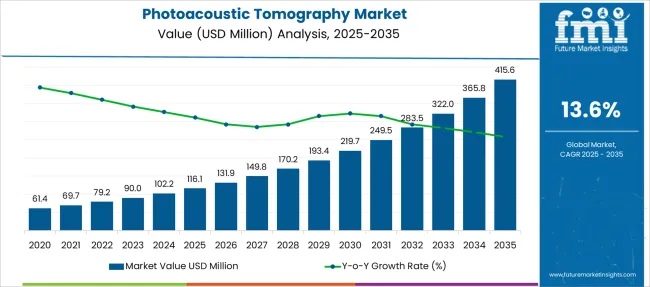

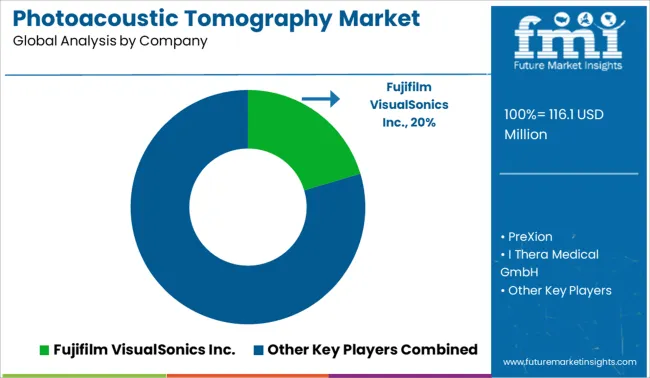

The Photoacoustic Tomography Market is estimated to be valued at USD 116.1 million in 2025 and is projected to reach USD 415.6 million by 2035, registering a compound annual growth rate (CAGR) of 13.6% over the forecast period.

| Metric | Value |

|---|---|

| Photoacoustic Tomography Market Estimated Value in (2025 E) | USD 116.1 million |

| Photoacoustic Tomography Market Forecast Value in (2035 F) | USD 415.6 million |

| Forecast CAGR (2025 to 2035) | 13.6% |

The photoacoustic tomography market is growing steadily, driven by advances in hybrid imaging technologies that combine optical and ultrasound methods for enhanced diagnostic capabilities. Clinical research has demonstrated the value of this technology in providing high-resolution, non-invasive imaging with functional and molecular information.

Increasing interest in precise imaging solutions for neurological and vascular conditions has propelled adoption. Innovations in system design have improved image quality and reduced scan times, making photoacoustic tomography more accessible for clinical and research settings.

Healthcare facilities are investing in imaging tools that aid early disease detection and treatment monitoring. The market outlook is positive as ongoing developments continue to expand application areas, improve patient outcomes, and reduce reliance on more invasive procedures. Segmental growth is anticipated to be led by the photoacoustic microscopy type, functional brain imaging as the leading application, and hospitals as the primary end user.

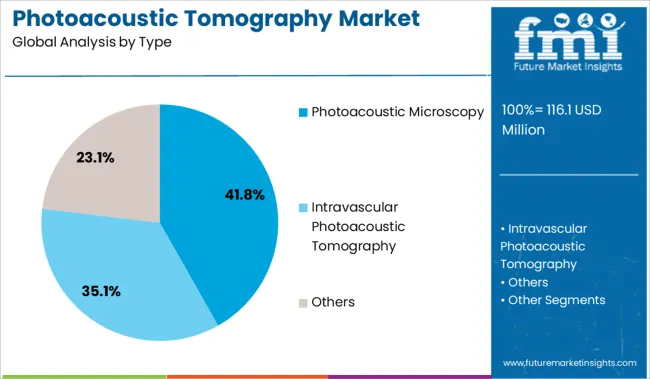

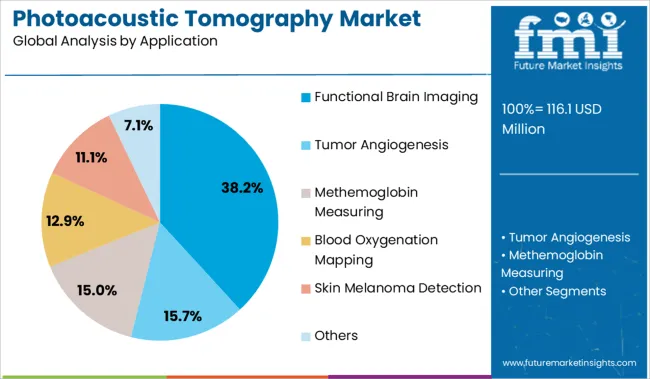

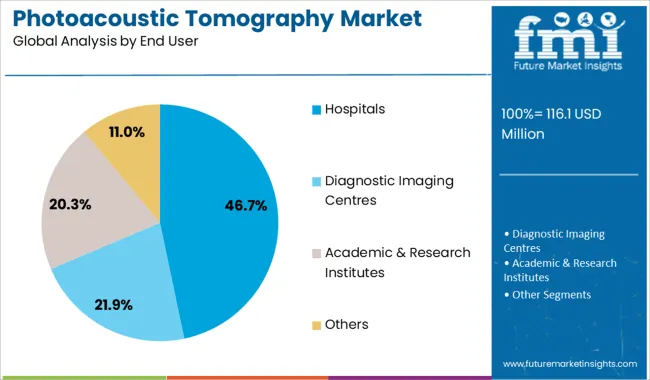

The market is segmented by Type, Application, and End User and region. By Type, the market is divided into Photoacoustic Microscopy, Intravascular Photoacoustic Tomography, and Others. In terms of Application, the market is classified into Functional Brain Imaging, Tumor Angiogenesis, Methemoglobin Measuring, Blood Oxygenation Mapping, Skin Melanoma Detection, and Others. Based on End User, the market is segmented into Hospitals, Diagnostic Imaging Centres, Academic & Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The photoacoustic microscopy segment is projected to hold 41.8% of the market revenue in 2025, leading the type category. Growth in this segment has been driven by the capability of microscopy systems to provide detailed imaging at cellular and microvascular levels.

The technology offers non-invasive visualization of tissue structures and oxygen saturation, which is crucial in research and clinical diagnostics. The increasing demand for high-resolution imaging in oncology, dermatology, and neurology has expanded the use of photoacoustic microscopy.

Its ability to integrate with other imaging modalities has also contributed to its widespread adoption. The focus on early detection and improved diagnostic accuracy continues to boost the photoacoustic microscopy segment.

Functional brain imaging is expected to contribute 38.2% of the market revenue in 2025, positioning it as the top application segment. This growth is supported by the need for detailed imaging of brain activity and vascular functions to aid diagnosis and treatment of neurological disorders.

Photoacoustic tomography provides real-time mapping of hemodynamic responses and oxygenation levels, making it a valuable tool in studying brain function and pathology. Research institutions and healthcare providers have increasingly integrated this technology into neurological studies, enhancing understanding of diseases like stroke, Alzheimer's, and epilepsy.

The ability to perform functional imaging with minimal invasiveness has expanded clinical applications and patient acceptance.

The hospitals segment is projected to account for 46.7% of the photoacoustic tomography market revenue in 2025, maintaining its position as the leading end user. Hospitals have adopted photoacoustic tomography for its ability to improve diagnostic workflows and provide comprehensive imaging data.

The technology’s non-invasive nature and safety profile make it suitable for a wide range of patient groups. Additionally, hospitals have invested in this technology to support multi-disciplinary diagnostic teams and enhance clinical decision-making.

Growing patient volumes and increasing focus on personalized medicine have further encouraged hospitals to integrate advanced imaging modalities like photoacoustic tomography into their diagnostic arsenal. The segment is expected to sustain its market dominance with ongoing technological advancements and expanding clinical applications.

Recent developments by medical equipment manufacturers and various research groups in the past few years have resulted in increased adoption of photoacoustic tomography imaging technology in the medical segment, which boosts the market's growth during the forecast period.

Growth in pre-clinical studies about photoacoustic tomography in various research and academic institutes are some of the key factors predicted to promote the growth of the photoacoustic tomography market in the future. Moreover, the expanding imaging technique of photoacoustic imaging is predicted to fuel the market growth during the forecast period.

The increasing prevalence of chronic diseases such as cardiovascular and cancer are grave concern in the healthcare industry. Still, these factors are said to support the lucrative growth of the photoacoustic tomography market. WHO says that in 2024, one of the leading causes of death was cancer across the world. This accounted for nearly 10 million deaths, with the most common type of cancer being lung and breast cancers.

Increasing awareness and the need for cancer detection at early stages have been driving key enhancements in medical and technology systems. In addition, advanced technology in non-invasive diagnosis and an increase in the application of non-ionizing radiation in healthcare science will encourage the demand for photoacoustic tomography to a substantial degree.

Several technologies, such as intravascular photoacoustic tomography, intravascular ultrasound (IVUS), and angiography, are used to detect cardiovascular diseases. The combined IVPA and IVUS imaging is utilized to characterize and detect atherosclerotic plaques. The demand for photoacoustic tomography is surging as it offers several advantages in atherosclerotic plaque imaging as compared to other techniques.

An upsurge in non-transmissible diseases cases, increasing demand for enhanced imaging methods, more cases of skin and eye-related diseases, surging demand by various oncology departments, and escalating awareness pertaining to early diagnosis procedures are some of the primary factors which promote the growth of photoacoustic tomography during the forecast period.

Additionally, support from the government is likely to further render prospective opportunities for the market growth of photoacoustic tomography in the future. However, photoacoustic imaging is expensive. This factor, coupled with strict regulations pertaining to laser usage, is anticipated to restrict the revenue growth of the market during the forecast period.

Lasers are known to be extremely precise and have high accuracy. However, they are cost-intensive systems that need high investments and funds. Therefore, new players find it challenging to penetrate and sustain in the market. Moreover, in the flow of research and development, surveillance in the case of pre-clinical applications on animals for research acts as a barrier. Lastly, the lack of skilled labor for the smooth operation of photoacoustic tomography is also said to hamper the growth of this market during the forecast period.

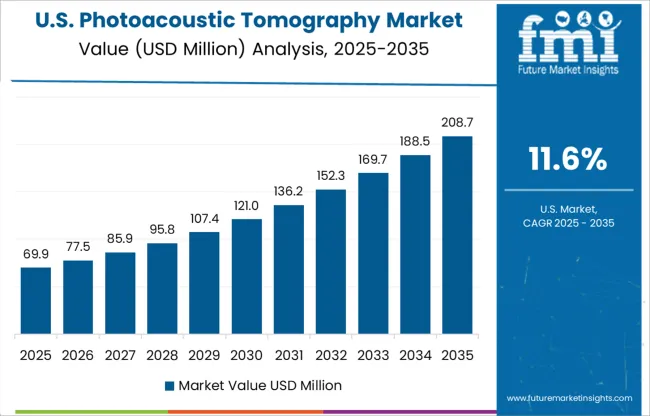

North America is dominating the global photoacoustic tomography market owing to rising pre-clinical studies related to this technique in several research and academic institutions. North America is responsible for holding a market share of 29.20% of the global market. The growing geriatric population and increasing cancer cases are among the key driving factors in the North American photoacoustic tomography market.

Safe non-ionizing radiation used in photoacoustic technology and the growing healthcare industry are key factors that are driving the market in this region. The initial cost of photoacoustic tomography is very high. This, along with the developing technology, can pose a challenge for the North American photoacoustic tomography market.

There is a constant upgradation in technology and features, which results in vendors attracting new consumers and growing their footprints in the upcoming markets. This factor is said to promote the growth of the photoacoustic tomography market in North America.

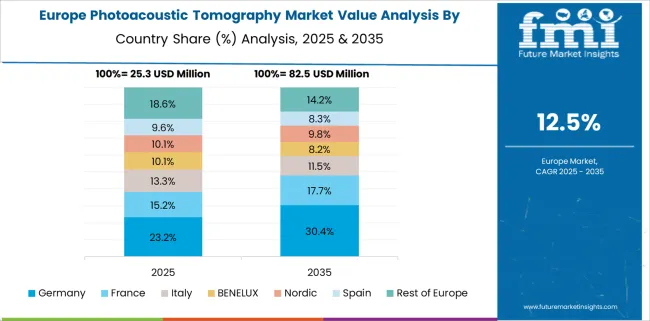

The increasing aged population coupled with the growing prevalence of cancer is the major driving factor of the Europe photoacoustic tomography market. Europe is responsible for holding a market share of 37.40% of the global market. Government support in developing innovative equipment, the trend of adoption of technology, and investment in research activities are accountable for the growth of the market in this region.

Increasing cases of fungal disease and infection are anticipated to promote market growth during the forecast period. In Europe, a country like Germany is anticipated to lead the market owing to constant research and the primary manufacturer being a major player in the industry.

The photoacoustic tomography industry opens numerous opportunities for new participants who concentrate on segments such as 3D imaging. For instance, in 2024, Luxonus, a Japanese start-up, produced a remarkable picture of the medial side of the lower leg. In practice, the colorized 3D showed the complex latticework of large and small vessels inside the leg and the blood flow through it. In comparison to any other type of medical imaging, the detail is unmatched. Luxonus used its novel devices, a game-altering photoacoustic 3D scanner that employs the novel science of photoacoustic imaging.

Some of the key players in the photoacoustic tomography market are Advantest Corporation; Fujifilm VisualSonics Inc., Seno Medical, PreXion, iThera Medical GmbH, InnoLas Laser GmbH, OPOTEK LLC, CYBERDYNE INC., TomoWave Laboratories, Inc., Aspectus GmbH, Endra, Inc., and others.

Market players have adopted strategies such as product approvals, product launches, market initiatives, and mergers and acquisitions. For example, in June 2024, FUJIFILM VisualSonics Inc, a subsidiary of FUJIFILM SonoSite, Inc, launched Vevo F2, the world’s first ultra-high-to-low-frequency ultrasound imaging system with a frequency range of 71-1 MHz.

In February 2025, FUJIFILM VisualSonics Inc and PIUR IMAGING, the European giant in tomographic ultrasound imaging, partnered to introduce UHF, which is a three-dimensional (3D) ultrasound imaging technology to researchers and clinicians.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 13.60% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, Application, End User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Advantest Corporation; Fujifilm VisualSonics Inc.; Seno Medical; PreXion; I Thera Medical GmbH; InnoLas Laser GmbH; OPOTEK LLC; CYBERDYNE INC.; TomoWave Laboratories, Inc.; Aspectus GmbH; Endra, Inc. |

| Customization | Available Upon Request |

The global photoacoustic tomography market is estimated to be valued at USD 116.1 million in 2025.

The market size for the photoacoustic tomography market is projected to reach USD 415.6 million by 2035.

The photoacoustic tomography market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in photoacoustic tomography market are photoacoustic microscopy, intravascular photoacoustic tomography and others.

In terms of application, functional brain imaging segment to command 38.2% share in the photoacoustic tomography market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Photoacoustic Microscopy Market Growth – Industry Trends & Forecast 2024-2034

Mobile Tomography Market Size and Share Forecast Outlook 2025 to 2035

Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Micro Computed Tomography Market Overview – Growth, Trends & Forecast 2024-2034

Mobile Computed Tomography Scanners Market Size and Share Forecast Outlook 2025 to 2035

Spectral Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Optical Coherence Tomography Market Insights – Size, Trends & Forecast 2025–2035

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

Veterinary Computed Tomography Scanner Market Growth -Trends & Forecast 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA