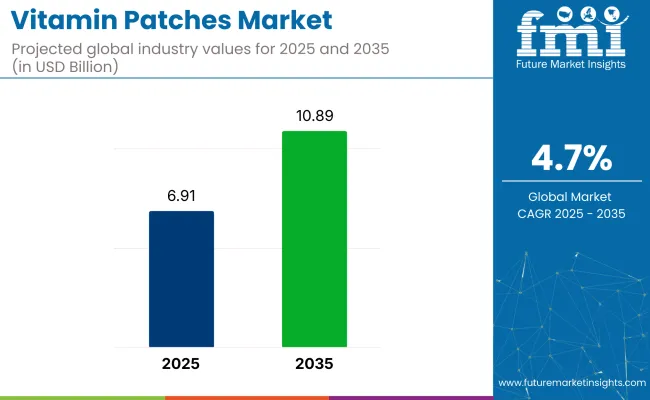

The global vitamin patches market is valued at USD 6.91 billion in 2025 and is projected to reach USD 10.89 billion by 2035, reflecting a CAGR of 4.7%. This growth is expected to be driven by rising health and wellness awareness, increasing consumer preference for non-invasive delivery systems, and technological advancements in transdermal formulations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6.91 billion |

| Market Value (2035) | USD 10.89 billion |

| CAGR (2025 to 2035) | 4.7% |

Additionally, market expansion will be supported by strategic collaborations, research investments for new formulations, and the demand for preventive healthcare solutions worldwide.

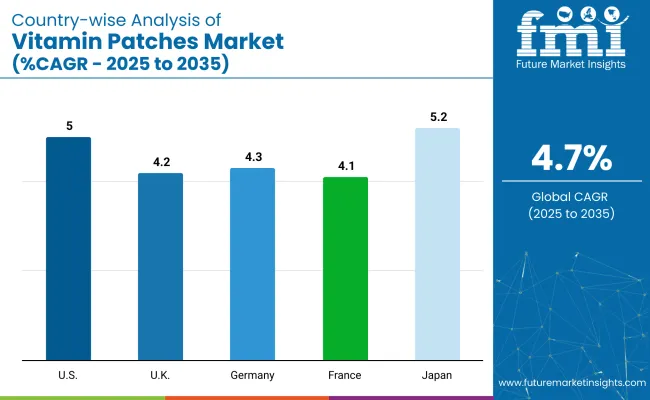

Japan is projected to hold the highest CAGR of 5.2% from 2025 to 2035, driven by strong demand for beauty-enhancing vitamin patches and advancements in transdermal technologies. The United States follows with a CAGR of 5.0%, supported by rising consumer preference for convenient, non-invasive supplementation solutions.

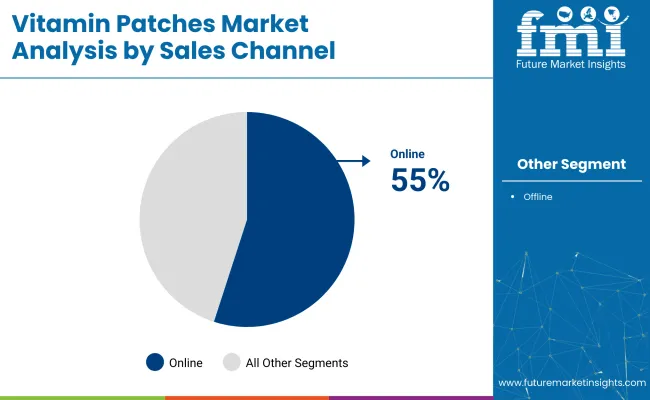

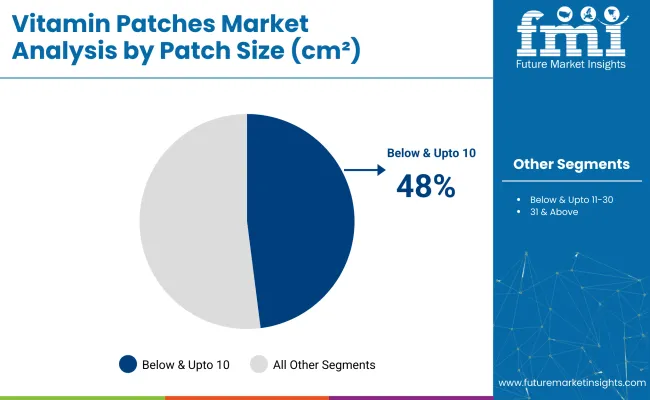

Germany is expected to register a steady CAGR of 4.3%, attributed to increasing demand for natural and herbal vitamin patches alongside robust regulatory standards ensuring product safety and quality. The online sales channel segment is expected to dominate the market with a 55% share in 2025, followed by below & upto 10 cm² patches holding a 48% market share due to effective absorption.

Government regulations are increasingly emphasising the safety, efficacy, and quality of vitamin patches, requiring manufacturers to adhere to stringent guidelines for transdermal products, including FDA and EMA approvals for health claims and ingredient transparency. Recent innovations have focused on developing advanced micro-reservoir systems for controlled nutrient release, hydrogel adhesives for better skin compatibility, and smart patches integrated with wearable sensors for real-time nutrient monitoring.

The vitamin patches market accounts for a small but growing share within its parent markets. It is estimated to hold around 3-5% of the overall food supplements and nutrition market, given its niche but expanding application. Within the transdermal drug delivery systems market, vitamin patches contribute approximately 6-8%, driven by rising consumer acceptance of non-invasive delivery methods.

In the broader nutraceuticals market, the share remains around 2-3%, while in the personal care and wellness market, it accounts for nearly 1-2%, reflecting its specialised position focused on preventive health, targeted nutrient delivery, and emerging smart patch innovations.

The vitamin patches market is segmented by product type, adhesive type, application, sales channel, patch size, and region. By product type, the market is segmented into drug-in-adhesive, matrix patches, reservoir membrane patches, microneedle patches, micro-reservoir system, and vapor patches.

By adhesive type, it is classified into non-adhesive type, acrylic adhesives, silicone adhesives, hydrogel adhesives, and other adhesive types. By application, it is divided into pain management, CNS (central nervous system), respiratory, NRT (nicotine replacement therapy), cosmetics, and other applications.

By sales channel, it is segmented into online and offline. By patch size, it is segmented into below & upto 10 cm², 11-30 cm², and 31 & above cm². By region, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA.

The drug-in-adhesive segment is anticipated to hold the largest market share of 30.8% in 2025.

The hydrogel adhesives segment is expected to hold a significant market share of 15.2% in 2025, driven by its superior moisture retention and skin compatibility properties.

The pain management segment is expected to hold the largest market share of 35% in 2025,

The online sales channel segment is expected to hold the largest market share of around 55% in 2025.

The below & upto 10 cm² patch size segment is expected to hold the largest market share of 48% in 2025.

The vitamin patches market is experiencing steady growth, driven by rising consumer preference for non-invasive nutrient delivery, increasing health and wellness awareness, and continuous innovations in transdermal technologies, including micro-reservoir and hydrogel adhesive systems, alongside growing demand for convenient and effective supplementation solutions.

Recent Trends in the Vitamin Patches Market

Challenges in the Vitamin Patches Market

Among the top countries, Japan is projected to record the highest growth with a CAGR of 5.2%, driven by rising demand for beauty-enhancing vitamin patches and strong technological expertise. The United States follows closely with a CAGR of 5.0%, supported by high adoption of transdermal health supplements.

Germany and the United Kingdom are expected to grow at CAGRs of 4.3% and 4.2%, respectively, owing to increasing consumer preference for natural, vegan, and herbal patches. France will see a comparatively moderate growth at a CAGR of 4.1%, driven by discreet beauty and skincare vitamin patch demand in urban markets.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA vitamin patches market is projected to grow at a CAGR of 5.0% from 2025 to 2035. Leading companies focus on developing multi-vitamin patches with enhanced bioavailability to cater to the wellness-focused consumer base.

Sales of vitamin patches in the UK are expected to register a steady CAGR of 4.2% from 2025 to 2035.

Germany’s vitamin patches market is anticipated to grow at a CAGR of 4.3% from 2025 to 2035.

Sales of vitamin patches in France are projected to grow at a CAGR of 4.1% from 2025 to 2035.

Japan’s vitamin patches revenue is expected to grow at a CAGR of 5.2% from 2025 to 2035.

The market is relatively fragmented, with numerous tier-one and tier-two players competing based on product innovation, pricing, and regional expansion strategies. Leading companies are focusing on developing advanced transdermal technologies, launching customised formulations, and leveraging online sales channels to increase their market share.

Top players like Patch MD, B12 Patch, and Mary Ruth Organics are competing through continuous product innovations, introduction of multi-nutrient patches, and expansion into Asian and European markets to capture the rising demand for non-invasive wellness solutions.

Recent Vitamin Patches Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.91 billion |

| Projected Market Size (2035) | USD 10.89 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in million unit |

| By Product Type | Drug-In-Adhesive, Matrix Patches, Reservoir Membrane Patches, Microneedle Patches, Micro-Reservoir System, Vapor Patches |

| By Adhesive Type | Non-Adhesive Type, Acrylic Adhesives, Silicone Adhesives, Hydrogel Adhesives, Other Adhesive Types |

| By Application | Pain Management, CNS (Central Nervous System), Respiratory, NRT (Nicotine Replacement Therapy), Cosmetics, Other Applications |

| By Sales Channel | Online, Offline |

| By Patch Size (cm²) | Below & Upto 10, 11-30, 31 & Above |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Nutraceuticals International Group, Nutrivend, Vita Patch, Vitamin Patch Company, Mary Ruth Organics, B12 Patch, Pillars of Wellness, Vitality Patch, Zahler, Vital Patch, Well Patch, Skinner Health, Aviva, Sundown Naturals, Life AID, Nutra Blast, Vita patch, Pepin Mfg,Mco Hospital Aids Pvt. Ltd, Bytox. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per product type, the industry has been categorized in Reservoir Membrane Patches, DIA (Single-Vitamin Patch, and Multi-Vitamin Patch), Vapour Patches, Matrix Patches, Microneedle Patches, and Micro-Reservoir System.

As per adhesive type, the industry has been categorized into Non-Adhesive Type, Acrylic Adhesives, Silicone Adhesives, Hydrogel Adhesives, and Other Adhesive Types.

This segment is further categorized in CNS, Pain Management (Cancer Pain, Severe Chronic Pain, Pain & Inflammation, and Post-herpetic neuralgia), Respiratory, NRT (Nicotine Replacement Therapy), Cosmetics and Other Applications.

As per sales channel, the industry has been categorized into Online, and Offline (Modern Trade, Pharma/ Drug Store, and Other Store Based).

This segment is further categorized into Below & Upto 10 cm2, 11-30 cm2, and 31 cm2 & above.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 6.91 billion in 2025.

The market is projected to reach USD 10.89 billion by 2035.

The market is expected to grow at a CAGR of 4.7% during this period.

The drug-in-adhesive segment holds the largest share at 30.8%.

The USA is the fastest-growing market with a CAGR of 5.4%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vitamin B12 Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Vitamin C Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Biomarkers Market Size and Share Forecast Outlook 2025 to 2035

Vitamin E Antioxidant Creams Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vitamin Tonics Market Size and Share Forecast Outlook 2025 to 2035

Vitamin A Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Premix Market Analysis - Size, Growth, and Forecast 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vitamin D Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Vitamin Yeast Market Analysis by Vitamin Composition, Application, Product Claim andOther Types Through 2035

Vitamin D Testing Market Analysis by Component, Type, and Region: Forecast for 2025 to 2035

Vitamin Supplement Market Insights - Wellness & Industry Growth 2025 to 2035

Vitamin B Test Market Insights - Size, Trends & Forecast 2025 to 2035

Vitamin and Mineral Supplement Market Insights - Trends & Forecast 2025 to 2035

Vitamin and Mineral Market – Growth, Innovations & Health Trends

Vitamin Shot Market – Growth, Demand & Functional Benefits

Vitamin D Deficiency Treatment Market

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA