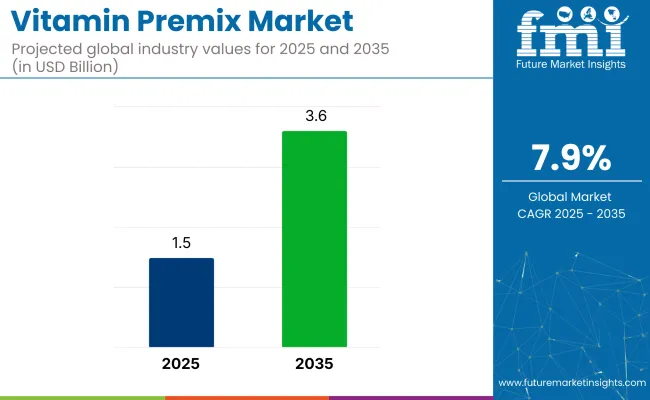

The global vitamin premix market is worth USD 1.5 billion in 2025 and is slated to witness a valuation of USD 3.6 billion by 2035, reflecting a CAGR of 7.9%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.5 billion |

| Projected Value (2035F) | USD 3.6 billion |

| CAGR (2025 to 2035) | 7.9% |

Factors driving this growth include rising consumer awareness about fortified foods, increased demand for customized nutritional solutions, and the continued popularity of functional foods and nutraceuticals. The surge in demand for health-focused products, particularly those related to sports nutrition, is expected to contribute significantly to the market’s expansion.

The global market is projected to witness robust growth from 2025 to 2035, driven by the rising demand for customized, nutrient-rich food products across industries like food & beverage, pharmaceuticals, and nutraceuticals.

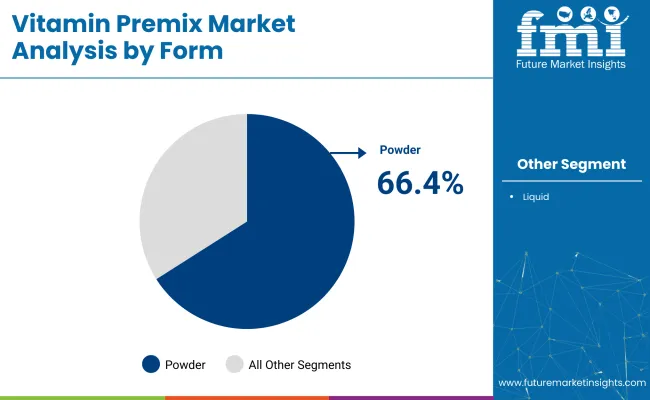

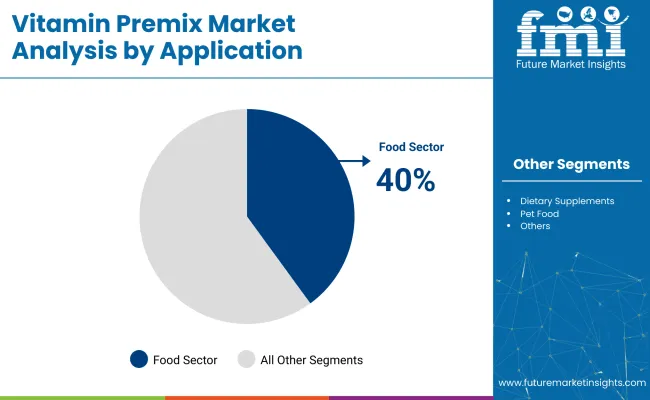

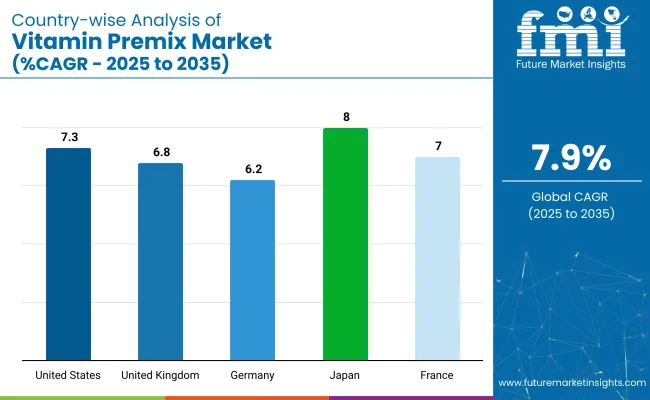

The powder form of vitamin premixes is anticipated to dominate the market, accounting for 66.4% of the market share in 2025. Meanwhile, the food sector by application segment holds 40% of the market share. Japanis anticipated to grow at a significant CAGR of 8.0%. Meanwhile, the USA and France closely follow this growth, rising at CAGRs of 7.3% and 7.0% respectively.

The market holds a significant share in several parent markets. In the functional food ingredients market, vitamin premixes contribute to about 10-12%, driven by their role in fortifying functional foods. In the nutraceuticals market, the share is approximately 8-10%, as premixes are essential in supplement formulations.

The dietary supplements market sees around 5-7% from vitamin premixes, given their use in enhancing product nutritional value. In the animal nutrition market, the share is about 6-8%, as vitamin premixes are widely used in animal feed. In the food fortification market, they account for 15-18% due to their widespread use in fortified products.

The global market is analyzed across several key segments, including form, function, application, and region. By form, the market is divided into powder and liquid segments. In terms of function, the segments include bone health, immunity, digestion, energy, heart health, weight management, vision health, brain health & memory, and resistance.

For applications, the market spans the food sector, dietary supplements, pharma OTC drugs, and pet food. Geographically, the market is segmented into regions such as North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa (Others).

The powder segment is set to remain dominant due to its superior homogeneity and convenience. Powdered vitamin premixes offer better stability, extended shelf life, and are easier to transport, making them the preferred choice for manufacturers. This segment is expected to account for over 66.4% of the market share in 2025.

Immunity-boosting premixes will hold the largest share of 30% in the function segment. With rising health concerns and a growing emphasis on immune system support, immunity-based premixes are seeing increasing adoption across the food and supplement industries. This segment is projected to witness significant growth throughout the forecast period.

The food sector remains the largest application area, driven by the continuous demand for fortified foods. The segment accounts for 40% of the market share in 2025. This segment includes functional foods and ready-to-eat products, which are expected to grow substantially as consumers become more health-conscious and prioritize nutrition.

Recent Trends in Vitamin Premix Market

Challenges in the Vitamin Premix Market

The growth rates of the market across the top countries vary, with Japan projected to experience the highest CAGR of 8.0% from 2025 to 2035, driven by its aging population and increasing demand for functional foods. The USA follows closely with a 7.3% CAGR, supported by strong consumer demand for health and wellness products.

France and the UK are also expected to see solid growth, with CAGRs of 7.0% and 6.8%, respectively, driven by health-conscious consumers and increasing interest in functional foods. Germany, while growing at a slightly slower pace of 6.2%, benefits from its strong regulatory framework and developed healthcare sector.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The vitamin premix revenue in the USA is expected to grow at a CAGR of 7.3% from 2025 to 2035. The country's strong demand for dietary supplements and functional foods is a key factor driving the growth of vitamin premix consumption.

The USA has a large and diverse consumer base that continues to prioritize health and wellness, making it a significant market for immune-boosting and personalized nutrition products. Key players are increasing their manufacturing capacities to meet the demand for vitamin premixes, particularly in the sports nutrition and dietary supplement sectors.

The sales of vitamin premix in the UK are projected to flourish at a CAGR of 6.8% from 2025 to 2035. The UK has witnessed a surge in the consumption of fortified foods and dietary supplements, particularly due to increased consumer awareness of nutritional deficiencies.

The country's increasing focus on functional foods and personalized nutrition is expected to boost the demand for vitamin premixes, with health-conscious consumers seeking tailored nutrient blends to support specific health needs.

The vitamin premix market in Germany is forecasted to experience a CAGR of 6.2% from 2025 to 2035 in the vitamin premix market. As one of Europe's largest economies, Germany has a highly developed healthcare and food industry. The demand for vitamin premixes is supported by the country’s emphasis on healthy living and nutritional supplements.

The revenue from vitamin premix in France is expected to grow at a CAGR of 7.0% in the vitamin premix market from 2025 to 2035. The French market is growing due to the increasing demand for health-oriented food products, including fortified foods and functional beverages. A growing aging population and rising health consciousness among consumers are driving the demand for vitamin premixes in both food and nutraceutical applications.

The sales of vitamin premix in Japan are projected to rise at a CAGR of 8.0% from 2025 to 2035. Japan is a leading market in Asia for functional foods and dietary supplements, with a strong focus on improving public health through fortified foods. The country's aging population and growing awareness about nutrition and wellness are major drivers for the increased consumption of vitamin premixes, particularly in functional foods and nutraceutical products.

The market is moderately consolidated, with a few global leaders accounting for a significant share of revenues. Tier-one companies like DSM-Firmenich, Glanbia plc, Vitablend, SternVitamin GmbH & Co., and Watson Inc. are competing based on innovation, pricing, and strategic partnerships. These companies focus on enhancing product portfolios, expanding manufacturing capacities, and meeting the growing demand for fortified foods and dietary supplements.

Company strategies increasingly revolve around cost-effective manufacturing, real-time market responsiveness, and sustainability. Firms like DSM-Firmenich and Glanbia are investing in R&D to develop customized premixes tailored to specific nutritional needs.

Additionally, partnerships with food and beverage companies are being forged to integrate premixes into new product lines. SternVitamin and Watson Inc. are focusing on expanding their presence in emerging markets and enhancing their distribution networks to meet regional demands.

Recent Vitamin Premix Industry News

DSM (now DSM-Firmenich) opened a new Animal Nutrition & Health premix and additives plant in Sadat City, Egypt, in September 2025. This facility is designed to meet the rising demand from livestock farms and feed millers across Egypt, the Middle East, Southern Europe, and Africa, strengthening DSM’s position in the global premix market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.5 billion |

| Projected Market Size (2035) | USD 3.6 billion |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Form | Powder, Liquid |

| By Function | Bone Health, Immunity, Digestion, Energy, Heart Health, Weight Management, Vision Health, Brain Health & Memory, Resistance |

| By Application | Food Sector, Dietary Supplements, Pharma OTC Drugs, Pet Food |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | DSM, Glanbia plc, Vitablend, SternVitamin GmbH & Co, Watson Inc., Wright Enrichment Inc., Zagro, Trouw Nutrition, Burkmann Industries, Inc., and Bar- Magen LTD |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-level growth insights |

In this segment, the industry has been categorized into Powder and Liquid.

This segment is further categorized into Bone Health, Immunity, Digestion, Energy, Heart Health, Weight Management, Vision Health, Brain Health & Memory, Resistance

Different Applications include Food Sector, Dietary Supplements, Pharma OTC Drugs, Pet Food

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is valued at USD 1.5 billion in 2025.

The market is forecasted to reach USD 3.6 billion by 2035, reflecting a CAGR of 7.9%.

Powder form is expected to lead the market with a 66.4% share in 2025.

The food sector is projected to hold a 40% share of the market in 2025.

Japan is anticipated to be the fastest-growing market with a CAGR of 8.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Australia Vitamin Premix Market Trends – Growth, Demand & Innovations 2025-2035

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin D Deficiency Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA