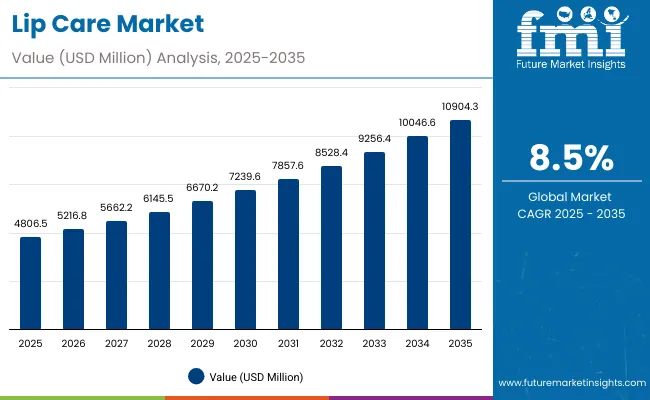

A valuation of USD 4,806.5 million has been projected for the lip care market in 2025, with the figure expected to advance to USD 10,904.3 million by 2035. This rise of over USD 6,000 million reflects a near doubling of market size within a decade, supported by a CAGR of 8.5%. The consistent growth trajectory highlights not only expanding consumer demand but also the deepening influence of wellness and skincare integration into daily routines.

Lip Care Market Key Takeaways

| Metric | Value |

|---|---|

| Lip Care Market Estimated Value in (2025E) | USD 4,806.5 million |

| Lip Care Market Forecast Value in (2035F) | USD 10,904.3 million |

| Forecast CAGR (2025 to 2035) | 8.50% |

From 2025 to 2030, the market is forecasted to move from USD 4,806.5 million to USD 7,239.6 million, contributing USD 2,433.1 million, which accounts for nearly 40% of the decade’s incremental growth. This period is expected to be shaped by rising adoption of moisturizing and repair-focused formulations, which address dryness and long-term lip health. Distribution through e-commerce platforms will strengthen this phase, enabling rapid reach among digital-first consumers.

The second half of the assessment, spanning 2030 to 2035, is anticipated to add USD 3,664.7 million, equivalent to nearly 60% of the decade’s expansion. The market is forecasted to leap from USD 7,239.6 million in 2030 to USD 10,904.3 million by 2035, fueled by accelerated premiumization, clean-label claims, and rising popularity of natural actives such as shea butter and beeswax. By function, repair and healing is projected to dominate with 53.0% share in 2025, while e-commerce is set to lead the distribution channels with 59.0%, reflecting shifting consumer purchasing behavior toward convenience-driven options.

From 2020 to 2024, steady progress was observed in the lip care industry, with demand influenced by heightened awareness of preventive skincare and increased product diversification. By 2025, the market is expected to reach USD 4,806.5 million, laying the foundation for accelerated growth. Over the next decade, value is forecasted to more than double, attaining USD 10,904.3 million by 2035. This expansion will be fueled by consumer preference for natural actives, dermatologist-tested claims, and e-commerce-led accessibility.

The competitive structure is anticipated to remain fragmented, with established brands such as Burt’s Bees and Nivea consolidating their positions, while digital-first and premium players intensify market rivalry. Differentiation is projected to be achieved not only through product innovation but also via sustainability-led packaging, clean-label formulations, and omnichannel strategies. Emerging entrants are expected to leverage niche opportunities in vegan and fragrance-free categories, reshaping the competitive advantage toward innovation ecosystems and consumer-driven personalization.

Growth of the lip care market is being propelled by rising awareness of preventive skincare and the essential role of lip health in overall beauty routines. Demand is being stimulated by consumer preference for natural and organic ingredients, as shea butter, beeswax, and plant oils are increasingly being integrated into formulations. Expansion of e-commerce platforms has enabled broader accessibility, allowing premium, vegan, and fragrance-free options to reach global audiences more effectively.

Urbanization and lifestyle shifts have elevated the incidence of dryness and environmental damage, leading to heightened demand for repair and healing solutions, which dominate the functional category. Innovation in clean-label and dermatologist-tested products is anticipated to strengthen consumer trust, particularly across Asia-Pacific and Europe. Sustainability-driven packaging and premium positioning are expected to further enhance adoption. With younger demographics embracing digital-first shopping and premium wellness products, the market is projected to sustain robust momentum over the forecast period.

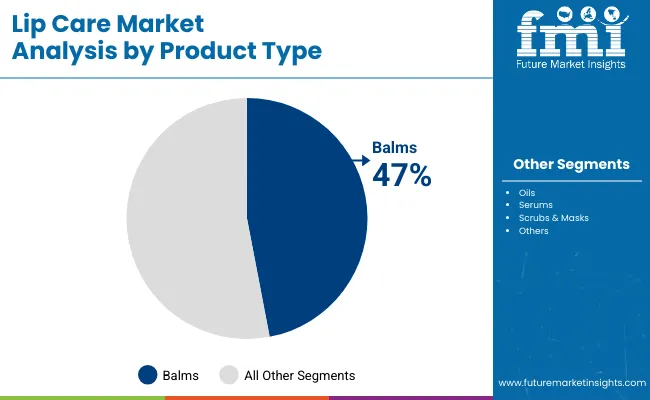

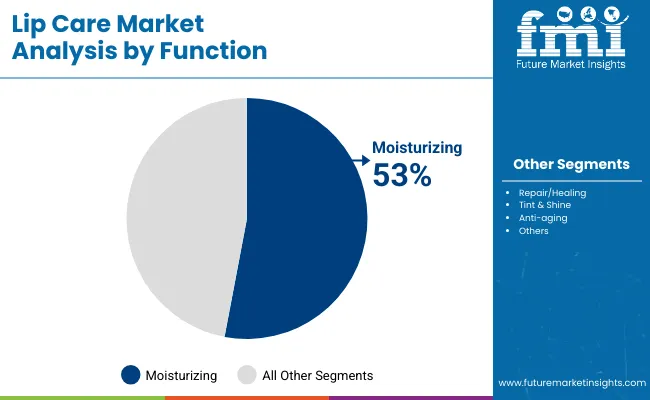

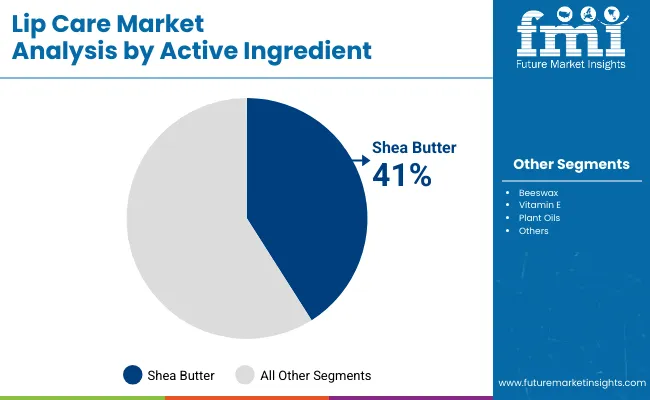

The lip care market is segmented by product type, function, and active ingredient, highlighting the diverse factors shaping consumer adoption. Product types such as balms and other advanced formats capture distinct usage preferences, while functions like moisturizing and repair define the value proposition for different consumer needs. Active ingredient selection, ranging from shea butter to beeswax and plant oils, reflects growing demand for natural, effective, and safe solutions. Together, these segments illustrate how evolving beauty trends, health awareness, and sustainability considerations are expected to reshape the market outlook across the forecast period.

| Product Type | Market Value Share, 2025 |

|---|---|

| Balms | 47% |

| Others | 53.0% |

Balms are projected to hold 47.0% share in 2025 with USD 588.9 million, while the "others" category is expected to dominate with 53.0% share, equivalent to USD 2,547.45 million. The preference for balms will be supported by their simplicity and daily-use nature, while diversified offerings including oils, serums, and scrubs are forecasted to accelerate growth. Functional innovation and premium positioning are anticipated to strengthen the "others" segment, with consumers seeking multi-benefit and natural-based formulations. Increasing demand for targeted solutions such as serums and overnight masks is likely to diversify this segment further. Over the decade, the balance between traditional balm formats and advanced product innovations is expected to define long-term value creation.

| Function | Market Value Share, 2025 |

|---|---|

| Moisturizing | 53% |

| Others | 47.0% |

Moisturizing is forecasted to dominate the function segment with 53.0% share in 2025, valued at USD 566.7 million, while the "others" group will capture 47.0% share, equal to USD 2,259.06 million. The dominance of moisturizing is expected to be reinforced by its core role in protecting against dryness and enhancing lip hydration. Increasing environmental stressors, such as urban pollution and weather fluctuations, are anticipated to keep moisturizing as the essential consumer choice. Meanwhile, the "others" category is projected to gain traction through claims of repair, tint, shine, and anti-aging, appealing to consumers who demand both aesthetics and wellness. This balance is forecasted to expand the functional diversity of lip care products, shaping strong future adoption.

| Active Ingredient | Market Value Share, 2025 |

|---|---|

| Shea butter | 41% |

| Others | 59.0% |

Shea butter is projected to secure 41.0% share in 2025 with USD 533.3 million, while the "others" segment is expected to dominate with 59.0% share, amounting to USD 2,835.84 million. The popularity of shea butter will be sustained by its reputation for deep moisturization and natural healing, particularly appealing to premium and clean-label categories. The "others" segment, comprising beeswax, vitamin E, and plant oils, is forecasted to expand more strongly, driven by vegan, natural, and dermatologist-tested positioning. The ability of these ingredients to provide protective, reparative, and anti-aging benefits is anticipated to enhance consumer trust. Ingredient innovation, coupled with sustainability in sourcing, is projected to shape the competitive edge in this segment.

Intensified consumer emphasis on wellness, natural formulations, and digital accessibility has been observed as key factors shaping the lip care market, although constraints linked to cost-sensitive markets and sustainability expectations continue to challenge consistent adoption across regions.

Digital-First Retail Transformation

Expansion of digital ecosystems is expected to redefine how lip care products are purchased, experienced, and recommended. The rise of algorithm-driven personalization in e-commerce and mobile applications has allowed lip care offerings to be curated according to consumer profiles, climate conditions, and lifestyle preferences. Subscription-based models, dynamic bundling, and virtual try-on technologies are anticipated to accelerate discovery and repeat purchases.

This transformation is not only reshaping sales channels but also building direct-to-consumer intimacy, enabling premium and niche players to capture traction beyond physical retail limitations. The structural shift towards digital-first engagement is projected to create a differentiated growth trajectory, as purchasing power increasingly consolidates online, where transparency, peer validation, and instant gratification dominate decision-making.

Sustainability and Packaging Complexity

Sustainability expectations have emerged as both a driver of innovation and a restraint on scalability. Although recyclable and biodegradable packaging solutions are being pursued, significant cost and infrastructure challenges are limiting widespread implementation. Regulatory tightening in regions such as Europe and North America is anticipated to increase compliance burdens, particularly for mass-market producers.

At the same time, consumers are increasingly discerning about lifecycle impacts, pushing brands to align packaging with eco-conscious values without compromising performance or affordability. This dual pressure has created a structural restraint, as failure to align sustainability with scale risks reputational setbacks and erodes brand trust. The inability to harmonize functionality, safety, and eco-compliance is projected to delay adoption in cost-sensitive markets, slowing the pace of industry-wide transition.

| Countries | CAGR |

|---|---|

| China | 17.4% |

| USA | 7.7% |

| India | 20.0% |

| UK | 11.3% |

| Germany | 8.6% |

| Japan | 14.4% |

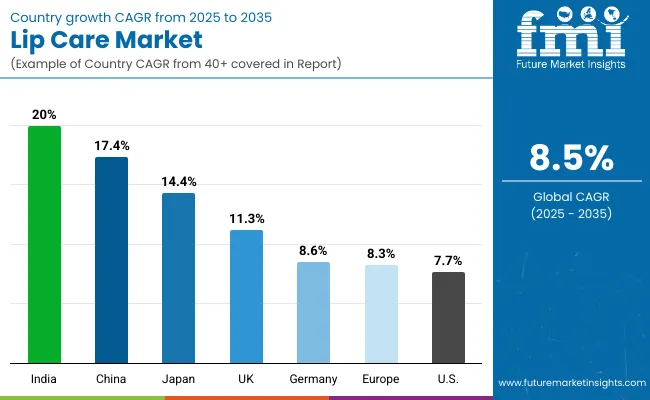

The global lip care market demonstrates clear country-level variations in growth, influenced by consumer behavior, regulatory frameworks, and evolving lifestyle dynamics. Asia-Pacific is expected to emerge as the fastest-expanding region, anchored by India with a CAGR of 20.0% and China with 17.4%. India’s rapid momentum is projected to be reinforced by increasing urbanization, rising demand for dermatologist-tested and fragrance-free formulations, and widespread digital adoption that brings premium products within consumer reach. China’s strong performance is anticipated to be supported by growing preference for natural and organic lip care, along with a rising middle-class population willing to pay for premium and eco-conscious brands.

Japan, with a CAGR of 14.4%, is forecasted to remain a sophisticated market where beauty-conscious consumers will drive uptake of multifunctional and advanced formulations. In Europe, the UK is projected to grow at 11.3%, while Germany is expected to expand at 8.6%, with clean-label regulations and sustainability mandates acting as catalysts for adoption. The USA is estimated to record a relatively moderate CAGR of 7.7%, reflecting maturity in consumer penetration yet steady expansion through e-commerce-led convenience and premiumization trends. These disparities highlight how regional dynamics will shape strategic opportunities for global and regional players across the forecast horizon.

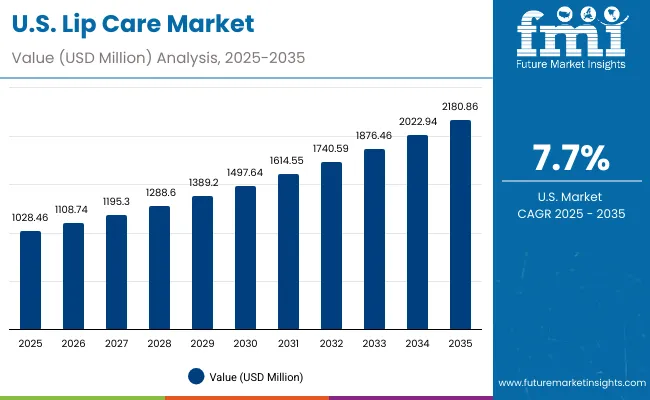

| Year | USA Lip Care Market (USD Million) |

|---|---|

| 2025 | 1,028.46 |

| 2026 | 1,108.74 |

| 2027 | 1,195.30 |

| 2028 | 1,288.60 |

| 2029 | 1,389.20 |

| 2030 | 1,497.64 |

| 2031 | 1,614.55 |

| 2032 | 1,740.59 |

| 2033 | 1,876.46 |

| 2034 | 2,022.94 |

| 2035 | 2,180.86 |

The lip care market in the United States is forecasted to grow at a CAGR of 7.7% from 2025 to 2035, expanding from USD 1,028.46 million to USD 2,180.86 million. Growth is anticipated to be reinforced by increasing consumer preference for clean-label and dermatologist-tested formulations, particularly those addressing hydration, repair, and anti-aging needs. E-commerce penetration and the popularity of subscription-based beauty boxes are expected to accelerate product accessibility and brand diversification. Premiumization trends, along with sustainability-focused packaging, are forecasted to shape consumer loyalty in an already mature market.

The lip care market in the United Kingdom is projected to expand at a CAGR of 11.3% during 2025-2035, supported by increasing demand for dermatologist-tested and premium formulations. Value creation is expected to be strongly tied to clean-label compliance, where regulatory mandates encourage safer and transparent ingredients. Consumer preference for multifunctional products addressing hydration and anti-aging is anticipated to reinforce innovation pipelines. E-commerce channels are forecasted to expand reach, particularly through beauty-specific online retailers and subscription services. Sustainability-led packaging and cruelty-free positioning are expected to elevate brand differentiation in a competitive landscape.

The lip care market in India is forecasted to record the highest CAGR globally at 20.0% during 2025-2035, reflecting robust expansion driven by urbanization, affordability, and rising skincare awareness. Growth is expected to be supported by demand for fragrance-free and dermatologist-tested products, aligning with increasing sensitivity to ingredient safety. Strong adoption of e-commerce platforms is anticipated to broaden product access, particularly in tier-2 and tier-3 cities. Premiumization trends, once limited to metropolitan markets, are projected to expand nationwide, reinforcing opportunities for both domestic and international players. Local ingredient sourcing and value-driven pricing strategies are forecasted to further accelerate penetration.

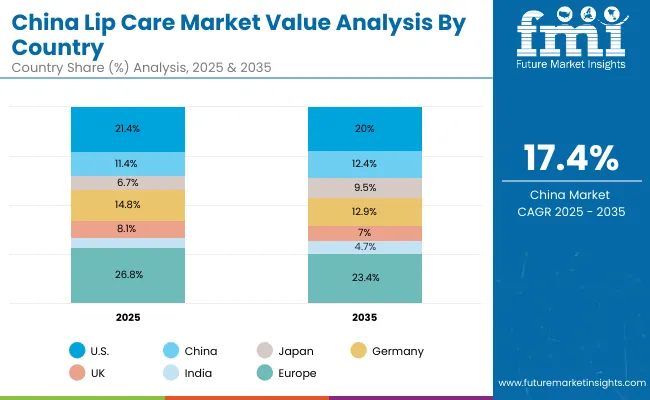

The lip care market in China is projected to expand at a CAGR of 17.4% from 2025 to 2035, supported by rising middle-class income levels and evolving consumer preferences toward natural and organic products. Expansion is expected to be reinforced by regulatory emphasis on safe, transparent ingredients and sustainability-led packaging. Widespread adoption of digital marketplaces, live-streaming channels, and social commerce is anticipated to accelerate brand penetration. Premium and imported lip care products are projected to gain traction among younger demographics, who associate wellness with status-driven consumption. Domestic players are expected to strengthen competitive positioning through cost-effective offerings aligned with traditional herbal actives.

| Countries | 2025 |

|---|---|

| USA | 21.4% |

| China | 11.4% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 8.1% |

| India | 5.1% |

| Countries | 2035 |

|---|---|

| USA | 20.0% |

| China | 12.4% |

| Japan | 9.5% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

The lip care market in Germany is expected to record a CAGR of 8.6% during 2025-2035, reflecting steady growth reinforced by sustainability mandates and high consumer awareness of ingredient safety. Demand is projected to be influenced by dermatologist-tested and fragrance-free claims, aligning with a mature beauty-conscious population. Growth in e-commerce platforms, particularly through direct-to-consumer and subscription-based models, is forecasted to expand convenience-driven adoption. Sustainability expectations are expected to play a decisive role, with eco-friendly packaging and vegan formulations shaping brand loyalty. Premium categories are anticipated to retain momentum, with multifunctional products delivering repair, hydration, and anti-aging benefits.

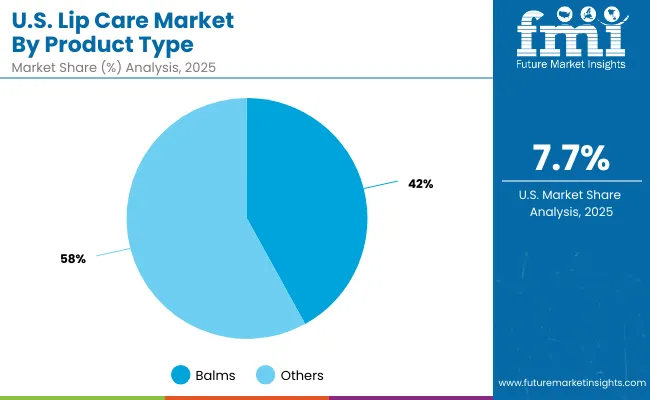

| USA by product type | Market Value Share, 2025 |

|---|---|

| Balms | 42% |

| Others | 58.0% |

The lip care market in the United States is projected at USD 1,028.46 million in 2025. Balms contribute 42.0%, while the "others" category holds 58.0%, underscoring consumer inclination toward diversified formats beyond traditional products. This preference reflects increasing interest in oils, serums, and scrubs that deliver multi-functional benefits, combining hydration with repair and aesthetic enhancement. The slight dominance of "others" signals a value transition as consumer priorities evolve toward personalized and premiumized options.

These products are anticipated to attract higher engagement in digital-first retail environments, where innovation and convenience drive purchasing decisions. Expanding penetration of clean-label and dermatologist-tested solutions is expected to further accelerate adoption of emerging product types. As health-conscious and sustainability-driven consumers seek greater functionality, the shift from single-use formats to advanced alternatives is projected to define the competitive structure of the USA market.

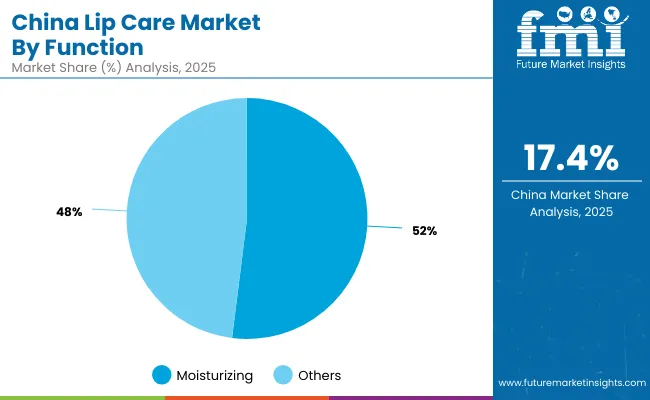

| China by Function | Market Value Share, 2025 |

|---|---|

| Moisturizing | 52% |

| Others | 48.0% |

The lip care market in China is projected at USD 548.62 million in 2025. Moisturizing products contribute 52.0%, valued at USD 285.3 million, while the "others" segment holds 48.0%, equivalent to USD 263.34 million. The dominance of moisturizing products reflects heightened consumer focus on hydration and protection, particularly in urban regions where pollution and climate conditions elevate skin sensitivity.

The near balance between moisturizing and other functional categories signals strong diversification potential, with repair, tint, shine, and anti-aging attributes expected to gain traction among younger demographics. Digital-first retail ecosystems, including social commerce and live-streaming platforms, are anticipated to accelerate awareness and adoption of these functional innovations. As clean-label claims and natural actives gain momentum, function-based differentiation is projected to remain a decisive growth driver across China’s evolving beauty landscape.

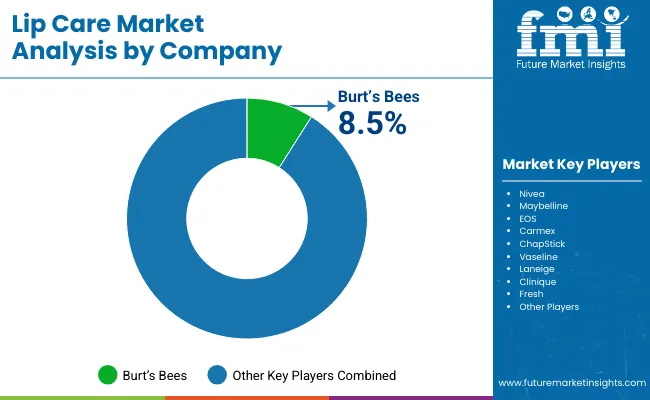

The lip care market is moderately fragmented, with global brands, regional innovators, and niche-focused specialists competing for share across both mass and premium categories. Burt’s Bees holds the leading global share at 8.5% in 2025, positioning itself as the dominant player in the market. Its strength is anticipated to be reinforced by strong consumer loyalty toward natural and eco-conscious formulations, as well as investments in sustainable packaging. The remainder of the market, representing 91.5%, is distributed across a wide pool of multinational brands and emerging regional companies.

Established players such as Nivea, Maybelline, EOS, Carmex, Vaseline, Laneige, Clinique, and Fresh are expected to maintain significant presence, each leveraging distinct strategies in clean-label innovation, digital-first retail, and multifunctional product development. Regional specialists are projected to capitalize on local preferences for herbal actives, vegan positioning, and price-sensitive offerings, ensuring competitive intensity remains high.

Differentiation in this market is shifting away from basic hydration claims toward integrated value propositions combining repair, anti-aging, and premium aesthetics. Brands are anticipated to pursue omnichannel distribution, influencer-driven marketing, and sustainability-focused storytelling to build long-term equity. With consumer priorities aligning around wellness, personalization, and eco-friendly commitments, competition is projected to intensify further.

Key Developments in Lip Care Market

| Item | Value |

|---|---|

| Market Size & Forecast | USD 4,806.5 million (2025); USD 10,904.3 million (2035); CAGR 8.5% (2025-2035) |

| Product Type | Balms; Others (oils, serums, scrubs, masks) |

| Function | Moisturizing; Repair/Healing; Tint & Shine; Anti-aging |

| Active Ingredient | Shea butter; Beeswax; Vitamin E; Plant oils (coconut, almond, jojoba) |

| Distribution Channel | Mass retail; E-commerce; Pharmacies; Specialty beauty retail |

| Claims | Natural/organic; Vegan; Fragrance-free; Dermatologist-tested |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | Burt’s Bees; Nivea; Maybelline; EOS; Carmex; ChapStick; Vaseline; Laneige; Clinique; Fresh |

| Competitive Share (Global, 2025) | Burt’s Bees 8.5%; Others 91.5% |

| Country Growth Benchmarks (CAGR 2025-2035) | India 20.0%; China 17.4%; Japan 14.4%; UK 11.3%; Germany 8.6%; USA 7.7% |

| USA Product Type Split (2025) | Balms 42.0% (USD 432.0 million); Others 58.0% (USD 596.51 million) |

| China Function Split (2025) | Moisturizing 52.0% (USD 285.3 million); Others 48.0% (USD 263.34 million) |

| Growth Drivers (Snapshot) | Clean-label and dermatologist-tested preferences; premiumization; natural actives (shea butter, plant oils); e-commerce subscriptions and DTC expansion |

| Restraints (Snapshot) | Sustainability and packaging cost trade-offs; price sensitivity in mass segments; compliance alignment across regions |

| Key Trends | Multifunctional formulas (repair + tint/shine); eco-friendly packaging; influencer/social commerce; personalization via digital skin diagnostics |

| Additional Attributes | Dollar sales by product type/function/channel; segmentation by claims; subscription/cohort retention metrics; sustainability impact tracking (recyclability, refill systems) |

The global Lip Care Market is estimated to be valued at USD 4,806.5 million in 2025.

The market size for the Lip Care Market is projected to reach USD 10,904.3 million by 2035.

The Lip Care Market is expected to grow at a CAGR of 8.5% between 2025 and 2035.

The key product types in the Lip Care Market are balms, oils, serums, scrubs, and masks.

In terms of product type, the “others” category, including oils, serums, and scrubs, is projected to command 53.0% share in the Lip Care Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Lipstick Market

Lipolyzed Butter Fat Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA