The lung cancer PCR panel market size is projected to reach USD 599.41 million in 2025. The market is expected to grow at a CAGR of 8.0% during the forecast period between 2025 and 2035. By 2035, the market will acquire a total valuation of USD 1.29 billion.

In 2024, the industry for lung cancer PCR panels saw significant developments and strategic moves that boosted its growth. One of the major developments was Pfizer's united effort to advance BRAF mutation testing in patients with lung cancer.

In September 2024, Pfizer announced three-year follow-up Phase 2 trial data showing patients with BRAF V600E-mutant metastatic NSCLC receiving Braftovi and Mektovi had a median progression-free survival of over two and a half years.

The industry also experienced an increase in the use of liquid biopsy tests, which screen for circulating tumor DNA (ctDNA) in blood. PCR panels were a central component of these tests since they were used to identify certain mutations and variations in ctDNA, enabling early detection and targeted treatment options.

The industry for lung cancer PCR panels is anticipated to grow steadily during the projection period between 2025 and 2035. This expansion is fueled by the rising incidence of lung cancer, increased awareness of early detection, and advances in diagnostic technology.

Technologies like liquid biopsies, next-generation sequencing (NGS), and artificial intelligence-based imaging devices are improving diagnostic precision and allowing non-invasive testing.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 599.41 million |

| Industry Value (2035F) | USD 1.29 billion |

| CAGR | 8.0% |

The lung cancer PCR panel industry is growing strongly, led by an increase in global lung cancer incidence and rising acceptance of precision diagnostics. The driving force is the need for early, mutation-specific detection to facilitate targeted therapies, complemented by advances such as liquid biopsy and integration with NGS.

Diagnostic firms and pharma companies with precision oncology platforms to offer will gain, but those that are tardy in responding to molecular test trends risk obsolescence.

Increase Molecular Testing Capabilities

Invest in PCR-based and complementary diagnostic platforms (e.g., NGS, liquid biopsy) to increase mutation detection accuracy and expand the clinical utility of lung cancer panels.

Align with Precision Medicine Trends

Form strategic partnerships with pharmaceutical firms developing targeted therapies to align diagnostic panels with new biomarkers and treatment approaches.

Enhance Global Access and Distribution

Seek collaborations with local labs, health systems, and distributors to enter underserved industries, while investigating M&A possibilities to expand R&D and manufacturing capabilities.

| Risk | Assessment (Probability - Impact) |

|---|---|

| Regulatory Delays in Approving New PCR Panels | Medium - High |

| Limited Reimbursement for Advanced Molecular Diagnostics | High - High |

| Technological Obsolescence Due to Rapid Innovation (e.g., AI/NGS) | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Expand Liquid Biopsy Integration | Run feasibility on integrating ctDNA-based liquid biopsy into PCR panels. |

| Strengthen Pharma-Diagnostic Collaboration | Initiate feedback loop with OEMs on emerging biomarker demands. |

| Accelerate Global Industry Penetration | Launch channel partner incentive pilot in APAC and LATAM regions |

In order to remain competitive in the fast-changing lung cancer PCR panel industry, the company needs to concentrate on speeding up its R&D spending in precision diagnostics, especially in high unmet-need areas such as China and Japan.

Through strategic collaborations with local healthcare players and obtaining appropriate certifications, the company can rapidly expand its offerings and establish a strong presence in these strategic industries. Moreover, the development of partnerships with cancer research centers and riding the wave of new trends in molecular targeted therapies will further its competitive advantage.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across diagnostic manufacturers, lab directors, oncologists, and procurement leads in the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

ROI Sentiment:

Consensus:

Regional Differences:

Shared Challenges:

Regional Breakdown:

Manufacturers:

Distributors & Labs:

Global Alignment:

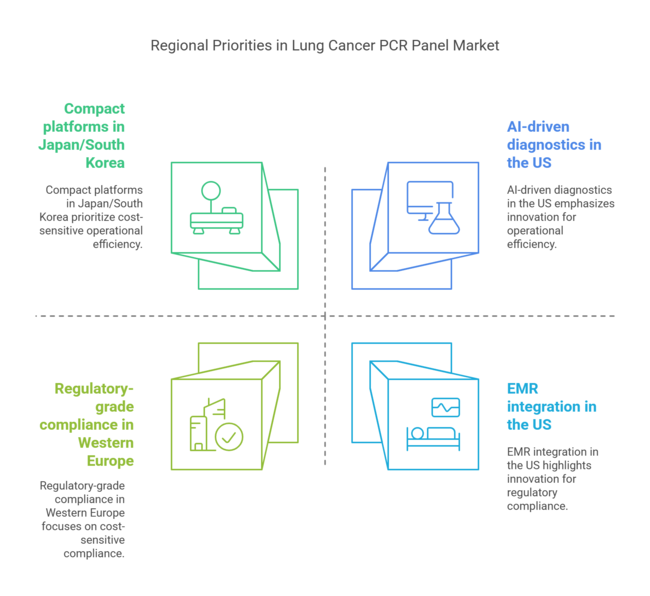

Regional Priorities:

Global Consensus:

Speed, accuracy, mutation breadth, and reimbursement remain central to PCR panel success.

Key Regional Contrasts:

Strategic Insight:

Success in the lung cancer PCR panel industry hinges on regional customization. A modular platform strategy - combining high-performance core capabilities with region-specific pricing, mutation targets, and support systems - will unlock industry share across developed and price-sensitive regions alike.

| Countries | Regulatory Impact and Mandatory Certifications |

|---|---|

| United States | The USA Food and Drug Administration (FDA) oversees the approval of in vitro diagnostic (IVD) devices, including lung cancer PCR panels. Manufacturers must obtain FDA clearance or approval, demonstrating safety and effectiveness through rigorous clinical evaluations. Companion diagnostics require specific FDA approval in conjunction with the associated therapeutic. |

| European Union | IVD devices in the EU must comply with the In Vitro Diagnostic Regulation (IVDR), which replaced the In Vitro Diagnostic Directive (IVDD) in May 2022. Manufacturers need to obtain CE marking by demonstrating conformity with the regulation, involving assessment by a Notified Body for higher-risk devices. The IVDR emphasizes increased scrutiny of clinical evidence and post-industry surveillance. |

| Japan | The Ministry of Health, Labour and Welfare (MHLW) regulates medical devices, including IVDs. Approval requires compliance with the Pharmaceutical and Medical Device Act (PMDA). The AmoyDx® Pan Lung Cancer PCR Panel, for instance, received MHLW approval as a companion diagnostic for specific therapies, reflecting Japan's stringent regulatory process for companion diagnostics. |

| China | The National Medical Products Administration (NMPA) oversees IVD regulation. IVD reagents are classified into three classes based on risk, with Class II and III requiring registration. Clinical trials may be necessary unless exempted. The NMPA has established numerous guidelines and standards for IVD products, and overseas clinical trial data can be considered if they meet specific criteria. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates IVD devices under the Medical Device Rules, 2017. IVDs are categorized based on risk, with higher-risk categories requiring prior approval. Manufacturers must obtain Import Licenses for foreign-made devices and ensure compliance with Indian standards and quality systems. |

| Australia | The Therapeutic Goods Administration (TGA) regulates IVDs, requiring inclusion in the Australian Register of Therapeutic Goods (ARTG). Devices are classified by risk, and higher-risk devices necessitate conformity assessment by the TGA or recognized bodies. Compliance with the Australian Regulatory Guidelines for Medical Devices (ARGMD) is mandatory. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) oversees IVD regulation. Devices are classified into four classes based on risk. Higher-class devices require more stringent review, including clinical data submission. Compliance with Korean Good Manufacturing Practice (KGMP) is also required for manufacturers. |

The USA lung cancer PCR panel industry is driven by the growing adoption of precision diagnostics and positive reimbursement dynamics. The prevalence of lung cancer, in particular among older populations, continues to fuel demand for fast, mutation-specific PCR assays.

The incorporation of PCR panels in NCCN guidelines and the increasing trend of liquid biopsy-compatible PCR kits are bolstering clinical adoption. Pharmaceutical company and diagnostics company collaborations are also driving companion diagnostic development.

Although reimbursement coverage is enhanced, clinician training and access gaps create moderate challenges. The USA continues to be a worldwide innovation center for oncology diagnostics, with hospital laboratories and reference laboratories giving high priority to PCR panel upgrades.

FMI opines that the United States lung cancer PCR panel sales are likely to grow at a CAGR of 9.06% from 2025 to 2035.

The United Kingdom PCR panel industry for lung cancer will grow steadily from 2025 to 2035 through NHS-led initiatives for precision medicine and cancer diagnosis networks cantered under the NHS.

The expansion of genomics hubs under the Genomic Medicine Service is generating opportunities for PCR-based biomarker analysis, especially among early-stage as well as metastatic NSCLC cases. The use of multiplex PCR assays is gaining pace with clinical pathways placing greater emphasis on targeted therapies.

Procurement delays, differing trust-level adoption rates, and pre-analytical sample handling standardization are among the challenges, though. The UK is determined to increase access to biomarker-driven diagnostics despite stringent budget restrictions and is therefore a primary growth region in Western Europe.

FMI opines that the United Kingdom's lung cancer PCR panel sales are likely to grow at a CAGR of 7.92% from 2025 to 2035.

France's PCR panel industry for lung cancer is estimated to grow and is driven by robust public healthcare infrastructure and investments by the country in molecular oncology. The nation has set up regional cancer genomics platforms (PLGAs), making PCR tests widely accessible in hospitals. EGFR and KRAS testing through real-time PCR are the norm in the majority of public oncology departments.

Nonetheless, fragmented regional financing and lower-than-anticipated adoption by the private sector create growth constraints. Clinical consciousness of early detection is rising, supported by government-sponsored screening pilots. Reimbursement parity for PCR-based and NGS-based testing is also a priority in France. With an expanding diagnostics ecosystem and strong clinical research in oncology, France continues to be a significant industry for PCR panel developers.

FMI opines that the France lung cancer PCR panel sales are likely to grow at a CAGR of 7.55% from 2025 to 2035.

Germany is likely to witness robust growth in the industry for lung cancer PCR panels by 2035, as a result of its well-developed diagnostics network and liberal reimbursement setup. Molecular testing is now part of the diagnostic process in lung cancer, particularly in DKG-certified oncology centers.

High usage of CE-marked PCR panels and good reimbursement by statutory health insurance is driving growth. Short-turnaround-time PCR platforms are becoming more popular than wide sequencing for standard mutation detection.

Germany also has a thriving clinical trials environment, with companion diagnostics being tested in parallel with new therapies. Regulatory certainty and laboratory automation are enhancing efficiency, although regional differences in lab capacities continue to be a limitation.

FMI opines that German lung cancer PCR panel sales are likely to grow at a CAGR of 8.30% from 2025 to 2035.

Italy's PCR panel industry for lung cancer is expected to expand with growth being more concentrated in the northern and central regions where hospital laboratories are more equipped. Adoption of PCR-based molecular diagnostics is increasing, especially for mutations in EGFR and ALK, but access continues to be unequal across regions. National cancer care networks are driving the implementation of uniform diagnostic standards, which will increase adoption in underpenetrated regions.

The PCR industry is being helped by EU recovery fund investments in health system digitization and diagnostic modernization. Nevertheless, prolonged public procurement timelines and uneven local reimbursement processes continue to hinder wider industry growth.

FMI opines that the Italy lung cancer PCR panel sales are likely to grow at a CAGR of 7.17% from 2025 to 2035.

Italy's PCR panel industry for lung cancer is expected to expand with growth being more concentrated in the northern and central regions where hospital laboratories are more equipped. Adoption of PCR-based molecular diagnostics is increasing, especially for mutations in EGFR and ALK, but access continues to be unequal across regions. National cancer care networks are driving the implementation of uniform diagnostic standards, which will increase adoption in underpenetrated regions.

FMI opines that South Korea's lung cancer PCR panel sales are likely to grow at a CAGR of 7.55% from 2025 to 2035.

Japan's lung cancer PCR panel industry is expected to surge during the forecast period. This growth will be driven by Japan's advanced healthcare infrastructure, high prevalence of lung cancer, and a strong focus on precision medicine. Government support for new-age diagnostic technologies and the availability of prominent pharmaceutical companies further drive the growth of the industry.

FMI believes that the Japanese lung cancer PCR panel industry is poised to register a growth rate of CAGR 6.2% during the forecast period from 2025 to 2035.

China's lung cancer PCR panel industry is anticipated to achieve significant growth. The country's vast population, growing smoking population, and escalating air pollution levels lead to a high prevalence of lung cancer. High investments in healthcare infrastructure and a rising emphasis on sophisticated diagnostic solutions are major drivers of industry growth.

FMI concludes that the industry of Chinese lung cancer PCR panels is anticipated to expand at a CAGR of 6.4% from 2025 to 2035.

The Australia and New Zealand combined lung cancer PCR panel industry is anticipated to register constant growth by 2035. Australia and New Zealand both possess robust healthcare infrastructures and a high level of healthcare spending, enabling the uptake of sophisticated diagnostic technologies. However, their smaller size means that there is a smaller total industry size as compared with larger nations.

FMI believes that the Australian and New Zealand lung cancer PCR panel industry will expand at a CAGR of 5.0% during 2025 to 2035.

Between 2025 and 2035, Adenocarcinoma will be the most profitable application segment for the lung cancer PCR panel industry. This is because it is highly prevalent in non-small cell lung cancer (NSCLC) subtypes and is increasingly pertinent in genomic testing and biomarker testing. PCR panels are highly efficient in detecting driver mutations like EGFR, ALK, ROS1, and BRAF that are predominantly found in adenocarcinoma.

The increasing focus on personalized medicine and early mutation detection has driven adoption in both diagnostic and monitoring applications. Moreover, growing awareness among clinicians and enhancements in reimbursement policies are also facilitating PCR-based adenocarcinoma testing. Therefore, the adenocarcinoma segment is expected to expand at a CAGR of around 9.2% during the period 2025 to 2035, ahead of the overall industry.

Between 2025 and 2035, Hospitals are also expected to be the highest-revenue-generating end-user segment for lung cancer PCR panels. This is fueled by the pivotal position of hospitals in diagnostic pipelines, especially in complex and metastatic cancer treatment environments. Hospitals tend to be the initial point of treatment for patients showing symptoms and have the appropriate infrastructure for molecular diagnostics and PCR testing. In addition, hospital labs increasingly interact with oncology departments to adopt precision medicine protocols.

Such centers also enjoy government funding access, patient volumes, and healthcare delivery models that incorporate integrated care to ensure continuity. Due to these structural advantages, the hospital segment is projected to grow at a CAGR of around 8.6% during the forecast period, ahead of research institutes and specialty clinics.

The industry is partially consolidated, with dominance by a few major players (Thermo Fisher, Roche, Qiagen) and increasing threats from niche and regional players. Competition is being fueled by innovation, regulatory clearances, and strategic alliances.

Leaders compete on:

Adenocarcinoma, Squamous Cell Carcinoma (SCC), Large Cell Carcinoma

Hospitals, Cancer Research Institutes, Specialty Clinics, Research & Educational Institutes

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

It detects genetic mutations in lung cancer to guide diagnosis and treatment decisions.

Adenocarcinoma, due to its high mutation rate and responsiveness to targeted therapies.

Hospitals and cancer research institutes are the main users.

Yes, they can identify actionable mutations even in early-stage lung cancer.

Yes, driven by rising cancer cases and expanding diagnostic infrastructure.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 02: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 03: Global Market Volume (Units) Analysis and Forecast 2015 to 2033, by Region

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Region

Table 05: North America Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 06: North America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 08: North America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 09: Latin America Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 10: Latin America Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 11: Latin America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 13: Europe Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 14: Europe Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 15: Europe Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 16: Europe Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 17: South Asia Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 18: South Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 19: South Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 20: South Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 21: East Asia Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 22: East Asia Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 23: East Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 24: East Asia Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 25: Oceania Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 26: Oceania Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 27: Oceania Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 28: Oceania Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Table 29: Middle East and Africa Market Value (US$ Million) Analysis 2015 to 2022 and Forecast 2023 to 2033, by Country

Table 30: Middle East and Africa Market Volume (Units) Analysis and Forecast 2015 to 2033, by Country

Table 31: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by Application

Table 32: Middle East and Africa Market Value (US$ Million) Analysis and Forecast 2015 to 2033, by End User

Figure 01: Global Market Volume (Units), 2015 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Lung Cancer PCR Panel, Pricing Analysis per unit (US$), in 2022

Figure 04: Lung Cancer PCR Panel, Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2015 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Application

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by End User

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Region

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 17: North America Market Value (US$ Million) Analysis, 2015 to 2022

Figure 18: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 19: North America Market Value Share, by Application (2023 E)

Figure 20: North America Market Value Share, by End User (2023 E)

Figure 21: North America Market Value Share, by Country (2023 E)

Figure 22: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 23: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 25: USA Market Value Proportion Analysis, 2022

Figure 26: Global Vs. USA Growth Comparison

Figure 27: USA Market Share Analysis (%) by Application, 2022 & 2033

Figure 28: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 29: Canada Market Value Proportion Analysis, 2022

Figure 30: Global Vs. Canada. Growth Comparison

Figure 31: Canada Market Share Analysis (%) by Application, 2022 & 2033

Figure 32: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 33: Latin America Market Value (US$ Million) Analysis, 2015 to 2022

Figure 34: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 35: Latin America Market Value Share, by Application (2023 E)

Figure 36: Latin America Market Value Share, by End User (2023 E)

Figure 37: Latin America Market Value Share, by Country (2023 E)

Figure 38: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 39: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 40: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 41: Mexico Market Value Proportion Analysis, 2022

Figure 42: Global Vs Mexico Growth Comparison

Figure 43: Mexico Market Share Analysis (%) by Application, 2022 & 2033

Figure 44: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 45: Brazil Market Value Proportion Analysis, 2022

Figure 46: Global Vs. Brazil. Growth Comparison

Figure 47: Brazil Market Share Analysis (%) by Application, 2022 & 2033

Figure 48: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 49: Argentina Market Value Proportion Analysis, 2022

Figure 50: Global Vs Argentina Growth Comparison

Figure 51: Argentina Market Share Analysis (%) by Application, 2022 & 2033

Figure 52: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 53: Europe Market Value (US$ Million) Analysis, 2015 to 2022

Figure 54: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 55: Europe Market Value Share, by Application (2023 E)

Figure 56: Europe Market Value Share, by End User (2023 E)

Figure 57: Europe Market Value Share, by Country (2023 E)

Figure 58: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 59: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 61: UK Market Value Proportion Analysis, 2022

Figure 62: Global Vs. UK Growth Comparison

Figure 63: UK Market Share Analysis (%) by Application, 2022 & 2033

Figure 64: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 65: Germany Market Value Proportion Analysis, 2022

Figure 66: Global Vs. Germany Growth Comparison

Figure 67: Germany Market Share Analysis (%) by Application, 2022 & 2033

Figure 68: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 69: Italy Market Value Proportion Analysis, 2022

Figure 70: Global Vs. Italy Growth Comparison

Figure 71: Italy Market Share Analysis (%) by Application, 2022 & 2033

Figure 72: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 73: France Market Value Proportion Analysis, 2022

Figure 74: Global Vs France Growth Comparison

Figure 75: France Market Share Analysis (%) by Application, 2022 & 2033

Figure 76: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 77: Spain Market Value Proportion Analysis, 2022

Figure 78: Global Vs Spain Growth Comparison

Figure 79: Spain Market Share Analysis (%) by Application, 2022 & 2033

Figure 80: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 81: Russia Market Value Proportion Analysis, 2022

Figure 82: Global Vs Russia Growth Comparison

Figure 83: Russia Market Share Analysis (%) by Application, 2022 & 2033

Figure 84: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 85: BENELUX Market Value Proportion Analysis, 2022

Figure 86: Global Vs BENELUX Growth Comparison

Figure 87: BENELUX Market Share Analysis (%) by Application, 2022 & 2033

Figure 88: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 89: East Asia Market Value (US$ Million) Analysis, 2015 to 2022

Figure 90: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 91: East Asia Market Value Share, by Application (2023 E)

Figure 92: East Asia Market Value Share, by End User (2023 E)

Figure 93: East Asia Market Value Share, by Country (2023 E)

Figure 94: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 95: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 96: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 97: China Market Value Proportion Analysis, 2022

Figure 98: Global Vs. China Growth Comparison

Figure 99: China Market Share Analysis (%) by Application, 2022 & 2033

Figure 100: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 101: Japan Market Value Proportion Analysis, 2022

Figure 102: Global Vs. Japan Growth Comparison

Figure 103: Japan Market Share Analysis (%) by Application, 2022 & 2033

Figure 104: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 105: South Korea Market Value Proportion Analysis, 2022

Figure 106: Global Vs South Korea Growth Comparison

Figure 107: South Korea Market Share Analysis (%) by Application, 2022 & 2033

Figure 108: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 109: South Asia Market Value (US$ Million) Analysis, 2015 to 2022

Figure 110: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 111: South Asia Market Value Share, by Application (2023 E)

Figure 112: South Asia Market Value Share, by End User (2023 E)

Figure 113: South Asia Market Value Share, by Country (2023 E)

Figure 114: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 115: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 116: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 117: India Market Value Proportion Analysis, 2022

Figure 118: Global Vs. India Growth Comparison

Figure 119: India Market Share Analysis (%) by Application, 2022 & 2033

Figure 120: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 121: Indonesia Market Value Proportion Analysis, 2022

Figure 122: Global Vs. Indonesia Growth Comparison

Figure 123: Indonesia Market Share Analysis (%) by Application, 2022 & 2033

Figure 124: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 125: Malaysia Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Malaysia Growth Comparison

Figure 127: Malaysia Market Share Analysis (%) by Application, 2022 & 2033

Figure 128: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 129: Thailand Market Value Proportion Analysis, 2022

Figure 130: Global Vs. Thailand Growth Comparison

Figure 131: Thailand Market Share Analysis (%) by Application, 2022 & 2033

Figure 132: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 133: Oceania Market Value (US$ Million) Analysis, 2015 to 2022

Figure 134: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 135: Oceania Market Value Share, by Application (2023 E)

Figure 136: Oceania Market Value Share, by End User (2023 E)

Figure 137: Oceania Market Value Share, by Country (2023 E)

Figure 138: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 141: Australia Market Value Proportion Analysis, 2022

Figure 142: Global Vs. Australia Growth Comparison

Figure 143: Australia Market Share Analysis (%) by Application, 2022 & 2033

Figure 144: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 145: New Zealand Market Value Proportion Analysis, 2022

Figure 146: Global Vs New Zealand Growth Comparison

Figure 147: New Zealand Market Share Analysis (%) by Application, 2022 & 2033

Figure 148: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 149: Middle East & Africa Market Value (US$ Million) Analysis, 2015 to 2022

Figure 150: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 151: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 152: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 153: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 154: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 155: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 156: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 157: GCC Countries Market Value Proportion Analysis, 2022

Figure 158: Global Vs GCC Countries Growth Comparison

Figure 159: GCC Countries Market Share Analysis (%) by Application, 2022 & 2033

Figure 160: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 161: Türkiye Market Value Proportion Analysis, 2022

Figure 162: Global Vs. Türkiye Growth Comparison

Figure 163: Türkiye Market Share Analysis (%) by Application, 2022 & 2033

Figure 164: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 165: South Africa Market Value Proportion Analysis, 2022

Figure 166: Global Vs. South Africa Growth Comparison

Figure 167: South Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 168: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 169: Northern Africa Market Value Proportion Analysis, 2022

Figure 170: Global Vs Northern Africa Growth Comparison

Figure 171: Northern Africa Market Share Analysis (%) by Application, 2022 & 2033

Figure 172: Northern Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lung Biopsy Systems Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Plunger Stopper Market Insights – Trends & Growth Forecast 2024-2034

Cold Plunge Tub Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Small Cell Lung Cancer (SCLC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Interstitial Lung Disease Treatment Market

Non-Small Cell Lung Carcinoma (NSCLC) Market Size and Share Forecast Outlook 2025 to 2035

Non-Small Cell Lung Cancer Market Size and Share Forecast Outlook 2025 to 2035

PD1 Non-Small Cell Lung Cancer Treatment Market - Growth & Outlook 2025 to 2035

Progressive Fibrosing Interstitial Lung Disease (PF-ILD) Treatment Market – Growth & Future Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA