The Lipase Testing Reagents Market is estimated to be valued at USD 723.0 million in 2025 and is projected to reach USD 1422.3 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

The lipase testing reagents market is experiencing steady growth driven by the increasing incidence of pancreatic and gastrointestinal disorders globally, alongside the expanding use of diagnostic tests in both acute and routine clinical settings. Rising awareness about early disease detection and the critical role of enzymatic assays in identifying pancreatic insufficiencies and associated conditions have supported consistent market demand.

Technological advancements in diagnostic reagent formulations, offering improved accuracy, stability, and faster processing times, have further contributed to market expansion. In recent years, healthcare systems across both developed and emerging markets have prioritized laboratory infrastructure upgrades, which has enhanced the accessibility and frequency of lipase testing, particularly for emergency and intensive care applications.

Over the forecast period, market prospects appear favorable, underpinned by growing hospital admissions linked to lifestyle-related gastrointestinal ailments, increased preventive health screenings, and the integration of enzymatic diagnostics into broader clinical chemistry test panels. The ability of lipase testing reagents to deliver rapid, reliable, and non-invasive diagnostic support positions them as essential tools within clinical diagnostics, ensuring sustained relevance and adoption within routine and acute care environments.

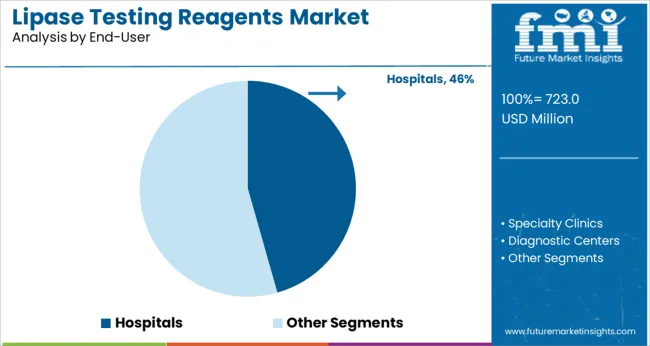

The market is segmented by Indication and End-User and region. By Indication, the market is divided into Pancreatic Disorders, Cancer, and Cystic fibrosis. In terms of End-User, the market is classified into Hospitals, Specialty Clinics, Diagnostic Centers, and Research Centers.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pancreatic disorders segment accounted for approximately 51.8% of the total lipase testing reagents market share, maintaining a dominant position within the indication category. This leadership has been reinforced by the persistently high prevalence of acute pancreatitis, chronic pancreatic dysfunction, and pancreatic cancer, all of which require enzymatic evaluation for accurate diagnosis and disease management.

Clinicians have increasingly relied on lipase testing as a preferred biomarker for pancreatic assessment due to its higher sensitivity and specificity compared to alternative enzyme markers. The growth of this segment has also been supported by the expanding inclusion of lipase tests within standard diagnostic protocols for abdominal pain and gastrointestinal distress.

Additionally, awareness campaigns and updated clinical guidelines advocating early pancreatic function screening have positively influenced testing volumes. The availability of automated, high-throughput analyzers in hospital and diagnostic laboratories has further streamlined the use of lipase testing reagents for these indications. Future growth is anticipated as healthcare providers address rising pancreatic disease burdens associated with changing dietary habits, alcohol consumption, and obesity, securing this segment’s ongoing market leadership.

The hospitals segment held a significant 45.6% market share within the end-user category, driven by the central role of inpatient and emergency care facilities in conducting enzymatic and clinical chemistry tests. Lipase testing remains a standard diagnostic tool in hospital settings for evaluating patients presenting with abdominal pain, suspected acute pancreatitis, and other digestive system disorders.

The high testing volume within hospitals can be attributed to the immediate diagnostic requirements of emergency departments, intensive care units, and inpatient wards, where rapid and reliable enzyme assays are essential for prompt clinical decision-making. Hospitals have increasingly adopted fully automated analyzers and integrated laboratory information systems, enhancing operational efficiency and enabling quicker turnaround times for lipase tests.

The segment’s growth has also been supported by public and private healthcare investments aimed at strengthening diagnostic infrastructure and laboratory capabilities, particularly in emerging economies. Anticipated increases in hospital admissions related to lifestyle-induced gastrointestinal conditions and the incorporation of lipase testing within broader biochemical panels for routine inpatient monitoring are expected to sustain the segment’s strong market position over the coming years.

A large number of patients suffering from acute and chronic pancreatic disorders may be leading to growth in the lipase testing reagent market. The widespread demand for lipase testing reagents because of indigestion, gastroesophageal reflux disease (GERD), and other disorders might create the fueling of the sales of lipase testing reagents as well as lipase testing reagent market for tests reagents used in lipase testing.

Disease conditions like persistent diarrhea, vitamin deficiency, and malnutrition will show the additional demand for lipase testing reagents. In children, cystic fibrosis (CF) or Shwachman-Diamond Syndrome (SDS) diagnosis may show the propelling growth of the demand for lipase testing reagents along with lipase testing reagents market.

Alternative diagnosis methods like CT scan, Endoscopy for pancreatic testing may show slower growth in the lipase testing reagents market and sales of lipase testing reagents.

Awareness of the people about cystic fibrosis and pancreatic cancer may show stagnancy in the lipase testing reagents market together with escalated demand for lipase testing reagents

Among the regions that will have a presence in the lipase testing reagents market share, North America will have the highest revenue, since people are increasingly concerned about complications related to the GIT tract.

With good hospital infrastructure and a greater number of hospitals in Europe, this region will show propelling growth for the lipase testing reagents market share together with sales of lipase testing reagents in the near future, because it has a higher number of hospitals and a better infrastructure.

Latin America region will show good demand for lipase testing reagents, due to the regional government's initiative towards the public health care program. Brazil market will be the most lucrative lipase testing reagents market for pancreatic amylase reagents.

In Asian countries like China and India, the rate of colon and rectum cancer is high due to lifestyle patterns and unhygienic conditions. This condition may show additional lipase testing reagents market share and sales of lipase testing reagents.

The Middle East and Africa are expected to account for being the least lucrative lipase testing reagents market share due to a lack of awareness about lipase test-related disorders in people.

To get a greater part of the lipase testing reagents market, players are focusing on new product launches and sophisticated technology.

Lipase Testing Reagents work on the enzymatic colour test principle. In which the colour produced after the assay method, is measured against a fixed wavelength to determine the Lipase level in serum and plasma. Lipase Testing Reagents act as important markers to study pancreas-related disorders and gall bladder cancer.

Pancreatic lipase test kits are based on the turbid metric & colorimetric methods, in which triglyceride is used as substrate. The lipase testing reagents use the colour rate assay, in which 1,2- diglyceride acts as a natural substrate.

Lipase testing reagents are highly sensitive toward the natural substrate and pancreatic lipase. In the lipase testing reagents, colipase and deoxycholate were used as activators.

Examples of some of the lipase testing reagents market participants in the global lipase testing reagents market identified across the value chain include DIALAB GmbH, DiaSys Diagnostic Systems GmbH, Sunson Industry Group Co.,Ltd, Randox Laboratories Ltd., Abbott, Beckman Coulter, Inc., Biocompare, Vitro Scient Co., Merck KGaA., Sisco Research Laboratories Pvt. Ltd. Biosystems S.A ,and others.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 7% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2025 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million/Billion and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Indication, End-User, & Region. |

| Regional scope | North America (USA, Canada); Latin America (Mexico, Brazil); Europe (Germany, Italy, France, UK, Spain, Russia); East Asia (China, Japan, South Korea); South Asia (India, ASEAN); Oceania (Australia, New Zealand); Middle East and Africa (GCC Countries, South Africa, Northern Africa) |

| Country scope | USA, Canada, Mexico, Brazil, Germany, Italy, France, UK, Spain, Russia, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, GCC Countries, South Africa, Northern Africa |

| Key companies profiled | DIALAB GmbH; DiaSys Diagnostic Systems GmbH; Sunson Industry Group Co.;Ltd; Randox Laboratories Ltd.; Abbott; Beckman Coulter; Inc.; Biocompare; Vitro Scient Co.; Merck KGaA.; Sisco Research Laboratories Pvt. Ltd. Biosystems S.A. and others |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global lipase testing reagents market is estimated to be valued at USD 723.0 million in 2025.

It is projected to reach USD 1,422.3 million by 2035.

The market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types are pancreatic disorders, cancer and cystic fibrosis.

hospitals segment is expected to dominate with a 45.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Phospholipase Enzyme Market Trends & Forecast 2024-2034

Microbial Lipase Market - Size, Share, and Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA