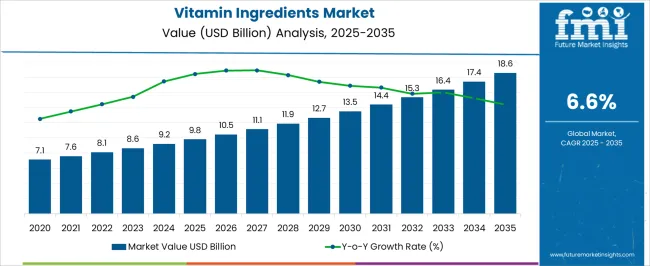

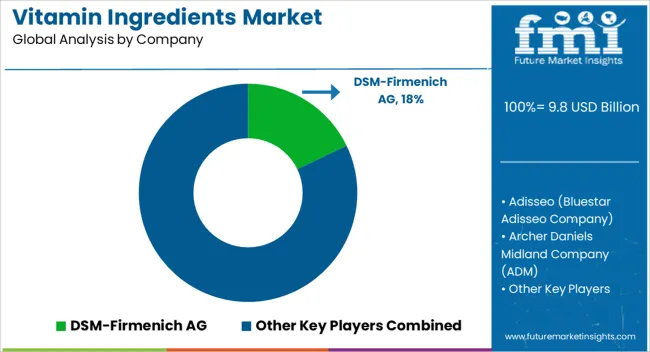

The vitamin ingredients market is projected to grow from USD 9.8 billion in 2025 to USD 18.6 billion by 2035, with a CAGR of 6.6%. Analyzing the contribution of volume versus price growth reveals distinct dynamics driving this market. Between 2025 and 2030, the market increases from USD 9.8 billion to USD 13.5 billion, contributing USD 3.7 billion in growth, with volume playing a dominant role in the early stages. The primary driver of growth during this phase is an increase in demand for vitamins across diverse sectors, particularly in dietary supplements, functional foods, and fortified beverages. The volume contribution is substantial due to the rising global focus on health and wellness, especially post-pandemic. From 2030 to 2035, the market grows from USD 13.5 billion to USD 18.6 billion, adding USD 5.1 billion in growth, where price growth becomes a more significant factor. The increase in the price of high-quality, premium-grade vitamins, along with innovations in production processes, such as bioavailability enhancement and sustainable sourcing, contributes to the price-driven portion of market growth. As the market matures, higher-quality ingredients and organic, plant-based alternatives demand premium pricing, driving the price component more than in the earlier years. The overall contribution analysis shows that while volume dominates in the first phase, price growth gains momentum in the latter phase, reflecting evolving consumer preferences for premium and specialized vitamin ingredients.

| Metric | Value |

|---|---|

| Vitamin Ingredients Market Estimated Value in (2025 E) | USD 9.8 billion |

| Vitamin Ingredients Market Forecast Value in (2035 F) | USD 18.6 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The vitamin ingredients market is experiencing consistent growth, driven by rising consumer awareness around preventive healthcare, functional nutrition, and personalized supplementation. The post-pandemic wellness shift has intensified demand for immunity-boosting and energy-enhancing vitamins, influencing purchasing behavior across pharmaceuticals, food, and nutraceutical sectors.

Strategic investments in clean label formulations, bioavailability enhancement, and product diversification are reshaping production pipelines. Regulatory support for micronutrient fortification and expanding geriatric populations in key economies are also contributing to the segment’s expansion.

Additionally, e-commerce penetration and direct-to-consumer distribution models are streamlining access to tailored vitamin solutions. Going forward, innovation in delivery formats, regional manufacturing capacities, and the use of sustainable sourcing practices are expected to influence market trajectories and stakeholder strategies.

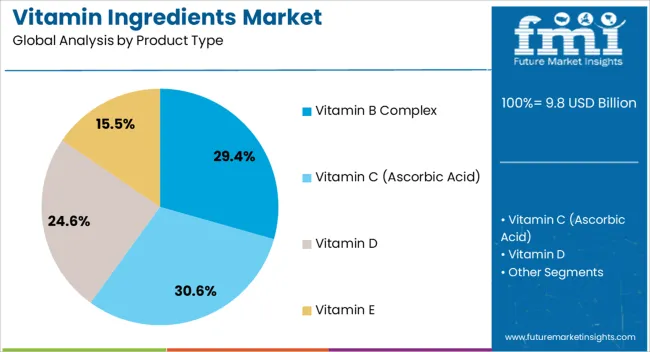

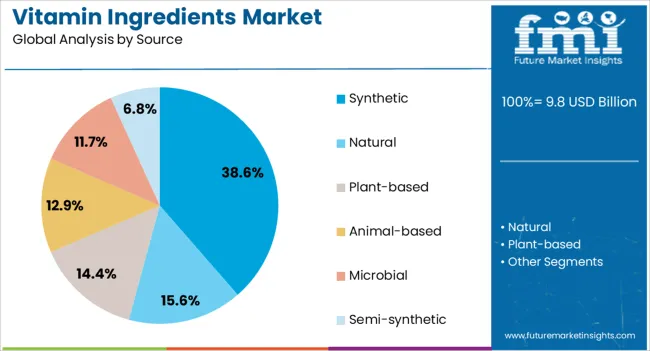

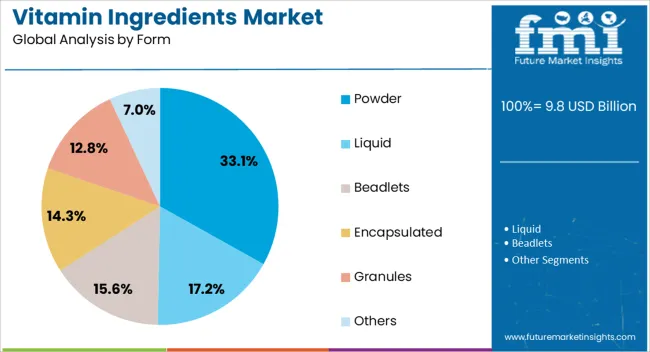

The vitamin ingredients market is segmented by product type, source, form, application, and region. By product type, it is divided into Vitamin B Complex, Vitamin C (Ascorbic Acid), Vitamin D, Vitamin E, Vitamin K, and Vitamin A. In terms of source, the market is classified into synthetic, natural, plant-based, animal-based, microbial, and semi-synthetic. Based on form, it is segmented into powder, liquid, beadlets, encapsulated, granules, and others. By application, the market is categorized into food & beverage applications, personal care applications, haircare, color cosmetics, oral care, body care, nutricosmetics, and others. Regionally, the vitamin ingredients market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Vitamin B complex is projected to lead the product type segment in 2025 with a 29.40% revenue share. This dominance is being supported by rising demand for metabolic, neurological, and energy-related health support across age groups.

Its multi-functionality in stress reduction, immunity enhancement, and cellular function has positioned it as a core component in preventive health regimens. Vitamin B complex is also widely used in fortified food and beverage formulations, contributing to its consistent demand in both clinical and consumer health domains.

High manufacturing scalability and favorable clinical validation have further strengthened its market performance. As awareness campaigns and self-care trends expand, demand for comprehensive micronutrient blends like the B complex is expected to sustain long-term growth.

Synthetic sources are expected to account for 38.60% of total market revenue in 2025, making them the leading source category. This segment’s growth is being driven by cost-efficiency, ease of production scalability, and consistent potency offered by chemically synthesized vitamins.

High stability and shelf-life advantages have made synthetic variants the preferred choice for industrial applications and high-volume formulations. Additionally, robust supply chains and lower raw material dependency compared to natural sources have supported their widespread use across pharmaceutical, food, and animal nutrition industries.

Innovations in microencapsulation and precision formulation are further enhancing the effectiveness of synthetic vitamins, making them a reliable option for brands seeking predictable outcomes and global regulatory compliance.

Powder form is forecast to command 33.10% of the vitamin ingredients market revenue in 2025, emerging as the top form segment. This preference is being driven by the format’s compatibility with a broad range of applications including capsules, sachets, functional foods, and beverage mixes.

Powders offer superior stability and shelf life while enabling higher dose delivery compared to liquid counterparts. Manufacturers favor powdered vitamins for ease of handling, reduced storage costs, and precise dosing capabilities.

Their adaptability in customized blends and clean-label formulations has also increased their uptake in health-conscious and athletic consumer segments. As convenience and multifunctionality become central to product development, powdered vitamin ingredients are expected to maintain their lead in both industrial and consumer use cases.

The vitamin ingredients market is witnessing growth due to increasing consumer awareness of the importance of health and wellness. As the demand for functional foods, dietary supplements, and fortified beverages rises, the market for vitamin ingredients continues to expand. These ingredients are essential for enhancing product functionality, improving nutritional value, and supporting overall health. The shift toward preventive healthcare and the growing trend of personalized nutrition are further driving the demand. While challenges related to raw material costs and regulatory standards persist, the market offers significant opportunities in emerging markets and innovation in vitamin formulations.

The rising awareness of the health benefits of vitamins is a key driver for the growth of the vitamin ingredients market. Consumers are increasingly focused on maintaining a healthy lifestyle, leading to higher demand for functional foods and dietary supplements. These products, enriched with essential vitamins, are being used to boost immunity, improve overall health, and prevent deficiencies. The shift toward preventive healthcare, particularly in developed regions, is increasing the consumption of vitamin-fortified products. The rising popularity of personalized nutrition, where consumers seek tailored solutions to meet their unique health needs, is further driving demand for vitamin ingredients in various food and beverage products.

The vitamin ingredients market faces challenges related to the high raw material costs and complex regulatory frameworks. The production of high-quality vitamins requires specific sourcing of raw materials, which can be expensive, particularly for natural ingredients. These cost pressures are passed on to manufacturers, limiting profit margins and increasing product prices. Furthermore, the regulatory landscape governing the use of vitamins in food, supplements, and cosmetics is stringent, with different countries imposing varying standards and approval processes. This creates additional compliance costs and operational complexities for manufacturers. Overcoming these challenges requires continuous innovation in sourcing, production processes, and regulatory navigation to meet market demands effectively.

The vitamin ingredients market presents significant opportunities, particularly with the rise of personalized nutrition. As consumers increasingly seek products tailored to their specific health needs, the demand for customized vitamin solutions is growing. Advances in digital health technologies, such as personalized health assessments and DNA-based dietary recommendations, are encouraging this trend. Additionally, the expanding middle-class population and rising disposable incomes in emerging markets such as Asia-Pacific and Latin America are creating new growth opportunities. As consumers in these regions adopt healthier lifestyles, the demand for fortified foods and dietary supplements is rising, presenting significant opportunities for vitamin ingredient manufacturers to expand their reach.

A significant trend in the vitamin ingredients market is the increased focus on technological advancements in production methods and the growing demand for natural ingredients. Manufacturers are investing in innovative technologies, such as fermentation processes and precision manufacturing, to improve the efficiency, purity, and bioavailability of vitamins. The demand for natural, plant-based vitamins is also increasing as consumers become more conscious of the sources of ingredients in their food and supplements. As environmental concerns rise, consumers are opting for sustainably sourced vitamins, leading manufacturers to explore eco-friendly production methods. These trends are shaping the future of the vitamin ingredients market, with a clear shift toward more sustainable, natural, and efficient solutions.

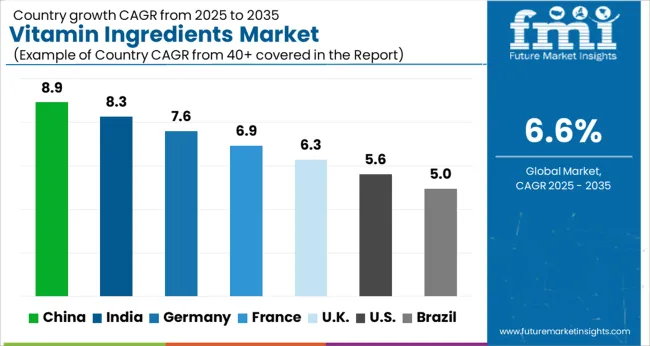

The vitamin ingredients market is projected to grow at a global CAGR of 6.6% from 2025 to 2035. China leads with a CAGR of 8.9%, followed by India at 8.3%, and Germany at 7.6%. The United Kingdom records 6.3%, while the United States stands at 5.6%. China and India, as part of the BRICS group, are seeing robust growth due to increasing demand for fortified foods and dietary supplements. Developed markets like Germany, the UK, and the USA show steady growth, driven by the increasing awareness of health and wellness and the rising demand for vitamins in the nutraceutical and functional foods sectors. The analysis spans over 40+ countries, with the top markets shown below.

China is projected to grow at a CAGR of 8.9% through 2035, driven by increasing demand for fortified foods, dietary supplements, and functional foods. China’s rapidly growing urban population, rising disposable incomes, and expanding health and wellness awareness are contributing to the market’s growth. The increasing adoption of vitamin-enriched foods and supplements as part of a proactive approach to health drives demand. The country’s growing nutraceutical industry and rising focus on immunity and wellness products further accelerate the demand for vitamin ingredients.

India is projected to grow at a CAGR of 8.3% through 2035, driven by the country’s increasing health consciousness and rising demand for fortified foods and supplements. With a large and growing middle class, the demand for vitamins in India is on the rise, especially for immunity-boosting and wellness products. Government initiatives aimed at promoting health and nutrition, as well as increased awareness of the benefits of vitamins, further support the market’s growth. Additionally, the expanding nutraceuticals industry in India plays a significant role in driving the demand for vitamin ingredients.

Germany is projected to grow at a CAGR of 7.6% through 2035, driven by strong demand for vitamins in nutraceuticals, functional foods, and dietary supplements. The country has a well-established health and wellness industry, with consumers increasingly looking for products that improve immunity, energy, and general well-being. Additionally, the aging population in Germany is contributing to the rise in demand for vitamin supplements for maintaining health. German consumers’ growing focus on preventive healthcare and nutrition is expected to continue driving the demand for vitamin ingredients.

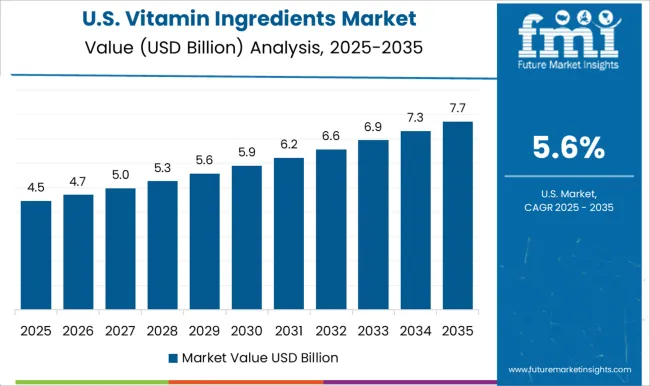

The United States is projected to grow at a CAGR of 5.6% through 2035, driven by the increasing demand for vitamins in functional foods, beverages, and dietary supplements. The USA market is supported by a well-established health and wellness sector, with consumers becoming increasingly aware of the benefits of vitamins for immunity, fitness, and overall health. The increasing popularity of plant-based, organic, and non-GMO vitamin supplements is also contributing to market growth. Additionally, the rising demand for personalized nutrition products is driving the use of vitamin ingredients in the USA

The United Kingdom is projected to grow at a CAGR of 6.3% through 2035, with rising health awareness driving the demand for vitamins in dietary supplements, food, and beverages. The UK market is supported by consumers’ increasing preference for products that enhance immunity, energy, and overall health. The growing demand for personalized nutrition products and functional foods further boosts the market. The UK’s well-established nutraceutical industry, alongside government initiatives to promote health, plays a crucial role in expanding the market for vitamin ingredients.

The vitamin ingredients market is led by key players offering a wide range of vitamin-based solutions for the food, beverage, nutraceutical, and pharmaceutical industries. DSM-Firmenich AG is a market leader, providing a comprehensive portfolio of vitamins, particularly focusing on high-quality, bioavailable forms for health and wellness applications.

BASF SE and Archer Daniels Midland Company (ADM) are major competitors, offering a broad range of vitamins, including A, D, E, and B vitamins, used in fortifying food products, dietary supplements, and functional foods. Eastman Chemical Company and Lonza Group provide specialized vitamin ingredients, focusing on innovation in production techniques, sustainability, and ensuring the efficacy and stability of vitamins in various applications.

Glanbia PLC and Kappa Bioscience AS emphasize the production of vitamin D3, with a focus on its increasing demand in the wellness and nutrition sectors. Lycored specializes in carotenoids and vitamins with a focus on natural and plant-based sources for health-conscious consumers. Nutraceutical Corporation and Prinova Group LLC offer a range of ingredients used in supplement formulations, while Sternchemie GmbH & Co. KG and The Lubrizol Corporation focus on high-performance vitamin solutions for the pharmaceutical sector.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Vitamin B Complex, Vitamin C (Ascorbic Acid), Vitamin D, Vitamin E, Vitamin K, and Vitamin A |

| Source | Synthetic, Natural, Plant-based, Animal-based, Microbial, and Semi-synthetic |

| Form | Powder, Liquid, Beadlets, Encapsulated, Granules, and Others |

| Application | Food & beverage applications, Personal care applications, Haircare, Color cosmetics, Oral care, Body care, Nutricosmetics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DSM-Firmenich AG, Adisseo (Bluestar Adisseo Company), Archer Daniels Midland Company (ADM), BASF SE, Eastman Chemical Company, Fenchem Biotek Ltd., Foodchem International Corporation, Glanbia plc, Kappa Bioscience AS, Koninklijke DSM N.V., Lonza Group, Lycored, Nutraceutical Corporation, Prinova Group LLC, Sternchemie GmbH & Co. KG, The Lubrizol Corporation, Vertellus Holdings LLC, Vitablend Nederland B.V., Vitalife Biosciences, and Zhejiang NHU Co., Ltd |

| Additional Attributes | Dollar sales by vitamin type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E) and end-use segments (food and beverages, nutraceuticals, pharmaceuticals). Demand dynamics are driven by the growing focus on health and wellness, the rise of personalized nutrition, and increasing consumer awareness about the benefits of vitamin supplements. Regional trends show strong growth in North America and Europe due to increasing consumer demand for dietary supplements, with emerging markets in Asia-Pacific expanding rapidly due to rising disposable incomes and health-conscious consumers. |

The global vitamin ingredients market is estimated to be valued at USD 9.8 billion in 2025.

The market size for the vitamin ingredients market is projected to reach USD 18.6 billion by 2035.

The vitamin ingredients market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in vitamin ingredients market are vitamin b complex, _vitamin b1 (thiamine), _vitamin b2 (riboflavin), _vitamin b3 (niacin), _vitamin b5 (pantothenic acid), _vitamin b6 (pyridoxine), _vitamin b7 (biotin), _vitamin b9 (folic acid), _vitamin b12 (cobalamin), vitamin c (ascorbic acid), vitamin d, _vitamin d2 (ergocalciferol), _vitamin d3 (cholecalciferol), vitamin e, vitamin k and vitamin a.

In terms of source, synthetic segment to command 38.6% share in the vitamin ingredients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Prenatal Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA