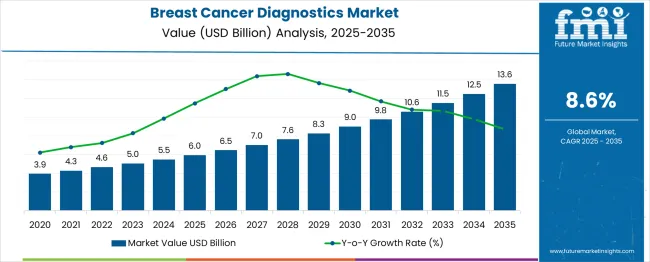

The global breast cancer diagnostics market is expected to reach USD 6 billion in 2025 and is anticipated to expand to USD 13.6 billion by 2035, expanding at a CAGR of 8.6% and an absolute increase of USD 7.6 billion over the forecast period. The year-on-year (YoY) growth pattern shows steady increments, starting from USD 6 billion in 2025, rising to USD 6.8 billion in 2026, USD 7.5 billion in 2027, USD 8.1 billion in 2028, USD 8.7 billion in 2029, and reaching USD 9.2 billion by 2030. The market expansion during this phase is largely influenced by growing awareness of breast cancer risks, the rising prevalence of the disease, and increasing adoption of early detection programs in both developed and emerging healthcare systems.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 6 billion |

| Forecast Value in (2035F) | USD 13.6 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

Early-stage growth from 2025 to 2030 will also be shaped by rising investments in digital pathology, molecular imaging, and liquid biopsy technologies, which allow for more accurate and rapid breast cancer detection. The introduction of high-sensitivity mammography systems, MRI-guided biopsy techniques, and advanced biomarker panels is expected to enhance diagnostic precision and reduce false-negative rates. Emerging markets, particularly in Asia-Pacific and Latin America, are likely to contribute significantly to market expansion due to increasing healthcare infrastructure, rising disposable incomes, and greater adoption of screening programs. In addition, awareness campaigns and government-led initiatives promoting preventive health check-ups are expected to drive patient demand for advanced diagnostics.

The historical growth trajectory between 2020 and 2025 set the foundation for long-term market expansion, with revenues increasing steadily from USD 4.5 billion in 2020 to USD 6 billion in 2025. This period witnessed the adoption of innovative diagnostic techniques such as molecular assays, AI-enabled imaging, and automated screening platforms. Increasing collaboration between hospitals, diagnostic labs, and research institutes supported the proliferation of early detection programs. Reimbursement support for advanced diagnostic tests and a rising focus on preventive healthcare contributed to market penetration. The breast cancer diagnostics market is anticipated to continue on a robust growth path, with YoY growth supported by technological innovations, personalized medicine adoption, and expanding healthcare accessibility across regions globally.

Market expansion is being supported by the increasing incidence of breast cancer worldwide and the corresponding demand for effective diagnostic solutions. Modern healthcare systems are increasingly focused on early detection strategies that can significantly improve treatment outcomes and patient survival rates. Advanced diagnostic technologies, including digital mammography, MRI, ultrasound, and molecular testing, are enabling more accurate and earlier detection of breast cancer, driving adoption across healthcare facilities.

The growing focus on personalized medicine and precision oncology is driving demand for sophisticated diagnostic tools that can provide detailed tumor characterization and treatment guidance. Healthcare providers are increasingly adopting comprehensive diagnostic approaches that combine imaging, biopsy, and molecular testing to develop optimal treatment strategies. The rising influence of government screening programs and healthcare awareness campaigns is also contributing to increased diagnostic testing volumes across different demographics and geographic regions.

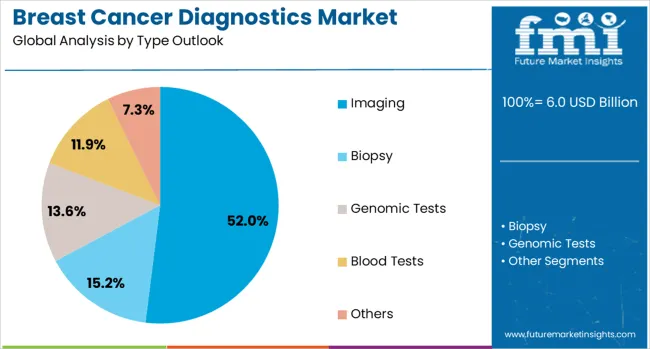

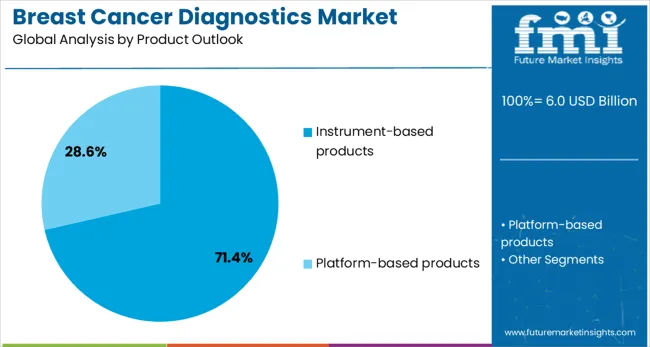

The market is segmented by type outlook, product outlook, application outlook, end use outlook, and region. By type outlook, the market is divided into imaging, biopsy, genomic tests, blood tests, and others. Based on product outlook, the market is categorized into instrument-based products and platform-based products. In terms of application outlook, the market is segmented into diagnostic & predictive, prognostic, research, and screening. By end use outlook, the market is classified into hospitals & clinics, medical labs & diagnostics centers, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The imaging segment is projected to account for 52% of the breast cancer diagnostics market in 2025, reaffirming its position as the primary diagnostic modality for breast cancer detection and monitoring. Healthcare providers increasingly rely on advanced imaging technologies including digital mammography, breast MRI, ultrasound, and tomosynthesis for comprehensive breast cancer screening and diagnosis. These imaging modalities provide non-invasive, detailed visualization of breast tissue, enabling early detection of suspicious lesions and accurate tumor characterization.

This segment forms the foundation of most breast cancer diagnostic workflows, as imaging serves as the initial screening tool and guides subsequent diagnostic procedures. Technological advancements in imaging resolution, contrast enhancement, and AI-assisted interpretation continue to improve diagnostic accuracy and reduce false positive rates. With expanding screening programs and growing awareness about early detection benefits, imaging maintains its dominant position as the most widely adopted and trusted breast cancer diagnostic approach across healthcare systems globally.

Instrument-based products are projected to represent 71% of breast cancer diagnostics demand in 2025, underscoring their role as the primary hardware foundation for diagnostic procedures. Healthcare facilities invest heavily in advanced diagnostic instruments including mammography systems, MRI machines, ultrasound devices, biopsy equipment, and molecular testing platforms, to provide comprehensive breast cancer diagnostic services. These instruments offer precision, reliability, and advanced technological capabilities essential for accurate cancer detection and characterization.

The segment is supported by continuous technological innovations that enhance diagnostic capabilities, improve workflow efficiency, and provide better patient experiences. Healthcare providers prioritize instrument upgrades and expansions to maintain competitive diagnostic capabilities and meet growing patient volumes. As diagnostic complexity increases and precision medicine approaches expand, instrument-based products continue to dominate market investment, reinforcing their critical role in delivering advanced breast cancer diagnostic solutions across diverse healthcare settings.

The diagnostic & predictive application is forecasted to contribute 49% of the breast cancer diagnostics market in 2025, reflecting the fundamental importance of accurate cancer detection and treatment prediction in clinical practice. Healthcare providers rely on comprehensive diagnostic approaches that not only identify the presence of breast cancer but also predict treatment responses and patient outcomes. This application encompasses initial cancer detection, staging, tumor characterization, and predictive biomarker testing that guides personalized treatment decisions.

The segment benefits from advancing molecular diagnostics and companion diagnostic tests that enable precision medicine approaches. Healthcare systems increasingly adopt integrated diagnostic workflows that combine imaging, tissue analysis, and molecular testing to provide comprehensive patient assessment. With growing focus on personalized treatment strategies and improved patient outcomes, diagnostic & predictive applications serve as the cornerstone of modern breast cancer care, driving demand for sophisticated diagnostic technologies and testing methodologies.

The breast cancer diagnostics market is advancing rapidly due to increasing cancer incidence rates, technological innovations in diagnostic imaging, and growing focus on early detection programs. The market faces challenges including high equipment costs, reimbursement limitations, and the need for specialized healthcare expertise. Innovation in artificial intelligence applications and molecular diagnostics continue to influence product development and market expansion patterns.

The growing integration of artificial intelligence and machine learning technologies is revolutionizing breast cancer diagnostic accuracy and efficiency. AI algorithms enhance image interpretation, reduce diagnostic errors, and support radiologists in detecting subtle abnormalities that might be missed in conventional screening. These technologies enable automated screening workflows, improve diagnostic consistency, and facilitate earlier detection of cancer cases, particularly in high-volume screening programs.

Modern breast cancer diagnostic manufacturers are developing advanced minimally invasive techniques including liquid biopsies, circulating tumor DNA testing, and image-guided precision biopsy systems. These technologies reduce patient discomfort, minimize procedural risks, and provide accurate tissue sampling for molecular analysis. Advanced diagnostic approaches also enable real-time monitoring of treatment responses and disease progression through less invasive testing methods.

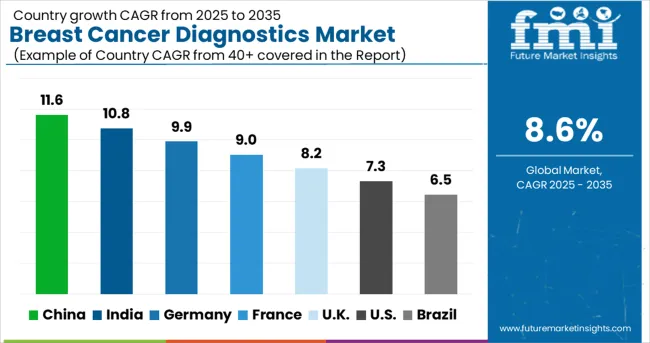

| Countries | CAGR (2025-2035) |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

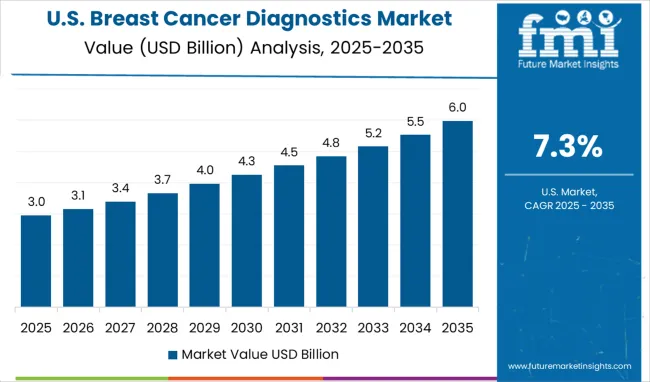

The global breast cancer diagnostics market is projected to grow at a CAGR of 9% between 2025 and 2035. China leads this expansion with an 11.6% CAGR, driven by increasing cancer prevalence, expanding screening programs, and adoption of advanced diagnostic technologies. India follows at 10.8%, supported by rising awareness of early detection, growth in healthcare infrastructure, and accessibility to modern diagnostic tools. Germany shows growth at 9.9%, emphasizing advanced imaging technologies and precision diagnostics. France records 9%, fueled by adoption of molecular diagnostics and targeted screening initiatives. The UK grows at 8.2%, focusing on national screening programs and high-quality diagnostic services. The USA stands at 7.3%, reflecting steady demand for innovative diagnostics and personalized cancer care, while Brazil follows at 6.5%, influenced by expanding healthcare access and government-led screening initiatives.

The analysis covers over 40 countries, highlighting key markets and regional consumption patterns.

The breast cancer diagnostics market in China is forecasted to grow at a CAGR of 11.6% from 2025 to 2035. Advanced imaging modalities such as digital mammography and tomosynthesis are being adopted more widely, especially in urban medical centers and large oncology hospitals. Molecular diagnostics and genetic testing are gaining traction as awareness increases and insurance coverage expands. Mobile screening units are being used in rural provinces to improve early detection rates. Local biotech firms are investing in developing diagnostic kits tailored to regional genetic variations. Regulatory reforms are facilitating faster approval of diagnostic technologies. Partnerships between hospital networks and diagnostic companies are improving sample logistics and reporting timeliness. Patient education and community awareness campaigns are also increasing demand for routine screening.

In India, the breast cancer diagnostics market is expected to grow at a CAGR of 10.8% from 2025 to 2035. Government and non-profit screening programs are scaling up in major states to detect breast cancer earlier, especially among women in rural and semi-urban areas. Diagnostic centres are adding ultrasound and MRI capacity to complement mammography in dense-breasted populations. Local manufacturers and lab networks are developing low-cost diagnostic kits to make tests more affordable. Genetic risk assessment services are emerging in metropolitan regions. Training of radiologists and technicians is being emphasized to maintain quality in interpretations. Public health campaigns are helping reduce stigma and encourage women to seek screening. Private payers are increasingly covering advanced diagnostics as part of broader cancer care packages.

In the United States, the breast cancer diagnostics market is projected to grow at a CAGR of 7.3% from 2025 to 2035. Personalized diagnostic pathways combining imaging, genetic testing, and biomarker panels are becoming more common. Private insurers and Medicare are increasingly covering diagnostic tests that guide therapy, such as HER2, BRCA mutation assays, and multigene panels. Technological advances in imaging, AI, and liquid biopsy are driving early detection and precision monitoring. Diagnostic service providers are offering faster turnaround times and patient-friendly sample collection methods. Regulatory agencies are updating guidance to accommodate diagnostic accuracy standards in AI diagnostics. Awareness of disparity and access issues is prompting mobile screening and telehealth diagnostic consultations in underserved communities.

Germany breast cancer diagnostics market is projected to expand at a CAGR of 9.9% from 2025 to 2035. Health systems are adopting precision diagnostics that combine imaging, pathology, and molecular profiling. Diagnostic laboratories are standardizing biomarker testing (e.g., HER2, hormone receptors) with high reproducibility. Referrals to specialized diagnostic centers are increasing for difficult cases. Private and public payers are evaluating value of multi-modality diagnostics and genetic panels. Technological improvements in image processing, AI-assisted mammogram reading, and liquid biopsy are being integrated. Regulatory oversight ensures test accuracy and safety. Patients are more often demanding minimally invasive diagnostics and faster turnaround times.

The United Kingdom breast cancer diagnostics market is anticipated to grow at a CAGR of 8.2% from 2025 to 2035. Imaging services are incorporating AI-assisted tools for mammography and ultrasound to improve detection rates and reduce false positives. National screening programs are refining risk stratification to target higher-risk populations. Diagnostic labs are scaling genomic assays and liquid biopsies for early detection and monitoring. Regulatory frameworks are adapting to evaluate and certify AI tools. Collaboration between NHS entities and private diagnostics firms is enhancing capacity and access. Patient awareness campaigns are helping more women to participate in regular screening schedules. Implementation of digital reporting systems is improving communication of diagnostic results.

France is forecast to see the breast cancer diagnostics market grow at a CAGR of 9% from 2025 to 2035. Government health policy is pushing for universal screening coverage and reducing disparities in diagnostic access across regions. Imaging centers are being upgraded and distributed to improve geographic reach. Molecular diagnostics and genetic risk scoring are more likely to be included in national care pathways. Reimbursement policies are evolving to support modern diagnostic techniques. Diagnostic labs are working to reduce test turnaround time through workflow optimization. Patient advocacy groups are influencing policy to ensure timely follow-ups after screening. Clinical guidelines are being updated to recommend multimodal diagnostic approaches for higher-risk patients.

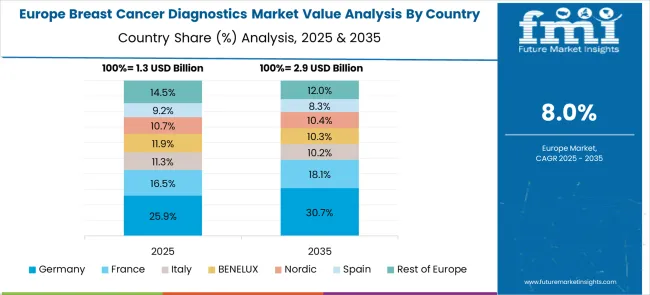

The breast cancer diagnostics market in Europe demonstrates mature development across major economies with Germany showing a strong presence through its advanced healthcare infrastructure and comprehensive cancer screening programs, supported by healthcare systems leveraging cutting-edge diagnostic technologies to provide effective breast cancer detection and monitoring services that improve patient outcomes and survival rates across diverse patient populations.

France represents a significant market driven by its robust healthcare system and sophisticated approach to cancer care, with healthcare providers implementing comprehensive breast cancer diagnostic protocols that combine advanced imaging technologies with molecular testing to deliver personalized diagnostic and treatment guidance for improved patient management and clinical outcomes.

The UK exhibits considerable growth through its National Health Service screening programs and focus on evidence-based diagnostic practices, with healthcare facilities adopting advanced breast cancer diagnostic technologies and standardized screening protocols that ensure consistent, high-quality cancer detection and monitoring services across diverse patient populations and geographic regions.

Italy and Spain show expanding adoption of advanced diagnostic technologies, particularly in comprehensive breast cancer screening programs and precision medicine applications. BENELUX countries contribute through their focus on innovative healthcare technologies and integrated diagnostic approaches, while Eastern Europe and Nordic regions display growing potential driven by healthcare infrastructure development and expanding access to advanced breast cancer diagnostic solutions across diverse healthcare settings.

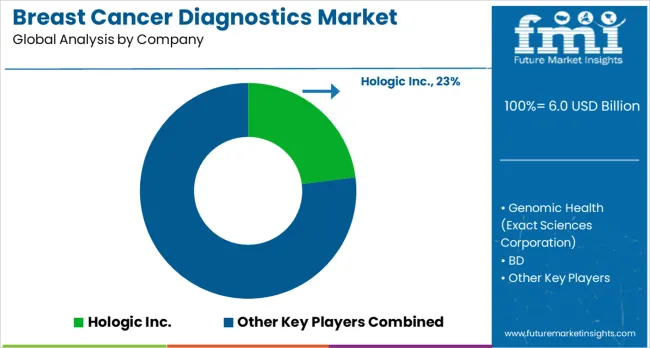

The breast cancer diagnostics market is defined by competition among imaging specialists, molecular testing innovators, and integrated diagnostics providers. Companies focus on early detection, assay sensitivity, and workflow integration to capture clinical and research adoption. Focus is placed on accuracy, reproducibility, and ease of use across hospital laboratories, diagnostic centers, and oncology clinics. Strategic partnerships, regulatory approvals, and technology-driven product portfolios shape market positioning.

HOLOGIC leads with advanced digital mammography and tomosynthesis systems. Product brochures highlight high-resolution imaging, fast acquisition, and workflow efficiency for screening programs. Genomic Health, part of Exact Sciences Corporation, drives adoption of genomic assays for treatment decision support. Tests focus on recurrence risk, personalized therapy planning, and clinical outcome improvement. BD provides biopsy and sample collection systems, enhancing laboratory workflows and supporting precise tissue sampling. Danaher offers a broad range of molecular and immunohistochemistry solutions through its subsidiaries, catering to early detection and monitoring needs.

Koninklijke Philips N.V. emphasizes AI-assisted imaging platforms for higher diagnostic confidence and workflow automation. QIAGEN delivers PCR-based molecular testing and companion diagnostics for precision oncology. Thermo Fisher Scientific Inc. provides immunohistochemistry, molecular, and genomic solutions, supported by research collaborations and global distribution. Argon Medical Devices, Inc. specializes in minimally invasive biopsy tools for targeted sampling. Myriad Genetics offers hereditary cancer testing and risk assessment panels, enhancing preventive care strategies. F. Hoffmann-La Roche Ltd. integrates automated laboratory systems with immunohistochemistry and molecular assays, addressing hospital and centralized lab requirements.

Market strategies revolve around clinical validation, personalized testing, and operational efficiency. Differentiation is achieved through proprietary biomarkers, AI-enhanced platforms, and seamless integration with diagnostic workflows. Product brochures highlight technological innovation, high sensitivity, reproducibility, and user-centric design. Expansion into point-of-care settings, partnerships with oncology networks, and continuous innovation in assay development drive global competitive dynamics across North America, Europe, and Asia-Pacific.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 6 billion |

| Type Outlook | Imaging, Biopsy, Genomic Tests, Blood Tests, Others |

| Product Outlook | Instrument-based products, Platform-based products |

| Application Outlook | Diagnostic & Predictive, Prognostic, Research, Screening |

| End Use Outlook | Hospitals & Clinics, Medical labs & Diagnostics Centers, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | HOLOGIC, Genomic Health (Exact Sciences Corporation), BD, Danaher, Koninklijke Philips N.V., QIAGEN, Thermo Fisher Scientific, Argon Medical Devices Inc., Myriad Genetics, and F. Hoffmann-La Roche Ltd. |

| Additional Attributes | Dollar sales by diagnostic technology and testing methodology, regional demand trends, competitive landscape, healthcare provider preferences for integrated versus standalone solutions, integration with AI-powered diagnostic platforms, innovations in molecular diagnostics, minimally invasive testing approaches, and personalized medicine applications |

The global breast cancer diagnostics market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the breast cancer diagnostics market is projected to reach USD 13.6 billion by 2035.

The breast cancer diagnostics market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in breast cancer diagnostics market are imaging, biopsy, genomic tests, blood tests and others.

In terms of product outlook, instrument-based products segment to command 71.4% share in the breast cancer diagnostics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

ESR1 Mutated Metastatic Breast Cancer Diagnostics Market - Growth & Forecast 2025 to 2035

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Devices Market Analysis - Innovations & Forecast 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA