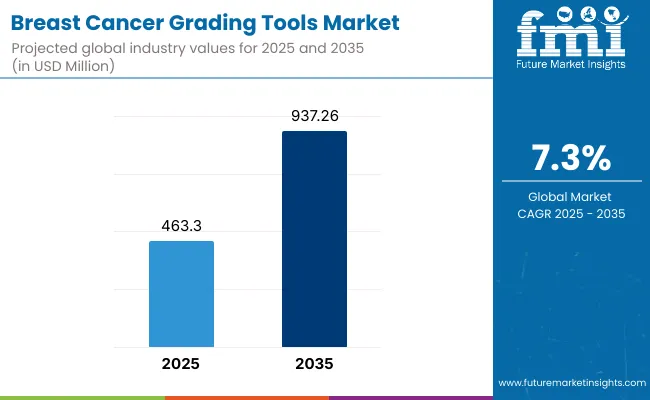

The global Breast Cancer Grading Tools Market is projected to reach a valuation of USD 463.3 million by 2025 and USD 937.26 million by 2035. This indicates a decade-long increase of USD 473.96 million between 2025 and 2035. The market is expected to expand at a compound annual growth rate (CAGR) of 7.3%, representing a 2.0X increase over the ten-year period.

| Metric | Value |

|---|---|

| Global Market Estimated Value (2025E) | USD 463.3 million |

| Global Market Forecast Value (2035F) | USD 937.26 million |

| Forecast CAGR (2025 to 2035) | 7.3% |

During the first five-year period from 2025 to 2030, the global Breast Cancer Grading Tools Market is projected to expand significantly, reflecting the increasing emphasis on early-stage cancer diagnosis, personalized treatment planning, and integration of molecular diagnostics.

The total market size is expected to grow from approximately USD 463.3 million in 2025 to around USD 659.0 million by 2030, adding USD 195.7 million in market value.The Nottingham Grading System will remain the dominant segment, holding approximately 65.1% share of the market by 2030, supported by its widespread clinical acceptance, standardization across pathology labs, and proven prognostic value.

In the second half of the decade from 2030 to 2035, the global Breast Cancer Grading Tools Market is projected to gain further momentum, with the market value rising from USD 659.0 million in 2030 to approximately USD 937.26 million by 2035.

This growth amounting to USD 278.26 million is fueled by the rising integration of grading tools into precision oncology workflows, expansion of digital pathology platforms, and increased adoption in both developed and emerging healthcare systems.

The demand is expected to surge across multiple end-user environments, including hospitals, diagnostic imaging centers, and cancer research institutes, as these facilities increasingly prioritize standardized grading systems and molecular diagnostics to support personalized treatment strategies and improve patient outcomes.

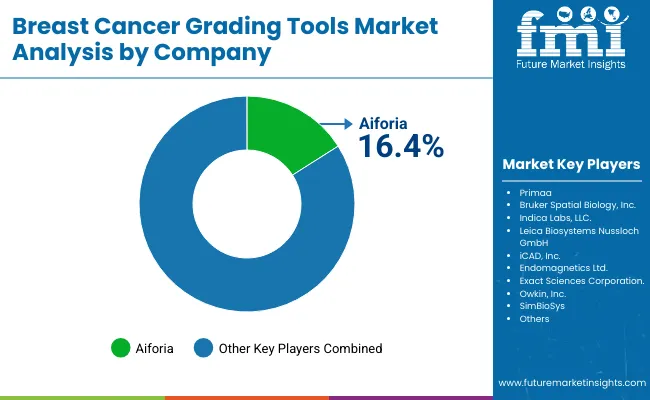

From 2020 to 2024, the global Breast Cancer Grading Tools Market grew from USD 315.6 million to USD 434.6 million. Leading companies such as Aiforia account for approximately 16.4% of the global market share, with the remaining 83.6% distributed among other players.

These market leaders gained early traction through the development of AI-powered digital pathology solutions, integration of molecular grading tools, and focused deployments in academic cancer centers, hospitals, and diagnostic laboratories across North America and Europe.

In 2025, the global Breast Cancer Grading Tools Market is projected to reach a value of approximately USD 463.3 million, driven by a growing shift towards precision oncology and the adoption of advanced histopathological and molecular grading tools. This transition reflects increasing demand for accurate tumor grading to guide personalized treatment decisions and improve patient outcomes.

Market growth will be accelerated by rising investments from healthcare systems and cancer research institutes in digital pathology platforms and AI-enabled diagnostics. Hospitals and cancer treatment centers are increasingly deploying breast cancer grading tools especially the Nottingham Grading System and molecular assays to support early detection, risk stratification, and tailored therapeutic strategies, particularly in regions with high breast cancer prevalence.

The Breast Cancer Grading Tools Market is experiencing rapid growth as healthcare systems worldwide strive to improve the accuracy of breast cancer diagnosis and support personalized treatment planning. Key drivers include the increasing prevalence of breast cancer, rising demand for standardized and precise tumor grading systems, and advances in AI-powered digital pathology platforms.

The global focus on early detection and molecular profiling is accelerating adoption, alongside growing investments in cancer diagnostic infrastructure. Stringent clinical guidelines and the shortage of skilled pathologists are prompting hospitals, diagnostic centers, and research institutes to integrate intelligent grading tools such as the Nottingham Grading System and molecular assays like Oncotype DX and MammaPrint.

Innovations including AI-assisted histopathological image analysis, automated tumor grading, and seamless integration with electronic health records (EHRs) are helping reduce variability in diagnosis, minimize human error, and enhance clinical workflow efficiency. These advancements are particularly critical in high-volume clinical settings such as hospitals and cancer centers, where precise grading directly impacts treatment decisions and patient outcomes.

The market is segmented by tools, tumor grade,cancer type, end user, and region. Tools include Nottingham Grading System, Bloom-Richardson Grading System,andMolecular Grading Tools. Tumor Grade classification covers Grade 1, Grade 2, and Grade 3.Cancer Type includes, Invasive Ductal Carcinoma, Invasive Lobular Carcinoma, Tubular, mucinous, and others.

Based on End User, the segmentation includes Hospitals & Clinics, Diagnostic & Imaging Centers, Cancer Research Institutes & Labs, and others.Regionally, the scope spans North America, Latin America, Western and Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

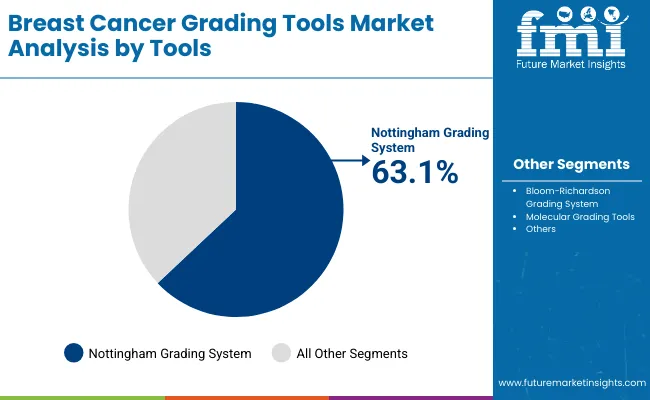

The Nottingham Grading System is projected to hold a dominant share of 63.1% in the global Breast Cancer Grading Tools Market in 2025, driven by its standardized methodology, ease of use in routine clinical settings, and long-standing validation across diverse patient populations.

Its widespread adoption is underpinned by the growing demand for reproducible, cost-effective grading solutions that support treatment planning and prognostic assessment. Used extensively in hospitals, cancer centers, and pathology labs, the Nottingham system provides clear classification based on tubule formation, nuclear pleomorphism, and mitotic count ensuring consistent interpretation even in high-throughput environments.

As healthcare systems increasingly prioritize early-stage diagnosis and personalized oncology, the Nottingham system remains a critical tool in frontline diagnostic workflows. Its compatibility with digital pathology platforms and emerging AI-based image analysis tools further enhances diagnostic precision while reducing inter-observer variability.

Moreover, the growing deployment of this system in emerging markets where molecular tools may be cost-prohibitive continues to reinforce its market dominance. Supportive clinical guidelines, low implementation costs, and strong integration within pathology training curricula have solidified the Nottingham Grading System’s position as the gold standard for tumor grading in both developed and developing economies.

| Tools | Market Share (%) |

|---|---|

| Nottingham Grading System | 63.1% |

| Bloom-Richardson Grading System | 7.2% |

| Molecular Grading Tools | 29.7% |

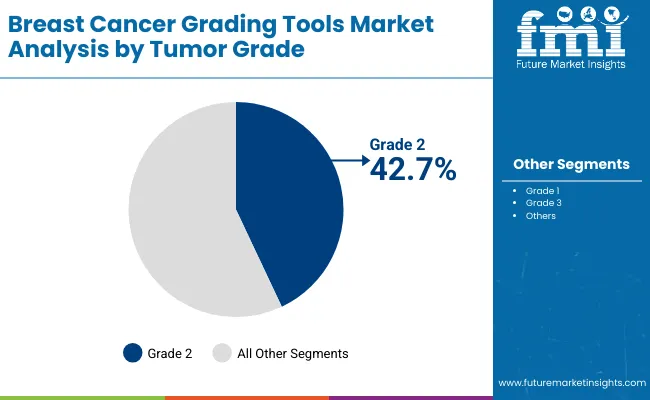

Grade 2 tumors have emerged as the leading application segment and are projected to hold approximately 42.7% of the global Breast Cancer Grading Tools Market in 2025, driven by their high clinical prevalence and critical role in guiding treatment decisions.

Grade 2 tumors are considered intermediate in aggressiveness, making accurate grading essential for determining whether patients require aggressive therapy or can benefit from more conservative approaches. This demand for precise risk stratification has elevated the use of both traditional histological grading systems such as the Nottingham Grading System and molecular tools like Oncotype DX and MammaPrint within this segment.

| Tumor Grade | Market Share (%) |

|---|---|

| Grade 1 | 34.8% |

| Grade 2 | 42.7% |

| Grade 3 | 22.5% |

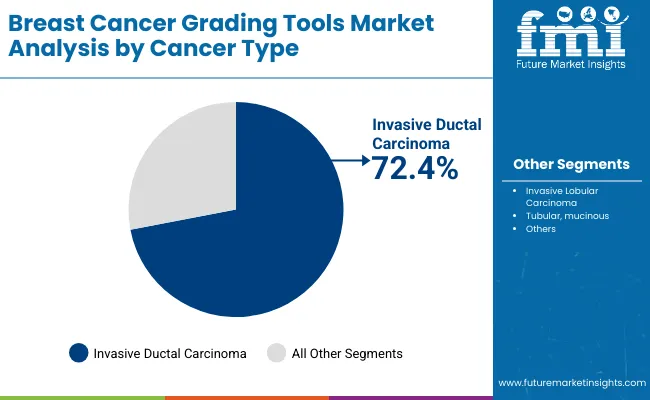

Invasive Ductal Carcinoma (IDC) has emerged as the leading cancer type segment and is projected to hold approximately 72.4% of the global Breast Cancer Grading Tools Market in 2025, driven by its status as the most common form of breast cancer globally.

IDC accounts for the majority of diagnosed breast cancer cases, significantly increasing the demand for accurate histopathological grading to guide therapeutic planning. As the clinical behavior of IDC can vary widely from low-grade, slow-growing tumors to aggressive high-grade variantsgrading tools play a crucial role in risk assessment and treatment selection.

This widespread clinical prevalence has reinforced the adoption of both conventional systems like the Nottingham Grading System and advanced molecular diagnostics such as Oncotype DX, MammaPrint, and Prosigna (PAM50). These tools enable oncologists and pathologists to evaluate tumor aggressiveness, predict recurrence risk, and tailor treatment strategies accordingly.

The segment’s dominance is further supported by international guidelines that emphasize tumor grading as a core component of IDC management. With growing integration of digital pathology and AI-assisted image analysis in hospital settings, IDC-focused grading continues to represent the backbone of diagnostic workflows in breast cancer care securing its leading position in the cancer type segment of the Breast Cancer Grading Tools Market.

| Cancer Type | Market Share (%) |

|---|---|

| Invasive Ductal Carcinoma | 72.4% |

| Invasive Lobular Carcinoma | 15.9% |

| Tubular, mucinous | 3.8% |

| Others | 7.9% |

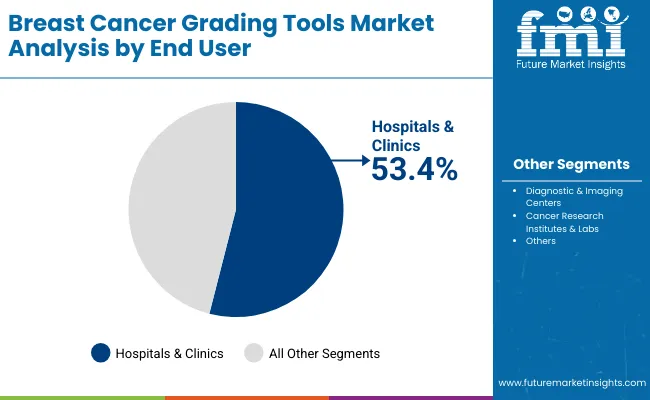

Hospitals & Clinics are expected to remain the largest end user segment, contributing approximately 53.4% to the global Breast Cancer Grading Tools Market in 2025, owing to their central role in cancer diagnosis, treatment planning, and multidisciplinary care coordination.

As primary centers for breast cancer screening and biopsy evaluation, hospitals and clinics are increasingly adopting both traditional histological grading systems such as the Nottingham Grading System and molecular tools like Oncotype DX and MammaPrint to ensure accurate and timely tumor assessment.

The demand is especially strong in oncology departments, surgical units, and pathology labs within hospitals, where the need for standardized, high-throughput, and clinically validated grading solutions is critical. Integration of digital pathology platforms and AI-based grading algorithms into hospital information systems (HIS) and electronic health records (EHRs) has enhanced workflow efficiency and diagnostic precision.

Furthermore, increasing cancer incidence, evolving clinical guidelines, and the growing emphasis on personalized oncology care have driven institutional investments in advanced grading tools.

| End User | Market Share (%) |

|---|---|

| Hospitals & Clinics | 53.4% |

| Diagnostic & Imaging Centers | 25.8% |

| Cancer Research Institutes & Labs | 12.8% |

| Others | 8.0% |

Rising Breast Cancer Incidence and Prevalence

Breast cancer remains the most commonly diagnosed cancer among women globally, with alarming increases in incidence and prevalence rates fueling intense demand for accurate diagnostic and grading tools. As the burden of breast cancer grows worldwide, particularly in low- and middle-income countries, healthcare providers increasingly rely on sophisticated grading systems and molecular profiling tools to guide clinical decisions.

Breast cancer is a malignant tumor that originates in breast tissue, primarily in milk ducts or lobules. Globally, it represents the leading cancer diagnosis among women, accounting for significant morbidity and mortality.According to the latest estimates from the International Agency for Research on Cancer (IARC) GLOBOCAN 2022 database, approximately 2.3 million new cases of female breast cancer were diagnosed worldwide in 2022, causing an estimated 670,000 deaths.

In 2022, breast cancer was the most frequent cancer diagnosis in women across 157 of 185 countries. According to The Lancet Oncology 2025, the incidence of breast cancer is expected to rise substantially by 2050. Projections estimate a 38% increase in new cases and a 68% increase in mortality if current trends persist, with disproportionate impacts poised for low- and middle-Human Development Index (HDI) countries.

Early and precise grading of breast cancer plays a crucial role in personalized treatment and prognosis estimation. Advances in grading tools have improved detection sensitivity, classification accuracy, and treatment guidance, which are pivotal in managing the rising caseload.

Limited Awareness and Infrastructure in Emerging Markets

In many emerging economies, public knowledge about breast cancer and its early symptoms remains limited. Cultural stigmas, low health literacy, and insufficient awareness campaigns reduce women's participation in regular screening programs. As a result, breast cancers are often diagnosed at later stages, when grading tools and molecular diagnostics are less frequently employed or become costlier and more complex to use.

Studies highlight that breast cancer awareness programs are still in nascent stages in countries like India, parts of Africa, and Southeast Asia compared to developed nations. Healthcare facilities with the capability to perform advanced histopathological grading and molecular testing are limited in emerging regions.

There is a deficiency of specialized pathology laboratories, trained oncologists, and pathology technicians equipped to handle and interpret complex grading tools such as Nottingham or Oncotype DX. Infrastructure gaps extend to diagnostic imaging facilities critical for biopsy and tumor characterization. This bottleneck reduces the utilization of breast cancer grading tools despite increasing case numbers.

Advanced grading technologies, particularly molecular assays and AI-powered digital pathology systems, are often prohibitively expensive for healthcare systems and patients in emerging markets. Limited insurance coverage and reimbursement policies further restrict their accessibility. Hospitals and diagnostic centers in these regions may prioritize more basic screening and diagnostic methods, curbing the adoption of comprehensive grading tools that are essential for personalized treatment planning

Shift toward Personalized Medicine

Personalized medicine, also termed precision medicine, is revolutionizing oncology by tailoring diagnosis, prognosis, and treatment to individual patients’ genetic, molecular, and clinical profiles. This paradigm shift greatly enhances breast cancer management, driving the demand for advanced breast cancer grading tools that combine traditional histopathology with molecular assays and artificial intelligence (AI)-enabled technologies.

Personalized medicine targets the heterogeneity of breast cancer, a complex disease characterized by diverse molecular subtypes with distinct prognoses and treatment responses. Traditional “one-size-fits-all” approaches are being replaced by strategies that leverage detailed molecular diagnostics and grading systems aligned with tumor biology at the genetic and proteomic level.

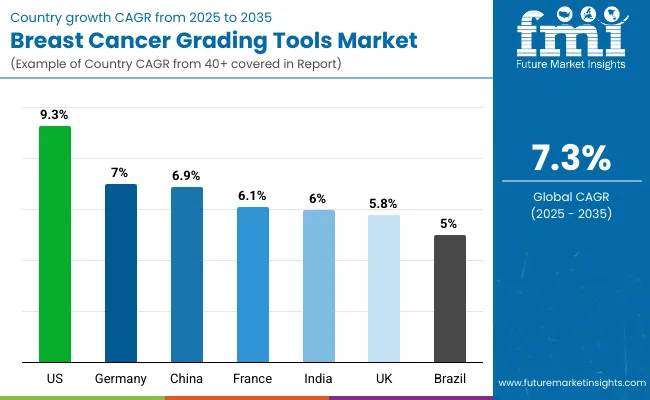

| Country | CAGR |

|---|---|

| USA | 9.3% |

| Brazil | 5.0% |

| China | 6.9% |

| India | 6.0% |

| Europe | 6.2% |

| Germany | 7.0% |

| France | 6.1% |

| UK. | 5.8% |

Asia Pacific is emerging as the fastest-growing region in the global Breast Cancer Grading Tools Market, projected to register a robust CAGR of approximately 6.0% between 2025 and 2030. Within the region, India is anticipated to grow at a CAGR of 6.0%, driven by the rising burden of breast cancer, expansion of diagnostic infrastructure, and growing investments in AI-based pathology solutions.

Increased awareness of early detection and government-backed oncology initiatives are further supporting market growth.China is expected to witness a higher CAGR of 6.9%, fueled by large-scale digitization of pathology labs, integration of molecular diagnostics into mainstream oncology workflows, and supportive national healthcare reforms.

The region’s accelerating adoption of precision medicine, combined with growing access to histological and genomic grading tools, is positioning Asia Pacific as a key growth engine for the Breast Cancer Grading Tools Market over the coming years.

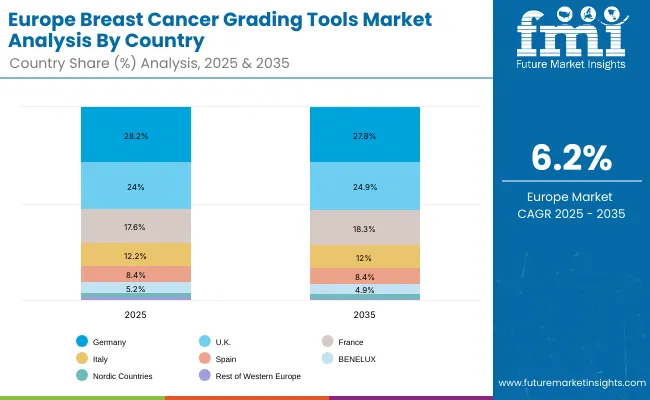

Europe is expected to grow steadily at a CAGR of 6.2% through 2035 in the global Breast Cancer Grading Tools Market, supported by the region's strong cancer screening infrastructure and increasing adoption of digital and molecular diagnostic tools. Among the key regional markets, Germany is projected to expand at a CAGR of 6.6%, driven by growing integration of AI in pathology workflows, increasing hospital investments in digital pathology platforms, and continued clinical reliance on standardized grading systems such as the Nottingham Grading System.

France is estimated to grow at a CAGR of 5.8%, fueled by national initiatives aimed at enhancing early cancer detection and rising clinical use of multigene assays like Oncotype DX and MammaPrint. Meanwhile, the UK. market is anticipated to grow at a CAGR of 6.1%, supported by NHS modernization programs focused on precision oncology, digitized pathology reporting, and increased funding for AI-enhanced diagnostic solutions.

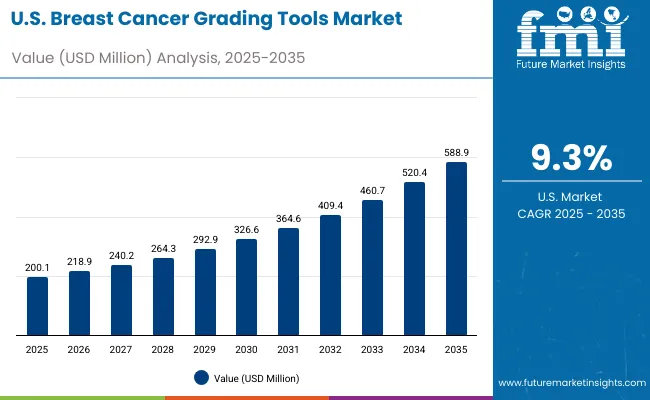

North America remains a mature yet innovation-led region in the global Breast Cancer Grading Tools Market, with the USA projected to grow at a strong CAGR of 9.3% between 2025 and 2035. Growth in the USA is largely driven by the increasing adoption of molecular grading tools like Oncotype DX, MammaPrint, and Prosigna (PAM50), which are now standard in many oncology practices for guiding personalized treatment decisions and reducing overtreatment.

The shift toward precision oncology, supported by favorable reimbursement frameworks such as those provided by Medicare, has accelerated clinical integration of genomic assays alongside traditional histopathological grading systems like the Nottingham Grading System.

Additionally, the widespread use of electronic health records (EHRs) and rising investment in AI-enhanced digital pathology platforms are enabling more accurate, scalable, and standardized tumor grading workflows across hospitals and cancer care centers.

The Breast Cancer Grading Tools market in the United States is projected to grow at a CAGR of approximately 9.3% between 2025 and 2035, driven by the increasing prevalence of breast cancer, advancements in digital pathology, and broader integration of genomic testing in clinical oncology.

The growing emphasis on personalized medicine and risk stratification has led to greater adoption of both traditional histological grading systems, such as the Nottingham Grading System, and molecular assays like Oncotype DX and MammaPrint. Hospitals, cancer centers, and diagnostic laboratories are leveraging these tools to enhance treatment decision-making, especially in hormone receptor-positive and early-stage breast cancer cases.

Regulatory support for precision diagnostics and favorable reimbursement policies for molecular tests are further accelerating market growth, as healthcare providers prioritize tools that deliver prognostic insights and guide therapy selection with greater accuracy.

The Breast Cancer Grading Tools market in the United Kingdom is expected to grow at a CAGR of approximately 5.8% through 2035, driven by the NHS’s strategic focus on early cancer detection, precision diagnostics, and digital pathology integration.

National programs under the NHS Long Term Plan, including the expansion of Rapid Diagnostic Centres (RDCs) and investments in genomic medicine, are accelerating the adoption of both histological and molecular grading tools across secondary and tertiary care settings.

The growing demand for personalized oncology treatment particularly for hormone receptor-positive and early-stage breast cancer has led to increased use of tools such as the Nottingham Grading System, Oncotype DX, and MammaPrint. Additionally, the UK’s commitment to reducing cancer diagnostic delays and enhancing clinical workflow efficiency is fostering greater deployment of AI-assisted digital pathology platforms within NHS trusts and academic medical centers.

The Breast Cancer Grading Tools market in Germany is projected to grow at a CAGR of approximately 7.0% through 2035, supported by Germany’s robust oncology infrastructure, widespread digitization of pathology services, and growing emphasis on precision diagnostics.

Under initiatives like the Hospital Future Act (Krankenhauszukunftsgesetz), significant federal funding has been directed toward modernizing diagnostic capabilities, including the deployment of digital pathology systems and AI-assisted image analysis tools in hospitals and cancer centers.

German healthcare institutions, recognized for their high diagnostic standards, are increasingly adopting advanced grading tools-ranging from standardized histological systems like the Nottingham Grading System to molecular profiling assays such as Oncotype DX and PAM50-to support risk stratification and personalized treatment planning.

The shift toward interoperable, AI-enhanced diagnostics is enabling more accurate tumor grading, reducing variability, and aligning with Germany’s national cancer strategy to improve early detection and outcomes in breast cancer care.

| Europe Country | 2025 |

|---|---|

| Germany | 28.2% |

| UK | 24.0% |

| France | 17.6% |

| Italy | 12.2% |

| Spain | 8.4% |

| Benelux | 5.2% |

| Nordics | 2.5% |

| Rest of Europe | 1.9% |

| Europe Country | 2035 |

|---|---|

| Germany | 27.8% |

| UK | 24.9% |

| France | 18.3% |

| Italy | 12.0% |

| Spain | 8.4% |

| Benelux | 4.9% |

| Nordics | 2.6% |

| Rest of Europe | 1.1% |

The Breast Cancer Grading Tools market in India is expected to grow at a strong CAGR of approximately 6.0% through 2035, making it one of the most promising emerging markets globally. Growth is being propelled by the rising incidence of breast cancer, expanding oncology infrastructure, and increasing adoption of digital pathology solutions in both public and private healthcare sectors.

Tertiary care hospitals and cancer institutes in Tier 1 cities are progressively implementing standardized histological grading systems such as the Nottingham Grading System to support consistent diagnosis and treatment planning.

Simultaneously, the growing availability of molecular grading tools like Oncotype DX is improving access to personalized oncology care for selected patient segments. Government initiatives such as the Ayushman Bharat Digital Mission (ABDM), along with rising investments in telepathology and digital health infrastructure, are further enabling adoption of advanced diagnostic technologies across Tier 2 and Tier 3 regions, bridging the urban-rural diagnostic divide and supporting earlier detection of breast cancer.

The Breast Cancer Grading Tools market in China is projected to grow at a robust CAGR of approximately 6.9% through 2035, driven by significant investments in digital health infrastructure and precision oncology initiatives under the Healthy China 2030 plan.

As China accelerates modernization of its healthcare system, there is increasing adoption of advanced diagnostic technologies including AI-powered digital pathology and molecular grading assays to enhance early detection and personalized treatment of breast cancer.

The National Health Commission (NHC) supports integration of intelligent clinical tools across tertiary hospitals, telemedicine platforms, and community health centers, enabling improved diagnostic accuracy and streamlined care pathways. Growing awareness of breast cancer screening and expanded access to genomic tests are further propelling market growth across urban and semi-urban regions.

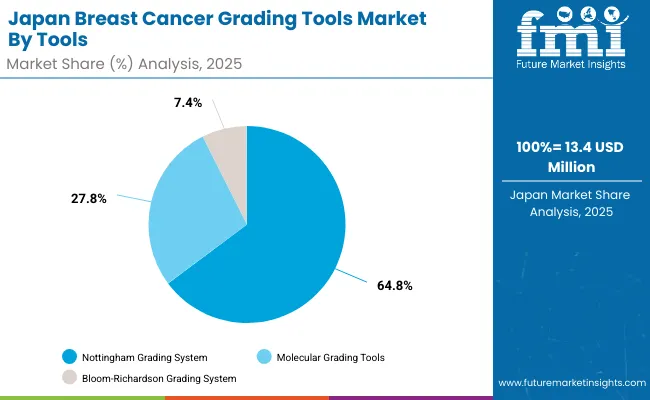

The Breast Cancer Grading Tools market in Japan is projected to reach approximately USD 13.4 million in 2025, with digital histopathology and molecular grading tools collectively accounting for a growing share of diagnostic modalities.

This growth is driven by Japan’s emphasis on medical precision, aging population management, and integration of advanced technologies into clinical oncology workflows. National initiatives such as Society 5.0 and the Medical Device Industry Vision 2025 are fostering innovation in digital diagnostics, supporting the adoption of AI-powered grading systems in hospitals, cancer research institutes, and outpatient clinics.

AI-assisted digital pathology platforms and molecular assays like Oncotype DX and Prosigna (PAM50) are increasingly deployed to improve diagnostic accuracy and personalize treatment for Japan’s growing elderly breast cancer patient population. The focus on early detection and tailored therapies aligns with the healthcare system’s strategy to optimize outcomes in an aging society where more than 28% of citizens are aged 65 and older.

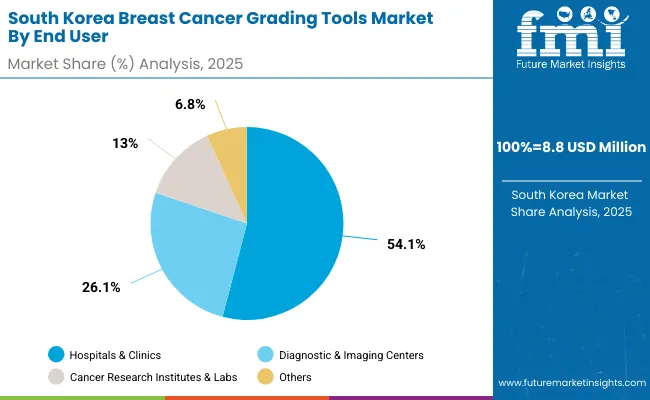

The Breast Cancer Grading Tools market in South Korea is projected to reach approximately USD 8.8 million by 2025, with invasive ductal carcinoma accounting for the largest cancer type segment. Growth is driven by the rising prevalence of breast cancer and the country’s strong focus on early detection, precision oncology, and digital healthcare transformation under the Ministry of Health and Welfare (MOHW).

National strategies like the Digital Health Innovation Strategy have been pivotal in accelerating the adoption of AI-powered grading tools and molecular assays across public hospitals, cancer specialty centers, and private clinics.

Hospitals and specialized oncology centers are actively integrating AI-enabled digital pathology and molecular grading tools into breast cancer diagnostic workflows. These technologies not only improve grading accuracy for diverse tumor types but also support personalized treatment planning by reducing interobserver variability and enabling data-driven clinical decisions.

The global breast cancer grading tools market is moderately fragmented, with a mix of established pathology technology leaders, innovative molecular diagnostics firms, and emerging AI-driven digital pathology startups competing across histopathology grading, molecular assays, and integrated diagnostic platforms. The market is increasingly driven by the convergence of AI-powered image analysis, genomic profiling, and interoperability with electronic health records (EHR) and oncology decision support systems.

eading players such as Aiforia dominate the market with robust AI-based digital pathology platforms that enhance tumor grading accuracy and workflow efficiency through deep learning algorithms. Aiforia’s solutions are widely adopted by hospitals, research institutes, and diagnostic labs globally, supported by continuous algorithm refinement, cloud-based analytics, and integration with established pathology workflows. Their leadership position is reinforced by strategic partnerships and regulatory compliance, enabling widespread clinical validation and adoption.

Other key players including Bruker Spatial Biology, Inc., Indica Labs, LLC, and Leica BiosystemsNussloch GmbH provide advanced digital pathology imaging systems and spatial biology tools that facilitate precise grading and biomarker analysis. These companies leverage cutting-edge multiplexing technologies and AI-enabled image interpretation to support personalized oncology care. Leica Biosystems, with its global distribution network and legacy in pathology instruments, remains a trusted partner for many hospital pathology departments.

Mid-sized innovators such as iCAD, Inc., Endomagnetics Ltd., and Exact Sciences Corporation focus on niche molecular grading assays and integrated cancer diagnostic solutions. iCAD’s AI-based image analysis tools, for example, support breast cancer margin assessment and grading, enhancing intraoperative decision-making. Exact Sciences combines molecular assays with digital reporting platforms, facilitating early-stage cancer risk stratification and treatment guidance.

Emerging companies like Owkin, Inc. and SimBioSys are gaining traction by offering AI-powered predictive analytics and virtual tumor models that enable more precise grading and prognostic assessments. These startups emphasize machine learning-driven interpretation of multi-modal data-combining histology, genomics, and clinical information-to improve treatment personalization, targeting research centers and advanced oncology clinics.

As the market evolves, differentiation is shifting from standalone grading tools to comprehensive, AI-augmented diagnostic ecosystems that integrate molecular data, digital histopathology, and clinical decision support. Players are investing heavily in cloud-based platforms, interoperability standards, and user-centric designs that enhance pathologist productivity and enable remote expert consultations. Moreover, alignment with global regulatory frameworks and participation in government cancer control programs are becoming key factors driving market adoption and competitive advantage.

Key Developments:

On September 22 2025, SOPHiA GENETICS, an AI technology company transforming precision medicine, announced an expansion of its collaboration with AstraZeneca (LSE/STO/Nasdaq: AZN) from the World CB & CDx Summit in Boston. The companies aim to improve the diagnosis and treatment of breast and prostate cancer by developing an optimized next generation sequencing (NGS) solution that leverages SOPHiA GENETICS's AI algorithms to detect genetic mutations in the PIK3CA/AKT1/PTEN pathway.

On June 24 2025, Aiforia Technologies Plc launched a new CE-IVD marked clinical AI solution for breast cancer grading. Aiforia Breast Cancer Grading AI solution is a part of the Aiforia Breast Cancer Suite, which also includes CE-IVD marked AI models for breast cancer biomarkers and the Aiforia Clinical Suite Viewer. This complete solution offers a fully digital cockpit for breast cancer diagnostics, supporting the entire diagnostic workflow.

| Item | Value |

|---|---|

| Market Value 2025 | USD 463.3 million |

| Tools | Nottingham Grading System, Bloom-Richardson Grading System, and Molecular Grading Tools |

| Tumor Grade | Grade 1, Grade 2, and Grade 3 |

| Cancer Type | Invasive Ductal Carcinoma, Invasive Lobular Carcinoma, Tubular, mucinous, and Others |

| End User | Hospitals & Clinics, Diagnostic & Imaging Centers, Ca ncer Research Institutes & Labs and Others |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK. etc. |

| Key Companies Profiled | Aiforia, Primaa, Bruker Spatial Biology, Inc., Indica Labs, LLC., Leica Biosystems Nussloch GmbH, iCAD, Inc., Endomagnetics Ltd., Exact Sciences Corporation., Owkin, Inc., and SimBioSys |

| Additional Attributes | Molecular assays such as Oncotype DX, MammaPrint, and Prosigna (PAM50) are widely adopted in the USA, Europe, and Japan for guiding treatment in early-stage hormone receptor-positive breast cancer. These tools reduce over-treatment, support value-based care, and are increasingly reimbursed by public and private payers. |

The global breast cancer grading tools market is estimated to be valued at USD 463.3 million in 2025.

The market size for breast cancer grading tools is projected to reach USD 937.26 million by 2035.

The breast cancer grading tools market is expected to grow at a CAGR of 7.3% during this period.

Key tools include Nottingham Grading System, Bloom-Richardson Grading System, and Molecular Grading Tools.

The Grade 2 segment is projected to command 42.7% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Biopsy Devices Market Analysis - Innovations & Forecast 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Smart Breast Imaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA