermo Fisher Scientific provides advanced molecular diagnostic platforms with a focus on next-generation sequencing and laboratory automation. Illumina Inc. delivers cutting-edge sequencing technologies with a focus on comprehensive genomic profiling and liquid biopsy applications. Agilent Technologies focuses on molecular pathology solutions that combine high-quality reagents with advanced instrumentation.

Qiagen and Abbott, operating globally, provide comprehensive molecular diagnostic portfolios across multiple testing platforms and clinical applications. Bio-Rad emphasizes quality control and standardization solutions with premium positioning in molecular diagnostics. Neogenomics Laboratories offers specialized cancer diagnostic services with a focus on comprehensive molecular profiling and clinical interpretation. bioMérieux and Myriad Genetics provide targeted diagnostic solutions with a focus on specific biomarker analysis and clinical decision support.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 13.3 billion |

| Type | Non-small cell lung cancer, Small cell lung cancer |

| Test | EGFR Mutation test, HER2 test, ALK test, Angiogenesis Inhibitors, CA Test, KRAS Mutation test |

| End Use | Laboratories, Hospitals, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific, Illumina Inc., Agilent Technologies, Qiagen, Abbott, Bio-Rad, Neogenomics Laboratories, bioMérieux, and Myriad Genetics |

| Additional Attributes | Dollar sales by diagnostic test type and technology platform, regional demand trends, competitive landscape, healthcare provider preferences for molecular versus conventional diagnostics, integration with precision medicine initiatives, innovations in liquid biopsy technologies, artificial intelligence integration, and companion diagnostic development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global lung cancer diagnostics market is estimated to be valued at USD 13.3 billion in 2025.

The market size for the lung cancer diagnostics market is projected to reach USD 27.4 billion by 2035.

The lung cancer diagnostics market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in lung cancer diagnostics market are non-small cell lung cancer and small cell lung cancer.

In terms of test outlook, egfr mutation test segment to command 38.9% share in the lung cancer diagnostics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Lung Biopsy Systems Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Plunger Stopper Market Insights – Trends & Growth Forecast 2024-2034

Cold Plunge Tub Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Interstitial Lung Disease Treatment Market

Non-Small Cell Lung Carcinoma (NSCLC) Market Size and Share Forecast Outlook 2025 to 2035

Non-Small Cell Lung Cancer Market Size and Share Forecast Outlook 2025 to 2035

PD1 Non-Small Cell Lung Cancer Treatment Market - Growth & Outlook 2025 to 2035

Progressive Fibrosing Interstitial Lung Disease (PF-ILD) Treatment Market – Growth & Future Outlook 2025 to 2035

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA