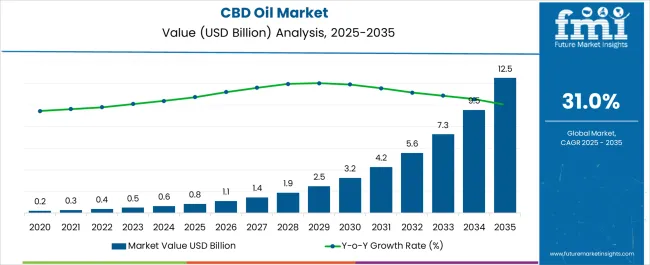

The CBD Oil Market is estimated to be valued at USD 0.8 billion in 2025 and is projected to reach USD 12.5 billion by 2035, registering a compound annual growth rate (CAGR) of 31.0% over the forecast period.

Market dynamics reflect the intersection of agricultural supply chains, pharmaceutical manufacturing processes, and consumer health trends. Production concentrates in regions with established hemp cultivation infrastructure and favorable regulatory frameworks, creating geographic clusters of manufacturing expertise. North American producers dominate large-scale extraction and processing operations, while European manufacturers focus on specialized formulations and quality certification protocols.

Distribution channels operate through multiple pathways including direct-to-consumer online platforms, specialty wellness retailers, pharmacies, and health food stores. The regulatory complexity creates segmented distribution strategies, with medical-grade products moving through pharmaceutical channels while wellness products utilize consumer retail networks. This dual-pathway approach generates different pricing structures and customer acquisition costs across product categories.

Consumer adoption patterns vary significantly across demographic groups and geographic regions. Early adopters typically demonstrate higher disposable incomes and pre-existing wellness product usage, while mainstream market penetration depends on regulatory clarity and physician endorsement. Age demographics show concentration in the 35-65 age range, with specific growth in senior populations seeking alternatives to traditional pain management and sleep aid products.

The supply chain involves agricultural producers, extraction facilities, manufacturing operations, quality testing laboratories, and distribution networks. Hemp cultivation requires specialized agricultural knowledge and compliance with tracking systems, creating entry barriers for new producers. Extraction processes demand significant capital investment in specialized equipment and facility certifications, while finished product manufacturing involves formulation expertise and packaging compliance across multiple jurisdictions.

Manufacturing facilities face competing priorities between production efficiency and regulatory compliance. Quality assurance departments must navigate testing requirements that vary by destination market, while production teams optimize for batch consistency and yield maximization. Procurement personnel balance raw material costs with quality specifications, often sourcing from multiple suppliers to ensure consistent inventory. These operational tensions create cost pressures that impact pricing strategies throughout the distribution chain.

Market competition includes established pharmaceutical companies developing prescription cannabinoid medications, consumer goods manufacturers entering through acquisition strategies, and specialized CBD companies building direct-to-consumer brands. The competitive landscape shifts as regulatory barriers either restrict or enable different participant categories, creating advantages for companies with compliance expertise and established distribution relationships.

Research and development activities focus on delivery mechanism optimization, bioavailability enhancement, and targeted formulations for specific health conditions. Product innovation requires substantial investment in clinical trials and regulatory submissions, while companies simultaneously must respond to rapidly changing consumer preferences and competitive product launches. The tension between innovation investment and market access timing creates strategic challenges for product development teams.

| Metric | Value |

|---|---|

| CBD Oil Market Estimated Value in (2025 E) | USD 0.8 billion |

| CBD Oil Market Forecast Value in (2035 F) | USD 12.5 billion |

| Forecast CAGR (2025 to 2035) | 31.0% |

The CBD oil market is experiencing robust expansion driven by increasing consumer awareness of therapeutic benefits, growing legalization of cannabis derived products, and rising acceptance across wellness and pharmaceutical sectors. Demand is being reinforced by clinical research highlighting CBD’s role in managing pain, anxiety, and neurological conditions, encouraging wider medical and recreational applications.

Pharmaceutical integration, coupled with innovations in extraction technologies, is ensuring consistency, purity, and efficacy, which are critical to healthcare adoption. Furthermore, consumer preference for natural and plant based remedies is accelerating the shift away from synthetic alternatives.

Regulatory clarity in key markets and investments in large scale production are expected to further consolidate growth. The market outlook remains positive with opportunities emerging in functional foods, nutraceuticals, and global healthcare distribution frameworks.

The hemp oil product type segment is projected to account for 58.60% of total market revenue by 2025, making it the leading product category. Its dominance is supported by widespread consumer acceptance, versatile applications, and favorable regulatory conditions for hemp derived products compared to marijuana based alternatives.

The high concentration of cannabinoids, cost effective cultivation, and easier scalability of hemp oil extraction processes have reinforced its position. Increasing demand from wellness and personal care industries has further elevated usage.

With consumers actively seeking non psychoactive CBD solutions, hemp oil continues to be the preferred option, driving its majority share in the product type category.

The pharmaceuticals application segment is expected to represent 42.30% of the total market revenue by 2025, positioning it as the dominant application area. This growth is being driven by clinical validation of CBD oil in treating conditions such as epilepsy, chronic pain, and anxiety disorders.

Pharmaceutical companies have been actively investing in CBD research and drug development to expand therapeutic portfolios. The integration of CBD oil into prescription medicines and supportive therapies has further reinforced adoption.

Additionally, regulatory approvals for specific CBD based medications in multiple regions are fostering trust among healthcare providers and patients, establishing pharmaceuticals as the most influential application segment.

The direct or B2B distribution channel is projected to capture 47.80% of the overall market revenue by 2025, highlighting its leadership position. This dominance is driven by bulk procurement from healthcare institutions, pharmaceutical companies, and wellness product manufacturers.

Direct channels ensure consistent quality, supply reliability, and competitive pricing for large scale buyers. Strategic partnerships between producers and B2B customers have enabled efficient product flow across domestic and international markets.

As manufacturers increasingly prioritize transparency, certification, and compliance in bulk supply, the direct or B2B channel has emerged as the preferred route, accounting for the largest share within distribution.

Increasing Understanding to control Market Demand and Supply

Small and medium-sized businesses are using cannabidiol more frequently as a result of growing public awareness of its therapeutic effects. Also, hemp oil is widely used in the pharmaceutical industry since it eases physical pain, which is a good indicator. This supports the market's expansion in turn.

Market Growth was Impacted by Cosmetic Industry’s Growth and Expansion

This market is expected to expand both directly and indirectly as a result of the personal care and cosmetics industry's growth and expansion. This is due to the fact that cannabidiol is useful for treating skin disorders, including eczema and psoriasis, as well as inflammation, discomfort, and redness brought on by ongoing outbreaks.

Increasing Research and Development Operations

Increased financing from the federal government related to research and development proficiencies is also encouraging the expansion of the industry. The best and quickest use of resources is likely to be ensured through research and development activities focused on sustainable development, increasing the market value.

| Attributes | Value |

|---|---|

| CBD Oil Value (2025) | USD 373.72 million |

| CBD Oil Market Expected Value (2025) | USD 389 million |

| CBD Oil Market Forecast Value (2035) | USD 5,980.6 million |

| CBD Oil Market Expected CAGR (2025 to 2035) | 31% |

Increasing demand for CBD oil in the production of medicines owing to its pain-reducing properties has been facilitating growth in the CBD oil market over the past few years. From 2020 to 2025, the market recorded a CAGR of 11.3%.

CBD oil regulates the endocannabinoid system (ECS) activity and interacts with neurotransmitters. This property makes it an ideal ingredient for anxiety and anti-depression drugs.

In 2020, The World Anti-Doping Agency (WADA) removed cannabidiol (CBD) oil from its list of a prohibited substances. However, all synthetic cannabinoids that mimic the effects of THC are prohibited.

Backed by favorable policies, the global CBD oils market recorded a CAGR of 31.5% and surpassed sales revenue of USD 0.6 million in 2024, says FMI.

Entrepreneurs in the CBD oil industry are concentrating on creating lotions, skin care, pet care, and textile items using cannabidiol, which on the other hand, is driving the CBD oil for pets market.

Increasing market prospects are likely to be offered, particularly in emerging economies, by increasing sales of a variety of CBD-fortified products, new product launches, and the expansion of the product pipeline.

The market is expected to expand as a result of increased research and development (R&D) efforts to lower THC concentration and growing pressure to obtain regulatory approval from agencies more quickly. However, regulations imposed on the application and sales of certain items are likely to hinder sales during the predicted period.

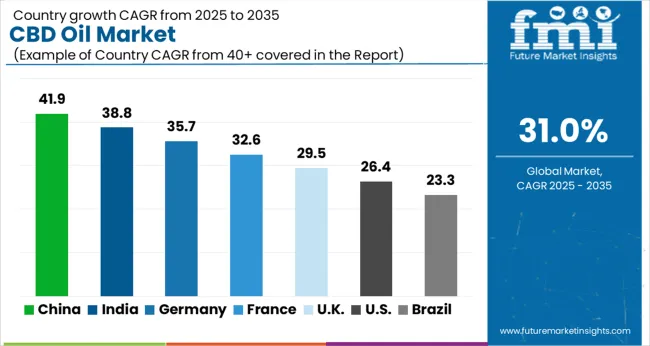

Due to a strong network of online sales channels, widespread knowledge of the many advantages of cannabidiol, and the introduction of retail products like CBD oil, CBD gummies, and CBD beverages in these regions, Europe and North America collectively are expected to hold more than 70% of the global market share for CBD oil.

Research has demonstrated that hemp and marijuana-derived CBD oil plants have the ability to reduce anxiety and tension. When taken as a supplement, CBD oil has therapeutic advantages for neurological illnesses and conditions like depression, discomfort from the nerves, insomnia, and inflammatory pain. This has accelerated the use of CBD oil in the production of drugs used to treat anxiety and pain.

Many pharmaceutical companies are looking to integrate CBD oil into pain-relief medication and introduce new products in the market. For instance, in 2024, dosist™ introduced its progressive new range of CBD+ topical products with all-natural solutions designed to help with pain relief.

The legalization of CBD oil's medical claims has been made possible by relaxing cannabis laws and rising public knowledge of its advantages. Numerous celebrities address their sleep difficulties using CBD oil and related products. In the future years, the sales of CBD oil products are likely to be boosted by celebrity evangelists' endorsement.

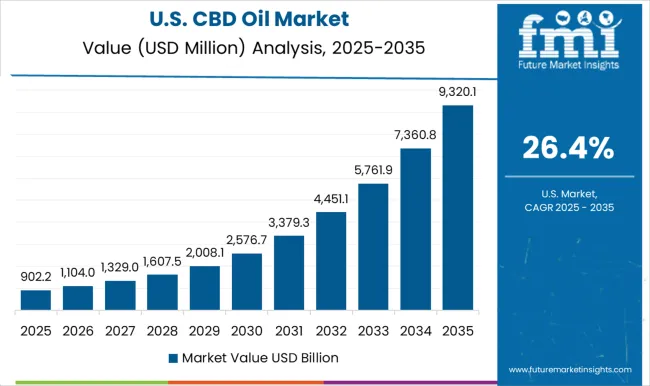

Due to favorable rules governing the use of CBD products and an increasing population who are concerned about their health, the United States is predicted to dominate the CBD oil market over the projected period. The United States agricultural bill's approval in 2024 increased the sales of CBD oil.

Around 50 million persons in the United States suffer from sleep disorders, according to the American Sleep Association. CBD oil modulates and interacts with neurotransmitters, thus helping in achieving deep sleep and alleviating insomnia.

The prevalence of sleep disorders is on the rise, and more studies are showing how well CBD works to treat these conditions, which is expected to help the industry expand in the United States.

Demand for this market is being driven by the high efficacy of CBD extracted from hemp for various medicinal uses, such as creating a treatment for Parkinson's illness.

Growth is anticipated to be fueled by rising consumer awareness of the health advantages of CBD extracted from hemp oil throughout the assessment period.

The rise in healthcare spending by consumers and the legalization of medical marijuana in North America and Europe are both factors contributing to the demand for hemp oil in the pharmaceutical sector.

According to FMI, more than 50% of CBD oil sales are likely to be accomplished through online channels.ommerce retail allowed top established and new entrants in CBD oil manufacturing, marketing, and sales to reach customers all around the world.

Some CBD oil manufacturers are selling their products exclusively through e-commerce websites to reach more consumers and create a loyal customer base. However, FMI predicts that the CBD oil market might reflect a paradoxical trend. The demand might shift towards brick-and-mortar stores through 2035.

By application type, the food and beverage industry is expected to record high growth due to increasing demand for CBD gummies and snacks across the globe. Market players are working to produce new flavors and are trying to make CBD snacks more accessible to gain a competitive advantage.

FMI expects this segment to grow exponentially owing to an increasing focus on getting certification by international organizations and growing awareness regarding the health benefits of consuming CBD gummies.

The CBD Oil Market is expanding rapidly, driven by growing awareness of cannabidiol’s therapeutic benefits, rising legalization of hemp-derived products, and increasing integration of CBD into wellness, pharmaceutical, and personal care formulations. CBD oil, extracted from hemp, has gained widespread acceptance for its potential in managing pain, anxiety, inflammation, and sleep disorders without psychoactive effects. Market growth is being fueled by evolving consumer preferences toward natural health remedies, expanding product availability, and supportive regulatory developments across North America, Europe, and parts of Asia-Pacific.

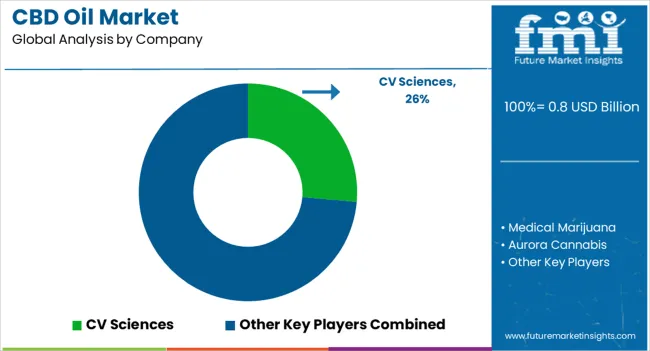

Leading players such as CV Sciences Inc., Medical Marijuana Inc., and Aurora Cannabis Inc. dominate the global market with diversified CBD oil portfolios spanning dietary supplements, tinctures, skincare, and therapeutic applications. CV Sciences Inc. is recognized for its PlusCBD™ line, emphasizing science-backed formulations and strict quality assurance. Medical Marijuana Inc., one of the earliest industry entrants, continues to expand its global footprint through subsidiaries focused on nutraceutical and pharmaceutical-grade CBD products. Aurora Cannabis Inc. leverages its pharmaceutical expertise to deliver high-purity, GMP-certified CBD oils tailored for both medical and wellness segments.

Canopy Growth Corporation and Tilray Brands Inc. are investing heavily in clinical research and global distribution networks to support the mainstream adoption of CBD products. CannTrust Holdings Inc. focuses on pharmaceutical-grade oils with controlled cannabinoid ratios for prescribed use in pain and sleep management, while Kazmira LLC is leading innovation in THC-free broad-spectrum CBD oils through advanced CO₂ extraction and purification technologies.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value & Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Rest of Latin America, EU-5, BENELUX (Belgium, Netherlands, Luxembourg), NORDIC (Denmark, Finland, Iceland, Norway, Sweden), Poland, Russia, Rest of Europe, China, India, Japan, GCC Countries, South Africa, Israel, Türkiye, Iran, Rest of Middle East & Africa, Australia, New Zealand, South Korea, the Philippines, Malaysia, and Thailand |

| Key Segments Covered | By Product Type, By Distribution Channel, By Application, and By Region |

| Key Companies Profiled |

CV Sciences Inc., Medical Marijuana Inc., Aurora Cannabis Inc., Canopy Growth Corporation, CannTrust Holdings Inc., Tilray Brands Inc., Kazmira LLC |

| Report Coverage | Market Overview, Market Background, Market Forecast, Segmental Analysis, Regional Profiling and Competition Analysis |

| Customization & Pricing | Available upon Request |

The global cbd oil market is estimated to be valued at USD 0.8 billion in 2025.

The market size for the cbd oil market is projected to reach USD 12.5 billion by 2035.

The cbd oil market is expected to grow at a 31.0% CAGR between 2025 and 2035.

The key product types in cbd oil market are hemp oil and marijuana oil.

In terms of application, pharmaceuticals segment to command 42.3% share in the cbd oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBD-Infused Skincare Market Size and Share Forecast Outlook 2025 to 2035

CBD Skin Care Market Size and Share Forecast Outlook 2025 to 2035

CBD Snacks Market Size and Share Forecast Outlook 2025 to 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CBD Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of CBD Product Packaging Market Share

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

Pet CBD Market

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Cannabidiol CBD Pet Market Size and Share Forecast Outlook 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA