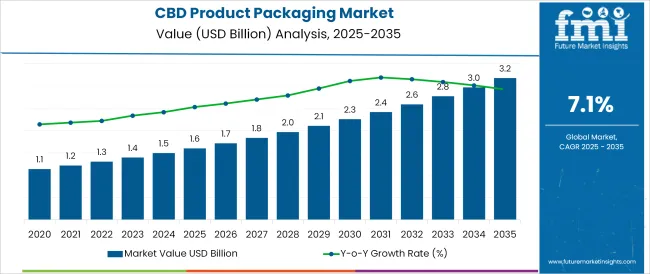

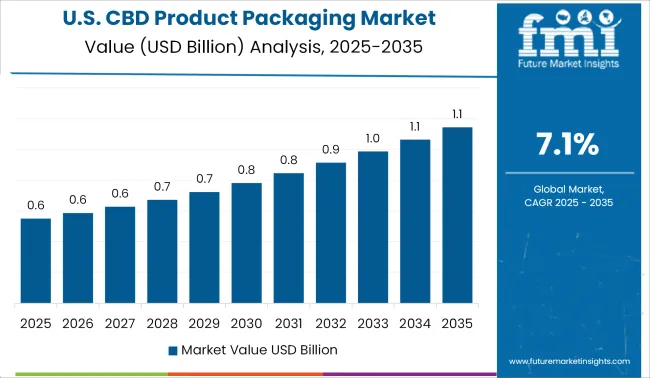

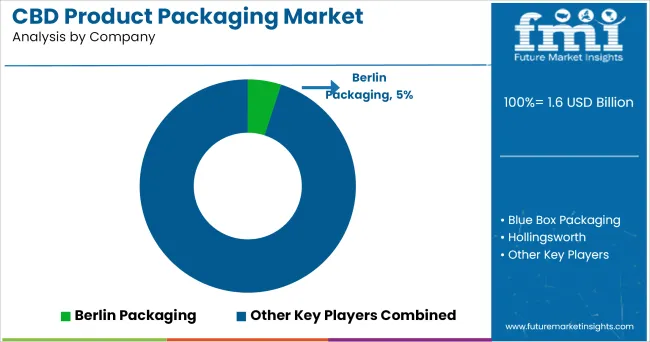

The CBD Product Packaging Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

The CBD product packaging market is gaining momentum as regulatory clarity, consumer trust, and brand differentiation emerge as central drivers in the cannabis derived products industry. Increasing demand for premium, compliant, and sustainable packaging has prompted manufacturers to invest in innovative formats that align with both consumer expectations and legal requirements.

The market is being shaped by heightened focus on child resistant designs, tamper-evidence, and environmentally friendly materials, which are enabling brands to enhance credibility and competitiveness. Future growth is anticipated to be bolstered by the rising legalization of CBD in new geographies, expansion of product portfolios beyond oils to include edibles and topicals, and continued emphasis on premiumization.

The integration of aesthetic appeal with functional safety features and sustainable materials is paving the path for sustained adoption and diversification of packaging solutions.

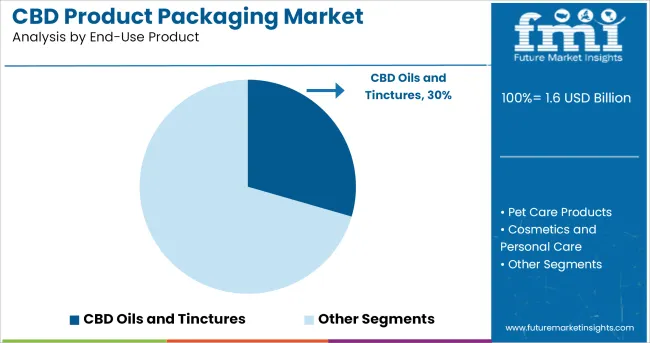

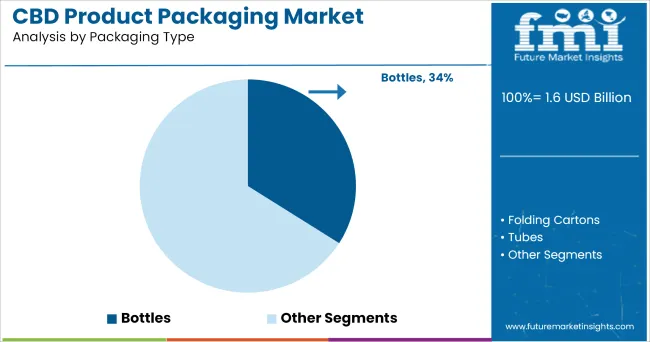

The market is segmented by End-Use Product, Packaging Type, Packaging Material, and Sales Channel and region. By End-Use Product, the market is divided into CBD Oils and Tinctures, Pet Care Products, Cosmetics and Personal Care, Beverages, Supplements, and Snacks. In terms of Packaging Type, the market is classified into Bottles, Folding Cartons, Tubes, Jars, Metal Tins, and Bags & Pouches.

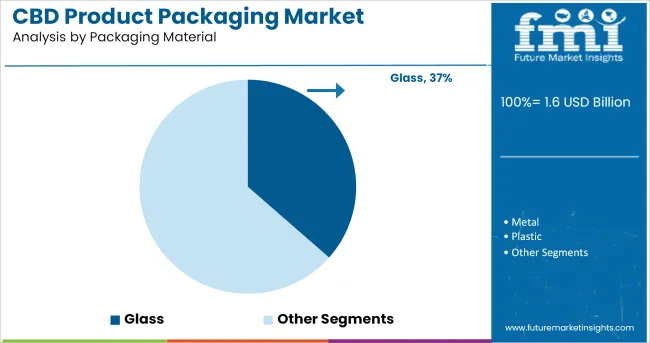

Based on Packaging Material, the market is segmented into Glass, Metal, Plastic, Cloth, and Paperboard. By Sales Channel, the market is divided into Online Channel, Modern Trade, Franchised Outlets, and Specialty Store. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by end-use product, CBD oils and tinctures are projected to hold 29.5% of the total market revenue in 2025, maintaining their leadership within the market. This dominance is attributed to the widespread consumer acceptance of oils and tinctures as the most accessible and versatile form of CBD consumption.

Their liquid format necessitates secure, leak proof, and dosage-controlled packaging, which has led to specialized innovations within this segment. The higher price point and perceived medicinal value of oils and tinctures have also motivated brands to invest in premium packaging that conveys quality and compliance.

Demand from both medical and wellness consumers has reinforced the need for packaging that ensures product integrity, precise dispensing, and extended shelf life. These factors collectively have positioned oils and tinctures as the cornerstone of end use demand in the CBD packaging landscape.

Segmented by packaging type, bottles are expected to account for 34.0% of the market revenue in 2025, securing their position as the leading packaging format. This prominence is driven by the compatibility of bottles with liquid and semi-liquid CBD products, particularly oils, tinctures, and topicals, where measured dispensing and preservation of potency are essential.

The adaptability of bottles to incorporate child-resistant caps, droppers, and tamper evident seals has further solidified their suitability in meeting regulatory and consumer safety requirements. Additionally, bottles offer ample surface area for branding and compliance labeling, enhancing their appeal to manufacturers seeking both functionality and marketability.

The durability and reusability of bottles have also contributed to their preference, particularly in premium product categories where presentation and user experience are prioritized. This combination of compliance, utility, and aesthetic value has reinforced bottles as the dominant packaging type.

When segmented by packaging material, glass is forecast to capture 36.5% of the total market revenue in 2025, establishing itself as the leading material choice. This leadership is underpinned by glass’s inherent advantages in preserving product purity, preventing contamination, and enhancing shelf appeal.

Its impermeable nature protects CBD formulations from moisture, oxygen, and UV exposure, which is critical for maintaining potency and efficacy over time. The premium look and feel of glass align well with the positioning of CBD products as high quality wellness or therapeutic items, further strengthening its preference among both brands and consumers.

The recyclability and perceived sustainability of glass have also aligned with the growing emphasis on eco-friendly packaging solutions, supporting its continued use. This combination of functional, aesthetic, and environmental benefits has made glass the material of choice across the CBD product packaging market.

Heightening pharmaceutical sector coupled with escalating trend of CBD infused medicines may upsurge demand for packaging products. According to IMF, Spending on healthcare sector is likely to increase by 6% on y-o-y basis in regards to current GDP forecast.

However, currently healthcare industry accounts for 10% of global GDP. Gradual uptrend in healthcare industry is expected to aid the packaging sector over the evaluation period.

CBD has been approved and legalized in a number of countries for both recreational and therapeutic purposes. In the United States, thirty-four states (including Washington, DC) have authorized CBD for therapeutic purposes, including 10 states legalizing CBD for both recreational and medicinal purposes.

CBD-infused supplements can aid with a variety of health and lifestyle issues, including anxiety, behaviour disorder, sleep disorders and few more, which might help the market grow throughout the forecast period.

Increasing trend for CBD infused beverages and snacks is one of the prominent end use industry. Dynamically shifting consumer preference towards the packaged food may aid to brisk penetration. Surging demand for such edibles will proportionally emphasize demand for packaging materials.

Whereas, in pet care products such as therapeutic-grade CBD oil for pet is anticipated to witness significant growth due to its wide range of applications, including pain and inflammation treatment. CBD oil for pets is gaining in popularity due to its increased adoptability and absence of tetrahydrocannabinol (THC), which eliminates the euphoric impact and does not disrupt a pet's nervous system.

In depth Analysis and exhaustive research has been conducted by the specialized team of FMI in packaging sector amidst light on six crucial regions including North America, Latin America, Europe, East Asia, South Asia & Oceania, Middle East & Africa. Among these prominent regions North America seems to be at forefront along with a significant global revenue share over the evaluation period.

Rising demand for CBD infused products across multitude avenues over multiple sectors attributed to intensified disposable income is expected to portray an upsurge in global revenue bar over the next decade.

North America is presumed to corner a significant CBD product packaging market share and possess an enormous growth trend over the assessment period. Due to world’s largest federally legal adult use of CBD in Canada with a blend of legalized framework in USA States, North America is likely to be the pivot for global industry.

The United States as well as Canada is dominant in legalizing the use of CBD which further influencing numerous countries and their regulatory bodies to approach towards the legalization of CBD.

Whereas, Asia has been historically known for their most restrictive cannabis policies. Asia comparatively lags behind other region owing to legalization of CBD. As far now recently in 2020 two countries “Thailand and South Korea” of Asia Pacific has legalized CBD for medical purposes.

However the trend of legalizing CBD is escalating gradually which further expected to amid growth for packaging sector. Although Asia have potential to dominate on global market owing to severe factors including fertility yield, low cost labor and gradually expanding industrialization.

However, Middle East and Africa is expected to register an immense demand for CBD product packaging owing to significant consumption of cannabis and hemp. Due to high consumption rate MEA is presumed to expand exponentially with a healthy CAGR over the forecast period.

Some of the leading manufacturers and suppliers operating at the global scale are

Market is evaluated as moderately consolidated Tier-1 players operating at global scale is presumed to hold a significant market share. Whereas, prominent players are opting both organic and inorganic growth strategies in order to expand their business horizontally and vertically.

Product launch, technological advancement, product development are the most preferable strategies which are being opted. However, companies are also leaned to robust their sales and distribution network worldwide.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global CBD product packaging market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the CBD product packaging market is projected to reach USD 3.2 billion by 2035.

The CBD product packaging market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in CBD product packaging market are CBD oils and tinctures, PET care products, cosmetics and personal care, beverages, supplements and snacks.

In terms of packaging type, bottles segment to command 34.0% share in the CBD product packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of CBD Product Packaging Market Share

CBD-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

CBD Skin Care Market Size and Share Forecast Outlook 2025 to 2035

CBD Oil Market Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

Pet CBD Market

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Cannabidiol CBD Pet Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Product Design Verification And Validation Solution Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA