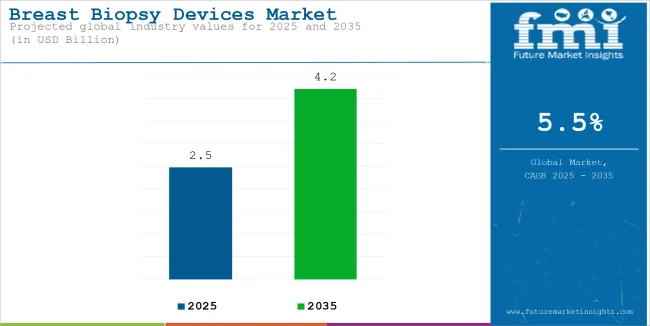

The global Breast Biopsy Devices Market is projected to be valued at USD 2.47 billion in 2025 and is expected to reach USD 4.21 billion by 2035, registering a CAGR of 5.5% during the forecast period. This growth is primarily driven by the increasing prevalence of breast cancer, which necessitates early and accurate diagnostic procedures.

Advancements in minimally invasive biopsy techniques, such as vacuum-assisted and image-guided systems, are enhancing diagnostic accuracy while improving patient comfort and reducing recovery times. Government initiatives promoting breast cancer awareness and screening programs further contribute to market expansion by encouraging early detection and diagnosis.

The rising demand for outpatient and ambulatory surgical centres, coupled with favourable reimbursement policies, is also facilitating the adoption of advanced biopsy devices. Collectively, these factors underscore the market's positive trajectory and the growing emphasis on early and precise breast cancer diagnosis.

Prominent players in the breast biopsy devices market include Hologic, Inc., Devicor Medical Products, Inc. (Mammotome), and Becton, Dickinson and Company (BD). Hologic maintains a significant market share, attributed to its comprehensive portfolio of vacuum-assisted biopsy systems and integrated imaging solutions.

In 2024 - Mammotome announced Mammotome RevolveTM biopsy system, an advanced tissue management system that automatically collects and organizes specimens in touch-free chambers, simplifying tissue verification. “The launch of the newly refined Mammotome RevolveTM system2 marks an exciting milestone for Mammotome,” said Suzanne Smith, Vice President of America Sales, Global Service and Commercial Marketing.

“These enhancements will empower clinicians to perform biopsy procedures with greater simplicity and efficiency. This advancement underscores our unwavering commitment to innovation and excellence in patient care.”

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 2.34 billion |

| Estimated Size, 2025 | USD 2.47 billion |

| Projected Size, 2035 | USD 4.21 billion |

| Value-based CAGR (2025 to 2035) | 5.5% |

North America leads the breast biopsy devices market, driven by advanced healthcare infrastructure, high adoption of cutting-edge biopsy technologies, and strong presence of key market players. The region's dominance is further supported by government initiatives promoting breast cancer awareness and screening programs, leading to early detection and diagnosis.

The integration of AI in imaging and biopsy procedures is streamlining workflows and improving diagnostic outcomes. Additionally, favourable reimbursement policies and the rising demand for outpatient and ambulatory surgical centres are facilitating the adoption of advanced biopsy devices.

Europe holds a significant share in the breast biopsy devices market, attributed to the rising prevalence of breast cancer, particularly in countries like Italy, Germany, and the Netherlands. The region's growth is bolstered by high adoption of novel technologies, development in healthcare infrastructure, and government initiatives to create awareness about breast cancer diagnosis programs.

The European market is also witnessing increased investment in research and development of minimally invasive procedures, enhancing diagnostic accuracy and patient comfort. Furthermore, favourable reimbursement policies and the presence of leading manufacturers contribute to the market's expansion.

The below table presents the expected CAGR for the global breast biopsy devices market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.2%, followed by a slightly lower growth rate of 5.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.2% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 5.5% |

| H2 (2025 to 2035) | 5.0% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.5% in the first half and decrease moderately at 5.0% in the second half. In the first half (H1) the market witnessed a decrease of 70.00 BPS while in the second half (H2), the market witnessed an increase of 90.00 BPS.

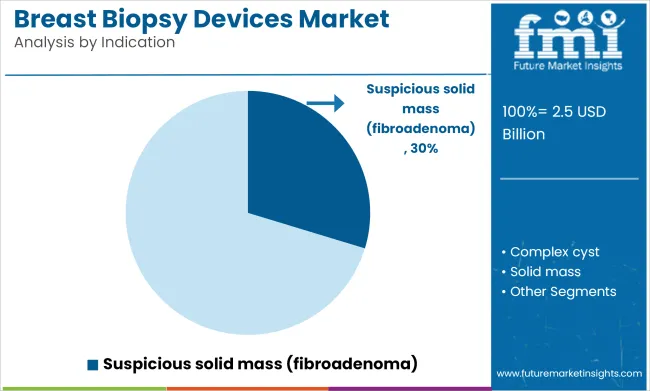

The suspicious solid mass (fibroadenoma) segment is expected to contribute approximately 29.7% of the global revenue share in the breast biopsy devices market in 2025. This segment has emerged as the leading indication due to the widespread occurrence of fibroadenomas, particularly in younger and middle-aged women. The increased availability and usage of imaging techniques, including mammography and ultrasound, have led to the early identification of solid breast masses that require biopsy for conclusive diagnosis.

Clinical focus has been increasingly placed on distinguishing benign tumors such as fibroadenomas from malignant lesions to avoid overtreatment and reduce diagnostic uncertainty. The growth of this segment has been further supported by the integration of minimally invasive techniques such as core needle and vacuum-assisted biopsies-into standard diagnostic protocols.

Hospitals are projected to account for nearly 36.8% of the global revenue share in the breast biopsy devices market in 2025, making them the dominant end-user segment. This leading position is attributed to hospitals’ access to advanced imaging modalities, specialized diagnostic teams, and integrated care settings, which are essential for the safe and accurate execution of breast biopsy procedures.

Hospitals are typically equipped with MRI-guided and stereotactic biopsy systems, allowing for comprehensive diagnostic workflows in a single location. A significant volume of breast biopsies especially those involving complex cases or high-risk patients is conducted within hospitals due to their ability to coordinate across radiology, oncology, and pathology departments.

Furthermore, structured reimbursement frameworks and insurance coverage in most countries make hospitals the primary point of care for such procedures. The continued expansion of hospital-based breast care units and growing investments in precision diagnostic tools have also contributed to the consolidation of hospitals as the preferred setting for biopsy. These factors collectively reinforce hospitals’ central role in breast cancer diagnostics and drive their market dominance.

The Expansion of Screening Programs and Awareness Campaigns Is Driving the Growth for Breast biopsy devices market.

Government and non-governmental associations across the world have focused on creating breast cancer awareness and early detection through comprehensive initiatives. These programs will help the public understand the importance of regular checkups, why they are risky, and possibly help the patient survive earlier.

For example, activities like Breast Cancer Awareness Month spearheaded by any organization like the American Cancer Society (ACS) and World Health Organization (WHO) have been crucial in fostering awareness across the globe.

Mass screening programs, especially mammography, form the core of these efforts. With such programs being initiated, thousands of women become a part of routine screening processes, which mostly reveal suspicious lesions or abnormalities in the breast tissue.

The discovery of these anomalies calls for further diagnostic evaluation, and the gold standard for the final diagnosis is breast biopsy. This direct correlation of increased screening efforts with the need for biopsy procedures has driven the advancement of breast biopsy devices.

Advancements in image-guided biopsy techniques have now made follow-up evaluations more efficient as well as highly accurate, well in line with the objectives behind such awareness measures that would ultimately allow for time- and evidence-based diagnosis. This increases the cumulative pool of the patient population getting biopsy procedures thus becoming an overarching factor in the acceleration of the demand for breast biopsy devices.

Advancements in Vacuum-Assisted Biopsy (VAB) Systems Are a Key Driver of Growth in The Market for breast biopsy devices

These systems have revolutionized the way breast tissue samples are collected, offering significant advantages over traditional biopsy techniques. Unlike conventional methods, VAB systems use a vacuum mechanism to extract tissue samples, enabling the collection of larger and more intact specimens.

This ability to obtain high-quality samples improves diagnostic precision, particularly in detecting subtle or early-stage abnormalities, which are crucial for effective breast cancer diagnosis and treatment planning.

The minimally invasive nature of VAB systems has pushed forward their application further. Such instruments can accurately reach small or located lesions which other techniques might have difficulty reaching.

The technique can be guided through advanced imaging techniques such as ultrasound, mammography, or MRI, to provide accuracy in collecting samples and limiting damage to other tissues. This makes VAB a patient-friendly option, reducing recovery time, procedure-related discomfort, and the need for repeat biopsies.

In addition, improvements in VAB systems, such as automation and ergonomic designs, have streamlined the process for clinicians to be faster and more efficient. These advancements are in line with the increased need for cost-effective, accurate, and patient-centered diagnostic solutions in modern healthcare settings.

Therefore, the constant improvement and adoption of VAB systems have become a significant driver of the expansion of the market for breast biopsy devices.

The Increasing Preference for Outpatient Settings Like Ambulatory Surgical Centers (ASCs) For Performing Biopsy Procedures Presents a Significant Opportunity

Ambulatory surgical centers have become the preference for patients and healthcare providers as they are less expensive, require shorter waiting periods, and the whole process runs much more efficiently than in hospitals. The growth of outpatient care has been further encouraged by a rising demand for minimally invasive procedures that take much less time and can be accomplished with minimal recovery time, so breast biopsies are most suitable for such ASCs.

This has opened up an area for manufacturers to develop compact, portable, and easy-to-use biopsy devices suitable for the ASCs requirements. The devices have to be manufactured keeping in mind the need for high precision and efficiency while being user-friendly to clinicians who function in a high-pace environment.

In addition, the cost-sensitive nature of the ASC will require diagnostic tools to be affordable yet with advanced technology, an area for innovative biopsy technologies.

In addition, the increasing number of ASCs worldwide, especially in developed and emerging markets, increases the potential customer base for breast biopsy device manufacturers. Devices designed for ASCs not only make procedures more efficient but also increase patient satisfaction due to faster procedures and quicker recovery times. This trend represents untapped growth potential in this market segment.

The Dependence of Breast Biopsy Devices on Advanced Imaging Modalities as Significant Growth Barrier for Market for breast biopsy devices Growth

Advanced imaging modalities such as MRI, mammography, and ultrasound pose a significant restraint on the market for breast biopsy devices, mainly because of resource-limited settings. These imaging systems are an essential part of many biopsy procedures that are performed with precision and effectiveness, because they allow accurate localization and targeting of suspicious lesions.

However, the high cost and need for specialized infrastructure make these unavailable, especially in smaller healthcare facilities and rural areas.

In developing areas or low-income countries, accessibility to advanced imaging technology is confined because of various economic constraints along with low-budget healthcare and inadequacy of infrastructure. Smaller clinics or outpatient centers also refrain from the investment of advanced imaging equipment in the developed regions also, thereby declining their ability for performing advanced biopsies through them.

These restrictions limit the usage of devices that are primarily based on the aforementioned modalities and act as a constraint toward the growth in the market.

In addition, the imaging-guided biopsy systems are operated by trained personnel who have knowledge in both imaging and biopsy techniques. The lack of such trained professionals in many areas aggravates the challenge, leaving some populations underserved.

For manufacturers, this reliance on imaging systems adds complexity, as devices must be designed to integrate seamlessly with a range of imaging technologies, further increasing costs. In summery, the availability of advanced imaging technologies can significantly limit access and widespread acceptance of breast biopsy instruments, limiting growth in low resource regions.

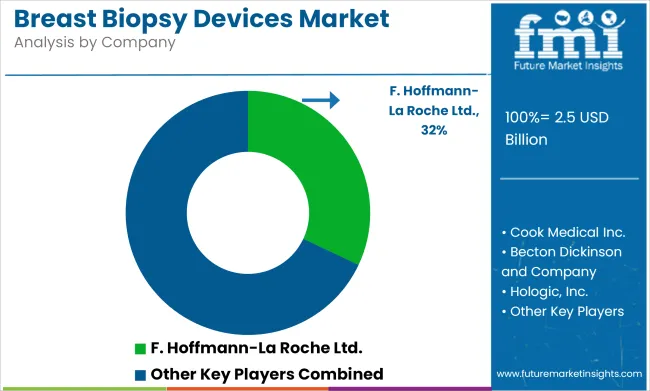

Tier 1 companies comprise market leaders with a significant market share of 58.9% in global market. These companies engage in strategic partnerships and acquisitions to expand their product portfolios and access cutting-edge technologies. Additionally, they emphasize extensive clinical trials to validate the efficacy and safety of their products. Prominent companies in tier 1 include F. Hoffmann-La Roche Ltd., GE Healthcare, Cook Medical Inc., Becton Dickinson and Company.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market and holds around 21.9% market share. They typically pursue partnerships with multispecialty hospitals and research organizations to leverage emerging technologies and expedite product development.

These companies often emphasize agility and adaptability, allowing them to quickly bring new products to market, additionally targeting specific types medical needs. Additionally, they focus on cost-effective production methods to offer competitive pricing. Prominent companies in tier 2 include Hologic, Inc., Siemens Healthier, ARGON MEDICAL, C.R. Bard, Inc. and Devicor Medical Products, Inc.

Finally, Tier 3 companies, such as Leica Biosystems, Medax Srl Unipersonale, Planmed Oy, and Scion Medical Technologies, LLC. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the breast biopsy devices sales remains dynamic and competitive.

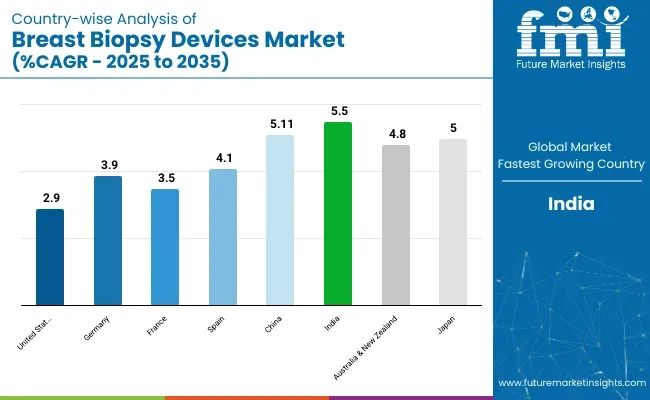

The section below covers the industry analysis for the market for breast biopsy devices for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle Ease & Africa, is provided. The United States is anticipated to remain at the forefront in North America, with higher market share through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| Germany | 3.9% |

| France | 3.5% |

| Spain | 4.1% |

| China | 5.1% |

| India | 5.5% |

| Australia & New Zealand | 4.8% |

| Japan | 5.0% |

United States. market for breast biopsy devices is poised to exhibit a CAGR of 2.9% between 2025 and 2035. Currently, it holds the highest share in the North American market.

According to the American Cancer Society (ACS), breast cancer is the most frequently diagnosed cancer among women in the country, with over 300,000 new cases of invasive and non-invasive breast cancer reported annually. This alarming incidence rate has heightened the need for early detection and accurate diagnosis, making advanced diagnostic tools, including breast biopsy devices, essential in healthcare.

Early diagnosis is very important for the effective treatment, and breast biopsy devices play a crucial role in confirming malignancies and guiding therapeutic decisions. This increasing prevalence has also led the government and nongovernmental initiatives to encourage widespread breast cancer screening, often finding suspicious lesions that require biopsy. This steady demand for accurate and reliable diagnostic solutions continues to propel the adoption and development of new and innovative breast biopsy technologies in the USA market.

Germany’s market for breast biopsy devices is poised to exhibit a CAGR of 3.9% between 2025 and 2035. Currently, it holds the highest share in the Western Europe market, and the trend is expected to continue during the forecast period.

The initiatives and healthcare campaigns carried out in Germany have equipped the public with information on breast cancer risks, signs, and early diagnosis benefits. National Mammography Screening Program emphasizes the need for women aged 50-69 years to be screened regularly, allowing for early detection of abnormal lesions in the breast.

This awareness helps to generate proactive healthcare behavior in that among other things, a larger segment of the female population has accepted regular check-ups and these tests. The additional tests are usually followed by biopsy procedures when evidence of abnormality is found.

The seemingly growing demand for such modern and accurate breast biopsy devices can be linked towards the rising awareness on breast cancer found among the various segments of the German population. Along with this is a well-educated and equally health-conscious German populace that promotes an immense call for timely medical intervention, maintaining a steady demand for diagnostic solutions. This focus on awareness and a preventive approach to healthcare also supports powerfully the growth of the market for breast biopsy devices in the country.

Japan market for breast biopsy devices is poised to exhibit a CAGR of 5.0% between 2025 and 2035. Currently, it holds the highest share in the East Asia market, and the trend is expected to continue during the forecast period.

Japan's rapidly aging population significantly impacts the market for breast biopsy devices. As of 2022, over 29% of Japan's population was aged 65 and above, reflecting a substantial increase over the past decade. This demographic shift correlates with a rise in breast cancer cases, particularly among older women. In 2020, approximately 92,150 new breast cancer cases were diagnosed among Japanese women, a significant increase from over 44,000 cases in 2003.

Elderly populations also suffer from hence, putting them at an increased risk of having comorbidities and hence making early diagnosis and the delivery of treatment all the more urgent. Biopsy devices, more so even minimally invasive ones, are now increasingly being embraced in giving appropriate diagnoses with low discomfort to the patient. The health care system in Japan, powered by universal coverage, endorses the systems toward the older generation accessing those tools. The government health initiatives also boost regular screening to assist in early detection of breast lesions that require biopsy.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in Market for breast biopsy devices

In terms of product, the industry is divided into- biopsy needle, MRI-guide biopsy systems, ultrasound guided breast biopsy systems, vacuum-assisted device (VAD), guide wire (localization wire) and breast biopsy marker.

In terms of indication, the industry is segregated into- complex cyst, solid mass, suspicious solid mass (fibroadenoma) and suspicious micro-calcifications.

In terms of end user, the industry is segregated into- hospitals, specialty clinics, ambulatory surgical centers and cancer research institutes.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global breast biopsy devices market is projected to witness CAGR of 5.5% between 2025 and 2035.

The global breast biopsy devices industry stood at USD 2.34 billion in 2024.

The global breast biopsy devices market is anticipated to reach USD 4.21 billion by 2035 end.

India is set to record the highest CAGR of 6.4% in the assessment period.

The key players operating in the global breast biopsy devices market include F. Hoffmann-La Roche Ltd., GE Healthcare, Cook Medical Inc., Becton Dickinson and Company, Hologic, Inc., Siemens Healthier, ARGON MEDICAL, C.R. Bard, Inc., Devicor Medical Products, Inc., Leica Biosystems, Medax Srl Unipersonale, Planmed Oy, and Scion Medical Technologies, LLC.

Table 01: Global Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 02: Global Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 03: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 04: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 05: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 06: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 07: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 08: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 09: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Region

Table 10: Global Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Region

Table 11: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 12: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 13: North America Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 14: North America Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 15: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 16: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 17: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 18: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 19: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 20: North America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 21: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 22: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 23: Latin America Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 24: Latin America Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 25: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 26: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 27: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 28: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 29: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 30: Latin America Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 31: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 32: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 33: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 34: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 35: Europe Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 36: Europe Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 37: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 38: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 39: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 40: Europe Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 41: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 42: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 43: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 44: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 45: East Asia Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 46: East Asia Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 47: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 48: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 49: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 50: East Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 51: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 52: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 53: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 54: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 55: South Asia Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 56: South Asia Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 57: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 58: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 59: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 60: South Asia Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 61: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 62: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 63: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 64: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 65: Oceania Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 66: Oceania Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 67: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 68: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 69: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 70: Oceania Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 71: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 72: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Country

Table 73: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 74: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 75: Middle East and Africa Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 76: Middle East and Africa Market Size Volume (Units) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Product

Table 77: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 78: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By Indication

Table 79: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Table 80: Middle East and Africa Market Size (USD Million) Analysis 2025 to 2025 and Forecast 2025 to 2035, By End User

Figure 01: Global Market Value Share, By Product 2025 (E)

Figure 02: Global Market Value Share, By Indication 2025 (E)

Figure 03: Global Market Value Share, By End User 2025 (E)

Figure 04: Global Market Value Share, By Region 2025 (E)

Figure 05: Global Market Volume (Units) Analysis, 2020 to 2025

Figure 06: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 07: Global Average Pricing Analysis Benchmark USD (Unit) (2025)

Figure 08: Global Market Size (USD Million) Analysis, 2020 to 2025

Figure 09: Global Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 10: Global Market Absolute $ Opportunity Analysis, 2025 to 2035

Figure 11: Global Market Analysis By Product -2025 & 2035

Figure 12: Global Market Y-o-Y Growth Projections By Product, 2025 to 2035

Figure 13: Global Market Attractiveness, By Product, 2025 to 2032

Figure 14: Global Market Analysis By Indication-2025 and 2032

Figure 15A: Global Market Y-o-Y Growth Projections By Indication, 2025 to 2035

Figure 15B: Global Market Attractiveness, By Indication, 2025 to 2035

Figure 16: Global Market Analysis By End User -2025 and 2032

Figure 17: Global Market Y-o-Y Growth Projections By End User, 2025 to 2035

Figure 18: Global Market Attractiveness, By End User, 2025 to 2032

Figure 19: Global Market Analysis by Region-2025 and 2032

Figure 20: Global Market Y-o-Y Growth Projections by Region, 2025 to 2035

Figure 21: Global Market Attractiveness, By Region, 2025 to 2035

Figure 22: North America Market Value Share, By Product 2025 (E)

Figure 23: North America Market Value Share, By Indication 2025 (E)

Figure 24: North America Market Value Share, By End User 2025 (E)

Figure 25: North America Market Value Share, By Region 2025 (E)

Figure 26: North America Market Size (USD Million) Analysis, 2020 to 2025

Figure 27: North America Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 28: North America Market Attractiveness Analysis, By Country

Figure 29: North America Market Attractiveness Analysis, By Product

Figure 30: North America Market Attractiveness, By Indication

Figure 31: North America Market Attractiveness, By End User

Figure 32: USA Market Value Proportion Analysis, 2025

Figure 33: Global Vs. USA Growth Comparison, 2025 to 2035

Figure 34: USA Market Share Analysis (%), By Product, 2025 to 2035

Figure 35: USA Market Share Analysis (%), By Indication, 2025 to 2035

Figure 36: USA Market Share Analysis (%), By End User, 2025 to 2035

Figure 37: Canada Market Value Proportion Analysis, 2025

Figure 38: Global Vs. Canada Growth Comparison, 2025 to 2035

Figure 39: Canada Market Share Analysis (%), By Product, 2025 to 2035

Figure 40: Canada Market Share Analysis (%), By Indication, 2025 to 2035

Figure 41: Canada Market Share Analysis (%), By End User, 2025 to 2035

Figure 42: Latin America Market Value Share, By Product 2025 (E)

Figure 43: Latin America Market Value Share, By Indication 2025 (E)

Figure 44: Latin America Market Value Share, By End User 2025 (E)

Figure 45: Latin America Market Value Share, By Region 2025 (E)

Figure 46: Latin America Market Size (USD Million) Analysis, 2020 to 2025

Figure 47: Latin America Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 48: Latin America Market Attractiveness Analysis, By Country

Figure 49: Latin America Market Attractiveness Analysis, By Product

Figure 50: Latin America Market Attractiveness, By Indication

Figure 51: Latin America Market Attractiveness, By End User

Figure 52: Brazil Market Value Proportion Analysis, 2025

Figure 53: Global Vs. Brazil Growth Comparison, 2025 to 2035

Figure 54: Brazil Market Share Analysis (%), By Product, 2025 to 2035

Figure 55: Brazil Market Share Analysis (%), By Indication, 2025 to 2035

Figure 56: Brazil Market Share Analysis (%), By End User, 2025 to 2035

Figure 57: Mexico Market Value Proportion Analysis, 2025

Figure 58: Global Vs. Mexico Growth Comparison, 2025 to 2035

Figure 59: Mexico Market Share Analysis (%), By Product, 2025 to 2035

Figure 60: Mexico Market Share Analysis (%), By Indication, 2025 to 2035

Figure 61: Mexico Market Share Analysis (%), By End User, 2025 to 2035

Figure 62: Argentina Market Value Proportion Analysis, 2025

Figure 63: Global Vs. Argentina Growth Comparison, 2025 to 2035

Figure 64: Argentina Market Share Analysis (%), By Product, 2025 to 2035

Figure 65: Argentina Market Share Analysis (%), By Indication, 2025 to 2035

Figure 66: Argentina Market Share Analysis (%), By End User, 2025 to 2035

Figure 67: Europe Market Value Share, By Product 2025 (E)

Figure 68: Europe Market Value Share, By Indication 2025 (E)

Figure 69: Europe Market Value Share, By End User 2025 (E)

Figure 70: Europe Market Value Share, By Region 2025 (E)

Figure 71: Europe Market Size (USD Million) Analysis, 2020 to 2025

Figure 72: Europe Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 73: Europe Market Attractiveness Analysis, By Country

Figure 74: Europe Market Attractiveness Analysis, By Product

Figure 75: Europe Market Attractiveness, By Indication

Figure 76: Europe Market Attractiveness, By End User

Figure 77: United Kingdom Market Value Proportion Analysis, 2025

Figure 78: Global Vs.United Kingdom Growth Comparison, 2025 to 2035

Figure 79: United Kingdom Market Share Analysis (%), By Product, 2025 to 2035

Figure 80: United Kingdom Market Share Analysis (%), By Indication, 2025 to 2035

Figure 81: United Kingdom Market Share Analysis (%), By End User, 2025 to 2035

Figure 82: Germany Market Value Proportion Analysis, 2025

Figure 83: Global Vs. Germany Growth Comparison, 2025 to 2035

Figure 84: Germany Market Share Analysis (%), By Product, 2025 to 2035

Figure 85: Germany Market Share Analysis (%), By Indication, 2025 to 2035

Figure 86: Germany Market Share Analysis (%), By End User, 2025 to 2035

Figure 87: Italy Market Value Proportion Analysis, 2025

Figure 88: Global Vs. Italy Growth Comparison, 2025 to 2035

Figure 89: Italy Market Share Analysis (%), By Product, 2025 to 2035

Figure 90: Italy Market Share Analysis (%), By Indication, 2025 to 2035

Figure 91: Italy Market Share Analysis (%), By End User, 2025 to 2035

Figure 92: France Market Value Proportion Analysis, 2025

Figure 93: Global Vs. France Growth Comparison, 2025 to 2035

Figure 94: France Market Share Analysis (%), By Product, 2025 to 2035

Figure 95: France Market Share Analysis (%), By Indication, 2025 to 2035

Figure 96: France Market Share Analysis (%), By End User, 2025 to 2035

Figure 97: Spain Market Value Proportion Analysis, 2025

Figure 98: Global Vs. Spain Growth Comparison, 2025 to 2035

Figure 99: Spain Market Share Analysis (%), By Product, 2025 to 2035

Figure 100: Spain Market Share Analysis (%), By Indication, 2025 to 2035

Figure 101: Spain Market Share Analysis (%), By End User, 2025 to 2035

Figure 102: BENELUX Market Value Proportion Analysis, 2025

Figure 103: Global Vs. BENELUX Growth Comparison, 2025 to 2035

Figure 104: BENELUX Market Share Analysis (%), By Product, 2025 to 2035

Figure 105: BENELUX Market Share Analysis (%), By Indication, 2025 to 2035

Figure 106: BENELUX Market Share Analysis (%), By End User, 2025 to 2035

Figure 107: Nordic Countries Market Value Proportion Analysis, 2025

Figure 108: Global Vs. Nordic Countries Growth Comparison, 2025 to 2035

Figure 109: Nordic Countries Market Share Analysis (%), By Product, 2025 to 2035

Figure 110: Nordic Countries Market Share Analysis (%), By Indication, 2025 to 2035

Figure 111: Nordic Countries Market Share Analysis (%), By End User, 2025 to 2035

Figure 112: Russia Market Value Proportion Analysis, 2025

Figure 113: Global Vs. Russia Growth Comparison, 2025 to 2035

Figure 114: Russia Market Share Analysis (%), By Product, 2025 to 2035

Figure 115: Russia Market Share Analysis (%), By Indication, 2025 to 2035

Figure 116: Russia Market Share Analysis (%), By End User, 2025 to 2035

Figure 117: East Asia Market Value Share, By Product 2025 (E)

Figure 118: East Asia Market Value Share, By Indication 2025 (E)

Figure 119: East Asia Market Value Share, By End User 2025 (E)

Figure 120: East Asia Market Value Share, By Region 2025 (E)

Figure 121: East Asia Market Size (USD Million) Analysis, 2020 to 2025

Figure 122: East Asia Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 123: East Asia Market Attractiveness Analysis, By Country

Figure 124: East Asia Market Attractiveness Analysis, By Product

Figure 125: East Asia Market Attractiveness, By Indication

Figure 126: East Asia Market Attractiveness, By End User

Figure 127: China Market Value Proportion Analysis, 2025

Figure 128: Global Vs. China Growth Comparison, 2025 to 2035

Figure 129: China Market Share Analysis (%), By Product, 2025 to 2035

Figure 130: China Market Share Analysis (%), By Indication, 2025 to 2035

Figure 131: China Market Share Analysis (%), By End User, 2025 to 2035

Figure 132: Japan Market Value Proportion Analysis, 2025

Figure 133: Global Vs. Japan Growth Comparison, 2025 to 2035

Figure 134: Japan Market Share Analysis (%), By Product, 2025 to 2035

Figure 135: Japan Market Share Analysis (%), By Indication, 2025 to 2035

Figure 136: Japan Market Share Analysis (%), By End User, 2025 to 2035

Figure 137: South Korea Market Value Proportion Analysis, 2025

Figure 138: Global Vs. South Korea Growth Comparison, 2025 to 2035

Figure 139: South Korea Market Share Analysis (%), By Product, 2025 to 2035

Figure 140: South Korea Market Share Analysis (%), By Indication, 2025 to 2035

Figure 141: South Korea Market Share Analysis (%), By End User, 2025 to 2035

Figure 142: South Asia Market Value Share, By Product 2025 (E)

Figure 143: South Asia Market Value Share, By Indication 2025 (E)

Figure 144: South Asia Market Value Share, By End User 2025 (E)

Figure 145: South Asia Market Value Share, By Region 2025 (E)

Figure 146: South Asia Market Size (USD Million) Analysis, 2020 to 2025

Figure 147: South Asia Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 148: South Asia Market Attractiveness Analysis, By Country

Figure 149: South Asia Market Attractiveness Analysis, By Product

Figure 150: South Asia Market Attractiveness, By Indication

Figure 151: South Asia Market Attractiveness, By End User

Figure 152: India Market Value Proportion Analysis, 2025

Figure 153: Global Vs. India Growth Comparison, 2025 to 2035

Figure 154: India Market Share Analysis (%), By Product, 2025 to 2035

Figure 155: India Market Share Analysis (%), By Indication, 2025 to 2035

Figure 156: India Market Share Analysis (%), By End User, 2025 to 2035

Figure 157: Malaysia Market Value Proportion Analysis, 2025

Figure 158: Global Vs. Malaysia Growth Comparison, 2025 to 2035

Figure 159: Malaysia Market Share Analysis (%), By Product, 2025 to 2035

Figure 160: Malaysia Market Share Analysis (%), By Indication, 2025 to 2035

Figure 161: Malaysia Market Share Analysis (%), By End User, 2025 to 2035

Figure 162: Indonesia Market Value Proportion Analysis, 2025

Figure 163: Global Vs. Indonesia Growth Comparison, 2025 to 2035

Figure 164: Indonesia Market Share Analysis (%), By Product, 2025 to 2035

Figure 165: Indonesia Market Share Analysis (%), By Indication, 2025 to 2035

Figure 166: Indonesia Market Share Analysis (%), By End User, 2025 to 2035

Figure 167: Thailand Market Value Proportion Analysis, 2025

Figure 168: Global Vs. Thailand Growth Comparison, 2025 to 2035

Figure 169: Thailand Market Share Analysis (%), By Product, 2025 to 2035

Figure 170: Thailand Market Share Analysis (%), By Indication, 2025 to 2035

Figure 171: Thailand Market Share Analysis (%), By End User, 2025 to 2035

Figure 172: Oceania Market Value Share, By Product 2025 (E)

Figure 173: Oceania Market Value Share, By Indication 2025 (E)

Figure 174: Oceania Market Value Share, By End User 2025 (E)

Figure 175: Oceania Market Value Share, By Region 2025 (E)

Figure 176: Oceania Market Size (USD Million) Analysis, 2020 to 2025

Figure 177: Oceania Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 178: Oceania Market Attractiveness Analysis, By Country

Figure 179: Oceania Market Attractiveness Analysis, By Product

Figure 180: Oceania Market Attractiveness, By Indication

Figure 181: Oceania Market Attractiveness, By End User

Figure 182: Australia Market Value Proportion Analysis, 2025

Figure 183: Global Vs. Australia Growth Comparison, 2025 to 2035

Figure 184: Australia Market Share Analysis (%), By Product, 2025 to 2035

Figure 185: Australia Market Share Analysis (%), By Indication, 2025 to 2035

Figure 186: Australia Market Share Analysis (%), By End User, 2025 to 2035

Figure 187: New Zealand Market Value Proportion Analysis, 2025

Figure 188: Global Vs. New Zealand Growth Comparison, 2025 to 2035

Figure 189: New Zealand Market Share Analysis (%), By Product, 2025 to 2035

Figure 190: New Zealand Market Share Analysis (%), By Indication, 2025 to 2035

Figure 191: New Zealand Market Share Analysis (%), By End User, 2025 to 2035

Figure 192: Middle East and Africa Market Value Share, By Product 2025 (E)

Figure 193: Middle East and Africa Market Value Share, By Indication 2025 (E)

Figure 194: Middle East and Africa Market Value Share, By End User 2025 (E)

Figure 195: Middle East and Africa Market Value Share, By Region 2025 (E)

Figure 196: Middle East and Africa Market Size (USD Million) Analysis, 2020 to 2025

Figure 197: Middle East and Africa Market Size (USD Million) & Y-o-Y Growth (%) Analysis, 2025 to 2035

Figure 198: Middle East and Africa Market Attractiveness Analysis, By Country

Figure 199: Middle East and Africa Market Attractiveness Analysis, By Product

Figure 200: Middle East and Africa Market Attractiveness, By Indication

Figure 201: Middle East and Africa Market Attractiveness, By End User

Figure 202: GCC Countries Market Value Proportion Analysis, 2025

Figure 203: Global Vs. GCC Countries Growth Comparison, 2025 to 2035

Figure 204: GCC Countries Market Share Analysis (%), By Product, 2025 to 2035

Figure 205: GCC Countries Market Share Analysis (%), By Indication, 2025 to 2035

Figure 206: GCC Countries Market Share Analysis (%), By End User, 2025 to 2035

Figure 207: Turkey Market Value Proportion Analysis, 2025

Figure 208: Global Vs. Turkey Growth Comparison, 2025 to 2035

Figure 209: Turkey Market Share Analysis (%), By Product, 2025 to 2035

Figure 210: Turkey Market Share Analysis (%), By Indication, 2025 to 2035

Figure 211: Turkey Market Share Analysis (%), By End User, 2025 to 2035

Figure 212: South Africa Market Value Proportion Analysis, 2025

Figure 213: Global Vs. South Africa Growth Comparison, 2025 to 2035

Figure 214: South Africa Market Share Analysis (%), By Product, 2025 to 2035

Figure 215: South Africa Market Share Analysis (%), By Indication, 2025 to 2035

Figure 216: South Africa Market Share Analysis (%), By End User, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breast Reconstruction Meshes Market Size and Share Forecast Outlook 2025 to 2035

Breast MRI Screening Market Size and Share Forecast Outlook 2025 to 2035

Breast Density Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Breast Lesion Localization Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast Lesion Localization Market Size and Share Forecast Outlook 2025 to 2035

Breastfeeding Accessories Market Size and Share Forecast Outlook 2025 to 2035

Breast Reconstruction Surgery Market Analysis - Size, Share, and Forecast 2025 to 2035

Breast Pump Market – Trends & Forecast 2025 to 2035

Breast Fillers Market Analysis - Trends & Forecast 2025 to 2035

The Breast Cancer Drug Market is segmented by Drug Class, and Distribution Channel from 2025 to 2035

Industry Share & Competitive Positioning in Breast Implants Market

Industry Share & Competitive Positioning in Breast Reconstruction Surgery Market

Breast Imaging Market Analysis - Size, Share & Growth Forecast 2024 to 2034

Breast Localization System Market

Breast Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Smart Breast Imaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breast & Prostate Cancer Diagnostics Market in Europe – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA