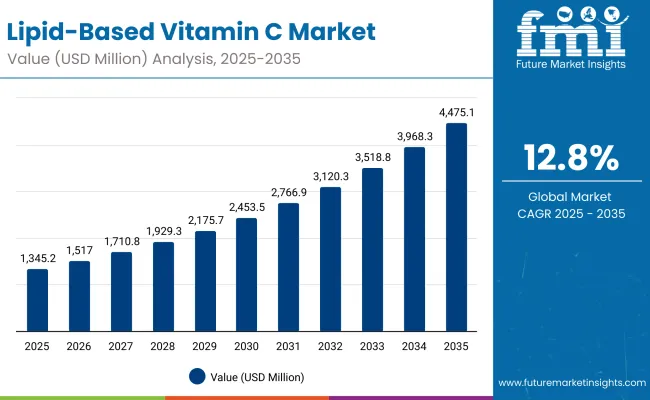

The Lipid-Based Vitamin C Market is expected to record a valuation of USD 1,345.2 million in 2025 and USD 4,475.1 million in 2035, with an increase of USD 3,129.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.8% and a 3.3X increase in market size.

Lipid-Based Vitamin C Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,345.2 million |

| Market Forecast Value in (2035F) | USD 4,475.1 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,345.2 million to USD 2,453.5 million, adding USD 1,108.3 million, which accounts for 35% of the total decade growth. This phase records steady adoption of lipid-based Vitamin C across serums and creams, driven by consumer focus on brightening and antioxidant protection. Serums dominate during this period as the most effective delivery system for lipid-soluble Vitamin C actives.

The second half from 2030 to 2035 contributes USD 2,021.6 million, equal to 65% of total growth, as the market jumps from USD 2,453.5 million to USD 4,475.1 million. This acceleration is powered by the widespread deployment of clinical-grade formulations, clean-label product launches, and mass adoption through e-commerce and specialty beauty retailers. Oils and ampoules capture a growing share by the end of the decade, complementing serums with targeted and professional-grade applications.

From 2020 to 2024, the Lipid-Based Vitamin C Market grew steadily as brands introduced more stable, lipid-soluble Vitamin C derivatives into serums and creams. The competitive landscape during this period was shaped by premium skincare leaders controlling the largest share of revenues, with SkinCeuticals emerging as a global frontrunner. Growth was primarily driven by rising consumer preference for brightening and antioxidant protection benefits, supported by dermatological endorsements and the clean-label movement.

By 2025, the market is set to expand to USD 1,345.2 million, and the revenue mix will begin shifting as clinical-grade, vegan, and dermatologist-tested formulations capture stronger demand. E-commerce and specialty beauty stores are also accelerating market penetration. Competitive differentiation is moving away from ingredient innovation alone toward ecosystem strength combining product efficacy, digital-first retailing, sustainability commitments, and subscription-driven consumer engagement.

Unlike traditional Vitamin C, lipid-based formulations resist oxidation and degradation, ensuring longer shelf life and consistent potency. This stability also enables deeper penetration into the skin’s lipid layers, improving efficacy in brightening, anti-aging, and antioxidant applications. These advantages are making lipid-based Vitamin C the preferred choice for premium skincare brands aiming to deliver reliable, clinically proven results to increasingly demanding consumers.

Consumers are shifting toward advanced skincare backed by dermatological validation, fueling demand for lipid-based Vitamin C in clinical-grade serums and creams. This ingredient’s ability to combine visible results with safety aligns well with regulatory and consumer expectations in mature markets. Simultaneously, luxury and mid-tier brands are positioning lipid-based formulations as high-value offerings, capturing interest from both professional clinics and beauty-conscious retail buyers.

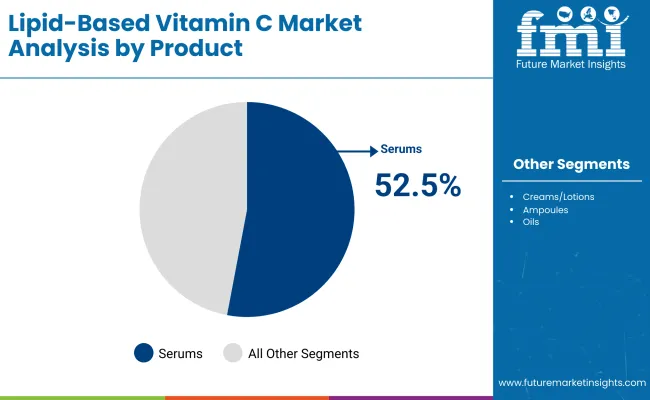

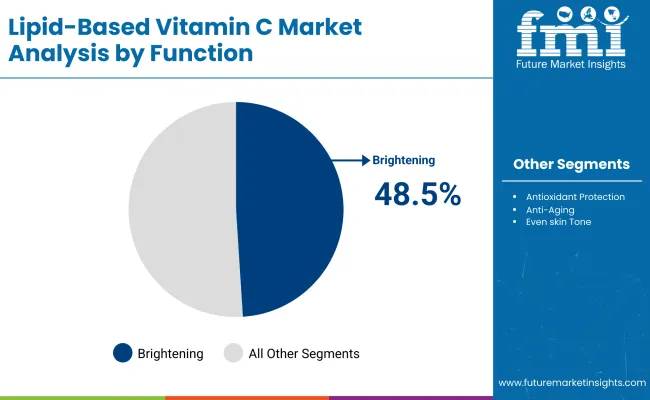

The market is segmented by function, product type, channel, claim, and region. Functions include antioxidant protection, brightening, anti-aging, and even skin tone, highlighting the broad spectrum of skincare benefits offered by lipid-based Vitamin C. Product type classification covers serums, creams/lotions, ampoules, and oils, each catering to different consumer preferences and application routines. By channel, distribution spans pharmacies, e-commerce, mass retail, and specialty beauty stores, reflecting the blend of clinical credibility, digital-first accessibility, and premium retail positioning driving adoption.

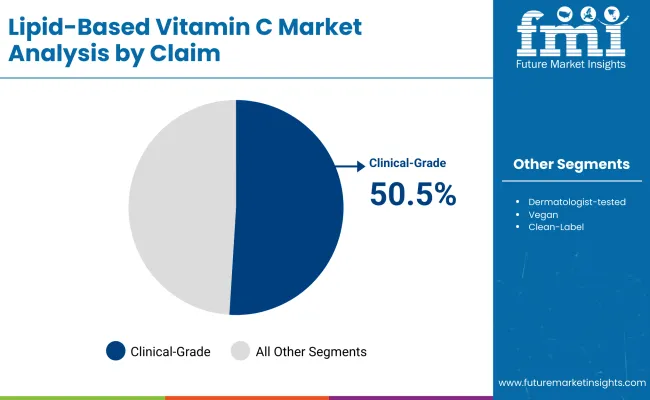

Based on claims, the segmentation includes clinical-grade, dermatologist-tested, vegan, and clean-label formulations, showcasing how efficacy, transparency, and ethical positioning influence consumer choices. Regionally, the scope spans North America, Europe, Asia-Pacific, and the Middle East & Africa. Within these, key countries such as the USA, China, India, Germany, UK, and Japan serve as major demand hubs, each shaped by unique retail ecosystems, regulatory frameworks, and consumer skincare priorities.

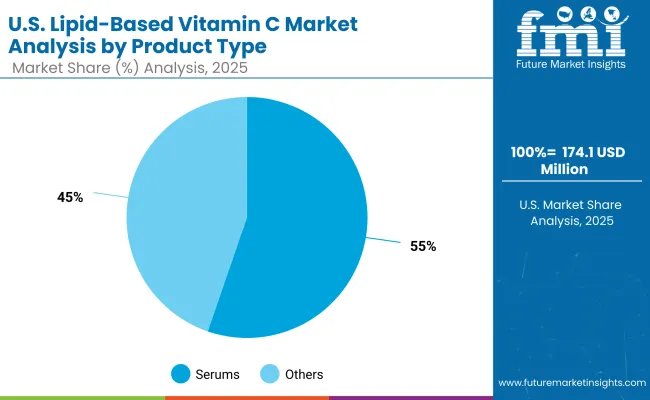

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 52.5% |

| Others | 47.5% |

The serums segment is projected to contribute 52.5% of the Lipid-Based Vitamin C Market revenue in 2025, maintaining its lead as the dominant product category. Serums are favored for their high concentration of actives, fast absorption, and ability to deliver lipid-based Vitamin C directly into deeper skin layers, making them particularly effective for brightening, antioxidant protection, and anti-aging. Their clinical-grade positioning further strengthens consumer trust, especially in premium and dermatologist-endorsed lines.

The others category, which includes creams, lotions, ampoules, and oils, accounts for 47.5% of revenues in 2025. These formats appeal to consumers seeking daily-use skincare and broader hydration benefits, while ampoules and oils are increasingly being positioned as professional-grade treatments and targeted boosters. Together, these complementary formats ensure a well-rounded product mix, with serums leading the premium space and others supporting mass-market accessibility and diversified consumer needs.

| Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 50.5% |

| Others | 49.5% |

The clinical-grade segment is expected to account for 50.5% of the Lipid-Based Vitamin C Market revenue in 2025, highlighting its importance as a driver of consumer trust and brand credibility. Clinical-grade products resonate strongly with buyers seeking scientifically validated efficacy, particularly in anti-aging, brightening, and antioxidant protection functions. Dermatologist endorsements and lab-tested claims further strengthen their positioning in both professional clinics and premium skincare lines.

The others category, which makes up 49.5% of revenues, includes dermatologist-tested, vegan, and clean-label offerings. These claims are gaining momentum among younger and eco-conscious consumers who value ingredient transparency, ethical sourcing, and sustainability alongside performance. This dynamic ensures that while clinical-grade products anchor the market with credibility, alternative claims broaden its appeal, attracting diverse consumer groups across regions and retail platforms.

| Function | Value Share% 2025 |

|---|---|

| Brightening | 48.5% |

| Others | 51.5% |

The brightening segment is projected to contribute 48.5% of the Lipid-Based Vitamin C Market revenue in 2025, establishing it as the leading function category. Lipid-based Vitamin C formulations are particularly effective at reducing dullness and improving skin radiance, as their enhanced stability and lipid solubility allow deeper penetration and sustained efficacy. This makes them highly attractive for consumers seeking even skin tone and visible glow.

The others category, which accounts for 51.5% of revenues, includes antioxidant protection, anti-aging, and even skin tone applications. Antioxidant protection supports preventive skincare routines, while anti-aging remains a consistent demand driver across mature consumer segments. Even skin tone products are gaining traction in Asia-Pacific, where uniform complexion is a high-priority beauty goal. Together, these functional areas ensure a well-balanced growth trajectory, with brightening as the anchor of demand and complementary functions expanding the market’s versatility.

Superior Stability and Bioavailability

Lipid-based Vitamin C formulations offer enhanced stability compared to traditional ascorbic acid, which often oxidizes quickly and loses potency. Encapsulation in lipid carriers allows for deeper skin penetration and prolonged release of active compounds, ensuring consistent performance in antioxidant protection, brightening, and anti-aging functions. This technological advancement has significantly increased consumer trust and brand adoption, especially in clinical-grade serums and creams marketed as high-efficacy solutions. The enhanced bioavailability advantage is central to driving premium positioning and repeat consumer demand.

Rising Consumer Shift Toward Clinical-Grade Skincare

Global consumers are increasingly prioritizing dermatologist-tested and clinically validated skincare, with lipid-based Vitamin C becoming a cornerstone ingredient in professional-grade formulations. Its compatibility with sensitive skin and ability to deliver visible brightening and anti-aging results aligns with consumer expectations for both safety and performance. Spas, clinics, and specialty beauty stores are capitalizing on this demand by incorporating clinical-grade lipid-based products into treatment menus, thereby expanding reach. The preference for trusted, science-backed skincare is accelerating adoption across developed and emerging markets alike.

High Production Costs Limiting Accessibility

Despite strong demand, lipid-based Vitamin C products face challenges due to higher production costs associated with encapsulation technologies and specialized stabilization processes. This cost burden often translates into premium pricing, limiting accessibility in mass-market retail channels. Smaller and price-sensitive consumer groups in emerging markets may find these products less affordable, restricting overall penetration. Unless economies of scale or cost-effective innovations are introduced, premium pricing will remain a barrier to mainstream adoption, slowing growth potential outside affluent demographics and high-income regions.

Integration with Multi-Functional Skincare Formulations

A key trend shaping the market is the integration of lipid-based Vitamin C into multi-functional skincare products that combine brightening, anti-aging, hydration, and antioxidant protection. Brands are increasingly formulating hybrid solutions such as Vitamin C serums enriched with hyaluronic acid, peptides, or botanical extracts to enhance value propositions. This reflects consumer demand for simplified routines with maximum benefits. The trend also aligns with clean-label and vegan preferences, where multifunctionality reduces product overload while offering high efficacy, driving broader adoption across regions.

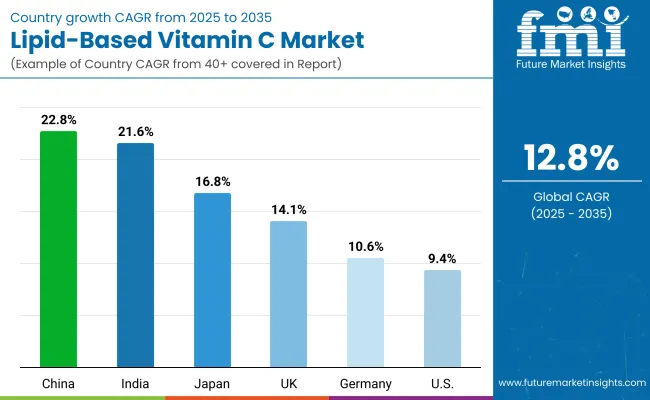

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.8% |

| USA | 9.4% |

| India | 21.6% |

| UK | 14.1% |

| Germany | 10.6% |

| Japan | 16.8% |

The global Lipid-Based Vitamin C Market shows clear disparities in adoption, shaped by consumer preferences, retail dynamics, and brand positioning. Asia-Pacific emerges as the fastest-growing region, led by China (22.8% CAGR) and India (21.6% CAGR). In China, the rise of e-commerce giants, influencer-led beauty marketing, and clinical-grade positioning have fueled adoption of lipid-based Vitamin C serums and creams. India reflects strong growth due to the blending of lipid-based formulations with Ayurvedic and herbal-inspired skincare, supported by expanding access in tier-2 and tier-3 cities. Japan (16.8% CAGR) continues to be a significant growth hub, with demand centered around brightening and anti-aging benefits.

Japanese consumers prioritize clinical-grade, dermatologist-tested formulations and value lipid-based Vitamin C for its stability and efficacy in multifunctional skincare routines. Europe maintains steady growth, led by the UK (14.1% CAGR) and Germany (10.6% CAGR). Demand here is strongly influenced by sustainability, clean-label claims, and ingredient transparency. Specialty beauty stores and pharmacies remain critical distribution channels, particularly for clinical-grade and dermatologist-tested formulations.

North America shows moderate expansion, with the USA at 9.4% CAGR. Growth is anchored by premium skincare brands and professional-grade adoption in spas and clinics. While the market is mature compared to Asia-Pacific, opportunities remain in e-commerce and subscription-driven clean-label product lines appealing to younger demographics.

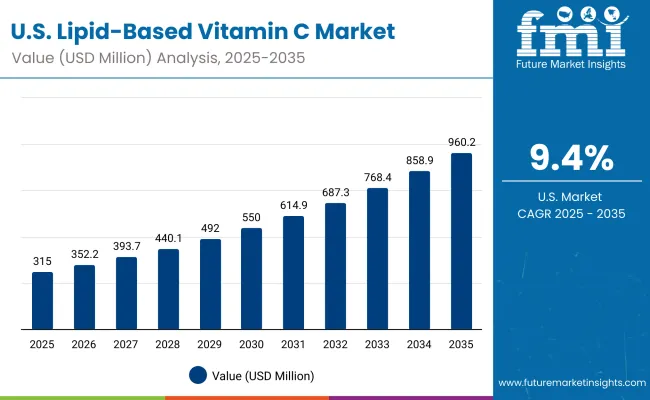

| Year | USA Lipid-Based Vitamin C Market (USD Million) |

|---|---|

| 2025 | 315.09 |

| 2026 | 352.23 |

| 2027 | 393.75 |

| 2028 | 440.17 |

| 2029 | 492.05 |

| 2030 | 550.06 |

| 2031 | 614.90 |

| 2032 | 687.38 |

| 2033 | 768.41 |

| 2034 | 858.99 |

| 2035 | 960.25 |

The Lipid-Based Vitamin C Market in the United States is projected to grow from USD 315.09 million in 2025 to USD 960.25 million by 2035, reflecting steady expansion across both premium and mass-market segments. Growth is primarily driven by the strong adoption of serums, which account for 55.3% of revenues in 2025, favored for their high concentration and superior absorption efficiency.

USA consumers show rising interest in clinical-grade and dermatologist-tested formulations, positioning lipid-based Vitamin C as a trusted solution in brightening, antioxidant protection, and anti-aging applications. Distribution is balanced across pharmacies, specialty beauty stores, and e-commerce, with digital platforms accelerating awareness and accessibility. Subscription-based models and influencer-led promotions are also reshaping consumer purchase behavior.

In professional settings, spas and clinics are incorporating lipid-based Vitamin C into treatment routines, reinforcing its reputation as a high-performance active. Meanwhile, younger demographics are increasingly drawn to vegan and clean-label product claims, adding further momentum to innovation pipelines.

The Lipid-Based Vitamin C Market in the United Kingdom is expected to grow steadily through 2035, driven by increasing consumer interest in brightening and anti-aging skincare routines. Premium serums and creams infused with lipid-based Vitamin C are highly sought after for their stability, deeper skin penetration, and visible results. Demand is reinforced by strong uptake in clinical-grade and dermatologist-tested product lines, which are widely distributed through pharmacies, specialty beauty retailers, and professional clinics.

The UK market is also characterized by high sensitivity to clean-label and sustainable skincare claims, with eco-conscious consumers prioritizing transparency and ingredient safety. E-commerce platforms and subscription services are further expanding brand reach, while luxury players continue to dominate in premium retail channels. Government-supported sustainability initiatives and the country’s strong regulatory environment around cosmetic safety are shaping product innovation and consumer trust.

India is witnessing rapid growth in the Lipid-Based Vitamin C Market, which is forecast to expand at a CAGR of 21.6% through 2035. Growth is being fueled by rising awareness of advanced skincare solutions and the blending of lipid-based Vitamin C with Ayurvedic and herbal-inspired formulations. Urban demand is strong, but tier-2 and tier-3 cities are becoming new hubs of adoption, supported by affordable launches and the expansion of e-commerce platforms.

Educational and vocational institutes are also beginning to integrate cosmetic science and dermatology-led innovations into training programs, building consumer trust in clinical-grade formulations. Professional clinics and spas are incorporating lipid-based serums into treatment menus, while younger demographics show increasing preference for vegan and clean-label products. Together, these factors are positioning India as one of the fastest-growing markets globally.

The Lipid-Based Vitamin C Market in China is expected to grow at a CAGR of 22.8%, the highest among leading economies. Growth is anchored by clinical-grade formulations, which hold 53.5% share in 2025, reflecting strong consumer preference for performance-driven skincare with dermatologist validation. E-commerce dominates distribution, with platforms like Tmall, JD.com, and Douyin enabling mass-market reach through livestreaming and influencer-driven campaigns.

Domestic brands are gaining momentum by offering competitively priced lipid-based serums and creams, expanding access beyond urban centers to regional markets. At the same time, premium international players continue to lead in the luxury skincare segment, leveraging their brand heritage and advanced formulations. Younger consumers are driving adoption of vegan and clean-label products, ensuring further market diversification.

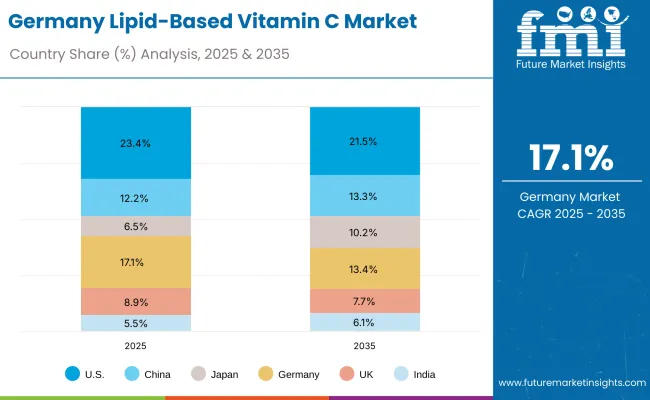

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.4% |

| China | 12.2% |

| Japan | 6.5% |

| Germany | 17.1% |

| UK | 8.9% |

| India | 5.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.5% |

| China | 13.3% |

| Japan | 10.2% |

| Germany | 13.4% |

| UK | 7.7% |

| India | 6.1% |

Germany accounted for 17.1% of the global Lipid-Based Vitamin C Market in 2025, with its share projected to decline slightly to 13.4% by 2035 as Asia-Pacific captures faster growth. Despite this relative slowdown, Germany remains a critical European market, shaped by its preference for clinical-grade and dermatologist-tested formulations. Consumers prioritize product safety, stability, and scientifically validated efficacy, making lipid-based Vitamin C highly attractive in anti-aging and brightening serums and creams.

The country’s strong regulatory environment under the EU framework has accelerated demand for clean-label and sustainable products, with brands emphasizing transparency, eco-certifications, and recyclable packaging. Pharmacies and specialty beauty retailers continue to dominate distribution, while e-commerce platforms are gradually gaining importance, particularly among younger consumers. Premium brands such as SkinCeuticals, La Roche-Posay, and Kiehl’s maintain leadership, but domestic players are carving space by highlighting eco-conscious positioning and ingredient innovation.

| USA by Product Type | Value Share% 2025 |

|---|---|

| Serums | 55.3% |

| Others | 44.7% |

The Lipid-Based Vitamin C Market in the United States is projected to expand steadily through 2035, supported by strong demand for serums, which hold 55.3% of revenues in 2025. Serums are widely recognized for their ability to deliver high concentrations of stabilized Vitamin C directly into the skin, addressing consumer needs for brightening, antioxidant protection, and anti-aging efficacy. Their clinical-grade positioning further strengthens trust, especially in professional skincare channels and pharmacies.

The others category (44.7%), which includes creams, ampoules, and oils, also plays a critical role in daily skincare routines, appealing to consumers seeking hydration, barrier repair, and long-term maintenance. Distribution is led by pharmacies, specialty beauty stores, and e-commerce platforms, with online channels gaining momentum through subscription models and influencer-driven promotions. Growing consumer interest in dermatologist-tested, vegan, and clean-label claims continues to shape product innovation pipelines and purchasing behavior.

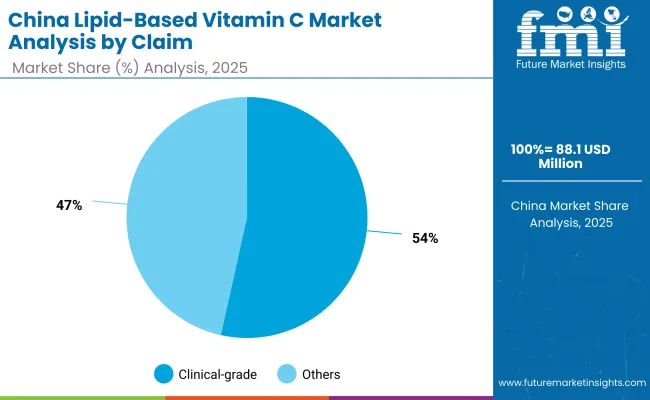

| China by Claim | Value Share% 2025 |

|---|---|

| Clinical-grade | 53.5% |

| Others | 46.5% |

In 2025, clinical-grade formulations hold 53.5% of the Lipid-Based Vitamin C Market in China, making them the dominant claim category. This reflects the strong consumer preference for scientifically validated skincare, where performance and visible results are prioritized. The dominance of clinical-grade products is further reinforced by dermatologist endorsements, KOL promotions, and integration into professional beauty clinics, which give them credibility across both luxury and mass-market segments.

The others category (46.5%), including dermatologist-tested, vegan, and clean-label claims, is also rising, especially among younger demographics that value sustainability and ingredient transparency. China’s vast e-commerce ecosystem led by Tmall, JD.com, and Douyin provides unmatched opportunities for brands to scale rapidly, combining livestreaming, influencer partnerships, and subscription services. Domestic brands are leveraging competitive pricing, while international players strengthen their edge through premium positioning and innovation in stable, multi-functional formulations.

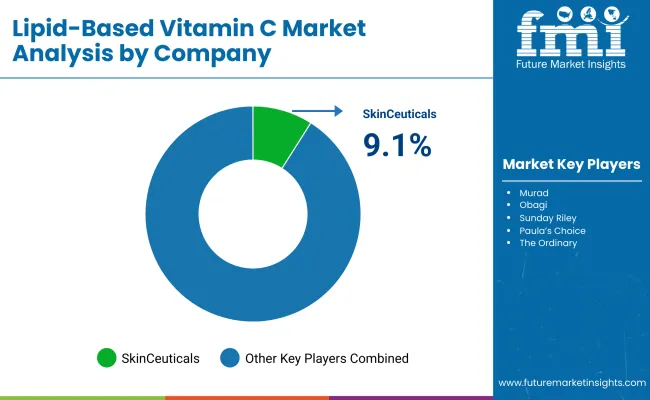

The Lipid-Based Vitamin C Market is moderately fragmented, with global leaders, established skincare brands, and niche innovators competing across diverse product formats and claims. In 2025, SkinCeuticals holds 9.1% of the global market, while the remaining 90.9% is shared among brands such as Murad, Obagi, Paula’s Choice, The Ordinary, Ole Henriksen, Kiehl’s, CeraVe, Sunday Riley, and Drunk Elephant. Global leaders like SkinCeuticals and Obagi dominate the clinical-grade space, leveraging dermatologist endorsements, patented stabilization technologies, and strong retail presence in pharmacies and specialty stores. Their strategies emphasize product efficacy, premium positioning, and expansion into Asia-Pacific markets through e-commerce and professional clinics.

Mid-sized players, including Murad, Paula’s Choice, and The Ordinary, are accelerating adoption through accessible price points, strong influencer-driven marketing, and innovation in vegan and clean-label lipid-based serums. These brands resonate strongly with younger demographics and digital-first consumers.

Niche-focused specialists such as Ole Henriksen and Sunday Riley focus on personalization, clean beauty, and targeted formulations, often highlighting eco-conscious sourcing and multifunctional benefits. Their adaptability and focus on ethical positioning help them capture loyal consumer bases in both Western and Asian markets. Competitive differentiation is shifting from ingredient innovation alone toward ecosystem strength combining clinical credibility, clean-label positioning, digital-first distribution, and sustainability practices. Brands that successfully merge science-backed efficacy with ethical and transparent branding are expected to consolidate long-term leadership.

Key Developments in Lipid-Based Vitamin C Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,345.2 Million |

| Function | Antioxidant protection, Brightening, Anti-aging, Even skin tone |

| Product Type | Serums, Creams/lotions, Ampoules, Oils |

| Channel | Pharmacies, E-commerce, Mass retail, Specialty beauty stores |

| Claim | Clinical-grade, Dermatologist-tested, Vegan, Clean-label |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SkinCeuticals, Murad, Obagi, Sunday Riley, Paula’s Choice, The Ordinary, Ole Henriksen, Kiehl’s, CeraVe, Drunk Elephant |

| Additional Attributes | Dollar sales by product type (serums, creams/lotions, ampoules, oils) and distribution channel, adoption trends in clinical-grade and dermatologist-tested formulations, rising demand for vegan and clean-label skincare, sector-specific growth across pharmacies, specialty beauty stores, and e-commerce platforms, premium positioning through antioxidant protection, brightening, and anti-aging functions, regional trends influenced by Asia-Pacific and Western Europe consumer shifts, and innovations in lipid-encapsulation technologies, multifunctional formulations, and sustainable packaging practices. |

The global Lipid-Based Vitamin C Market is estimated to be valued at USD 1,345.2 million in 2025.

The market size for the Lipid-Based Vitamin C Market is projected to reach USD 4,475.1 million by 2035.

The Lipid-Based Vitamin C Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the Lipid-Based Vitamin C Market are serums, creams/lotions, ampoules, and oils. Among these, serums dominate with 52.5% share in 2025, reflecting their role as the most effective format for delivering lipid-soluble Vitamin C.

Within functions, brightening applications are expected to hold 48.5% of revenues in 2025, as Vitamin C remains one of the most trusted actives for skin radiance and even tone.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Deficiency Treatment Market

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA