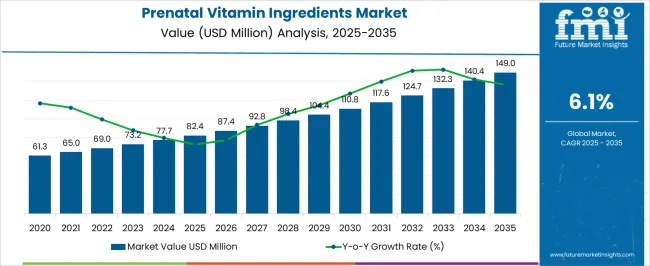

The Prenatal Vitamin Ingredients Market is estimated to be valued at USD 82.4 million in 2025 and is projected to reach USD 149.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. The early phase from 2020 to 2025 sees growth from USD 61.3 billion to USD 77.7 billion, driven by rising awareness of maternal health, a growing emphasis on preventive nutrition, and medical recommendations for vitamins such as folic acid, iron, and DHA during pregnancy. This period is shaped by higher adoption of prenatal supplements in both developed and emerging regions, alongside wider retail penetration and e-commerce availability.

Between 2026 and 2030, the market advances further from USD 82.4 billion to USD 104.4 billion, supported by broader clinical endorsements, the rising popularity of personalized nutrition products, and innovation in delivery formats like gummies, capsules, and fortified powders. Expanding middle-class populations and increasing access to healthcare consultation also elevate product consumption in this phase. The final stage from 2031 to 2035 accelerates expansion, with the market surging from USD 110.8 billion to USD 149.0 billion. This acceleration is attributed to the integration of plant-based and allergen-free ingredients, stronger focus on multi-nutrient formulations, and growing reliance on dietary supplements as a core component of maternal healthcare. Partnerships between nutraceutical brands and pharmaceutical companies, alongside regulatory approvals for novel ingredient combinations, further reinforce growth. Overall, the prenatal vitamin ingredients market demonstrates a consistent upward trajectory, shaped by medical guidance, consumer health consciousness, and continued innovation in product formulations and distribution channels worldwide through 2035.

| Metric | Value |

|---|---|

| Prenatal Vitamin Ingredients Market Estimated Value in (2025 E) | USD 82.4 million |

| Prenatal Vitamin Ingredients Market Forecast Value in (2035 F) | USD 149.0 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The prenatal vitamin ingredients market is witnessing sustained growth due to increasing global awareness around maternal nutrition and its long-term impact on fetal development. The rising prevalence of micronutrient deficiencies in pregnant women has led to greater reliance on fortified supplements to ensure optimal gestational health. Governments and health organizations worldwide have issued clinical recommendations emphasizing prenatal supplementation, further boosting demand for multivitamin and mineral blends.

The shift toward evidence-based maternal care, particularly in emerging economies, is encouraging greater adoption of prenatal vitamins at the prescription and over-the-counter level. The expansion of women's health portfolios by pharmaceutical and nutraceutical companies, alongside the availability of personalized nutrition offerings, is reshaping the landscape of prenatal nutrition.

Market growth is also being supported by increasing participation in early pregnancy planning and routine antenatal checkups, which integrate supplement protocols In the near future, innovation in ingredient bioavailability, plant-based formulations, and clean label trends is expected to unlock new avenues for product development and consumer adoption.

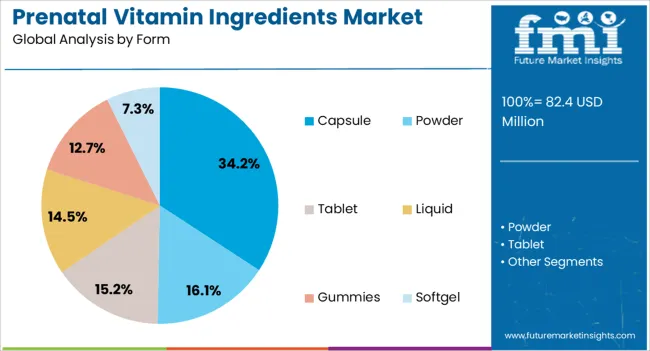

The prenatal vitamin ingredients market is segmented by product, form, function, and geographic regions. By product, prenatal vitamin ingredients market is divided into Vitamins, Calcium, Iron, Zinc, EPA/DHA, Magnesium, and Others. In terms of form, prenatal vitamin ingredients market is classified into Capsule, Powder, Tablet, Liquid, Gummies, and Softgel.

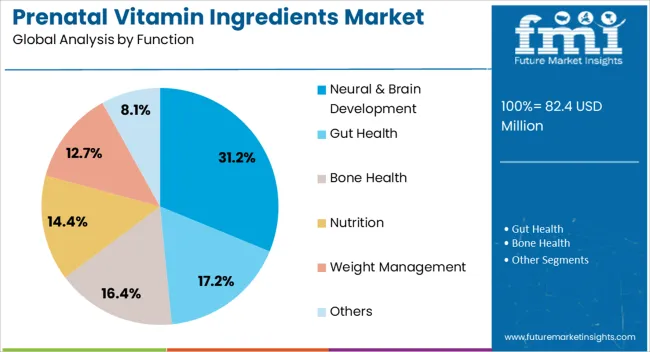

Based on function, prenatal vitamin ingredients market is segmented into Neural & Brain Development, Gut Health, Bone Health, Nutrition, Weight Management, and Others. Regionally, the prenatal vitamin ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vitamins segment is projected to account for 25.3% of the total revenue share in the prenatal vitamin ingredients market in 2025. This leading share is being driven by the essential role that core vitamins play in supporting fetal organ development, maternal immunity, and metabolic stability throughout pregnancy. Vitamins such as B-complex, C, D, and E are widely recognized for their role in preventing neural tube defects, oxidative stress, and bone-related complications during gestation.

The segment’s growth is being reinforced by increasing consumer awareness of individual vitamin benefits and improved physician-led prescription practices. Innovation in microencapsulation, sustained-release delivery, and ingredient stability is enabling better formulation of multivitamin products with enhanced shelf life and absorption profiles.

Regulatory emphasis on adequate vitamin intake during pregnancy by health authorities has further supported market penetration As more consumers seek science-backed prenatal solutions with proven efficacy and safety, the demand for vitamin-based formulations is expected to remain strong across both prescription and direct-to-consumer channels.

The capsule form segment is expected to capture 34.2% of the total revenue share in the prenatal vitamin ingredients market in 2025. This dominance is attributed to the convenience, bioavailability, and consumer preference associated with capsule-based supplements. Capsules offer advantages such as tasteless administration, reduced gastric irritation, and precise dosage delivery, which are especially important during pregnancy when digestive sensitivity is common.

Their ability to encapsulate multiple active ingredients in a single dose supports simplified regimens and improved adherence among expecting mothers. The pharmaceutical-grade precision and scalability of capsule manufacturing have further positioned this form as a reliable option for large-scale prenatal supplement producers.

Clean-label trends, including plant-based and gelatin-free capsule options, are also enhancing appeal across vegetarian and ethically conscious consumers. Additionally, the stability of active ingredients in capsule formulations and reduced need for preservatives align with ongoing demand for natural and safe prenatal products, reinforcing the form’s market-leading position.

The neural and brain development function segment is projected to represent 31.2% of the overall revenue share in the prenatal vitamin ingredients market in 2025. This segment’s growth is being strongly influenced by the heightened clinical focus on cognitive and neurological outcomes in fetal development. Key prenatal ingredients such as folic acid, choline, DHA, and iron have been widely recognized for their critical role in neural tube formation, synaptic development, and overall brain maturation during gestation.

Consumer education campaigns and public health initiatives have emphasized the importance of early supplementation to prevent neural tube defects and developmental delays, leading to a higher demand for targeted formulations. Continuous research linking maternal nutrition to long-term cognitive health in children has reinforced demand for function-specific prenatal supplements.

The integration of advanced nutrients supported by clinical validation and their inclusion in standard prenatal prescriptions has further elevated the prominence of this functional segment. As more parents prioritize brain health from the earliest stages, this segment is expected to maintain its leadership in the years ahead.

Prenatal vitamin ingredients are supported by healthcare-led programs, lifestyle-driven deficiencies, retail and e-commerce growth, and evolving formulations. Together, these factors establish them as a critical component of women’s health worldwide.

Government initiatives and healthcare campaigns have played a pivotal role in boosting the demand for prenatal vitamin ingredients. Public health authorities across regions have introduced supplementation programs targeting women of reproductive age, with folic acid and iron supplementation often being prioritized. These programs emphasize the prevention of birth defects, anemia, and other deficiencies linked to maternal and fetal health. Hospitals and clinics are increasingly recommending multivitamin combinations during pregnancy, further pushing the adoption of high-quality ingredients. Pharmaceutical companies and supplement brands are aligning their product portfolios to meet these requirements, creating a steady base of demand. The integration of prenatal vitamins into healthcare systems has enhanced both awareness and market stability.

Changing dietary habits and the prevalence of nutritional deficiencies have created a stronger case for prenatal vitamin supplementation. Busy lifestyles, processed food consumption, and declining nutrient density in diets have increased the dependency on external supplementation. Women planning pregnancies are now turning toward prenatal vitamins as a preventive measure to support overall reproductive health. Key ingredients such as DHA, vitamin D, and calcium are particularly emphasized for bone, neural, and cognitive development in the fetus. The demand is not only coming from expectant mothers but also from women preparing for conception. This shift has expanded the role of prenatal vitamin ingredients beyond pregnancy into preconception nutrition.

The retail and e-commerce landscape has emerged as a major distribution channel for prenatal vitamin ingredients. Traditional pharmacies continue to be strong contributors, but online platforms are increasingly influencing purchase decisions. E-commerce provides broader access to ingredient-based supplements, enabling consumers to compare formulations and ingredient transparency before buying. Subscription-based models and digital health platforms have further increased the convenience of consistent supplementation. This channel has proven effective in reaching women in remote or underserved areas, thereby broadening the customer base. Ingredient manufacturers are partnering with supplement brands to highlight clinically supported benefits and ensure differentiation in an increasingly competitive digital marketplace.

The prenatal vitamin ingredients market is witnessing a surge in diverse formulations and delivery formats. Beyond traditional tablets, soft gels, chewables, and gummies are being introduced to improve compliance and consumer experience. Ingredient suppliers are focusing on enhancing bioavailability through encapsulated minerals, microencapsulation of DHA, and stabilized forms of folates. Personalized nutrition is gaining traction, with products designed to meet varying needs such as vegetarian, vegan, or allergen-free requirements. Innovations in taste masking and texture have made supplements more palatable, reducing drop-offs in adherence. These advancements are reshaping consumer perception, making prenatal vitamins more appealing and accessible, and supporting long-term market growth.

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

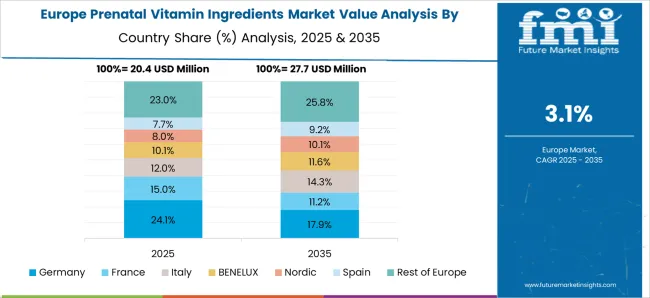

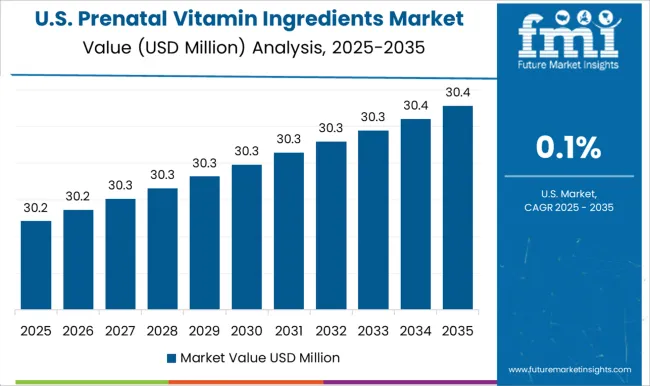

The prenatal vitamin ingredients market is projected to grow globally at a CAGR of 6.1% from 2025 to 2035, supported by rising maternal healthcare awareness, higher physician recommendations, and increasing adoption of fortified supplements. China leads with a CAGR of 8.2%, driven by expanding maternal health programs, growing urban middle-class populations, and broad retail access to prenatal formulations. India follows at 7.6%, supported by government-led supplementation initiatives, increased e-commerce penetration, and expanding demand for folic acid, iron, and DHA ingredients. France achieves 6.4% growth, influenced by EU-backed health policies, strong consumer preference for preventive healthcare, and premium prenatal formulations. The United Kingdom records 5.8%, driven by growing consumer awareness of preconception health and brand-led diversification of delivery formats. The United States posts 5.2%, shaped by steady demand for premium formulations, expansion of nutraceutical offerings, and integration of prenatal ingredients into functional food and beverage formats. This performance highlights Asia-Pacific as the fastest expanding hub, while Europe and North America maintain steady adoption, reinforcing prenatal vitamin ingredients as a critical component of women’s health solutions globally.

China is projected to achieve a CAGR of 8.2% during 2025–2035, well above the global benchmark of 6.1%. For the earlier period of 2020–2024, CAGR is estimated at 7.1%, driven by strong public health campaigns, government-subsidized supplementation programs, and rapid uptake of multivitamin products in urban centers. The higher growth expected in 2025–2035 reflects a wider reach of maternal health initiatives into rural areas, expanding online retail channels, and growing awareness among younger families planning pregnancies. Ingredient demand is particularly strong for folic acid, DHA, and iron, supported by both clinical guidance and retail consumer preference. China’s robust manufacturing base and investment in pharmaceutical-grade raw materials have reinforced availability and lowered cost barriers, creating a favorable environment for continuous adoption.

India is forecast to post a 7.6% CAGR for 2025–2035, compared with an estimated 6.4% CAGR in 2020–2024 based on proportional scaling to the 6.1% global baseline. The lower growth during the earlier years was linked to limited rural penetration, restricted awareness, and infrastructural challenges in supply chains. However, the upward trajectory for 2025–2035 is expected due to expanded government nutrition missions, rising e-commerce distribution, and growing consumer preference for premium formulations containing DHA, vitamin D, and chelated minerals. Increasing healthcare spending and awareness among urban middle-class populations are also contributing to stronger growth prospects. India’s nutraceutical sector is now integrating with global supply networks, supporting both export and domestic use of prenatal vitamin ingredients.

France is projected to grow at a 6.4% CAGR during 2025–2035, compared with an estimated 5.5% CAGR in 2020–2024. The earlier period showed slower progress as adoption was largely dependent on prescription-driven demand and moderate consumer awareness in over-the-counter prenatal supplements. Moving into the next decade, growth is anticipated to rise through stronger EU maternal healthcare policies, expanded usage of premium organic formulations, and preference for allergen-free, plant-derived ingredients. Clinical validation of DHA and folates has further strengthened consumer trust. The pharmacy-led distribution model continues to dominate, but digital health platforms are gradually expanding product accessibility. France’s health-conscious consumer base is increasingly prioritizing high-quality prenatal supplements, ensuring a steady trajectory for the market.

The United Kingdom is expected to post a 5.8% CAGR during 2025–2035, up from an estimated 4.9% CAGR in 2020–2024. The earlier period was characterized by modest adoption due to cost sensitivity, slower awareness levels, and limited product diversity. The improvement to 5.8% is attributed to heightened consumer education on preconception health, expanding variety in delivery formats such as gummies and soft gels, and NHS-backed campaigns for folic acid supplementation. Rising e-commerce penetration and greater involvement of retail pharmacy chains are making these products more accessible. Ingredient suppliers are focusing on bioavailable forms of iron and vitamin D, which are increasingly favored by healthcare practitioners, driving steady demand in both urban and suburban regions.

The United States is projected to achieve a 5.2% CAGR during 2025–2035, compared to an estimated 4.4% CAGR in 2020–2024. The earlier years reflected steady but modest demand, constrained by slower category growth in middle-income households and reliance on premium-priced formulations. The shift toward a higher rate in 2025–2035 is influenced by increased integration of prenatal nutrients into functional foods, physician-backed recommendations, and rising consumer preference for clean-label and bioavailable formats. Subscription models through digital health platforms and expanding retail pharmacy presence are further strengthening consistency of use. The USA market benefits from high innovation activity and premium consumer segments, ensuring stable, long-term demand for prenatal vitamin ingredients.

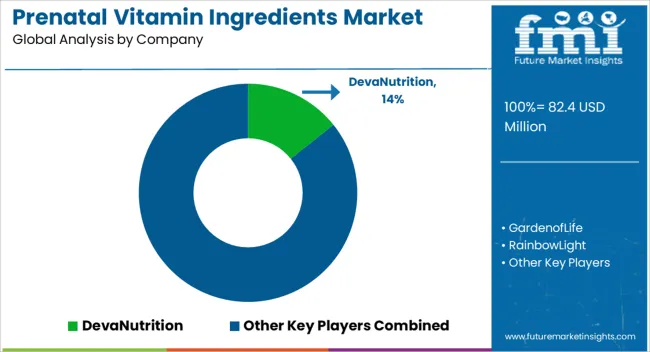

The prenatal vitamin ingredients market is characterized by strong competition among global nutraceutical brands and specialized supplement manufacturers focusing on maternal health. Deva Nutrition has built a strong reputation by offering vegan-certified prenatal vitamins that target plant-based consumers seeking clean-label products. Garden of Life emphasizes organic, whole-food-based formulations, positioning its prenatal lines as premium, doctor-recommended solutions with probiotics for digestive support. Rainbow Light is well-known for its food-based prenatal blends, integrating natural superfoods and essential minerals, catering to women seeking gentle yet effective supplementation.

Church & Dwight, through its Vitafusion and other subsidiaries, offers affordable gummy-based prenatal solutions that have gained popularity among younger demographics. Nature Made has secured a wide retail presence by supplying pharmacist-recommended prenatal vitamins that emphasize purity, potency, and clinical validation. New Chapter differentiates itself with fermented multivitamin technology, enhancing nutrient absorption and catering to consumers who prefer holistic and bioavailable supplements. MegaFood focuses on farm-to-table sourcing, promoting traceability of its prenatal vitamin ingredients and building trust among eco-conscious buyers. Nordic Naturals is recognized for its DHA-rich formulations, strengthening the neurological development segment within prenatal nutrition. Vitafusion, under Church & Dwight, leads in chewable gummy prenatals, emphasizing convenience and compliance. SmartyPants specializes in multi-nutrient gummies, using non-GMO and allergen-free ingredients that resonate strongly with millennial mothers.

Key competitive strategies include innovation in delivery formats such as gummies and soft gels, incorporation of bioavailable forms of minerals like chelated iron and methylated folate, and strategic distribution through pharmacies, supermarkets, and digital health platforms. Partnerships with healthcare professionals, emphasis on clean-label certifications, and consumer-focused product diversification are central to maintaining differentiation. Growth is set to favor companies offering transparency in sourcing, clinical validation of ingredients, and engaging digital marketing strategies aimed at younger, health-conscious families.

| Item | Value |

|---|---|

| Quantitative Units | USD 82.4 Million |

| Product | Vitamins, Calcium, Iron, Zinc, EPA/DHA, Magnesium, and Others |

| Form | Capsule, Powder, Tablet, Liquid, Gummies, and Softgel |

| Function | Neural & Brain Development, Gut Health, Bone Health, Nutrition, Weight Management, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DevaNutrition, GardenofLife, RainbowLight, Church&Dwight, NatureMade, NewChapter, MegaFood, NordicNaturals, Vitafusion, and SmartyPants |

| Additional Attributes | Dollar sales, share, regional growth trends, demand by nutrient type, regulatory frameworks, competitor strategies, pricing benchmarks, consumer preferences, and opportunities in fortified food and supplement applications. |

The global prenatal vitamin ingredients market is estimated to be valued at USD 82.4 million in 2025.

The market size for the prenatal vitamin ingredients market is projected to reach USD 149.0 million by 2035.

The prenatal vitamin ingredients market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in prenatal vitamin ingredients market are vitamins, _vitamin a, _vitamin b1, _vitamin b2, _vitamin b3, _vitamin b5, _vitamin b6, _vitamin b7, _vitamin b9, _vitamin b12, _vitamin c, _vitamin d, _vitamin e, _vitamin k, calcium, iron, zinc, epa/dha, magnesium and others.

In terms of form, capsule segment to command 34.2% share in the prenatal vitamin ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Prenatal Nutrition Market Analysis - Size, Growth, and Forecast 2025 to 2035

Prenatal Vitamin Preparation Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Supplement Market Analysis - Size, Share, and Forecast 2025 to 2035

Examining Market Share Trends in the Prenatal Vitamin Supplement Industry

UK Prenatal Vitamin Supplement Market Outlook – Demand, Trends & Forecast 2025-2035

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

ASEAN Prenatal Vitamin Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Europe Prenatal Vitamin Supplement Market Analysis – Size, Share & Forecast 2025-2035

Australia Prenatal Vitamin Supplements Market Insights – Size, Growth & Forecast 2025-2035

Latin America Prenatal Vitamin Supplement Market Outlook – Size, Share & Forecast 2025-2035

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA