The computed tomography (CT) market is advancing steadily, propelled by the increasing global burden of chronic diseases, the rise in emergency care admissions, and technological advancements in imaging resolution and scan speed. Healthcare publications and medical technology press releases have emphasized a shift toward faster and more accurate diagnostic modalities, leading to widespread CT system upgrades in hospitals and diagnostic centers.

The demand for high-performance CT systems has surged, particularly in oncology, cardiology, and neurological diagnostics, where precise imaging is essential for treatment planning. Medical device companies have accelerated innovation in dose-reduction technologies, AI-assisted reconstruction algorithms, and multimodal imaging integration, improving both patient safety and diagnostic confidence.

In addition, expanding access to healthcare infrastructure in emerging economies, along with favorable reimbursement policies in developed regions, has contributed to market expansion. Looking ahead, adoption of high-slice CT systems, increased neurological imaging volumes, and hospital-centric installations are expected to shape the market’s trajectory, supported by capital investment in advanced diagnostic infrastructure and the global push for early and accurate disease detection.

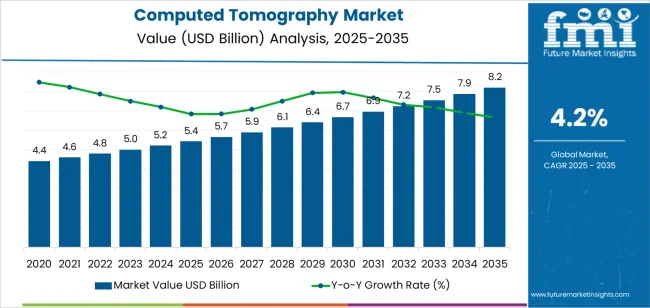

| Metric | Value |

|---|---|

| Computed Tomography Market Estimated Value in (2025 E) | USD 5.4 billion |

| Computed Tomography Market Forecast Value in (2035 F) | USD 8.2 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

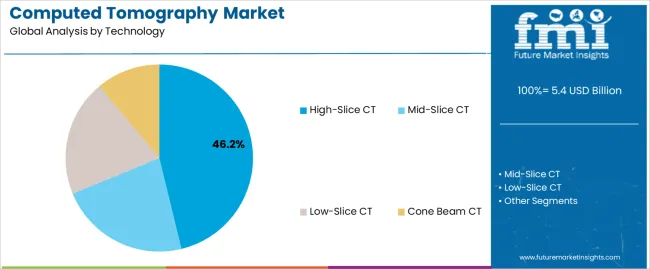

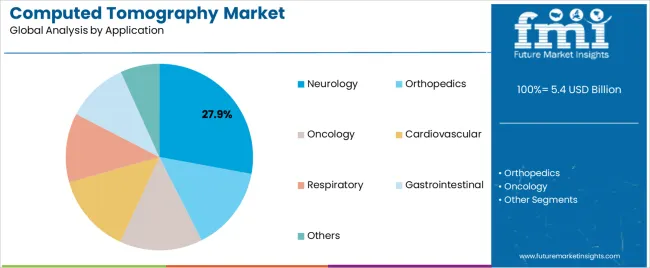

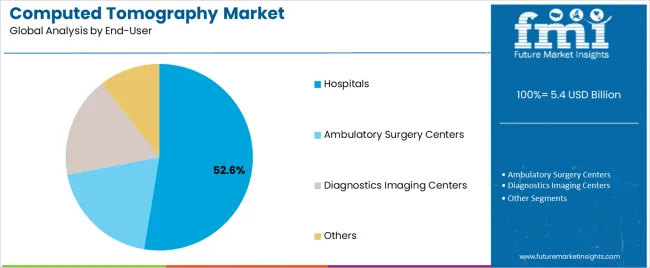

The market is segmented by Technology, Application, and End-User and region. By Technology, the market is divided into High-Slice CT, Mid-Slice CT, Low-Slice CT, and Cone Beam CT. In terms of Application, the market is classified into Neurology, Orthopedics, Oncology, Cardiovascular, Respiratory, Gastrointestinal, and Others. Based on End-User, the market is segmented into Hospitals, Ambulatory Surgery Centers, Diagnostics Imaging Centers, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The High-Slice CT segment is projected to capture 46.2% of the computed tomography market revenue in 2025, establishing itself as the dominant technology type. This leadership has been supported by clinical preferences for systems that enable rapid image acquisition, especially in time-sensitive applications like trauma and cardiac imaging.

High-slice CT scanners, often equipped with 64 slices or more, have allowed radiologists to obtain high-resolution volumetric images within seconds, significantly reducing motion artifacts and enhancing diagnostic precision. Hospital procurement decisions have favored high-slice CT due to their ability to manage large patient throughput and support a broader range of complex imaging procedures.

Additionally, manufacturers have introduced radiation dose-reduction technologies in high-slice CT systems, addressing safety concerns without compromising image quality. These features have made high-slice CT indispensable for tertiary care centers and academic hospitals, where comprehensive diagnostic capabilities are essential. As imaging demand rises across multiple specialties, this segment is expected to maintain strong market momentum.

The Neurology segment is projected to contribute 27.9% of the computed tomography market revenue in 2025, positioning it as the leading application area. Growth of this segment has been driven by the critical role of CT in diagnosing acute neurological conditions, including stroke, traumatic brain injuries, and intracranial hemorrhage.

Emergency care protocols have increasingly relied on non-contrast CT scans as the first-line diagnostic modality for suspected neurological events due to their speed, availability, and accuracy. Clinical guidelines and stroke management pathways have reinforced the use of CT for rapid triage and treatment planning, especially in time-critical interventions.

Additionally, the aging global population has led to a higher prevalence of neurodegenerative conditions, contributing to increased imaging volumes. Medical journals have highlighted ongoing advancements in perfusion CT and CT angiography techniques, which have further extended the modality’s value in neurological care. These developments, along with expanding access to stroke-ready centers, are expected to sustain the Neurology segment’s leading role in application-based adoption.

The Hospitals segment is projected to account for 52.6% of the computed tomography market revenue in 2025, continuing its dominance as the primary end-user category. This segment’s growth has been underpinned by the high capital investment hospitals make in advanced diagnostic equipment to meet diverse clinical demands across departments.

Hospitals have consistently led CT adoption due to their ability to integrate imaging services with surgical, emergency, and intensive care workflows, ensuring timely and comprehensive patient assessment. Clinical infrastructure in hospitals has supported the installation of high-slice and specialty CT systems, particularly for oncology, cardiovascular, and neurological diagnostics.

Furthermore, hospitals benefit from institutional reimbursement models and access to skilled radiologists, enabling them to deliver high-volume imaging services efficiently. Health system modernization efforts in both developed and developing countries have prioritized imaging capacity expansion within hospitals, contributing to sustained equipment upgrades. As CT becomes a cornerstone of routine and advanced diagnostics, the Hospitals segment is expected to maintain its leadership in end-user demand.

Increasing prevalence of chronic diseases such as cancer and cardiovascular disorders. These conditions require accurate and early diagnosis, for which CT scans are highly effective. The rising geriatric population, which is more susceptible to chronic illnesses, also contributes to the demand for CT imaging.

Technological advancements in CT imaging systems play a significant role in market growth. Innovations such as high-resolution imaging, faster scan times, and the development of portable and low-dose CT scanners enhance diagnostic accuracy and patient safety. These improvements make CT imaging more accessible and attractive to healthcare providers.

Government initiatives and funding for improved healthcare infrastructure further boost the CT market. Many countries are investing in advanced diagnostic equipment to enhance their healthcare services, driving the adoption of CT scanners. Additionally, the increasing number of healthcare facilities, especially in emerging economies, expands the market for CT imaging systems.

Rising awareness about the benefits of early diagnosis and preventive healthcare also fuels market growth. As patients and healthcare providers prioritize early detection and treatment of diseases, the demand for CT scans increases.

Moreover, the growing use of CT imaging in various medical fields, including oncology, neurology, and orthopedics, broadens the market scope, ensuring continued expansion and innovation in CT equipment.

A combination of advanced healthcare infrastructure, a high prevalence of chronic diseases, and significant technological advancements drives the computed tomography (CT) market in the United States.

The United States has a well-established healthcare system with a strong emphasis on early diagnosis and preventive care. This environment fosters the widespread adoption of advanced diagnostic tools, including CT scanners.

Chronic diseases such as cancer, cardiovascular disorders, and respiratory conditions are highly prevalent in the United States, necessitating the use of CT imaging for accurate diagnosis and treatment planning. The aging population further exacerbates this demand, as older individuals are more susceptible to these conditions. This demographic trend ensures a steady increase in the need for CT scans.

Healthcare expenditure in China has been steadily increasing, driven by economic growth and government initiatives to improve healthcare services. This increase in spending allows for the procurement of advanced medical equipment, including high-resolution and low-dose CT scanners, which are essential for accurate diagnosis and treatment.

The government's focus on modernizing healthcare facilities and incorporating advanced technologies plays a significant role in driving the CT market.

Technological advancements and local production capabilities also boost the CT market in China. Chinese manufacturers are increasingly developing and producing advanced CT scanners, making the technology more affordable and accessible.

This domestic production capability, combined with technological innovations, ensures a robust supply of CT scanners to meet the growing demand in the country.

The computed tomography (CT) market in the United Kingdom is driven by various factors, including an increasing emphasis on personalized medicine, the integration of artificial intelligence (AI) in diagnostic imaging, and government initiatives to reduce diagnostic waiting times.

The shift towards personalized medicine requires precise and accurate diagnostic tools, and CT imaging plays a crucial role in tailoring treatments to individual patient needs. This demand for personalized care drives the adoption of advanced CT technology in healthcare settings.

The integration of AI in diagnostic imaging significantly enhances the capabilities of CT scanners. AI algorithms can rapidly analyze CT images, improving diagnostic accuracy and enabling earlier detection of diseases.

This technological advancement is highly valued in the UK, where there is a strong focus on leveraging AI to improve healthcare outcomes. The incorporation of AI in CT imaging systems not only boosts efficiency but also aids in addressing the shortage of radiologists by assisting in image interpretation.

High-slice CT technology is significantly contributing to the growth of the computed tomography (CT) market. These advanced systems, offering up to 320 slices per rotation, provide remarkably detailed images, enhancing diagnostic accuracy.

This level of detail is particularly beneficial in diagnosing complex conditions such as cardiovascular diseases, where precise imaging is critical. The ability of high-slice CT scanners to capture images quickly reduces the need for repeat scans, which improves patient throughput and operational efficiency in healthcare facilities.

The speed of high-slice CT scanners is another growth driver. Faster imaging times not only improve patient comfort but also allow for better imaging of moving organs, such as the heart and lungs, without compromising image quality. This capability is essential for accurate diagnostics in dynamic studies, contributing to the broader adoption of high-slice CT technology in clinical practice.

the versatility of high-slice CT scanners supports various applications, from routine diagnostic procedures to complex interventional radiology. This versatility enhances their appeal to healthcare providers looking to invest in multipurpose imaging equipment, further driving market growth.

The continuous advancements in high-slice CT technology, such as integration with artificial intelligence for automated image analysis, further boost their adoption, ensuring sustained growth in the computed tomography market.

The integration of artificial intelligence (AI) in CT imaging further boosts its application in oncology. AI algorithms can analyze CT images quickly and accurately, aiding in the early detection of subtle changes in tumor size or density that might be missed by the human eye.

This technological enhancement not only improves diagnostic accuracy but also streamlines workflows in busy oncology departments, thereby supporting the growth of the computed tomography market.

CT imaging is also integral in guiding minimally invasive procedures and radiation therapy planning. It helps in accurately targeting tumors while sparing surrounding healthy tissues, which is vital for effective treatment and reducing side effects.

The role of CT in post-treatment monitoring and recurrence detection is equally important, as it allows for timely interventions and adjustments in therapy, ensuring ongoing patient care and management.

The rising prevalence of cancer globally intensifies the demand for advanced diagnostic tools like CT scanners. As cancer incidence increases, the need for effective diagnostic imaging grows, driving the market for CT technology.

Furthermore, advancements in CT technology, such as multi-slice and high-resolution scanners, enhance the ability to detect and monitor tumors more effectively, contributing to their widespread adoption in oncology departments.

Leading companies in CT market are expanding their geographical presence to tap into emerging markets with growing healthcare infrastructure and demand for advanced medical imaging technologies. This expansion may involve establishing partnerships, distribution agreements, or setting up subsidiaries in key regions.

Collaboration with healthcare providers, research institutions, and technology companies is becoming increasingly common. These partnerships facilitate the development of innovative solutions, clinical validation studies, and access to complementary technologies that enhance the overall value proposition of CT systems.

In terms of technology, the market includes high-slice CT, mid-slice CT, low-slice CT, and cone beam CT.

In terms of application, the market is segmented into neurology, orthopedics, oncology, cardiovascular, respiratory, gastrointestinal, and others.

The end user industries include hospitals, ambulatory surgery centers, diagnostics imaging centers, and others.

In terms of region, the industry is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

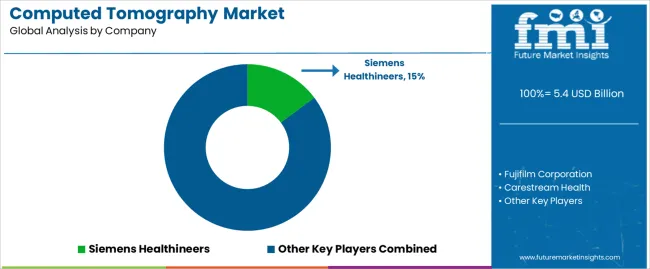

The global computed tomography market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the computed tomography market is projected to reach USD 8.2 billion by 2035.

The computed tomography market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in computed tomography market are high-slice ct, mid-slice ct, low-slice ct and cone beam ct.

In terms of application, neurology segment to command 27.9% share in the computed tomography market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micro Computed Tomography Market Overview – Growth, Trends & Forecast 2024-2034

Mobile Computed Tomography Scanners Market Size and Share Forecast Outlook 2025 to 2035

Spectral Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Computed Tomography Scanner Market Growth -Trends & Forecast 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Mobile Tomography Market Size and Share Forecast Outlook 2025 to 2035

Photoacoustic Tomography Market Size and Share Forecast Outlook 2025 to 2035

Optical Coherence Tomography Market Insights – Size, Trends & Forecast 2025–2035

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA