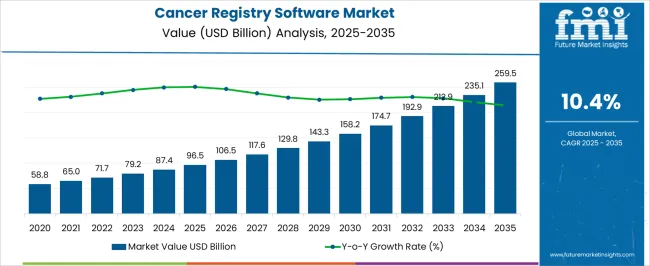

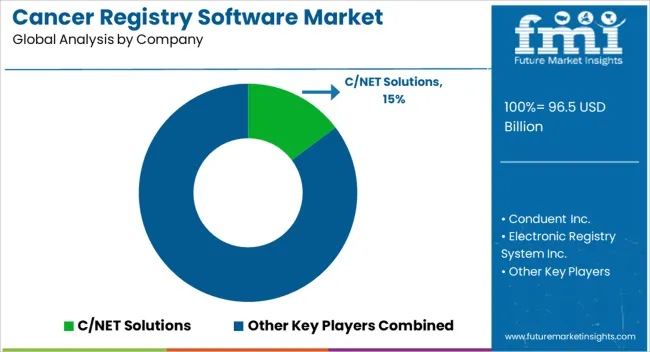

The Cancer Registry Software Market is estimated to be valued at USD 96.5 billion in 2025 and is projected to reach USD 259.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

The cancer registry software market is expanding rapidly, driven by the increasing incidence of cancer worldwide and the growing emphasis on data-driven healthcare management. The need for efficient cancer data collection, patient tracking, and analysis to improve treatment outcomes has strengthened market demand.

Integration of advanced analytics, interoperability solutions, and cloud-based platforms has enhanced data accuracy and accessibility for healthcare professionals. Governments and healthcare organizations are investing in digital health infrastructure to streamline cancer surveillance and research.

The current market is characterized by the adoption of automated registry systems that reduce manual data entry errors and improve reporting efficiency. As personalized medicine and predictive analytics gain momentum, the market is projected to experience sustained growth supported by continuous technological innovation and expanding healthcare digitization.

| Metric | Value |

|---|---|

| Cancer Registry Software Market Estimated Value in (2025 E) | USD 96.5 billion |

| Cancer Registry Software Market Forecast Value in (2035 F) | USD 259.5 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

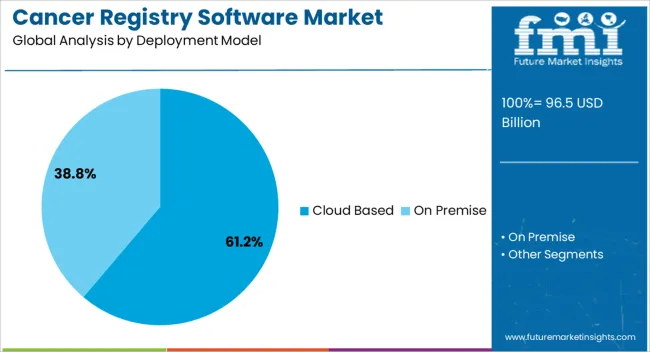

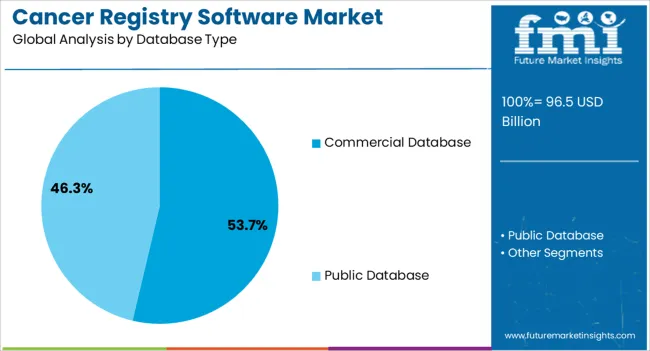

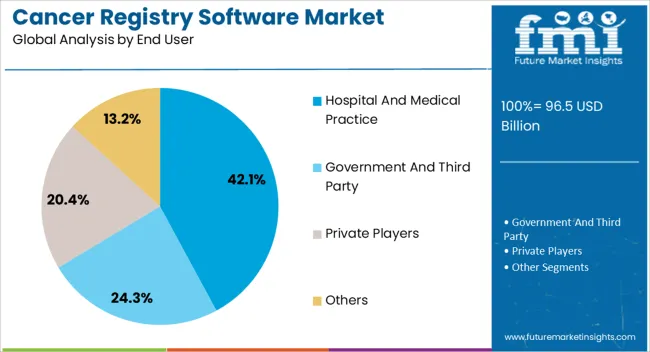

The market is segmented by Deployment Model, Database Type, and End User and region. By Deployment Model, the market is divided into Cloud Based and On Premise. In terms of Database Type, the market is classified into Commercial Database and Public Database. Based on End User, the market is segmented into Hospital And Medical Practice, Government And Third Party, Private Players, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud-based segment leads the deployment model category with approximately 61.2% share, reflecting a strong shift toward flexible, scalable, and cost-effective data management solutions. Cloud-based platforms enable real-time access, remote collaboration, and secure storage of large oncology datasets, significantly improving workflow efficiency in healthcare institutions.

The segment’s growth is further supported by reduced maintenance requirements and seamless integration with electronic health record systems. Increased acceptance among hospitals and research centers has solidified its market presence.

With the ongoing digital transformation in healthcare and growing reliance on telemedicine and remote diagnostics, the cloud-based segment is expected to maintain dominance in the coming years.

The commercial database segment accounts for approximately 53.7% share within the database type category, driven by the need for structured and standardized cancer data for analytics, compliance, and research purposes. Commercial databases offer robust data management tools, regular updates, and regulatory adherence, ensuring reliability for healthcare organizations.

The segment benefits from partnerships between healthcare institutions and specialized vendors that provide integrated database solutions tailored to oncology requirements. Continuous advancements in AI-driven data categorization and data sharing frameworks have reinforced market adoption.

With growing emphasis on interoperability and large-scale data utilization, the commercial database segment is poised to sustain its leading position.

The hospital and medical practice segment holds approximately 42.1% share of the end-user category, driven by the widespread adoption of cancer registry software for clinical documentation, treatment planning, and patient tracking. Hospitals require efficient systems to manage increasing cancer case volumes and comply with national reporting standards.

The segment benefits from government initiatives promoting digital health adoption and the integration of cancer registries into broader healthcare IT ecosystems. Enhanced data accuracy and accessibility support better decision-making and patient outcomes.

With the expansion of healthcare infrastructure and the push toward evidence-based medicine, hospitals and medical practices are expected to remain the primary users of cancer registry software.

The scope for cancer registry software rose at an 11.5% CAGR between 2020 and 2025. The global market for cancer registry software is anticipated to grow at a moderate CAGR of 10.4% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025. There was a steady rise in cancer incidence globally due to various factors such as aging populations, lifestyle changes, and environmental exposures, during this period. The growing burden of cancer highlighted the need for robust cancer registry software solutions to track and manage cancer data effectively.

Healthcare regulatory bodies in many countries enforced regulations mandating the establishment and maintenance of cancer registries. Compliance with these regulations drove the adoption of cancer registry software among healthcare institutions and research organizations.

The period witnessed significant advancements in technology, including the integration of artificial intelligence, machine learning, and big data analytics in cancer registry software. The technological innovations enhanced the capabilities of cancer registry platforms for data collection, analysis, and predictive modeling.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. The forecast period is expected to witness further advancements in personalized medicine, driven by innovations in genomics, biomarker research, and targeted therapy development. Cancer registry software will play a pivotal role in integrating genomic data, biomarker profiles, and clinical outcomes to inform personalized treatment decisions and improve patient outcomes.

The integration of digital health technologies, including telehealth, remote monitoring, and patient engagement tools, will become more prevalent in cancer care delivery. Cancer registry software platforms will leverage digital health innovations to enhance patient communication, symptom management, and survivorship care coordination, promoting patient centered cancer care models.

There is a growing need for efficient methods of cancer data management and analysis, as cancer rates continue to rise globally. Cancer registry software provides a systematic approach to collect, manage, and analyze cancer data, which is crucial for understanding trends, treatment outcomes, and planning healthcare resources.

The below table showcases market revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 10.5% |

| China | 11.1% |

| The United Kingdom | 11.5% |

| Japan | 11.8% |

| Korea | 13.2% |

The cancer registry software market in the United States expected to expand at a CAGR of 10.5% through 2035. The government of the country mandates the establishment and maintenance of cancer registries to track cancer incidence, treatment outcomes, and survival rates.

Compliance with regulations such as the Cancer Registries Amendment Act drives the adoption of cancer registry software among healthcare facilities, research institutions, and cancer centers.

The United States places significant emphasis on cancer research, prevention, and surveillance to improve public health outcomes. Cancer registry software facilitates the collection, analysis, and dissemination of population based cancer data, supporting epidemiological studies, health disparities research, and evidence based public health interventions.

The cancer registry software market in the United Kingdom is anticipated to expand at a CAGR of 11.5% through 2035. The country operates the National Cancer Registration and Analysis Service, which collects, manages, and analyzes cancer data from across the country.

The NCRAS serves as a central repository for cancer registry data and supports population based cancer surveillance, research, and public health initiatives. The demand for cancer registry software is driven by the need to enhance data collection, analysis, and reporting capabilities to support the objectives of the service and improve cancer care outcomes.

The National Health Service in the country is also undergoing a digital transformation to modernize healthcare delivery, improve patient outcomes, and enhance data driven decision making. Cancer registry software plays a crucial role in digitizing cancer care pathways, facilitating seamless data exchange, and enabling interoperability between healthcare systems and providers. The adoption of cancer registry software aligns with the strategic goals of NHS enhancing data quality, patient safety, and healthcare efficiency.

Cancer registry software trends in China are taking a turn for the better. An 11.1% CAGR is forecast for the country from 2025 to 2035. The country has made substantial investments in healthcare infrastructure development, including the expansion of cancer centers, hospitals, and oncology departments across the country.

The growth of healthcare facilities and oncology services creates opportunities for cancer registry software adoption to support cancer care delivery, clinical research, and quality improvement initiatives in diverse healthcare settings.

China has witnessed rapid advancements in healthcare technology, digital health solutions, and telemedicine platforms, driven by the proliferation of mobile technology, internet connectivity, and digital innovation.

Cancer registry software leverages technology advancements to digitize cancer care pathways, enable remote data capture, and facilitate teleconsultations between healthcare providers and patients, enhancing access to cancer care services and improving care coordination.

The cancer registry software market in Japan is poised to expand at a CAGR of 11.8% through 2035. Japanese healthcare providers are increasingly focused on quality improvement initiatives, clinical research, and outcomes research to enhance the quality, safety, and effectiveness of cancer care services.

Cancer registry software enables healthcare organizations to track key performance indicators, monitor treatment outcomes, and identify opportunities for process improvement and care optimization. The adoption of cancer registry software supports evidence based decision making, clinical governance, and continuous quality improvement efforts across the cancer care continuum.

Japan actively participates in collaborative networks, research consortia, and international partnerships focused on cancer research, clinical trials, and translational science. Cancer registry software facilitates data sharing, collaborative research, and knowledge exchange among stakeholders, enabling Japanese researchers, healthcare providers, and policymakers to leverage global best practices, standards, and evidence based guidelines in cancer care delivery and public health interventions.

The cancer registry software market in Korea is anticipated to expand at a CAGR of 13.2% through 2035. Korea has embraced telemedicine and digital health platforms to improve access to healthcare services, especially in remote or underserved areas.

Cancer registry software integrates with telemedicine platforms, mobile applications, and remote monitoring devices to enable virtual consultations, patient engagement, and remote data capture. The adoption of telemedicine enabled cancer registry software expands access to cancer care services, enhances patient provider communication, and facilitates continuity of care across geographic locations.

Precision medicine and genomic based approaches are transforming cancer diagnosis, treatment selection, and personalized therapy in Korea. Cancer registry software integrates with genomic databases, molecular profiling platforms, and precision oncology tools to support precision medicine initiatives, identify genetic mutations, and stratify patients based on molecular subtypes.

The adoption of genomic enabled cancer registry software enables oncologists to tailor treatment regimens, optimize therapeutic outcomes, and improve patient survival rates in the country.

The below table highlights how on premise segment is projected to lead the market in terms of deployment model, and is expected to account for a CAGR of 10.3% through 2035. Based on database type, the commercial database segment is expected to account for a CAGR of 10.2% through 2035.

| Category | CAGR through 2035 |

|---|---|

| On Premise | 10.3% |

| Commercial Database | 10.2% |

Based on deployment model, the on premise segment is expected to continue dominating the cancer registry software market. Healthcare organizations prioritize data security and control, particularly when dealing with sensitive patient health information.

The on premise deployment model allows organizations to maintain full control over their data, ensuring compliance with regulatory requirements and internal security policies. Healthcare providers have greater visibility and control over data access, encryption, and authentication mechanisms, with on premise solutions, mitigating the risk of data breaches and unauthorized access.

Many healthcare organizations have invested heavily in existing IT infrastructure, including electronic health record systems, picture archiving and communication systems, and laboratory information management systems. On premise cancer registry software seamlessly integrates with existing infrastructure and legacy systems, facilitating data exchange, interoperability, and workflow integration across disparate systems.

Integration with existing infrastructure streamlines data capture, reduces duplicate data entry, and enhances data consistency and accuracy, optimizing operational efficiency and resource utilization.

In terms of database type, the commercial database segment is expected to continue dominating the cancer registry software market. Commercial databases prioritize data security and compliance with industry regulations and best practices. Database vendors implement advanced security features, including encryption, access controls, auditing, and authentication mechanisms, to protect sensitive cancer registry data from unauthorized access, data breaches, and cyber threats.

Commercial databases support compliance with healthcare data privacy laws, regulatory mandates, and accreditation standards, enhancing the trust and confidence of healthcare organizations in deploying cancer registry software solutions. Commercial databases offer advanced data management capabilities, including data indexing, query optimization, and transaction processing, to streamline data storage, retrieval, and manipulation tasks.

Cancer registry software vendors leverage commercial databases to implement efficient data modeling, normalization, and transformation processes, facilitating the integration of diverse data sources, data cleansing, and data quality assurance initiatives within cancer registry software platforms.

The competitive landscape of the cancer registry software market is characterized by a diverse array of vendors offering solutions designed to streamline data collection, management, analysis, and reporting for cancer registries worldwide. The market is witnessing intense competition fueled by technological advancements, regulatory requirements, and evolving healthcare needs, as the demand for comprehensive cancer surveillance and research continues to grow.

Key Developments

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 87.4 million |

| Projected Market Valuation in 2035 | USD 236.0 million |

| Value-based CAGR 2025 to 2035 | 10.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Deployment Model, Database Type, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | C/NET Solutions; Conduent Inc.; Electronic Registry System Inc.; Elekta; Himagine solutions; IBM Corporation; McKesson Corporation; NeuralFrame, Inc.; Onco Inc.; Ordinal Data Inc.; Rocky Mountain Cancer Data Systems |

The global cancer registry software market is estimated to be valued at USD 96.5 billion in 2025.

The market size for the cancer registry software market is projected to reach USD 259.5 billion by 2035.

The cancer registry software market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in cancer registry software market are cloud based and on premise.

In terms of database type, commercial database segment to command 53.7% share in the cancer registry software market in 2025.

=

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA