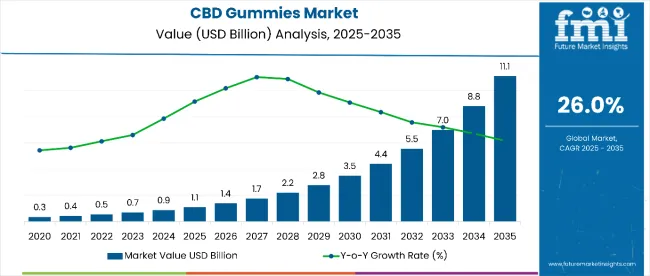

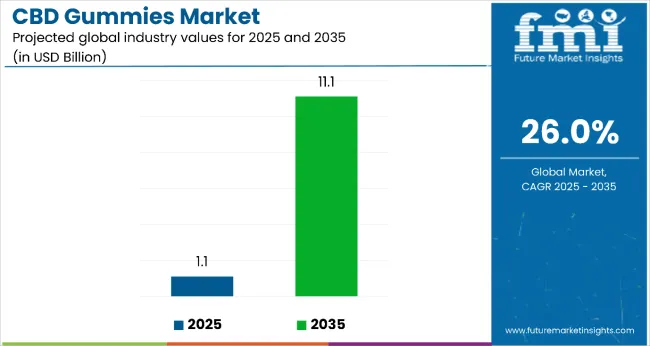

The CBD gummies market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a CAGR of 26.0% over the forecast period. The market is anticipated to deliver an absolute dollar opportunity of USD 10.0 billion over the ten-year period, reflecting a 10.09-times growth, fueled by the rapid expansion of legal cannabis use and growing consumer interest in convenient, non-intoxicating wellness formats.

| Metric | Value |

|---|---|

| CBD Gummies Market Estimated Value (2025E) | USD 1.1 billion |

| CBD Gummies Market Forecast Value (2035F) | USD 11. 1 billion |

| Forecast CAGR (2025 to 2035) | 26.0% |

By 2030, the market is likely to surpass USD 4.6 billion, contributing approximately USD 3.5 billion in incremental value during the first half of the decade. The remaining USD 6.5 billion is expected between 2030 and 2035, signaling a strong, front-loaded growth trajectory. Product uptake is accelerating due to CBD gummies ease of consumption, consistent dosing, and appeal to wellness-conscious consumers seeking alternatives to pills and tinctures.

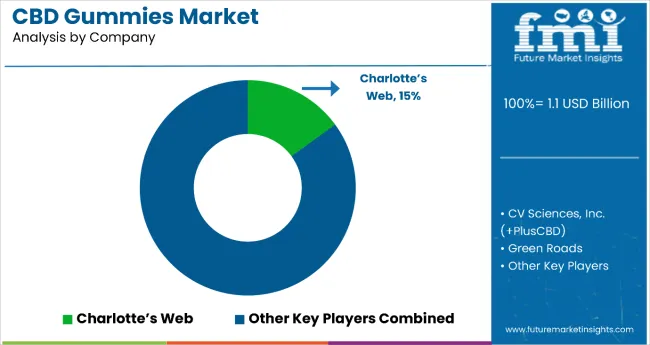

Companies such as Charlotte’s Web, CV Sciences, Inc. (+PlusCBD), Green Roads, CBDfx, and Medterra CBD are fortifying their competitive positions through innovation in full-spectrum and isolate-based formulations, branding strategies, and expansion into online and retail channels. The market is expected to be shaped by regulatory clarity, consumer education, and product differentiation based on potency, spectrum type, and delivery formats.

The market holds approximately 46% of the global CBD edibles market, driven by growing consumer preference for convenient, flavored, and discreet delivery formats. Its appeal is particularly strong among wellness-focused consumers seeking non-intoxicating ways to manage stress, pain, and sleep. The segment represents nearly 39% of the cannabinoid-infused functional food market, supported by expanding applications in mood-enhancing and therapeutic gummies.

CBD gummies account for about 36% of the North American CBD consumables market, where legalization trends and product innovation continue to support growth. The market contributes nearly 33% to the hemp-derived wellness products category, reflecting increased trust in standardized dosage and consistent formulations. It also holds close to 31% of the online CBD retail market, where digital convenience, variety, and educational content are accelerating product adoption.

The market is undergoing structural transformation driven by regulatory clarity, brand consolidation, and expanding consumer demographics. Advances in formulation science, including the use of nano emulsions and full-/broad-spectrum extracts, are improving bioavailability and consumer satisfaction. Manufacturers are launching THC-free, low-sugar, and vegan gummy variants to appeal to health-conscious users and wellness-oriented product segments, extending CBD gummies' role well beyond recreational use.

CBD gummies’ appeal lies in their convenient, flavorful, and discreet format, combined with non-intoxicating wellness benefits such as stress relief, improved sleep, and pain management. These attributes make them highly attractive to health-conscious consumers seeking natural alternatives to pharmaceuticals and traditional supplements.

The market is further driven by growing consumer awareness of CBD’s therapeutic potential, increasing legalization of hemp-derived products, and a shift toward preventive wellness routines. As consumers become more educated about cannabinoid health benefits, CBD gummies are gaining rapid traction in nutraceutical, functional food, and wellness applications.

Additionally, advances in formulation including improved bioavailability, THC-free options, and vegan-friendly formats are enhancing product quality and expanding consumer reach. With regulatory clarity improving across key markets and e-commerce platforms enabling wide accessibility, CBD gummies are well-positioned to benefit from the continued shift toward natural, functional, and personalized wellness products.

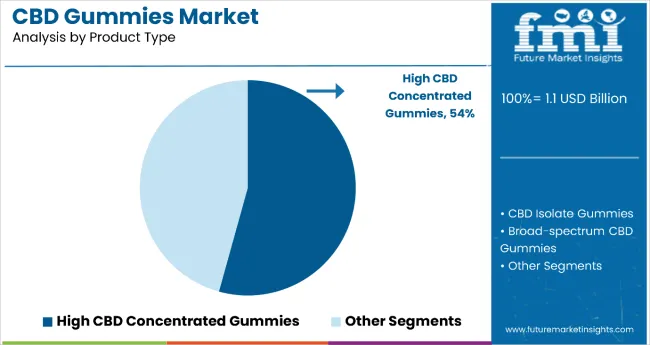

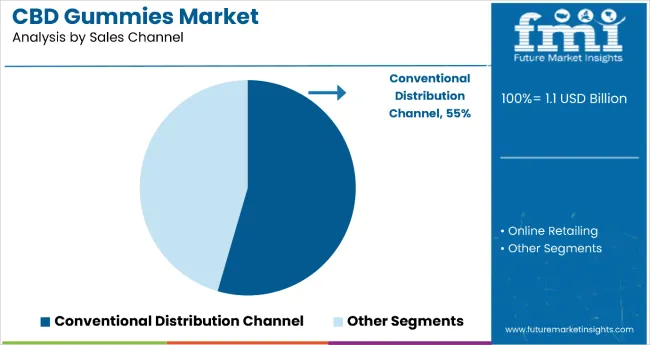

The market is segmented by product type, sales channel, packaging, and region. By product type, the market is classified into high CBD concentrated gummies, CBD isolate gummies, broad-spectrum CBD gummies, and full-spectrum CBD gummies. Based on sales channel, the market is bifurcated into conventional distribution channels (supermarkets/hypermarkets, head shops, smoke shops, local health stores, and others such as CBD kiosks, supplement stores, and holistic wellness outlet sand online retailing. In terms of packaging, the market is divided into pouches, bottles, jars, tins, and others such as (stick packs, blister packs, and single-serve sachets). Regionally, the market is characterized into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The high CBD concentrated gummies segment leads the global CBD gummies market with a projected 54% market share in 2025, driven by growing demand for higher-dosage, fast-acting CBD solutions among consumers managing chronic pain, anxiety, and sleep disorders. Offering 25 mg or more of CBD per serving, these high-potency gummies deliver quicker therapeutic effects while reducing the number of gummies needed per dose. Health-conscious consumers are increasingly prioritizing efficacy, bioavailability, and measurable results, all of which favor high-concentration formats.

The price-per-milligram advantage further strengthens appeal among repeat users seeking cost efficiency. As regulatory frameworks evolve and dosage labeling becomes more transparent, trust in high-strength CBD products continues to rise. Supported by clinical evidence for high-dose CBD efficacy, this segment is also expanding into sports recovery, sleep aid, and mental wellness categories, solidifying its long-term growth prospects.

The conventional distribution channel dominates the CBD gummies market with a projected 55% share in 2025, benefiting from a trusted in-store buying experience where consumers can review product labels, dosage information, and certifications before purchase. Supermarkets, hypermarkets, and local health stores are seeing strong growth as wellness-focused CBD brands secure prominent shelf space. Head shops and smoke shops cater to returning customers, while health stores attract first-time and wellness-oriented buyers.

In markets such as the USA and Canada, mainstream retailers are increasingly stocking CBD products post-legalization, offering premium placement and promotional support. Despite the expansion of e-commerce, many consumers prefer face-to-face consultation, especially for high-dosage or therapeutic formats. With in-store education, loyalty programs, and sampling opportunities, conventional retail remains a critical channel for brand visibility, consumer trust, and market penetration.

Between 2025 and 2035, growing consumer interest in natural wellness solutions and stress-relief supplements is expected to drive significant demand for CBD gummies. With expanding regulatory clarity and increased acceptance of hemp-derived products, CBD gummies are positioned as a convenient, non-intoxicating solution for pain relief, anxiety, and sleep management. Brands that focus on clinically supported, accurately dosed formulations are likely to benefit most from this trend.

Therapeutic Versatility and Consumer Preference Drive CBD Gummies Market Growth

The rising popularity of CBD gummies is largely attributed to their multi-functional health benefits and ease of use. By 2024, clinical and consumer data reinforced CBD’s effectiveness for sleep, stress, and inflammation, factors that encouraged widespread adoption across wellness categories. In 2025, consumers are expected to increasingly favor gummies over tinctures and capsules due to superior taste, pre-dosed convenience, and discretion in usage.

As health-conscious users seek natural, THC-free solutions with measurable outcomes, high-concentration, full-spectrum, and vegan formulations are expected to dominate the market. Brands that deliver certified potency and transparency in sourcing are well-positioned to capture the loyalty of educated wellness consumers and clinical practitioners recommending CBD-based interventions.

Regulatory Complexity and Misinformation Restrain Market Expansion

Despite strong consumer interest, the CBD gummies market still faces regulatory and labeling inconsistencies, particularly in regions where cannabis laws remain fragmented. The lack of standardized testing, inconsistent enforcement, and the prevalence of low-quality or mislabeled products may erode consumer trust. Furthermore, ongoing misconceptions around CBD’s association with THC and psychoactive effects continue to hinder first-time adoption, especially in emerging markets. To address these concerns, leading manufacturers are investing in 3rd-party lab testing, GMP-certified production, and clear dosage guidance, aiming to differentiate from unregulated players and meet future compliance standards.

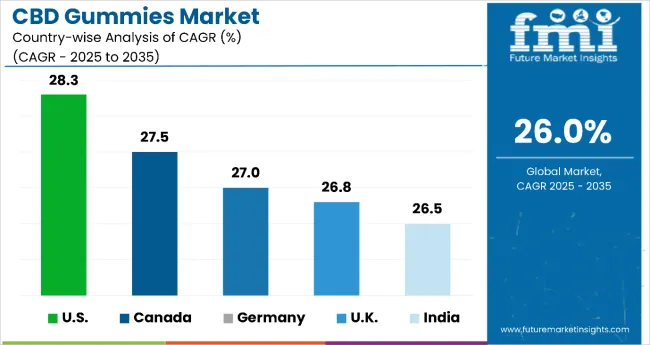

| Country | CAGR |

|---|---|

| USA | 28.3% |

| Canada | 27.5% |

| Germany | 27.0% |

| UK | 26.8% |

| India | 26.5% |

Between 2025 and 2035, the USA leads the CBD gummies market with a projected CAGR of 28.3%, reflecting strong regulatory support, a mature wellness culture, and increasing senior citizen adoption. Canada closely follows with a 27.5% CAGR, driven by its progressive cannabis legislation and demand for clean-label edibles. Germany posts a 27% CAGR, benefitting from EU regulatory alignment and growing pharmacy-level acceptance. The UK, at 26.8% CAGR, is rapidly mainstreaming CBD through retail and e-commerce, with emphasis on vegan and stress-relief products. India, while still developing its regulatory clarity, shows strong momentum with a 26.5% CAGR, propelled by Ayurveda-based CBD and metro-driven demand.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA CBD gummies market is projected to grow at a CAGR of 28.3% from 2025 to 2035, driven by favorable regulations, wellness trends, and increasing demand for non-psychoactive CBD edibles. The USA has become a leading hub for CBD innovation, with manufacturers focusing on high-concentration, full-spectrum products. Increasing retail availability, especially across pharmacies and wellness stores, is aiding product accessibility. The segment is also benefiting from growing senior citizen interest in CBD for pain and sleep support. Evolving FDA positions on CBD in functional food also shape the landscape.

The CBD gummies market in Canada is expected to expand at a CAGR of 27.5% from 2025 to 2035, fueled by the country’s progressive cannabis laws and consumer preference for discreet, edible wellness options. The legal framework under the Cannabis Act has supported a surge in licensed manufacturers offering THC-free CBD formulations. Demand for sugar-free and natural ingredient-based products is also contributing to premiumization. Canadian consumers are particularly receptive to sustainability claims, prompting brands to adopt recyclable packaging and organic certifications.

Sales of CBD gummies in Germanyare forecast to grow at a CAGR of 27% from 2025 to 2035, with increasing mainstreaming of CBD wellness products among health-conscious consumers. While EU Novel Food regulations apply, Germany’s market benefits from growing physician and pharmacy-level awareness of cannabidiol benefits. Retailers are emphasizing THC-free and medically-aligned formulations. Online sales platforms have helped in expanding reach, especially in tier-2 and tier-3 cities. Germany also sees rising demand for full-spectrum and broad-spectrum variants from the aging population.

The UK CBD gummies revenue is advancing at a CAGR of 26.8% from 2025 to 2035, with CBD gaining mainstream acceptance through high-street retailers, health food stores, and e-commerce platforms. Brands are increasingly targeting wellness-focused consumers with clean-label, vegan, and gelatin-free offerings. Product positioning is shifting from recreational to health-enhancing, particularly around stress relief and sleep aid. Ongoing MHRA oversight and FSA Novel Food submissions shape product compliance across the market.

Sales of CBD gummies in Indiaare projected to grow at a CAGR of 26.5% from 2025 to 2035, driven by rising wellness awareness and the gradual destigmatization of hemp-based products. Though regulatory ambiguity exists, Ayurveda-aligned formulations and THC-compliant offerings are gaining acceptance. Startups are introducing niche variants infused with ashwagandha, turmeric, and natural adaptogens. Demand is surging in metro cities with high disposable income and growing e-commerce access. Product acceptance is rising among young adults seeking natural solutions to anxiety and insomnia.

The CBD gummies market is moderately consolidated, led by Charlotte’s Web Holdings, Inc., which commands a 7.8% market share. The company’s dominance stems from its vertically integrated operations, robust online presence, wide product variety, and emphasis on USA-grown hemp and full-spectrum formulations.

Leading player status is held by Charlotte’s Web Holdings, Inc. Other key players include Medterra CBD, CBDfx, Green Roads, Sunday Scaries, Joy Organics, Verma Farms, PureKana, JustCBD, Hemp Bombs, and Premium Jane, all of whom offer diverse CBD gummy formats including broad-spectrum, full-spectrum, and CBD isolate variants with targeted functionalities such as sleep aid, pain relief, and relaxation. Their success is underpinned by clean-label ingredients, third-party lab testing, and compliance with regulatory standards.

Emerging players are gaining entry via niche wellness positioning, adaptogen blends, and D2C distribution. However, legacy players retain a competitive edge through scale, brand trust, and pharmacy partnerships. Market growth is being fueled by the rising demand for natural anxiety relief, sleep solutions, and legalization-led access expansion across key regions.

Key Development in CBD Gummies Market

In November 2024, CV Sciences announced that it had entered into a purchase agreement to acquire Extract Labs, Inc., which manufactures and distributes premium cannabinoid offerings, including gummies, tinctures, and topicals.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | High CBD Concentrated Gummies, CBD Isolate Gummies, Broad-spectrum CBD Gummies, Full-spectrum CBD Gummies |

| sale s channel | Conventional Distribution Channels (Supermarkets/Hypermarkets, Head Shops, Smoke Shops, Local Health Stores, and Others (Gas Stations, Kiosks, Convenience Stores ), and wellness spas, Online Retailing |

| Packaging | Pouches, Bottles, Jars, Tins, and Others (includes blister packs, sachets, and single-serve wraps used primarily for sample or travel-sized products) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | CV Sciences, Charlotte's Web, Verma Farms, PureKana, Dixie Brands Inc., Premium Jane, Kushie Bites, Sunday Scaries, Hemp Bombs, Reliva CBD Wellness, CBD Oil Europe, Medterra, Balance CBD, CBDfx, CBD Pure. |

| Additional Attributes | Dollar sales by product type and sales channel, rising adoption among wellness-focused millennials, demand for THC-free and full-spectrum products, regulatory developments in CBD legalization and compliance, innovation in gummy formulation for sleep, anxiety, and pain management |

The global CBD gummies market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the CBD gummies market is projected to reach USD 11.1 billion by 2035.

The CBD gummies market is expected to grow at a 26.0% CAGR between 2025 and 2035.

The high CBD concentrated gummies segment is projected to lead the CBD gummies market with 54% market share in 2025.

In terms of sales channel, the conventional distribution channel segment is expected to command 55% share in the CBD gummies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

CBD-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

CBD Skin Care Market Size and Share Forecast Outlook 2025 to 2035

CBD Oil Market Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of CBD Product Packaging Market Share

Pet CBD Market

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Cannabidiol CBD Pet Market Size and Share Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Ectoin Gummies Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Jellies and Gummies Market Size and Share Forecast Outlook 2025 to 2035

Multivitamin Gummies Market Analysis by Source, End-user, Application, Sales Channel, Distribution Channel, and Region Through 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA