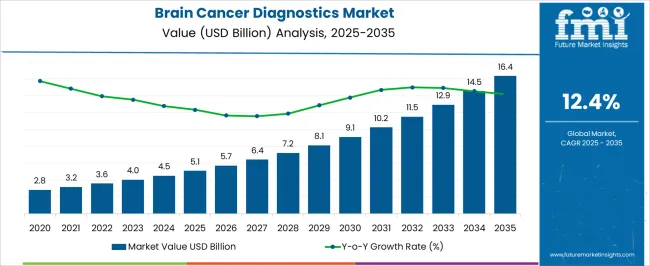

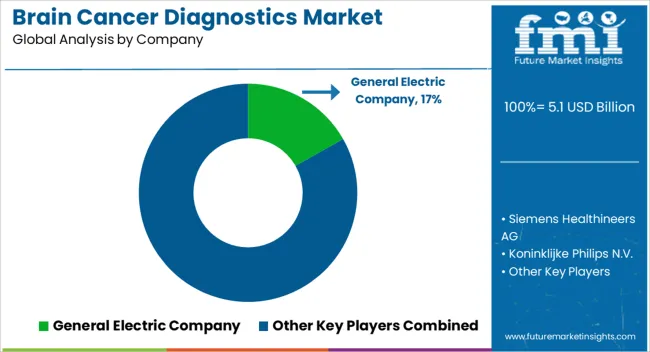

The Brain Cancer Diagnostics Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 16.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.4% over the forecast period.

| Metric | Value |

|---|---|

| Brain Cancer Diagnostics Market Estimated Value in (2025 E) | USD 5.1 billion |

| Brain Cancer Diagnostics Market Forecast Value in (2035 F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 12.4% |

The Brain Cancer Diagnostics market is witnessing steady growth, driven by the rising prevalence of brain tumors and increasing demand for accurate and early diagnosis. Advancements in diagnostic technologies, including imaging, spectroscopy, and molecular profiling, are enabling precise detection and characterization of brain cancers. The integration of advanced software, AI-driven imaging analysis, and high-resolution modalities has enhanced diagnostic accuracy and reduced time to diagnosis.

Growing awareness among healthcare providers and patients regarding early detection benefits is further supporting market expansion. Investments in healthcare infrastructure, particularly in hospitals and specialized oncology centers, are accelerating adoption. Regulatory frameworks emphasizing patient safety, accurate reporting, and standardized diagnostic procedures are shaping the market landscape.

Increasing research in personalized medicine and targeted therapies is also driving the need for precise diagnostic tools As clinical demand for improved treatment outcomes grows, the Brain Cancer Diagnostics market is expected to expand steadily, supported by technological innovations, rising healthcare expenditure, and enhanced clinical expertise in neuro-oncology.

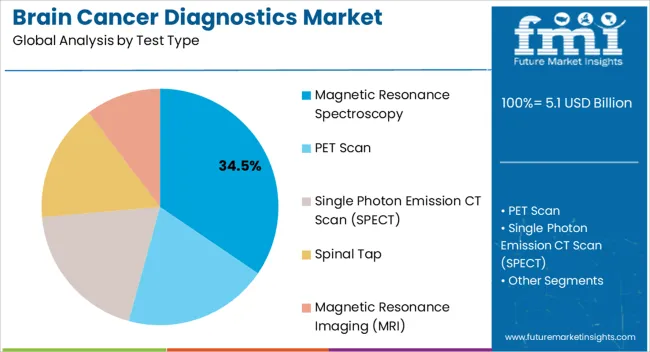

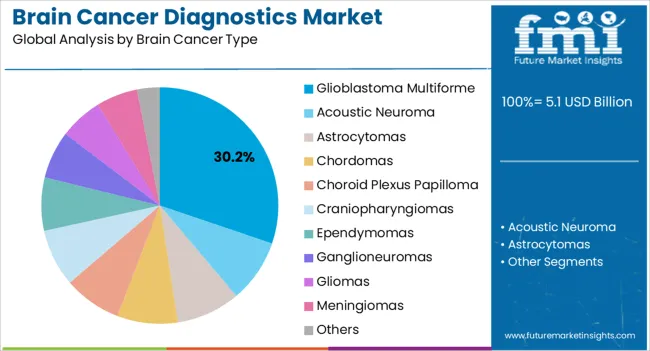

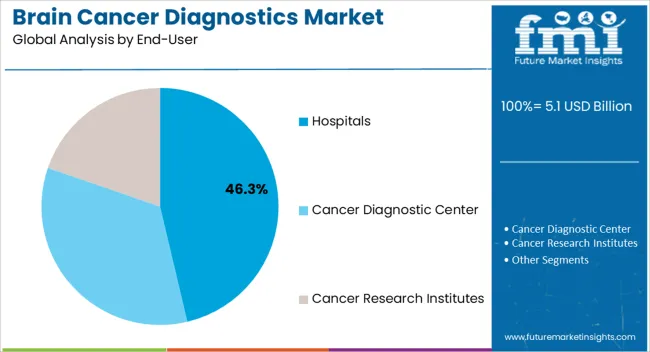

The brain cancer diagnostics market is segmented by test type, brain cancer type, end-user, and geographic regions. By test type, brain cancer diagnostics market is divided into Magnetic Resonance Spectroscopy, PET Scan, Single Photon Emission CT Scan (SPECT), Spinal Tap, and Magnetic Resonance Imaging (MRI). In terms of brain cancer type, brain cancer diagnostics market is classified into Glioblastoma Multiforme, Acoustic Neuroma, Astrocytomas, Chordomas, Choroid Plexus Papilloma, Craniopharyngiomas, Ependymomas, Ganglioneuromas, Gliomas, Meningiomas, and Others. Based on end-user, brain cancer diagnostics market is segmented into Hospitals, Cancer Diagnostic Center, and Cancer Research Institutes. Regionally, the brain cancer diagnostics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The magnetic resonance spectroscopy test type segment is projected to hold 34.5% of the market revenue in 2025, positioning it as the leading test type. Growth in this segment is being driven by its non-invasive nature, high sensitivity, and ability to provide metabolic and chemical information about brain tissue, which is critical for accurate tumor characterization. Magnetic resonance spectroscopy allows clinicians to differentiate between tumor types, monitor progression, and assess treatment response without the need for invasive procedures.

The integration of AI-driven image analysis and enhanced software algorithms has improved precision and reproducibility, making it the preferred choice among hospitals and research centers. Increasing adoption in both clinical and research settings is fueled by growing awareness of its diagnostic advantages over conventional imaging.

Continuous improvements in resolution, signal processing, and workflow integration have strengthened its market position As demand for precise, safe, and efficient diagnostic modalities grows, magnetic resonance spectroscopy is expected to maintain its leadership in brain cancer diagnostics.

The glioblastoma multiforme segment is anticipated to account for 30.2% of the market revenue in 2025, making it the leading brain cancer type. This segment’s growth is being driven by the high prevalence, aggressive nature, and complex treatment requirements associated with glioblastoma multiforme. Accurate and early diagnosis is critical to improving patient outcomes, creating strong demand for advanced diagnostic tools.

Clinicians rely on sophisticated imaging, spectroscopy, and molecular profiling to detect, monitor, and plan personalized treatment strategies for glioblastoma patients. Research into targeted therapies, immunotherapies, and clinical trials has further increased the need for precise and reliable diagnostic methods. Hospitals and specialized oncology centers are adopting advanced diagnostic modalities to support patient management and clinical decision-making.

The high mortality rate, coupled with rising awareness among healthcare providers, ensures that glioblastoma multiforme remains the primary focus of diagnostic development As treatment strategies evolve, the demand for accurate and rapid detection tools in this segment is expected to remain a key driver of market growth.

The hospitals end-user segment is projected to hold 46.3% of the market revenue in 2025, establishing it as the leading end-user category. Growth in this segment is being driven by hospitals’ central role in patient diagnosis, treatment planning, and follow-up care for brain cancer patients. Advanced diagnostic equipment, trained personnel, and integrated oncology departments make hospitals the preferred venue for accurate detection and monitoring.

The adoption of magnetic resonance spectroscopy and other high-precision modalities is facilitated by hospitals’ investment in cutting-edge imaging infrastructure and IT-enabled diagnostic systems. Increasing hospital partnerships with research institutions and clinical trials enhance the utilization of advanced diagnostic technologies. Rising patient awareness, insurance coverage, and demand for timely and accurate diagnosis are further supporting market expansion.

Hospitals also benefit from the ability to offer comprehensive diagnostic services alongside treatment planning, positioning them as the primary end-users As healthcare delivery becomes increasingly technology-driven, hospitals are expected to maintain dominance in the brain cancer diagnostics market.

Brain cancers are the extracellular growth in the brain that includes primary brain tumors, and secondary brain tumors. Primary brain tumors start in the brain and do not spread to other parts of the body while the secondary tumors or metastases are those, which are caused by cancers that began in another part of the body.

Brain tumors may be categorized into 40 major types, which are grouped into two major groups such as benign and slow growing with less possibility to spread and the other type is the malignant and cancerous that is more likely to spread. There are some causes, which results in brain cancer and are more common in people with certain gene factor or hereditary conditions.

Brain cancer can also be caused due to the exposure of very high doses of radiation to head. Brain cancer is most commonly diagnosed through MRI. Other prevalent methods include angiograms, CT scans, diffusion tensor imaging, fMRI, etc. Technological evolution coupled with accelerated demand for faster diagnosis are factors pushing R&D in the brain cancer diagnostics market.

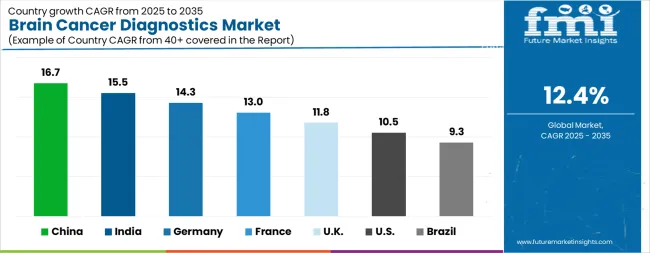

| Country | CAGR |

|---|---|

| China | 16.7% |

| India | 15.5% |

| Germany | 14.3% |

| France | 13.0% |

| UK | 11.8% |

| USA | 10.5% |

| Brazil | 9.3% |

The Brain Cancer Diagnostics Market is expected to register a CAGR of 12.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.7%, followed by India at 15.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.3%, yet still underscores a broadly positive trajectory for the global Brain Cancer Diagnostics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 14.3%. The USA Brain Cancer Diagnostics Market is estimated to be valued at USD 1.8 billion in 2025 and is anticipated to reach a valuation of USD 5.0 billion by 2035. Sales are projected to rise at a CAGR of 10.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 253.2 million and USD 158.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Test Type | Magnetic Resonance Spectroscopy, PET Scan, Single Photon Emission CT Scan (SPECT), Spinal Tap, and Magnetic Resonance Imaging (MRI) |

| Brain Cancer Type | Glioblastoma Multiforme, Acoustic Neuroma, Astrocytomas, Chordomas, Choroid Plexus Papilloma, Craniopharyngiomas, Ependymomas, Ganglioneuromas, Gliomas, Meningiomas, and Others |

| End-User | Hospitals, Cancer Diagnostic Center, and Cancer Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | General Electric Company, Siemens Healthineers AG, Koninklijke Philips N.V., Canon Medical Systems Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., QIAGEN N.V., Illumina, Inc., Abbott Laboratories, and Agilent Technologies, Inc. |

The global brain cancer diagnostics market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the brain cancer diagnostics market is projected to reach USD 16.4 billion by 2035.

The brain cancer diagnostics market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in brain cancer diagnostics market are magnetic resonance spectroscopy, pet scan, single photon emission ct scan (spect), spinal tap and magnetic resonance imaging (mri).

In terms of brain cancer type, glioblastoma multiforme segment to command 30.2% share in the brain cancer diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Brain Fitness Market Size and Share Forecast Outlook 2025 to 2035

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Brain Metastasis Therapeutics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Brain Implants Market Size and Share Forecast Outlook 2025 to 2035

Brain Imaging and Neuroimaging Market Size and Share Forecast Outlook 2025 to 2035

Brain Health Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brain Tumor Treatment Market Analysis-- Size and Share Forecast Outlook 2025 to 2035

Brain Biomarker Market Trends and Forecast 2025 to 2035

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Brain Mint Market Analysis by Functionality, Consumer Orientation, Sales Channel and Region Through 2035

Brain Monitoring Systems Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Brain Fingerprinting Technology Market

Deep Brain Stimulator Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Brain Health Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Auditory Brainstem Response Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Wireless Brain Sensors Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA