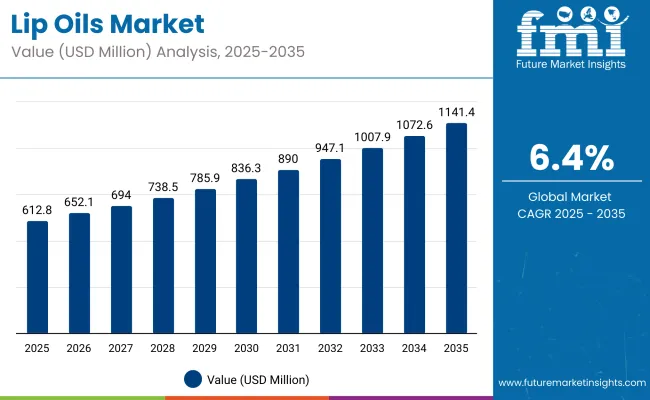

The Global Lip Oils Market is expected to record a valuation of USD 612.8 million in 2025 and USD 1,141.4 million in 2035, with an increase of USD 528.6 million, which equals a growth of 86% over the decade. The overall expansion represents a CAGR of 6.4% and a 2X increase in market size.

Global Lip Oil Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 612.8 million |

| Market Forecast Value in (2035F) | USD 1,141.4 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

During the first five-year period from 2025 to 2030, the market increases from USD 612.8 million to USD 836.3 million, adding USD 223.5 million, which accounts for 42% of the total decade growth. This phase records steady adoption in hybrid beauty routines, Gen Z skincare preferences, and clean label demand, driven by the need for multifunctional products. Tinted lip oils dominate this period as they cater to over 41.6% of cosmetic applications, accounting for USD 254.92 million in 2025.

The second half from 2030 to 2035 contributes USD 305.1 million, equal to 58% of total growth, as the market jumps from USD 836.3 million to USD 1,141.4 million. This acceleration is powered by widespread deployment of AI-based lip personalization, natural actives in gloss-serum hybrids, and subscription-driven retail in the beauty sector.

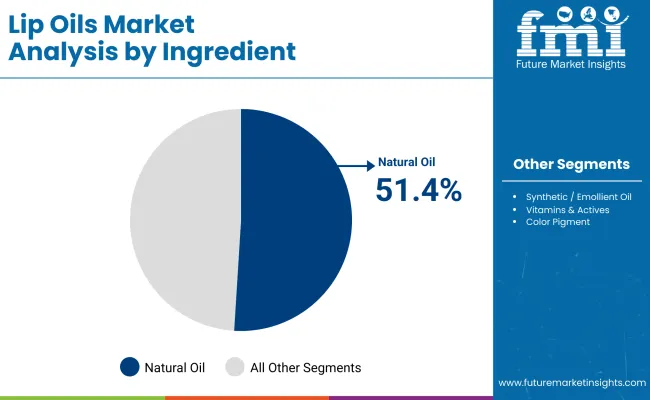

Natural oils capture a larger share above 51.4%, reaching USD 314.98 million in 2025. Ingredient-led innovation and eco-friendly packaging add recurring demand, increasing the use of Tube with Wand Applicator packaging, which holds a 62.3% share in 2025 (USD 381.77 million).

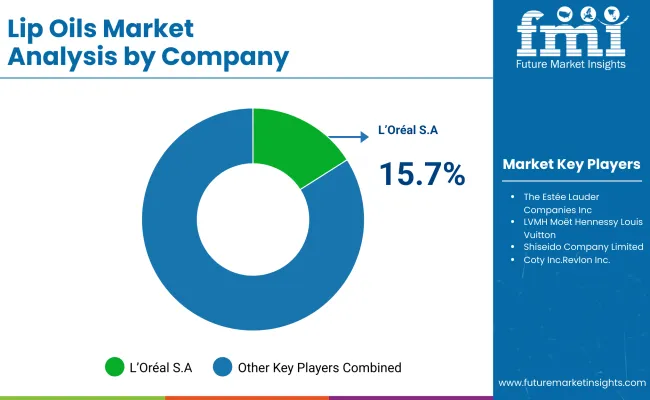

From 2020 to 2024, the Global Lip Oils Market grew from USD 340 million to USD 573 million, driven by tinted and gloss-infused formulations. During this period, the competitive landscape was dominated by cosmetics conglomerates controlling nearly 55% of revenue, with leaders such as L’Oréal S.A., Estée Lauder, and Clarins focusing on hybrid formulations combining skincare and makeup functionality.

Competitive differentiation relied on natural ingredients, retail availability, and shade versatility, while ingredient transparency was often bundled as a consumer claim rather than a regulatory mandate. Service-based retail models had minimal traction, contributing less than 10% of the total market value.

Demand for lip oils will expand to USD 612.8 million in 2025, and the revenue mix will shift as clean beauty brands and refillable packaging models grow to over 30% share. Traditional cosmetic leaders face rising competition from digital-first players offering lip oils with SPF, AI-matched tints, and gloss-serum hybrids.

Major players are pivoting to ingredient-focused models, integrating camellia oil, jojoba, and squalane to retain shelf appeal. Emerging entrants specializing in vegan, cruelty-free formulations and eco-packaged forms are gaining share. The competitive advantage is moving away from brand legacy alone to formulation efficacy, sustainability credentials, and DTC commerce agility.

The market is witnessing robust growth due to the convergence of skincare and makeup trends, where consumers increasingly demand hybrid beauty products offering both aesthetic appeal and functional skincare benefits. Tinted lip oils, which combine hydration, nourishment, and soft color payoff, are gaining popularity among Gen Z and Millennial consumers who prefer clean, minimalist beauty routines. The rise in plant-based formulationsfeaturing ingredients like jojoba oil, camellia oil, and rosehip oilhas aligned lip oil products with clean beauty standards, further driving their adoption across global markets.

Brands are actively innovating with non-sticky textures, SPF protection, and active skincare ingredients, expanding usage from casual gloss to daily lip treatment routines. Digital-first distribution models have played a significant role, with e-commerce and social commerce platforms (e.g., TikTok, Instagram) enabling rapid consumer engagement, influencer-driven promotion, and direct-to-consumer access.

This has allowed indie and clean beauty brands to scale quickly and challenge traditional cosmetics giants. Furthermore, increasing consumer awareness of sustainability has encouraged brands to shift toward eco-friendly packaging, refillable tubes, and vegan/cruelty-free certifications, which not only drive differentiation but also add to recurring revenue through re-purchase cycles.

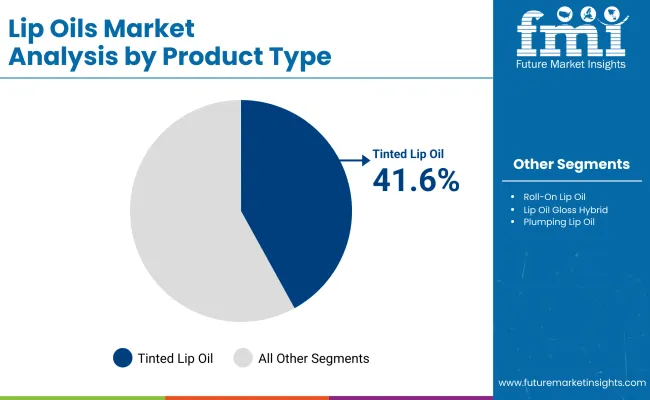

The market is segmented by product type, ingredient type, packaging type, and region. Product types include tinted lip oils and others, highlighting the consumer shift toward multifunctional beauty products that combine hydration and color. Ingredient classification covers natural oils and others, reflecting the rising preference for plant-based, clean-label formulations with added skincare benefits.

Based on packaging, the segmentation includes tube with wand applicator and others, representing the dominant delivery forms used across retail and e-commerce distribution. Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Russia and CIS, East Asia, South Asia and Pacific, and the Middle East and Africa, with high growth potential observed in countries such as India, China, and Southeast Asia, driven by beauty personalization, digital engagement, and natural product adoption.

| Product Type | Market Value Share, 2025 |

|---|---|

| Tinted Lip Oil | 41.6% |

| Others | 58.4% |

The tinted lip oils segment is projected to contribute 41.6% of the Global Lip Oils Market revenue in 2025, maintaining its lead as the dominant product category. This is driven by ongoing demand for hybrid cosmetic products that combine hydration, nourishment, and color payoff in a single formulation. Tinted lip oils are increasingly favored by consumers seeking a lightweight, non-sticky alternative to traditional lipsticks and glosses.

The segment’s growth is also supported by innovations in clean and plant-based ingredients such as jojoba, camellia, and rosehip oils, which offer both aesthetic and therapeutic benefits. As personalization and social media-driven beauty trends gain traction, tinted lip oils are being positioned as versatile staples in minimalist and skincare-oriented routines. The segment is expected to retain its position as the most compelling form in the lip oils category, blending functionality with trend-aligned formulations.

| Ingredient Base | Market Value Share, 2025 |

|---|---|

| Natural Oils | 51.4% |

| Others | 48.6% |

The natural oils segment is projected to contribute 51.4% of the Global Lip Oils Market revenue in 2025, maintaining its lead as the dominant ingredient category. This growth is fueled by rising consumer awareness and preference for clean, plant-based formulations that deliver both skincare benefits and product safety. Ingredients such as jojoba oil, camellia oil, and rosehip oil are being embraced for their hydrating, anti-inflammatory, and antioxidant properties.

The segment’s expansion is further supported by the broader clean beauty movement, where product labels emphasizing botanical origin and non-toxicity play a key role in purchase decisions. As ethical consumption and sustainable sourcing become standard expectations, natural oil-based lip oils offer both a functional and emotional value proposition to consumers. This segment is expected to remain a pillar of product innovation, brand positioning, and consumer trust within the lip oils market.

| Packaging Type | Market Value Share, 2025 |

|---|---|

| Tube with Wand Applicator | 62.3% |

| Others | 38.6% |

The tube with wand applicator segment is projected to contribute 62.3% of the Global Lip Oils Market revenue in 2025, establishing itself as the leading packaging form across the industry. This is primarily driven by the applicator’s ease of use, controlled dispensing, and hygienic designfeatures that align closely with consumer expectations in both premium and mass-market segments.

The segment’s continued dominance is supported by its compatibility with oil-based textures and its adaptability across tinted, clear, and treatment-focused formulations. As brands prioritize portability, aesthetics, and on-the-go usage, tube applicators have become the default standard in lip oil product development. With rising demand for refillable and eco-friendly forms, manufacturers are also reimagining wand-based tubes in sustainable materials, ensuring the segment's leadership in the evolving clean beauty space.

Drivers

Hybridization of Skincare and Makeup Categories

Lip oils are benefiting from the convergence of skincare and makeup, where consumers expect beauty products to offer not only aesthetic benefits but also long-term skin health. Tinted lip oils, often infused with active ingredients like hyaluronic acid, squalane, or vitamin E, are perceived as both lip color and daily treatment. This dual-functionality makes them highly desirable among skincare-savvy consumers, especially Gen Z.

Ingredient-Driven Premiumization

Premium growth in the market is driven by demand for plant-based, transparent, and dermatologically trusted ingredients, such as jojoba oil, rosehip oil, and camellia oil. These oils carry perceived therapeutic value and align with clean beauty trends. Brands using these natural oils can command higher price points, helping the lip oil segment outperform traditional lip gloss and balm forms in profitability.

Restraints

Short Product Lifecycle and Saturation in Trends

Lip oils are vulnerable to rapid trend cycles. Viral popularity on platforms like TikTok can boost short-term demand, but just as quickly lead to oversaturation. Consumers often shift preferences within 12-18 months toward newer “it” products like lip serums or balms with pH-reactive technology, limiting brand loyalty and lifecycle longevity for lip oils.

Formulation Stability and Performance Limitations

Many oil-based formulations face challenges related to texture separation, oil migration, and limited pigment load. This restricts the product’s appeal among consumers seeking richer, long-wear color or high-impact finishes. Brands may also face difficulty balancing lightweight glide with long-lasting hydrationespecially in climates with high humidity or dryness.

Key Trends

Rise of Lip Oils with SPF and Blue Light Protection

Consumers are increasingly seeking multifunctional lip oils with sun protection and blue light defense, extending usage from cosmetic to protective skincare. Products containing SPF15-30 or ingredients like marigold extract (lutein) and niacinamide are emerging in portfolios from both mass and luxury brands, making lip oils a 24/7 wear item rather than just a gloss alternative.

Refillable and Eco-Conscious Packaging Innovation

The surge in sustainable packaging forms, particularly refillable tubes with wand applicators, is reshaping how lip oils are marketed and retailed. Clean beauty and conscious consumerism have made packaging design a decision driver. Brands like Fenty, Clarins, and indie clean labels are investing in recyclable and modular packaging to reduce waste while maintaining visual appeal.

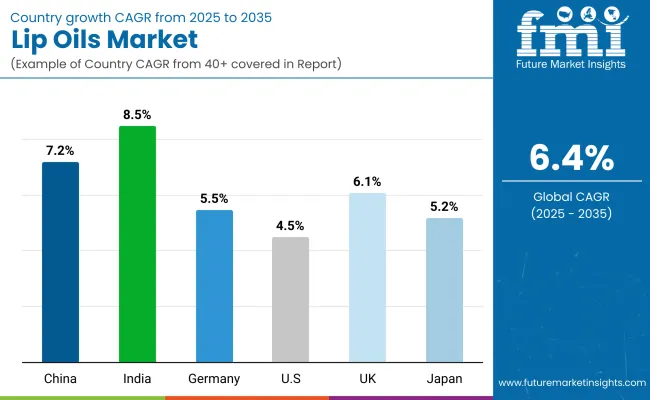

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

| India | 8.5% |

| Germany | 5.5% |

| USA | 4.5% |

| UK | 6.1% |

| Japan | 5.2% |

The global Lip Oils Market shows a pronounced regional disparity in adoption speed, strongly influenced by beauty personalization trends, social commerce penetration, and the rising demand for clean beauty formulations. Asia-Pacific emerges as the fastest-growing region, anchored by China at 7.2% CAGR and India at 8.5%. This acceleration is driven by large-scale influencer-led beauty ecosystems, aggressive investment in direct-to-consumer (DTC) skincare brands, and government-backed promotion of local cosmetic manufacturing hubs.

China’s regulatory framework encouraging ingredient transparency and cruelty-free certification further accelerates adoption of natural oil-based lip care products. India’s trajectory reflects rising integration of lip oils in affordable hybrid makeup lines, supported by value-conscious consumers and expanding retail access through online platforms. Europe maintains a strong growth profile, led by Germany at 5.5%, and the UK at 6.1%, supported by stringent ingredient safety standards and growing demand for sustainable packaging.

High adoption of clean-label cosmetics and regulatory alignment with eco-design standards keep Europe ahead of North America, particularly in refillable packaging, vegan formulations, and hybrid lip care innovations. North America shows moderate expansion, with the USA at 4.5% CAGR, reflecting maturity in core cosmetic categories and slower adoption of emerging lip care trends compared to Asia and Europe.

Growth in North America is more premium-segment driven, with increasing demand for tinted lip oils featuring active ingredients, multi-functionality, and dermatologist-backed efficacy, rather than entry-level gloss replacements. Japan, with a CAGR of 5.2%, continues to uphold its reputation for minimalist, treatment-oriented beauty routines. Lip oils in Japan are gaining traction within sensitive skin categories and luxury-tier applications, where product texture, absorption, and sensory experience are key purchase drivers.

| Year | USA Lip Oil Market (USD Million) |

|---|---|

| 2025 | 131.75 |

| 2026 | 137.11 |

| 2027 | 142.69 |

| 2028 | 148.50 |

| 2029 | 154.54 |

| 2030 | 160.83 |

| 2031 | 167.37 |

| 2032 | 174.18 |

| 2033 | 181.27 |

| 2034 | 188.65 |

| 2035 | 196.32 |

The Lip Oils Market in the United States is projected to grow at a CAGR of 4.5%, led by increased consumer demand for hybrid beauty products that combine lip color and skincare functionality. Tinted lip oils are recording a notable year-on-year rise, particularly among Gen Z and Millennial users seeking clean, non-sticky alternatives to traditional gloss and lipstick. The premium segment, especially clean and plant-based formulations, has seen consistent uptake across online and specialty beauty channels.

Adoption is also rising in professional beauty spaces, including salons and makeup artists who favor oils for layering and treatment applications. High emphasis on ingredient transparency and sustainability is creating opportunities for refillable packaging forms and eco-certified clean beauty labels in the USA market.

The Lip Oils Market in the United Kingdom is expected to grow at a CAGR of 6.1%, supported by widespread adoption across beauty retailers, clean cosmetic brands, and digital-first skincare companies. Premium lip oils infused with natural oils and active skincare ingredients are seeing accelerated uptake among young consumers drawn to minimalist and hybrid beauty products.

Clean beauty mandates and sustainable packaging standards in the UK have prompted brands to launch refillable tubes and vegan-certified formulations. Department stores and specialty beauty chains are promoting lip oils as part of the lip treatment category, while UK-based indie brands are expanding through influencer-driven platforms. Product innovation is focused on combining hydration, gloss, and protection in a single product to meet the needs of modern, multifunctional routines.

India is witnessing rapid growth in the Lip Oils Market, which is forecast to expand at a CAGR of 8.5% through 2035. The segment is gaining traction in tier-2 and tier-3 cities due to the affordability of mass-market tinted lip oils, rising social media influence, and the popularity of skincare-infused makeup. Growth is also supported by D2C startups and beauty subscription boxes introducing clean and natural lip care solutions to digitally connected young consumers.

Indian consumers are increasingly drawn to products offering both aesthetic and therapeutic benefits. Brands are localizing their ingredient positioninghighlighting oils like coconut and almondto meet traditional preferences while staying aligned with global clean beauty trends.

The Lip Oils Market in China is expected to grow at a CAGR of 7.2%, the highest among leading economies. This momentum is driven by massive uptake in hybrid lip treatments, growing K-beauty and C-beauty influence, and the rapid rise of livestreaming commerce on platforms like Douyin and Xiaohongshu.

Premium and mid-range tinted lip oils featuring active hydration ingredients, natural oils, and SPF protection are gaining popularity. The government’s promotion of cosmetic ingredient transparency and cruelty-free labeling has further boosted adoption of lip oils over traditional lipsticks. Local beauty brands are innovating with pH-reactive tints and functional packaging to appeal to a digitally savvy demographic.

The Global Lip Oils Market is moderately fragmented, with global beauty conglomerates, emerging indie players, and region-specific clean beauty brands competing across premium, mass, and hybrid skincare segments. Global leaders such as L’Oréal S.A., Estée Lauder Companies Inc., and Shiseido Company, Limited hold significant market share, driven by diversified product portfolios, global retail access, and aggressive digital marketing strategies.

Their lip oils often feature plant-based ingredients, dermatologist-backed claims, and SPF-infused multifunctionality, tailored for skincare-makeup fusion consumers. Established mid-sized players, including Clarins Group, e.l.f. Beauty, Inc., and Coty Inc., are accelerating adoption through tinted lip oil ranges, vegan formulations, and refillable packaging.

These companies target trend-conscious buyers via DTC platforms, influencer partnerships, and Gen Z-aligned branding across major beauty marketplaces. Specialized indie and regional brands are focusing on natural oil-based treatments, hyper-local ingredient sourcing, and sustainable packaging innovation. Their strength lies in agility, ingredient storytelling, and high engagement through TikTok, Instagram, and clean beauty subscription boxes.

Competitive differentiation is shifting from traditional lip gloss packaging and shade range toward ingredient transparency, skincare-level functionality, and eco-conscious design. Brands offering hybrid product ecosystemsincluding lip serums, oils, and overnight repair treatmentsare gaining traction through subscription models, refill forms, and personalization tools that foster consumer loyalty.

Key Developments in the Global Lip Oils Market

| Item | Value |

|---|---|

| Quantitative Units | USD 612.8 Million |

| Product Type | Liquid Lip Oils, Tinted Lip Oils, Roll-On Lip Oils, Lip Oil Gloss Hybrids, Plumping Lip Oils, SPF-Infused Lip Oils |

| Ingredient Base | Natural Oils, Synthetic / Emollient Oils, Vitamins & Actives, Color Pigments, Fragrance Additives, Functional Additives |

| Packaging Type | Tube with Wand Applicator, Roll-On Bottles, Twist-Up Sticks, Dropper Bottles, Mini / Travel Sizes |

| Distribution Channel | Offline Retail: Beauty Specialty Stores, Pharmacies / Drugstores, Department Stores, Supermarkets, Salon Retail Counters Online Retail: E-commerce Marketplaces, Brand-owned DTC Sites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L’Oréal S.A., The Estée Lauder Companies Inc., LVMH Moët Hennessy Louis Vuitton, Shiseido Company, Limited, Coty Inc., Revlon, Inc., Unilever PLC, Amorepacific Corporation, Clarins Group, Procter & Gamble Co., e.l.f. Beauty, Inc., Kao Corporation, Beiersdorf AG, The Proactiv Company LLC, Natura &Co Holding S.A. |

| Additional Attributes | Dollar sales by product type, ingredient base, and packaging; tinted oil leadership in APAC; influence of celebrity & clean beauty trends; rise in multifunctional and SPF lip oils; offline/online channel preferences by country; demand patterns across individual and professional salon use cases |

The global Lip Oils Market is estimated to be valued at USD 612.8 million in 2025.

The market size for the Lip Oils Market is projected to reach USD 1,141.4 million by 2035.

The Lip Oils Market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types include Liquid Lip Oils, Tinted Lip Oils, Roll-On Lip Oils, Lip Oil Gloss Hybrids, Plumping Lip Oils, and SPF-Infused Lip Oils.

Tinted Lip Oils will dominate with a 41.6% value share in 2025.

Natural Oils will lead with a 51.4% share in 2025, reflecting the clean beauty trend.

Tube with Wand Applicator is the dominant packaging type with a 62.3% share in 2025.

Online retail, particularly through brand-owned DTC platforms and e-commerce marketplaces, is experiencing the fastest adoption, especially among Gen Z consumers.

Leading companies include L’Oréal S.A., The Estée Lauder Companies Inc., LVMH, Shiseido, Coty, Revlon, Unilever, and others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lipid Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Lipidomics Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA