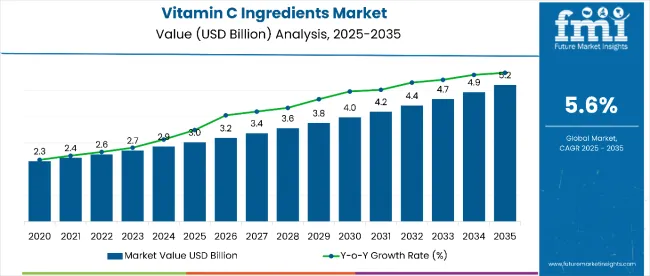

The vitamin C ingredients market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. The vitamin C ingredients market is projected to add an absolute dollar opportunity of USD 2.2 billion over the forecast period.

| Metric | Value |

|---|---|

| Vitamin C Ingredients Market Estimated Value (2025E) | USD 3.0 billion |

| Vitamin C Ingredients Market Forecast Value (2035F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

This reflects a 1.73 times growth at a compound annual growth rate of 5.6%. The market's evolution is expected to be shaped by increasing consumer health awareness, rising demand for fortified foods, and expanding applications across pharmaceuticals, nutraceuticals, and the cosmetics sectors.

By 2030, the market is likely to reach approximately USD 4.0 billion, accounting for USD 1.0 billion in incremental value over the first half of the decade. The remaining USD 1.2 billion is expected during the second half, suggesting steady, sustained growth. Natural vitamin C sources are gaining traction, although synthetic ingredients continue to dominate due to cost-effectiveness and supply stability.

Companies such as Koninklijke DSM N.V., CSPC Pharmaceutical Group, Foodchem International, and China BBCA Group are advancing their competitive positions through investments in capacity expansion, clean-label production, and sustainable sourcing initiatives. Innovation in product delivery, including extended-release and bioavailable formulations, is accelerating market diversification. Market performance will remain anchored in manufacturing efficiency, product innovation, and compliance with clean-label trends.

The market holds approximately 38% of the immunity-boosting ingredients market, driven by its strong antioxidant properties and role in supporting immune health. It accounts for around 33% of the functional food ingredients segment, as Vitamin C is commonly used in fortified beverages, dairy, and snacks.

The market contributes nearly 29% to the nutraceutical ingredients category, especially within dietary supplements targeting cardiovascular, skin, and cellular health. It holds close to 25% of the clean-label supplements market, with synthetic and natural variants gaining preference for transparency and traceability. The share in the pharmaceutical excipients segment reaches about 27%, reflecting its growing role in therapeutic formulations and bioavailable drug delivery systems.

The market is undergoing transformation due to rising health awareness and increasing demand across food, pharma, and cosmetic industries. Innovations in coated, slow-release, and bio-enhanced Vitamin C forms have improved efficacy and consumer experience.

Manufacturers are introducing natural-source Vitamin C, liposomal delivery formats, and cosmetic-grade derivatives to address evolving application needs. Strategic partnerships between ingredient manufacturers and supplement brands are accelerating the adoption of Vitamin C in targeted health solutions and lifestyle-focused products.

Rising global health consciousness and increased focus on preventive healthcare have elevated Vitamin C as a core ingredient across various dietary and therapeutic applications. Its well-documented role in supporting immune function, antioxidant protection, and skin health has made it a staple in dietary supplements and functional food products across age groups and geographies.

The market is further driven by expanding applications in pharmaceuticals, nutraceuticals, cosmetics, and food & beverage industries. Vitamin C is widely used in tablets, gummies, energy drinks, fortified juices, serums, and creams. Innovation in granulation, coating, and delivery systems such as sustained-release formats has expanded its appeal to both consumers and manufacturers.

As demand rises for clean-label, plant-based, and immune-boosting ingredients, Vitamin C remains at the forefront of product development pipelines. Backed by strong clinical validation and widespread consumer awareness, the market is poised for steady growth, particularly in emerging markets where nutritional deficiencies and preventive health are growing public health priorities.

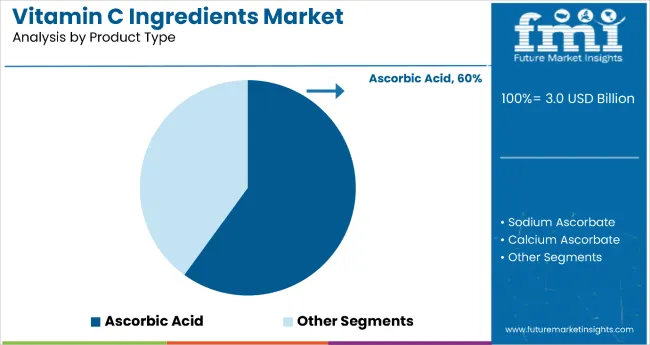

The market is segmented by product type, form, source, process, end use, and region. By product type, the market is classified into ascorbic acid (ascorbic acid 90% granulation, ascorbic acid 95% granulation, and ascorbic acid 97% granulation), sodium ascorbate, calcium ascorbate, coated vitamin C, and others (magnesium ascorbate, potassium ascorbate, and ascorbyl palmitate).

Based on form, the market is divided into powder, granules, and others (liquid, tablets, and capsules). Based on source, the market is bifurcated into natural and synthetic.

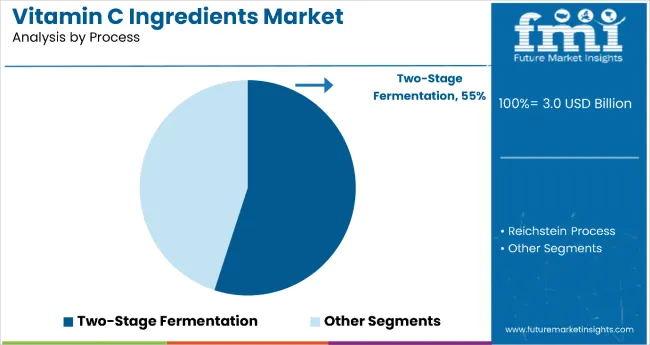

In terms of process, the market is classified into Reichstein process and two-stage fermentation process. By end use, the market is divided into food & beverages, cosmetics & personal care products, pharmaceuticals, and animal feed. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The ascorbic acid segment leads the market with an estimated 60% share in 2025, driven by its broad range of applications, cost-effectiveness, and well-established role as a potent antioxidant and essential nutrient. Within this segment, ascorbic acid is the preferred sub-type due to its high purity and functional versatility, especially in pharmaceuticals, dietary supplements, and fortified foods. Its ability to support immune health, enhance iron absorption, and improve skin vitality fuels demand among health-focused consumers.

Advances in synthetic production, such as the efficient and scalable two-stage fermentation process, have improved the availability and affordability of ascorbic acid, reinforcing its position as the most commercially viable product. Widespread regulatory approval and a strong safety profile further support its use in both developed and emerging markets, making it the primary growth driver within the product type category.

The two-stage fermentation process dominates the market with a 55% share by process type, recognized as the most lucrative and widely adopted production method. This process is favored for its cost-efficiency, scalability, and lower environmental impact compared to the traditional Reichstein method. Utilizing microbial fermentation, it enables high-yield, continuous production from renewable raw materials. This biotechnological advancement supports sustainable manufacturing and aligns with industry’s growing emphasis on clean-label and green chemistry practices.

Ascorbic acid produced through this method meets stringent quality standards, making it highly preferred for nutraceuticals, fortified beverages, dietary supplements, and functional foods. The process also ensures greater consistency in purity and particle size, which is critical for product formulation across multiple industries. Ongoing investments in microbial strain optimization and downstream processing position this segment to maintain its market leadership in the coming years.

From 2023 to 2025, rising demand for immunity-boosting ingredients and functional nutrition has significantly shaped the trajectory of the Vitamin C ingredients market. As consumers globally seek preventative health solutions, particularly post-pandemic, Vitamin C's role as a vital antioxidant and immune modulator has amplified. Manufacturers promoting clinically supported efficacy and clean-label claims are benefiting from this wellness-centric shift in dietary preferences.

Health & Wellness Consciousness Driving Market Growth

Increasing consumer focus on immune health, chronic disease prevention, and clean nutrition is a key driver of the Vitamin C ingredients market. By 2025, Vitamin C became one of the most incorporated active ingredients in fortified foods, beverages, supplements, and even skincare products. The pharmaceutical and nutraceutical sectors are expanding usage due to its established roles in immune response, collagen synthesis, and antioxidant defense. Synthetic ascorbic acid leads the market with a 60% share, supported by stable costs and scalability.

Technological Innovation and Process Efficiency Enable Expansion

Two-stage fermentation, accounting for a leading 55% share, is gaining prominence due to its efficiency, purity, and cost-effective yields compared to the traditional Reichstein process. Meanwhile, product innovation is accelerating in areas like microencapsulated Vitamin C, sustained-release formats, and natural-sourced variants. As clean-label and organic preferences grow, companies investing in bioavailable, plant-based, or sustainably manufactured Vitamin C ingredients are positioned to benefit from expanding demand across food, cosmetics, and pharmaceutical applications.

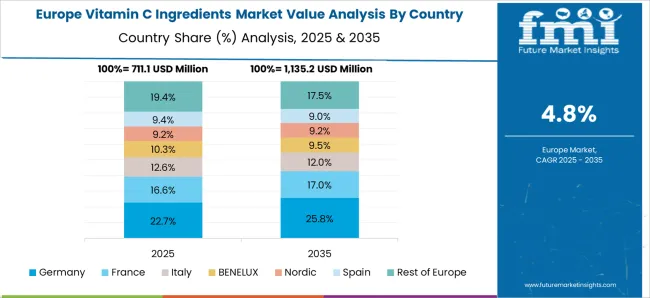

| Country | CAGR |

|---|---|

| USA | 5.8% |

| France | 5.5% |

| Germany | 4.9% |

| UK | 4.3% |

| Japan | 3.8% |

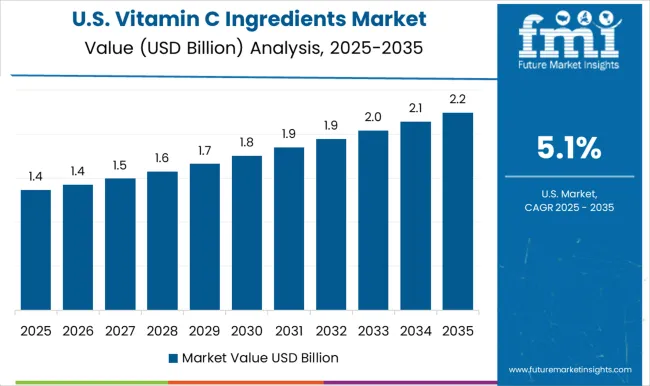

The USA leads with the highest projected CAGR of 5.8%, driven by robust R&D, wellness-focused innovation, and e-commerce expansion. France follows closely with a 5.5% CAGR, benefiting from demand for organic formats and cosmeceutical integration. Germany stands at 4.9%, owing to its strong production capacity, pharmaceutical-grade innovation, and sustainability standards.

The UK CAGR of 4.3% reflects rising consumer preference for clean-label, allergen-free supplements and widespread e-commerce adoption. Meanwhile, Japan registers a more moderate CAGR of 3.8%, supported by advanced encapsulation technologies and strong demand in the cosmetic and pharmaceutical sectors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA vitamin C ingredients revenue is projected to grow at a CAGR of 5.8% between 2025 and 2035.The USA maintains its dominance due to high consumer awareness, increasing demand for immune-boosting products, and advanced R&D in health and wellness sectors. Pharmaceutical and nutraceutical companies are incorporating high-purity ascorbic acid in tablets, capsules, and injectables.

Demand for clean-label, non-GMO, and vegan-certified Vitamin C is rising in functional foods. Innovation in gummy vitamins, powdered sachets, and water-soluble formats is also accelerating market traction. Retailers and D2C supplement brands are leveraging e-commerce to expand access.

Vitamin C ingredients market in France is expected to grow at a CAGR of 5.5% from 2025 to 2035.French consumers are increasingly shifting toward organic and natural Vitamin C sources in response to wellness trends. Demand is being driven by the beauty-from-within movement, where Vitamin C is heavily used in dermal supplements and functional cosmetics.

In food processing, ascorbic acid serves both as a preservative and nutritional enhancer in beverages and baked goods. French regulatory bodies continue to support clean-label initiatives and transparency, further boosting consumer trust. Pharmaceutical manufacturers are also investing in sustained-release and coated Vitamin C tablets to cater to long-term wellness use.

Revenue from vitamin C ingredients in Germanyis forecasted to register a CAGR of 4.9% from 2025 to 2035.Germany remains a major producer and exporter of high-quality Vitamin C ingredients across Europe. Known for its strict quality standards, the country focuses on highly pure granulation types such as 95% and 97% ascorbic acid.

Pharmaceutical and food industries are both investing in clinical formulations with advanced coating technologies to improve stability and absorption. Additionally, sustainable production and traceable sourcing are key to German consumer trust. Increasing use in dairy, cereals, and immunity-enhancing beverages positions Germany as both a production and consumption hub.

Sales ofvitamin C ingredients in the UK are expected to grow at a CAGR of 4.3% between 2025 and 2035.UK consumers are prioritizing clean-label and allergen-free supplements, which is boosting demand for natural Vitamin C formats like sodium ascorbate and calcium ascorbate.

Health-focused marketing and growing trust in nutraceuticals have led to greater market penetration through pharmacies and e-commerce channels. Popular delivery formats include chewables, gummies, and oral sprays, particularly among younger demographics. Additionally, there's increased investment in plant-based Vitamin C solutions to support vegan diets.

Vitamin C ingredients revenuein Japan is projected to grow at a CAGR of 3.8% between 2025 and 2035.Japan's focus on longevity and anti-aging has led to a strong demand for Vitamin C across cosmetic, food, and pharma segments. High cultural emphasis on skin health and immunity has popularized ascorbic acid in whitening products, functional beverages, and clinical supplements.

The Japanese market is also known for high-precision coating and encapsulation technologies, enabling extended shelf life and bioavailability. Functional tonics and convenient packaging formats dominate Japan’s retail market, catering to busy consumers. Trust in pharma-quality standards further supports demand for refined and high-purity Vitamin C derivatives.

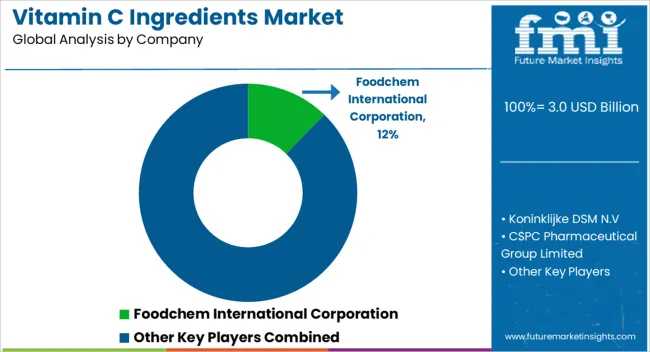

The market is moderately consolidated, led by industry giants such as DSM Nutritional Products and BASF SE, which maintain substantial market presence through global manufacturing capacities, R&D investments, and integrated supply chains. These players offer a diverse portfolio spanning synthetic and natural Vitamin C derivatives such as ascorbic acid, sodium ascorbate, and coated variants, used extensively in food, pharmaceutical, cosmetic, and animal nutrition sectors.

Key players in the market include Northeast Pharmaceutical Group Co. Ltd., CSPC Pharmaceutical Group Limited, Shandong Luwei Pharmaceutical Co. Ltd., Anhui Tiger Biotech Co. Ltd., Foodchem International Corporation, Jubilant Life Sciences, Bluecraft Agro, Vaneeghen, China BBCA Group Corporation, and Amway Corporation.

Market demand is driven by rising awareness around immunity, clean-label nutrition, functional food innovation, and increased consumer preference for preventive health solutions. Manufacturers focusing on organic certification, sustainable sourcing, and advanced formulation technologies are well-positioned to capitalize on the growing demand across both developed and emerging economies.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Product Type | Ascorbic Acid ( Ascorbic Acid 90% Granulation, Ascorbic Acid 95% Granulation, and Ascorbic Acid 97% Granulation ), Sodium Ascorbate, Calcium Ascorbate, Coated Vitamin C, Others (Magnesium Ascorbate, Ascorbyl Palmitate, etc.) |

| Form | Powder, Granules, Others (Crystals, Microencapsulated, Liquid, etc.) |

| Source | Natural, Synthetic |

| Process | Reichstein Process, Two-Stage Fermentation Process |

| End-Use | Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care Products, Animal Feed |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Foodchem International Corporation, Koninklijke DSM N.V, CSPC Pharmaceutical Group Limited, Northeast Pharmaceutical Group Co., Ltd, North China Pharmaceutical Co., Ltd, The TNN Development Limited, Microbelcaps, Hangzhou Focus Corporation, Beijing Heronsbill Food Material Co., Ltd, Triveni Interchem Pvt. Ltd., China BBCA Group Corporation. |

| Additional Attributes | Surging demand for immunity-boosting supplements, clean-label ingredients in fortified foods, rising incorporation in beauty & personal care, growing applications in nutraceutical blends |

The global vitamin C ingredients market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the vitamin C ingredients market is projected to reach USD 5.1 billion by 2035.

The vitamin C ingredients market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in vitamin C ingredients market are ascorbic acid, _ascorbic acid 90% granulation, _ascorbic acid 95% granulation, _ascorbic acid 97% granulation, sodium ascorbate, calcium ascorbate, coated vitamin C and others.

In terms of form, powder segment to command 54.2% share in the vitamin C ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Caramel Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Chlorella Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Alcohol Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Custom Dry Ingredients Blends Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Clean-Label Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Canned Tuna Ingredients Market Analysis by Ingredients Type and End User Through 2035

Pet Care Ingredients Market

Confectionery Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cosmeceutical Ingredients Market Growth – Trends & Forecast 2022-2027

Vitamin D Deficiency Treatment Market

Upcycled Pet Ingredients Size and Share Forecast Outlook 2025 to 2035

APAC Savory Ingredients Market Analysis – Trends & Forecast 2016-2026

Insect-based Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Cosmetic Polymer Ingredients Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA