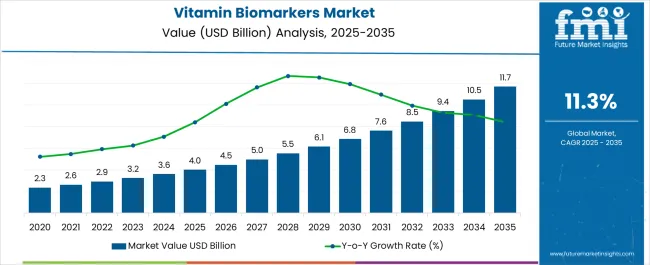

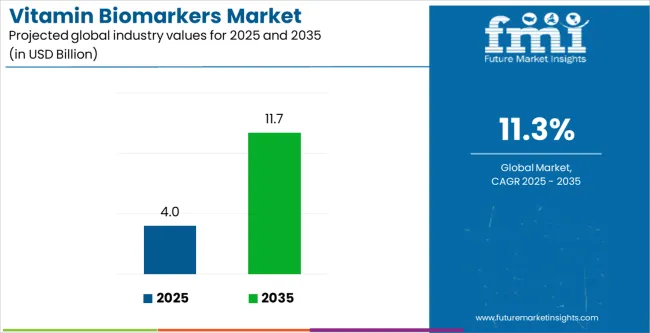

The Vitamin Biomarkers Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

| Metric | Value |

|---|---|

| Vitamin Biomarkers Market Estimated Value in (2025 E) | USD 4.0 billion |

| Vitamin Biomarkers Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The vitamin biomarkers market is experiencing consistent growth as healthcare systems emphasize preventive care, nutritional assessment, and precision diagnostics. Rising incidences of vitamin deficiencies, lifestyle-related disorders, and the growing elderly population have accelerated demand for reliable biomarker-based testing.

Technological advancements in immunoassay platforms, automation, and multiplexing capabilities have improved testing accuracy and efficiency. Integration of biomarker testing into clinical workflows and public health programs is further reinforcing adoption, especially in screening and monitoring applications.

Regulatory focus on nutritional standards and the expansion of personalized nutrition are expected to create long-term growth opportunities. The outlook remains strong as healthcare providers and diagnostic laboratories continue to prioritize early detection and patient-specific nutritional management strategies.

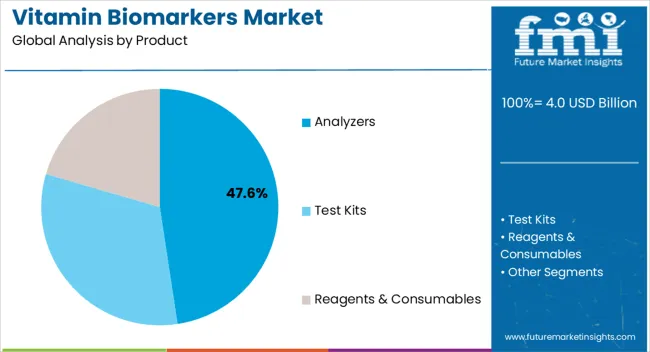

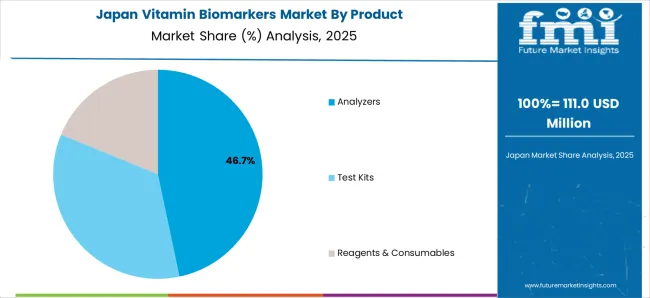

The analyzers segment is expected to account for 47.60% of total market revenue by 2025, making it the leading product category. This dominance is being driven by the need for high throughput, automated, and reliable diagnostic systems in laboratories and clinical settings.

Analyzers support precise quantification of vitamin levels, minimize manual intervention, and enhance reproducibility of results. Their integration with advanced software and connectivity features has allowed seamless data management and reporting, aligning with the broader shift toward digital healthcare infrastructure.

As demand for efficient and scalable diagnostic solutions grows, analyzers remain the preferred product choice, reinforcing their leading position in the vitamin biomarkers market.

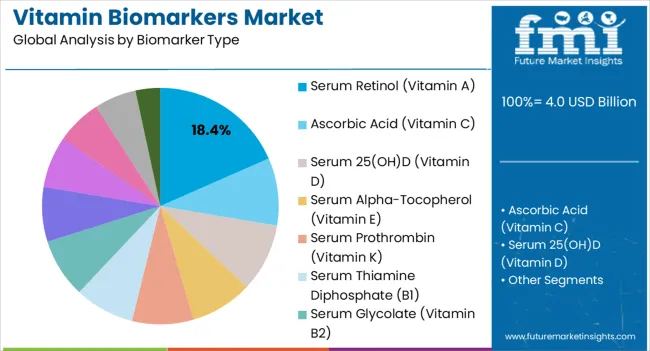

The serum retinol biomarker type segment is projected to hold 18.40% of overall revenue by 2025 within the biomarker type category. This growth is attributed to the widespread prevalence of vitamin A deficiency and its established role in assessing nutritional and immune health.

Serum retinol levels provide a reliable measure for identifying deficiency risks in both developed and developing regions. Increased focus on maternal and child health, coupled with nutritional monitoring programs, has further supported adoption.

Clinical reliability and cost-effectiveness of serum retinol testing have ensured its position as the most recognized biomarker for vitamin A assessment, strengthening its leadership in this category.

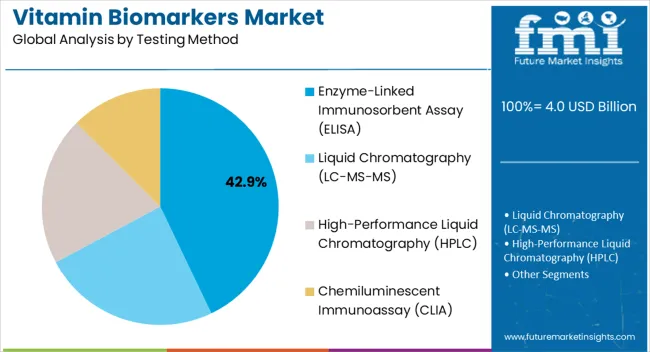

The enzyme linked immunosorbent assay segment is expected to contribute 42.90% of total revenue by 2025 within the testing method category, making it the dominant technique. Its success is attributed to high sensitivity, versatility, and scalability across a range of vitamin biomarker assessments.

ELISA has been widely adopted due to its cost effectiveness, compatibility with automated analyzers, and proven clinical reliability. The ability to process large sample volumes with consistent accuracy has made it the preferred testing method in laboratories and hospitals.

Continuous improvements in assay design and the availability of ready-to-use kits have further reinforced ELISA’s leading share in the vitamin biomarkers market.

From 2020 to 2025, the global vitamin biomarkers market experienced a CAGR of 12.2%, reaching a market size of USD 4 billion in 2025.

From 2020 to 2025, the global vitamin biomarkers industry witnessed significant growth as advancements in testing technologies have significantly contributed to the historic growth of the market.

There has been a shift in healthcare focus from reactive treatment to preventive care, emphasizing early detection and intervention. Vitamin biomarkers play a crucial role in identifying deficiencies at an early stage, allowing for timely interventions to prevent the onset of associated health issues, which has contributed to the growth of the market.

Future Forecast for Vitamin Biomarkers Market Industry:

Looking ahead, the global vitamin biomarkers market industry is expected to rise at a CAGR of 11.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 11.7 billion by 2035.

The vitamin biomarkers industry is expected to continue its growth trajectory from 2025 to 2035, Emerging markets characterized by increasing disposable incomes, growing healthcare awareness, and improving healthcare infrastructure, present significant growth opportunities for the vitamin biomarkers market.

As these markets experience a shift towards preventive healthcare and personalized nutrition, the demand for biomarker-based assessments is expected to increase.

Ongoing research on the role of vitamins in health, advancements in understanding the mechanisms of vitamin metabolism, and the discovery of novel biomarkers will drive innovation and expand the range of biomarkers available for assessing vitamin status.

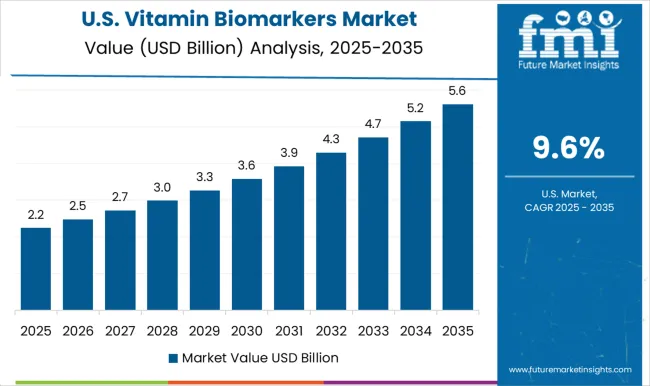

The vitamin biomarkers industry in the United States is expected to reach a market size of USD 11.7 billion by 2035, expanding at a CAGR of 12.4%. The opioid crisis remains a significant driver of the vitamin biomarkers market in the United States.

Association of Vit-D deficiency among patients consuming higher opioid dose for chronic pain is shown in various studies. There is a growing awareness and emphasis on maintaining optimal health and wellness among the population in the United States.

This driver motivates individuals to monitor their vitamin levels through biomarker testing to ensure they meet their nutritional needs and prevent deficiencies.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 303.1 million |

| CAGR % 2025 to End of Forecast (2035) | 8.9% |

The vitamin biomarkers industry in the United Kingdom is expected to reach a market value of USD 303.1 million, expanding at a CAGR of 8.9% during the forecast period. Vitamin deficiencies, such as vitamin D, vitamin B12, and iron deficiencies, are common in the United Kingdom.

Factors such as poor dietary habits, limited sun exposure, vegetarian or vegan diets, and certain medical conditions contribute to the prevalence of these deficiencies. This drives the need for vitamin biomarker testing to identify and address deficiencies.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 902.4 million |

| CAGR % 2025 to End of Forecast (2035) | 14.6% |

The vitamin biomarkers industry in China is anticipated to reach a market size of USD 902.4 million, moving at a CAGR of 14.6% during the forecast period. The Chinese government has implemented various initiatives and public health campaigns to address nutritional deficiencies and promote public health.

These initiatives raise awareness about the importance of vitamin intake and encourage individuals to monitor their vitamin levels through biomarker testing.

The vitamin biomarkers industry in Japan is estimated to reach a market size of USD 612.8 million by 2035, thriving at a CAGR of 14.0%. Japan is known for its technological advancements and integration of technology in healthcare.

This trend extends to the vitamin biomarkers market, where digital health solutions, wearable devices, and mobile apps are utilized for tracking nutrient intake, physical activity, and biomarker levels. Technology integration provides real-time feedback and personalized recommendations for optimizing vitamin status.

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 291.9 million |

| CAGR % 2025 to End of Forecast (2035) | 12.9% |

The vitamin biomarkers industry in South Korea is expected to reach a market size of USD 291.9 million, expanding at a CAGR of 12.9% during the forecast period. South Korea has witnessed shifts in dietary patterns over the years, including an increased consumption of processed foods and a shift towards more Westernized diets.

These changes can contribute to vitamin deficiencies. Biomarker testing helps individuals and healthcare professionals identify and address nutrient gaps caused by these dietary shifts.

Analyzers are expected to dominate the vitamin biomarkers industry with a CAGR of 12.3% from 2025 to 2035. Analyzers used for vitamin biomarkers must possess high sensitivity and specificity to accurately detect and quantify low concentrations of biomarkers in complex biological samples.

The sensitivity of an analyzer determines its ability to detect even trace amounts of the biomarker, while specificity ensures that it measures only the target biomarker without interference from other compounds.

Serum 25(OH) D (Vitamin D) are expected to dominate the vitamin biomarkers industry with a CAGR of 13.8% from 2025 to 2035. Low serum 23 levels indicate vitamin D deficiency. Vitamin D deficiency is a significant public health concern in many parts of the world, particularly in developing countries.

Vitamin D deficiency can result in reduced bone density increasing risk factors like osteoporosis or even fractures. Vitamin D helps absorb and retain phosphorus and calcium in body.

Enzyme-Linked Immunosorbent Assay (ELISA) are expected to dominate the vitamin biomarkers industry with a CAGR of 10.8% from 2025 to 2035. ELISA provides quantitative results, allowing for the precise measurement of vitamin biomarker levels in the sample.

Calibration curves are constructed using known concentrations of the vitamin biomarker, and the signal generated by the assay is compared to the calibration curve to determine the concentration of the vitamin in the sample.

Diagnostic Laboratories is expected to dominate the vitamin biomarkers industry with a CAGR of 13.3% from 2025 to 2035. Diagnostic laboratories are responsible for receiving and processing samples from individuals.

These samples may include blood, serum, plasma, urine, or other biological fluids that are collected for the measurement of vitamin biomarkers. Proper sample collection techniques are followed to ensure sample integrity and minimize pre-analytical errors. The laboratories employ validated and quality-controlled procedures to ensure accurate and reliable results.

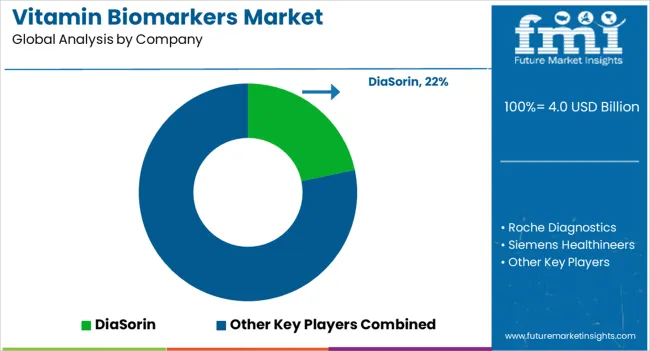

The vitamin biomarkers market is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must develop effective conjugates.

Key Strategies Used by the Participants

Product Development

Companies are investing in research & development to deliver product that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Strategic Alliances & Collaborations

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

Expansion into Emerging Markets

The vitamin biomarkers market is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the vitamin biomarkers industry to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Vitamin Biomarkers Market:

The global vitamin biomarkers market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the vitamin biomarkers market is projected to reach USD 11.7 billion by 2035.

The vitamin biomarkers market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in vitamin biomarkers market are analyzers, test kits and reagents & consumables.

In terms of biomarker type, serum retinol (vitamin a) segment to command 18.4% share in the vitamin biomarkers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin D Deficiency Treatment Market

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA