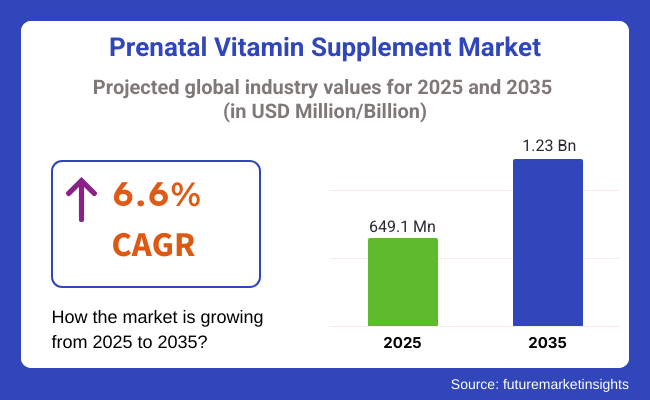

The global prenatal vitamin supplement market is projected to grow steadily, with its valuation expected to increase from approximately USD 649.1 million in 2025 to nearly USD 1.23 billion by 2035. This growth corresponds to a CAGR of 6.6% over the forecast period. Increasing awareness regarding maternal health, rising adoption of prenatal nutrition products, and the growing emphasis on prenatal care are key factors driving market expansion.

Prenatal vitamin supplements play a critical role in supporting the nutritional needs of pregnant women, ensuring healthy fetal development, and preventing complications such as neural tube defects and anemia. These supplements typically contain essential vitamins and minerals including folic acid, iron, calcium, vitamin D, and DHA, tailored to address the increased nutritional demands during pregnancy.

The market growth is propelled by the increasing number of pregnancies worldwide and heightened focus on maternal and child health programs by governments and healthcare organizations. Awareness campaigns and prenatal screening initiatives encourage expectant mothers to adopt supplementation regimens, thereby boosting demand. Additionally, the rise in maternal age and lifestyle-related health issues such as obesity and diabetes further underscore the need for specialized prenatal nutrition.

Product innovation and diversification are significant market trends. Manufacturers are developing prenatal supplements in various formats such as tablets, capsules, gummies, and powders to cater to consumer preferences and improve compliance. The growing popularity of organic and natural ingredients is also influencing product formulations, driven by increasing consumer interest in clean-label and toxin-free supplements.

In August 2024, Vitabiotics launched Pregnacare Conception Max, a premium prenatal supplement designed to support women's fertility. This formulation includes L-methylfolate, a bioavailable form of folic acid, along with high-purity omega-3 fish oil providing DHA and EPA. It also offers increased levels of vitamin B12, vitamin D, selenium, magnesium, coenzyme Q10, N-acetyl cysteine, and inositol compared to the standard Pregnacare Conception. The product aims to provide comprehensive nutritional support for women preparing for pregnancy.

Market segmentation highlights distribution channels including pharmacies, online retail, supermarkets, and specialty stores. The online channel is gaining prominence due to convenience, wider product variety, and increasing digital adoption. Pharmacies and healthcare facilities continue to serve as trusted sources for prenatal supplements, especially in emerging markets. Challenges such as pricing pressures, regulatory complexities, and variability in consumer education may restrain growth in some areas. However, ongoing efforts to enhance product accessibility and efficacy are expected to mitigate these factors.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global industry. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 6.2% (2024 to 2034) |

| H2 2024 | 6.8% (2024 to 2034) |

| H1 2025 | 6.4% (2025 to 2035) |

| H2 2025 | 7% (2025 to 2035) |

The global industry's predicted compound annual growth rate (CAGR) over a semi-annual period from 2025 to 2035 is shown in the above table. The business is anticipated to grow at a CAGR of 6.2% in the first half (H1) of 2024 and then slightly faster at 6.8% in the second half (H2) of the same year. The CAGR is anticipated to decrease somewhat to 6.4% in the first half of 2025 and continue to grow at 7% in the second half. The industry saw a decline of 30 basis points in the first half (H1 2025) and an increase of 40 basis points in the second half (H2 2025).

The capsules and tablets segment is projected to hold a dominant 45% market share in 2025, reflecting its widespread preference in prenatal vitamin supplements. These formats are favored for their precise nutrient dosing, long shelf life, and controlled nutrient release, which are crucial for effective prenatal nutrition.

Unlike gummies or liquids, capsules and tablets are not affected by sugar content, oxidation, or degradation, allowing for higher concentrations of essential vitamins and minerals such as iron, folate, and DHA. Leading brands like Garden of Life employ slow-delivery peptide-coated tablets, while Bayer’s One A Day and Thorne utilize delayed-release capsules to enhance absorption and minimize side effects like nausea.

Recent innovations include smaller, easy-to-swallow tablets, soft gels, and enteric-coated capsules that dissolve in the intestines, further improving user compliance and nutrient bioavailability. These advancements reinforce capsules and tablets as the gold standard for prenatal supplementation worldwide, combining efficacy with safety. As consumer demand for scientifically advanced and convenient prenatal nutrition grows, this segment is expected to maintain strong leadership throughout the forecast period.

The drug stores and pharmacies segment is estimated to capture approximately 30% market share in 2025, remaining the leading sales channel for prenatal vitamin supplements. Pharmacies offer trusted, easily accessible points of purchase where pregnant women benefit from personalized consultation with pharmacists, ensuring clinical safety and physician-approved formulations.

Large pharmacy chains such as CVS, Walgreens, and Boots provide extensive selections of both over-the-counter and prescription prenatal vitamins, establishing themselves as comprehensive destinations for pregnancy essentials. Pharmacies also stock high-bioavailability and exclusive pharmacy-only brands, adding value and choice for consumers.

Insurance coverage and government prenatal programs further support the dominance of this channel by making supplements more affordable and accessible. As e-commerce expands, many pharmacies have integrated online prescription services and home delivery options, enhancing convenience and maintaining their critical role in the prenatal supplement supply chain. This blend of trust, expertise, and accessibility positions drug stores and pharmacies as the foremost channel in prenatal vitamin distribution.

The Increasing Popularity of Multi-Stage Pregnancy Supplements Over Multi-Stage Pregnancy Supplements

The classic prenatal vitamin, with its one-size-fits-all component, is now being dethroned by multi-stage variations that are specifically made for preconception, every trimester, and postpartum recovery. Expectant mothers are in need of different nutrients at different pregnancy times- more folate and choline for neural tube development in the first trimester, more iron and calcium for fetal growth in the second trimester, and omega-3s and vitamin D for brain and immune system development in the third trimester.

After delivery, the need switches to the vitamins that help along lactation (B12, iodine) and those that balance mood (magnesium, DHA). For instance, labels like Pink Stork and Needed are on-trend with them, as well as pre-natal lines of a specific stage. The OB-GYN supports this demand, along with the rising consumer awareness of nutrient timing, really stresses the production of trimester-based and extended postpartum formulas by supplement companies.

The Surge in Awareness of the Problems Related to Nutrient Absorption in Pregnant Women

Due to the increased consumer awareness of the bioavailability of the ingredients and the genetic factors affecting nutrient absorption, the whole prenatal supplementation scheme is left in a mess. The MTHFR gene mutation, which leads to reduced folate, is one of the factors that cause an increasing requirement for methylated folate (L-methylfolate).

The preference for chelated iron and magnesium over traditional mineral forms for better absorption and fewer gastrointestinal side effects is no less. Algae-based DHA will replace fish oil since it is cleaner and comes from plants. Brands like Theralogix, Ritual, and MegaFood have adopted bioavailable nutrient forms as a response to these issues.

The movement was fueled by doctors practicing functional medicine and social media influencers who instructed women as to their genetic predispositions, challenges in their digestion, and the importance of proper nutrients in order to maintain their health and that of their child.

Popularity of Formats Low in Nausea and Easily Consumable

Conventional prenatal vitamins, specifically rich in iron and generally big pills, are the ones that initiate nausea, vomiting, and digestive discomfort among pregnant women, particularly in the first trimester. A pill aversion and morning sickness are the reasons that the market is transforming into gummies, softgels, liquids, dissolvable powders, and chewables.

Gummies are getting broader recognition for their taste and the fact that they are easier to take since they are sometimes devoid of iron and thus require separate supplementation. Brands like SmartyPants and Nature Made deliver gummy prenatals that are iron-free without any other elements.

For instance, Mary Ruth’s holds the advantage of liquid formulas that are fast absorbed and easy on the stomach. The effervescent powders for consumers to mix the vitamins into the drinks, thus enhancing compliance. This trend is promoted by the comfort and convenience preferences of pregnant women, making alternative delivery formats a competitive advantage for supplement brands.

The Development of Precision Prenatal Supplements through Genetic Testing

Personalized nutrition is a main trend yet has a rupture point, the prenatal supplement market, where the beginning brands, with the help of DNA health assessments and blood tests, create custom formulations. Companies such as Beli, Needed, and Persona Nutrition are providing personalized prenatal remedies which are based on genetic markers, lifestyle, and dietary habits.

Advanced blood tests can give information about vitamin deficiencies, such as iron, vitamin D3, or omega-3, that are targets for a nuanced supplementation plan. Artificial Intelligence (AI) is also suggesting nutrition plans across the board, and the overall personalized health ideas are building a new market ecosystem.

This change is spurred by consumer interest in scientifically backed solutions, particularly among millennial and Gen Z mothers-to-be. As genetic testing has become less expensive, it is likely that this personalized prenatal nutrition will find wider recognition, which, in turn, will form the basis for brands to offer very specific types of formulations that will, in the end, be hard to imitate.

Micro-Encapsulation and Delayed-Release Technologies

Manufacturers of prenatal supplements are using microencapsulation, liposomal technology, and enteric-coated capsules to enhance nutrient absorption and minimize side effects. Iron and folate are crucial, but they often lead to gastrointestinal distress; the use of advanced encapsulation techniques is a solution for lowering the amount of release.

Liposome-coated DHA and fat-soluble vitamins (A, D, E, K) are the vehicles that transport and enhance nutrient bioavailability by protecting these nutrients from being destroyed in the digestive system. Like, the Theralogix and Seeking Health firms make use of the slow-release iron and time-release B vitamins to secure steady nutrient availability without vector spikes or crashes.

Plus, the generic probiotics having the enteric coating added will be the support component in prenatal supplements for gut health & immune function. By these methods, not only are the supplements better, but they also win the trust of the consumers, as pregnant women are looking for supplements that will maximize their nutrient absorption and at the same time decrease their digestive discomfort, which is the most common in pregnancy.

The Vertically Integrated Manufacturing of Supplements to Assure Quality

As prenatal quality supplements face the heat of increased regulation, the best brands react by either moving the whole production in-house or collaborating with pharmaceutical-grade manufacturers exclusively to secure quality, compliance, and good channels of supply.

Most of the consumers have also become aware of the problems of heavy-metal contamination, sourcing of ingredients, and added third-party tests, and as such, companies have resorted to stringent quality control. A good example of this would be the Garden of Life and Nordic Naturals. They have managed to instill a variety of quality measures such as overseeing ingredient purity, testing, production transparency, and the like.

The credibility now comes from ISO, NSF, and third-party lab tests (ConsumerLab, Labdoor), which are the major differentiators, as most pregnant women are into taking safe and clinically proven products. Domestic manufacturing is also up and running because of the risks to foreign supply chains, which are unstable, therefore letting the expectant mothers receive the products on time and without any difficulties.

The prenatal vitamin supplements market had a positive growth trend throughout the 2020 to 2024 period, propelled by a surge in maternal health education, physician recommendations, and the introduction of premium and bioavailable formulations. The pandemic era shifted the spotlight onto immune-boosting prenatal supplements, leading the market towards high-quality, clinically proven, and organic products.

The introduction of direct-to-consumer brands, subscription models, and clean-label formats facilitated further reshaping of the market. In the period 2025 to 2035, the demand will also continue to increase through the research achievements on precision nutrition, the inclusion of new genetic-based supplementation, and the innovation in bioavailability.

The market is anticipated to witness the introduction of more personalized, gut-health-focused prenatal alternatives, as well as the expansion of the currently untapped emerging markets in distribution. Furthermore, the path towards the market's future will also be determined by e-commerce leadership, regulatory changes, and the rising penetration of AI-driven personalized recommendations.

The worldwide prenatal vitamin supplements market can be subdivided into three levels, each with a unique strategy that impacts the market differently and attracts different types of consumers.

Players Tier 1 are led by Bayer AG (One A Day), Abbott Laboratories (Similac), Nestlé (Garden of Life), Vitabiotics (Pregnacare), and Church & Dwight (Vitafusion), which together comprise 50-60% of the total market. These multinational companies use their strong branding, hospitals/personal associations, plus retail and pharmacy channels, to secure this level of control.

Their strategy is focused on the proposed scientific rationale, clinical validation, and advanced formulations that are at the forefront in both over-the-counter (OTC) and prescription-based prenatal supplements. Their control over the market not only comes from the active promotion of bioavailable nutrient formats but also through the implementation of subscription models and targeted formulations for specific stages during pregnancy.

Tier 2 players, for instance, including Ritual, Needed, Thorne, New Chapter, MegaFood, and Nordic Naturals, own approximately 25-35% of the market. These are mid-range brands which present themselves as high quality, clean-label, and personalized products for pregnancy nutrition, appealing to eco-friendly, organic, vegan, and allergen-free seekers.

They develop and operate on a direct-to-consumer (DTC) sales model, focusing on subscription models and the overall growth of e-commerce, as well as using digital marketing, influencer endorsements, and OB-GYN collaborations to differentiate themselves. They are propelled ahead due to the new functionality of absorbed nutrients, making gut-friendly formulations, and precision-based supplementation.

Tier 3 includes brands such as Persona Nutrition, Perelel Health, Beli, and other regional supplements, which altogether represent 10-15% of the market. These pioneer brands ensure their marks by applying hyper-personalized, functional, and holistic prenatal solutions and intricate genetics-based nutrition, TCM-infusion, and Ayurvedic blends, among other things. Some Tier 3 companies are in specialty health stores and niche online wellness platforms, appealing to engaged, information-seeking consumers.

The following table shows the estimated growth rates of the top three countries. USA, China and Germany are set to exhibit high consumption, and CAGRs of 3.8%, 5.5% and 4.5% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 3.2% |

| China | 5.5% |

| Germany | 4.5% |

The USA prenatal vitamin market is experiencing a tremendous growth of subscription-based, doctor-formulated, and AI-driven personalized supplement plans. Companies such as Ritual, Needed, and Perelel Health have adopted the approach of a monthly subscription, where consumers receive customized prenatal packs according to their specific nutrient needs.

These brands, being different from standard OTC supplements, incorporate third-party lab testing, targeted ingredient dosing, and science-backed formulations to come up with personalized regimens. The convenience, transparency, and medical credibility are some of the factors that consumers associate with these subscription models, which is why they are more attractive.

The e-commerce-first companies are also the leaders, as they sell through DTC platforms and establish their credibility through medical advisory boards. The situation with OB-GYNs, who more often recommend precision nutrition, and people who are ready to pay for personalized, clinically effective prenatal formulas, is slightly deviating from the trend toward which the market is switching from the one-off supplement sell to the continuous tracking of maternal health. The Latin America prenatal vitamin supplement market is seeing substantial price differentiation for premium, organic, and conventional products

Traditional Chinese Medicine (TCM) is being integrated into prenatal vitamins in the China market. Companies like BY-HEALTH, Tong Ren Tang, and Swisse are making combinations of herbal ingredients (Ginseng, goji berry, Astragalus, and Cordyceps) with pregnancy essential vitamins like Folate, Bifidobacteria, and Iron.

Expectant mothers in China go for natural, holistic prenatal care, which in turn drives the demand for plant-based and TCM-inspired prenatal supplements. Cross-border and e-commerce channels have contributed to the entry of premium foreign brands in the TCM market on platforms such as Tmall and JD.com, while domestic brands are using the cultural trust in TCM remedies to leverage their position.

The trend is a reflection of the growing interest in pre-pregnancy preventive health, where adaptogenic herbs, antioxidants, and traditional botanicals are used in addition to proven prenatal nutrients to promote fetal growth and mothers well-being.

Germany's prenatal vitamin market is evolving, seen from the angle of fermented, bioavailable, and gut-friendly products, where brands such as Doppelherz, Orthomol, and Pure Encapsulations show the way. A considerable number of German customers tend to select the more digestible type of probiotics as well as the naturally fermented prenatal vitamins, which work all the better in the absorption of nutrients during the use of these products.

This situation can be explained by the country’s continued emphasis on optimizing gut health and the preference for clean-label supplements. Prenatal supplements featuring liposomal iron, methylated folate, and algae-based DHA are the latest innovations, which promote outreach and lessen nausea and digestive discomfort.

Expectant mothers in Germany also tend to pick low-excipient and filler-free formulations, which further underlines the demand for minimalist, high-purity supplements. The emphasis is being shifted towards maintaining a balanced microbiome in pregnancy and because of that, prenatal vitamins that include prebiotics, probiotics, and postbiotics are getting popular, thus, it marks the German market as different as compared to other worldwide regions.

The prenatal vitamin supplement market is full of competition with the likes of Vitabiotics, Bayer AG, Church & Dwight, Abbott Laboratories, and Nestlés Garden of Life being at the forefront. Achieving the widest market share is the main priority for all the brands that have started providing individualized solutions, just like Ritual’s traceable prenatal with delayed-release technology and Needed’s trimester-specific formulations.

Companies are also focusing on the fashion of choices where the products are gut-friendly and do not have sugar that is accessible, as seen in Theralogix's methylated folate prenatal & MegaFoods whole-food-based vitamins. Subscription models, such as Perelel Health or Persona Nutrition, are the ones to make a remarkable impact on customer retention, as well as partnerships with OB-GYNs and pharmacists that strengthen the credibility.

Of course, we can also mention new products like SmartyPants, which have released omega-3 DHA prenatal gummies, and New Chapter, which has created fermented prenatal multivitamins. Mothers are now wondering about new clean-label vegan and allergen-free formats from the companies which they continuously explore in order to fulfill their changing needs regarding health during the bearing period of their children.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 649.1 million |

| Projected Market Size (2035) | USD 1.23 billion |

| CAGR (2025 to 2035) | 6.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Forms Analyzed (Segment 1) | Capsules/Tablets, Gummies, Powders, Liquids, Others |

| Sales Channels Covered (Segment 2) | Online, Drug Stores & Pharmacies, Hospital & Clinics, Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, France, Japan, Australia |

| Key Players Influencing the Market | Vitabiotics, Bayer AG, Church & Dwight, Abbott Laboratories, Swisse, Garden of Life, Nordic Naturals, MegaFood, New Chapter, Rainbow Light, SmartyPants, Thorne Research, Nature Made |

| Additional Attributes | Dollar sales by form and channel, trends in bioavailability and personalization, e-commerce growth, regulatory impacts, maternal health initiatives |

| Customization and Pricing | Customization and Pricing Available on Request |

Capsule/Tablets (45%), Gummies (30%), Powders, liquids, others

Online (25%), Drug Stores and Pharmacies (30%), Hospital & Clinics, Hypermarkets/Supermarkets (35%), Convenience Stores, Health and, wellness Stores, Specialty Stores, Departmental Stores

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is expected to reach USD 1.23 billion by 2035, growing from USD 649.1 million in 2025.

The market is projected to expand at a CAGR of 6.6%, driven by increasing awareness of maternal health and the benefits of prenatal nutrition.

Leading companies in the market include Bayer AG, Church & Dwight Co., Inc., Nestlé, Abbott Laboratories, and Nordic Naturals, focusing on innovative formulations and expanding product availability.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 24: Western Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Eastern Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 42: East Asia Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 13: Global Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 31: North America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 49: Latin America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 67: Western Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 121: East Asia Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Examining Market Share Trends in the Prenatal Vitamin Supplement Industry

UK Prenatal Vitamin Supplement Market Outlook – Demand, Trends & Forecast 2025-2035

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

ASEAN Prenatal Vitamin Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Europe Prenatal Vitamin Supplement Market Analysis – Size, Share & Forecast 2025-2035

Australia Prenatal Vitamin Supplements Market Insights – Size, Growth & Forecast 2025-2035

Latin America Prenatal Vitamin Supplement Market Outlook – Size, Share & Forecast 2025-2035

Prenatal Nutrition Market Analysis - Size, Growth, and Forecast 2025 to 2035

Prenatal Vitamin Preparation Market Size and Share Forecast Outlook 2025 to 2035

Prenatal Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Patches Market - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA