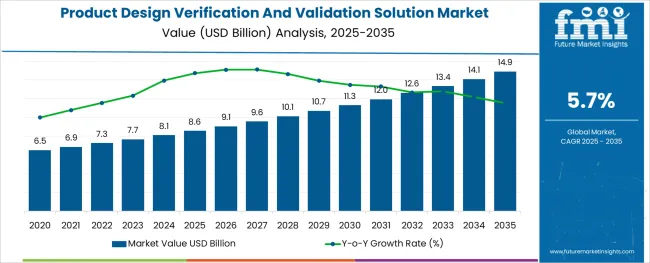

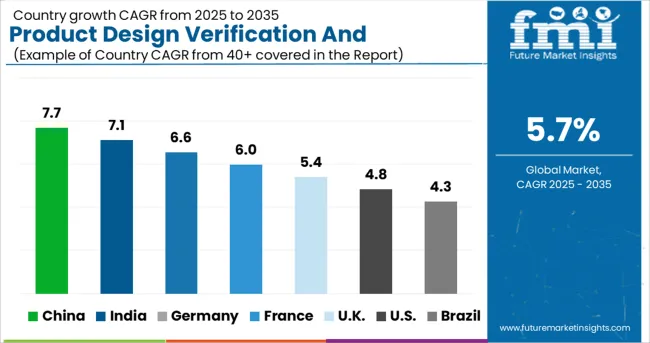

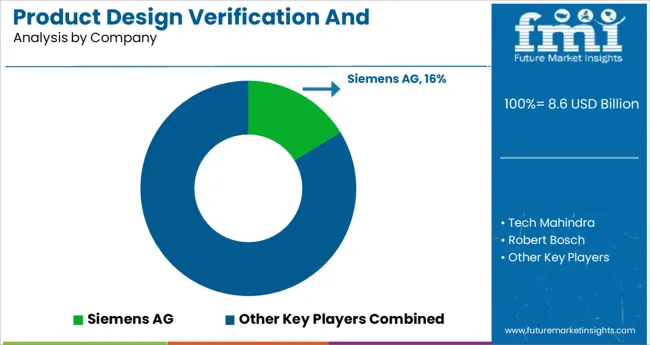

The Product Design Verification And Validation Solution Market is estimated to be valued at USD 8.6 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The product design verification and validation solution market is experiencing significant growth driven by the increasing complexity of product development and the demand for high-quality, reliable products. Industries are focusing on reducing product development cycles while ensuring compliance with stringent quality standards. The rising adoption of digital tools and simulation technologies has enhanced the efficiency and accuracy of design verification processes.

Furthermore, growing regulatory requirements and the need to minimize product recalls have pushed companies to invest in robust validation solutions. The market is expected to expand further due to increasing emphasis on innovation and the integration of automated testing systems.

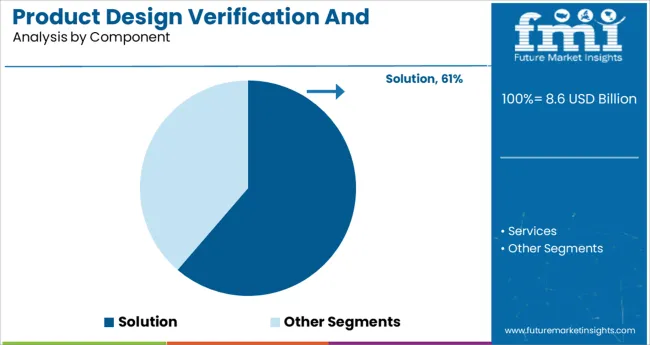

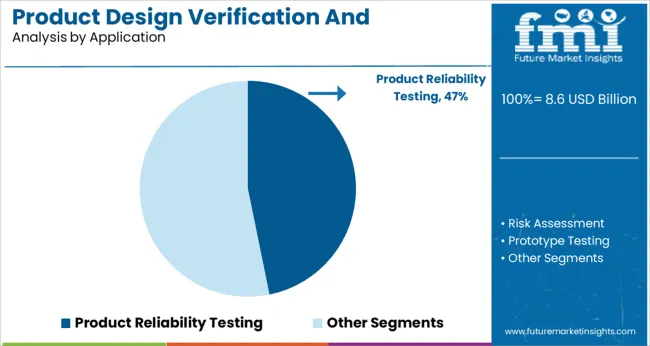

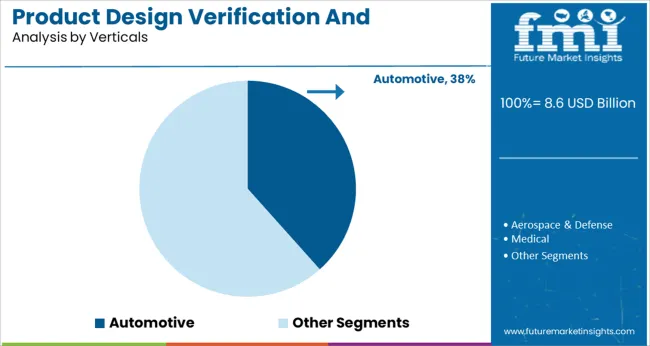

Segmental growth is being driven primarily by the Solution component, Product Reliability Testing application, and the Automotive vertical, which demands rigorous quality assurance for safety-critical products.

The market is segmented by Component, Application, and Verticals and region. By Component, the market is divided into Solution and Services. In terms of Application, the market is classified into Product Reliability Testing, Risk Assessment, Prototype Testing, and Environment Testing. Based on Verticals, the market is segmented into Automotive, Aerospace & Defense, Medical, Industrial Automation, and IT & Telecom. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Component, Application, and Verticals and region. By Component, the market is divided into Solution and Services. In terms of Application, the market is classified into Product Reliability Testing, Risk Assessment, Prototype Testing, and Environment Testing. Based on Verticals, the market is segmented into Automotive, Aerospace & Defense, Medical, Industrial Automation, and IT & Telecom. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solution segment is projected to hold 61.3% of the market revenue in 2025, establishing itself as the leading component category. Growth in this segment is attributed to the widespread adoption of comprehensive software and hardware solutions that streamline the verification and validation process.

These solutions provide integrated platforms for simulation, testing, and data analysis, helping companies detect design flaws early and reduce costly iterations. The increasing complexity of modern products across sectors has driven demand for versatile and scalable verification tools.

Additionally, the shift towards Industry 4.0 and digital twins has accelerated the uptake of advanced solutions that enable virtual testing environments. This segment’s expansion reflects the growing need for efficient and reliable design validation workflows across industries.

The Product Reliability Testing segment is expected to contribute 46.8% of the market revenue in 2025, maintaining its position as the dominant application area. This segment’s growth has been driven by the critical role of reliability testing in ensuring product durability and performance under various operating conditions.

Industries have prioritized reliability testing to meet customer expectations, reduce warranty costs, and comply with safety standards. Increasing adoption of accelerated life testing and environmental stress screening techniques has enhanced the accuracy and speed of reliability assessments.

The importance of reliability in competitive markets has pushed companies to invest in comprehensive testing frameworks. As product lifecycles shorten and quality demands rise, reliability testing remains a cornerstone of the verification and validation process.

The Automotive vertical is projected to represent 38.4% of the market revenue in 2025, securing its position as the leading industry sector. The automotive industry’s focus on safety, regulatory compliance, and technological innovation has driven significant investments in design verification and validation solutions.

Increasing complexity of vehicle systems, including electric and autonomous vehicles, has heightened the need for rigorous testing and validation protocols. Manufacturers are adopting advanced solutions to verify software, hardware, and integrated systems to prevent failures and ensure customer satisfaction.

Additionally, growing pressure to reduce time-to-market and development costs has encouraged the use of automated and virtual validation tools. With ongoing innovation and evolving safety standards, the automotive sector is expected to continue leading demand for verification and validation solutions.

Thedemand for product design verification and validation solutionsis anticipated to increase at a robust pace over the forecast period (2025 to 2035). Growth in the market is attributed to the increasing need for efficient and improved design quality products worldwide.

Verification and validation of products are two separate procedures extensively used by end-users to cross-check the quality of products and services. The expansion of manufacturing and retail sectors is increasing the need for improved quality of products.

To cater to the growing system requirements, industries are increasing the adoption andsales of product design verification and validation solutions. Evaluation of product's design and quality on the basis of specific development, design requirement, and conditions.

With the growing need for advanced products and customized requirements, especially in IT & telecom, healthcare, and manufacturing industries, key companies are developing advanced solutions for verifying and validating the design and quality of the product.

Thesales of product design verification and validation solutionswitnessed an uptick through 2024 amid growing demand for specific COVID-19 medicines and vaccination. Leading healthcare companies implemented advanced verification and validation solutions for efficient medicines to adhere to the surgingdemand for product design verification and validation solution.

Besides this, rapid digitization and automation in the public and manufacturing sector are also propelling the demand for product design verification, and validation solutions are slated to rise over the coming years.

Growing production and adoption ofsmart devicesand automated equipment in healthcare, retail, manufacturing, and industrial sectors are the major factors driving thedemand for product design verification and validation solutions.

Additionally, the integration of advanced technology such asmachine learning, big data, and artificial intelligence in these solutions is increasing sales in the market. With the surging expansion of the manufacturing industry and the development of industrial automated equipment, end users are implementing verification process solutions to determine the quality of the products.

They are also adopting solutions that verify the product quality as per the consumer's requirement to improve efficiency and reduce latency. This is projected to fuel thesales of product design verification and validation solutions.

As per Future Market Insights (FMI), Asia Pacific is expected to emerge as the most lucrativeproduct design verification and validation solution market.Rapid development in the manufacturing and healthcare industries, especially across India and China, will fuel thedemand for product design verification and validation solution.

The expansion of the retail sector and booming commercial industryin India is propelling the demand for improved quality products with specific requirements. Consumers are becoming increasingly aware of the products they require, enabling the increasedsales of product design verification and validation solutions.

Backed by these factors, the Asia Pacificdemand for product design verification and validation solutionsis slated to witness growth at a significant rate during the assessment period.

According to FMI, the North Americansales of product design verification and validation solution areprojected to account for the lion’s share between 2025 and 2035.

Ongoing advances in the manufacturing, transportation and IT sectors are driving thedemand for product design verification and validation solutions.

Increasing demand for automation in these sectors and the need for efficient products will promote growth in North America.Demand for product design verification and validation solutionsis expected to increase with a heavy presence of industries and key players in the USA.

As per the study, the USA is projected to spearhead the growth in North Americanproduct design verification and validation solutions sales.

Some of the key participants present in the globalproduct design verification and validation solution marketinclude Igate Patni Ltd., MathWorks Inc., Tech Mahindra Ltd., Intent Design Pvt Ltd., The RealTime Group Inc., and IVT Network Limited, among others.

According to the study, the market is projected to be highly competitive due to the rise indemand for product design verification and validation solutions withnumerous leading players. Key players are collaborating with end users to cater to the surgingdemand for product design verification and validation solutionfor these solutions.

Some of the players are adopting strategies such as mergers & acquisitions and product development to increase theirsales of product design verification and validation solution. They are also integrating advanced technologies such as big data science and real-time analytics to improve the efficiency of the products.

| Report Attributes | Details |

|---|---|

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD Million, volume in kilotons, and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Component, Application, Verticals, Region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | The RealTime Group Inc.; MathWorks Inc.; IVT Network Limited; Intent Design Pvt Ltd.; Tech Mahindra Ltd.; and Igate Patni Ltd. among others |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global product design verification and validation solution market is estimated to be valued at USD 8.6 billion in 2025.

It is projected to reach USD 14.9 billion by 2035.

The market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types are solution and services.

product reliability testing segment is expected to dominate with a 46.8% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Product Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Product Information Management Market Growth – Trends & Forecast 2024-2034

Product Dispensing Machinery Market

Product Cost Management Market

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Competitive Overview of CBD Product Packaging Market Share

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Date Product Market Share

Teff Products Market

Dairy Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Early Production Facility Market Size and Share Forecast Outlook 2025 to 2035

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA