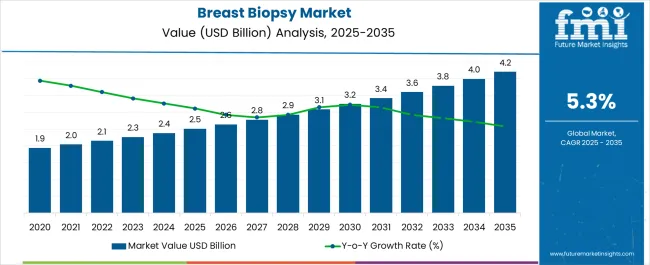

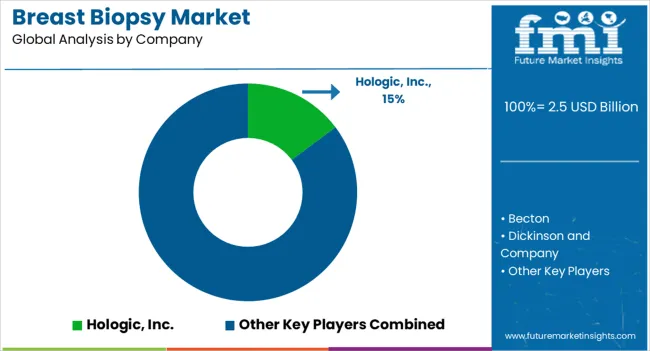

The Breast Biopsy Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Breast Biopsy Market Estimated Value in (2025 E) | USD 2.5 billion |

| Breast Biopsy Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The breast biopsy market is witnessing consistent expansion, driven by rising global incidence of breast cancer and the growing emphasis on early detection and accurate diagnosis. Increasing patient awareness, improved access to screening programs, and the availability of minimally invasive diagnostic tools are influencing demand patterns. Technological advancements in imaging-guided biopsy procedures, including ultrasound, MRI, and stereotactic techniques, are improving accuracy while reducing procedural risks, which is further supporting adoption.

Hospitals and specialized diagnostic centers are expanding investments in advanced biopsy equipment to ensure precision in both detection and tissue characterization. Regulatory frameworks across regions are also placing greater importance on early-stage detection to improve survival rates, which in turn is driving the integration of advanced biopsy solutions into clinical practice.

As global healthcare infrastructure strengthens and demand for accurate, patient-friendly diagnostic methods continues to grow, the breast biopsy market is positioned for sustained progress The increasing development of targeted therapies and personalized medicine strategies further underscores the importance of accurate biopsy procedures as a critical diagnostic foundation.

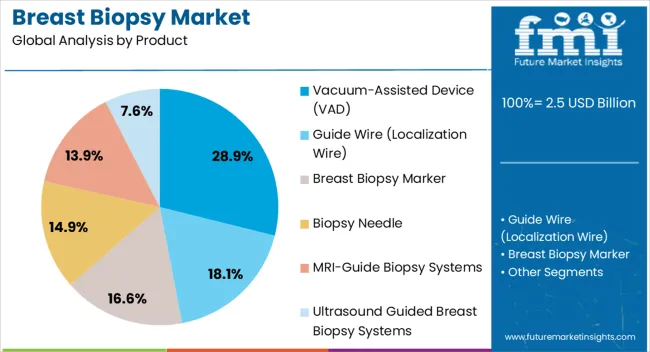

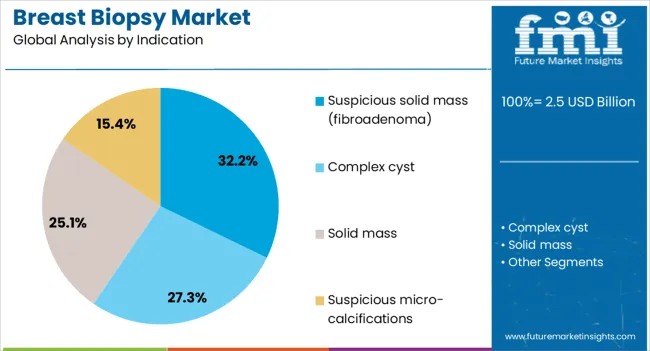

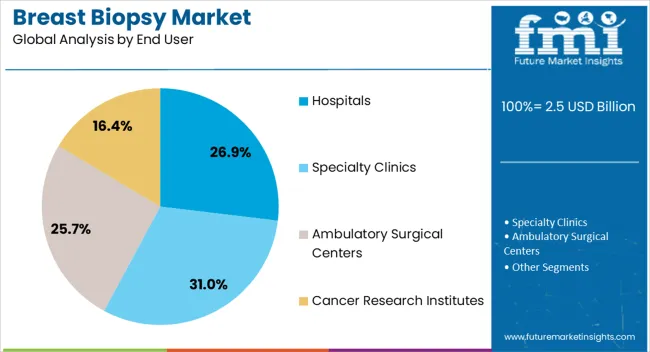

The breast biopsy market is segmented by product, indication, end user, and geographic regions. By product, breast biopsy market is divided into Vacuum-Assisted Device (VAD), Guide Wire (Localization Wire), Breast Biopsy Marker, Biopsy Needle, MRI-Guide Biopsy Systems, and Ultrasound Guided Breast Biopsy Systems. In terms of indication, breast biopsy market is classified into Suspicious solid mass (fibroadenoma), Complex cyst, Solid mass, and Suspicious micro-calcifications. Based on end user, breast biopsy market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Cancer Research Institutes. Regionally, the breast biopsy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vacuum-assisted device segment is projected to account for 28.9% of the breast biopsy market revenue share in 2025, making it the leading product category. Its adoption is being driven by the ability to collect larger and higher-quality tissue samples in a single insertion, which improves diagnostic accuracy and reduces the need for repeat procedures. Minimally invasive characteristics, shorter procedure times, and reduced scarring are increasing patient preference for this device type.

Healthcare providers are adopting vacuum-assisted devices due to their capability to support both diagnosis and small lesion removal, thereby offering dual clinical utility. Continuous advancements in device design, including enhanced needle systems and compatibility with imaging guidance, are reinforcing their use in complex diagnostic scenarios.

Cost-effectiveness in terms of reducing repeat biopsies and hospital stays is also contributing to the segment’s leadership As demand for precision medicine and early diagnosis accelerates, vacuum-assisted devices are expected to remain at the forefront of breast biopsy product innovation and adoption.

The suspicious solid mass indication segment, particularly fibroadenoma, is expected to represent 32.2% of the breast biopsy market revenue share in 2025, establishing it as the leading indication area. This dominance is being reinforced by the high prevalence of fibroadenomas, especially among younger women, and the necessity of biopsy to confirm benignity and rule out malignancy. The segment benefits from the widespread recommendation of tissue sampling for suspicious solid masses, as imaging alone may not provide sufficient diagnostic clarity.

The ability of modern biopsy techniques to provide rapid, minimally invasive, and reliable results is driving their application in this indication. Increased awareness and participation in routine screening programs are leading to the early detection of fibroadenomas, further expanding demand.

Clinicians favor advanced biopsy systems that minimize patient discomfort while maximizing diagnostic confidence, thereby strengthening the adoption of biopsy procedures for this segment With continued focus on early and accurate detection, suspicious solid masses remain a leading driver of procedural volume in the breast biopsy market.

The hospitals segment is anticipated to hold 26.9% of the breast biopsy market revenue share in 2025, positioning it as the dominant end-user category. Its leadership is being supported by the availability of advanced imaging and biopsy equipment within hospital settings, which enables comprehensive diagnostic and treatment services under one roof. Hospitals serve as primary centers for cancer screening, diagnosis, and treatment, creating higher patient inflows for biopsy procedures.

Investments in technologically advanced biopsy systems, coupled with specialized oncology departments, are reinforcing the role of hospitals as the preferred setting for accurate diagnosis. The ability to integrate biopsy procedures with surgical and therapeutic interventions is also driving reliance on hospitals for breast cancer management.

Increasing government and private healthcare spending, particularly in developing regions, is strengthening hospital infrastructure and improving access to diagnostic technologies As the demand for precision diagnostics and multidisciplinary cancer care continues to rise, hospitals are expected to maintain their dominant share in the breast biopsy market.

The North American region commands the largest market share for breast biopsy, followed by Europe. The breast biopsy market growth in the North American region is aided by the rising incidences of breast cancer and the rising demand for non-invasive treatments.

The European market for breast biopsy is anticipated to grow profitably during the anticipated period. The market for breast biopsy is expected to grow as a result of rising government spending on research studies into breast cancer and the adoption of technologically advanced treatments.

Due to their developing healthcare infrastructure, the regions of Latin America, the Middle East, and Africa are currently experiencing a period of rapid growth.

The huge rise in women's susceptibility to mammary cancer, along with screenings and awareness campaigns launched in their favor, are driving the growth of the breast biopsy market. Furthermore, minimally invasive and the development of more accurate treatments for the early detection of breast cancer have benefited to broad and active research environment for breast biopsy. The increasing incidence of breast cancer worldwide and the fact that they are the least invasive procedure will expand market expansion.

Additionally, favorable reimbursements policy and various initiatives taken by the government are increasing the adoption of breast biopsy, which is expected to propel the market in the upcoming year.

In the breast biopsy market, the North American region holds the highest market share followed by Europe. The increasing demand for non-invasive treatment and rising incidences of breast cancer will boost the market growth in the North American region.

The European market is expected to show lucrative growth in the forecasted period.

Government investment in breast cancer research studies is increasing as well as the adoption of technologically advanced treatment is anticipated to propel the breast biopsy market. Latin America, the Middle East, and Africa regions are at a blossoming stage and are expected to show sustainable growth in the near future, owing to the developing healthcare infrastructure.

Hologic, Inc., Becton, Dickinson, and Company, Danaher Corporation, Merit Medical Systems, Medtronic, IZI Medical Products, Argon Medical, STERYLAB S.r.l., Scion Medical Technologies LLC, QIAGEN, Biocept Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd.

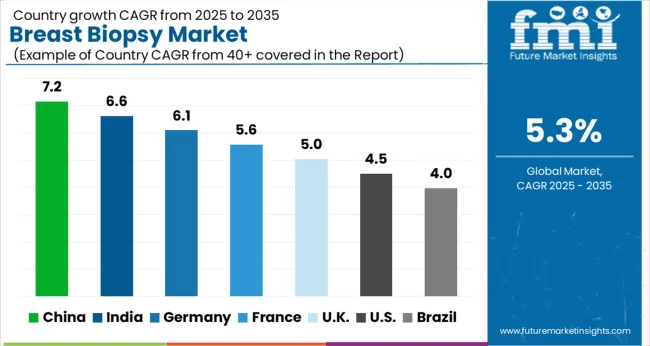

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The Breast Biopsy Market is expected to register a CAGR of 5.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.2%, followed by India at 6.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.0%, yet still underscores a broadly positive trajectory for the global Breast Biopsy Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.1%. The USA Breast Biopsy Market is estimated to be valued at USD 858.4 million in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 128.4 million and USD 83.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Product | Vacuum-Assisted Device (VAD), Guide Wire (Localization Wire), Breast Biopsy Marker, Biopsy Needle, MRI-Guide Biopsy Systems, and Ultrasound Guided Breast Biopsy Systems |

| Indication | Suspicious solid mass (fibroadenoma), Complex cyst, Solid mass, and Suspicious micro-calcifications |

| End User | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, and Cancer Research Institutes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hologic, Inc., Becton, Dickinson and Company, Danaher Corporation, Merit Medical Systems, Medtronic, IZI Medical Products, Argon Medical, STERYLAB S.r.l., Scion Medical Technologies LLC, QIAGEN, Biocept Inc., Bio-Rad Laboratories, Inc., and F. Hoffmann-La Roche Ltd. |

The global breast biopsy market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the breast biopsy market is projected to reach USD 4.2 billion by 2035.

The breast biopsy market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in breast biopsy market are vacuum-assisted device (vad), guide wire (localization wire), breast biopsy marker, biopsy needle, _core needles, _fine aspiration needles, mri-guide biopsy systems, ultrasound guided breast biopsy systems, _two-dimensional (2-d) mammographic ultrasonic scanning systems and _three-dimensional (3-d) b-mode mammographic ultrasonic scanning systems.

In terms of indication, suspicious solid mass (fibroadenoma) segment to command 32.2% share in the breast biopsy market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA