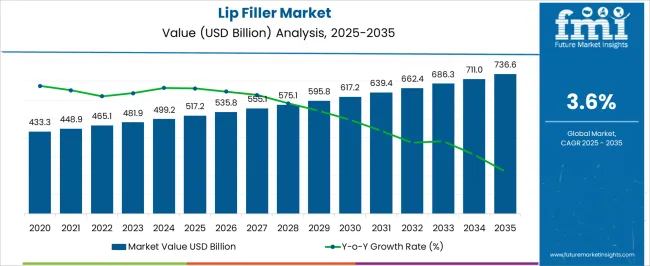

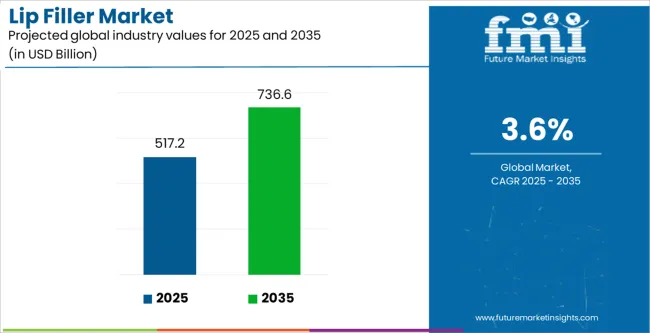

The Lip Filler Market is estimated to be valued at USD 517.2 billion in 2025 and is projected to reach USD 736.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Lip Filler Market Estimated Value in (2025 E) | USD 517.2 billion |

| Lip Filler Market Forecast Value in (2035 F) | USD 736.6 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The lip filler market is advancing rapidly, driven by the rising demand for minimally invasive aesthetic procedures and growing social acceptance of cosmetic enhancements. Clinical journals and industry announcements have underlined the increasing popularity of lip augmentation among younger demographics, influenced by social media trends and beauty standards.

Technological progress in filler formulations has enhanced safety, longevity, and natural-looking outcomes, boosting patient satisfaction and repeat procedures. Healthcare providers and clinics have expanded their service offerings, supported by training programs and regulatory approvals for advanced filler products.

Additionally, investor briefings from pharmaceutical companies have highlighted significant R&D focus on biocompatible materials that minimize adverse reactions. With the aesthetic medicine industry experiencing strong growth across both developed and emerging economies, the lip filler market is expected to maintain steady momentum. Future opportunities will be shaped by innovations in hyaluronic acid-based fillers, increased adoption in hospitals and clinical settings, and expanding availability through specialized dermatology and plastic surgery practices.

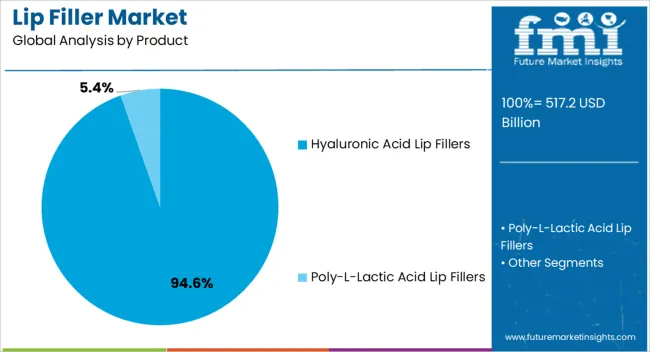

The Hyaluronic Acid Lip Fillers segment is projected to capture 94.6% of the lip filler market revenue in 2025, maintaining its clear dominance among product categories. Growth of this segment has been driven by the superior safety profile, reversibility, and natural integration of hyaluronic acid with human tissues.

Medical publications have consistently emphasized the biocompatibility and hydrating properties of hyaluronic acid, which contribute to enhanced patient outcomes with minimal risk. Healthcare providers have favored these fillers for their predictable results, shorter recovery times, and widespread regulatory approvals across major markets.

Additionally, the ability to dissolve hyaluronic acid fillers with hyaluronidase in case of complications has further strengthened their clinical acceptance. Pharmaceutical firms have prioritized the development of next-generation hyaluronic acid fillers with improved cross-linking technologies, offering longer-lasting results and tailored aesthetic options. These factors collectively ensure that the Hyaluronic Acid Lip Fillers segment will continue to be the cornerstone of the lip filler market.

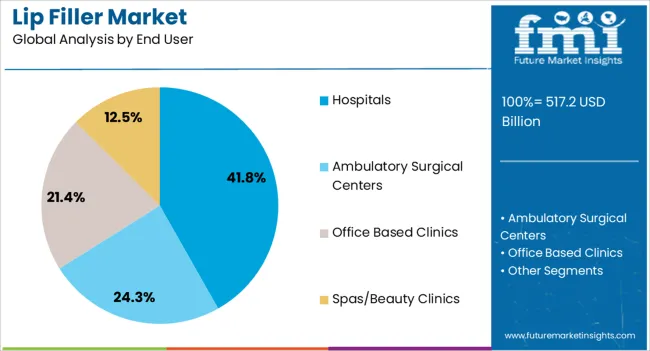

The Hospitals segment is projected to account for 41.8% of the lip filler market revenue in 2025, establishing itself as the leading end-user category. This leadership has been shaped by the growing trust in hospital-based procedures, where patients perceive higher safety standards and access to experienced medical professionals.

Hospitals have increasingly incorporated aesthetic medicine into their service portfolios, supported by investments in specialized dermatology and plastic surgery departments. Regulatory frameworks and healthcare accreditation standards have also reinforced the preference for hospital-based procedures, ensuring compliance with patient safety protocols.

Additionally, hospitals have attracted a wider demographic of patients, including those seeking corrective and reconstructive procedures alongside aesthetic enhancements. Reports from healthcare providers have highlighted rising patient volumes in hospital settings due to bundled services, insurance support, and comprehensive post-procedure care. As demand for safe and reliable cosmetic treatments continues to grow, hospitals are expected to remain the primary end-user segment driving the adoption of lip fillers.

Beauty Standards are Evolving and Amplifying the Demand

Lately, there has been more of a liking for fuller lips because they're seen as youthful and attractive. It is often seen and talked about by celebrities. This has led many people to want to have plump lips too, so they get lip injections. As more people want this look, there's a bigger demand for procedures that make lips plump. This shows how what people think is beautiful affects what they do, and it's why the demand for lip fillers is growing.

Lip augmentation procedures have risen nearly 60% since 2000. As it is a minimally invasive procedure, lip injections are getting more popular. According to a 2025 NCBI survey, 20.1% of respondents who were between the ages of 18 and 29 and 38.4% and 45.2% of those who were between the ages of 40 and 49, respectively, utilized fillers.

More Males are Getting their Lips Plumped

Men are now more open to getting cosmetic procedures like lip and dermal fillers. They do this to fix issues with their lips, such as them being too thin or uneven. As society becomes more accepting, more men are interested in getting lip injections.

This change means that there are new opportunities for places that offer these procedures to get more customers. It shows that people are becoming more accepting of different beauty standards. It affirms that men want to look after themselves too. Nearly, 100,000 men receive filler injections every year in the United States. These numbers are rising due to generational changes, helping the fillers industry.

Some Countries are Standing Out as the Top Destinations for Lip Filler Surgeries

More people are traveling to foreign countries to get lip filler treatments. They are doing so because it is cheaper and of high quality. They visit clinics in other countries, often as part of a vacation package. This trend helps clinics and boosts the local economy in those places.

It shows that people want affordable and good cosmetic treatments, even if they have to travel for them. Also, it highlights how clinics not only provide medical care but also a nice experience for patients who come from other countries.

Countries like South Korea, Thailand, the Philippines, Mexico, Brazil, Turkey, and Iran are top destinations for these procedures. Iran ranks 1st in lip augmentation, injections, and fillers. There are plenty of skilled cosmetic surgeons and experts in Iran’s aesthetic industry.

| Segment | Hyaluronic Acid (Product Type) |

|---|---|

| Value Share (2025) | 94.6% |

The hyaluronic acid product type segment holds the leading lip filler market shares in 2025. Hyaluronic acid-based lip fillers are popular for lip enhancements because they are safe and well-tolerated by the body. They make lips look natural and plump by blending in smoothly with the surrounding tissue. HA lip fillers can be customized to meet individual needs and can be reversed if necessary.

They last a long time and don't require much downtime after the procedure. Improvements in how they're made and used make them even better. More people know about them now and trust them. So, their demand stays high in the market.

| Segment | Hospitals (End User) |

|---|---|

| Value Share (2025) | 41.8% |

The hospitals end user segment holds the leading lip filler market shares in 2025. People often choose hospitals for lip filler treatments because they have skilled doctors and advanced equipment, making them feel safer. Hospitals can handle difficult situations and complications that might happen during or after the treatment.

They provide thorough care by involving different medical experts and checking for any health problems that could affect the treatment. Hospitals also have a good reputation for following rules and providing high-quality care, which gives patients confidence. These factors make hospitals the top-end users in the industry.

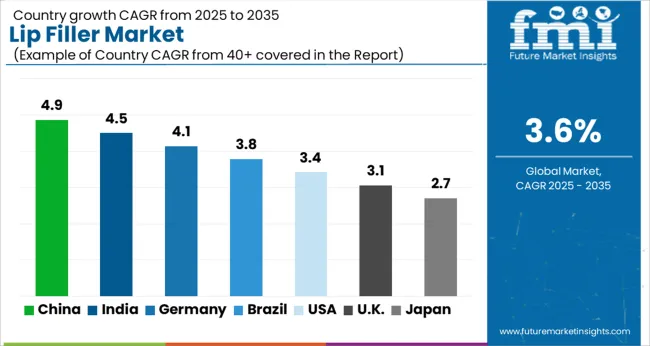

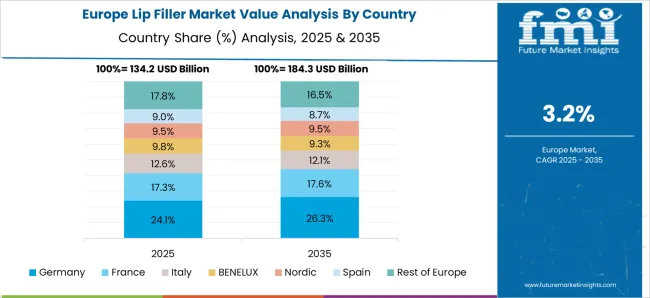

This section analyzes the demand for lip fillers in key countries as given in the table below. The industry is led by sales of lip fillers in China and India is catching up too. This indicates that Asia Pacific is emerging as a key hotspot for growth. Germany, in Europe, is in the second spot.

Germany is becoming popular as a medical tourism destination. In North America, the United States is one of the leading locations for getting cosmetic surgeries. The country experiences stable growth when it comes to lip augmentation.

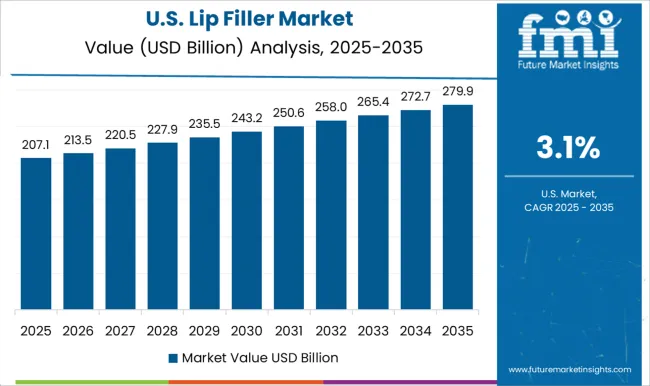

The sales of lip fillers in the United States will rise at a 3.1% CAGR until 2035. More people in the United States are choosing non-surgical cosmetic treatments like lip injections because they're quick, safer, and have less downtime. As the population gets older, more people want treatments to make them look younger.

Technology keeps improving these treatments, and places that offer them are getting more popular. Plus, more spas and clinics are coming up offering these treatments. This is making it easier for American people to get them.

Galderma Laboratories, L.P. leads in aesthetic and dermatological solutions in the United States. It provides lip fillers like Restylane. The company increases its appeal in the professional aesthetic market through product differentiation and consumer awareness.

The demand for lip fillers in Germany will amplify at a 3.3% CAGR until 2035. In Germany, people are getting lip augmentation treatments from trained medical professionals because they trust them for high safety. Hamburg is a popular spot to get these treatments done in Germany.

Consumers here prefer natural-looking results and treatments backed by scientific research. Using technology to personalize treatments and being environmentally friendly also matters to them. Germany is a popular place for people from other countries to come for medical treatments, which helps the industry thrive because more people want it.

Teoxane Laboratories, a Swiss-based company, is prominent in Germany. The company invests in marketing and promotional activities for more reach.

The sales of lip fillers in China will escalate at a 4.5% CAGR till 2035. In China, more people have money to spend because the middle class is growing. They are getting interested in cosmetic treatments because they want to look better and follow trends from the West. Social media platforms like WeChat and Weibo influence what people think is beautiful and what they want to do to look better.

China is also a popular place for people from other countries to get medical treatments, including lip augmentation. This makes the professional aesthetic industry in China even bigger. Places that offer these treatments can expect more customers, both from China and other countries, leading to more business.

Yvoire Medical Co. Ltd. is a prominent player in China. The company partners with dermatologists and aestheticians for more product awareness.

The lip filler market growth in India is estimated at a 3.2% CAGR till 2035. Though, Indian consumers have a ‘beauty from within’ mindset, sales of lip injections are rising in the country. a rising middle class wants cosmetic enhancements like lip injections for status and self-expression. Influenced by Bollywood and social media, people prefer natural-looking results.

India's reputation for affordable, quality healthcare attracts medical tourists for procedures like lip plumping. Government support also boosts the Indian cosmetic industry.

Cipla Limited is a prominent pharmaceutical company in India. The company offers various aesthetic medicinal products. It focuses on product quality and safety. It expands through partnerships with cosmetic clinics and invests in marketing and promotions.

The sales of lip fillers in Australia will rise at a 2.9% CAGR till 2035. Having a closer at the Australian aesthetic industry, it is evident that non-surgical aesthetic market is gaining ground here. Medical-aesthetic channels could expand as investors consider consolidating the regional and local providers. Business models, like subscriptions, can be opportunistic. Advancing consumer funnel management and advancing value-based pricing can also bring in avenues.

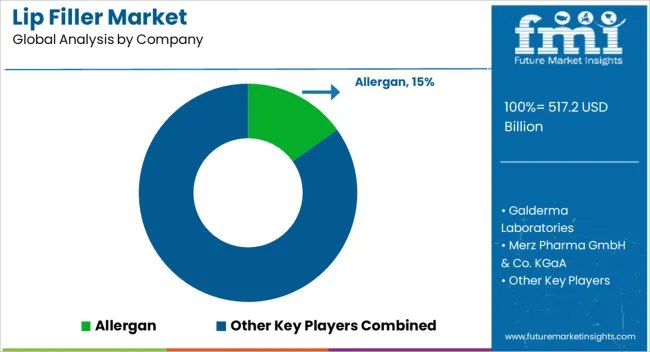

The lip augmentation industry is fiercely competitive, with top manufacturers such as Allergan, Galderma, and Merz Pharma leading the way. To preserve their market positions, these corporations make significant investments in research and development, acquisitions, and worldwide expansion.

Smaller firms concentrate on specific markets or specialized formulas. Pricing, marketing, and distribution tactics are primary battlegrounds. Regulatory compliance and product safety are important for keeping up the reputation and competitiveness in this volatile industry.

Key Development

The market is classified into Hyaluronic Acid Lip Fillers and Poly-L-Lactic Acid Lip Fillers.

Key end-user present in the industry are Hospitals, Ambulatory Surgical Centers, Office Based Clinics, and Spas/Beauty Clinics.

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global lip filler market is estimated to be valued at USD 517.2 billion in 2025.

The market size for the lip filler market is projected to reach USD 736.6 billion by 2035.

The lip filler market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in lip filler market are hyaluronic acid lip fillers and poly-l-lactic acid lip fillers.

In terms of end user, hospitals segment to command 41.8% share in the lip filler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lip Plumping and Filler Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposuction Market Size and Share Forecast Outlook 2025 to 2035

Lipstick Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lipid-Based Vitamin C Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Liposomal Doxorubicin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lip Oils Market Size and Share Forecast Outlook 2025 to 2035

Lip Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Lip Injection Market Size and Share Forecast Outlook 2025 to 2035

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Lip Gloss Tube Market Analysis by Product Type, Material, Capacity, and Region Through 2025 to 2035

The Liposuction Surgery Devices Market is segmented By Technology and End User from 2025 to 2035

Lipase Market Size, Growth, and Forecast for 2025 to 2035

Lip Powder Market Analysis by Form, End-User, Sales Channel and Region from 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Industry Share Analysis for Lip Gloss Tube Providers

Lipids Market Growth - Key Drivers & Sales Trends

Lip Balm Tube Market Trends & Industry Growth Forecast 2024-2034

Lipstick Market

Lipolyzed Butter Fat Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA