The Breast and Prostate Cancer Diagnostics Market in Europe is valued at USD 4.21 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 2.2% and reach USD 5.23 billion by 2035.

In 2024, the industry experienced steady but modest growth, supported by a combination of technological advancements and increasing awareness around early cancer detection. On a granular level, several European countries ramped up investments in AI-powered diagnostic tools, especially in urban hospitals and specialty clinics.

Germany and France led the way in integrating digital pathology and machine learning algorithms for biopsy interpretation, improving accuracy and reducing diagnosis time. Meanwhile, smaller industries like Portugal and Greece focused more on affordability and access, expanding public screening programs for high-risk populations.

Another key trend in 2024 was the growing use of non-invasive liquid biopsies for prostate cancer, which gained traction in clinical settings due to their ease of use and promising accuracy. Collaborations between public health bodies and private diagnostics companies helped scale these innovations more widely.

Looking ahead to 2025 and beyond, the industry is expected to benefit from continued investment in personalized diagnostics, pan-European cancer screening initiatives, and further adoption of AI-driven solutions, ensuring broader and faster access to accurate cancer diagnostics.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.21 billion |

| Industry Value (2035F) | USD 5.23 billion |

| CAGR (2025 to 2035) | 2.2% |

The Breast and Prostate Cancer Diagnostics Industry in Europe is on a steady growth path, driven by rising demand for early detection and advancements in AI-powered diagnostic technologies. Public health systems and private diagnostic firms are key beneficiaries as investment and innovation accelerate access and accuracy. However, regions with limited infrastructure may lag behind, missing out on the latest diagnostic improvements.

| Risk | Probability - Impact |

|---|---|

| 1. Slow adoption of AI diagnostics in public healthcare systems | Medium - High |

| 2. Regulatory delays in approving new diagnostic technologies | High - Medium |

| 3. Limited access to advanced diagnostics in rural or underserved areas | High - High |

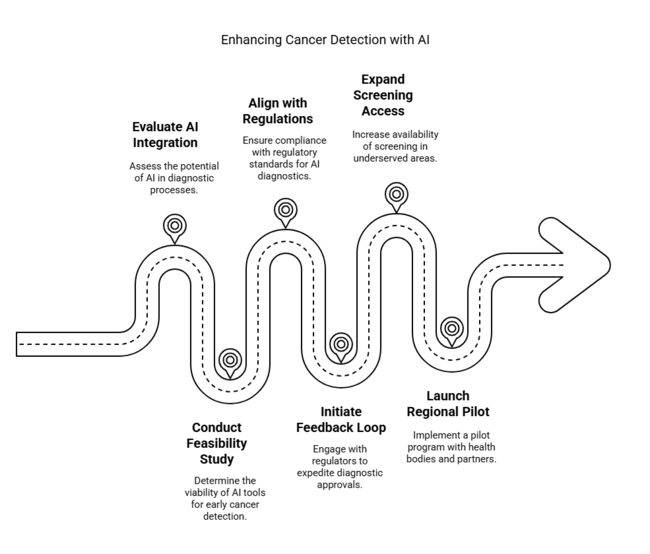

| Priority | Immediate Action |

|---|---|

| Evaluate AI diagnostic integration | Run feasibility study on AI-based tools for early cancer detection in urban centres |

| Align with regulatory pathways | Initiate feedback loop with EU regulators on fast-tracking diagnostic approvals |

| Expand screening access in underserved regions | Launch regional pilot with public health bodies and diagnostic partners |

To stay ahead, companies must accelerate the adoption of AI-powered diagnostic tools while actively shaping regulatory and public health dialogues across Europe. This intelligence highlights a shift toward non-invasive, personalized diagnostics and reveals widening gaps in access between urban and rural regions.

To capture emerging opportunities, stakeholders should embed digital innovation into their core roadmap, prioritize strategic partnerships with public health agencies, and invest in local distribution capabilities. These moves will not only future-proof operations but also position companies as leaders in equitable and scalable cancer diagnostics across the region.

The segment with the highest projected CAGR of 4.5% from 2025 to 2035 is Circulating Tumour Cells (CTCs) within the Liquid Biopsy category. This growth is driven by the increasing demand for non-invasive diagnostic methods that offer real-time monitoring of cancer progression. CTCs enable early detection of metastasis and provide insights into tumor dynamics without the need for invasive procedures.

Advancements in microfluidic technologies and molecular assays have enhanced the sensitivity and specificity of CTC detection, making it a valuable tool in personalized medicine. The integration of CTC analysis into clinical practice is expected to revolutionize cancer diagnostics by facilitating timely therapeutic interventions and improving patient outcomes.

Cancer Research Institutes are anticipated to experience a CAGR of 3.0% from 2025 to 2035, reflecting their pivotal role in advancing cancer diagnostics. These institutions are at the forefront of developing and validating innovative diagnostic technologies, including liquid biopsies and molecular imaging. Their contributions are crucial in translating laboratory discoveries into clinical applications, thereby enhancing the accuracy and efficiency of cancer detection.

Collaborations between research institutes and healthcare providers are fostering the adoption of cutting-edge diagnostics, ultimately leading to more personalized and effective cancer care. The sustained investment in research and development within these institutes is expected to drive significant advancements in the field of oncology diagnostics.

Triple Negative Breast Cancer (TNBC) is projected to grow at a CAGR of 3.5% from 2025 to 2035, highlighting its emerging significance in the diagnostics industry. TNBC lacks the three most common types of receptors known to fuel most breast cancer growth, making it more challenging to treat. This has led to an increased focus on developing specialized diagnostic tools that can accurately identify TNBC and guide targeted therapies.

Advancements in genomic and proteomic profiling are enabling the identification of specific biomarkers associated with TNBC, facilitating early detection and personalized treatment strategies. The rising incidence of TNBC and the need for effective diagnostic solutions are expected to drive growth in this segment.

Sales in Western Europe are anticipated to grow at a CAGR of 2.3% during 2025 to 2035, slightly above the global average. The region continues to dominate the European breast and prostate cancer diagnostics industry due to robust healthcare infrastructure, advanced research capabilities, and early adoption of next-gen diagnostics. Countries like Germany, France, and the UK are at the forefront of innovation in diagnostic imaging, molecular testing, and biopsy techniques.

Germany holds the largest industry share owing to its strong reimbursement frameworks, high awareness among the population, and established cancer screening programs. France and the UK are fast adopters of precision diagnostic tools, including liquid biopsy and BRCA gene testing. In the UK, government support under the NHS and public-private partnerships have boosted screening access and advanced cancer detection. Increasing geriatric population and lifestyle-related risks have heightened demand for early and regular cancer diagnosis.

Moreover, Western Europe is actively responding to the European Commission’s “Europe’s Beating Cancer Plan,” which further strengthens early detection and diagnostic infrastructure. Sustainability trends are also evident, with France and Germany showing rising interest in green diagnostics and low-waste biopsy tools. These dynamics are expected to reinforce Western Europe’s leadership in this sector throughout the forecast period.

The industry in Eastern Europe is anticipated to grow at a CAGR of 2.0% from 2025 to 2035, slightly below the global average, reflecting both growth opportunities and systemic challenges. While Eastern Europe lags behind Western Europe in healthcare access and technology adoption, the diagnostics landscape is beginning to evolve as public health initiatives gain traction and cancer incidence rates increase across the region.

Countries like Poland, Czech Republic, and Hungary are witnessing rising demand for cancer diagnostics due to increasing public awareness, rising income levels, and government-backed screening initiatives. However, the availability of high-end diagnostics like liquid biopsy or molecular imaging remains limited outside urban hubs. Infrastructure gaps and limited insurance coverage continue to challenge wide-scale deployment of advanced diagnostic systems.

Despite these challenges, regional governments and EU support funds are helping bridge the gap through investment in healthcare modernization and cancer registries. The ongoing digitalization of healthcare and the entry of multinational diagnostic players have opened the door for collaborations, particularly in mammography and MRI-based screenings. With growing private sector involvement and partnerships with Western European manufacturers, Eastern Europe is poised to steadily improve its cancer diagnostics ecosystem in the coming decade.

Sales in the Rest of Europe are anticipated to grow at a CAGR of 2.1% between 2025 and 2035, reflecting steady growth supported by growing awareness, better screening practices, and improvements in medical infrastructure. This segment includes smaller yet emerging healthcare industries such as the Nordics (Sweden, Norway, Finland), Switzerland, and several Southeastern countries.

Nordic countries are spearheading digital healthcare transformation, with integrated screening programs and high adoption of AI-based diagnostic imaging in Sweden and Finland. These nations are also focusing on patient-centric approaches and precision medicine, enhancing demand for diagnostics like HER2, BRCA testing, and liquid biopsies. Switzerland, with its high per capita healthcare spending, continues to lead in early cancer detection technologies, particularly immunohistochemistry and MRI scanning.

On the other hand, countries like Greece, Portugal, and the Baltics are catching up, driven by EU-supported healthcare reforms and increasing prevalence of breast and prostate cancer. Governments are now prioritizing national cancer plans, improving hospital-based diagnostics, and supporting cross-border collaborations. While access to cutting-edge technologies may remain uneven, gradual infrastructure improvements and policy support indicate consistent, long-term growth potential in this cluster of countries through 2035.

The breast and prostate cancer diagnostics industry is moderately fragmented, with key players like rochediagnostics, siemenshealthineers, and Hologic leading the sector. These companies compete through innovation, strategic partnerships, and geographic expansion to strengthen their industry positions. Their growth strategies focus on developing advanced diagnostic technologies, forming collaborations to enhance product offerings, and expanding into emerging industries.

In 2024, the cancer diagnostics landscape saw significant consolidation and innovation through a series of high-impact acquisitions and regulatory milestones. Lantheus acquired global rights to a novel diagnostic and therapeutic pair targeting the Gastrin-Releasing Peptide Receptor (GRPR), aiming to improve the diagnosis and treatment of prostate and breast cancers.

Siemens Healthineers expanded its oncology imaging capabilities by acquiring part of Novartis’s Advanced Accelerator Applications (AAA) business, strengthening its PET radiopharmaceutical supply across Europe. Meanwhile, Caris Life Sciences received FDA approval for MI Cancer Seek™, the first companion diagnostic to integrate whole exome and transcriptome sequencing for comprehensive solid tumor profiling. In the AI diagnostics space, Lunit acquired Volpara Health Technologies, a leader in breast cancer screening software, to accelerate its mission of transforming cancer diagnostics through artificial intelligence.

Koninklijke Philips N.V. holds an estimated 12.5% share of the European industry. The company's leadership stems from its comprehensive portfolio of advanced imaging systems, including MRI and ultrasound technologies specifically optimized for breast and prostate cancer detection.

Philips has strengthened its position through strategic investments in AI-powered diagnostic tools and digital pathology solutions, particularly through its IntelliSite Pathology platform. The company maintains strong partnerships with leading European healthcare institutions, facilitating widespread adoption of its technologies across the region.

F. Hoffmann-La Roche Ltd. controls approximately 11.8% of the industry. Roche's dominance is built on its innovative molecular diagnostics platforms, notably the cobas® and Ventana systems for tissue-based testing. The company has made significant advances in liquid biopsy technologies through its Foundation One Liquid CDx test, enabling non-invasive cancer detection and monitoring. Roche's extensive European laboratory network and recent acquisitions in genomic profiling have further solidified its position as a key player in precision oncology diagnostics.

Abbott Laboratories, Inc. maintains a 9.4% industry share. The company's Alinity™ series of diagnostic instruments and PCR-based assays are widely used for breast and prostate cancer testing across European laboratories. Abbott has focused on developing companion diagnostics that support personalized treatment approaches, while its automation solutions help streamline diagnostic workflows in high-volume clinical settings.

Siemens Healthineers holds about 8.7% of the industry. The company's strength lies in its advanced imaging modalities, including mammography systems and MRI technologies tailored for cancer detection. Siemens has been integrating AI algorithms into its diagnostic platforms to improve accuracy in tumor identification and characterization. Its established presence in European hospitals and ongoing collaborations with research institutions contribute to its strong industry position.

Thermo Fisher Scientific Inc. accounts for roughly 7.9% of the industry. The company provides comprehensive oncology testing solutions, including next-generation sequencing platforms and PCR-based diagnostic assays. Thermo Fisher's focus on developing biomarkers for early cancer detection and its partnerships with European cancer centers have been instrumental in maintaining its competitive edge.

GE HealthCare has secured a 6.5% industry share. The company specializes in breast imaging technologies, particularly its Senographe mammography systems and contrast-enhanced MRI solutions. GE HealthCare has been incorporating AI tools to enhance diagnostic accuracy and workflow efficiency, while its strong distribution network across Europe ensures broad industry penetration.

Becton, Dickinson and Company (BD) holds approximately 5.8% of the industry. BD's core strength lies in its biopsy systems, including the BD Vacutainer® products for sample collection. The company has been expanding its portfolio of minimally invasive biopsy devices for prostate and breast cancer diagnosis, addressing the growing demand for precision sampling techniques in European healthcare facilities.

Danaher Corporation (including Cepheid and Beckman Coulter) maintains a 5.2% share. Danaher's Cepheid Xpert® tests for prostate cancer biomarkers have gained significant adoption in European laboratories due to their rapid turnaround times and high accuracy. The company's focus on automated diagnostic solutions and strategic acquisitions in molecular diagnostics have strengthened its position in the cancer testing industry.

Hologic, Inc. accounts for about 4.9% of the industry. The company is a leader in breast health solutions, with its 3D mammography systems and Breast Biopsy Suite being widely used across Europe. Hologic has been investing in AI-powered imaging analysis tools and has established strong relationships with breast cancer screening programs throughout the region.

QIAGEN N.V. holds a 4.3% industry share. The company specializes in sample preparation technologies and molecular testing solutions for cancer diagnostics. QIAGEN's automated platforms for NGS and PCR-based testing have been adopted by European laboratories seeking to enhance their oncology testing capabilities, while its companion diagnostic partnerships with pharmaceutical companies have expanded its industry presence.

Agilent Technologies, Inc. maintains a 3.7% share. The company provides advanced pathology solutions, including in-situ hybridization tests for breast and prostate cancer biomarkers. Agilent's focus on developing companion diagnostics and its collaborations with European research institutions have supported its position in the cancer diagnostics industry.

The industry is segmented into tumorbiomarkers tests, imaging, biopsy, liquid biopsy, immunohistochemistry and in situ hybridization

The industry is divided into breast cancer and prostate cancer

The industry is divided into hospital associated labs, independent diagnostic laboratories, diagnostic imaging centers, cancer research institutes and others

The industry is studied across Western Europe, Eastern Europe, Rest of Europe

The industry is valued at USD 4.21 billion in 2025.

The industry is projected to grow at a CAGR of 2.2%, reaching USD 5.23 billion by 2035.

AI-powered diagnostic tools and liquid biopsy technologies are key growth drivers.

Germany and France are leading in integrating digital pathology and AI for diagnostics.

Investing in AI tools, expanding access via public-private partnerships, and boosting R&D are top priorities.

Table 01: Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 02: Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 03: Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 04: Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 05: Sales(US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Region

Table 06: Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Region

Table 07: United Kingdom Sales(US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 08: United Kingdom Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 09: United Kingdom Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 10: United Kingdom Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 11: United Kingdom Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 12: Germany Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 13: Germany Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 14: Germany Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 15: Germany Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 16: Germany Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 17: Spain Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 18: Spain Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 19: Spain Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 20: Spain Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 21: Spain Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 22: Italy Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 23: Italy Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 24: Italy Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 25: Italy Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 26: Italy Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 27: France Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 28: France Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 29: France Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 30: France Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 31: France Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 32: BENELUX Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 33: BENELUX Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 34: BENELUX Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 35: BENELUX Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 36: BENELUX Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 37: Nordics Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By States

Table 38: Nordics Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 39: Nordics Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 40: Nordics Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 41: Nordics Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 42: Poland Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 43: Poland Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 44: Poland Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 45: Poland Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 46: Hungary Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 47: Hungary Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 48: Hungary Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 49: Hungary Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 50: Romania Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 51: Romania Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 52: Romania Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 53: Romania Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 54: Russia Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 55: Russia Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 56: Russia Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 57: Russia Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 58: Czech Republic Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 59: Czech Republic Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 60: Czech Republic Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 61: Czech Republic Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Table 62: Rest of Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 63: Rest of Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Test

Table 64: Rest of Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By Indication

Table 65: Rest of Sales (US$ million) Analysis 2018 to 2022 and Forecast 2023 to 2033, By End User

Figure 01: Value Share By Test (2022 A)

Figure 02: Value Share By Indication (2022 A)

Figure 03: Value Share By End User (2022 A)

Figure 04: Value Share By Region (2022 A)

Figure 05: Value Analysis (US$ million), 2018 to 2022

Figure 06: Value Forecast (US$ million), 2023 to 2033

Figure 07: Absolute $ Opportunity, 2023 to 2033

Figure 08: Share Analysis (%) By Test, 2023 and 2033

Figure 09: Y-o-Y Growth (%) By Test, 2023 to 2033

Figure 10: Attractiveness Analysis By Test, 2023 to 2033

Figure 11: Share Analysis (%) By Indication, 2023 and 2033

Figure 12: Y-o-Y Growth (%) By Indication, 2023 to 2033

Figure 13: Attractiveness Analysis By Indication, 2023 to 2033

Figure 14: Share Analysis (%) By End User, 2023 and 2033

Figure 15: Y-o-Y Growth (%) By End User, 2023 to 2033

Figure 16: Attractiveness Analysis By End User, 2023 to 2033

Figure 17: Share Analysis (%) By Region, 2023 and 2033

Figure 18: Y-o-Y Growth (%) By Region, 2023 to 2033

Figure 19: Attractiveness Analysis By Region, 2023 to 2033

Figure 20: United Kingdom Value Share By Test (2022 A)

Figure 21: United Kingdom Value Share By Indication (2022 A)

Figure 22: United Kingdom Value Share By End User (2022 A)

Figure 23: United Kingdom Value Share By States (2022 A)

Figure 24: United Kingdom Value Analysis (US$ million), 2018 to 2022

Figure 25: United Kingdom Value Forecast (US$ million), 2023 to 2033

Figure 26: United Kingdom Attractiveness Analysis, By Test

Figure 27: United Kingdom Attractiveness Analysis, By Indication

Figure 28: United Kingdom Attractiveness Analysis, By End User

Figure 29: United Kingdom Attractiveness Analysis, By States

Figure 30: England Share Analysis (%), By Test, 2022 and 2033

Figure 31: England Share Analysis (%), by Indication, 2022 and 2033

Figure 32: England Share Analysis (%), by End User, 2022 and 2033

Figure 33: Wales Share Analysis (%), By Test, 2022 and 2033

Figure 34: Wales Share Analysis (%), by Indication, 2022 and 2033

Figure 35: Wales Share Analysis (%), by End User, 2022 and 2033

Figure 36: Northern Ireland Share Analysis (%), By Test, 2022 and 2033

Figure 37: Northern Ireland Share Analysis (%), by Indication, 2022 and 2033

Figure 38: Northern Ireland Share Analysis (%), by End User, 2022 and 2033

Figure 39: Scotland Share Analysis (%), By Test, 2022 and 2033

Figure 40: Scotland Share Analysis (%), by Indication, 2022 and 2033

Figure 41: Scotland Share Analysis (%), by End User, 2022 and 2033

Figure 42: Germany Value Share By Test (2022 A)

Figure 43: Germany Value Share By Indication (2022 A)

Figure 44: Germany Value Share By End User (2022 A)

Figure 45: Germany Value Share By States (2022 A)

Figure 46: Germany Value Analysis (US$ million), 2018 to 2022

Figure 47: Germany Value Forecast (US$ million), 2023 to 2033

Figure 48: Germany Attractiveness Analysis, By Test

Figure 49: Germany Attractiveness Analysis, By Indication

Figure 50: Germany Attractiveness Analysis, By End User

Figure 51: Germany Attractiveness Analysis, By States

Figure 52: Baden-Württemberg Share Analysis (%), By Test, 2022 and 2033

Figure 53: Baden-Württemberg Share Analysis (%), by Indication, 2022 and 203353

Figure 54: Baden-Württemberg Share Analysis (%), by End User, 2022 and 2033

Figure 55: Bavaria Share Analysis (%), By Test, 2022 and 2033

Figure 56: Bavaria Share Analysis (%), by Indication, 2022 and 2033

Figure 57: Bavaria Share Analysis (%), by End User, 2022 and 2033

Figure 58: Lower Saxony Share Analysis (%), By Test, 2022 and 2033

Figure 59: Lower Saxony Share Analysis (%), by Indication, 2022 and 2033

Figure 60: Lower Saxony Share Analysis (%), by End User, 2022 and 2033

Figure 61: Hesse Share Analysis (%), By Test, 2022 and 2033

Figure 62: Hesse Share Analysis (%), by Indication, 2022 and 2033

Figure 63: Hesse Share Analysis (%), by End User, 2022 and 2033

Figure 64: Spain Value Share By Test (2022 A)

Figure 65: Spain Value Share By Indication (2022 A)

Figure 66: Spain Value Share By End User (2022 A)

Figure 67: Spain Value Share By States (2022 A)

Figure 68: Spain Value Analysis (US$ million), 2018 to 2022

Figure 69: Spain Value Forecast (US$ million), 2023 to 2033

Figure 70: Spain Attractiveness Analysis, By Test

Figure 71: Spain Attractiveness Analysis, By Indication

Figure 72: Spain Attractiveness Analysis, By End User

Figure 73: Spain Attractiveness Analysis, By States

Figure 74: Madrid Share Analysis (%), By Test, 2022 and 2033

Figure 75: Madrid Share Analysis (%), by Indication, 2022 and 2033

Figure 76: Madrid Share Analysis (%), by End User, 2022 and 2033

Figure 77: Barcelona Share Analysis (%), By Test, 2022 and 2033

Figure 78: Barcelona Share Analysis (%), by Indication, 2022 and 2033

Figure 79: Barcelona Share Analysis (%), by End User, 2022 and 2033

Figure 80: Valencia Share Analysis (%), By Test, 2022 and 2033

Figure 81: Valencia Share Analysis (%), by Indication, 2022 and 2033

Figure 82: Valencia Share Analysis (%), by End User, 2022 and 2033

Figure 83: Seville Share Analysis (%), By Test, 2022 and 2033

Figure 84: Seville Share Analysis (%), by Indication, 2022 and 2033

Figure 85: Seville Share Analysis (%), by End User, 2022 and 2033

Figure 86: Italy Value Share By Test (2022 A)

Figure 87: Italy Value Share By Indication (2022 A)

Figure 88: Italy Value Share By End User (2022 A)

Figure 89: Italy Value Share By States (2022 A)

Figure 90: Italy Value Analysis (US$ million), 2018 to 2022

Figure 91: Italy Value Forecast (US$ million), 2023 to 2033

Figure 92: Italy Attractiveness Analysis, By Test

Figure 93: Italy Attractiveness Analysis, By Indication

Figure 94: Italy Attractiveness Analysis, By End User

Figure 95: Italy Attractiveness Analysis, By States

Figure 96: Rome Share Analysis (%), By Test, 2022 and 2033

Figure 97: Rome Share Analysis (%), by Indication, 2022 and 2033

Figure 98: Rome Share Analysis (%), by End User, 2022 and 2033

Figure 99: Abruzzo Share Analysis (%), By Test, 2022 and 2033

Figure 100: Abruzzo Share Analysis (%), by Indication, 2022 and 2033

Figure 101: Abruzzo Share Analysis (%), by End User, 2022 and 2033

Figure 102: Basilicata Share Analysis (%), By Test, 2022 and 2033

Figure 103: Basilicata Share Analysis (%), by Indication, 2022 and 2033

Figure 104: Basilicata Share Analysis (%), by End User, 2022 and 2033

Figure 105: Calabria Share Analysis (%), By Test, 2022 and 2033

Figure 106: Calabria Share Analysis (%), by Indication, 2022 and 2033

Figure 107: Calabria Share Analysis (%), by End User, 2022 and 2033

Figure 108: France Value Share By Test (2022 A)

Figure 109: France Value Share By Indication (2022 A)

Figure 110: France Value Share By End User (2022 A)

Figure 111: France Value Share By States (2022 A)

Figure 112: France Value Analysis (US$ million), 2018 to 2022

Figure 113: France Value Forecast (US$ million), 2023 to 2033

Figure 114: France Attractiveness Analysis, By Test

Figure 115: France Attractiveness Analysis, By Indication

Figure 116: France Attractiveness Analysis, By End User

Figure 117: France Attractiveness Analysis, By States

Figure 118: Auvergne - Rhône-Alpes Share Analysis (%), By Test, 2022 and 2033

Figure 119: Auvergne - Rhône-Alpes Share Analysis (%), by Indication, 2022 and 2033

Figure 120: Auvergne - Rhône-Alpes Share Analysis (%), by End User, 2022 and 2033

Figure 121: Bretagne (Brittany) Share Analysis (%), By Test, 2022 and 2033

Figure 122: Bretagne (Brittany) Share Analysis (%), by Indication, 2022 and 2033

Figure 123: Bretagne (Brittany) Share Analysis (%), by End User, 2022 and 2033

Figure 124: Bourgogne - Franche-Comté Share Analysis (%), By Test, 2022 and 2033

Figure 125: Bourgogne - Franche-Comté Share Analysis (%), by Indication, 2022 and 2033

Figure 126: Bourgogne - Franche-Comté Share Analysis (%), by End User, 2022 and 2033

Figure 127: Ile de France (Paris) Share Analysis (%), By Test, 2022 and 2033

Figure 128: Ile de France (Paris) Share Analysis (%), by Indication, 2022 and 2033

Figure 129: Ile de France (Paris) Share Analysis (%), by End User, 2022 and 2033

Figure 130: BENELUX Value Share By Test (2022 A)

Figure 131: BENELUX Value Share By Indication (2022 A)

Figure 132: BENELUX Value Share By End User (2022 A)

Figure 133: BENELUX Value Share By States (2022 A)

Figure 134: BENELUX Value Analysis (US$ million), 2018 to 2022

Figure 135: BENELUX Value Forecast (US$ million), 2023 to 2033

Figure 136: BENELUX Attractiveness Analysis, By Test

Figure 137: BENELUX Attractiveness Analysis, By Indication

Figure 138: BENELUX Attractiveness Analysis, By End User

Figure 139: BENELUX Attractiveness Analysis, By States

Figure 140: Belgium Share Analysis (%), By Test, 2022 and 2033

Figure 141: Belgium Share Analysis (%), by Indication, 2022 and 2033

Figure 142: Belgium Share Analysis (%), by End User, 2022 and 2033

Figure 143: Netherlands Share Analysis (%), By Test, 2022 and 2033

Figure 144: Netherlands Share Analysis (%), by Indication, 2022 and 2033

Figure 145: Netherlands Share Analysis (%), by End User, 2022 and 2033

Figure 146: Luxembourg Share Analysis (%), By Test, 2022 and 2033

Figure 147: Luxembourg Share Analysis (%), by Indication, 2022 and 2033

Figure 148: Luxembourg Share Analysis (%), by End User, 2022 and 2033

Figure 149: Nordics Value Share By Test (2022 A)

Figure 150: Nordics Value Share By Indication (2022 A)

Figure 151: Nordics Value Share By End User (2022 A)

Figure 152: Nordics Value Share By States (2022 A)

Figure 153: Nordics Value Analysis (US$ million), 2018 to 2022

Figure 154: Nordics Value Forecast (US$ million), 2023 to 2033

Figure 155: Nordics Attractiveness Analysis, By Test

Figure 156: Nordics Attractiveness Analysis, By Indication

Figure 157: Nordics Attractiveness Analysis, By End User

Figure 158: Nordics Attractiveness Analysis, By States

Figure 159: Denmark Share Analysis (%), By Test, 2022 and 2033

Figure 160: Denmark Share Analysis (%), by Indication, 2022 and 2033

Figure 161: Denmark Share Analysis (%), by End User, 2022 and 2033

Figure 162: Norway Share Analysis (%), By Test, 2022 and 2033

Figure 163: Norway Share Analysis (%), by Indication, 2022 and 2033

Figure 164: Norway Share Analysis (%), by End User, 2022 and 2033

Figure 165: Sweden Share Analysis (%), By Test, 2022 and 2033

Figure 166: Sweden Share Analysis (%), by Indication, 2022 and 2033

Figure 167: Sweden Share Analysis (%), by End User, 2022 and 2033

Figure 168: Finland Share Analysis (%), By Test, 2022 and 2033

Figure 169: Finland Share Analysis (%), by Indication, 2022 and 2033

Figure 170: Finland Share Analysis (%), by End User, 2022 and 2033

Figure 171: Poland Value Share By Test (2022 A)

Figure 172: Poland Value Share By Indication (2022 A)

Figure 173: Poland Value Share By Indication (2022 A)

Figure 174: Poland Value Analysis (US$ million), 2018 to 2022

Figure 175: Poland Value Forecast (US$ million), 2023 to 2033

Figure 176: Poland Attractiveness Analysis, By Test

Figure 177: Poland Attractiveness Analysis, By Indication

Figure 178: Poland Attractiveness Analysis, By End User

Figure 179: Hungary Value Share By Test (2022 A)

Figure 180: Hungary Value Share By Indication (2022 A)

Figure 181: Hungary Value Share By Indication (2022 A)

Figure 182: Hungary Value Analysis (US$ million), 2018 to 2022

Figure 183: Hungary Value Forecast (US$ million), 2023 to 2033

Figure 184: Hungary Attractiveness Analysis, By Test

Figure 185: Hungary Attractiveness Analysis, By Indication

Figure 186: Hungary Attractiveness Analysis, By End User

Figure 187: Romania Value Share By Test (2022 A)

Figure 188: Romania Value Share By Indication (2022 A)

Figure 189: Romania Value Share By Indication (2022 A)

Figure 190: Romania Value Analysis (US$ million), 2018 to 2022

Figure 191: Romania Value Forecast (US$ million), 2023 to 2033

Figure 192: Romania Attractiveness Analysis, By Test

Figure 193: Romania Attractiveness Analysis, By Indication

Figure 194: Romania Attractiveness Analysis, By End User

Figure 195: Russia Value Share By Test (2022 A)

Figure 196: Russia Value Share By Indication (2022 A)

Figure 197: Russia Value Share By Indication (2022 A)

Figure 198: Russia Value Analysis (US$ million), 2018 to 2022

Figure 199: Russia Value Forecast (US$ million), 2023 to 2033

Figure 200: Russia Attractiveness Analysis, By Test

Figure 201: Russia Attractiveness Analysis, By Indication

Figure 202: Russia Attractiveness Analysis, By End User

Figure 203: Czech Republic Value Share By Test (2022 A)

Figure 204: Czech Republic Value Share By Indication (2022 A)

Figure 205: Czech Republic Value Share By Indication (2022 A)

Figure 206: Czech Republic Value Analysis (US$ million), 2018 to 2022

Figure 207: Czech Republic Value Forecast (US$ million), 2023 to 2033

Figure 208: Czech Republic Attractiveness Analysis, By Test

Figure 209: Czech Republic Attractiveness Analysis, By Indication

Figure 210: Czech Republic Attractiveness Analysis, By End User

Figure 211: Rest of Value Share By Test (2022 A)

Figure 212: Rest of Value Share By Indication (2022 A)

Figure 213: Rest of Value Share By Indication (2022 A)

Figure 214: Rest of Value Analysis (US$ million), 2018 to 2022

Figure 215: Rest of Value Forecast (US$ million), 2023 to 2033

Figure 216: Rest of Attractiveness Analysis, By Test

Figure 217: Rest of Attractiveness Analysis, By Indication

Figure 218: Rest of Attractiveness Analysis, By End User

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Europe's Golden Generation Travel Market Size and Share Forecast Outlook 2025 to 2035

Europe Automotive Night Vision System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA