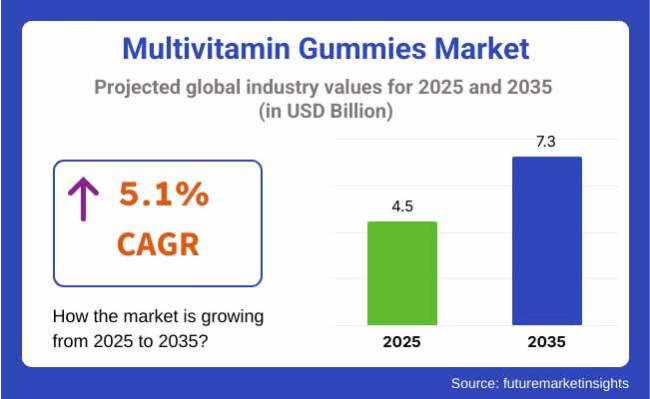

The global multivitamin gummies market is slated to register USD 4.5 billion in 2025. The industry is poised to witness 5.1% CAGR from 2025 to 2035, observing USD 7.3 billion by 2035.

The industry is growing at a fast pace, fueled by increasing health and wellness awareness, particularly among the younger generations. Gummies, which were historically considered a kids' product, have become popular among adults because they are convenient, delicious, and easy to consume.

This move to more natural and plant-based products in the health industry is also extending to the growth of multivitamin gummies, with consumers turning to organic or non-GMO ingredient-based products.

Further, the industry is witnessing growing demand for personalized nutrition, where consumers are turning to products that are specifically tailored to meet their needs, whether it's for immunity, skincare, or overall wellness.

The hectic lives of today's consumers, particularly those living in the city, have contributed to a rise in consumption of supplements in convenient forms to be able to fit into one's busy daily schedules.

These gummies are an accessible and fun way to take multivitamins as compared to tablets and capsules, hence finding increasing popularity among consumers who have difficulty swallowing tablets. Furthermore, the promotion of products as a tasty, enjoyable, and more accessible form of supplement is pushing the industry further.

Increased interest in self-care and preventative healthcare is also contributing significantly, as individuals become more proactive about keeping themselves healthy through supplementation. These conditions, coupled with the growing availability of products across different retail channels, have positioned the industry as an increasingly competitive and profitable industry.

The industry is experiencing a boost in demand, especially in the adult health supplement category. Customers, particularly millennials and Gen Z, are more and more choosing gummy supplements because of their flavor, ease of use, and simplicity of consumption.

The trend towards plant-based, vegan, and organic products is also affecting the industry, with consumers increasingly choosing gummies that contain non-GMO and natural ingredients. Personalized nutrition is increasingly becoming a major driver, as consumers seek multivitamins with specific health requirements, like immunity support, energy, or stress relief.

Buying behavior in this category is driven by taste, brand, and ingredient clarity. Convenience also plays a large role, as gummies are convenient to add to daily regimens versus regular pills or capsules. Health-oriented buyers are specifically concerned with claims of the product and seeking labels that are organic, gluten-free, or without additives.

As wellness awareness grows, supplements are coming out in statements as being used in an attempt to remain well, and individuals are spending extra money on greater-quality products when it meets what they aim to do with respect to health. With these increasing trends, products are becoming more of a fun and necessary component of daily nutrition.

The industry experienced high growth between 2020 and 2024 due to rising awareness of health and wellness among consumers. Throughout this time, demand for products was on the rise, especially among adults who were looking for a simpler and more enjoyable means of supplementing their diet.

Gummies emerged as the go-to choice because they are easily palatable, hence highly favored by those who have trouble swallowing the conventional pills and capsules. Online platforms were instrumental in broadening access to products, making them readily accessible to a wider population.

Additionally, an increasing interest in personalized nutrition contributed to an upsurge in gummies targeted at particular health issues, including immunity enhancement, skin health, and energy boost. Demand for natural and organic ingredients also gained momentum, with consumers increasingly becoming concerned about clean-label products and sustainability.

The industry is poised to maintain its growth from 2025 through 2035, with further specialized and bespoke products getting launched in the industry. Customers will demand supplements based on their specific individual health requirements, underpinned by improvements in technology and customized nutrition platforms. Gummies will be further functionalized, specifically targeting aspects such as mental performance, stress management, and mood enhancement.

The movement towards organic and plant-based ingredients will become more pronounced, as consumers with health concerns prefer products containing natural and non-GMO ingredients. Clean-label products with transparent disclosure of sourcing and manufacturing processes will be the norm.

Convenience will also continue to fuel the popularity of gummies, as active consumers seek quick, fun solutions to filling the gaps in daily nutrition. The industry will also witness the growth of eco-friendly packaging, with companies emphasizing recyclable and green materials.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing awareness of the role of vitamins in immunity, energy, and skin well-being, spurring a boom in multivitamin gummy sales. | Increased emphasis on specific health benefits, including mental clarity, cognitive function, and stress relief, combined with a trend toward more tailored supplements. |

| Gummies grew in popularity because they were tasty to eat and easy to consume, particularly for adults who didn't want to swallow pills. | Gummies grew in popularity because they were tasty to eat and easy to consume, particularly for adults who didn't want to swallow pills. |

| Increased demand for organic and plant-based gummies fueled by consumerism for natural, non-GMO, and environmentally friendly solutions. | Organic and plant-based products will be mainstream, with numerous consumers looking for vegan and allergen-free solutions. |

| A powerful move toward clean-label offerings, with customers insisting on clarity about ingredients, sourcing, and production methods. | Transparency around sourcing, ingredient labeling, and sustainability practices will be a core buying consideration. Brands will be focusing on authenticity and sustainability in their communications. |

| Shoppers began to look for gummies addressing specific health issues, such as immunity, skin, energy, and bones, giving way to the popularity of niche products. | More gummies for very specific purposes will be observed in the industry, which include sleep, digestive health, cognitive function, and DNA or health data-driven personalized formulations. |

| Brands started emphasizing sustainable packaging and ingredients, as consumers who care about the environment wanted more sustainable products. | Anticipate broad acceptance of sustainable packaging alternatives (biodegradable, recyclable) and more stress on sourcing ingredients in a responsible way, with increased attention to the climate footprint. |

The industry is susceptible to numerous risks that may inhibit its growth. To begin with, as the industry expands, there is greater competition, which may result in price wars and lower profit margins. The surge in new brands and products may also confuse consumers, and it may be challenging for companies to differentiate themselves.

Another major threat is the regulation of dietary supplements, which could become more stringent in the next few years. More stringent marketing, labeling, and ingredient sourcing regulations could drive up compliance expenses and restrict the promotion of specific health benefits.

Furthermore, there is increasing skepticism about supplements, with some consumers doubting their efficacy, which may affect total demand. As demand for organic and plant-based products grows, firms that fail to innovate in these spaces risk losing industry share. Disruptions in the supply chain, particularly with ingredients imported from international markets, are another threat.

Raw materials used in gummies like vitamins and plant-based ingredients are prone to price volatility and geopolitical issues, which can affect production. In addition, consumer behavior can change quickly, and if businesses don't keep pace with changing tastes-like gummies that are personalized or functional health ones-they risk being left behind. Finally, illicit products in the industry could erode consumer confidence in products as a category.

| Segment | Value Share (2025) |

|---|---|

| Adults | 76.4% |

Adults are significant end consumers of products because of a number of reasons. One of the main reasons is the growing awareness among adults regarding the need to keep themselves healthy and avoid nutrient deficiencies.

With age, nutritional requirements shift, and they find it difficult to get enough vitamins and minerals from their regular diet. Products offer a fun and easy way for adults to guarantee that they're getting their daily needs, especially when they have hectic lifestyles or with poor nutrition.

Moreover, adults tend to seek supplements that address specific health issues. Products come in different formulations addressing particular needs such as immune health, energy, joint comfort, and skin wellness.

This adaptability makes them attractive to a wide adult audience, ranging from those interested in overall well-being to those who seek supplements aimed at specific uses. The convenient-to-swallow gummy texture also makes them an attractive option for adults who struggle to swallow pills or capsules.

Online selling outlets are commonly employed in purchasing products because they provide convenience and simplicity to users. Online buying makes it easier for customers to select a high selection of merchandise, compare costs, and know about other shoppers' experiences through comments without physical movements.

It is especially pleasing to individuals who possess hectic agendas or do not wish to shop physically. The fact that one can shop at any time, during the day or night, introduces an element of convenience that cannot be matched by physical stores.

The other factor behind the growth of online sales is the growing list of health-conscious buyers who seek information about products actively prior to buying them. Online shopping enables consumers to view detailed product descriptions, ingredient claims, and health benefits, which enable them to make informed choices.

In addition, the increased utilization of social media and influencer marketing also serves to drive traffic to websites, where individuals are exposed to a range of brands and products via endorsements, reviews, and recommendations.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

| UK | 4.8% |

| France | 4.3% |

| Germany | 5.2% |

| Italy | 4.6% |

| South Korea | 6.2% |

| Japan | 5.4% |

| China | 5.9% |

| Australia | 5.5% |

| New Zealand | 5.3% |

The United States is anticipated to experience a 5.6% CAGR in the market during the period of 2025 to 2035. As there is increased awareness of health and wellness, the demand for products has increased tremendously. People are seeking convenient and enjoyable methods of enhancing their well-being, and gummies provide a tasty and easy-to-swallow option compared to traditional tablets and capsules. The industry is also driven by the increased trend of preventative health, specifically that of immunity, energy, and overall well-being.

An ageing population in America also drives demand, as seniors increasingly choose to take gummy vitamins because of their ease of use. And demand for specialty products targeting individual health needs, such as probiotics, immune system support, and beauty supplements, continues to increase.

The movement towards natural ingredients, organic composition, and veganism in clean-label products is also making waves in the US. The e-commerce base is widening so that consumers are able to choose from a pool of brands and products with increased ease. Growing awareness about the advantages of products will fuel the industry forward.

The UK industry is estimated to register a CAGR of 4.8% from 2025 to 2035. Demand for products is being spurred by the rising trend of healthy living, especially post-pandemic, with consumers paying greater attention to immune system boosts and overall health. Consequently, there is a surge in demand for gummy supplements that address targeted health benefits like immune system, hair and skin, and energy.

The UK is blessed with a well-developed nutraceutical industry, which is led by adults and children consuming products. The trend of veganism and plant-based diets is also on the rise, affecting the industry with customers choosing vegan gummy supplements that are not produced using animal-based products like gelatin. There is also an increasing demand for natural, organic, and sugar-free gummies.

The growth in the industry is facilitated by a strong retail distribution channel, consisting of health food stores, pharmacies, and digital channels, with gummies thus becoming readily available to consumers. Growing online buying trends are delivering higher convenience levels to consumers, further driving growth in the industry.

The industry in France will grow at a CAGR of 4.3% from 2025 to 2035. French consumers have increased interest in well-being and health, which has been fueled by increased awareness for nutrition and preventative medicine. Products are becoming more popular as they are easy to consume, tasty, and convenient.

The industry is also trending towards natural and organic gummy supplements, since French consumers are very interested in product quality and origin. There is also growing demand for gummies with targeted health benefits, including immunity, digestion, and skin health. France's elderly population is another key driver of industry growth, since older adults are looking for easy-to-take supplements that provide health benefits.

Vegan and gluten-free gummies are becoming more popular in France, mirroring wider trends of healthier and sustainable living. There is also industry growth being pushed by e-commerce, with greater numbers of consumers in France doing their shopping online to buy health supplements. Due to increased focus on preventative wellness and natural remedies, the France industry is poised to grow steadily for the next decade.

The German industry is expected to expand at a CAGR of 5.2% during the period from 2025 to 2035. Germany is among the top nations in Europe for wellness and health trends, and the demand for products is increasing in line with this. With Germans increasingly concerned about staying healthy, the ease and attractiveness of gummy vitamins make them a favorite.

The demand is being driven by greater awareness of the health benefits of multivitamin supplements for immunity, energy, and skin care. Children's gummies are also picking up speed as they have appeal among young consumers, especially among parents who want a more convenient way of giving vitamins. The growing shift towards plant-based diets in Germany is driving the demand for sugar-free, vegan-friendly, and organic gummy vitamins.

Apart from these trends, German consumers are also looking for clean-label and ethically certified products, including organic, gluten-free, and cruelty-free labels. E-commerce is expanding as a channel of distribution, particularly as consumers increasingly favor the convenience of online shopping for health products. The German industry is expected to experience steady growth as consumer trends for health-oriented products continue to change.

The industry in Italy is projected to expand with a CAGR of 4.6% during the period from 2025 to 2035. People in Italy are increasingly focusing on health and wellness, resulting in increased demand for quick and efficient vitamin supplements. Products are particularly favored among young people, who find gummies more acceptable than conventional tablets and capsules because of their flavor and simplicity of use.

There is a strong trend towards natural and organic products in Italy, with consumers choosing gummies containing natural flavors, colors, and sweeteners. Furthermore, the increasing popularity of vegan and vegetarian diets in Italy is driving demand for vegan-friendly and plant-based products. The industry is also being supported by the popularity of functional gummies, with products for immunity, energy, skin, and hair health becoming increasingly popular.

Italy's retail industry encompasses both physical stores, including pharmacies and health food shops, and online platforms, which are becoming increasingly prominent for targeting Italian consumers. With sustained interest in wellness and health and concern for natural ingredients, the industry in Italy will continue to grow.

The South Korean multivitamin gummies market is anticipated to record a CAGR of 6.2% between 2025 and 2035. The consumers in South Korea are very health-aware and are eager to follow the new wellness trends, thereby demanding functional foods and supplements. Products, as an easy-to-swallow and enjoyable pill substitute, are also finding popularity in various age segments, particularly with the young population.

The South Korean industry is most interested in beauty-from-within health products like vitamins for skin health, hair growth, and anti-aging. There is also increasing demand for gummies that enhance energy levels and the immune system. Vegan and plant-based products, as in other markets, are increasingly popular, and South Korean consumers are also opting for supplements that fit into their clean and natural ingredient expectations.

Well-developed e-commerce infrastructure in the country is the major driver for growth in the industry, with easy access to numerous different products available. With growing awareness of preventive health, growth in the industry is anticipated to be strong in South Korea.

The industry in Japan is anticipated to expand at a CAGR of 5.4% during the period 2025 to 2035. Japan boasts one of the world's oldest populations, and therefore, there is high demand for health supplements that ensure vitality, energy, and longevity. Products are gaining popularity as they provide a convenient and fun means of ensuring daily vitamin intake.

There is strong consumer interest in gummies specifically addressing health issues, including joint health, cognitive function, and digestive health. Furthermore, the Japanese obsession with beauty and health has driven more interest in gummies that have ingredients which have skin benefits as well as anti-aging. The plant-based and natural movement is also increasing, with some Japanese consumers following vegan and organic gummy supplements.

Japan boasts a strong retail infrastructure, with numerous distribution channels such as traditional retail stores, pharmacies, and online. With Japanese consumers becoming increasingly health-oriented and looking for easy-to-take supplements, the industry is poised to expand consistently over the decade.

The industry in China is expected to develop at a CAGR of 5.9% during 2025 to 2035. China's fast-growing middle class, rising awareness of health issues, and expanding disposable incomes are all fueling the demand for dietary supplements like multivitamin gummies. The industry is especially fueled by the youth segment, who prefer easy-to-take, convenient supplements that accommodate their hectic lives.

There is also growing demand for gummies with particular health benefits, including immune system support, weight management, and beauty benefits. Furthermore, as Chinese consumers increasingly care about the quality and origin of their foodstuffs, demand for natural, organic, and ethically sourced gummies is on the rise.

E-commerce websites are becoming a critical channel for multivitamin gummy distribution in China, with online retail growing in popularity. As preventative healthcare and wellness become more of a focus, China's multivitamin gummies market is anticipated to grow over the coming decade.

The industry in Australia is anticipated to develop at a 5.5% CAGR during 2025 to 2035. The country enjoys a strong culture of health and wellness, and people look for products that contribute to improved nutrition, immunity, and well-being. Products are increasing demand due to convenience and taste factors being favored by customers, primarily millennials and Gen Z.

There is increasing demand for vegan, organic, and sugar-free alternatives, as health-conscious Australian consumers become more discerning. Industry expansion is also driven by rising popularity of functional gummies-that is, those with added health benefits like immune support, beauty benefits, and energy boosting.

The popularity of online shopping and greater accessibility of e-commerce is facilitating consumer purchase of products. With growing awareness regarding preventive healthcare and wellbeing, the Australian multivitamin gummy industry is on the verge of steady expansion.

The industry in New Zealand is expected to register a CAGR of 5.3% during the forecast period of 2025 to 2035. Similar to Australia, New Zealand also possesses an expanding population of health-conscious individuals who are increasingly relying on products due to their convenience and efficacy. The industry is also being fuelled by growing awareness of the importance of vitamins and supplements, especially for immunity and overall health.

New Zealand’s growing demand for natural, organic, and clean-label products is driving the expansion of the industry. Additionally, the trend towards veganism and plant-based diets is boosting the popularity of vegan gummies. As in other countries, e-commerce platforms are becoming an essential distribution channel for products in New Zealand, with more consumers opting for online shopping.

Competition is increasing in the multivitamin gummies segment as both traditional supplement firms and new players compete for consumers' attention. Companies are competing on innovation, launching niche gummies addressing particular health issues such as immunity, beauty, and energy. As natural, organic, and vegan products gain popularity, firms are developing products that resonate with health-oriented consumers seeking clean-label and allergen-free products.

The industry is also experiencing expansion in direct-to-consumer models, as e-commerce platforms allow businesses to expand their reach. Partnerships with health influencers and wellness experts are now necessary for establishing brand trust and loyalty. In addition, investment in research and development to produce gummies with increased bioavailability or added functional ingredients is fueling differentiation in the industry.

| Company Name | Industry Share |

|---|---|

| SmartyPants Vitamins | 10-15% |

| Pharmavite LLC | 10-12% |

| Garden of Life | 5-8% |

| OLLY Public Benefit Corporation | 8-12% |

| Vitafusion (Church & Dwight Co., Inc.) | 15-20% |

| Halcon Group | 2-4% |

| Nature’s Way Brands, LLC | 3-5% |

| MRO MARYRUTH, LLC | 2-4% |

| Viteey | 1-3% |

| Bayer AG | 4-6% |

| GNC Holdings, LLC | 4-6% |

| Company | Key Offerings/Activities |

|---|---|

| SmartyPants Vitamins | Specializing in high-quality adult and child gummy vitamins. Best known for their products with supplementary nutrients such as omega-3, fiber, and probiotics. Focus on clean label and non-GMO offerings. |

| Pharmavite LLC | Has a broad variety of health supplements, such as Nature Made products. Emphasizes high-quality ingredients, with products that promote cardiovascular, immune, and bone health. |

| Garden of Life | Renowned for plant-based and organic supplements, i.e., multivitamin gummies. Products are formulated using whole food ingredients, clean-label brands, and environmentally friendly packaging. |

| OLLY Public Benefit Corporation | Serves up tasty, colorful gummy vitamins that are both healthy and tasty. Serves up sleep, immune-boosting, beauty, and stress relief gummies with transparency and sustainability. |

| Vitafusion (Church & Dwight Co., Inc.) | A leader in the industry, Vitafusion is a wide-ranging offering of gummy vitamins that focuses on wellness, immune support, and key vitamins. Robust taste, quality, and convenience dedication. |

| Halcon Group | Has expertise in the production of gummy vitamins with a focus on high-quality ingredients and customized formulations. Has a series of vitamins aimed at health, energy, and vigor. |

| Nature’s Way Brands, LLC | Known for a multitude of products with support for general health, immune system, and energy. Emphasizes natural and non-GMO ingredients and eco-friendly practices. |

| MRO MARYRUTH, LLC | Offers a broad variety of natural and organic products and is dedicated to products targeted towards adults and children. Recognized for allergen-free formulas and quality ingredients. |

| Viteey | Specializes in immune wellness, energy, and general health gummy vitamins. Viteey prioritizes all-natural, non-GMO formulas and vegan options. |

| Bayer AG | Is known for making products with the One A Day brand. Specializes in daily wellness formulations, such as immunity, cardiovascular health, and overall wellness. Prioritizes quality and safety highly. |

| GNC Holdings, LLC | Has a range of products in the wellness, energy, and vitality categories. Known for science-backed products, such as weight management, muscle care, and immunity products. |

Key Company Insights

SmartyPants Vitamins (10-15%)

SmartyPants Vitamins is a leading brand in the multivitamin gummies segment, with high-quality gummy vitamins that are suitable for both adults and kids. The company focuses on products with enhanced nutrients like omega-3, probiotics, and fiber. SmartyPants specializes in providing clean-label, non-GMO, and allergen-free products.

They seek to develop health-aware, tasty, and easy-to-swallow supplements. Moreover, SmartyPants follows sustainability through environment-friendly packaging and ingredient sourcing methodologies that promote both consumer wellness and environmental health.

Pharmavite LLC (10-12%)

Pharmavite LLC, an industry leading manufacturer, is engaged in producing a broad spectrum of health supplements under the brand name Nature Made. The organization is known for its science-validated, high-quality products supporting overall well-being, such as vitamins for cardiovascular, immune system, and bone health.

Pharmavite is committed to the use of pure ingredients, providing natural and organic alternatives. They remain committed to product innovation, with a focus on clean-label products and convenience, while maintaining sustainability efforts for environmentally friendly production.

Garden of Life (5-8%)

Garden of Life is highly regarded for its organic and plant-based supplements, such as multivitamin gummies. The brand is promoting the utilization of whole food ingredients and presents a variety of gummy vitamins that address a range of health issues, from immune function to digestive health to overall wellness.

Garden of Life also focuses on sustainability through organic, non-GMO ingredient sourcing and environmentally friendly packaging. Their commitment to transparency and clean-label products makes them a reliable option for health-conscious consumers looking for natural and ethical products.

OLLY Public Benefit Corporation (8-12%)

OLLY Public Benefit Corporation is known for tasty and playful gummy vitamins for both adults and kids. Their gummy multivitamins are for diverse health functions such as sleep, beauty, immunity, and stress. OLLY is focused on developing products that taste great and work as well as ensuring clean ingredients and sustainability.

They are committed to green packaging and transparent sourcing. The mission of the company is to enhance the overall health of its customers while generating a positive environmental footprint, thus emerging as a top brand in the health and wellness sector.

Vitafusion (Church & Dwight Co., Inc.) (15-20%)

Church & Dwight Co., Inc.'s Vitafusion is a dominant player in the multivitamin gummy category with numerous choices that foster overall wellness, immune function, and overall health. Vitafusion is known for its tasty, high-quality gummy vitamins that consumers of all ages love.

The company is committed to making safe, effective, and easy-to-take products, with an emphasis on non-GMOs and great taste. Their research and development focus continues to fuel innovation in the multivitamin category, responding to the changing needs of health-aware consumers.

Halcon Group (2-4%)

Halcon Group is one of the leading players in the industry, providing quality products that emphasize health and wellness. Its portfolio features gummies that promote immune support, energy, and general wellness, with formulas that address adult and pediatric needs.

The company guarantees quality ingredients and makes clean-label products without allergens. Halcon Group is increasingly making its mark worldwide by formulating innovative gummy supplements and being at the cutting edge of trends in the industry, such as offering vegan, gluten-free, and plant-based products.

Nature's Way Brands, LLC (3-5%)

Nature's Way Brands, LLC is a name that has been in the industry for a long time, providing an extensive range of supplements for supporting general health, immune system function, and digestive health. Nature's Way prioritizes natural ingredients, frequently using organic and non-GMO materials.

The company specializes in clean-label products that are free of artificial colors, flavors, and preservatives. The sustainability initiatives target minimizing environmental impact without compromising product integrity. The company continues to innovate with new, health-oriented gummy formulations.

MRO MARYRUTH, LLC (2-4%)

MRO MARYRUTH, LLC provides a wide variety of natural and organic products. The firm's product offerings feature gummies that are both for adults and kids, enhancing immune health, energy, and well-being. MRO MARYRUTH believes in allergen-free and vegan-friendly gummies and places an emphasis on using non-GMO ingredients.

The firm prides itself on green practices and environmentally friendly packaging. MRO MARYRUTH continues to grow its presence in the marketplace by innovating and focusing on clean, wholesome formulations that respond to the increased demand for natural supplements.

Viteey (1-3%)

Viteey is a fast-growing company, focusing on immune health, energy, and wellness support products. Viteey offers high-quality, natural gummies that appeal to diverse consumer needs, including vegan, non-GMO, and allergen-free offerings.

The firm focuses on transparency of manufacturing and sourcing, and delivers value to consumers focused on health as they seek convenient and tasty supplements. Viteey further asserts its industry positioning by engaging emerging trends and clean, efficient consumer preferences for gummy supplements.

Bayer AG (4-6%)

Bayer AG, an international pharmaceutical and healthcare firm, also contributes notably towards the multivitamin gummy industry with the One A Day brand. One A Day offers a variety of gummy supplements that support overall wellness, including heart wellness, immunity, and everyday wellness.

Bayer focuses on scientifically valid formulas and high-quality ingredients in all of its products. Bayer has made sustainability commitments through environmentally friendly packaging and production methods. Bayer continues to grow its line of multivitamins to accommodate changing health needs of consumers.

GNC Holdings, LLC (4-6%)

GNC Holdings, LLC is a global leader in retail and manufacturing of health and wellness products such as multivitamin gummies. They provide products ranging from overall health and immune system support to more focused vitamins aimed at beauty, energy, and fitness. GNC focuses on the use of high-quality ingredients, with growing attention to clean-label and sustainable product formulations.

The organization has developed much in growing its product range to encompass vegan and plant-based supplements, a trend that suits the increasing consumer preference for natural and organic dietary supplements. GNC continues to build its presence on the global platform and expand into new business by innovating with industry needs.

In terms of source, the industry is divided into plant-based gelatin substitute and gelatin.

With respect to end-user, the industry is classified into adults, geriatric, pregnant women, and children.

By application, the industry is divided into general health, bone & joint health, immunity, cardiac health, diabetes, skin/hair/nails, prenatal health, and others.

In terms of sales channel, the market is classified into OTC and prescribed.

With respect to distribution channel, the market is divided into offline and online.

Regionally, the industry is analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 4.5 billion in 2025.

The industry is predicted to reach a size of USD 7.3 billion by 2035.

Key companies include SmartyPants Vitamins, Pharmavite LLC, Garden of Life, OLLY Public Benefit Corporation, Vitafusion (Church & Dwight Co., Inc.), Halcon Group, Nature’s Way Brands, LLC, MRO MARYRUTH, LLC, Viteey, Bayer AG, and GNC Holdings, LLC.

South Korea, slated to grow at 6.2% CAGR during the forecast period, is poised for the fastest growth.

Adults are major end users.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Global Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 12: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 18: North America Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 20: North America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 21: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 22: North America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 23: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 28: Latin America Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 30: Latin America Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 31: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 32: Latin America Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 33: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 34: Latin America Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 35: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 36: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 40: Western Europe Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 41: Western Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 42: Western Europe Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 43: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 44: Western Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 45: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 46: Western Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 47: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 52: Eastern Europe Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 53: Eastern Europe Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 54: Eastern Europe Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 56: Eastern Europe Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 58: Eastern Europe Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 60: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 64: South Asia and Pacific Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 66: South Asia and Pacific Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 68: South Asia and Pacific Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 70: South Asia and Pacific Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 72: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 74: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 75: East Asia Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 76: East Asia Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 77: East Asia Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 78: East Asia Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 79: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 80: East Asia Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 81: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 82: East Asia Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 83: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 84: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 86: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2019 to 2034

Table 88: Middle East and Africa Market Volume (Unit Pack) Forecast by Source, 2019 to 2034

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 90: Middle East and Africa Market Volume (Unit Pack) Forecast by End-user, 2019 to 2034

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 92: Middle East and Africa Market Volume (Unit Pack) Forecast by Application, 2019 to 2034

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 94: Middle East and Africa Market Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 96: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Source, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by End-user, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 6: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 8: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 11: Global Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 12: Global Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 13: Global Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 14: Global Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 15: Global Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 16: Global Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 17: Global Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 18: Global Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 19: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 20: Global Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 21: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 22: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 23: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 24: Global Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 25: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 26: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 27: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 28: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 29: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 30: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 31: Global Market Attractiveness by Source, 2024 to 2034

Figure 32: Global Market Attractiveness by End-user, 2024 to 2034

Figure 33: Global Market Attractiveness by Application, 2024 to 2034

Figure 34: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 35: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 36: Global Market Attractiveness by Region, 2024 to 2034

Figure 37: North America Market Value (US$ Million) by Source, 2024 to 2034

Figure 38: North America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 39: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 40: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 41: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 42: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 44: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 47: North America Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 48: North America Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 49: North America Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 50: North America Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 51: North America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 52: North America Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 53: North America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 54: North America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 55: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 56: North America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 57: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 58: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 59: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 60: North America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 61: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 62: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 63: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 64: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 65: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 66: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 67: North America Market Attractiveness by Source, 2024 to 2034

Figure 68: North America Market Attractiveness by End-user, 2024 to 2034

Figure 69: North America Market Attractiveness by Application, 2024 to 2034

Figure 70: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 71: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: North America Market Attractiveness by Country, 2024 to 2034

Figure 73: Latin America Market Value (US$ Million) by Source, 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) by End-user, 2024 to 2034

Figure 75: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 76: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 77: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 83: Latin America Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 84: Latin America Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 87: Latin America Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 88: Latin America Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 89: Latin America Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 91: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 92: Latin America Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 95: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 96: Latin America Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 99: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 100: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 103: Latin America Market Attractiveness by Source, 2024 to 2034

Figure 104: Latin America Market Attractiveness by End-user, 2024 to 2034

Figure 105: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 106: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 107: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 108: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 109: Western Europe Market Value (US$ Million) by Source, 2024 to 2034

Figure 110: Western Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 111: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 113: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 114: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 116: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 119: Western Europe Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 120: Western Europe Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 123: Western Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 124: Western Europe Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 127: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 128: Western Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 131: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 132: Western Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 135: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 136: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 139: Western Europe Market Attractiveness by Source, 2024 to 2034

Figure 140: Western Europe Market Attractiveness by End-user, 2024 to 2034

Figure 141: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 142: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 143: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 145: Eastern Europe Market Value (US$ Million) by Source, 2024 to 2034

Figure 146: Eastern Europe Market Value (US$ Million) by End-user, 2024 to 2034

Figure 147: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 148: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 149: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 152: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 156: Eastern Europe Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 160: Eastern Europe Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 164: Eastern Europe Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 168: Eastern Europe Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 172: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 175: Eastern Europe Market Attractiveness by Source, 2024 to 2034

Figure 176: Eastern Europe Market Attractiveness by End-user, 2024 to 2034

Figure 177: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 178: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 179: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 180: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 181: South Asia and Pacific Market Value (US$ Million) by Source, 2024 to 2034

Figure 182: South Asia and Pacific Market Value (US$ Million) by End-user, 2024 to 2034

Figure 183: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 184: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 188: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 192: South Asia and Pacific Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 196: South Asia and Pacific Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 200: South Asia and Pacific Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 204: South Asia and Pacific Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 208: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 211: South Asia and Pacific Market Attractiveness by Source, 2024 to 2034

Figure 212: South Asia and Pacific Market Attractiveness by End-user, 2024 to 2034

Figure 213: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 214: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 215: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 217: East Asia Market Value (US$ Million) by Source, 2024 to 2034

Figure 218: East Asia Market Value (US$ Million) by End-user, 2024 to 2034

Figure 219: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 220: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 221: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 222: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 224: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 227: East Asia Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 228: East Asia Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 231: East Asia Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 232: East Asia Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 233: East Asia Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 235: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 236: East Asia Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 239: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 240: East Asia Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 243: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 244: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 247: East Asia Market Attractiveness by Source, 2024 to 2034

Figure 248: East Asia Market Attractiveness by End-user, 2024 to 2034

Figure 249: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 250: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 251: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 252: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 253: Middle East and Africa Market Value (US$ Million) by Source, 2024 to 2034

Figure 254: Middle East and Africa Market Value (US$ Million) by End-user, 2024 to 2034

Figure 255: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 256: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 257: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 260: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2019 to 2034

Figure 264: Middle East and Africa Market Volume (Unit Pack) Analysis by Source, 2019 to 2034

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2024 to 2034

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2024 to 2034

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 268: Middle East and Africa Market Volume (Unit Pack) Analysis by End-user, 2019 to 2034

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 272: Middle East and Africa Market Volume (Unit Pack) Analysis by Application, 2019 to 2034

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 276: Middle East and Africa Market Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 280: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 283: Middle East and Africa Market Attractiveness by Source, 2024 to 2034

Figure 284: Middle East and Africa Market Attractiveness by End-user, 2024 to 2034

Figure 285: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 286: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 287: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 288: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multivitamin-Infused Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Ectoin Gummies Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Jellies and Gummies Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA